The World Bank is an international financial institution that provides loans to countries of the world for capital projects. The World Bank is a part of the World Bank Group. With 189 member countries, staff from more than 170 countries, and offices in over 130 locations, the World Bank Group is a unique global partnership, five institutions working for sustainable solutions that reduce poverty and build shared prosperity in developing countries. Let us explore in detail what is World Bank? Difference between the World Bank and the IMF, Where does World Bank gets money from, How much has India borrowed from World Bank.

Table of Contents

What is the World Bank?

The World Bank was created at the 1944 Bretton Woods Conference along with the International Monetary Fund (IMF). The World Bank and the IMF are both based in Washington, D.C., and work closely with each other.

The mission of the World Bank

- To end extreme poverty: End Extreme Poverty by 2030 By reducing the share of the global population living on less than $1.90 a day.

- To promote shared prosperity: By increasing the incomes of the poorest 40 per cent of people in every country.

In fiscal 2017, the World Bank (IBRD/IDA) committed $42.1 billion to partner countries, distributed in credits, loans, grants, and guarantees.

As of November 2018, the largest recipients of world bank loans were India ($859 million in 2018) and China ($370 million in 2018), through loans from IBRD.

Jim Yong Kim became the 12th president of the World Bank Group on 1 Jul 2012 and resigned in Jan 2019.

Annual Report, which covers the period from July 1, 2017, to June 30, 2018, is prepared by the Executive Directors of both the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA) in accordance with the respective bylaws of the two institutions. Link to Annual Report.

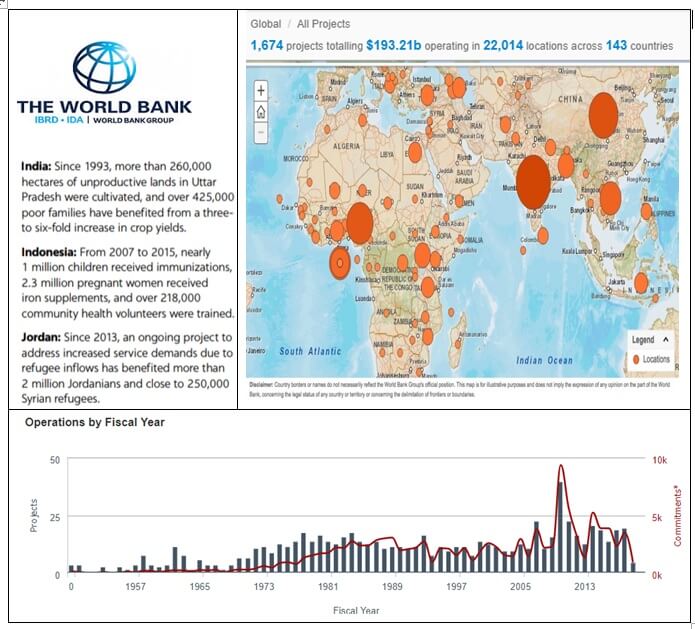

World Bank Logo, projects and loans given

Where does World bank get money from?

The World Bank’s money comes from a number of different sources. IBRD, which provides loans to middle-income countries and to poorer countries able to repay loans at terms based on market rates, raises most of its funds on the world’s financial markets by selling World Bank bonds to investors. IBRD is an AAA-rated financial institution with unusual characteristics: its shareholders are sovereign governments; its member-borrowers have a voice in setting the Bank’s policies; and, unlike commercial banks, its goal is improved development impact rather than profit maximization.

By contrast, IDA, which provides interest-free loans to the poorest countries, is funded largely by contributions from donor member governments, who meet every three years to replenish its funds. Additional funds come from IBRD net income, and repayments of IDA credits go into issuing new credits.

Strong shareholder support for IBRD and IDA is reflected in the capital backing they receive from members and in the excellent repayment record of IBRD and IDA borrowers. IBRD has $178 billion in callable capital that can be drawn from shareholders as backing should it ever be needed to meet IBRD’s obligations for borrowings (bonds) or guarantees, but it has never had to call on this resource.

India and World Bank

India has been accessing funds from the World Bank (mainly through IBRD and IDA) for various development projects. Details about it can be found from the World Bank website here.

- World Bank assistance in India started in 1948 when funding for Agricultural Machinery Project was approved.

- World Bank resident mission was established in India in 1957.

- In August 1958, the first meeting of the Aid India Consortium was held at Washington DC under the aegis of the World Bank.

- The first investment of IFC in India took place in 1959 with US$ 1.5 million

- Example of Type of Loans provided to India by World Bank.

- In 1958 when IBRD provided US$ 11.20 million loan to India for Project P009602 Railway Project (02) at 0.07 Interest. The Second Railway Project in 1958 directed to increasing the capacity of the railways to handle additional traffic. Its most important elements are the acquisition of new rolling stock, the doubling of main-line tracks, improvement in yards, and new signalling. A beginning is made on dieselization of some mainline services, and further important development in motive power is electrification of certain very high-density passenger and freight traffic areas.

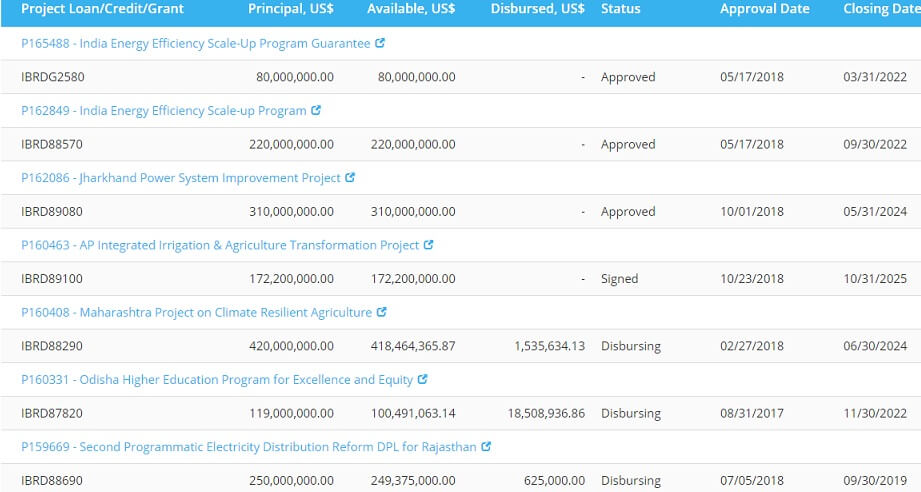

- In 2018, IBRD committed US$ 420 million for P160408 project Maharashtra Project on Climate Resilient Agriculture.

FINANCIER APPROVAL DATE CLOSING DATE PRINCIPAL DISBURSED REPAYMENTS INTEREST, CHARGES & FEES IBRD88290 February 27, 2018 June 30, 2024 420.00 1.54 N/A 3.06

- Total lending at the project level, starting from the first loan of FY1947: Original Principal value of IBRD Loans US$ 61,518.12 million. Original Principal value of IDA Credits US$ 51,084.67 million

India is one of the founder members of IBRD, IDA and IFC. India became a member of MIGA in January 1994. India is not a member of ICSID (International Centre for Settlement of Investment Disputes).

There were rumours circulating that India has not taken loan from World Bank since Narendra Modi Govt came to power. That is not true. The following image from World Bank site shows loans India took from the World Bank since 2010.

World Bank Loans to India from 2010

This image shows the types of projects in India for which the World Bank gave loans to India. Details about projects can be found from the World Bank website here or here

World Bank Loan for projects in India

Who leads the World Bank?

World Bank is led by President. After the Second World War, when the World Bank and IMF were created in the 1940s, the understanding was that an American would run the World Bank and a European would be in charge of the International Monetary Fund. It’s an arrangement that many regard as anachronistic.

The two institutions now have more formalised selection procedures, and the recent preferred European and US candidates have faced challenges. Jim Yong Kim – a Korean American nominated by the Obama Administration – was up against a Colombian and a Nigerian when he was first appointed.

In Jan 2019 Jim Yong Kim announced his resignation from the post of President of World Bank. His resignation will take effect from 1 February. Mr Kim, was not due to leave until 2022 after he was re-elected for a second five-year term in 2017. Jim Yong Kim was nominated by former President Barack Obama for both his first(2012-2017) and the second term(2017-) at the head of the World Bank. Kristalina Georgieva, the World Bank’s chief executive officer, will assume the role of interim president.

So far, the post-war understanding has prevailed. Will the US under President Trump be open to the idea of ending that arrangement? It would be quite a surprise.

Difference between IMF and World Bank

Both organizations were established as part of the Bretton Woods Agreement in 1945. IMF and the World Bank are inseparable twins, membership in the former is a prerequisite for membership in the latter. The IMF and World Bank collaborate regularly and at many levels to assist member countries and work together on several initiatives. But Both these institutions are complementary to each other.

The primary difference between the International Monetary Fund (IMF), and the World Bank lies in their respective purposes and functions. The IMF exists primarily to stabilize exchange rates, while the World Bank’s goal is to reduce poverty.

Our article What is IMF? How does it work? Difference from World Bank covers IMF and World Bank in Detail

Criticism against World Bank

One of the strongest criticisms of the World Bank has been the way in which it is governed. While the World Bank represents 188 countries, it is run by a small number of economically powerful countries. These countries (which also provide most of the institution’s funding) choose the leadership and senior management of the World Bank, and their interests dominate the bank. Decisions are made and policies implemented by leading industrialised countries—the G7—because they represent the largest donors without much consultation with poor and developing countries.

The World Bank and the IMF often attach loan conditionalities based on what is termed the ‘Washington Consensus’, focusing on liberalisation—of trade, investment and the financial sector—, deregulation and privatisation of nationalised industries. Often the conditionalities are attached without due regard for the borrower countries’

With the World Bank, there are concerns about the types of development projects funded. Many infrastructure projects financed by the World Bank Group have social and environmental implications for the populations in the affected areas and criticism has centred on the ethical issues of funding such projects. For example, World Bank-funded construction of hydroelectric dams in various countries has resulted in the displacement of indigenous peoples of the area.

As the World Bank and the IMF are regarded as experts in the field of financial regulation and economic development, their views and prescriptions may undermine or eliminate alternative perspectives on development.

Related Articles: