If someone needs to buy shares or stocks, Exchange traded funds (ETFs) then one needs to have a demat account. This article tries to explain what is Demat Account. What are Brokerage, Transaction Charges and compares various demat account providers?

Table of Contents

Basics of Demat Account

What is demat account?

In India, shares and securities are held electronically in a Dematerialized or Demat account , instead of the investor taking physical possession of certificates. Just like a bank which holds the funds for depositors one needs a Depository to hold these shares in electronic format.

What is a Depository and Depository Participant?

A depository is an organisation which holds securities (like shares, debentures, bonds, government securities, mutual fund units etc.) of investors in electronic form. To avail the depository services one needs an intermediary through which investors can avail the depository services i.e store their shares etc in electronic format called as Depository Participant(DP). DPs also provides services related to transactions in securities. In India there are two depositories National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL) . While ICICIdirect, HDFCSecurities and independent brokerage firms like Indiabulls, Religare, Reliance, IndiaInfoline and ShareKhan are Depository Participants.

What is the difference between NSDL and CDSL?

- CDSL is promoted by Bombay Stock Exchange Limited (BSE) jointly with Bank of India, Bank of Baroda, State Bank of India and HDFC Bank Many other banks are also stakeholders.

- NSDL is promoted by Industrial Development Bank of India Limited (IDBI) , Unit Trust of India (UTI) and National Stock Exchange of India Limited (NSE). Many other banks are also stakeholders

Comparison as on Aug 2018 from Statistics of NSDL, Statistics of CDSL

| Description | NSDL | CDSL |

| Number of Account | 74,32,643 | 1,55,72,153 |

| Number of Depository Participants | 275 | 596 |

| Number of securities (in millions) | 1,566,791 | 3,07,963 |

| Value of securities (INR in millions) | 18,447,742 | 2,09,57,498 |

What is Trading account? How does it differ from Demat Account?

If I have a demat account can I buy or sell shares or stocks? No, if you only have a demat account you cannot buy or sell stocks. For purpose of buying or selling shares, you need a trading account. Trading account is an interface between your Bank account and your Demat account used during buying and selling.

Buying shares: To buy shares, you need to transfer money from your bank account to trading account. For example , if you want to buy 50 shares at Rs 100 , you have to transfer Rs 5000 from your bank account to the trading account. The shares that you buy will be stored in the demat account.

Selling shares: When you sell, your trading account takes back the shares from your Demat account and Sells them in Stock Market and gets the money. It then transfers the money to your bank account.

Some financial institutions like ICICIdirect or HDFC Bank offer bank account, trading account and demat account together called as 3 in 1 account. While financial institutions or brokerage institutions like IndiaBulls or sharekhan offer only demat account and trading account. Then one needs to link the bank account to transfer money to and from the trading account using Payment gateway, Net transfer or cheque.

Opening a Demat account

How many account holders can a demat account have?

A demat account can be opened as single holder account or a joint holder account. A demat account can have maximum three account holders the main holder and two joint holders.

Note: Once a demat account is opened addition or modification or deletion of account holder names is not permitted. You cannot even add or change your surname name (last name), to your demat account because making changes are not allowed even in case of marriage or divorce. If you want changes you need to open a new demat account. Changes in trading account are also not allowed.

How many demat accounts can a person have?

Just like saving bank account there are no restrictions of the number of Demat Accounts a person can have (even with the same Depository). But banks can limit the number of accounts. For example, ICICIDirect allows 5 demat accounts; but the first name in all accounts should be EXACTLY the same. The names of joint holders may vary. (Thanks to Kapil for information)

Can an investor close his demat account with one DP and transfer all securities to another account with another DP?

Yes. The investor can submit account closure request to his DP in the prescribed form. The DP will transfer all the securities lying in the account, as per the instruction, and close the demat account. The securities gets transferred to the other DP.

What is Basic Services Demat Account

Basic Services Demat Account (BSDA). is a demat account for all holdings under Rs 50,000 has no annual maintenance charges which otherwise a normal demat account would be charging. Anything above Rs 50,000 and up to Rs 2 lakh would attract annual maintenance charges of Rs 100.

How to open a Demat Account?

You have to approach a DP and fill up an account opening form. The account opening form must be supported by copies of any one of the approved documents which serve as proof of identity (POI) and proof of address (POA) as specified by SEBI. Apart from these PAN card has to be shown in original at the time of account opening from April 01, 2006. An investor has to sign an agreement with DP in a depository prescribed standard format, which gives details of rights and duties of investor and DP. DP should provide the investor with a copy of the agreement and schedule of charges for their future reference. The DP will open the account in the system and give a unique account number, which is also called Beneficial Owner Identification number (BOID) and used for all future transactions.

What is intraday trading and delivery based trading?

For stocks or shares, you can either do intraday trading or can opt for delivery based. (There are other transactions like Futures and options, IPOs, Mutual Funds, Commodities which we are not discussing here)

- Intraday trading: refers to the trading system where you have to you have to do the buy and sell or sell and buy transaction on the same day before the market close. This is also called as squaring off the trade on the same day. Intraday Trading is also referred to as Day trading by many traders. In Intra Day trading shares are not registered in the name of the owner.

- Delivery based trading refers to trading in which share is bought by making an upfront payment and the same is held to be sold later. Shares are registered in the name of the owner. If you have bought 50 stocks of some company on delivery basis, these stocks will be transferred to your Demat Account (usually it takes 2-3 days to complete the transfer) and you can do whatever you want with the stocks. You can keep them for 5 years or sell them the next week.

What are the Charges for demat account/trading account?

The fees charged for DP services differ across the industry. Though the rates change, the charges normally go under the following heads:

- Account opening fee: Fee for opening the demat and trading account or 3-in-1 account. It is one-time charge. Depending on the DP, account opening charges range between Rs. 500 to Rs. 700. some even do not charge any no opening account fee

- Annual maintenance fee: The fee required to maintain the account. It’s annual charge and is taken in advance.

- Transaction fee or Brokerage: Fee charged for buying or selling securities. While some DP charges a flat fee per transaction, some peg the fee to the transaction value, which is subject to a minimum amount. The fee also differs based on the kind of transaction (buying or selling) also for different types of transactions – intraday, delivery, F&O etc.. Other than Brokerage GST(Good and Services Tax),

Service tax (at the rate of 12.36%) andx Securities Transaction Tax (STT),Stamp Duty, Exchange Levy etc are also charged by DP. An example of fees and taxes of buying and selling shares is given below,

Example of Fees and taxes on buying and selling shares

Let’s say you want to BUY 10 shares of company ABC at the rate of Rs 1000 per share with the brokerage of 0.5% volume.

| Volume/Turnover | Qty * Price | 1,00,000 |

| Brokerage | .50% of Volume | (.05/100) * 100000= 500 |

| GST | 18% of Brokerage | Rs 90 |

| Education Cess | (2 % + 1 %) of GST | 3 % of 90 = 2.7 |

| STT | .125% of Volume | 125(.125/100 * 100000) |

| Stamp Duty | .01% on Volume | (.01/100 * 100000) = 10 |

| Exchange Levy | .0035% of Volume on NSE | (.00035/100 * 100000) =3.5 |

| Total cost | 500+90+2.7+125+10+3.5=500+190=731.2 |

To ensure your broker doesn’t cheat you the exchange specifies that every day that you transact, the broker must provide you a note of complete details of how many stocks were bought/sold, what brokerage and contract note numbers exist etc.

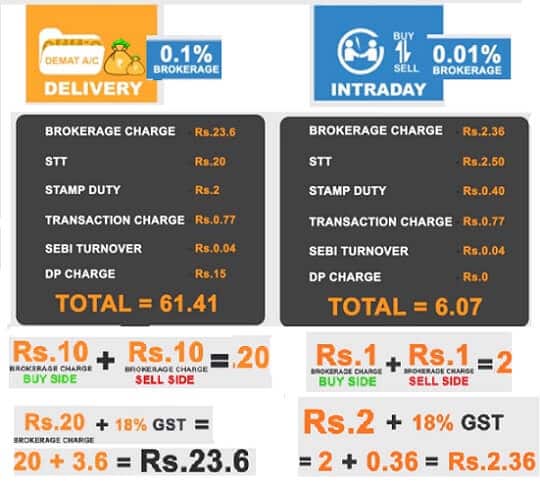

The image below shows the brokerage charge for intraday and delivery when 1000 shares are bought and sold at 10 Rs for intra day and Delivery

Comparison of few demat account providers in India

Most brokers offer different types of accounts or plans to suit different individual investors need. The below comparison is done for selected account type. (We have chosen then randomly. Many readers have pointed out that brokerage in other plans is less For ex ICICIDirect Variable structure plan. So please check the plan)

By 2-in-1 we mean Demat Account and online trading by 3-in-1 we mean Savings account, Demat account, Online trading. Chittorgarh provides Comparison of demat accounts providers

|

Services |

Account Opening Charges (AOC) |

Annual Maintenance Charge |

Brokerage |

|

|

(iSecure plan) |

3-in-1 |

975 |

450 |

0.55% Delivery 0.275% Intra Day |

|

ICICI Direct Variable Brokerage structure |

3-in-1 | 975 | 450 | Rs 25/-per trade Or 2.5% of trade value (which ever is lower) |

|

IndiaBulls(power IndiaBulls) |

2-in-1 |

900 |

450 |

0.40% Delivery 0.04% Intra Day |

|

SBI(ezTrade) |

3-in-1 |

500 |

350 |

0.50% Delivery 0.15% Intra Day |

Video explaining Charges while Trading and Investing in Demat Account

Video on Clearing and settlement process of shares in India

- Stock exchange : What is it, Who owns, controls it

- Stock Market Index: The Basics

- News that affect the Stock Market

- Ups and Downs of Sensex

How did you choose your demat account provider? What factors did you consider? Do you track your charges?

73 responses to “What is Demat Account : Brokerage, Transaction Charges ,Comparison”

Writing a good post is not everyone’s skill, You have done a great job, I have read, and you illuminate a lot like this, I myself visit your post regularly.

Thankyou for the valuable information I also found some information related to your article in Funds

Nice Article , In-depth explanation about what is demat account? between i came across one more article on that subject where mention how to open Demat account online in 10 mins?

https://www.investallign.in/open-demat-account-zerodha/

Feel free to check and comments

Thanks

Nupur Gupta

This is an excellent blog that enumerates all facts regarding demat account as well as trading account. Thank you for listing out the details regarding brokerage, Service Tax and other expenses that may be associated with trading. This is sure to help many investors get a clear picture before heading to invest money.

Zerodha is best broker for trading and charges is much lower than other broker.

https://zerodha.com/open-account?c=RY0523

Thanks for sharing this informative blog. It helps to understand the difference between trading account and demat account. It also helps to eliminate some misconceptions regarding trading in shares and in commodities. This is a great way to encourage a modern trader to put money in the right investments. Thanks for this share.

Can you share some insights on some of top discount brokers.

I was reading this article at A Digital Blogger:

http://www.adigitalblogger.com/trading/best-stock-brokers-in-india-full-service-discount/

Would like to know your views on this. I am looking for low brokerage but reasonable customer service. Have heard that Zerodha is not that good in customer service. Kindly suggest

so much of mistakes are there while calculating brokerage in this blog

I am looking to open a Demat ac. I will be doing only Delivery based trading (No Intraday). Can anyone suggest me any broker with minimum charges in this regards?

zerodha ..its best..with brokerage free for delivery investment

Thanks for given nice information about demat account. It is really useful for us. I am very happy read this because I got lots of essential information from your post. I liked it. Thanks for share this useful information.

Its really a great article having great information about the demat account. And this is also very good for beginners who are make their future in stock market.

Demat account information is superb. Your article is useful and helpful. Now I can basically go with this supportive article. You can get excellent demat and trading account opening bank from Tradebulls with least brokage charges. Thank you.

Please update your website for depository AMC; I have icicidirect and they have increased it to Rs.700/-

Dear sir,please tell me best demat and trading account opening bank with minimum brokage charges.

I have traded share with intraday upto 1 crore rs in a year is there any limitations for individuals

Sir/Madam, i have one query regarding inter settlement charges. I have kotak securities demat account and when i am buying or selling the stocks, they are charging me inter settlement (@0.04%) charges every time. Please clarify are these charges levied in every banks or this is in kotak securities only.

Settlement charges are basically fees for their work for making settlement of your transaction i.e. transferring fund to seller, debiting share from his account and crediting to your demat account. Every DP charges this as it is a minor source of income to manage the operating expenses of maintaining the accounts and membership with the depository.

What is settlement?

Investors do buying and selling of securities on stock exchange platform by placing buy / sale orders

through their brokers. This process is referred as trading and is carried out by stock exchanges for a

specific period.

After the trading is activity is completed, the process of delivering securities by the seller and delivery

of money by the buyer is called as payin process. This activity also has to be conducted within a

specified time frame. After the payin is over, then starts the process of payout wherein the buyer will

get shares and seller will get money.

The above activities of trading, payin, payout are collectively referred as settlement. Each settlement

is identified by a unique number called as settlement id. Settlement number is a 7 digit number.

i want to know whether two persons with a joint demat account can use their individual trading accounts to trade/invest using the same demat account.

A demat account can have a maximum of three account holders which means there is one main account holder and a maximum of two joint holders. Once a demat account is opened no modification in the account holder names is allowed. All joint holders need to sign up a nomination form for making nomination for their joint demat account.

he trading account is always on single name.The demat account can be in joint names and the name of the trading account holder should be first in demat account. So you can use the the demat account in joint names for giving/receiving deliveries for trading done in your trading account provided the demat account is either in your single name of a joint account with you as the first holder.

There is no provision of adding other account holders name in demat account to make it joint ( it is not like a bank account where add/delete of names is possible. You will have to open a new demat account in joint names with your name as first name if you desire to hold the shares in joint demat account.

Demat account is very similar to a bank account. It is just like the entry that you make on your passbook for bank balance which is not held physically. The same way securities are stored in a dematerialised or an electronic form and credited or debited.

Angel Trade Brokerage Charges 2016

Demat Account opening fees at Angel Broking:

Stock trading account – Nil

Demat account – Nil

Annual Maintenance Charge- As per Account type

Commodity trading – Nil.

Which demate account is best in user interface and easy to use.

Thanks

It depends on what you find easy to use.

Are you a techie? How much comfortable are you with computers?

Please check http://www.indiansharebroker.com/ for more details. for comparison of brokers

You could try with Angel Broking, who offers Lifetime free* demat account service in India powered by DKYC, which enables you to start trading in just 1 Hour!

They have also introduced an automated investment advisory engine that has been designed to offer personalized advice, based on an individual investor’s unique needs.

Open Free Demat Account with HoldPuris for free and get complete trading support May we provide you with quick solutions for extra margin and trading-related problems?

i want to transfer money from my demat account to savings account . is it possible?

Great article for the ones who are new to the world of brokerage.

I want to open BSDA account but broker says that every transaction charges and other charges are levied at double rate. and it will be costly more then normal account. should i open a BSDA account or not ?

Dear Mukesh,

there is no extra charge in term of brokerage with BSDA. this is because of that broker personal interest. so please go with some other broker

HI,

CAN ANYONE TELL ME ABOUT THE DEPOSITORY CHARGES,AND HOW THE BANK CHARGE THEM ON REGULAR BASIS BECOZ I HAVE SOME SHARES IN MY DEMAT ACCOUNT EVEN I AM NOT BUYING ANYTHING OR SELLING ,THEY CHARGE ME MONTHLY LIKE 551 RS SOMETIME 900 RS ,PLEASE HELP,I M USING HDFC SEC. ALSO YOU CAN TELL ME THE OTHER BANK OPTION!!!! PLS

Plz contact me for the same 09268372023

You can contact any Indian Bank (head quarters– Chennai) branch inyour area. They have a subsidiary Merchant banking dept. who is acting as DP and brokers. They have three in one account .Amc charges Rs300/-per annum. Trading account i charged separately. Talk to the Indian Bank first and know the details to contact their merchant bank division.

Our also made hard effort for indian investors to choose thier best broking firm by comparising and reviews status

I like this topic “What is Demat Account : Brokerage,Charges,Comparison”. Every one has own opinion and experience with their online stock broker in India. In my point of view My Value Trade is best.

Compare charges: Single trading platform, provides unlimited trading at Rs. 1000 per month and Rs. 10000 per year fixed brokerage charge. They provides Rs 10 only per executed.

After trading you can calculate your brokerage charge through brokerage calculator.

Calculate brokerage charge in India through brokerage calculator at http://www.myvaluetrade.com/BrokerageCalc.aspx

Excellent article in very simple language. From long time I was searching how to enter in stock market as a beginner. Now I can easily go with this helpful article .

Thanks a lot.

Thanks for appreciating it

Plz contact me for the same 09268372023

This site mentioned:

Basic Services Demat Account (BSDA). is a demat account for all holdings under Rs 50,000 has no annual maintenance charges which otherwise a normal demat account would be charging. . Anything above Rs 50,000 and up to Rs 2 lakh would attract annual maintenance charges of Rs 100.

Then Why Asit Mehta and Co. is charging me DMat account fees for last 4 years and I havent even signed an ECS bank form, and have Zero transactions and Zero funds with them. They are forcing me to pay a settlement amount since I am begging to close account since End of 1st year of account opening.

Can someone help ?

In my view Zerodha is the best brokerage house in India, have been using their services for year now……..I referred Zerodha to one of my friend last month and a few days back he came to me saying, ‘Abhishek, Zerodha is the best broker I have ever traded with, you should know I just loved it”….he was so impressed by Zerodha pi, back office support and trading platforms that since then he has been referring Zerodha to all……………… the best thing about Zerodha is their industry leading brokerage of 0.01% for intraday and 0.1% for delivery for options its just Rs. 20 per trade means you can trade even 10 lots or 100 or more for just flat fee of Rs. 20…………..ti comes out to be 70-80% less compared to traditional brokers……………… and if you open your account through this website you can also get training material and services worth Rs. 6000 for free. Click here to visit the website now

I suppose it doesn’t provide options to invest in IPO, FPO, Mutual Funds, Offer For Sale (OFS), Bond and NCD’s. Have you dealt with these using zerodha ??

Yes you are right/ Zerodha provides Trading, Trading & Demat, Commodity.

It says Online Mutual Funds and IPOs (coming soon).

U can buy Mfs ,bonds , stocks , commodities and online research with IIFL trading account , 9268372023

Thanks for sharing wonderful information

DPL Online.

Hi its good blog, I have 1 question. My gain out of my share is considered as income and how much the tax has to be paid for that. Say I got 1000 out of my shares by selling how much the income tax has to be paid

Great information. Lucky me I recently found your site

by accident (stumbleupon). I’ve bookmarked it for later!

Good info

We are now in April 2015. Most comments are pretty old . Quite a things have changed since then. As example most DPs do not charge joining fee now and the first year AMC is free. There are differential rates of brokerages based on committed trade or quantum of advanced brokerages. Can a knowledgeable person compile an objective review for the benefit of large number of potential entrants into the capital market ?

It’s really remarkable post for dummies who seriously thinking about trading.

It’s really remarkable post for dummies who seriously thinking about trading.

You can also try FundsIndia.com which offers competitive rates for Equity Trading.

FundsIndia charges Rs.500 as the equity account opening fee. However your brokerage charges for the first three months upto the limit of Rs.500 will be free (whichever comes first – 3 months or transactions worth Rs. 1.5 lakhs) The demat account charges will be waived for the first year. A demat account fee of Rs. 200 per year will be charged starting the second year.

At FundsIndia the brokerage is Rs. 15 or 30 basis points (i.e. 30 paisa on every Rs 100 charged), whichever is higher.

You can also get access to loads of value-added services with FundsIndia.com such as Stock Recommendations, Market Updates, Customer Support and an interactive online account to keep track of your investments.

You can read more about opening an equity account with FundsIndia here: http://www.fundsindia.com/pages/learning/about-equity-opening-equities/

You can also call us on (0) 7667 166 166 and a member of our staff will be ready to assist you further.

Thanks Arjun. I was not aware that FundsIndia offers demat accounts I thought it was only mutual funds. Thanks for updating us!

You can also try FundsIndia.com which offers competitive rates for Equity Trading.

FundsIndia charges Rs.500 as the equity account opening fee. However your brokerage charges for the first three months upto the limit of Rs.500 will be free (whichever comes first – 3 months or transactions worth Rs. 1.5 lakhs) The demat account charges will be waived for the first year. A demat account fee of Rs. 200 per year will be charged starting the second year.

At FundsIndia the brokerage is Rs. 15 or 30 basis points (i.e. 30 paisa on every Rs 100 charged), whichever is higher.

You can also get access to loads of value-added services with FundsIndia.com such as Stock Recommendations, Market Updates, Customer Support and an interactive online account to keep track of your investments.

You can read more about opening an equity account with FundsIndia here: http://www.fundsindia.com/pages/learning/about-equity-opening-equities/

You can also call us on (0) 7667 166 166 and a member of our staff will be ready to assist you further.

Thanks Arjun. I was not aware that FundsIndia offers demat accounts I thought it was only mutual funds. Thanks for updating us!

gold online – Rmoney how to buy gold and pure silver at branche of R-money in India that signifying highest level of purity.

gold online – Rmoney how to buy gold and pure silver at branche of R-money in India that signifying highest level of purity.

Demat Account india – Demat Account india designed to give you the edge in the stock markets. We offer you R-money demat accounts, armed with an entire range of conveniences specially designed to make your money work harder.

Demat Account india – Demat Account india designed to give you the edge in the stock markets. We offer you R-money demat accounts, armed with an entire range of conveniences specially designed to make your money work harder.

Dear Kirti,

Kudos to you for writing such excellent blogs that one can’t resist reading. They are highly informative and written in simple and lucid language. A couple of points I would like to make:

You have rightly pointed that no change in name is allowed in a demat account. If my full name mentioned is first + last name in the demat account, I cannot add even my middle name or even an initial in between. I would like to add that change in name is also NOT allowed even in the trading account.

Furthermore, you cannot have unlimited demat accounts with a DP. ICICI allows maximum 5 demat accounts; but the first name in all accounts should be EXACTLY the same. The names of joint holders may vary.

Thanks Kapil for such great comment. Started day on a good note.

Thanks for information on changes not allowed even in trading account name. Have updated it.

I was not sure about multiple accounts thanks for clarifying it. Have updated it

Dear Kirti,

Kudos to you for writing such excellent blogs that one can’t resist reading. They are highly informative and written in simple and lucid language. A couple of points I would like to make:

You have rightly pointed that no change in name is allowed in a demat account. If my full name mentioned is first + last name in the demat account, I cannot add even my middle name or even an initial in between. I would like to add that change in name is also NOT allowed even in the trading account.

Furthermore, you cannot have unlimited demat accounts with a DP. ICICI allows maximum 5 demat accounts; but the first name in all accounts should be EXACTLY the same. The names of joint holders may vary.

Thanks Kapil for such great comment. Started day on a good note.

Thanks for information on changes not allowed even in trading account name. Have updated it.

I was not sure about multiple accounts thanks for clarifying it. Have updated it

Hi

A very good article on a newbie. I really appreciate your articles.

But I just to point out something.

The brokerage you have shown as 0.5 – 0.4 for delivery and .04 for intraday is really very very high brokerage. Now a days it is very common to get a brokerage of 0.1 for delivery basis and .01 for intraday.

Moreover there are brokerage of R 15-25 per trade (irrespective of volume of the trade) or the monthly unlimited brokerage starting from R 750 onwards.

Hello Umesh for encouraging words.

Even Maniparna mentioned it. I tried finding information for minimum brokerage but couldn’t find. Can you let us know which broker provides 0.1 for delivery basis and .01 for intraday?

Zerodha a B’lore based broker provides .1 and .01 brokerage.

There are a few discount discount brokers that provides 15-25 INR per trade irrespective of volume per trade like, Zerodha, Achiievers, RKSV, Tradesmartonline etc.etc.

A few online discount brokers that charges 750 – 1947 INR per month for unlimited trading in equity and derivatives like Achiievers, RKSV, Tradesmartonline, SASOnline.

One can visit their respective websites for further details. I may add that I neither recommend nor vouch for any broker. The names are mentioned in good faith and to help investors and traders. One should satisfy oneself before opening account with them.

Thanks Umesh for Info. You are right one should satisfy one self before opening account with them.

Hi

A very good article on a newbie. I really appreciate your articles.

But I just to point out something.

The brokerage you have shown as 0.5 – 0.4 for delivery and .04 for intraday is really very very high brokerage. Now a days it is very common to get a brokerage of 0.1 for delivery basis and .01 for intraday.

Moreover there are brokerage of R 15-25 per trade (irrespective of volume of the trade) or the monthly unlimited brokerage starting from R 750 onwards.

Hello Umesh for encouraging words.

Even Maniparna mentioned it. I tried finding information for minimum brokerage but couldn’t find. Can you let us know which broker provides 0.1 for delivery basis and .01 for intraday?

Zerodha a B’lore based broker provides .1 and .01 brokerage.

There are a few discount discount brokers that provides 15-25 INR per trade irrespective of volume per trade like, Zerodha, Achiievers, RKSV, Tradesmartonline etc.etc.

A few online discount brokers that charges 750 – 1947 INR per month for unlimited trading in equity and derivatives like Achiievers, RKSV, Tradesmartonline, SASOnline.

One can visit their respective websites for further details. I may add that I neither recommend nor vouch for any broker. The names are mentioned in good faith and to help investors and traders. One should satisfy oneself before opening account with them.

Thanks Umesh for Info. You are right one should satisfy one self before opening account with them.

0.5% brokerage ! Only in theory man.. ..Its a pity that in this highly competitive market , one finds it hard to coax even 0.3% from the clients. 🙁

Is it so..how does the client bargain ?

0.5% brokerage ! Only in theory man.. ..Its a pity that in this highly competitive market , one finds it hard to coax even 0.3% from the clients. 🙁

Is it so..how does the client bargain ?