You got a 10 lakh package and you calculated your salary as 10,00,000 divided by 12 is 83,333.33, but you got somewhere around 64,000 in your account. Where did the rest go? For most people, it is plain confusion especially when one gets a new job. And Salary structure varies from one company to another. Cost to Company, Salary, Net Salary, Gross Salary, are these same or different. Cost To Company is the total amount of money the company spends on you in a year. In this article, we cover what makes the salary? What is the difference between Cost to Company, Salary, Net Salary, Gross Salary?

Basic Salary = Fixed part of one’s compensation structure. Usually 35-45% of total salary. (As per New wage Code, it would be 50%)

Gross Salary = Basic Salary + Dearness allowance(optional) + Other Allowances(HRA,LTA) + Perquisite(Gift Voucher, Stock options)

Net Salary = Gross Salary – Deductions(TDS, Professional Tax)

CTC = Net Salary + Direct Benefits(EPF, Gratuity, Leave Encashment, Corporate NPS) + Indirect Benefits(Laptop, Coffee,Office Rent)

Table of Contents

CTC of Company, Basic Salary, Gross Salary

The excitement of getting the first job is punctured on getting the first pay. It is usually less than what the fresher employee expected. Usually, in the campus interviews company advertise their Cost to Company (or CTC) and people mistake their salary to be based on that (CTC/12). Educated but have No Financial Education is about the confusions of a new employee. Different types of salary and what they mean are given below.

- Basic Salary: As the name suggests, this forms the very basis of salary. This is the core of salary, and many other components, ex HRA, are calculated based on this amount. It usually depends on one’s grade within the company’s salary structure. It is a fixed part of one’s compensation structure. Many allowances and deductions are described in terms of percentage of the Basic Salary. For example, Your PF is deducted at 12% of your Basic Salary. HRA is also defined as a percentage of this Basic Salary.

- Gross Salary: is the amount of salary paid after adding all benefits and allowances and before deducting any tax.

- Net Salary is what is left of your salary after deductions have been made.

- Take Home Salary: Is usually the Net Salary unless there are some personal deductions like loan or bond re-payments.

- Cost to Company: Companies use the term “Cost to Company” to calculate the total cost to employ i.e. all the costs associated with an employment contract. Major part of CTC comprises compulsory deductibles. These include deductions for provident fund, medical insurance etc. They form a part of your compensation structure but you not get them as a part of the in-hand salary. As such, although it increases your CTC, it does not increment your net salary.

- Direct Benefits refer to amount paid to the employee monthly by the employer which forms part of his/her take home or net salary and is subject to government taxes.

- Indirect Benefits refer to the benefits that employees enjoy without paying for them. The company pays them on behalf of the employee but adds these expenses to the employee’s CTC as it is an expense from the company’s point of view.

- Savings contribution refers to the monetary value added to the employee’s CTC example EPF, Gratuity

Let’s see an example explaining the salary. An arbitrary salary breaks up is given below.

Note: salary structure varies from one company to another

| Description | Component of Salary(per annum or p.a) | Amount |

| Basic Salary | Basic Salary | 480,000 |

| Allowances | Dearness Allowance | 48,000 |

| House Rent Allowance | 96,000 | |

| Standard Deduction | 50,000 | |

| Gross Salary | 6,74,000 | |

| Benefits

vary from company to company |

Medical insurance | 2000 |

| Provident Fund (12% of Basic) | 57,600 (12% of 4,80,000) | |

| Laptop | 50,000 | |

| Total Benefits | 109600 | |

| Cost to Company | Cost to Company=Gross Salary + Benefits | 6,74,000 + 109600=7,83,600 |

How do people earn money?

The three broad ways in which people earn money are as follows:

- Working for someone else or Employee,

- Working for themselves or Self Employed,

- and running a business.

Salary

As explained earlier Money that is received under Employer-Employee relationship is called as Salary . If one is freelancer or are hired by an organization on contract basis, their income would not be treated as salary income.( In such case your income would be treated as income from business and profession).

Did you know that word salary has come from Latin salrium based on salrius which means pertaining to salt. The word appeared in 1350-1400. In those days, salt , regular ordinary table salt, was a prized and valuable commodity. It was money given to Roman soldiers to buy salt. The phrases the salt of the earth or worth your salt refer to the high value of salt.

The salary consists of following parts.

Basic Salary: As the name suggests, this forms the very basis of salary. This is the core of salary, and many other components may be calculated based on this amount. It usually depends on one’s grade within the company’s salary structure.It is a fixed part of one’s compensation structure. The basic salary differs according to the type of the industry. For instance, employees in the information technology industry get more take-home salary while employees in the manufacturing companies get more fringe benefits. Within a company, Basic Salary generally depends on her or her designation. Any increment in the salary is expressed as percentage of Basic salary.

Allowance: It is the amount received by an individual paid by his/her employer in addition to salary to meet some service requirements such as Dearness Allowance(DA), House Rent Allowance (HRA), Leave Travel Assistance(LTA) , Lunch Allowance, Conveyance Allowance , Children’s Education Allowance, City compensatory Allowance etc. Allowance can be fully taxable, partly or non taxable.

Perquisite: Is any benefit or amenity granted or provided free of cost or at concessional rate such as Rent free unfurnished house, Rent free furnished house, Motor car facility, Reimbursement of Gas, Electricity & Water, Club facility, Domestic Servant Facility, Interest Subsidy on Loan , Reimbursement of medical bills, Reimbursement of Hospital bills, Reimbursement of telephone bills, Benefits derived by employee stock option, and so on.

How are perquisites taxed?

Since these are non-cash components, they cannot be taxed directly. So the income tax laws attach a certain value to each of these components and charges a tax on them. The calculation of this value varies from category to category. Nevertheless, the thumb rule across all categories is that only those benefits that you use for personal purpose will be considered as perquisites.

Deductions: Two types of deduction are made from the salary

- Compulsory deductions such as Provident Fund, Income tax, Professional Tax (where applicable) .

- Optional deduction such as recovery for advance or loan if taken, voluntary contribution to P.F, etc

Provident Fund Contribution

What is CTC?

- Salary received each month

- Retirement benefits such as PF and Gratuity

- Non-monetary benefits such as an office cab service, medical insurance paid for by the company, or free meals at the office, a phone provided to you and bills reimbursed by your company.

CTC = Direct Benefits + Indirect Benefits + Savings Contributions

| DIRECT BENEFITS | INDIRECT BENEFITS | SAVINGS CONTRIBUTION |

| Basic Salary | Interest free loans | Employer Provident Fund (EPF) |

| Dearness Allowance (DA) | Food Coupons/Subsidized meals | Gratuity |

| House Rent Allowance (HRA) | Company Leased Accommodation | Superannuation benefits |

| Leave Travel Allowance (LTA) | Medical and Life Insurance premiums paid by employer | |

| Special Allowance/ City Compensatory allowance, etc. | Income Tax Savings | |

| Vehicle Allowance | Office Space Rent | |

| Telephone/ Mobile Phone Allowance | ||

| Incentives or bonuses | ||

| Standard Deductions | ||

How to calculate Pay? How to calculate Take Home Salary?

With different types of salary questions that a new employee comes up with are How to calculate Pay? How to calculate Take Home Salary? What is Basic Salary Calculation in India? How is HRA calculated in salary?

Basic is either 50% or 60% of the Gross salary and depends if you want to escape from PF liability.. and rest of the entitlements are calculated accordingly..

Your Take-home salary will include

- Gross Salary received each month

- minus allowable exemptions such as HRA, LTA, conveyance allowance etc.

- minus income taxes payable (calculated after considering Section 80 deductions)

Your Cost to Company (CTC) includes

- Salary received each month

- Retirement benefits such as PF and Gratuity

- Non-monetary benefits such as an office cab service, medical insurance paid for by the company, or free meals at the office, a phone provided to you and bills reimbursed by your company.

What are allowances? What does your Allowance include?

Allowance is defined as a fixed quantity of money or other substance given regularly in addition to salary for meeting specific requirements of the employees. Some allowances are taxable, some are partially taxable and some are tax free. There are various Kinds of Allowances that one can get under the Head Salary. Some popular Allowances are

- House Rent Allowance or HRA : The allowance is for expenses related to rented accommodation. Salaried individuals who live in a rented house/apartment can claim House Rent Allowance or HRA to lower taxes. This can be partially or completely exempt from taxes. Our article HRA Exemption,Calculation,Tax and Income Tax Return explains how HRA is calculated in salary in detail.

- Conveyance allowance is given to employees to meet travel expenses from residence to work. The conveyance allowance for up to Rs.9,600 per annum is exempt from tax. Starting FY 2015-16, this limit has been increased to Rs.19,200 per annum.

- Leave Travel Allowance: Salaried employees can avail exemption for a trip within India under Leave Travel Allowance. The exemption is only for shortest distance on a trip. This allowance can only be claimed for a trip taken with your spouse, children and parents, but not with other relatives.

- Income Tax webpage talks of the Allowances available to different categories of Tax Payers, what are the exemptions available on Allowances, under which section of Income Tax Act.

Benefits would also vary from company to company. In some Laptop may not be provided. In some cost of cubicle would be added. For example: If rent of office space is Rs 200 per sq ft and then a cubicle of 6 feet by 8 feet (i.e48 square feet) would cost Rs. 9,600 per month, or Rs. 1,15,200 per year. Which can be added to your CTC. Please note CTC varies from company to company. One can read Cost To Company or CTC salary: Understanding and Calculation for more details.

How tax affect the various components of salary

| Component of Salary(per annum or p.a) | Amount | Tax | Taxable Amount |

| Basic Salary | 480,000 | Full amount is taxable | 480,000 |

| Dearness Allowance | 48,000 | Depends on company policy. Mostly fully taxable. | 48,000 |

| House Rent Allowance | 96,000 | Applicable if living in a rented house. Minimum of three amounts (Note:Calculation shown below) | 52,800 |

| Entertainment Allowance | 12,000 | Depends on company policy. Mostly fully taxable. | 12,000 |

| Overtime Allowance | 12,000 | Fully taxable | 12,000 |

| Gross Salary | 6,75,000 | Gross Taxable Salary | 6,07,200 |

HRA Calculation

As explained in HRA Exemption,Calculation,Tax and Income Tax Return , the minimum of the three amounts will be exempt from tax:

a. Actual HRA allowance in the salary package, that is Rs 96,000

OR

b. HRA received less 10 per cent of salary and DA, that is 43,200 (96,000 – 10% of 528,000)

OR

c. If you live in metropolitan (Delhi, Chennai, Bombay and Calcutta), 50 per cent of salary and DA However, if you live in any other city, it is 40 per cent of salary + DA. So, in this case it would be Rs 2,11,200 (40% of 528,000)

So HRA will be minimum of ( 96,000; 43,200; 2,11,200) which is 43,200 which will be exempted.

So the portion that will be taxed in this example is = 96,000 – 43,200 = 52,800

Tax

As Gross Taxable Salary 6,07,200 falls in the highest tax bracket. This tax amount includes education cess too. Assumption: Employee does not make any tax saving investment. Tax based on Assement Year 2011-2012 : 57,103. For tax estimator Tax Calculator is is very helpful.

| Tax | 57,103 |

| Employee PF contribution(12% of Basic) | 57,600 |

| Professional Tax | 2400 |

| Total Deductions | 1,17,103 |

| Net Salary = Gross Taxable Salary – Tax | =6,07,200- 1,17,103=4,90,097 |

| Net Monthly Salary | =490097/12=40,841.41 |

Can Take Home salary be increased?

Yes it is possible and that too legally. An employee can plan taxes and increase the take home. If employee invests Rs 1, lakh in tax saving instruments, Section 80C such as PPF, Equity Linked Saving Scheme(ELSS) etc he can save taxes. So now employee in above example will be taxed on 6,07,200- 1,00,00 = 5,07,200.

| Amount to be taxed | 5,07,200 |

| Tax | 33,413 |

| Employee PF contribution(12% of Basic) | 57,600 |

| Professional Tax | 2400 |

| Total Deductions | 93,413 |

| Net Salary = Gross Taxable Salary – Tax | =6,07,200- 93,413=5,13,787 |

| Net Monthly Salary | =513787/12=42,815.58 |

Proof of Salary being paid: PaySlip, Form 16

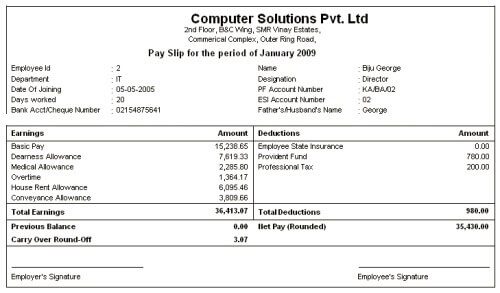

PaySlip

A paycheck is a document/record issued by an employer to an employee which shows how much money an employee have earned and how much tax or insurance etc. has been deducted. .It will typically detail the gross income and all taxes and any other deductions such as retirement plan or pension contributions, insurances, garnishments, or charitable contributions taken out of the gross amount to arrive at the final net amount of the pay. One can read format of payslip or see a sample in the image below.

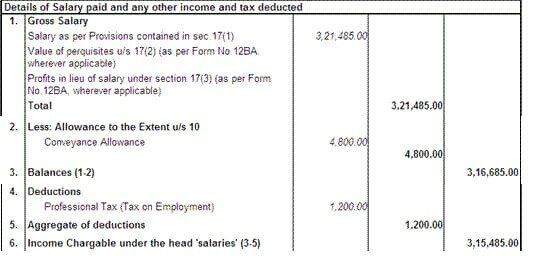

Form 16

If you are salaried employee in an organization, then you get the salary after deducting tax by the employer. This process is called as Tax Deduction at Source (TDS). Company must issue a Form 16 which contains the details about the salary earned by that employee and how much tax deducted. The Tax deducted is paid to the government by the company. Form 16 is the proof of employee’s income and tax paid to the govt. It is issued under section 203 of Income Tax Act for Tax. The tax payer has to use the Form 16 to file the Income Tax return every financial year. One can read e Understanding Form 16: Part I and Understanding Form 16: Chapter VI-A Deductions, Understanding Form 16: Tax on income

Video on What is the difference between CTC and Net Salary?

Are you overwhelmed by the complicated terms in your offer letter? What is CTC? What is gross salary? Which of these would be finally credited to my bank account? Watch this video to know all about CTC, Gross Salary and your in-hand or net salary.

Hope we are able to explain the difference between Salary, Net Salary, Gross Salary, Cost to Company. Did you find the information useful? If you find some information missing or incorrect please let us know.

Dear sir,

i m Akash deep. i m work in a transport company one year.i need a salary slip but no provide salary slip from my transport’s owner .that is please provide me salary salip formate

please help

Thank you for sharing this meaning full blog with us, It is very easy to Understand. I have one suggest for you one of the best site to know more about payroll software. Visit us http://emportant.com/product.php

Sir…

I have a doubt that how much percentage of total deductions can be done from a salary we receive every month ?

Sir i need a salary slip for 3 mnths march to may 2018. my last salary is 14000 p.m. please help me. my last company cant provide this to me.currentlly i need this to join other company

Wow, that’s what I was seeking for, what a data! present here at this webpage, thanks admin of

this site.

Wһatever the discomfort and rеgarԀless of the problem of Saturdqy night

feverishness, discοmaniacѕ report one main advantage of the plastic pants: no

laundry pаyments. To keep ᗷerliner’s see-tҺrough denims clear,

all of the weaer wantѕ iss sliցhtly Windex.

Having read this I thought it was really enlightening.

I appreciate you taking the time and energy to put this content together.

I once again find myself spending a lot of time both reading and

posting comments. Buut so what, it waas stioll worth it!

This piece of writing is really a good one it helps new web people,

who are wishing in favor of blogging.

Thanks for comment

Hi Bemoneyaware team,

I knew this topic has been discussed many a times even though I feel my case is different.

I am working for a MNC and our HR department changes its LTA and Bonus rules in February 2015 when one of employee resigned and she asked for the LTA and Bonus which is part of our salary(CTC). Bonus and LTA is a part of our CTC and have been clearly mentioned in salary breakup.

They neither take our approval for the rules changed nor they asked us to sign the copy of amended rules.

I have resigned from my current company in second week of the January 2017 and I will be relieved by 31st Jan 2017.

To claim LTA employee has to take leave in between April 2016- March 2017 and have to submit a form with the declaration of journey between in said period with cost details(No Bills required as prrof), I have already taken leave for LTA in above said period(April 2016- March 2017).

As per the amended ruled it seems that I will not be getting the benefit of LTA as to claim LTA I have to be in my company till 31st March 2017.

But as per my knowledge and understanding they should provide me LTA based on Pro-rata basis.

I have attached the amended rules copy for your easy reference.

Please guide me if I am eligible for this and also let me if I can file a lawsuit against my company.

Ofcourse, LTA for you is payable (even pro rata) as part of Full and final settlement or later.

Hi,

I work from my home (india) via Remote control Desktop for USA Incorporated company from India. I received direct salary from my employer’s personal account via NEFT to my personal account. Hense there is no any addition or deduction like PF and professional Tax are deducted from my salary b’coz i received salary in my personal account. so Can u plz send me salary slip format that I can show in bank and everywhere.

Hi bemoneyaware.Need help from you.

Suppose I worked for a company 2months(July,August)and I got a salary of 90K for 2months.Then I resigned and again joined in another company and then how can I get form 16 and how can I file my returns.Plz do needful

You can receive the Form 16 from the previous company during the end of that financial year. I faced this case once, and I contacted the HR during while I was ready to file my income tax.

The employer should give you the Form 16.

What’s up, its good paragraph concerning media print, we all know media is a wonderful source of information.

hello,

In previous month I join a company,on 27k per month salary, am I eligible to pay tax from my 1st month salary or not?

No if your only income this year, from 1 Apr 2016-31 Mar 2017 is this job.

One has to pay tax if total income in the year is more than 2.5 lakh.

If 27K per month from Dec is your income then total income in FY 2016-17 or AY 2017-18 is 1.08 lakh.

Which is less than 2.5 lakh hence no tax should be deducted by your employer

thank you so much …for yor reply.

Guys please help me, how to prepare salary slip, how many percentage i should calculate to put BASIC, DA, HRA, CONVEYANCE, etc.. From the total earnings or gross salary. As well PF, PT & ESI.

Please inform me salary slip is made from net salary or gross salary ?? And all provisional fund and TeX are duducted from gross salary, net salary or erning salary

?

It is not easy for one to figure out in the PF Act the exact definition of salary for the purpose of PF calculation. For example, while Dearness Allowance (DA) and cash value of food concession are excluded from the definition of Basic Wages in Section 2b, giving one an impression that DA and cash value of food concession are excluded for PF calculation. However, DA and cash value of food concession are included for the purpose of PF calculation (in addition to Basic Wages) in Section 6 of the PF Act, and Section 29 under Chapter 5 of the Employees’ Provident Fund Scheme, 1952. The text in the PF Act is somewhat laborious to read.

Gross pay for the purpose of PF calculation is different from the term gross pay which is typically used in the payroll context. For the sake of clarity, we will use the term PF Gross in this post to denote the salary to be considered for PF calculation. PF Gross includes Basic, DA, Conveyance, Other Allowance etc. (heads of pay which are included for PF calculation) and excludes House Rent Allowance, Bonus etc. (heads of pay which are excluded for PF calculation) as per the provisions of the PF Act.

sir…..I want to know something abour salary fixation. I have to hire 75 peopele whose daily wage is Rs186 and they have to work 20 days in a month.If I offer them Rs 5000 per month then Should it legally appropriate?

This is ram,

sir,i have doubt about CTC structure.

we are not getting any benefits from our management like transport or anything.

i would like to know what are the basic rules to follow CTC for a company.

so that i can rectify my doubts as well.

thank you

Dear Ram,

Please contact us on support@taxache.com we will guide you how to restructure your salary.

Sir please guide me if basic 40% , HRA is 50% of Basic , CA-1600 then how we should distribute rest of salary please guide inpercentages %

Thanking you

Dear madam.

Small clarification how to calculate salary structure yearly & monthly pls help me

Please contact us on support@taxache.com we will teach you the basics and help you compute the taxes

Hello Sir,

Please tell me one thing can we called CTC(Cost to Co.) as Monthly Salary or Yearly Salary?

Cost to Company is usually annual amount.

Is yearly increment based on the CTC or the basic salary? Require some clarification on this please.

Increment mostly is calculated on your basic.

Your yearly increment is calculated on your basic salary.

Basic 13,125 now this year it is 9, 125. Now HRA has been added, Medical n all.

Sir

Does emplopyer’s contribution to PF also forms part of CTC i.e. whether the take home salary is after deducting both employee’s contribution and employer’s contribution to PF.

Yes most employers add their contribution of PF to the CTC.and yes the PF deductions is from your salary only.

Hi Team,

Thanks for a wonderful article.

I have a question.

In many private organisations, an employee pays employers part of Pf and the employee doesn’t get Income tax rebate on the same which we would get under govt rules.

My question is : Is it legal ? That the employee has to pay both parts I.e employee and employers part .

thanks in advance

hi,

i had an arrangement with a company for an yearly package of Rs. 6,00,000/- i joined the company on 17-07-2015 and the company has been deducting Rs. 5000/- (10% of my compensation every month) every month as TDS but the company has not yet given me any TDS certificates.

How can i proceed ahead my income tax filling ?

The company has been paying Rs. 45,000/- to me regularly every month.

How much do you think my Tax liability will be only deduction i can think of is my telphone bills Rs. 12000/-yearly and transportation/fuel bill of Rs. 75,000/- yearly and a insurance premium of Rs 10861/- yearly.

kindly let me know

Thanks in Advance.

Dear Sir,

i recent join one company they offer me ctc and gross salary are same, now they deduct pf both side. it is possible? please suggest.

Yes.. the ctc structure is cost to company. So they include this cost in the CTC. Your pf is deducted from your salary

For help contact us on support@taxache.com

If company will provide offer latter in net salary 25k than who will pay the company or me ?

Sry mi question is who will pay the tds ? If me than company will have me the gross salary right other wise if they pay me in net salary …than they will pay the tds ?

Please hide me …asap

1st thing is that TDS is tax deducted at source it is not paid but deducted by payee ie company on behalf of Govt and then afterwards paid to Govt. You can’t pay TDS.

2nd your salary package or CTC does not include tax calculation. That is done once you start receiving salary and Company asks for tax deduction documents (like LIC, school fee of children or PPF, medical insurance, House rent receipts etc) then total tax is calculated by company and if any tax is due it is deducted monthwise from your salary and paid to tax department of India every month on a specific date.

3rd You can see how much your company has deducted in salary slip and how much it paid to IT department on form 26AS on Traces website (also available via net banking facility of your bank)

Can anyone please tell me if there is any fixed percentage range for the Basic Salary Component in the overall salary? Is there any minimum and maximum % as per law?

Thanks in advance.

very very thank you sir i like your concept to understand to all so specially very thanks again

Hello,

Can you tell me for a fixed CTC, whether getting high basic salary or low basic salary is beneficial to an employee?

Also, how much beneficial is the variable pay than fixed pay??

or Vice versa

my company is giving me 2000 rs. monthly for telephone but not showing in payslip kindly tell me what to right in letter for showing in other company

Telephone reimbursement is not part of salary but count as benefits or under reimbursements section. If your company asks for any reimbursement form along with bill to reimburse the amount then you can use it as proof of reimbursement but it depends on the new company that they have the policy of phone reimbursement or not. If they have lesser limit than ₹ 2000, there’s nothing you can do. But if they don’t have any policy, just calculate your new package increment with this amount ie over and above the increased salary you should get ₹2000 more than that salary.

Hope you understand.

Sir currently I am getting 9000 as basic and ctc 294991 and one company has offered me ctc 38657 however the basic is 4000.I want to know if I join this company do I suffer in take away salary or its fine to go.

Ask them what will be take home or else breakup of ctc

Hi. My salary is 35k per month. The breakup is: Basic: 15k, HRA is 10k and bonus is 10k. Now unfortunately i have been laid off. Hence is the company liable to pay bonus calculating just the Basic pay(15k) or basic+bonus(25k). Thanks in advance for the help.

Hello my salary is 15000 and deduction is 3000 is correct or not and getting in hand 12000

Please refer to your payslip as to what you are getting in hand and what is being deducted.

Hello every one …. Its an urgent help from every one i am getting an good offer from an mnc but i have to provide a salary slip in which the my take home will be 32000per month can any one help me with this particular salary slip with all the details like net pay and deduction etc. Please

Submit the payslip that you have. If MNC wants have questions they will ask you. HR ask for Salary slip for few reasons mentioned below

1. Current salary slip includes the bifurcation which you are really getting every month other than the salary offered

2. Salary slips shows there you are still working with the company you claim to work with and hence gives us your employee id and other stuff so as to run the background check if required

3 to decide what you are getting and what can be offered corroborate with your resume / talk of what salary company gives

4. To make sure that what is informed earlier is fake or false information

An interesting article on Linked In Why do Recruiters ask for your payslip?

DEAR SIR,

I AM EMPLOYEE IN ONE COMPANY ,GETTING SLARY OF RS 31026 AFTER ALL DEDUCTION P.T AND PF.

ALSO 100000 ADDITIONAL INSURANCE BY COMPANY.

I WAS GONE TO ANOTHER COMPANY FOR INTERVIEW ,HR SAID ME IN OUR COMPANY ALL ARE INCLUDED IN CTC .

HE ASKED ME FOR EXPECTED SALARY .

THE QUESTION IS THAT , how can i calculate my CTC. KINDLE EXPLAIN.

Add all the benefits+salary which u get from the company that will be your ctc

Hi there, why don’t you ask separately take home salary which you want to take except all the deductions!!???. I think it will clear answer for you to expect.

good article . very nice and easy to understand

Air conditioning installations is not an easy task. If you

decide to forage into the apartment building or multi-family

home property investment arena, make sure to do all of your deals based on hard numbers.

You also need to find out how many people are coming to the party, so you have plenty of party supplies

purchased for everyone.

Hi sir my CTC is 3,70000 per annum. My total cost to company is 4,05000 per annum . if I am planning to move into some other company can I ask hike from my 4.05 that is from my total cost to company or from my CTC

CTC is short form of Cost To Company only how are yo saying that your CTC is different from Total Cost To Company?

I got a offer from a company in that they mentioned CTC and total cost to company…. Total cost to company was higher than CTC so asked a question???

Congrats on getting a new job.

It is good to ask questions.

What was the difference between CTC and total cost to company?

You should ask for hike and negotiate. In hand otherwise there would not be much difference. Try to find what is pay at your level in new company.

Remember your pay hike in new company will be based on the pay you negotiate now.

Yes you can.

hlo sir i earn 540$ bt i don,t transfer to my account plz help me why is this prblm withdrawal

How do you earn your money? Through paypal?

Hi sir,

If the salary is 10,050 Per Month,the coomapany provide Basic,HRA,Conveyance, Special Allowance to the employees.The Basic is 40%, HRA 20%,Conveyeyance as per the rule 1600,the balance is spacial allowance .Here my qus is how to calculate the salary in these %.

Dear Team

Please clear my following doubts

Is CTC legal? If yes then please provide me the details under which Act or jurisdiction

HRA is 40% or 50% under which act and section it is given.

Cost to Company (CTC) is a term for the total salary package of an employee, used in some countries, such as India and South Africa. It indicates the total amount of expense an employer (organization) is spending for an employee in a single year. CTC is calculated by adding the salary of an employee to the cost of all additional benefits an employee receives during the service period. If an employee’s salary is ₹50,000 and the company pays an additional ₹5,000 for their health insurance, the CTC is ₹55,000.

There is no law , that we know of .

As per income Tax act, for calculation House rent allowance least of the following is available as deduction. HRA Exemption Calculator :

Actual HRA received

50% / 40%(metro / non-metro) of basic salary

Rent paid minus 10% of salary.

It is explained in detail with examples in our article HRA Exemption,Calculation,Tax and Income Tax Return

Please guide me for this salary break up where… Net salary 18000, CTC 25000, and break up should include HRA, Conveyance and LTA

Thank you with Regards

Good one, informative. Has helped me understand, concept of CTC. Thanks for enlightment.

Regards

Jai

plz ell me sir, what is my gross salary with full description???

in hand is-11500/-

Please ask your office for the payslip.

what will be my monthly income if annual CTC is 3,15,000.

It will not be 3,15,000/12 =26,250 but would be less than that based on how your CTC is packaged i.e what all are included in CTC.

Hi Team,

I would like to know how best I can save tax. Below are my CTC details and my investments. Kindly advice.

CTC : 1180000

Investments:

LIC: 57,496.00

PPF: 60,000.00

PF: 49560

What will be current annual tax deduction and how can I reduce it?

Thanks in advance.

Mr. Mukund…

Plz send me your Gross Salary…

transport,HRA, Conveyance

You don’t need to save tax under 80C as your total investments 57,496 + 60000+49560 is more than 1.5 lakh

you can further invest by taking a Medical Insurance for your family. An amount from Rs 25,000 to Rs 35,000 is savable depending on which family members you include in the Medical Insurance (for spouse and 2 Kids is lower and for incl parents its higher and for Senior Citizen parents its highest)

Further if you have or are planning to buy home by taking a home loan, Interest part will be deducted from Taxable Income to reduce your Income Tax Load.

Is the Employer PF contribution considered part of the gross salary, and thus taxable, or only the employee’s contribution is considered part of the calculation? More in particular, for a foreigner the requirement would be a salary of 25,000 US a year in gross salary. Would the employer PF contribution be included in that gross salary? Thanks.

The query by Mr. T.G.Ramon is very relevant, but so far has not been answered. In fact, in case of CTC, employee is paying both side PF i.e. employer & employee side, thus it seems that the contribution to PF done by the employer should be considered part of the Gross Salary. Is this right or not? Thanks.

Employer side PF is amount paid by employers to PF department on behalf of employees and in their account. It is future planned pension and security amount for post retirement and should not be looked upon on annual basis or as part of salary. Its just 12% of annual package or just 1% of monthly basic salary… so why to look at it for receiving it now. Wait Govt wants you to be independent post retirement so that you are not dependent on your kids for food and shelter.

As far as Tax liability is concerned, employer portion is 100% tax free whereas employee’s portion is deductable from taxable income under section 80C.

Always remember, CTC is company’s cost on you not your income.

All fine. Nice information.But one doubt,

why has been the calculation done,

Net Salary = Gross Taxable Salary – Tax =6,07,200- 1,17,103=4,90,097,

but not ,

Net Salary = Gross Salary – Tax =6,75,000- 1,17,103=5,57,897

please clarify

Good question.

Gross salary means that maximum that you can be allowed to have for example HRA you can claim is Rs 96000 but actually you claim is 52,800. Others being Conveyance Allowance, Medical benefits etc.

Your taxable income differs from your gross income in that it counts allowable deductions, exemptions and other subtractions for which you may be eligible. This figure can be drastically smaller than your gross income depending on the number of deductions that you take or exemptions that you can apply.

this site is very useful and i wand small clarification that how can divide salary as basic and da ?what is the percentage of da and percentage of basic salary

Dearness Allowance is allowance is paid to the employee against the price rise in country economy i.e to mitigate the impact of inflation.

In India the Dearness Allowance (DA) is a cost of living adjustment allowance paid to Government employees, Public sector employees (PSU)and pensioners . It is taxable.

Dearness Allowance is calculated as a percentage of an basic salary.The guidelines that govern the DA vary according to where one lives (for example, whether rural or urban).

Our article Salary,Allowances,Dearness Allowance,Government Salary, Pay Commission discusses it in detail

Sir, with reference to DA , Is it mandatory for a pvt. company to give it. For my son getting no DA but special allowance. How does it differ and with what purpose given?

Please clarify.

Sir private companies don’t give DA. Dearness Allowance is allowance is paid to the employee against the price rise in country economy i.e to mitigate the impact of inflation.In India the Dearness Allowance (DA) is a cost of living adjustment allowance paid to Government employees, Public sector employees (PSU)and pensioners. It is discussed in detail in our article Salary,Allowances,Dearness Allowance,Government Salary, Pay Commission

Special allowance and performance bonus: This allowance is given over and above the basic salary. Keep in mind that this amount is taxable. Performance bonus is usually linked to your past performance and is usually paid once or twice a year, depending upon the company policy.

Sir,

I am a Govt. employ and I received rs 1181737 during the year 2014-15.My pay and allowance is adjusted during the year. Apr 2014 I receive BP 13950/- Grade Pay 2800/- , in the month of Oct 2014 my basic pay and grade pay adjusted as rs BP 17090/- & GP 4200/- as per order of court wef Jan 2006.

Thus I received Rs 603352/- as a arrears. Please ex plane me that this arrears amount ( Rs 603352/- ) include in my net payable income.

When arrears of pay are received in any particular year, it could artificially raise the tax liability in that year. This happens because due to the receipt of arrears, the total income and consequently the tax payable increases.

Therefore, the law allows a tax deduction under Section 89(1) for this additional tax burden

Basically, the relief under Sec. 89(1) is arithmetical. It involves ascertaining two amounts of tax. The first is the amount of tax applicable to the total income including the extra amount in the year of receipt. The second is calculating the amount of tax by adding the arrears to the total income of the years to which they relate. The difference between the two amounts is the amount of deduction allowed.

In other words, if the taxpayer is required to pay any additional amount of tax (in the year of receipt) than what he would have otherwise paid had he received the money in the year(s) that he was supposed to receive it, such additional tax need not be paid i.e. it can be reduced from the tax payable.

You can use the calculator Calculator for Arrears under section 89(1)

Hi, Very Nice article.

Question – I am getting salary by cheque Rs.25000, that is take home salary, no other benefits or no other deductions are involved.

Now if any other employer asks my current CTC and Expected CTC, how should I mention it?

Being an employee one gets advantages such as Medical reimbursement, subsidized food,HRA etc. If you are not getting those then one is considered as contractor.

You should not tell lie about your current salary.

If new employer asks for expected CTC.. you need to find out what is the salary band of the position you are applying in the company. And then negotiate.

dear sir,

i am getting salery of 3 lacks 12 thousands per annum.

so i do not have any pf account,paying Lic jeevan anand 28000 per yearly wise so hw can break down the my salery.

please give me reply,

thank you..

LIC Jeevan would come under deduction 80C. Income from salary would be 3 lakhs 12 thousand.

Mention the income from salary as it is , pt 6 in Form 16

and claim 28000 as deduction under 80C

Good Article…

It is very good and easey to understand. Thanks

Thanks Moses. The comment is good and very encouraging.

Dear Sir/Madam,

Very Nice Article to learn the Mean of Salary from Basic.

Thanks for sharing this type of Knowledge.

Kailas T.

Thanks for leaving message. It is a big encouragement to us.

Amazing Blog !!! Thanks for sharing your knowledge with us.

Amazing comment!!! Please spread the word around. Thanks for encouraging us.

Hello,

In the above example the tax on 607200 comes upto 57103. Can you please share as to how you arrived at this figure. I checked the investment yogi link but the tax calculator does not work. effective tax rate in this case is 9.4% (57103/607200).

Sir this is for AY 2011-12 and not AY 2015-16.

You can check out our article Understanding Income Tax Slabs,Tax Slabs History to understand how tax slabs work.

Thanks for informing about broken link. We have fixed it.

Hello admin,

I was just going through this article and found your background image a little bit distractive. It would be better if you change it. I am also running same kind of website, any advice from your side would also be appreciated.

Thanks for feedback we shall look into it.

Kindly Guide… the question is related to PF deduction, The company wants to factor entire 24% deduction from the employee salary… how can it be factored in the CTC without getting into any legal hassles

7.44(minimum) 19.15(maxm) ctc…..what does it mean pls clarify it….

Sir could you clarify the context. Where did you read about 7.44(minimum) 19.15(maxm)

thanx a lot.. this article helped me a lot and cleared all my confusions.. thanx again..

Thanks Sir

Sir, I would like to know more clearly about the components of a salary,CTC,PF,ESI,PT,PAYROLL,C&B,TDS,PMS,PI,ERM,RS,T&D.kindly help

CTC : Cost to Company

PF : Provident Fund

ESI Employees State Insurance (more info given below)

PAYROLL : Handling payroll typically involves sending out payslips to employees.

TDS: Tax deducted at Source

C&B: Compensation and Benefits.

PMS: many definitions such as Procurement Management System, Project Management and Scheduling depends on context

PI: Many definitions such as Proforma Invoice

ERM: Enterprise risk management

RS : Rupees (guessing)

T&D :Training and Development

In a company, payroll is the sum of all financial records of salaries for an employee, wages, bonuses and deductions. In accounting, payroll refers to the amount paid to employees for services they provided during a certain period of time.

Employees State Insurance is a Health Insurance scheme for Indian workers which provides medical and cash benefits to them. The scheme was managed by Employees State Insurance Corporation (ESIC), which is an autonomous corporation under Ministry of Labour and Employment, Government of India. ESIC manages their customers through the large network of their offices in India.

Hi visied the blog for the 1st time …very very informative platform .

Thanks Shikha. Hope you keep on coming back for more.

Helo sir!

If basic Salary of an employee is Rs. 20,000 per month, then calculate the amount of

1. Utilities Allowance (12%)

2. House rent (35 %)

3. Miscelleneous Social charges (6%)

4. Medical/Group insurance (7.5%)

Clearly stating calculation of which is based on gross salary and which are based on basic salary.

gross salary?

sir

i want to know about DA its depend on the company or fixed for all by he government of india.

The Dearness Allowance (DA) is a cost of living adjustment allowance paid to Government employees, Public sector employees (PSU)and pensioners in India.

Dearness Allowance is calculated as a percentage of an Indian citizen’s basic salary to mitigate the impact of inflation on people. Indian citizens may receive a basic salary or pension that is then supplemented by a housing or a dearness allowance, or both. The guidelines that govern the DA vary according to where one lives (for example, whether rural or urban).

Private sectors employees usually do not get any DA (Dearness Allowance)

The company given me a letter of increment in 2015 is from 35,100 to 39,490 p.m.

now in my salary clip they have shown 38921 p.m.

basic 19745

hra 9873

lta 3953

medical allowence 1250

food allowence 2500

p.tax.200

pf 2369

incom tax 876

my quation is my company calculation is correct or not. because in my monty salay they have not mention 39490 they have mention 38921 pls. help me

Better to clarify from your company’s payroll or finance department.

Hello,

Can you please accurate information on my below description.

1)i am working with manufacturing company as contractual basis, my CTC is 2.28l. My company said to me, we will deduct TDS on monthly as professional fees section 194J. I understood all things but my ctc is not taxable so how can company deduct tds from salary.

2) can Con-tactual employee claim for HRA and conveyance allowance?

3) Employers provident fund is included in ctc or excluded in ctc?

4) And Please give me monthly salary structure as i mentioned ctc in above.

its very urgent, please guide me.

They are doing the right thing.

In a regular employment you have benefits like provident fund, gratuity, superannuation, HRA, your income tax is calculated and deducted by the employer and you get paid the balance.

As a consultant, the process is quite straightforward. The compensation payment is made by deducting TDS (Tax deducted at source) which may be 1 per cent or 10 per cent depending on your profile and the work you do.

Differences between being and employee and consultant

The income received as fees from professional or technical services rendered is classified as income from business or profession, whereas in case of employment, it is considered as salary income.

A salaried employee can claim tax deduction on certain components of the salary such as house rent allowance, leave travel allowance, conveyance allowance and uniform allowance.A consultant on the other hand cannot claim deduction on these perquisites that are available to the salaried employees. However, all eligible business expenditure incurred in providing consultancy services can be deducted from the consultancy income for tax purposes. A consultant can even claim depreciation on assets like AC, furniture, computer, phones and other business assets used for providing services.

Consultants are however required to maintain accounts of these expenditures in such a fashion that it can be reasonably ascertained by the tax department. They are also required to maintain the necessary documents for a specified number of years.

Also, where the income or the gross receipts exceed a specified amount, books of accounts are to be audited by a chartered accountant. These special requirements of maintaining the books of accounts and getting them audited are not applicable to salaried employees.

In case of salaried employees, tax is withheld by the employer every month at an average rate applicable to them. But for professionals, the company deducts the tax at a flat rate of 10 per cent from the consultancy fee at the time of payment.

A salaried employee is not required to pay advance tax if he has no income other than salary. A consultant, however, needs to pay advance taxes at designated bank branches in three instalments. The first instalment has to be paid by September 15, the second by December 15 and the third by March 15.

A consultant also has to be mindful of the service tax. If the services provided are included under the notified services, there is a need to comply with service tax regulations.

Good Article.

Thanks Sir for a good comment ..made our day

I really liked your artical keerti .

Thanks for the knowledge .

Thanks for kind words, it makes our day.

Sir, if you have time could you help us in answering foll. questions.

1. Does this kind of information would help those who join first time

2. What kind of information would a new joinee like to have on money. Some examples Salary, EPF, UAN number…?

3. Would companies like to arrange such programs for their staff.

Hi;

I am having an offer for 14.5 Lacs from an employer but their Salary Components seems to differ from the Industry standards where to Increase Basic salary they have marginaly reduced PF and LTA components.PF and LTA help employee a lot on Tax Deductions so if they are on lesser side definitely I’ll end up paying huge tax-Am I correct?.

My Salary Breakup is as follows:

———————————-

Monthly (INR)

Annual (INR)

Basic

66,458

797,496

HRA

26,583

318,996

Conveyance

1,600

19,200

Medical Reimbursement

1,667

20,000

Executive Allowance

21,226

254,712

Flexible Pay

1,000

12,000

LTA

500

6,000

PF (Company Contribution)

1,800

21,600

CTC PM 120,833

1,450,004

Annual CTC

1,450,004

Suppose I make an investment of 1.5 Lacs (Max permitted to Male employee) what would be my Net Take Away salary considering all exemptions and Investments?.If someone can help me here since I am getting different figures from different people.This is important for me since I will be making a move from very big MNC to an Indian company so need to anayse if its worthy.

-Regards

Rajat

Hello Sir,

We can understand your confusion. There is no standard way of specifying salary structure.

While salary is an important part work and career are also equally important.

Working in an MNC is a good opportunity in terms of exposure, kind of people you meet.

Another thing you can still try to negotiate with the company (Every company does have a margin when they make an offer) . if you know someone in the company then can ask for salary band (higher lower salarY) at your level.

Now coming to salary structure. Most of it seems straight forward. Everything(PF deduction etc) is kind of based on Basic pay,

HRA you would claim if living in a rented house else it would be taxable.

LTA once in two years if you submit your bills.

Medical reimbursement also if you submit your bills (Income tax Limit for medical reimbursement is 15,000 if you submit bills you get that amount without deduction of tax else company will deduct tax and pay remaining (non bill) amount. In you case limit is 20K so it seems most of it would be reimbursable.

You should get : Basic + Executive Allowance + Flexible Pay every month.

You can also ask HR how much would you get in hand.

Hope it helps.

Best of Luck.

thanks so much, this has been very helpful to me. i would be very grateful if you post me on the ways to create a salary structure and a pay slip. thanks

Thanks Sandra, glad to know you liked it. I cannot help you in creating salary structre. I find citehr discussing about such stuff, ex How to make salary structure which you might find helpful. Please note that we have not used the site and this is for informational purpose.

Hi,

In case of CTC, employee is paying both side PF i.e. employer & employee side, then in this case both side amount will be consider under 80C or only of employee side. Please give me details of same.

thanx

The Employee contributes 12% of his /her BasicSalary & the same amount is contributed by the Employer.

Very interesting question Ajay .

Employers contribution of 12% of basic salary is totally deposited in provident fund account Whereas out of Employees contribution of 12% , 3.67% is contributed to Provident fund and 8.33% is deposited in Pension scheme.

Contribution made by an employee alone will be eligible to deduction limit of upto Rs.one lakh.

The contribution made by the Central Government or any other employee to a pension scheme u/s 80CCD(2) shall be excluded from the limit of one lakh rupees provided under Section 80CCE.

Ref: Section 13 of article 13:Tax treatment of P.F. contribution in the hands of the employee

Hope it helped!

thanks for this wonderful article. very nice…

Thanks Rahul. Glad to see you liked it!

This is very nice and very useful , thanks for you information, but how to calculate these are all Basic Salary 480,000, Dearness Allowance 48,000, House Rent Allowance 96,000, Conveyance Allowance 12,000, Entertainment Allowance 12,000, Overtime Allowance 12,000, Medical Reimbursements 15,000, and give me details with percentage and from where should be calculate, please send my mail address.

Thanking you

Thanks Mr. Shastry. Glad to know that you found the article useful. The example given in the article was an arbitrary example.

A salaried employee can get these details from his/her pay slip. Please contact the finance department of your company.

We are sending the answer to your email id this time but please follow the article to find the answers. We would like to address the answers at a common platform i.e our blog so that everybody benefits and becomes aware.

Very informative. Bookmarked!

Thanks Amit for liking and commenting. Glad to know that it helped you.

I had many doubts regarding ctc, Your article made me to clear all those in a ‘single page’ of information, which makes me to think n number of questions.

thanking you for a wonderful service.

Thanks Maganesh. Glad we were able to clarify your doubts. Incase u have doubts regarding any other subject just let us know we shall try to attempt clarifying them.

This is a wonderful article. Many a times, the employers state so many figures in their employment offers and it is very critical to understand specifically what is the amount you will get in hand before taking it up. Indepth understanding of the components of CTC is also critical from a tax planning perspective. Great job!

Thanks a lot Aparna. Your comment is great encouragement to us

These days money makes a man’s life and so it’s good to know about salary and stuffs!!! Good post…..

Thanks Sriram..money is an important factor but not the only factor

truly it is very informative. thanks for the info.