This article explains How to Fill Income from house property in Income Tax Return with rules and pictures. The Income Tax Act of India classifies income in five heads of which “Income from House Property” is one of them. It comprises of income earned by a person through the property(s) owned by him/her. Our article Tax : Income From House Property discusses it in detail.To fill in Income from House Property in ITR you need following

Table of Contents

Type of House Property you own

Find the type of property you own ex Self Occupied, Rental etc and understand rules corresponding to it. For example, for Self Occupied Property Annual Value is Nil, Standard deduction of 30% not allowed.

- Self occupied property, i.e. property where the owner or his family reside in the house property.

- Let out: Property given on rent.

- Vacant or Deemed Let out : If the house is vacant it is considered as Deemed to be Let out . It is expected to generate income for you and you need to pay tax on what you could have earned.

- If you have more than 1 property you cannot file ITR1. You can file any other ITR based on your type of Income. Use our article to find Which ITR Form to Fill?

- You can choose any house as Self-occupied which will minimize your tax liability.

Our article Income From House Property for more than 1 house explains it in detail.

Tax on House Property

- The Stamp duty/ Registration charges paid while acquiring property are allowed deduction Under section 80C. The maximum tax deduction allowed under Section 80C is Rs. 1,50,000 only. This tax deduction of Rs. 1,50,000 is the total of the deduction allowed under Section 80C and includes amount invested in PPF Account,Tax Saving Fixed Deposits Equity Oriented Mutual funds etc.

The Principal of Home Loan

Principal amount paid towards Housing loan for purchase or construction of House Property is allowed as a tax deduction under Section 80C of the Income Tax Act only after the construction is complete and the completion certificate has been awarded.

- The maximum tax deduction allowed under Section 80C is Rs. 1,50,000 only. This tax deduction of Rs. 1,50,000 is the total of the deduction allowed under Section 80C and includes amount invested in PPF Account,Tax Saving Fixed Deposits Equity Oriented Mutual funds etc.

- Section 80C allows for deduction only on payment basis i.e you should have paid the prinicipal

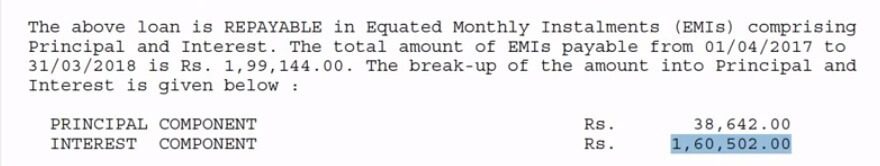

The interest of Home Loan

Two types of deductions for interest on Home Loan are available u/s 24

1) The standard deduction of 30% of the annual value

2) Interest paid on home loan

Tax Benefit on payment of interest on housing loan is allowed as a deduction under section 24 of the Income Tax Act which states that the amount of interest on housing loan whether accrued or paid, shall be deducted from the income from house property. Here, the loan must have been taken for the purpose of purchase or construction.

Section 80EE: Deduction for First Time Home Buyers

- 80EE deduction on the interest paid on home loan is only available to first time home buyers.

- The deduction can be availed on home loans sanctioned between 1st April 2016 and 31st March 2017 only

- The value of property for which the loan has been taken should be less than Rs 50 lakh

- The home loan amount should not exceed Rs 35 lakh

- The tax benefit here can be claimed till the time repayment of loan continues

- The deduction is only applicable on home loan paid for first house property

- The property in question can be either self-occupied or non-self-occupied

- The quantum of deduction is Rs 50,000 for interest paid on home loan.

- This deduction is available over and above the deduction of section 24 and section 80C which are Rs 2,00,000 and Rs 1,50,000 respectively. First claim your deduction under section 24, then claim under 80RR.

- The government reintroduced section 80EE in the Union Budget 2016-17.

- It was first introduced in the Union Budget for Financial Year 2013-14 as a means to help home buyers in the lower income group through tax reliefs. At that time, the amount of tax benefit given by this section was Rs 1 lakh, which was available to be claimed only once by the first time home buyer.

Note,

- Income from house property is taxable in the hands of owner/deemed owner of the property. Owner is a person who is entitled to receive income from property. A deemed owner is an owner by implication, although he may not be the owner in whose name property is registered. For example An individual who gifts property to his spouse or minor child will be treated as the deemed owner of that property. Here, though legally the owner of the property is his spouse or minor child, any income from that property will be treated as his income.

- Where property is owned by two or more persons and their respective shares are definite and ascertainable share of each person in the income from the property shall be included in each of their income.

- If the loan is joint, divide income, loan in ratio or ownership. Our article Joint Home Loan and Tax discuss it in detail

- If you have reported income from House Property to your employer, it will be shown in Form 16 but you still need to show it in ITR.

Loan during Pre construction stage

- The interest paid/payable for the pre-construction period is to be aggregated and claimed as deduction in five equal instalments during five successive financial years starting with the year in which the acquisition or construction is completed. Pre-construction period starts from the date on which loan is taken to March 31st, immediately prior to the date of completion of construction.

- No deduction would be allowed under this section for repayment of principal for those years during which the property was under construction.

- For example If one takes a housing loan of Rs 25,00,000 @4% p.a. for constructing a House on 1st April, 2009 and Construction of house gets completed on 28th February, 2013, then pre-construction period is 01-04-2009 to 31.03.2012 Now if the interest for above pre-construction period amounts to Rs 3,00,000 then deduction will be available in 5 equal instalments of Rs .60,000 each starting from the Financial year 2012-13 to 2016-17.

When one sells/transfers his Property and earns profit, it is taxable under Capital Gain in the year of transfer. Our article On Selling a House, Capital Loss on Sale of House discusses Capital gain of house property in detail.

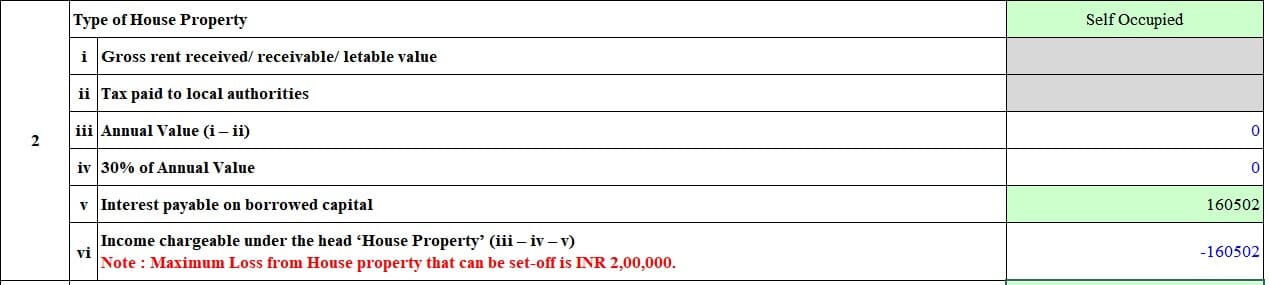

Filling Income from House Property in ITR1 which is Self Occupied

You can fill ITR1 only when you have income from salary and have only 1 house in which you are either living or rent out but is not vacant which technically is called as Deemed to be let out.

- Show Type of House Property as Self Occupied.

- Interest payable on borrowed capital. if it is more than 2,00,000 only 2,00,000 will be considered as Interest payable on borrowed capital.

- If you have not finished the 1.5 lakh limit of 80C you can claim the principal on the home loan.

- If you have interest component more than 2 lakh and you satisfy the 80EE requirements you can claim remaining interest under 80E deduction.

Show Self Occupied property in ITR1 with home loan interest

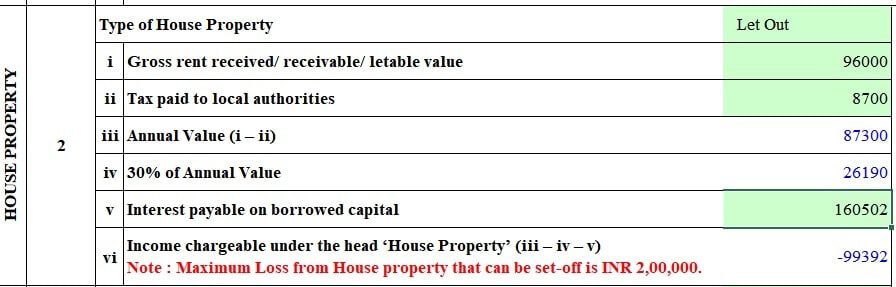

Filling Income from House Property in ITR1 which is Let Out

You can fill ITR1 only when you have income from salary and have only 1 house in which you are either living or rent out but is not vacant which technically is called as Deemed to be let out.

- Show Type of House Property as Let Out.

- Fill in the Rent received in Gross rent received/receivable/letable value

- Interest payable on borrowed capital. if it is more than 2,00,000 only 2,00,000 will be considered as Interest payable on borrowed capital.

- If you have not finished the 1.5 lakh limit of 80C you can claim the principal on the home loan.

- If you have interest component more than 2 lakh and you satisfy the 80EE requirements you can claim remaining interest under 80E deduction

How to Fill Income from House Property in ITR (other than ITR1)

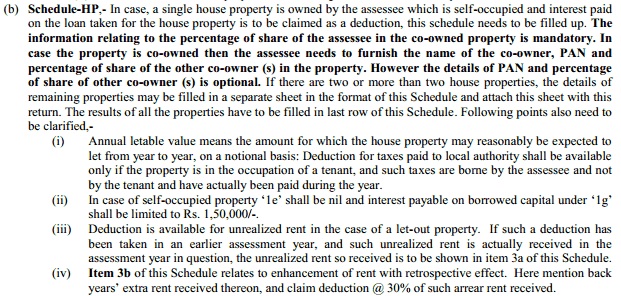

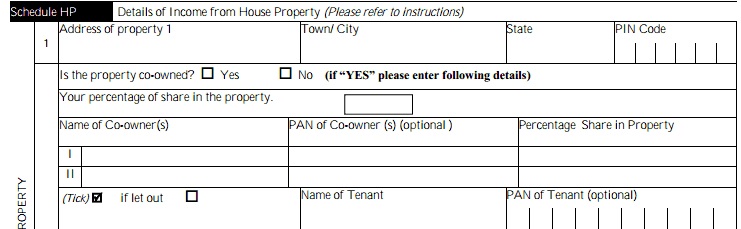

Instructions to fill Income Income from House Property in ITR2 are shown in image below

Fill the details in Schedule HP of ITR as shown in image from ITR2 below

Fill in information about property and co-owners

- The information relating to the percentage of share of the assessee in the co-owned property is mandatory.

- In case the property is co-owned then the assessee needs to furnish the name of the co-owner, PAN(optional) and percentage of share of the other co-owner (s) in the property.

- If property is not co-owned one can fill Is the property co-owned as NO, Your percentage of share in the property as 100.

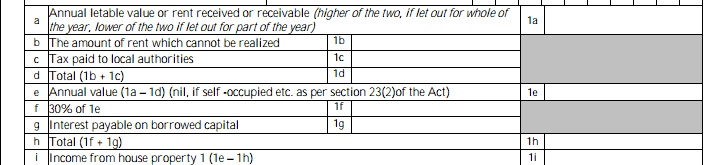

- a Annual letable value/ rent received or receivable (higher if let out for whole of the year, lower if let out for part of the year) : The Rent (amount) received from the let out property

- b The amount of rent which cannot be realized : If there is Bad debts from the rent amount included in above (a)

- c Tax paid to local authorities : If property tax has been paid during the year irrespective of the period (amount due can not be deducted actual payment must)

- d Total (1b + 1c) : total calculated automatically

- e Balance (1a – 1d) : total calculated automatically or Nil if self occupied

- f 30% of e :Standard deduction of 30% of the annual value ,calculated automatically

- g Interest payable on borrowed capital : Interest accrued on house loan . This amount can not be 1,50000 in case of self occupied house per individual or full amount if let out.

- h Total (1f + 1g) :total calculated automatically

- i Income from house property which will be used for tax calculation

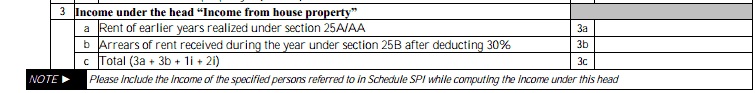

If there are two or more than two house properties, the details of each of the properties need to be filled. The results of all the properties will be Total income from House Properties and would be filled in last row,3c of this Schedule(HP), as shown in figure below.

If you are claiming Principal in section 80C then total value of all your 80C deductions with the maximum value of 1,50,000 needs to be filled under Chapter VI-A shown in image below.

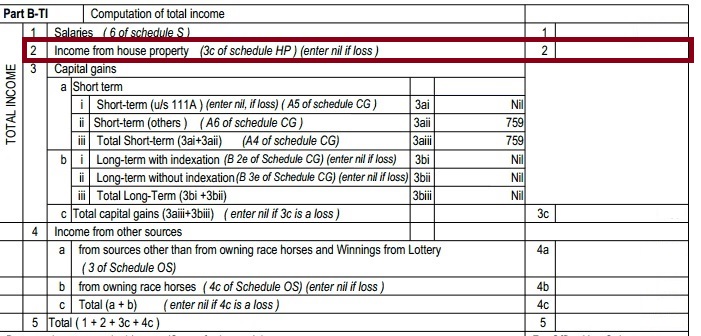

Income details filled in will be automatically reflected in total calculation in Total Income section of ITR as shown in image below

Related Articles :

- How to Calculate Income Tax, Tax : Income From House Property

- Tax and Income From One Self Occupied property , Tax and Income from Let out House Property

- Joint Home Loan and Tax

- On Selling a House, Capital Loss on Sale of House

- E-filing : Excel File of Income Tax Return

Disclaimer : Please use article the for informational purpose only. We do not hold any responsibility for mis-information or mis-communication.

If you fill the ITR return yourself, please be careful of filling the required information. If you get it filled by some one else(CA,tax website) please verify that information is reflected properly. Hope it helped you in understanding how to show Income from House Property in Income Tax Return. Looking forward to you your comments,feedback,questions.

Thanks for this post. It is very informative and very useful.

Hello, thanks for the very useful information.

if both husband and wife are income tax payee. Situation:-

1. Husband own a house in his name –

2. Wife also has one house property in her name -.

3. 3rd house property in joint name 50% share purchased recently on loan, let out for one year and now vacant.

Pl tell how to fill in ITR?

Husband will have to show details of house in his name and 3rd house (50% share)

Same for wife.

For more details you can read our article

http://bemoneyaware.com/income-from-house-property-for-more-than-1-house/

Hi,

I am a salaried person.

I have purchased a Home (First Home) in under construction stage in July 2014.

I go the possession in Jan 2018.

So as per my understanding I can claim Interest I have paid in April 2017-March 2018 + 1/5th of Interest paid during Pre-construction stage.

Which ITR Form is applicable for this case.

1) As per article on your website I think ITR 1 should be OK & can calculate interest manually & enter in Interest Paid because I have only one House.

2) Some of my colleague informed me that for claiming a APPI I have to compulsory file ITR 2.

Please advise.

PS:- Please note that Currently I am leaving in a house owned by my father hence I have rented out this home own by me in May 2018.

You can file ITR1 to claim the interest for the preconstruction stage.

Interest allowed to be claimed as deduction = Interest for the Financial Year + 1/5th of the Interest before completion of Construction.

However, it is to be note the max Total Deduction that can be claimed during the year cannot be more than Rs. 2 Lakhs

Hi,

I am a salaried person.

I have purchased a Home (First Home) in under construction stage in July 2014.

I go the possession in Jan 2018.

So as per my understanding I can claim Interest I have paid in April 2017-March 2018 + 1/5th of Interest paid during Pre-construction stage.

Which ITR Form is applicable for this case.

1) As per article on your website I think ITR 1 should be OK & can calculate interest manually & enter in Interest Paid because I have only one House.

2) Some of my colleague informed me that for claiming a APPI I have to compulsory file ITR 2.

Please advise.

PS:- Please note that Currently I am leaving in a house owned by my father hence I have rented out this home own by me in May 2018.

I am salaried individual and if I have 2 houses on which I am paying bank loan emis for both.

I have one house in which I am staying so no income from it

2nd house is rented and I get income from it.

Can’t understand your question.

From the facts given

You cannot file ITR1.

You have to show 2 houses in Income from House property

1 in which you live is Self occupied. You can claim interest on House Loan.

2nd in which you live is Let Out. You have to show rental income and claim appropriate deductions.

Hi Sir

I want to file return for 2018-19 for: Which ITR to be used?

1) Wife. Income details – a) 1L from tuition and b) 50k from interest.

2) Mother: Income details – a) From house rent and b) interest from fd.

In India, you have to file individual ITR.

So your wife salary and your mother salary will not be counted in yours.

They might file ITR individually.

As your wife income is less than 2.5 lakhs called basic exemption limit she does not need to file ITR unless TDS is deducted and she wants refund.

Same with your mother income

for assesement year 2017-18

i want to file my two house rent income. But which no of itr to be filled

please suggest me

Itr-2 can be filed

We know that interest paid during construction period can be included in ITR for five years in equal amount. If a person has claimed 1/5th in the first year, is the balance amount of 4/5th required to be mentioned on ITR? If so, which section?

Hello all

I rented a property to a department in march 2013. However they have finalised rental agreement in march 2016 and paid rent amount for the period between march 2013 to feb 2016 inb april 2016 and deducted TDs on that.

Now my query is that Should i fill yearly unpaid rent in the ITR for AY 2015-16 and AY 2016-17 or not.

It can be claimed under section 25B

Where the assessee receives any amount by way of arrears of rent in respect of any property consisting of buildings or land appurtenant thereto of which he is the owner, the amount so

received shall be chargeable to tax under the head “Income from House Property”. It shall be charged to tax as the income of the previous year in which such rent is received, even if the assessee is no longer the owner of such property. In computing the income chargeable to tax in respect of the arrears so received, 30% shall be allowed as a deduction and, consequently 70% alone shall be chargeable to tax. The deduction of 30% is irrespective of the actual expenditure incurred.

i am a central govt employee. i get my salary. I took loan along with my wife in 2009 to buy a flat. We repaid the loan in 2012. We were transferred to another state .In jan 2016 we again took a combined loan and bought a flat in the place where we are working now. my parents are staying in my first flat and we are in second flat at new place. My questions are

a) which ITR has to be used by me and my wife.

b) Do we get deductions for loan taken since we are paying principal and interest from Feb 2016 (Since it is a 2nd loan).

Thank you very much to guide efill IT return about home loan interest amount in ITR1

You are welcome

Hi,

I bought a new House still its in construction stage for three years, how

to get housing loan interest& repayment as well HRA. is it possible

Dear Sir,

My HR department deducted tax of 33000/- from my march 2016 salaray as he has not incorporated details of my second let out flat .I had already submitted the required documents but they have not gone through the same.

Now they r telling that u can recover ur money while submitting return file. I would like to know the procedure for the same.please guide me.

NITIN YASHWANT KADAM

MB: 9821512046

Dear Sir

I own two houses…one is given on rent while i live in the other house with my parents.i am nri for income tax purposes as i am a seafarer( and have completed my nri days).

I have filed ITR 1 while filing ITR for AY 2015-2016 on 31 march 2016( no tax was payable as incone is less ggan 2 lacs).

Is the form correct and what is the remedy if it is wrong?

Many thanks

I am constructing house which will complete in next financial year. I took 22lac loan from bank. I have invested around 5lac of my own money apart from the bank loan. Can i claim as loss in tax ? if i can claim can anyone suggest me how ?

Loan Application

================

Hello

We welcome you to Happiness Loan Company and we would be very glad to

give you a loan of your desire provided you can be trusted and can be

relied on. We offer loans to individuals at just 2% interest rate. So

feel free in doing business with us.

I want you to know that our transaction does not take time but it

depends on how serious you are to get your loan from us because we

love doing business with serious people who will be ready to pay us

back at the stipulated time. ( genuine people only).

Qualifications On Our Transaction:

==========================

1)The Borrower must be trusted with good faith and unlimited grace

2)Even with Bad credit, we still Guarantee the Borrower the Loan with

unlimited grace in this company.

3)The Loan Can Be Granted Even With low credit.

4) Fixed Rate Of The Loan interest is 2%.Feel free to write us on our mail (rosariochristiana@outlook.com)

Sir,

I am aware that taking Advantage of House Rent Allowance (HRA) & Interest on Housing Loan together within the same city is not allowed but let me know if we can take House Rent Allowance (HRA) & Loss from house property within the same city. Are both things same i.e Interest on Housing Loan and Loss from house property.

One person has taken a joint house loan with his wife, now he is working at outside of india.Wife is working, Can his wife taken deduction u/s 80c full amount of principal i.e 1.5 lac max paid as well as interest of House Loan i.e rs. 2.00 max paid

To claim the tax benefits on the property –

You must be a co-owner in the property

You must be a co-borrower for the loan

When these conditions are met, the tax benefits that can be claimed in financial year 2015-16 are –

Each co-owner, who is also a co-applicant in the loan, can claim a deduction of maximum Rs 2,00,000 towards interest on the home loan in their Income Tax Return – where the property is the only property owned and it is self –occupied or is lying vacant. For a property which is given on rent the entire interest can be claimed as a deduction.

Each co-owner, can claim a deduction of maximum Rs 1,50,000 towards repayment of principal under section 80C. This is within the overall limit of Rs 1,50,000 of Section 80C.

So if your wife is co-owner and co-borrower then she can claim both 1.5 lakh and 2 lakh irrespective of whether you claim or not?

And when you say you are working outside India ..have you not spent 182 days in India from Apr 1 2015-31 Mar 2016?

An NRI can also claim Principal and Interest

Principal repayments on loan for purchase of house property: NRIs can claim deduction for repayment of loan taken for buying or constructing residential house property. Also allowed for stamp duty, registration fees and other expenses for purpose of transfer of such property to the NRI.

Similar to Residents, NRIs can claim a deduction of maximum Rs 2,00,000 for interest paid on a home loan for a house property which is lying vacant. For a property which is rented out, the entire interest out go is allowed as a deduction. While calculating rental income of the house property, deduction towards property tax paid as well as 30 per cent standard deduction is allowed to be claimed.

As far as I know the total limit of accrued interest on HBA is Rs.2,00,000/- in 2016-17. So when two persons are co-borrower(i.e Husband and wife), then the amount of rebate on interest will be Rs.1,00,000/- each or Rs.2,00,000/- each. Please clarify

this is great thanks it helped me for my assignments

Thanks for sharing. Good to know that we could be of help.

Sir,

I have given two houses on rent.Though I am the actual owner of the house ,however the rent is being paid to my wife. Who is liable to pay tax on rental income? Please clarify.

If your wife has no separate income then clubbing of income would apply and rental income would be clubbed with yours.

Our articles Investing in name of Wife and Clubbing of Income explain it in detail.

I am regularly filling income tax for income from house property by deducting Muncipale tax & std 30% deduction.But now Munciple corparation has reassessed tax to Rs 6.5 Lakh wef 2008 to2014-2015.My income from house property is Rs 6Lakhs for 2015-2016.Pl guide how to claim benifits of extra money paid in form of tax to corporation.PL GUIDE

please clarify for assured return income through commercial property constracted and which head shown in income tax return. income for other source or income for house and property.

I have assured return income for commercial corporate park in which head shown in our itr4 income for other sources or interest part or income form house property and the property is also construct not delivered so, I couldn,t understand is income for house property shown to self occupied.

Income from house property in general is taxable under the head “Income from House property” in the hands of the owner. This applies to both residential as well as commercial property. The amount of rent received or reasonably expected to be received from such property which is known as “annual value” is taxable under this head after deduction of certain expenses.

In case you are not the owner and sublet the commercial property, your income from such sub-letting shall however be taxable under the head “Income from other Sources”.

In case you are running a proper business centre and amount in respect of provision of other services along with letting out of the space constitute significant portion, the same can be treated as business income, depending on facts of the case.

For calculating the income taxable under the house property head, the taxation laws allow you two deductions. The first deduction is standard deduction in respect of repairs etc. at the flat rate of 30% of the annual value calculated as above. The deduction in respect of a let out commercial property or a residential property which is deemed to have been let out is available whether you have actually incurred any expenditure on repairs or not.

The other deduction available is in respect of interest on loan taken to purchase or construct a house property, or even for repair or reconstruction of your existing property. This benefit of interest deduction is available for all properties whether residential or commercial. Please note that even processing fee or prepayment fee paid in respect of any loan taken for the commercial property is also treated as interest and is thus eligible for deduction

I am an employee of Central Public Sector Undertaking. I am entitled for company leased accommodation in lieu of HRA. I provided my own flat in New Delhi to the company as self leased accommodation, for which the company is paying me Rs. 15030 a month (Net after TDS 16700-1670) as rent. Simultaneously, the company is adding some perquisite value (Rent Free Accommodation) in my salary income for TDS from my salary.

I have income from salary and Self leased accommodation only. Company is issuing Form 16 Part-A (from Traces) for Salary and Form 16A For lease(from Traces)(1 for each quarter. However in company’s form 16 total income is indicated as Salary income + perquisites in lieu of Accommodation etc.

My question is whether I need to file to ITR-1 or ITR-2.

Great post. Complex information presented in a easy way. Is very helpful and makes for delightful reading.

PLease guide me if the amount I have spent on repairs of the house, and society charges paid on account of lift, generator repairs etc, can also be entered in the ITR-2A.

If so, where?

Also, my Net Taxable Income is over 12 lacs. I have already paid 356177 as tax (reflected in Form-16). But I am getting a refund of 356180 !!

Can’t make out where I am going wrong. Can I send you my filled ITR-2A?

Regards,

Manish

Hi,

I took a Housing Loan & the House is Built in My Native. I’m staying in another city & currently my parents are staying in that house. For which i don’t receive any rent. So while filling the income tax through ‘https://incometaxindiaefiling.gov.in’ website. I’m not sure which option to be selected ‘Self Occupied’ or ‘Letout’

A self occupied property is one which is owned and used by you for your own residential purpose. You have to occupy the property throughout the year. Thus, a property or a house not occupied by the owner for his/her residence cannot be treated as a self-occupied property.

There is an exception to the above rule. If the following conditions are satisfied then the property can be treated as self-occupied and the annual value of a property (considered while calculating ‘Income from House Property’) will be NIL.

If you (tax payer) own a property;

If such property cannot be occupied by you, by reason of the fact that owing to your employment, business or profession carried on at any other place (other than the place where your self occupied property is there), you have to reside at other place in a building not owned by you;

If the property mentioned in (a) above is not let-out at any time during the year. (The property should not be let-out fully or part thereof);

No other benefit derived from such property.

So you can call your house as Self Occupied Property and also claim HRA as you are in other side

sir,

I took home loan of 20 lakhs for construction of house on 09 september 2013.I am first time home loan borrower.my house construction got completed in may 2014.Am I eligible for tax benefit under section 80 EE and section 24 in FY 2014-15(AY 2015-16).I had not mentioned home loan interest in FY2013-14.My interest in FY 2013-14 is Rs.70350 and during FY 2014-15 ,the interest is Rs.199222.

please reply sir as soon as possible.

Also can I claim whole amount of interest Rs.70350 under section 80EE in AY 2015-16.

The pre- construction interest is allowed as deduction in five equal installments beginning the year in which the property is acquired or constructed (however this is subject to the overall limit of Rs 1.5 /2 lakhs ) under section 24.

if you are able to satisfy conditions of both Section 24 and Section 80EE, both the benefits shall apply to you. First exhaust your limit under section 24 and then go on to claim the additional benefit under section 80EE.

Conditions to claim 80EE:

being an Individual Tax Payer, there are a set of conditions that you must satisfy before you go on to claim the benefit under this section –

This is your 1st house purchased

Value of this house is Rs 40lakhs or less

Loan taken for this house is Rs 25lakhs or less

Loan has been sanctioned by a Financial Institution or a Housing Finance Company

Loan has been sanctioned between 01.04.2013 to 31.03.2014

As on the date loan is sanctioned no other house is owned by the tax payer

A very nice article. I have few queries,

I have purchased an under construction flat Noida in Jun 2009 and availed loan for the same in Oct 2009. My father is joint owner in the flat. He contributed around 10% money in the flat purchase. Full loan was repaid by me (no contribution from my father in loan repayment) in March 2014, and I got possession of the flat in March 2015. My queries are,

1. Can I claim 1/5 of the total interest payment (total interest is around 5 Lacs) on loan in FY 2014-15 (AY 2015-16) as I got possession in March 2015. Is there any restriction as I got flat possession after 3 years.

2. How to calculate my father’s % share in the property. Will it be equal to his contribution in purchase i.e. 10%, or it is always 50% in case of 2 co-owners?

A very nice article. I have few queries,

I have purchased an under construction flat Noida in Jun 2009 and availed loan for the same in Oct 2009. My father is joint owner in the flat. He contributed around 10% money in the flat purchase. Full loan was repaid by me (no contribution from my father in loan repayment) in March 2014, and I got possession of the flat in March 2015. My queries are,

1. Can I claim 1/5 of the total interest payment (total interest is around 5 Lacs) on loan in FY 2014-15 (AY 2015-16) as I got possession in March 2015. Is there any restriction as I got flat possession after 3 years.

2. How to calculate my father’s % share in the property. Will it be equal to his contribution in purchase i.e. 10%, or it is always 50% in case of 2 co-owners?

Hi Kirti,

I have a house, which is jointly owned by me and my wife. We both are working and have income from salary. The house is self-leased to my company and the rental income goes to the account held singly by my wife. There is no housing loan existing as on date against the house in question and so no tax benefit is being availed by us towards housing loan.

My question is : Can the rental income from the house, which is self-leased to my company, be considered fully as my wife’s income?

My wife falls under a lower tax bracket, so if your answer to my question is YES, I can save on my income tax liability.

Thanks,

Manoj

Very tricky question Manoj and we would recommend confirming with your CA/tax lawyer.

From what we know yes it should be considered as your wife income.

Your company would be considering the lease as perquisite and paying tax on it.

We can refer you to the case

HRA exemption allowable on Rent Paid to wife

Hope it helps

Thanks Kirti, for your prompt response to my query. I value your guidance and timely support.

As you rightly said, my company is considering the lease as perquisite which is added to my income and I am paying Income Tax on this.

Going logically, there is nothing wrong in considering rental income from house as my wife’s income.

Would appreciate, if you can confirm this from some authenticate source.

Thanks again,

Manoj

If a person havind two house in one he is residing and taken loan against that for which the inrest loss is there and 2nd house is let out and having rent income. sowhich itr form 1 or 2 should he file please clarify

Hello sir,

this is nice blog and very informative in the term of people.thank you for sharing such valuable information to us!

Join property in husband, wife name.

Principal and interest paid by husband, so I understand husband gets house loss deduction. However, ITR-2 ask is if property is in join name, when i says yes it asks percentage, and I put 50% each. When I put 50% in husband name, the annual value reduces to half as well and the loss increases compared to the case where ownership was put in as 100%

Case 1: Now, I am in dilemma, if I put 100% ownership, its facutally incorrect since house and loan are in joint name. House loss will be = 2 lakh( rent) – 5 lakh ( interest) = 3 lakhs

Case 2: If I put 50%, since annual value decrease to half, the loss widens. House loss = 1 Lakh (rent) – 5 lakh( interest) = 4 lakhs. (Omitting 30% maintenance for simplicity) Can I claim higher loss like case 2 above?

Thanks for the informative article Mr. Kirti. I need to claim (1/5th) pre-construction interest for earlier year (2013-14) as well as interest paid in the current financial year (2014-15) in last year’s IT return. Do I add both of them and fill in the Sl. 2(h) of House Property or some component is to be filled in CYLA/BFLA?

Need urgent help pse.

Interest on Home loan comes under Income from House property.

If you have only one house you can fill ITR1.

In your case you seem to be filling ITR2.

So you have to fill in 1/5 of interest from interest paid in pre-construction phase plus interest paid this year.

If the house is self occupied benefit on total interest cannot be more than 2 lakh.

If it is let out there is no limit on interest amount.

Hope it helps.

Hi Kirti,

if a person(employed in govt.service) resides in residence / quarter alloted to spouse by govt and possess 2 houses in same city rented out at Rs 10,000 p.m and Rs 5000 p.m. Is it possible to save tax and how? Kindly reply.

In the form ITR1 and 2 for Ay2015-16 (similar to previous year form snapshots pasted in blog above) there is only one row -“Interest Payable on Borrowed capital”.

Do we combine the current year interest on HP AND the 1/5 of Pre construction Interest.

I wanted to show it seperately as my property is in separate state (let out) and i am claiming HRA as well

Appreciate a quick response

Regards

For ITR1 you have to combine and show as there is only one column.

But in ITR2 information about two properties are shown but one can add more propertoes

1. Can you pl guide on how to fill in details in itr1 form to claim tax relief under section 24 as well as section 80ee?

2. Also, as the finance minister had proclaimed ‘the tax relief under section 80ee will be max 1,00,000/- over and above 1,50,000/- under section 24 per FY for FY 2013-14,2014-15,in case the amount under section 80ee in the previous FY was 90,000/- over and above the 1,50,000/- under sec 24, if I add 10,000/- from FY 2014-15 to complete the 1,00,000/- for the FY 2013-14 under sec 80ee (which is a valid course of action as per provisions of 80ee if I am not mistaken), then can I repeat the procedure next year for FY 2014-15 to complete the 1,00,000 for FY 2014-15 by adding 20,000/- form the money I pay towards interest on the home loan over and above the tax relief under sec 24?

I have query, i had rented out a part of my house, which i had declared in my IT Last Year, currently i have self occupied ? so how do i show it in in my IT that i have occupied the house and no more rents are received.

Pl.clarify on following points regarding Income from house property.

1)My house in Pune was rented out to my old tenant in F.Y. 2013-14 and that income was shown by me in my last year’s return. The tenant vacated the house in May 2014 and the proerty was vacant from june 2014 till 28/02.2015. From 1st March 2015 new tenant has occupied the same. Please guide me whose name should I mention as a tenant in ITR2 in part “Income from House Property”

2)I have received rent for Apri & May 2014 and for March 2015 i.e. for 3 months only dyring the FY 2014-15. The Pune municipal corporation(PMC) while working out property tax has consdered certain annual rateble value. Pl. indicate whether I have to show the actual income received for 3 months plus proportionate 9 months ratable value worked out from the PMC property tax as my income from house property for A.Y.2015-16 or is there any other method to workout the rent income for the year?

Thanks.

Suresh Wagh

Dear Sir,

I have one query, pl. help as I am going to buy a house in near time.

What if the house is owned by the Husband (Single Owner) and Wife is only Co-borrower (not co-owner) in the loan (To increase the loan eligibility only) in the following cases,

1. If Husbund is paying full EMI, will Husband be eligible for the full deduction u/s 80 C for the total repayment made by him, will Husband be eligible for the full deduction u/s 24 for the total interest payment made by him ? as he is the sole owner and sole repayer of the EMI (Principal + Interest)

2. will there be any amount not eligible for tax deduction for the payment made by the husband?

I try to get resolve my query of situation where wife is added only for the increasing loan eligibility, wife is not the co-owner as well as not paying a single rupee for the loan+Interest repayment.

Pl. help what would be the tax treatment.

Is any agreement of the repayment liability with the wife has to be made for claiming total payment as tax deduction in the hands of husband.

Let me know the course of action for full tax deduction as I want to add my wife as co-borrower in the loan for enhancing loan eligibility only. (She will not be co-owner) My wife will not pay a single rupee for the Loan & Interest payment. I will pay full EMI. Will I be eleigible for the tax benefit as if I am the single owner and single borrower? pl. help urgently as I have to take decision.

Nilesh sorry for delay in replying, I was on vacation.

Coming to your question :

A joint home loan is a loan which is taken by more than one person.

Coowner: means a person who has a share in the property

CoBorrower: A co-borrower is a person with whom you take the home loan jointly. In India, a home loan can have upto 6 co-borrowers. Usually a joint home loan is taken by spouses, or parent and child. You cannot take a home loan jointly with your friend or colleague or an unmarried partner. Usually banks insist co-owners to be co-borrowers of the loan. However, the reverse is not necessary.

Although the loan is taken by more than one person, the EMI payment can be made from only one bank account which can be single or joint account of one of the borrowers. The borrowers can choose to share the number of EMIs between them in the whole year.

Tax benefits on home loan can be be availed if :

if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in question. A co-owner, who is not a co-borrower, is not entitled to tax benefits. Similarly, a co-borrower, who is not a co-owner, cannot claim benefits. Before you sign as a co-applicant in a home loan, make sure that you get a right to the property as well. Registering the house in joint names will get you additional tax benefits as mentioned earlier and your share in the property also becomes indisputable.

The tax benefit is shared by each joint owner in proportion to his share in the home loan. It’s important to establish the share for each co-borrower to claim tax benefits.

We have explained this with example in our article Joint Home Loan and Tax

So you can claim all the tax deduction and tax exemption.

Dear Sir,

I have one query, pl. help as I am going to buy a house in near time.

What if the house is owned by the Husband (Single Owner) and Wife is only Co-borrower (not co-owner) in the loan (To increase the loan eligibility only) in the following cases,

1. If Husbund is paying full EMI, will Husband be eligible for the full deduction u/s 80 C for the total repayment made by him, will Husband be eligible for the full deduction u/s 24 for the total interest payment made by him ? as he is the sole owner and sole repayer of the EMI (Principal + Interest)

2. will there be any amount not eligible for tax deduction for the payment made by the husband?

I try to get resolve my query of situation where wife is added only for the increasing loan eligibility, wife is not the co-owner as well as not paying a single rupee for the loan+Interest repayment.

Pl. help what would be the tax treatment.

Is any agreement of the repayment liability with the wife has to be made for claiming total payment as tax deduction in the hands of husband.

Let me know the course of action for full tax deduction as I want to add my wife as co-borrower in the loan for enhancing loan eligibility only. (She will not be co-owner) My wife will not pay a single rupee for the Loan & Interest payment. I will pay full EMI. Will I be eleigible for the tax benefit as if I am the single owner and single borrower? pl. help urgently as I have to take decision.

Nilesh sorry for delay in replying, I was on vacation.

Coming to your question :

A joint home loan is a loan which is taken by more than one person.

Coowner: means a person who has a share in the property

CoBorrower: A co-borrower is a person with whom you take the home loan jointly. In India, a home loan can have upto 6 co-borrowers. Usually a joint home loan is taken by spouses, or parent and child. You cannot take a home loan jointly with your friend or colleague or an unmarried partner. Usually banks insist co-owners to be co-borrowers of the loan. However, the reverse is not necessary.

Although the loan is taken by more than one person, the EMI payment can be made from only one bank account which can be single or joint account of one of the borrowers. The borrowers can choose to share the number of EMIs between them in the whole year.

Tax benefits on home loan can be be availed if :

if you are a co applicant in a housing loan as long as you are also the owner or co owner of the property in question. A co-owner, who is not a co-borrower, is not entitled to tax benefits. Similarly, a co-borrower, who is not a co-owner, cannot claim benefits. Before you sign as a co-applicant in a home loan, make sure that you get a right to the property as well. Registering the house in joint names will get you additional tax benefits as mentioned earlier and your share in the property also becomes indisputable.

The tax benefit is shared by each joint owner in proportion to his share in the home loan. It’s important to establish the share for each co-borrower to claim tax benefits.

We have explained this with example in our article Joint Home Loan and Tax

So you can claim all the tax deduction and tax exemption.

Just cause it’s simple doesn’t mean it’s not super hefplul.

Hi Kriti,

Thanks for the info. I have a query.

“Sl.No.” Assessment Year “Date of Filing(DD/MM/YYYY)” “Houseproperty loss” “Short-term capital loss” “Long-term

Capital loss” “Other sources

loss (other

than loss from

race horses)” “Other

sources loss

(from owning

race horses)”

i 2005-06

ii 2006-07

iii 2007-08

iv 2008-09

v 2009-10

vi 2010-11

vii 2011-12

viii 2012-13

ix Total of earlier year losses 0 0 0 0

Hope u understand the above lines in ITR 2 Schedule CFL.

My loss during the construction period was 100000 in FY 11-12. House got completed in 12-13. Loss of current can be taken care of. but how to fill in the above data for year 11-12. do i have to fill total amount 100000 or i just have to show 20000 there. this is blowing my mind then how will i show it in future years??

Pls help.

Mukesh let me get the facts right

You are having loss in the house property due to construction of the house due to interest payment.

If this is so you don’t need to fill in the Carry Forward of Loss(CFL) section.

To claim interest during the construction stage as discussed in our article Income from House Property and Income Tax Return

The interest paid/payable for the pre-construction period is to be aggregated and claimed as deduction in five equal instalments during five successive financial years starting with the year in which the acquisition or construction is completed. Pre-construction period starts from the date on which loan is taken to March 31st, immediately prior to the date of completion of construction.

No deduction would be allowed under this section for repayment of principal for those years during which the property was under construction.

For example If one takes a housing loan of Rs 25,00,000 @4% p.a. for constructing a House on 1st April, 2009 and Construction of house gets completed on 28th February, 2013, then pre-construction period is 01-04-2009 to 31.03.2012 Now if the interest for above pre-construction period amounts to Rs 3,00,000 then deduction will be available in 5 equal instalments of Rs .60,000 each starting from the Financial year 2012-13 to 2016-17.

Hi Kriti,

Thanks for the info. I have a query.

“Sl.No.” Assessment Year “Date of Filing(DD/MM/YYYY)” “Houseproperty loss” “Short-term capital loss” “Long-term

Capital loss” “Other sources

loss (other

than loss from

race horses)” “Other

sources loss

(from owning

race horses)”

i 2005-06

ii 2006-07

iii 2007-08

iv 2008-09

v 2009-10

vi 2010-11

vii 2011-12

viii 2012-13

ix Total of earlier year losses 0 0 0 0

Hope u understand the above lines in ITR 2 Schedule CFL.

My loss during the construction period was 100000 in FY 11-12. House got completed in 12-13. Loss of current can be taken care of. but how to fill in the above data for year 11-12. do i have to fill total amount 100000 or i just have to show 20000 there. this is blowing my mind then how will i show it in future years??

Pls help.

Mukesh let me get the facts right

You are having loss in the house property due to construction of the house due to interest payment.

If this is so you don’t need to fill in the Carry Forward of Loss(CFL) section.

To claim interest during the construction stage as discussed in our article Income from House Property and Income Tax Return

The interest paid/payable for the pre-construction period is to be aggregated and claimed as deduction in five equal instalments during five successive financial years starting with the year in which the acquisition or construction is completed. Pre-construction period starts from the date on which loan is taken to March 31st, immediately prior to the date of completion of construction.

No deduction would be allowed under this section for repayment of principal for those years during which the property was under construction.

For example If one takes a housing loan of Rs 25,00,000 @4% p.a. for constructing a House on 1st April, 2009 and Construction of house gets completed on 28th February, 2013, then pre-construction period is 01-04-2009 to 31.03.2012 Now if the interest for above pre-construction period amounts to Rs 3,00,000 then deduction will be available in 5 equal instalments of Rs .60,000 each starting from the Financial year 2012-13 to 2016-17.

Hi Kirti,

My brother wants to sell a property. The prospective buyer is ready to pay the cost 60% by draft and 40% by cash.

How can my brother pay Long time capital gain tax on the cash part. Is it that the sale deed will be made on the 60% of the amount.Is it legal to receive the payment from buyer in form of cash. If yes, what should be the precautions to be taken.

Thanks

Gagan

Very difficult question to answer. It is a very common situation in India. I cannot help much but can only provide pointers. Hope they help.

Please read How you become a loser when you pay in black for your real estate property ?

And government has become very vigilant. The PAN card provides the crucial link to the scattered expenditure and this is then assembled at one place to provide the entire picture at a glance. Please read Income Tax dept comes down heavily on tax dodgers, sends letters to 35,170 PAN holders on high value cash transactions

Hi Kirti,

My brother wants to sell a property. The prospective buyer is ready to pay the cost 60% by draft and 40% by cash.

How can my brother pay Long time capital gain tax on the cash part. Is it that the sale deed will be made on the 60% of the amount.Is it legal to receive the payment from buyer in form of cash. If yes, what should be the precautions to be taken.

Thanks

Gagan

Very difficult question to answer. It is a very common situation in India. I cannot help much but can only provide pointers. Hope they help.

Please read How you become a loser when you pay in black for your real estate property ?

And government has become very vigilant. The PAN card provides the crucial link to the scattered expenditure and this is then assembled at one place to provide the entire picture at a glance. Please read Income Tax dept comes down heavily on tax dodgers, sends letters to 35,170 PAN holders on high value cash transactions

OMG! The tax net don’t even leave a vacant land. Thanks for the info.

Only thing certain in life are death and taxes

OMG! The tax net don’t even leave a vacant land. Thanks for the info.

Only thing certain in life are death and taxes