The International Monetary Fund (IMF) mission is to ensure the stability of the international monetary system. IMF promotes monetary cooperation internationally and offers advice and assistance to facilitate building and maintaining a country’s economy. The worst financial crisis, India faced was the Balance of Payment crisis in 1991. It led the Indian government to pledge national gold reserves to a conditional bailout from the IMF and World Bank in exchange for a loan to cover the balance of payment debts. The crisis led to the liberalisation of the Indian economy. Gita Gopinath has been appointed as Chief Economist at the IMF in 2018. She is the second India-born to hold the prestigious post, first being the former RBI governor Raghuram Rajan.

Table of Contents

What is IMF? How does it Help?

The IMF has played a part in shaping the global economy since the end of World War II. The International Monetary Fund (IMF) is an international organization headquartered in Washington, D.C., consisting of 189 countries. The International Monetary Fund promotes monetary cooperation internationally and offers advice and assistance to facilitate building and maintaining a country’s economy. It does so in three ways: keeping track of the global economy and the economies of member countries, lending to countries with balance of payments difficulties and giving help to member countries. http://imf.org/

When a country joins the IMF, it agrees to subject its economic and financial policies to the IMF. IMF does Surveillance of its Member countries, Like A Doctor. It is the only organization that has the mandate to examine on a regular basis the economic circumstances of virtually every country in the world.

Countries contribute to a pool which could be borrowed by countries with payment imbalances. Quotas, which are pooled funds of member nations, generate most IMF funds. The size of a member’s quota depends on its economic and financial importance in the world. Nations with larger economic importance have larger quotas. Higher quota gives higher voting rights and borrowing permissions.

The IMF has a management team and 17 departments that carry out its country, policy, analytical, and technical work.

The current Managing Director (MD) and Chairwoman of the International Monetary Fund is noted French lawyer and former politician, Christine Lagarde, who has held the post since 5 July 2011.

Gita Gopinath has been appointed as Chief Economist at the International Monetary Fund.

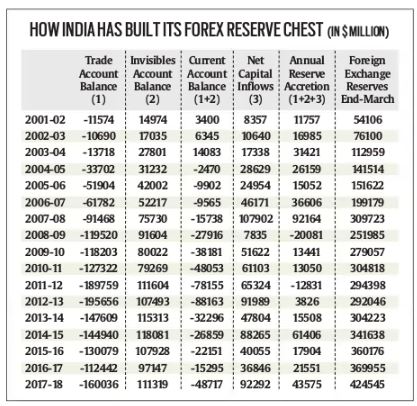

India Joined IMF on 27 Dec 1945 and is an Original member. India landed in an acute balance of payments crisis in 1991 with forex reserves down to cover for just seven weeks of imports, when it turned to the IMF and the Bank for support and was forced to adopt economic reforms for economic liberalisation in 1991.

- Original members All those countries whose representatives took part in BRETTON WOODS CONFERENCE and who agreed to be the members of the fund prior to 31st December 1945

- Ordinary members: All those who became members subsequently

What is the Balance of Payments?

In a globalized world, every country purchases and sells goods and services to another. This includes both public and private transactions. A country’s balance of current payments is the result of its commercial transactions (i.e. imported and exported goods and services) and its financial exchanges with foreign countries. The balance of payments is a measure of the financial position of a country vis-à-vis the rest of the world. A country with a surplus in its current payments is a lending country for the rest of the world. On the other hand, if a country’s balance is in the red, that country will have to turn to the international lenders to meet its funding needs.

Examples of Loans provided by IMF

The IMF provides loans and helps countries develop policy programs that solve the balance of payment problems if a country cannot obtain financing sufficient to meet its international obligations. The loans offered by the IMF, however, are loaded with conditions. Often, a loan provided by the IMF as a form of “rescue” for countries in serious debt ultimately only stabilizes international trade and eventually results in the country repaying the loan at rather hefty interest rates.

- In 2018-19 Pakistan is negotiating an $8 billion bailout package from the International Monetary Fund (IMF) to overcome a severe balance-of-payments crisis that threatens to cripple the country’s economy. The conditions for bailout by IMF are; increased energy tariffs from 20 to 22%, the imposition of more taxes and sharing details related to Chinese financial assistance, further devaluation of the Pakistani rupee. In the outgoing fiscal year, Pakistan’s current account deficit has swelled to an all-time high of $18 billion, while the budget deficit edged up to around 6.6% of GDP. Pakistan requires approximately $12 billion for the balance of payments support by the end of June 2019. UAE is giving a $6.2 billion assistance package to Islamabad to bolster its foreign exchange reserves and the government’s fiscal policies. It involves $3.2 billion worth of oil supplies on deferred payment, besides a $3 billion cash deposit,

- In March 2014, the IMF secured an $18 billion bailout fund for the provisional government of Ukraine in the aftermath of the 2014 Ukrainian revolution

- In May 2010, the IMF participated, in 3:11 proportion, in the first Greek bailout that totalled €110 billion, to address the great accumulation of public debt, caused by continuing large public sector deficits. As part of the bailout, the Greek government agreed to adopt austerity measures that would reduce the deficit from 11% in 2009 to “well below 3%” in 2014. A second bailout package of more than €100 billion was agreed over the course of a few months from October 2011.

- The IMF provided two major lending packages in the early 2000s to Argentina (during the 1998–2002 Argentine great depression) and Uruguay (after the 2002 Uruguay banking crisis).

Difference between IMF and World Bank

Both organizations were established as part of the Bretton Woods Agreement in 1945. IMF and the World Bank are inseparable twins, membership in the former is a prerequisite for membership in the latter. The IMF and World Bank collaborate regularly and at many levels to assist member countries and work together on several initiatives. But Both these institutions are complementary to each other.

The primary difference between the International Monetary Fund (IMF), and the World Bank lies in their respective purposes and functions. The IMF exists primarily to stabilize exchange rates, while the World Bank’s goal is to reduce poverty.

| IMF | World Bank | |

| The IMF promotes international monetary cooperation and provides policy advice and capacity development support to help countries build and maintain strong economies. | The World Bank promotes long-term economic development and poverty reduction by providing technical and financial support to help countries reform certain sectors or implement specific projects—such as building schools and health centres, providing water and electricity, fighting disease, and protecting the environment | |

| The IMF also makes loans and helps countries design policy programs to solve balance of payments problems when sufficient financing on affordable terms cannot be obtained to meet net international payments. | World Bank assistance is generally long term | |

| IMF loans are short and medium term and funded mainly by the pool of quota contributions that its members provide. IMF staff are primarily economists with wide experience in macroeconomic and financial policies. | World Bank assistance is funded both by member country contributions and through bond issuance. World Bank staff are often specialists on particular issues, sectors, or techniques |

The video on the difference between IMF and World Bank

How IMF helps India

India has been one of the frequent borrowers from the IMF. India Joined on December 27, 1945; Article VIII and Total Quota: SDR 4,158.20 million

India borrowed from the Fund immediately after independence, her dependence on it for financial assistance became critical during to 1955-61 when we witnessed a sharp fall in our foreign exchange reserves. India borrowed $200 million to meet the crisis. As the BOP crisis remained precarious we again borrowed $250 million in 1961. As there was no sign of improvement in the BOP position, India devalued her currency in 1966 to the extent of 36.5 p.c. allegedly on the advice of the IMF.

India again made a huge borrowing from the IMF in 1981 to tide over the BOP difficulties following the second oil price rise by the OPEC and the large volume of trade deficit. Under the borrowing arrangement with the IMF, India agreed to draw SDR 5 billion, over a three year period. As BOP situation as well as economic conditions improved, actual drawing from the Fund was only SDR 3.9 billion, rather than SDR 5 billion.

The economic reforms of the 1990s in India are said to have been introduced at the instance of the IMF- World Bank. In August 1991, the Indian Government applied for a standby loan of $ 2.3 million for a 20-month period. For this, a letter of intent was issued. In this letter, India promised to launch several structural reforms. In other words, the conditionality clause was incorporated by the IMF against such loans.

Gita Gopinath and IMF

Gita Gopinath has been appointed as Chief Economist at the International Monetary Fund succeeding Maurice Obstfeld. She will be the second India-born to hold the prestigious post, first being the former RBI governor Raghuram Rajan. Between 2003 and 2006, Rajan was the Chief Economist and Director of Research at the International Monetary Fund.

Gita was born in December 1971 to Malayalee parents. Her father, TV Gopinath, is a farmer and mother is a homemaker. Both hail from Kannur district in Kerala. She is a US citizen and an Overseas Citizen of India.

Gita is married to Iqbal Singh Dhaliwal, who is an executive director at Abdul Latif Jameel Poverty Action Lab at the Department of Economics at the Massachusetts Institute of Technology.

Gita did her schooling from Calcutta and graduated from the Lady Shri Ram College of Commerce in Delhi. She completed her Master’s degree from the Delhi School of Economics as well as from the University of Washington. She got PhD in economics from Princeton University in 2001 and she was guided by Kenneth Rogoff, Ben Bernanke and Pierre-Olivier Gourinchas. She joined the University of Chicago in 2001 as an Assistant Professor before moving to Harvard in 2005 where became a tenured Professor there in 2010. She was John Zwaanstra Professor of International Studies and Economics at Harvard University.

in 2016, Gita was appointed as financial advisor to Kerala Chief Minister Pinarayi Vijayan. It created a controversy as some communist leaders questioned the CPM-led state government for roping in a person who was more into the market economy and liberal policies

In 2014, she was named one of the top 25 economists under 45 by the IMF and was chosen as a Young Global Leader by the World Economic Forum in 2011

How does IMF work?

Countries contribute to a pool which could be borrowed by countries with payment imbalances. Quotas, which are pooled funds of member nations, generate most IMF funds. The size of a member’s quota depends on its economic and financial importance in the world. Nations with larger economic importance have larger quotas. Higher quota gives higher voting rights and borrowing permissions. Quota subscriptions are a central component of the IMF’s financial resources. Each member country of the IMF is assigned a quota, based broadly on its relative position in the world economy.

Till 1971, all the amounts of quotas and the assistance provided were denominated in USD, but since December 1971 all the quotas and transactions of IMF are expressed in SDRs (Special Drawing Rights), also known as the Paper Gold. In 1971, The value of the SDR was initially defined as equivalent to 0.888671 grams of fine gold, which, at the time, was also equivalent to one U.S. dollar but since then there have been changes.

Special Drawing Rights (SDR) The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves. The XDR is the unit of account for the IMF, and is not a currency per se. XDRs instead represent a claim to currency held by IMF member countries for which they may be exchanged. The value of the XDR is based on a basket of key international currencies reviewed by IMF every five years. The weights assigned to each currency in the XDR basket are adjusted to take into account their current prominence in terms of international trade and national foreign exchange reserves. In the review conducted in November 2015, the IMF decided that the Renminbi (Chinese yuan) would be added to the basket effective October 1, 2016. From that date, the XDR basket now consists of the following five currencies: U.S. dollar 41.73%, Euro 30.93%, Renminbi (Chinese yuan) 10.92%, Japanese yen 8.33%, British pound 8.09%

IMF is managed by a Board of Governors. Each member country nominates a Governor. All the nominated Governors make the Board of Governors. Each country also nominates an alternate Governor, who casts his vote in the absence of the Governor. Each Governor is allotted a number of votes which is determined by the quota allotted to the respective country in the capital of IMF. Each Governor has got the right of 250 votes on the basis of the membership. And one additional vote for each SDR 1,00,000 of quota. The addition of these two types of votes becomes the actual voting right of the member country.

| The table below shows quota and voting shares for some IMF members | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

IMF HAS DIFFERENT TYPE OF LOANS

IMF provides four types of loans:

FCL (Flexible Credit Line): This is usually given to countries well before they get into a problem. They are the ones with better policies.

PLL (Precautionary Lending): This is for countries that are beginning to get weak.

SBA (Stand By Arrangement): This is for countries that are quite weak, but can be rescued quickly.

EFF (Extended Fund Facility): This is for countries that are in a lot of trouble and will need help for a long time.

WHAT HAPPENS IF A COUNTRY FAILS TO PAY BACK A LOAN (DEFAULTS) FROM THE IMF?

- No fresh loan till the loans are repaid. In IMF parlance, countries that miss payments are deemed to be in “arrears”.

- Currency Depreciation

- Foreign investors would quit the stock markets and eventually even direct investments would vanish. That would ransack the stock markets and destroy domestic companies.

What is Balance of Payments?

The balance of payments calculates the value of these transactions. Usually, the value of the outflows should be equal to the total inflow of money into the country. However, this is not so because payments are sometimes delayed or paid over a longer term. For this reason, countries can have a deficit or surplus of BoP in the short-term. A deficit is when you owe money to the world, while a surplus is when your cash inflows exceed your outflows.

Balance of payments comprises three kinds of accounts – current, capital and financial account.

- The current account calculates the total value of imports and exports of goods and services.

- Money is also exchanged between countries through investments or other kinds of financial transactions. This is calculated in the capital and financial accounts. After the 1990 crisis when India did not have enough money left to fund its deficit, it opened markets partially to foreign investors.

History of IMF

The IMF was conceived at a UN conference in Bretton Woods, New Hampshire, United States, in July 1944 by Harry Dexter White and economist John Maynard Keynes. The IMF came into formal existence in December 1945, when its first 29 member countries signed its Articles of Agreement. It began operations on March 1, 1947.

- UN, IMF, World Bank: Rich and Poor countries of World, MUN

- What is Inflation? How is it Calculated? WPI, CPI in India,HyperInflation

- What is GDP, Gross Domestic Product

- What are Central Banks,What is RBI? What do they do?

2 responses to “What is IMF? How does it work? Difference from World Bank”

[…] What is IMF? How does it work? Difference from World Bank […]

[…] What is IMF? How does it work? Difference from World Bank […]