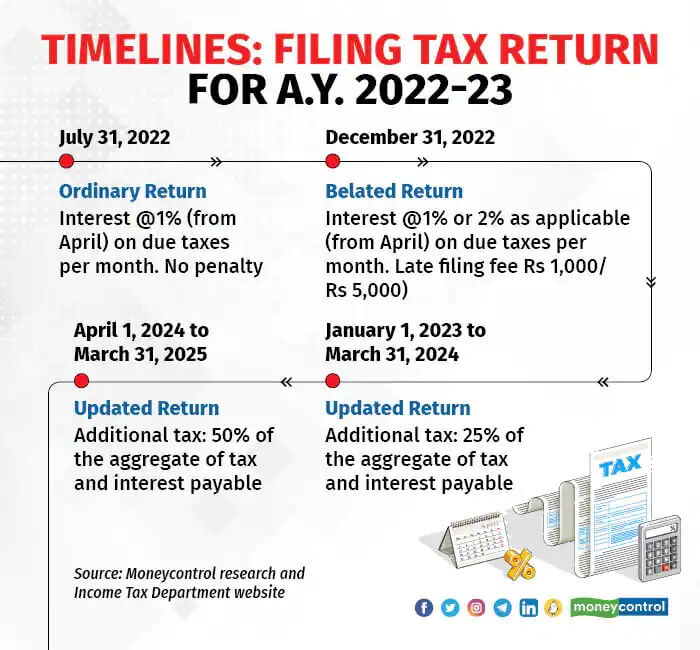

If you don’t file your income tax return till due date (31 Aug 22 for FY 2021-22 or AY 2022-23) all is not lost you can file your income tax return with fine or penalty. If you miss this deadline as well, then you will not be able to file ITR unless you receive a notice from the tax department to do so. This article explains Filing Income Tax Return after the deadline, the last date for filing Income Tax Returns, Penalty in file ITR late

Check out our course on Income Tax here.

Check out the Workbook on Income Tax here.

As per section 139 (4) of the Income Tax Act, 1961, taxpayers are allowed to file their tax return after due date with a late fee. Individual taxpayers will have to pay a late fee of Rs 5,000 if they miss filing the ITR by 31 July. If the total income of the person is less than Rs 5 lakh in a financial year, then he will have to pay a late fee of Rs 1,000.

Table of Contents

Types of ITR and Due Dates for filing Income Tax Returns

An individual below 60 years of age, who has a total income of Rs 2.5 lakhs or more in a financial year is liable to file an income tax return. For a senior citizen (aged 60 years or more) and for a very senior citizen (aged 80 years or more) this income limit gets increased to Rs 3,00,000 and Rs 5,00,000 respectively for filing a return of income.

The tax filing due date for all non-audit ITRs is 31 July of the relevant assessment year (AY), unless the government extends the date. However, there are two exceptions.

- Original ITR Section 139(1): A tax return filed on or before July 31 is termed as original ITR.

- Belated ITR Section 139(4):

- A tax return filed for that assessment year after Jul 31 and till 31 Dec is termed as Belated ITR, Section 139(4).

- One has to pay penalty under Section 234F and due tax. For small taxpayers whose total income does not exceed Rs 5 lakh, the penalty would be Rs 1,000 or less. For others, it is Rs 5,000. No penalty is applicable if the gross total income is below Rs 2.5 lakh.

- Updated ITR Section 139(8A): A tax return filed within 24 months from the end of the relevant assessment year is called Updated ITR

- No refund or Carry forward of Loss is not allowed

- Under section 140B an additional tax of 25% or 50% of the tax and interest due is levied, depending on whether the ITR-U is filed within 12 or 24 months from the end of the relevant assessment year.

- This was introduced in Budget 2022.

- Updated ITR, ITR U: What is it? How to file it? covers it in detail

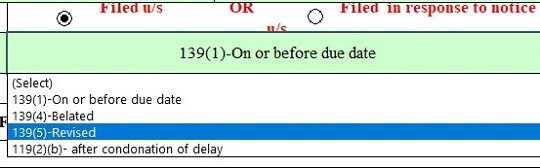

- Revised ITR under Section 139(5) If a person makes a mistake while filing the original ITR, then he has an option to correct the mistake through a revised ITR. For example, if a person forgets to disclose a bank account or interest from FD in the ITR, she can file a revised ITR to correct the mistake.

- According to income tax laws, the last date to file a revised ITR is December 31 – the same as a belated

- individual may have to pay the additional income tax and penal interest may be applicable on such tax paid

- There is no limit to the number of times a revised ITR can be filed. However, tax experts advise that one must not revise the ITR excessively as it can invite scrutiny from the income tax department.

- Condonation of Delay in Filing ITR Section 119(2)(b)

- has to be filed within 6 years from the end of the assessment year for which income tax return has to be filed.

- An individual can file condonation delay request by logging into his account on the Income Tax e-filing website.

- Missed Filing ITR: Check Tax Liability,File Condonation of Delay, covers it in detail.

Procedure for Filing Income Tax Return after the deadline: Belated Return

There is no difference in the filing of ITR before or after the deadline. The steps to file belated ITR are the same as how ITR is filed before the deadline. Calculation of income, the tax remains the same, but one has to pay a late fee, extra tax.

-

- Choose the assessment year for which you are filing the belated return. For e.g., if you are filing the return for FY 2018-19 select 2019-20 as assessment year.

- Select ITR form applicable to you and fill in the same manner. The correct form depends on your sources of income.

- For ITR1/ITR4 you can file online or you can Download the utility related to Assessment Year for which you are filing from income tax website. Our article How to fill ITR1 for Income from Salary,House Property,TDS explains the process with pictures.

- You also cannot carry forward any losses. Those who file by the due date can carry forward their capital losses up to eight financial years and adjust them against any future capital gains. For example, if someone suffered capital losses in 2013-14, these can be adjusted against gains made till 2021-22. However, this benefit is not available if the return is filed after the due date

- You need to file your income tax return under Section 139(4). Filing ITR under Section 139(1) is only meant for taxpayers who have adhered to the deadline. Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax explains the process of filing an income tax return in detail with pictures.

- Penalty for filing an income tax return after the due date under section 234F is available from FY 2017-18. The government has introduced a late fee of Rs 5000 if filed between last date and 31 Dec. And Rs 10,000 from 1 Jan to 31 Mar. If an individual’s gross total income does not exceed the basic exemption limit, then he/she will not be liable to pay late filing fees if he/she files belated ITR.

- If there are any taxes due which is unpaid, penal interest at 1% per month will be charged under section 234A, 234B and section 234C. If there is no tax due, you won’t be charged any extra amount.

- After the final submission, verify your ITR. Your ITR wouldn’t be considered valid until it is verified by you. Or send the ITR-V.

- The processing of your ITR will begin after the IT department receives your verified ITR. You will be notified about the status of your ITR via SMS on your registered mobile number and e-mail.

Why people miss filing their Income Tax Returns

In some cases, it is the unavoidable circumstances and in some cases, it is sheer laziness. Many think that My employer has already deducted tax on my salary income hence I don’t need to file my income tax returns!

Other than being your legal obligation Filing of income tax returns is important to have a three-year record of income tax returns for getting a loan from a bank, for getting Visa. It is proof of your financial life. Our article If You don’t file the Income Tax Return on time explains it in detail.

Financial Penalty on late filing of ITR

If an individual’s gross total income does not exceed the basic exemption limit, then he/she will not be liable to pay late filing fees if he/she files belated ITR.

If you have some tax due, apart from the late filing fee, you will also have to pay a monthly interest of 1% on your tax due till the month of payment.

Section 234F was introduced in the Income Tax Act from the AY 2018-19 which made income tax return filing mandatory. Before this was the sole discretion of the assessing officer to levy penalty if the individual failed to file his/her tax return before the end of the relevant assessment year.

For small taxpayers whose total income does not exceed Rs 5 lakh, the maximum late fee amount will not exceed Rs 1,000 irrespective of when it is filed, i.e., before March 31.

The late filing fee structure is as follows:

| Date of filing ITR FY 2021-22/AY 2022-23 | Amount (Rs) |

| After August 31 but on or before December 31 |

5000 |

| Between January 1 and Jun 30 | 10,000 |

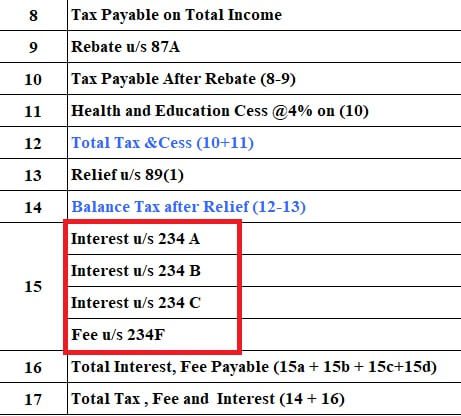

Interest while filing ITR under section 234A, 234B,234C

There are certain types of interests that a taxpayer has to pay for non-payment of taxes. The image and table below show the reason for the penalty and the section. Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time explains it in detail.

- Delay in the filing of Income Tax Return under section 234A

- Delayed Payment of Advanced Tax under section 234B

- Delayed Payment of Advanced Tax Instalment under section 234C

Calculation of interest under section 234A

Interest penalty for delay in filing an income tax return with tax due if any tax is due comes under Section 234A. As per the Income Tax Act, if you have any outstanding tax payable at the end of a Financial Year (FY), you must pay the balance tax amount and file your income tax returns by last date(July 31st) of the corresponding Assessment Year (AY). This is called Self Assessment Tax. Our article Self Assessment Tax, Pay Tax using Challan 280, Updating ITR explains it in detail.

If you file your returns after the due date, then under Section 234A you are liable to pay 1% simple interest per month on the balance tax payable, applicable from the month of August of the AY till the month in which return is filed. Note Section 234A penalty is not applicable if you don’t have any balance tax payable.

So, for example, if you have an outstanding tax payable of Rs. 8,000 and you did not file ITR by the due date of 31 Jul.

- you file your tax returns on 15 Oct, you will have to pay an interest penalty of 1% per month x 3 months on the balance tax amount of Rs. 8,000, i.e. Rs. 240.

- if you file your returns on 5 Jan, you will have to pay an interest penalty of 1% per month x 7 months on the balance tax amount of Rs. 8,000, i.e. Rs. 560.

But If you have outstanding tax payable more than Rs 10,000 in addition to interest under section 234A for filing late you would also have to pay interest under section 234B & 234C. This also applies if you file your income before the due date.

Calculation of interest under section 234B

At least 90% of the total tax payable must be paid by the end of the Financial Year (FY), i.e. March 31st. So if you have balance tax payable at the end of the FY, and the amount is more than 10% of your total tax liability, then you will have to pay interest under Section 234B , a simple interest penalty of 1% per month on the balance tax amount, applicable from April 1 of the Assessment Year (AY). For example, if you have an outstanding tax liability of Rs. 12,000 at the end of an FY and pay this amount on July of the AY, you will have to pay a penalty of 4% (1% p.m. x 4 months i.e .01 * 12000), i.e. Rs. 480.

NOTE: Section 234B penalty is not applicable if the outstanding tax liability is less than 10% of the total tax payable for the relevant FY.

Interest penalty for delay in periodic payment of tax under Section 234C

Section 234C mandates periodic payment of tax during the year, called as Advance Tax so that at least 90% of the total tax due is paid by the end of the Financial Year. As per this section:

- 15% of the total tax amount must be paid by June 15.

- 30% of the total tax amount must be paid by September 15th of the FY.

- If the tax paid by you by 15th September of the FY is less than 30% of total tax payable for the entire year, then under Section 234C you are liable to pay simple interest of 1% per month for 3 months (i.e. total 3%) on the shortfall below 30%.

- 60% by December 15th. If the tax paid by you by 15th December is less than 60% of total tax payable, again you need to pay 1% simple interest per month for 3 months on shortfall below 60%.

- 100% by March 15th of the FY. If the tax paid by you by 15th March of FY is less than 100% of total tax payable, the simple interest of 1% on outstanding amount needs to be paid.

So if your total tax liability for a given FY is Rs. 1,00,000, then at least Rs. 30,000 must be deposited by September 15th, Rs. 60,000 by December 15th and entire amount, i.e. Rs. 1,00,000, by March 15th. If you don’t then you need to pay penalty under section 234C. Our article Section 234A,234B,234C : Interest Penalty for not paying Expected IncomeTax on Time explains it in detail.

Last date for Filing Income Tax Returns

The last date for filing returns for an individual is usually 31 Jul of the assessment year but many times it gets extended.

If one missed the last date for filing returns, one can still file returns till 31st Mar of the Assessment year. So one can still file for returns for FY 2018-19 which is AY 2019-20 till 31st Mar 2020.

If you have received a notice from the I-T Department asking you to file your returns which go beyond 2 financial years, then you should prepare your return and submit it to the Income Tax Office in your ward. Usually, old returns are filed as a response to an income tax notice.

Related Articles:

- How to Revise Income Tax Return (ITR)

- After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1)

- E-filing : Excel File of Income Tax Return

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- Updated ITR, ITR U: What is it? How to file it?

- Missed Filing ITR: Check Tax Liability,File Condonation of Delay

You need to understand that filing IT returns is not just a legal necessity but also a must exercise for your big-ticket loan applications such as home loans or getting Visa. It is in your best interest to file your Income Tax Returns timely. It not only makes you a law-abiding citizen but also saves you from being penalised by the government. By when do you file an income tax return? Is the process of filing income tax return stressful?

I M BYMISTAKE NOT FILLED INCOME TAX RETURN A.Y.2017-18 MY TAXABLE INCOME TAX INCOME RS.547145 CAN I FILLED RETURN WHICH SECTION

Is there any way to file the return after 31st march 2018?

My father’s annual income is below 1 lakh and returns need to be file for some formalities?

Is it still possible to file the return for the AY 2016-17 & 2017-18

31st March 2018 was the deadline for all the belated tax return filers for the

AY 2016-17(FY 2015-16 for income earned between 1 Apr 2015- 31 Mar 2016)

AY 2017-18( FY 2016-17 for income earned between 1 Apr 2016 to 31 Mar 2017)

Sir,

I want to file my ITR for the AY (2016-17) now! means in March 2018. What is the option for A22 field in e filing.

If you are filing returns after deadline which is 31st Jul 2017, you need to fill in “After due date:139(4)”.

For more details check Filling Individual ITR Form: Fields A1 to A22

Can i fill the income tax returns for AY 2015-16 and get refund?

Sorry you can’t

31 Mar 2018 is last date to file ITR for following years

AY 2016-17(FY 2015-16 for income earned between 1 Apr 2015- 31 Mar 2016)

AY 2017-18( FY 2016-17 for income earned between 1 Apr 2016 to 31 Mar 2017)

Sir ,can I File ITR of 1 April 2015 to 31March 2016,,and please explain under wich section..I can do that..

Thanks..

Have you received notice from the Income Tax department?

Even otherwise Yes you can file ITR for FY 2015-16 ie from 1 Apr 2015 to 31 Mar 2016 till 31 Mar 2018.

If your income is over Rs 2.5 lakh, then it is compulsory for you to file your income tax return in India. However, in one financial year you can file your income tax returns for the previous two financial years only.

For example, “in the FY 2017-18, up till 31st March 2018, you can file return for the previous two financial years – 2016-17 and 2015-16.

However, this process will change when you file your returns in the FY2018-19 as you will be allowed to file returns for FY 2017-18 only and not any other previous year

delayed filing has its own drawbacks:

# Penal interest may be applicable under section 234A, 234B and 234C.

# Delayed returns cannot be revised. (From FY 2016-17, belated return can also be revised).

# You will not be allowed to carry forward some losses that belong to the years for which returns were not filed.

There is no difference in the filing procedure before or after the deadline. The steps to file belated ITR are same as how ITR is filed before the deadline. Calculation of income , tax remains the same.

Choose the assessment year for which you are filing the belated return. For e.g. if you are filing the return for FY 2016-17 select 2017-18 as assessment year.

Select ITR form applicable to you and fill in the same manner. The correct form depends on your sources of income.

You need to file your income tax return under Section 139(4) instead of Section 139(1). Filing ITR under Section 139(1) is only meant for taxpayers who have adhered to the deadline. Our article Fill Excel ITR1 Form : Income, TDS, Advance Tax explains the process of filing income tax return in detail with pictures.

if there is no tax due, you won’t be charged any extra amount. If there are any taxes which is unpaid, penal interest at 1% per month will be charged under section 234A and section 234B.

There is no penalty or fine for filing ITR late. Penalty for filing income tax return after due date is only applicable from FY 2017-18. The government has introduced a maximum late fee of Rs 10,000 for delayed filing of income tax return by individuals. However, this fee is applicable with effect from April 1, 2018 and will not apply for returns filed for FY2016-17 or FY 2015-16

After the final submission, verify your ITR. Your ITR wouldn’t be considered valid until it is verified by you. Or send the ITR-V.

Hi, if ITR is not filled for FY 2014-15. Is there any rule that till notice does not come organisation cannot file.

Hi, till may’13 2016 i have worked in another company and then i have joined in new company on may’25 2016. I have e-filed for 2015-16 in June 2017. While e-Filing, i have used only my current employer Form16 and forgot to add previous employer Form16. So i have received intimation u/s 143(1)(a) from IT Department in July . Then i have e- filed again by adding two Form16 documents in August and paid the tax due Rs.5,700. but, i didn’t submit response to “intimation 143(1)(a) proceeding” . Will they take any action as i didn’t submit the response for the intimation and also want to confirm whether it will affect VISA processing .

Please submit the response to eProceedings that you agree to additions.

As this eProceedings etc is new one is not sure how Income tax department will proceed.

No it should not affect your Visa processing. Visa processing just asks for ITRS processed/submitted.

Sir,

I am a civil contractor and have a receipt of Rs.2747041/-for the financial year 2014-2015.

I have not filed income tax return for the financial year 2014-2015, because work was very loss.and closed my business immediately.

I have received a notice from department to file compliance. While checking through website, it is noticed that Rs.10,00,000/-cash transaction was done through my bank account. Rs.10,00,000 was spent for wages and materials purchase related for my work. What will I choose under the tab “related information summary ” while compliance filing. Expect your early reply in this matter.

Thanking you

Jose thomas

Business professional are always busy in their office work and didn’t get time to file their return or sometimes forget to file their return so they can also file their ITR through Belated Online it return filing option. A Nice article having lots of information regarding income tax filing.

Thanks

Hi

I watched your blog to be especially illuminating. I am on a particularly essential level empowered by your posts and considering shaping mine now. A dedication of appreciation is all together to be an inspiration to me as I was other than attempting to make makes however was not getting the fitting class.

BANk has deducted TDS on my fd in financial year 2011-12 . But i am unable to file ITR because of late form 16 given by bank.Can i submit my ITR now for refund of TDS. If possible please explain how I take my refund?

The due date for filing the ITR is over. You can’t file returns now.

Yes, you can file return and get refund now also.

Yes, u can file now also and can get refund too, but last date is 31st, Mar, 2018.

U can contact me, i will help out.

Sir I have filed ITR 2 for AY 2016-17 on 23/12/16 and claimed refund of wrong TDS by bank on FD for 2015-16 FY as my total income is below 2.5 lacs. I have also claimed TDS refund for 2013-14, 2014-15 FY in this ITR. Will I get refund. And will AO impose Rs. 5000/- penalty for late filing ITR. I have zero outstanding tax.

I have been unable to pay advance tax for the financial year 15-16. Its around Rs 25000. Only Rs 3000 have been deposited as TDS. What penalty I will have to pay If I submit my return within December 2016.?? ,please help..

you have to pay total amount with an interest of rupees 1100 ,so you have to pay an tax of rupees 23100

hi..i have some query..if you could pld help.

i have filed my return late u/s 139 (4), some time after filing it i received an intimation u/s 143(1) calling for tax payable. The officer calls for tax payable from the error apparent on the filing. The amount entered under head Salary is wrong and thus taxes are shown payable. Since the original filing was made late u/s 139 (4) how can i rectify the amount that was erroneously punched under the salaries head.

Thanks in advance

solution for filing of revised i.t. return , original was filed after due date, other source of income not considered in original i.t. rtn

i have filed original return after due date under section 139(4) after two days filed revised return due to omission in first return. the officer has process original return and raise the demand and he has not consider revised return.i have submit application under section 154 to rectify the

mistake and drop demand . the officer neither rectify the demand nor reject the application.and state your revised return have valid bacuse not sunmit

in time . so pl whAT SOLUTION FOR THE MATTER .

Hello. What if the deadline for belated return is over too? Is there any option for me to still file IT return.i want to file return for the Assessment year 2014-15..any option? TDS has already been deducted.no tax liability. But I need tje ITR for banking purpose.what to do?

We are experienced CAs in filing returns with 100% Accuracy & for any assistance in taking financial decisions, contact us @ arknco@outlook.com

HI,

I fail to file my ITR for the AY 2014 to 2015. Is it possible to file for return now? If possible what is the procedure and how much it cost for to get my ITR. I have payed tax of 48,000 that year. I consulted an Auditor and he says that to file belated return i have to spend nearly 8,000, is that true?.Please help!

We are experienced CAs in filing returns with 100% Accuracy & for any assistance in taking financial decisions, contact us @ arknco@outlook.com

No..He is saying wrong..

When I tried to file ITR of Assesment Year 2015-16 then system reply as The Due date for filing this ITR is over. When we submit as 139(4). How can we submit my ITR.

You can file your IT return before 31st March 2017.

To file IT returns with 100% accuracy by experienced CAs & in a safe and secure manner, contact us @ kattashome@gmail.com

Sir, i am college teacher and i have received form 16 from my employer but i have forgotten to inform about ppf of rs 40000 as a result deduction u/s80c was not claimed by me and my tax liability is 12000 which was already paid. I have not filled tax return till now. So my question is that can i claim deduction of ppf in belated return( but ppf amount 40000 is not mention in form 16).if yes then am i able to claim refund.. There is no item in 80c other than ppf

You can claim PPF amount and file your Income Tax return after claiming the deduction u/s 80C.

Sir I have my efiling before one month ago it also processing the refund amount also received . but the filing was wrong and I want to that may I again efiling correctly

To file IT returns with 100% accuracy by experienced CAs & in a safe and secure manner, contact us @ kattashome@gmail.com

Sir I have filed my IT for ASSESSMENT YEAR 2015-2016 today 17.09.2016 (delayed) but I have got my ITR-V receipt or acknowledgement mentioned as assessment year 2016-17. Is it OK or do I have to correct it

Please verify which ITR form did you fill. ITR-V should show the Assessment Year for the year you filed in.

For income earned between 1 Apr 2015-31 Mar 2016 you need to file ITR for AY 2016-17 or FYY 2015-16

For income earned between 1 Apr 2014-31 Mar 2015 you need to file ITR for AY 2015-16 or FY 2014-15

To file IT returns with 100% accuracy by experienced CAs & in a safe and secure manner, for any queries regarding IT returns filing, contact us @ kattashome@gmail.com

Sir,

I RECEIVED LIMITED SCRUTINY NOTICE FROM IT DEPT. U/S 143(2) SEEKING DETAILS REGARDING MY DERIVATIVE TRANSACTIONS FOR ITR-2 FILED FOR AY2015-16.CAN I FILE REVISED RETURNS UNDER ITR-4 NOW ? PLEASE CLARIFY

scrutiny for derivative (futures) transaction.

The income tax department wants the taxpayer who has received this notice to furnish evidence regarding their transactions in the derivatives market. If you receive this notice, you should reply to it. A taxpayer should never ignore a notice from the tax department.

When you get a notice under Section 143(2), it means that your income tax return has been selected for detailed scrutiny by your assessing officer. The officer can serve this notice up to 6 months after completion of the assessment year to which it pertains. The assessing officer may ask you to provide books of accounts of your trading activity such as trading statements and bank account details.

The next steps for the taxpayer would be to get in touch with their assessing officer and submit the evidence that has been sought. Not doing so will result in another notice from the department. Taxpayers in the cities of Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkatta and Mumbai can have an email-based communication with the assessing officer if they want.

Sir,

But can I revise the returns after receiving notice u/s 143(2)and later submit the details sought by Assessing officer?

Yes u can revise it if it within time limit as assesment is not completed bt in that case practically it would be a problem as it will arouse more suspicion in the mind of assesing officer and instead of limit scrutiny he may do complete scrutiny of your case. So do revise bt by taking extreme care and giving logical reasoning behind doing the same.

See, what rule of revision of return states is, if after filing of original return if assessee finds that he has committed some mistakes , then he can revise return u/s139(5) of the act.

But, here one thing you must keep in mind that revised return can only be filed before

Expiry of one year from relevant assessment year OR

Completion of assessment by A.O which is earlier

I don’t know for which period you are talking about but if your ccase fits in above mentioned condition then YES you can revised return even if you have received notice u/s 143(2).

Sir, I have done ITR filing after due date and submitted the return file with some tax(below 10k) being payable,thinking that site will take through e-pay tax page after submission. Subsequently I get to know that’s wrong procedure. Later I paid the due through NEFT. Now, please let me know what is the procedure to complete return filing.

Also I would like to know the min time for self assessment tax paid to be updated in 26AS.

NEft means u have paid through challan 280 no? U need to revise the return otherwise it will be considered as defective by adding the challan details in tax paid section.

i filled ay-2014-15 in august 16 2016, after received the itr-v in itd, the system transfer it to ito.. have in problem. i had tds deducted in the said year

i filled ay-2014-15 in august 16 2016, after received the itr-v in itd, the system transfer it to AO.. have in problem. i had tds deducted in the said year

how u have filed the 2013-14 return after the 31.03.2016

Dear sir

I traded shares & got total loss of 70000/-. & My total traded turn over in d mat a/c was one crore.i am an employee and paid tax correctly. But my auditor made delay in return filing because he want to show the loss incurred during trading of share. If I file within 31 St aug 2016 how much will be the penalty kindly guide me

I am a dependant and my personal income is from bank FDs which is below taxable limit. But previous year (on 2 apr 2015) my bank deducted tax and it has not been refunded. I want to file tax return. But I got to know that deadline was 5th Aug 2016. For A22 column should I 139(1) or 139(4)? Will I be refunded in full for the deducted amount or is there any penalty for filing return after due date?

Go ahead and file ITR u/s 139(4) i.e. After due date. The law states it may levy penalty so it is not necessary that u will be penalised . Secondly do fill bank details properly in ITR as u would be getting refund direct in that account. In case in query in filling ITR refer article on bemoneyware for filling ITR or else contact me @ ca.ehjaz@gmail.com with your specific query.

sir,

I filed my ITR-2 showing losses of 50000 in STCG schedule before Due date. But, i want to file revise returns (after due date) under ITR-4, where total losses works out to be 90000 due to the involvement of additional expense. Will my carry-forward losses be only 50000 or 90000 as per revised returns

See filing & revising of ITR from ITR-1/ ITR-2 to ITR-4 does not affect carry forward of loss category subject to you shuld have filed original return in time prescribed u/s 139..

Here You have filed original return in time, so you are eligible to claim and carry forward loss as per revised return.

Since here as per you revised return Loss worked out as 90000/- , which you can carried forward to next year .

I’m Filed ITR-4 2016-17 Assessment year Today (17.08.2016) ordinary return i want to revised the return there is any possibilities.

No you cannot revise your return as you filed it after due date

Wht exactly u want to revise in itr?

can somebody help:

1. i got 4 months income as salary and 5 months income from profession in 2015-16. which form should i use.

2. earlier i was easily filling up form 1 online for salary only. now form 4 is too tough and i am confused also.

3. further deductor has not paid tds for 3 payments. what should i do.

Surely itr-4 is tough in. 1st look u need to file the same in your case. If you Need help mail me or contact me. I will help u out. And for tds part what exactly u meant to say?

I am a govt employee. I have recieved my salary from sept 2015 to march 2016 in april 2016. My salaried income is nearlt 4 lakh.i have also invested 1.5 lakh in p.p.f. my employer had not deducted tds on salary. He is now refusing to mention this income in form 16 as he thinks that salary is recieved after 31 march. Now i have to file return..what shoul i do?

Itr fill FY 2014- 15 KO KESE FILE KARE USME TDS RETURN HE

sir u can file ofline return @ income tax office near u. u have to take itr wth an application in which reasion is return why u dint life the itr.

Hi, When it comes to ITR, I turn to Tax2Win. I suggest you to use it and help make your ITR hassle free. They also have CA assistance at affordable prices.

Sir can i file income tax return ay 13-14 & ay 14-15 tds in that year 15000 and 12000 when yes how to file plz provide procuder

sir u have to file ofline return, download return n submit to your near incomeoffice tax , with an aplication mentioning reasion of not filling itr.

Hi sir, I’m a retired employee, age 66. I get pension of about 1200/- only and I receive money from my son and my wife.

Recently I got letter from Income tax officer saying I did not file return for AY 2014-2015 and to submit compliance response online.

I need help, I want to know if the money I receive from my son and wife will be taxable or not, under what section should I keep this (other income or exempt income)? I’m worried about this I am also thinking about filing return for AY 2014-2015 what should I do next.

Surely there must be any FD Interest income or so in your case so you received notice share me at ca.ehjaz@gmail.com i will help you out.

The Income Tax department is sending this letter to people who have not e-Filed or have not disclosed all incomes according to their records. So it wants to ask why have you not filed your return or explain the discrepancy between your earnings and spendings, or ask you to explain your sources of income. Note that ITR is a way to legitimise your financial standing and maintain a healthy financial transaction. Our article Compliance Income Tax Return Filing Notice explains it in detail

CAN i file nil Income tax return for F.y. 2014-15 after March – 2016 without Penalty

It is said that Income tax officer may levy penalty , and this happens in very rare to rare cases, (as of now i didn’t come across in any such case) , Moreover u don’t have to pay penalty while filling return , it will or may be levied by officer after scrutinising your return which happens in rare cases and in your case as your return is nil u no need to worry on that part so go ahead and file the ITR!!

Hello Team,

First of all, thanks for sharing the valuable information. It is quite helpful.

I missed sending signed copy of ITRV against ITR for AY 14-15. Now because 120 days have lapsed, my ITR is invalid. During the entire financial year 13-14 I was outside India, thus no taxable salary, Nil balance. But still I have to have a valid ITR processed.

What should I do? AS I understand even belated date for ITR AY14 has been passed. Please advise.

Thanks,

Vaibhav

Once the Due date of sending ITR V is passed,or missed out then filed return will be treated as if its not filed. and you have to file a fresh.

Now you have Two option.

1) Validate your return with Options Provided for e validating your return. ( There might be chances that it may accepted or else you will get intimation for filing a fresh unless officer condones delay as some officers are more lenient with this particular rule, and some officers follow this very strictly.

2) You can approach your assessing officer with manual ITR of same period . Unless officer condones delay you cant file return manually, but you can approach them as I said , some officers are more lenient with this particular rule, and some officers follow this very strictly.

Mine is a Partnership firm, for the AY 2014-2015 the return of income to be filled want electronically ie Online.

I have filled manual return before the due date ? ITO says that we have to file online.

what is the remedy & consequences for the same, Pls Advice ?

Sir you have to file your ITR online.

I am now unable to file my ITR for fy 2013-14. What is the best possible way to get ITR return filled now and get ITR acknowledgement???? Pls suggest…

Electronic Filing is not possible as 31 Mar 2016 is over. So now its time barred.

But you can file under section 119(2)

CBDT has issued circular where procedure has been laid down for condoning which means pardoning or forgiving such delays and how to get these processed. Below are the details of this circular which now supersede all earlier circulars in this regard. (this is covered under section 119(2)(b) of the income tax act).

Authority for accepting/rejecting applications

Where the claims do not exceed Rs 10lakhs The Principal Commissioners of Income tax/ Commissioners of Income tax (Pr.CsIT/CsIT)

Where the claims are more than Rs 10lakhs but do not exceed Rs 50lakhs The Principal Chief Commissioners of tax/Chief Commissioners of Income tax (Pr.CsIT/CsIT)

Where the claims exceed Rs 50lakhs CBDT

CBDT has the power to examine any grievance arising out of an order passed or not passed by the authorities mentioned above and issue suitable directions to them for proper implementation of this Circular. However, no review of or appeal against the orders of the authorities listed above will be entertained by the Board.

01. Write as Application u/s 119 (2) (b) of the IT Act giving the reason for delayed in filing return and then file your return.

02. Enclosed Evidence in supporting of your Claim.

03. Enclose Evidence of TDS.

04. Clearly state the Computation of your Income & Tax for the year.

Once the CIT or CCIT or CBDT makes an order condoning the delay u/s 119 (2) (b) of I T Act. , AO will give refund.

Hi,

AY2014-15 ITR 4 return was invalid under 139(9) section.

I won’t want to carry forward losses. I want to upload ITR-1 with interest.

Online won’t allow me to upload return.

How can apply return for AY2014-15.

Thanks,

Venky

You can rectify online

One of my client is in receipt of a notice from the Income Tax Department u/s 148 for the A.Y. 2009-10. Can I e-file return in response to notice u/s 148. Can you please guide me What procedure (step by step) I have to follow for assessment ? Thanks in advance

when a notice u/s 148 is received the assessee is asked to file a return of the relevant assessment year. After filling the return the assessee should ask for the copy of reasons recorded for issue of notice u/s 148 and can file objection to the issuance of notice. The assessee should ask specifically assessing officer to pass a speaking order by disposing off the objections giving reference of the Judgment of Honorable Supreme Court in GKN Driveshafts (India) Ltd vs ITO (2003) 259 ITR 19 (SC). The objections should be filled giving reasons for challenging the legality of the notice u/s 148. All this procedure has been laid down by the Honorable Supreme court in GKN Driveshafts (India) Ltd case. This procedure has been provided by the Honorable Supreme court to enable the assessee to file writ petition before the respective High court challenging the legality of the notice u/s 148 before the assessment is completed.

how can i fill income tax return for A.Y.2014-15 & which sec…….its nil return

U can’t file nil return as of now for the year 2013-14

Sir, How do I file AY 2014-15 ITR that got closed even for belated returns on Mar 2016/ I got a letter from the IT Dept, and worried about the consequences.

Thanks

Send me the notice u recd from IT at ca.ehjaz@gmail.com i will help u out

Hi I file the e return before 31st March 2016 for fy 14-15 /ay 13-14.

But I forgot to send the printout to the IT Dept before 120days.

What will be the cosequnces I need to face?????

Dnt worry send it now or else check it out whether there is option online to everify it

Dear Sir,

Can I filed itr form 4 with nil tax for ay 2015-16 without any penalty.

or there is penalty of Rs.5000/- if I file in April 2016

Don’t worry as per income tax it is said that assessing officer “may levy” penalty in case of late filling of ITR and this happens in very rare to rare cases. So no need to worry file ITR for A.Y. 15-16

Hello sir,

Can i file incometax return for financial year13-14.if i am receiving notification letter now(after 31march16).after filing,still i need to give penalty for 13-14? Please advice

Which type of notification letter u received from dept? Share it with me on ca.ehjaz@gmail.com i will help u out

I wish to file earlier years returns like AY 13-14, 14-15 without any tax nor any penalty. pls suggest the section under Art.21 for return file.

Not possible as of now. Better u file for A.Y. 15-16 & 16-17. It is possible only in case if u have tds deducted for that year

Hello Sir,

TDS is deducted by department, in which sec i have to file return for tds refund…. plz suggest me….

Please go through our article Income Tax Refund: How to claim Refund,Check Status on how to claim Refund

Can we file it return u/s. 44AD FY 2013-14 (AY 2014-15) after 31-03-2016?

If u have your tds deducted for that year than file return u/s 119(2)(b) physically with department and there is no other route for this. Better now file for ay 15-16 & 16-17

Respected sir

how can i fill income tax return for A.Y.2014-15 & which sec

U can file it now u/s 119(2)(b)by filling application of con donation OF DELAY to ITO

hi ,

I have filed my ITR 1 for AY 2015-16 ON 31-MAR-2016 NIGHT and till the time I processed it time moved to 01 apr-16 (past 00:00 hrs) ,hence date says 01-apr-16 but the acknowledgement date which is put of 31-mar-16. could you pls confirm if this would attrach any penalty?

note- my ITR shows refundable amt.

regards,

shashi

There is penalty when tax is payable in case of refund no penalty

Dear Sir/Madam, I just want to know that can i file my ITR for AY 215-16 till 31.3.2017 with nil tax

Yes u can

your article is in error regarding section 234A interest. Up until 1/march 2015/ the act requires that self assessment tax paid after 31 march shall attract section 234A interest if IT.returns are filed after 31 july.

However, yours truly escalated this matter to CBDT/TPL/CPC for revision of tax laws such that this flaw in the law gets rectified. After a protracted struggle, i am happy to report that CBDT issued a circular based on Supreme court order in Prannoy Roy case which has now authorized CPC to rectify the software program such that section 234A interest will not be applicable for self assessment tax payments prior to 31 july.

very nice article. Very useful too. Keep sharing necessary information like this please. While surfing, i escorted a website named finmart.com which provides online IT Return filing and advisory services.

very nice article. Very useful too. Keep sharing necessary information like this please. While surfing, i escorted a website named finmart.com which provides online IT Return filing and advisory services.

Awesome blog.thanks thanks to kind information.keep sharing like this.

Awesome blog.thanks thanks to kind information.keep sharing like this.

hey love the post ! and great articles and congrates on reaching the top sites,………….i will be back visit to often.

hey love the post ! and great articles and congrates on reaching the top sites,………….i will be back visit to often.