The Unified Payment Interface or UPI is a system to allow account holders across banks to send and receive money from their smart phones using a single identity mode- Aadhar Card Number, Mobile Number or virtual payment address without entering bank account details. Unified Payment Interface System(UPI) was launched by RBI Governor,Raghuram Rajan, on the 11th of April, 2016 in Mumbai. This article explains What is Unified Payment Interface? How does UPI work? How will it make life simpler for common man? What kind of transactions can one do with UPI? How is UPI What’s App of Payment?

Table of Contents

Send and receive money using UPI is like sending email

UPI is a single payment interface across all payment systems thus enabling all account holders to send and receive money from their smart phones using a single identity mode- Aadhar Card Number, Mobile Number or virtual payment address. This doesn’t require the bank details of the beneficiary or the sender. The ultimate aim of UPI is to enable cash-less hassle free transactions all the time, i.e, 24 x 7, for millions of people in India. This will replace the existing Immediate Payment Service(IMPS) and will act as a revolution in the banking sector. UPI was launched with 21 banks and is now offered by about 114 banks.

UPI makes sending or receiving money easy like sending an email. To send or collect money you need to just give the UPI id and you are done. So no remembering bank account number, IFSC code etc .

Just like you need to create an Email account similar way you need to create a UPI id which linked with your bank account. UPI id format is also like email id format <Number/name>@<upi/paytm>. UPI ID’s all begin with your mobile number followed by the ‘@’ symbol and the app you’re using. For example, in BHIM app UPI ID is shown as XXXXXXXXXX@upi, and in Paytm it’s XXXXXXXXX@paytm. You can create your unique UPI ID too! It isn’t necessary for one to remember your UPI ID to send or request for money. You can simply choose from your contact list and the registered UPI ID will be displayed.

The image below shows the steps for creating UPI Id (one-time activity, Sending and receiving money)

Unified Payment Interface is What’s App for payments? What’s-App has become the new social hub. At the occurrence of any event from birthdays to marriages it is mandatory to create a what’s-App group so that all the information is under one roof, everybody need not be informed individually and it free from any confusions and dilemmas. Similarly, UPI is a WhatsApp event for payments as it will be a centralized source for payment to any channel – From paying money to requesting to pay money, everything will be done in a few clicks with the minimum vital information required.

- UPI is built over Immediate Payment Service (IMPS) for transferring funds.

- Being a digital payment system it is available 24-7 and across public holidays.

- There are no charges for using UPI

- Unlike traditional mobile wallets, which takes a specified amount of money from user and stores it in its own accounts, UPI withdraws and deposits funds directly from the bank account whenever a transaction is requested. I

- It uses Virtual Payment Address (a unique ID provided by the bank), Account Number with IFS Code, Mobile Number with MMID (Mobile Money Identifier), Aadhaar Number, or a one-time use Virtual ID. A UPI-PIN (UPI Personal Identification number that one creates on the UPI app of the bank) is required to confirm each payment.

- Another big feature of UPI is that you can use any bank’s systems to transfer money or make payments. You don’t need an account with that specific bank to be able to use its UPI app. All you need to do is to download that bank’s UPI app, register yourself and make the payment.

UPI 2.0

UPI 2.0, was launched on 16 Aug 2018. Here are key features of UPI 2.0:

1. Linking of overdraft account: In addition to current and savings accounts, customers can link their overdraft account to UPI. Customers will be able to transact instantly and all benefits associated with overdraft account shall be made available to the users. UPI 2.0 will serve as an additional digital channel to access the overdraft account.

2. One-time mandate: UPI mandate could be used in a scenario where money is to be transferred later by providing commitment at present. UPI 2.0 mandates are created with one-time block functionality for transactions. Customers can pre-authorise a transaction and pay at a later date. It works seamlessly for merchants as well as for individual users. Mandates can be created and executed instantly. On the date of actual purchase, the amount will be deducted and received by the merchant/individual user.

3. Invoice in the inbox: According to NPCI, this feature is designed for customers to check the invoice sent by merchant prior to making payment. It will help customers to view and verify the credentials and check whether it has come from the right merchant or not. Customers can pay after verifying the amount and other important details mentioned in the invoice.

4. Signed intent and QR: This feature is designed for customers to check the authenticity of merchants while scanning QR or quick response code. It notifies the user with information to ascertain whether the merchant is a verified UPI merchant or not. This provides an additional security. Customers will be informed in case the receiver is not secured by way of notifications, said NPCI.

UPI 2.0 member banks as on date are State Bank of India (SBI), HDFC Bank, Axis Bank, ICICI Bank, IDBI Bank, RBL Bank, YES Bank, Kotak Mahindra Bank, IndusInd Bank, Federal Bank and HSBC, NPCI said in a statement on Thursday.

Is Unified Payment Interface safe?

UPI will be one of the most secured and authenticated interface available for making payments online as it involves the database of millions of people. Already NPCI’s IMPS network handles more than Rs 8,000 crore worth of transactions a day, which will experientially increase with the use of mobile phones. There are various security set up done like:

- Mpin/Password/OTP: Every transaction will be authenticated with entering a MPIN/password before making the final payment.

- Also, there will be SMS-based OTP that will be sent on the phone of the person who is making the payment thus the information will be available only on the smart phone of the payer.

- No Bank information: As none of the bank details will be entered in the app while making payments, it will be safer to make payment to any third party.

- Encryption: Encryption means to convert the data into a code to prevent unauthorized access or to secure from illegal usage. All the private data like Pins, passwords, linked bank account, biometrics will be in the encrypted form. Name, transaction history (amount, timestamp, response code, location, etc.) will be stored in unencrypted form.

The huge surge in UPI transactions in 2017–18 were largely due to launch of PhonePe, Paytm, Chillr and then Google Tez, UPI based payments applications. PhonePe came up with attractive cashback & referral offers & Google Tez with incentives for customers which led to greater adoption of UPI platform.

| Year | Transaction volume (millions) | Transaction value (billions, INR) |

| 2016–17 | 17.86 | 69.47 |

| 2017–18 | 737.18 | 856.59 |

Which Banks support Unified Payment Interface?

UPI was launched with 21 banks and is now offered by about 114 banks. As on Aug 2018, 114 banks support UPI including ICICI Bank, Axis Bank, YES Bank, Punjab National Bank, Andhra Bank, State Bank Of India, are integrating the interface with their mobile apps.

The website of National Payments Corporation of India lists the banks that facilitate UPI. Banks here are termed as Payment Service Providers (PSP) and issuers. PSP includes those banks which have their own mobile application to facilitate transaction and issuers include banks which don’t have their payments interface and rely on third party software for the transaction using UPI. The list of PSPs and Issuers can be viewed here: UPI Live Members

It also gives links to Apps for Android Phones on Google Play Store.

Video on creating and Using UPI Id on SBI Pay

What is Unified Payment Interface?

Under the UPI, a payment address is a handle that can uniquely identify account details. In this architecture, all payment addresses are denoted as “account@provider” form. Address translation may happen at provider or gateway level or at NPCI level.

Imagine buying grocery from a supermarket by paying cash. You hand over the cash, the biller hands you a receipt and the purchased good. UPI is as simple as this. Instead of handing over the cash, you tell your virtual identity to the cashier. The cashier generates an invoice through UPI, you approve it using your mobile phone and the payment is made!

More Details at NPCI Payment United Interface

Features of Unified Payment Interface (UPI)

It is a significant step towards moving into a cashless economy. Apart from a bank account, all that you need is a smartphone. Once you register for UPI with your bank, a unique ‘virtual address’ will be created. This is mapped with your mobile phone.

- To initiate the payment, UPI invokes this virtual identity of the beneficiary and transfers money in real-time. It works on single-click 2-factor authentication. Two-factor authentication is a security process in which the user provides two means of identification from separate categories of credentials; one is typically a physical token, such as a card, and the other is typically something memorized, such as a security code. Ex Net banking and One time Password.

- UPI will allow a customer to have multiple virtual addresses for multiple accounts in various banks. In order to ensure privacy of customer’s data, there is no account number mapper anywhere other than the customer’s own bank. This allows the customer to freely share the financial address with others.

- A customer can also decide to use the mobile number or Aadhaar number as the name instead of the short name for the virtual address.

- UPI can potentially eliminate the need for maintaining a mobile wallet, as this ‘virtual address’ is not limited only to individuals.

How Can one use Unified Payment Interface?

If you want to transfer money using UPI, you have to go through the following steps.

- You need to have a bank account and a smart phone.

- Download the UPI app of a bank.

- Connect the bank account

- Create a Unique ID

- Generate a mobile pin

- Start transferring money using the mobile app. Use MPIN to authenticate the payment.

API or Application Programming Interface is a set of routines, protocols, and tools for building software applications. The API specifies how software components should interact. A good API makes it easier to develop a program by providing all the building blocks. A programmer then puts the blocks together.

How will the United Payment Interface be different from the apps that banks provide?

Every bank requires you to download its app. So, if you have two bank accounts, you will have to download two apps on your smartphone. But, with UPI interface, you need to download only one app. The UPI interface will network all the banks together and make it possible for the customer to make transactions using a single app.

Compare UPI with NEFT, RTGS, IMPS and Digital Wallets

Let’s look at traditional electronic payment methods: NEFT, RTGS, IMPS,Digital Wallets and their disadvantages

Some of the electronic payment methods are at your disposal and their disadvantages are given below.

- Net Banking

- In National Electronic Funds Transfer (NEFT), money transfers are made via electronic messages. The bank details of the sender and the beneficiary are linked using bank branch name and IFSC code. When a payment is initiated, the payer’s bank sends a ‘message’ to its NEFT service centre. All such messages are pooled every hour and the bank’s NEFT centre sends it to the RBI, which initiates the transfer. The process typically takes a little more than an hour and is available only during the bank’s working hours.

- In Real Time Gross Settlement (RTGS), fund transfers handled on one-to-one basis. Large value transactions, typically over Rs. 2 lakhs, are carried out using this method. This is also done during working hours.

- Immediate Payment Service (IMPS) is a more recent form of fund transfer that is gaining popularity. A user is given a 7-digit Mobile Money Identifier (MMID) Code. The sender initiates payment using mobile bank by giving the MMID code and registered mobile number of the beneficiary. Most banks offer this service free-of-cost now. It is a round-the-clock immediate payment service.

- Online payment through credit/debit card: You either have to enter your credit/ debit card number, name, expiry date and verification codes, or sign in with your net-banking account and go through a similarly tedious process. Our article What happens when credit card is swiped? talks about the magic behind credit card payments

- Digital and mobile wallets: We add money in them using debit/credit card or net banking. The amount in these wallets can be used to make payments at various merchants but mostly online. Freecharge has started to tie-up with various retail brands like Shopper’s Stop and payment can be made from the freecharge wallet. Wallets have one big drawback that is they are not centralized for all the merchants. From booking hotels, to booking a cab we need to add money in different wallets, using card details at multiple places

Who has developed Unified Payment Interface?

UPI is created by the National Payment Network Company (NPCI), set up with the support of the Reserve Bank of India and Indian Banks Association (IBA). The National Payments Corporation of India has tied up with Kolkata-based payments technology company RS Software to create a platform for the former’s Unified Payment Interface (UPI). For every transaction made using UPI, NPCI will earn 50 paise.

How does Unified Payment Interface work?

Transfer of payment on UPI is as easy as making a phone call and as secure as paying money physically. The biggest impact of this app will be on third-party payments. Generally, if we want to pay someone, we use RTGS or NEFT, and we need to add him or her as a beneficiary. This takes anywhere around half an hour to one working day depending on the bank. We also need the bank account number, IFSC code. If we are making any payment online we need to enter your own debit card details like number, name, expiry and CVV but the UPI app does away with all this. Every payment has the following core elements:

- Smart phone and bank account: Every beneficiary(payee) and payer should have a smart phone with UPI app installed on it which can be downloaded from the App Store/ Play Store.

- Create Unique ID: Every person (payer and payee) will have a unique ID mapped with its mobile number. Unique IDs will be virtual say for example, hetald@axisbank.com or we can use mobile/Aadhaar number- 1234567890@axisbank.com etc. Unique ID will be available for various accounts so that you can select the account from which you want to make the payment.

Once the unique id is created, we just need to login, enter the unique ID of the person/entity to whom the payment is to be made and select send. A push notification or a pop up will be received on our payment service provider (PSP)/mobile for confirmation of the payment. We need to authenticate the transaction after entering our secure Pin or password and WOW! the payment is done. This transaction will then be pushed to our bank, where the credentials are verified and our account will be debited. This confirmation is again forwarded to the UPI server and it in turn initiates a credit message to the beneficiary’s bank and eventually to his account. Sounds a tedious procedure but is done in seconds!

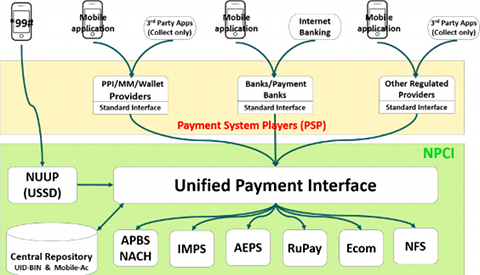

The image below shows the UPI infrastructure. You can use Internet Banking, Aadhar based ,Mobile phones, Credit Cards, 3rd party apps to pay and UPI will use the appropriate payment method, IMPS, Nach,Rupay etc to do transactions.

Unified Payment Interface provides the following core features via a single payment API and a set of supporting APIs.

- 1. Ability to use personal mobile as the primary device for all payments including person to person, person to entity, and entity to person.

- 2. Ability to use personal mobile to “pay” someone (push) as well as “collect” from someone (pull).

- 3. Ability to use Aadhaar number, mobile number, card number, and account number in a unified way. In addition, ability to pay and collect using “virtual payment addresses” that are “aliases” to accounts that may be payee/amount/time limited providing further security features.

- 4. Make payments only by providing an address with others without having ever provide account details or credentials on 3rd party applications or websites.

- 5. Ability for sending collect requests to others (person to person or entity to person) with “pay by” date to allow payment requests to be “snoozed” and paid later before expiry date without having to block the money in the account until customer is ready to pay.

- 6. Ability to pre-authorize multiple recurring payments similar to ECS (utilities, school fees, subscriptions, etc.) with a one-time secure authentication and rule based access.

- 7. Ability for all payment system players to use a standard set of APIs for any-to-any push and pull payments.

- 8. Ability to have PSP provided mobile applications that allow paying from any account using any number of virtual addresses using credentials such as passwords, PINs, or biometrics (on phone).

- 9. Ability to use a fully interoperable system across all payment system players without having silos and closed systems.

- 10. Ability to make payments using 1-click 2-factor authentication all using just a personal phone without having any acquiring devices or having any physical tokens.

This can be useful not just in making regular payments at the super market or online but also in many transaction, for example.

- We all have that one friend we FORGETS their wallet at home specially on those days when we have decided to splurge. But now, just provide your ID or mobile number and money can be easily transferred from his account.

- A migrant worker, Suresh, living in Mumbai having an account with State Bank of India, using his smart phone, can send money to his wife, Rekha, in a village via her Aadhaar number with single click. He can download the UPI app and should secure his account with a MPIN. If he has not obtained an MPIN, he can use *99 (NPCI USSD service accessible across country) on his phone to set first time MPIN. He adds his wife’s Aadhaar card number, press end and his wife will receive the money! No other information such as IFSC code, Bank account or any other details needs to be entered( Rekha’s Aadhaar card should also be linked to her bank account). The purpose of the UIDAI is to issue a Aadhaar number to every Indian resident so that it can eliminate duplicate creation is IDs and the it can be verified easily, electronically and in a cost-effective manner. Currently there are more than 730 million Aadhaar card holders.

- We all have been in that early morning rush where it is impossible to find a Taxi/Ricksaw, and say fortunately you find one but at the end of the journey you realize you do not have change and you are in no mood to argue. So what do you do? Give him 1000 bucks for a short trip to station?! Of course not! Enter his details (provided he has one) on the UPI app, smartly transfer the fare amount and peacefully leave! Or, the driver can enter your unique ID request pulling of money from your account, you can authenticate the transaction and done!

- Remittances will also become easier and the same process applies here as well. Cash on delivery, the big driver behind the eCommerce boom, will probably die a natural death for people with smart phones. They can use the UPI app to pay after receiving the goods. All they need to know is the unique ID of the eCommerce firm. The buyer can also scan a QR code that the delivery boy carries through his UPI app or pay directly to the unique ID of the delivery boy.

So Will Unified Payment Interface be successful?

Theoretically United Payment Interface is very simple but powerful concept.

- Under UPI the payments can be initiated by sender or receiver and are carried out in a secure, convenient and integrated fashion.

- UPI will enable anywhere, anytime payment to anyone!

- UPI is also expected to propel easy instant payment via mobile, web and other applications.

- UPI will get the payment gateways and merchants under one head thus enabling swift transactions.

- Use of currency notes would come down and the economy would become more transparent, open to compilation of reliable data.

Mobile wallets especially like Freecharge and Paytym have one big leverage over UPI i.e CASHBACKS. Using various coupon codes or making payment on various partner sites, we receive a cashback in our wallet. This results in savings and thus mobile wallets might not completely get extinguished till the time UPI also comes up with something similar.

Everything said, now with NPCI opening the API to developers, it will be interesting to see how startups leverage the power of the platform and how. You can express your opinion by voting for Will UPI be successful: Yes, No,May be, Who cares

Related Articles:

- Payment Banks,Types of Banks in India, History of Banking in India

- Interest on Saving Bank Account : Tax, 80TTA

- What do we want from Bank : Is Social Banking the way to go?

- What is Auto Sweep Bank Account?

- JAM Trinity: Jan Dhan Yojana, Aadhaar and Mobile number

- NACH: What is NACH? NACH OTM,How NACH will replace ECS

Digital money is the next big revolution in the banking sector. Will UPI be successful and make life easier for millions of people? Will people use it? Please write in the comments and vote!

4 responses to “What is Unified Payment Interface or UPI?How to use it?”

[…] collect request which can be scheduled and paid as per requirement and convenience. Our article What is Unified Payment Interface or UPI?How to use it? explains it in […]

Thanks for sharing this blog… I really great..

Thanks for sharing informative blog becuase this blog related to unified payment interface. UPI is a very easy used for each persion safe & secure.

Great article!! But will UPI not make wallets redundant? If so, Axis Bank has recently tied up with Freecharge, a wallet company. So, how is UPI helping Axis Bank and Freecharge at the same time? Please reply