We have been told by our parents “Mantra for the ideal life is growing up, graduate and find a decent job”. And you sweated out in school and in college to get THAT job. Now if your time, you are young, beautiful and geared up to enjoy life finally. You have that new restaurant to try, that new mobile, that vacation to plan. Old age happens to others, maybe to your parents but not you. Future, Saving, investment, Retirement you will figure out, “Financial planning woh bhi kar lenge poori zindagi padi hai.. YOLO..chill bro, Go with the flow”.

Why is Financial Planning important?

Financial planning is all about what you want to achieve financially for your family and you. It’s NOT about which stocks/mutual funds you should have or which managed fund you should invest into or which stock or shares you should buy and sell.

How would it feel if you can’t send your children to a college of their choice due to a money crunch? Not being able to take your family on an international trip where all their friends are going, Or to retire without an adequate bank balance is heartbreaking

How to safeguard yourself from being in such situations? It’s simple, make a ‘big picture’ of your goals, dreams and objectives so that a roadmap can be designed to help you navigate your way to your ‘big picture’ destination. Don’t drive aimlessly, you will only end up burning fuel.

It’s about taking the time out of busy chaotic lives, and focusing your thoughts on one’s situation first, and laying down the steps for a future of financial independence.

A personalized financial plan

- measures the distance between your current location and your destination.

- Then it checks whether or not you have enough time to reach your destination.

- It offers you various routes to reach your destination. Some routes might be short, but full of pitfalls; while others might be longer, but relatively safe.

Children education, marriage, retirement or exotic vacation—all of this might be within your reach if you follow your financial plan.

The earlier you start planning and caring for your future, the better prepared and organised you will be to give yourself a head start in life that could help you achieve financial Nirvana.

Don’t blindly follow the investment plans of your friends and relatives as

- Their financial circumstances might be different than those of yours

- Their risk appetite might be higher/lower than that of yours

If you don’t have the times, expertise, to do a financial planning you can take help of experts like Geojit which offer financial planning as shown in this video.

If you don’t do Financial Planning

We can compile a long list of reasons people give for not doing a financial plan – no time, no money, no need, no hurry, no need and dozens of variations of each.

Let’s try to be honest about it. Isn’t it that you hate financial planning because it’s tedious, time-consuming, and agonizingly painful. In a survey, it was found that many people prefer a root canal to financial planning.

One person said he avoided financial planning in the same way he avoided taking his car into the garage because he was afraid to find out what was wrong with his car and how much it would cost him. And that is the reason why many don’t take that health test, Ignorance is bliss right. Or is it?

A problem which needs to be fixed must be fixed, it won’t go away. If you have a puncture in your tyre then you need to get it fixed else, you might end up buying a new tyre.

We all want to have fun, work on our bucket list and we hate financial planning. Disorganization and procrastination are difficult behaviours to overcome, but it’s worth the effort. Take control of your money no matter how much (or little) you have. Planning your financial future isn’t exactly fun. Then again, neither is going broke. And to avoid one, you just might have to do the other.

Taking just a few steps, getting a financial plan, can reduce stress and lead you on a path toward financial peace of mind

Early Start is important

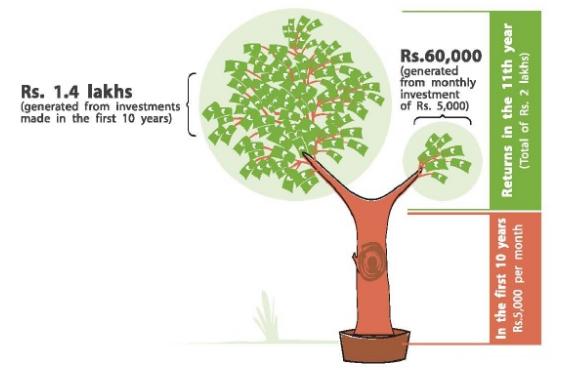

Early investing is very much like growing a tree…if you can take good care of it at the start, it will take care of itself later

Growing your wealth is similar to growing the new tree. Given lots of tender care, your small baby steps will become your Mighty Money Tree. Your investments in first 5 yrs out of a 30 yrs period makes the 50% final corpus and rest another 25 yrs makes another 50% corpus. That means the initial 16% tenure makes 50% corpus and later 84% tenure builds rest 50% corpus Money might not actually grow on trees, unless you plant your own Mighty Money Tree, and early!

Ignore Financial Planning at your own peril. The earlier you start planning and caring for your future, the better prepared and organised you will be to give yourself a head start in life that could help you achieve financial Nirvana.

Money App to help you track your Spendings: ETMoney App, Qkly etc

2 responses to “Why is Financial Planning Important, What if you don’t do it, Early Start”

Financial planning is important as it allows you to manage your finances in a manner that it is linked to your life goals. When investment goals are chalked out in a financial plan, it helps you maintain focus and work towards achieving your goals.

Saving money or investing them fruitfully, has always been a cause of concern which gives us sleepless nights. No matter how much you earn, you always feel as if you are running out of money and there is a lot left to be done on the financial front which requires money.

When I was working in an MNC few years back, I used to go for the so called safest options in order to save money– Fixed Deposits and Recurring Deposits, but the problem is, their rate of return is extremely low. I wanted to have the best of both worlds i.e save money and at the same time receive great returns on it.

Then I came across a digital chits platform called KyePot which is a P2P lending mobile app. Its functionality involves borrowing, saving and investing money in ‘pots’. Initially I was a bit apprehensive about investing my hard earned money in some mobile digital chits application but then I came across their ‘Pocket Money -12k’ plan where the monthly installment is as low as Rs 1000, giving a monthly dividend of up to Rs 150 for 12 months. I must say that after my first investment with KyePot there was no looking back.

I started investing and saving my money with KyePot because:

• It is easy to understand

• A single tool to save money and get loans

• Not subject to market risks

• Transparency at every

• Better returns for savings, lower borrowing rates

• Easy digital transactions

• Goal setting and tracking

• Legal processes and compliance to safeguard investors

Saving with KyePot will give you consistent and handsome monthly dividends with plans especially tailor made to suit your monetary goals.

• Piggy Bank – monthly installment of Rs. 10,000/month for 24 months where you earn a monthly dividend of up to Rs 2500

• Money Bag – 24K – monthly installment of Rs. 2000/month for 24 months where you earn a monthly dividend of up to Rs 300

• Cookie Jar – 60K – monthly installment of Rs. 5000/month for 12 months where you earn a monthly dividend of up to Rs 750

• Treasure Chest – 2.4L – monthly installment of Rs. 10,000/month for 12 months where you earn a monthly dividend of up to Rs 3000

You can download KyePot app from Google play store http://www.bit.ly/kyepot

Thank You For Telling Us The Importance Of Financial Planning.