What is Mobile Banking? What are the various forms of Mobile Banking – SMS Banking, USSD, Apps? What is is status of mobile banking in India? Is Mobile Banking safe. Such questions are answered in this article.

What is Mobile Banking?

A mobile phone is no longer a simple device to make calls. It is used from e-mailing, what’s app, facebook. It can also be used to pay bills, transferring money and do many banking transactions. Mobile banking allows you to conduct financial transactions on your phone just as you would at a bank branch or through Net banking. Banks are now evolving mobile banking as they launch innovative products. Other than SMS banking, banks are now offering banking services on mobile handsets through WAP-based internet websites and application based mobile banking services.

What can one do through Mobile Banking?

Mobile banking extends to basic feature-phone users with SMS and missed-call banking as well as a mobile site. All that a customer needs to do is, send a text or call a toll-free number to know his account balance, get a mini statement, request a check book, or detailed account statement.

Till 2010 Mobile banking was performed via SMS or the mobile web. Rapid growth of smart phones have led to increasing use of special client programs, called apps, downloaded to the mobile device. So now many banks are attempting to turn a smartphone into a bank branch. HDFC Bank launched ,Bank Aap Ki Muththi Mein an app on the three popular smartphone platforms ,iOS, Android, and Windows Phone. It allows over 75 banking transactions, apart from essential transactions such as: booking fixed and recurring deposits, bill and tax payments, buying insurance, and mutual funds, the app allows customers to buy all kinds of loans instantly. It also provides customized, location-specific promotions, as well as offers and deals on shopping, dining, movies, and entertainment.

Table of Contents

What are the various types of Mobile Banking?

When you withdraw cash from an ATM, a second later you get SMS from your bank informing you of the transaction. Similarity when you swipe your debit card(or credit card) in a store, you again get SMS . These alerts are the simplest of mobile-based services offered by banks. These alert you immediately in case of a wrong or a fraudulent debit. Some banks charge a fee for alerts on accounts . These are SMS alerts. Various forms of Mobile banking are

Toll Free

Call specified numbers to access Banking service from your registered Indian Mobile Number. Ex for HDFC Bank Call 1800-270-3333 to get your account Balance. For Axis BankDial 1800 419 5959 to get your account Balance, Dial 1800 419 6969 to get your Mini Statement

Browsing Internet on the cellphone

- The bank’s website can be accessed with the help of customer identification and net banking password which is the same used for Internet banking.

- No installation needs to be done. Most of the banks have their mobile sites. For example m.icicibank.com is ICICIBank’s mobile website. These websites are similar to regular websites usually built with WAP (Wireless Application Protocol . WAP is a technical set of communication standards for the way wireless devices (like cell phones) connect to the Internet.). User just needs to type the mobile website address on the browser in mobile. A WAP site is just like a website, but for your mobile phone. Because bandwidth is far less on a mobile phone, and because your mobile phone screen size is only a fraction of what is on a computer, WAP sites are tiny compared to their larger brothers.

- These websites works on the data connection ie GPRS/3G/Wi-fi. This is a free service provided by bank for its saving account customers. However, operator data charges may be applicable as per your data plan.

Video below is the demo of mobile banking of HDFC Bank, from Youtube.

SMS Banking

SMS Banking services allow you to pay bills, recharge prepaid services and avail banking services by sending a simple SMS. One needs to register for SMSBanking The bank gives a particular code, which needs to be sent to a designated number and a response is received from the bank. These can be for queries such as balance enquiry, stop cheque, account statement and other such services. You do not need a smart phone or a data plan activated on your mobile phone to avail our SMS Banking services. SMS are charged like any other SMS.

For example, HDFC Bank account holders can request for their Balance Enquiry by messaging bal to 5676712 or Mini Statemen by messaging txn to 5676712 . While some banks allow only non-financial transactions through SMS-based services, few also allow services such as mobile or DTH top-ups or recharge.

USSD

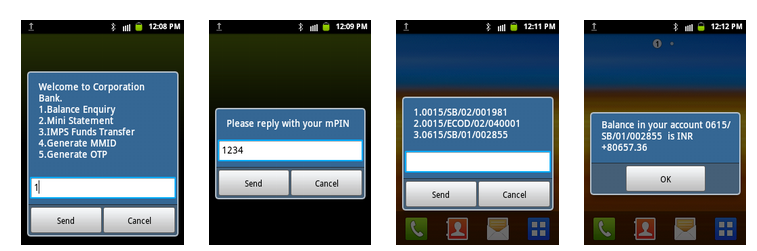

USSD or Unstructured Supplementary Service Data means a real-time or instant session-based messaging service for GSM (Global System for Mobile Communication) offered on a short code: *99# by National Payment Corporation of India(NPCI). The service allows every banking customer to access banking services with a single number across all banks ,irrespective of the telecom service provider, mobile handset make or the region. This is similar to *121# we use on the mobile. Image below shows USSD .

A great advantage to the customer is that he is not be charged for USSD unlike SMS where he is charged as per the SMS tariff plan of the telecom operator. The other benefits of USSD are as below-

- GPRS(internet) is not required, it works on voice connectivity. Smartphone is not required.

- Works on all GSM mobiles.

- No application installation is required.

- You can access details of all your bank accounts (across banks).

The services under USSD are as follows –

- Balance Inquiry

- Last few transactions

- IMPS – Person-To-Person (P2P) funds transfer.

- IMPS – Person-To-Account (P2A) funds transfer.

- Generate MMID

- Generate OTP

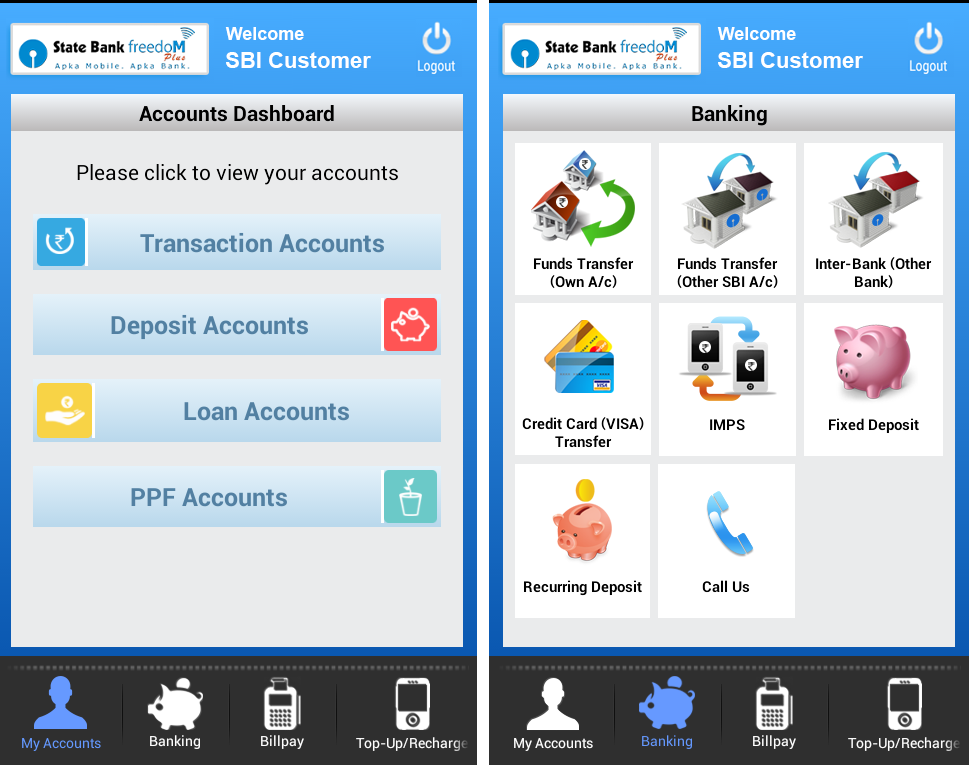

Apps

Banks offer full-fledged mobile banking services through downloadable applications that can be stored in the mobile phone. Following image shows snapshot of SBI’s mobile app Freedom plus on Android.

ICICI mobile app is called as iMobile, Axis Bank mobile app is called Axis Mobile.

To use apps one first needs to register his mobile numbers with the bank. Also, the customer has to generate a Personal Identification Number (MPIN) that acts as a security password for mobile banking. In case the wrong MPIN is entered three times during a transaction, the mobile banking service account gets deactivated . All data that is stored on the phone is encrypted using strong encryption standards thereby making it secure.

Banking via a mobile app is safe as it provides a direct link from the device to the bank, without having to go through any additional browser or third-party application. It is safer than banking through a browser on a personal computer When customers use their browser to do their banking(on personal computer ot through internet on mobile), they leave themselves open to malware and man-in-the-middle attacks Even when a bank has strong security, if users’ computers are infected with malware or a virus, they may be vulnerable to attack.

IMPS

One feature which I have seen being used often on mobile banking that I want to bring to attention is IMPS. Immediate Payment Service (IMPS) is an instant interbank electronic fund transfer service mostly through mobile phones, though many banks also allow it through internet banking and ATMs. IMPS transactions can be sent and received at any time and any day. There are no timing or holiday restrictions on IMPS remittances. You will need a 7 digit MMID (Mobile Money Identifier) number to transfer funds via IMPS. In the seven digits of the MMID are four digits used to identify the bank of the user and three digits used to identify the account of the user.

A mobile number(registered with the bank) and a MMID will uniquely identify a customer’s account with the respective bank. The design of the MMID allows customers to operate multiple bank accounts linked to a single mobile number; each bank account has its own MMID. The MMID is not intended to be a secret it is simply an identifier and it does not give away any sensitive information about the customer. For example, a merchant will advertise his mobile number and MMID publicly in order to receive payments from the customers.

Website www.npci.org.in/bankmember.aspx shows list of banks offering IMPS ,channel through which they are offering IMPS (Mobile/Internet/ATM). To know more about IMPS one can watch Youtube video by NPCI

Is Mobile Banking Popular?

Mobile banking services in India started with SMS banking way back in 2002. Though mobile banking is synonymous with the word convenience banking, its usage is not anywhere close to its potential. There are over 900 million mobile users in the country but there are only 40 million mobile customers. . RBI has also asked banks to promote mobile banking. SBI has 50% share in mobile banking, said the report in Times of India

Is Mobile Banking Safe?

The customers are mostly using ATM and online banking services. Most of the customers feel comfortable without mobile banking. They also feel, there are chances of misuse in mobile banking due to mobile handset theft. What if someone gets a hold of my phone? Can’t they then access my account?” Even if someone is able to obtain a customer’s phone, they will still be required to put in a username and password, and if available, provide a second factor of authentication, in order to gain access to the accounts. But some Dos and Don’t if using Mobile Banking are :

- Set the phone to require a password to power on the device or unlock it.

- Whether you’re using the mobile Web or a mobile app, don’t let it automatically log you in to your bank account.

- Don’t save our password, account number, PIN, answers to secret questions or other such information information anywhere on your handset.

- Immediately tell your bank or mobile operator if you lose your phone.

Related Articles:

- Third Party Fund Transfer : NEFT,RTGS

- Service Charges on Saving Accounts by Bank,QAB,MAB

- Cheque: Clearing Process, CTS 2010

- Saving Bank Account:Do you know how interest is calculated and more

- Interest on Saving Bank Account : Tax, 80TTA

Innovations have made cellphones into a personal banking tool, but there is still some way to go? Do you use Mobile Banking? Which form – SMS, USSD,App? What do you use Mobile Banking for – finding information such as balance enquiry or to do Financial transactions such as Pay bills, transfer money ?

4 responses to “What is Mobile Banking?”

this was explained very well. I have recently started using mobile banking and i have got many issues actually. it was really helpful in better understanding it.

Thanks for sharing this good information.. This blog is really useful to those who are new to the mobile banking.

Thank you for sharing such great information.

Thanks for sharing. This blog is really going to be useful to those who are new to the mobile banking. I’ve deposited the cheque amount via mobile banking. I usually do the monetary transactions from a reputed Credit Union establishment in New jersey. They provide us an app in which we snap the pictures of the cheque and forward it to them. This technique of depositing cheque amount really works.