All new loans sanctioned on or after April 1, 2016 will be linked to MCLR or marginal cost-based lending rate. MCLR is the new benchmark lending rate at which banks will now lend to new borrowers. Till 31 March 2016, banks used the base rate as the benchmark rate to lend. So far, banks followed diverse methodologies for computing the minimum rate at which they could lend—the base rate. Now, the RBI has asked all banks to follow the marginal cost of funds method to arrive at their benchmark lending rate. The RBI expects that the new method of calculating interest rate will make floating lending rates more responsive to its policy rate cuts. This article explains What it MCLR or marginal cost-based lending rate? How Does MCLR affect Loan Rates? What is Role of RBI in controlling the interest rate? Should one switch Home Loan from Base Rate to MCLR Rate?

What is Role of RBI in controlling the interest rate?

A central bank of a country is an institution that manages a country’s currency, money supply, and interest rates. The primary function of a central bank is to control the nation’s money supply (monetary policy), through active duties such as managing interest rates, setting the reserve requirement, and acting as a lender of last resort to the banking sector during times of bank insolvency or financial crisis. Central banks usually also have supervisory powers, intended to prevent bank runs and to reduce the risk that commercial banks and other financial institutions engage in reckless or fraudulent behavior. Central Banks are designed to be independent from political interference. India’s Central Bank is Reserve Bank of India or RBI. Ref:Central Bank on Wikipedia

Monetary policy consists of the actions of a central bank that determine the size and rate of growth of the money supply, which in turn affects interest rates. Monetary policy is maintained through actions such as modifying the interest rate, buying or selling government bonds, and changing the amount of money banks are required to keep in the vault (bank reserves). Until the mid-90s, RBI had only two monetary policy reviews a year. From 1997, quarterly reviews were introduced. Mid-quarter review was introduced by Y V Reddy which resulted in an announcement every 45 days. From April 1, 2014 Reserve Bank shifted to a system of announcing its policy statement bi-monthly. This is a major event in financial circles with everyone talking about whether RBI will increase or decrease rates like CRR,Repo rate?

The Monetary policy has become important due to announcements in the interest rates. A reduction in interest rates would mean bank would lower their lending rates and borrowing rates. So if you want to place a deposit with a bank or take a loan, it would offer it at a lower rate of interest. On the other hand, if there were to be an increase in interest rates, banks would increase their lending and borrowing rates. We have covered this in detail in our article Factors that affect the Stock Market: RBI Meeting,Inflation Numbers,Quarterly Results

From January 2015 to Jan 2016 , RBI had reduced the repo rate(the rate at which RBI lends to banks) by 125 basis points (bps. 1% is equivalent to 100 basis points), but banks have passed on only around ..5-.6%(50-60 bps) to their borrowers.

What is MCLR?

MCLR stands for marginal cost-based lending rate. Reserve Bank of India has directed all banks to shift to MCLR from the base rate. All new loans sanctioned on or after April 1, 2016 will be linked to MCLR. But it does not mean that there would be one rate for all the banks. Each Bank would add an extra amount to cover its credit risk, profit mark-up etc ,technically called as spread . The amount of the spread may differ from one bank to another and its not transparent.

Secondly unlike Base Rate which was common for all loans, MCLR is different for loans with different time periods. Tenor is the period after which the interest rate of a loan resets. Basically, the MCLR will be published by the banks each month. If you take a loan with a 1 year tenor in April 2016, then your interest rate will reset in April 2017 and according to the MCLR of that month. And MCLR is different for tenors of 1 month, 3 months, 1 year and so on. Each bank would publish new MCLR rates for different time periods. So say if the MCLR of a bank is 9.5% the banks have to lend at 9.5% or below and not above.

The rate of interest on a loan would be derived as MCLR Base Rate + Risk premium(spread) + operating cost mark up.

The applicable MCLR rate will be the rate corresponding to the interest rate reset frequency of the loan. Say for example, if you plan to take a floating home loan for Rs. 2 crore on 15th April, 2016 for one year at MCLR of 9.50% with a spread of 0.50 bps. So the effective MCLR will be 10% for one year. Say, on 14th April, 2017 the MCLR changes to 9%+ 0.25 bps i.e 9.25%, then the effective interest rate for the future installments will be 9.25%. For home loans, bank will use either 6 months(ex Kotak Bank for Home loan) or 1 year MCLR (SBI, ICICI bank) as benchmark rate. The image below,from Times of India, shows how rate cut by RBI is expected to be passed on.

MCLR is expected to make banks respond faster to policy rate revisions announced by the central bank. Given the current falling interest rate scenario, the immediate impact will be the lowering of rates.

How will RBI’s new MCLR guidelines change the interest rate? Will MCLR help the borrowers?

The objective of RBI is to pass the benefit of repo rate to the borrowers. For a bank, the difference between the rates of borrowing from RBI and lending to common man is the profit. Let us see if the borrowers will benefit or not from the new MCLR guidelines after we compare the old Base rate system and MCLR with the help of an example: If the borrowing cost is 9% and the profit margin/spread is 1%, then lets see 2 scenarios

Where interest rate is in the decreasing trend:

- Base Rate: Lets assume RBI has decreased the interest rates to 7%, then the effective rate of lending to the common borrowers will be 9% (8%+1%)

- MCLR: According to MCLR, the effective rate will be 8%

- Conclusion: You benefit by 1% on interest if the RBI decreases the rate as it will be applicable immediately according to the benchmark period selected. This results in huge amount of savings over a period of time. The benefits from RBI are directly transferred to the common borrower.

Where interest rate is in the increasing trend.

- Base Rate: Lets assume RBI increased the rates to 10% + 1% spread, then the effective rate of lending to the borrowers will be 10.50% (10+11/2)

- MCLR: According to MCLR, the effective rate will be 11%

- Conclusion: If, RBI increases the interest rates, the base rates help us to curtail the loss incurred due to the hiked rates.

- Common borrowers will benefit is the rates are in the decreasing trend, but if the rates are hiked, we might have to pay slightly higher than the base rate. For people who are planning to switch over from BASE rate to MCLR, can give it a thought after observing the trend in change in rates, though currently RBI aims to reduce the lending rate to serve more people and increase their creditability.

- Fixed rate loans with tenure of less than 3 years need not comply with the MCLR norms. All floating rate loans of any duration and fixed rate loans above 3 years will benefit immediately from the rate change.

- Assuming, interest rates are cut by the bank within a few days of taking the loan, the benefit can be availed only after the reset date. In such cases, you may consider refinancing your loan from another lender. But, MCLR is like a double- edge sword and it might benefit when the rates soar high, as the hiked rates will be applicable after the reset date too.

- Short term loan borrowers will benefit as there are different interest rates according to period and risk.

- Since the MCLR has to be published every month, banks cannot hide their borrowing cost from the customers.

How much impact reduced interest rate has on your home loan?

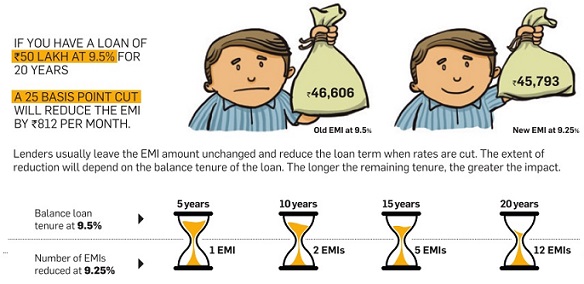

Following image from Economic Times shows that if you home loan interest reduces by .25%.

- Either the EMI goes down , in example below from Rs 46,606(old EMI at 9.5%) to 45,793 (new EMI at 9.25%) a saving of 813 per month on loan of Rs 50 lakh for 20 years. You can check the EMI using our EMI Calculator

- Or the tenure reduces. If you have 15 years of loan left then Balance loan at 9.25% will save you 5 EMIs. Longer the tenure greater the impact.

So have the banks reduced the home loan rate after change to MCLR?

Most of the major banks have announced their MCLR rate. SBI & ICICI have decided that home loans will have a tenor of 1 year. Kotak Mahindra Bank has chosen to reset home loan interest rates every six months i.e Kotak Mahindra Bank is using 6-month MCLR for home loans. For SBI moving to MCLR has reduced Interest rate by 0.1% as shown in table below. For ICICI Bank, the interest rate has reduced by .15% on moving from Base Rate to MCLR..

| Description | After MCLR | Before MCLR(Base rate) |

| MCLR 9.2% | Base Rate 9.3% | |

| Spread | .25% | .25% |

| Effective Interest Rate | 9.45% | 9.55% |

So all loans now follow MCLR way of calculating Interest Rate?

New loans issued from 1 Apr 2016 will be on MCLR but the loans which have been taken on or before 31st March 2016, will continue to be on the Base Rate system. So you can choose to stay on Base Rate till the end of your tenure or you can switch to MCLR.

So should I shift from Base rate to MCLR for my loan?

Note that Once you switch to MCLR, you cannot revert to Base Rate. It would be wiser to wait and find out how well the new system works. Though

- Rates on MCLR are lower than Base Rate( SBI by .1% ICICI by .2%)

- Interest rates could fall in the next few quarters, as RBI is expected to ease policy rates—but they will go up sharply once the cycle turns and RBI increases rates.

- But Banks will use their discretion to decide the reset period—daily, quarterly, half-yearly or annual MCLR—applicable to home and mortgage loans. So, your home loan interest rate will be pegged to the MCLR basket chosen by your bank.

- Despite being introduced as the panacea for all ills afflicting the home loan space, the MCLR regime is not without its share of complexities and limitations. In fact, the flexibility that banks enjoy within the MCLR system could create a fertile ground for variable pricing, say experts

Will MCLR be actually beneficial?

When RBI had ushered in the base rate regime in 2010, the objective was to ensure better transmission, transparency and fair treatment to new and existing borrowers. However, it met with limited success as banks displayed great haste in hiking rates in a hardening interest rate scenario and reluctance in reducing them when the situation turned benign, disappointing borrowers. MCLR is being seen as one of the tools to get banks to be more generous. But lets wait and watch.

What is Base Rate?

The Base Rate is the minimum interest rate of a Bank decided by RBI below which it cannot lend loans to its customers, except in cases allowed by RBI. The Base Rate system had replaced the BPLR system with effect from July 1, 2010. Banks can decide their individual base rate but that cannot be lower than the one already stated by RBI. Repo rate was not considered while arriving on the base rate. For example, the base rate is 9.75% as decided by RBI, so a bank can decide any base rate but not lower than 9.75%. Base rate has now been replaced by MCLR with effect from 1st April, 2016. The borrowers before first April have an option to switch over to MCLR, though it is not mandatory. Our article Understanding Base Rate of Loans explains it in detail.

What is BPLR?

BPLR (Bench-mark Prime Lending Rate)is the reference interest rate that commercial banks normally charge their most credit-worthy or premium customers. Loans are given out to other borrowers based on this reference rate. The lending rate for others will be a little more or little less than this reference lending rate

Related Articles:

- Understanding Inflation

- Terms associated with Home Loan

- Understanding Loans

- Joint Home Loan and Tax

- FAQ on CIBIL CIR Report and Score

Do you believe that this new new way of Calculating, MCLR rate will be beneficial to loan borrowers? Will Banks pass the reduced rates by RBI to borrowers. Please share your views on Marginal Cost of Funds based Lending Rate.

One response to “What it MCLR? Should one switch Loan from Base Rate to MCLR Rate?”

Learn more about Mortgage & Home loans at Loankuber https://www.loankuber.com/blog/borrower/mortgage-place/shift-mclr-borrowers-benefit