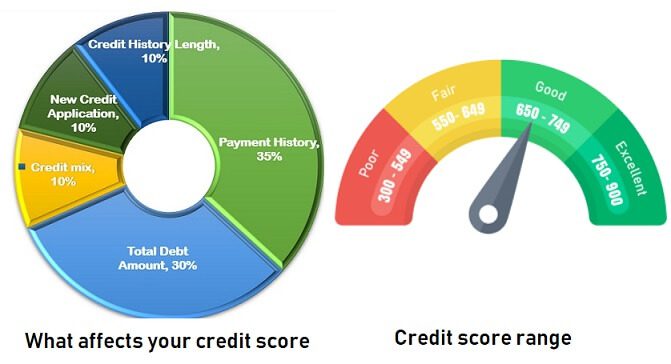

When you apply for credit, the bank or a company must calculate your credit score to decide whether to lend you. Here, your credit score plays a determinant role since all your plans will depend on it. The credits score is the number that encapsulates necessary information from your credit reports. With this information, your lender and other organizations will predict whether you’ll be able to repay your loan.

A steady credit score isn’t as difficult to build as many would believe. Certainly, it will take some time, patience and even some changes in your financial world. But don’t forget that an exceptional credit score is your answer to lower rats and easy approval for loans and credit cards. How long does it take to boost your credit score? This might depend on how bad your credit is right now, but with a diligent approach, you’ll soon start to see significant progress in your credit score as in little as 30 days. However, if you find yourself in a difficult situation, take into consideration the following strategies.

Table of Contents

1. Make Small and Often Payments

Making frequent payments is maybe one of the fastest ways to increase your credit score. Small payments, often called micropayments, are known to maintain your credit card balanced down. A sure way would be to treat your credit card as if it was a debit, you can pay various things online as soon as you see the purchase is posted. Using your credit card as often as possible throughout the month works on a factor called credit utilization, which has a dominant effect on your credit scores.

What is credit utilization? It’s simple how much of your accessible credit you use, described as a percentage. Credit utilization is what we know as a total of balances on your credit cards divided by the total of all your credit limits and plays a crucial role in your credit score. Thus, if you can maintain your utilization low instead of allowing to build on a due date, this should improve your credit score faster than you’d believe

2. Track All of Your Expenses

To avoid losing valuable points in your score for overusing your available credit is by simply being aware of how much you’ve charged to each credit card. Losing credit points can be easily avoided if you develop a habit from checking your accounts and expenses more often than you usually do. Also, keeping your balance below 30 % on all your credit cards all the time should be essential if you want to avoid losing points.

3. Get Higher Credit Limits

Your credit limit can affect your credit utilization. When the limit is up and your balance maintains its actual state, this directly reduces your credit utilization. To avoid that we advise you to call your credit issue and ask for a higher limit for your credit without a “hard” inquiry which may pull down your credit score a few points.

A hard inquiry is triggered when you apply for credit such as a mortgage, student loans, auto loans, personal and business loans. This inquiry becomes a huge part in your credit report, which means that anyone else who does a soft pull will notice the inquiry.

4. Dispute Possible Errors

Being highly aware of your credit reports it’s important for your score because one single and a minor mistake can immediately pull down your credit score.

Everyone is entitled to get a free report every 12 months from major credit bureaus such as Experian, TransUnion and Equifax. Make sure you take your reports seriously and check them diligently for mistakes such as negative information that’s too old to be registered and most importantly, late payments. If you’ve found irregularities in your reports make sure you list and dispute to get them removed. In this situation, the credit bureau has 30 days to proceed with an investigation and response.

5. Become an Authorized User

To become an authorized user, you can ask either a friend or a relative with a long record of responsible and reliable credit card use and high limit to add you as an authorized user on her card. To benefit from such an alliance the user won’t have to give control of her or his account, for you to benefit.

Becoming an authorized user works wonders for those who have little credit experience and this impact can be valuable since it will offer you longer credit history, decrease your credit utilization and feed your credit file.

6. Don’t Close Your Credit Cards

This it’s available for everyone, regardless you just signed up for a credit card or you already have a long and chunky credit history. Closing your credit cards can make the process even more difficult in case you’re avid to maintain a steady credit profile. Closing a credit card will lose a necessary limit when the overall credit utilization is calculated, which will bring you a lower score. You may still use those cards occasionally so the issuer can’t close it and use their limit to improve your credit score.

7. Pay Your Bills in Time

One of the most effective strategies to skyrocket your credit score would be to pay your bills on time. Most probably you’ve heard it before, but your payment history has the biggest influence on your credit score, a reason why you should avoid late payments.

In case you’ve missed your payment within 30 days make sure you check with your creditor as soon as possible to arrange payment and ask to no longer consider reporting your late payment to an official credit bureau. Unfortunately, such mistakes are often seen and when your account is considered delinquent this might hurt your score. Luckily, in time the impacts of late payments start to diminish. However, demonstrating positive credit behaviour after a late payment can diminish the damage even faster.

To boost your credit score and achieve your long-planned goals, there are some rules you’ll have to follow. Thus, don’t forget to maintain your credit balance low, pay your bills in time and demonstrate a positive credit behaviour to get those scores high.

Related Articles:

List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- Understanding CIBIL CIR report,

- CIBIL CIR : Account and Negative Factors

- FAQ on CIBIL CIR Report and Score

- How to Get Free Credit Report in India

- How to get Free CIBIL Credit Report and CIBIL Credit Score

4 responses to “7 Ways to Improve Your Credit Score ASAP”

What required

My mail I’d is bishwaghosh1@gmail.com

Forget my password

Did you follow the steps mentioned in the article Forgot UAN Password: How to reset and change UAN password