Senior Citizens are a treasure to our society. They have worked hard all these years for the development of the nation as well as the community. They possess a vast experience in different walks of life. This article is a compilation of all our articles on Senior Citizen.Who is Senior Citizen? Where can the Senior Citizen invest their retirement money? What are Sources of Income for Senior Citizen? Senior Citizen and filing of ITR

Table of Contents

Who is Senior Citizen?

According to Income Tax Act, 1961, those who on the last day of a financial year (for 2016-17 is 31-Mar-2017) have attained 60 years of age belong to the Senior citizen category and those aged 80 or more belong to the Very senior citizen category. These definitions apply ONLY to Resident individuals and not to those who qualify as non-resident in any tax year.

From Income tax perspective ( from FY 2012-13) there are two categories of Senior Citizens:

- Senior Citizen: For age of 60-80 years

- Very Senior Citizen: Above 80 years

Under the Income Tax Act, a senior citizen is a person who at any time during the previous year has attained the age of 60 years or more i.e for a person who is of age 60 but less than 80 years on end date of financial year (for 2016-17 is 31-Mar-2017) will be considered as senior citizen for that Financial Year. So

- A person who is of age between 60-80 years on 31st Mar 2017(including 31st Mar) will be considered as Senior Citizen for FY 2016-17 or Assessment Year 2017-18.

- A person who is above 80 years on 31st Mar 2017(including 31st Mar) will be considered as Senior Citizen for FY 2016-17 or Assessment Year 2017-18.

Senior Citizen where to invest Retirement Money

Before or On retirement the question that one has is how to use the retirement kitty? You are or will be retired and are looking forward to living a relaxed life. Collecting your pension and provident fund money is work half-done. You have to plan meticulously to not only make your money yield returns that are higher than inflation but also minimise the amount you have to pay as tax. To ensure a regular stream of income, you need to deploy your retirement corpus in the the right products.

Comparison of few retirement options are as follows: Our article compares the various Retirement Options. Our article Senior Citizen and How to invest Retirement money? discusses it in detail. For Various investments

Senior Citizen Savings Scheme (SCSS) is a five-year scheme which was introduced in the Oct 2004. This scheme provides interest at around 9% pa at a quarterly interval, which is taxable. The SCSS is safe as the scheme is backed by the Government of India, making it totally risk-free with guaranteed returns.

Senior Citizen,Fixed Deposits and Tax, Banks offer a higher rate of interest on fixed deposits to senior citizens. The offering is 0.25-0.75% more than the prevalent interest rates. The minimum age to get a premium on your deposit is 60. A younger age group person can also enjoy this benefit if he opens a joint account with a senior citizen.

The Varishtha Pension Bima Yojana (VPBY) 2017, will provide an assured pension based on a guaranteed rate of return of 8 per cent per annum for ten years, with an option to opt for a pension on a monthly/ quarterly half-yearly and annual basis.

| Fixed Deposit | SCSS | Post Office Term Deposit | NSC | Mutual Funds | Pensions Plans | |

| Minimum Investment | 7 days | Rs 1,000 | Rs 200 | Rs 100 | Rs 500 | Rs 200 |

| Maximum Investment | No upper limit | Rs 15 lakh | No upper limit | No upper limit | No upper limit | No upper limit |

| Investment tenure | 7 days-10 years | Up to 8 years | 1-5 years | 5-10 years | Can be both short and long term | Can be both short and long term |

| Lock-in period | Same as tenure | 5 years | No lock-in | Same as tenure | 3 years | 3 years |

| Rate of interest | 6%-8% | around 8.5% | 7-8% | around 8% | Market-linked | 3%-7%(depends on the issuer) |

| Penalty on premature withdrawal | Interest rate applicable will be 1% less than the original rate. | 1%-1.5% | Interest paid will be according to the postal saving scheme and not as per the plan. | No premature withdrawal allowed | No premature withdrawal allowed | No premature withdrawal allowed |

| Tax status | EET | EET | EET | EET | EET | EET |

Advantages of being Senior Citizens

Other Facilities offered to Senior Citizens are:

- Banks offer a higher rate of interest on fixed deposits to senior citizens. The offering is 0.5-0.75% more than the prevalent interest rates. The minimum age to get a premium on your deposit is 60.

- A Senior Citizens Savings Scheme offering an interest rate is 9% per annum on the deposits made by the senior citizens in post offices has been introduced by the Government.

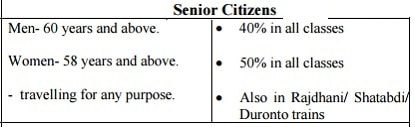

- The Ministry of Railways provides 40% fare concession to men above 60 years and 50% concession to women above 58 years in aall classes, all trains including Rajdhani, Shatabadi, Jan Shatabadi . The Indian Railways also have the facility of separate counters for senior citizens for purchase or cancellation of tickets. Ref:.indianrailways.gov.in Concession Rules, indianrailways.gov.in list of categories (pdf)

- The Ministry of Road Transport and Highways mandates the reservation of two seats for senior citizens in front row of the buses of the State Road Transport Undertakings. Some state governments give fare concessions to senior citizens in the State Road Transport Undertaking buses and have introduced bus models that are convenient to the elderly.

- Indian Airlines provides 50 per cent Senior Citizen Discount on Normal Economy Class fare for all domestic flights to Indian senior citizens who have completed the age of 63 years ubject to certain conditions.

- JetLite offers Senior Citizens (65 years and above) concession on basic adult fare in Economy class, on all domestic sectors operated by JetKonnect. To avail of this concession, you have to fill the “Concession Form” and submit it along with a photograph and proof of age

Concessions and Facilities given to Senior Citizens has information on benefits to Senior Citizens.

Senior Citizens and Tax

Our article Senior Citizen and Income Tax, discusses their sources of income, tax deductions exemptions, their tax slabs. TDS and Form 15H, filing of income tax return. Do Senior Citizen have to pay advance tax? Scrutiny and Senior Citizen Tax slabs for Income Tax for AY 2017-18 or FY 2016-17 is as follows.( Our article Understanding Income Tax Slabs,Tax Slabs History discusses Tax slabs etc in detail)

| TAX | MEN and WOMEN below 60 years | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 10% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 15% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

What are Sources of Income for Senior Citizen?

Senior citizens largely depend on passive sources of income, such as pensions, fixed deposits, Rental incomes of house properties, Senior Citizen Saving Scheme, Post office scheme, interest on savings, Reverse Mortgage etc.

Tax : Income From House Property, Tax and Income from Let out House Property

Senior Citizen and Income tax on Pension?

As per Section 17 (1) (ii) of the Income Tax Act, 1961 pension is a payment made by the employer after the retirement or death of the employee as a reward for past service. Pension is normally paid a periodical payment on monthly basis which is fully taxable, under the head Income from Salary, in the hand of the employee, whether Government employee or non government employee. The pension may be fully or partly commuted. i.e. in lieu of pension a lump sum payment is made to the employee. The treatment of the two kinds of pension is as follows:

- Uncommutted Pension : Periodical pension fully taxable in the hand of the employee, whether Government employee or non-government employee.

- Commuted Pension: Exemption under section 10 (10 A)

Let’s first understand commuted pension by way of an example.

At the time of retirement, you may choose to receive a certain percentage of your pension in advance. Such pension received in advance is called commuted pension. For e.g. – At the age of 60, you decide to receive in advance 10% of your monthly pension of the next 10 years of Rs 10,000. This will be paid to you as a lump sum. Therefore, Rs 10% of 10000x12x10 = 1,20,000 is your commuted pension. You will continue to receive Rs 9,000 (your uncommuted pension) for the next 10 years until you are 70 and post 70 years of age, you will be paid your full pension of Rs 10,000.

Uncommuted pension or any periodical payment of pension is fully taxable as salary. In the above case Rs 9,000 received by you is fully taxable. Rs 10,000 starting the age of 70 yrs are fully taxable as well.

Filing of Income Tax Return for Senior Citizen

Senior citizens don’t have to pay Advance Tax if He does not have any income chargeable to tax under the head “Profits and gains of business or profession”

The Central Board of Direct Taxes has instructed the field officers that cases of senior citizens should not be selected for scrutiny unless there is credible information that warrants such assessment.

The process for filing of income tax return is same as citizen less than 60 years of age. Other than exemption limit there is no change in Income under various heads, type of ITR form to fil. l So if your income in year is above 5 lakhs you need to e-File your return. If TDS has been deducted (at times even after submitted Form 15H), only way to reclaim is to ask for refund while filing the income tax return. Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax discusses it in detail.

Senior Citizen Avoid TDS and submit Form 15H

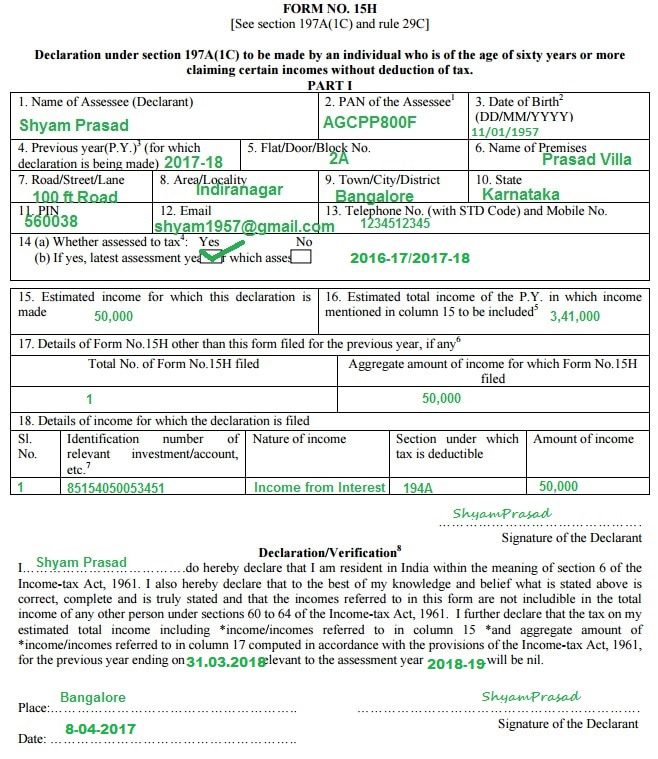

Senior citizens can file Form 15H to prevent banks, post office etc from deducting tax at source on the interests payable on their money if their estimated taxable income for the financial year is less than the basic exemption limit. Senior citizens have been exempted from the condition of total interest income from all sources not exceeding the basic exemption limit. This is applicable only to Form 15G. Our article Avoid TDS : Form 15G or Form 15H discusses it in detail.

Almost every bank in the country offers high senior citizen term deposit rates. These can be as much as 0.5% higher than the prescribed rates. However, you need to understand that the high rate is available only if certain terms and conditions are met. Hence, it is recommended that you check with your bank before opening the FD account.

Sample filled Form 15H for Senior Citizen for Fixed Deposit

Will and Senior Citizen

Most of us assume that a financial asset is inherited by the spouse, children or other family members in our absence but the law doesn’t recognize things this way. It needs valid papers in the form of Survivorship mandate, Nominations, Will.

Nomination is the process of appointing a person to take care of your assets in the event of your death. For all investments except company bonds and equity or stocks, nomination does not provide ownership of your assets. The nominee will only be the custodian of the asset till it is given to its beneficiaries.

Will is an official or legal document prepared by a person that describes how they want their assets to be divided among their heirs after their death. Preparing a clear will ensures that the heirs are left in no doubt about their inheritance. It reduces(not erases) the chances of dispute and lessens emotional distress. Let’s see what happens if one doesn’t make a will.

Our article Will: Right PaperWork For Those You Love-Part II discusses it in detail.

12 responses to “Senior Citizen and Retirement, Income Tax, Form 15H,Will”

after my retirement i am looking to invest money. but i have no idea where should i invest money with low risk .is mutual funds are safe?

Hello

Hello Sir

A very good decision taken for seniors.

A very good decision taken for seniors of our nation. Just try to spread this information as much as can.

I read above that senior citizens need not pay advance tax.But if the senior citizen is still earning and is under taxable category,does this rule apply?

A senior citizen is exempted from paying tax is

1)He is of the age of 60 years or above at any time during the year

2) He is not having any income chargeable to tax under the head “Profits and gains

of business or profession

Hey great article you publish here about senior citizen retirement and tax form.Also greatly helpful!Many people will get benefitted from it.

Thanks for encouraging words.

Do spread the word around.

Hello,

Prime Minister had announced 10 year Bank deposits to get 8% interest for Senior Citizens.

http://www.thehindubusinessline.com/economy/sr-citizens-to-get-8-interest-on-10-yr-deposits-up-to-rs-75-l/article9453298.ece

Has this scheme been launched ?

Which bank offer this scheme and what is this scheme called ?

Thanks,

Gagan

It has not been launched till 3 Apr 2017.

It is expected to be announced by LIC soon.

Hi Gagan

Pradhan Mantri Vaya Vandana Yojana Plan by LIC. You can get all details in LIC website