Income-Tax Department uses the registered contact details (Mobile number & E-mail ID) for all communications related to e-Filing. It is mandatory that one must have valid contact details registered in the e-Filing portal. This article talks about how you can create or update contact details on the Income tax e-filing website, Why should one have updated Contact Details on Income Tax eFiling Website, Difference between Primary and Secondary Contact Details.

Table of Contents

Overview of How to update contact details on Income Tax e-Filing website

Overview of steps to update contact details on the Income tax e-filing website are as follows. These are explained with pictures in the article.

- Go to incometaxindiaefiling.gov.in.

- Now login with your account details with your user id, password, and date of incorporation/birth.

- Go to Profile Settings in the Menu

- Click on My Profile as shown in Image.

- Click on Contact Details. You would see the current Primary and Secondary Email Ids that are set currently.

- Click on Edit to make changes.

- Update the correct Contact Number and Mail Id

- Click Save after making Changes

- Verify with OTP sent on Mobile and Email.

Why should one have updated Contact Details on Income Tax eFiling Website?

Income tax e-filing portal has made the lives of innumerable taxpayers hassle-free as it allows online submission of returns, payments, and grievances. One should have correct contact details such as Mobile number and eMail Id in Income tax e-filing site so that the communication can be sent to the valid Mobile number and E-mail ID.

It has been noticed that many registered users are not having authenticated contact details in eFiling or may have provided details of other persons for convenience ex when CA or tax lawyer registers account at Income tax website. This prevents the Department from interacting directly with taxpayers on their personal email and Mobile. Further, it has been observed that in many cases taxpayers are not able to reset their password since the email communication from the Department may be sent to their registered email or Mobile which may be different from the taxpayer’s personal email or mobile.

Difference between Primary and Secondary Contact Details

Income tax website uses Mobile Number and Email Ids for communications including resetting of Password. There are two contact details Primary and Secondary that one can provide in Income Tax Efiling website. Primary Contact Details are mandatory and Secondary Contact details are optional.

Typically a member of the family usually the father files return for himself, his parents, his wife and his adult children. So He can enter his contact details as Primary contact for all members of his family and provide family member as secondary contact of their own income tax website. Or enter family member contact detail as Primary and his as secondary. But in many cases when one who files Income tax return provides his email id and mobile number as Primary contact details and does not provide any login access for the client.

Either Primary or Secondary Contact Details can be used for sending the Alert, SMS, Email, and Notifications. But OTP Pin will be sent to Primary Contact Detail only.

- One should provide his own email id and Mobile number as Primary Contact.

- One can enter any other person’s email or mobile number as a Secondary Contact.

- Primary and Secondary contact details should not be same.

- Same Primary contact details can be used for a maximum of 10 taxpayers or assessees.

- There are no restrictions number of user accounts linked as Secondary Contact.

You don’t have Password for your Income Tax Login

If you’ve don’t have access to your Income Tax Department Account because you don’t have the password or you have lost You can reset your Income Tax Department Password by sending an email to validate@incometaxindia.gov.in with the following details:

1. PAN

2. PAN holder’s Name

3. Date of Birth

4. Father’s Name

5. Registered PAN address

You would receive a reply from the income tax dept within 48 hours and then you can reset your password on the income tax efiling website.

How can New Users update contact details on the efiling Income Tax website?

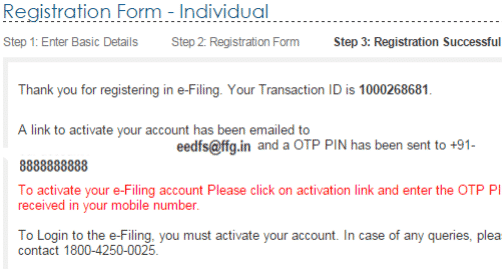

If you are a new user, you need to register yourself on www.incometaxindiaefiling.gov.in. To successfully make an account with Income tax, PAN is the only pre-requisite. Make sure to provide the right mobile number and email ID while you pitch in the details. Our article Registering on Income Tax efiling Website covers how to register on the website.

Once you enter the details, an activation link will be sent to email id and an OTP will be sent to the mobile number. The new user needs to enter the OTP on the website when he opens the activation link in the mail. This is a two-way authentication process by the Income Tax Department.

How can Registered Users update contact details on the efiling Income Tax website?

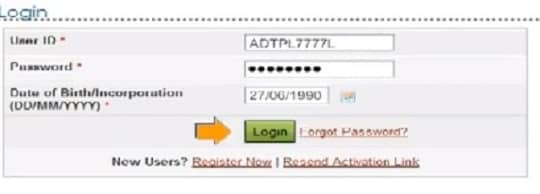

- Go to incometaxindiaefiling.gov.in.

- Now login with your account details with your user id, password, and date of incorporation/birth.

- Go to Profile Settings in the Menu

- Click on My Profile as shown in Image.

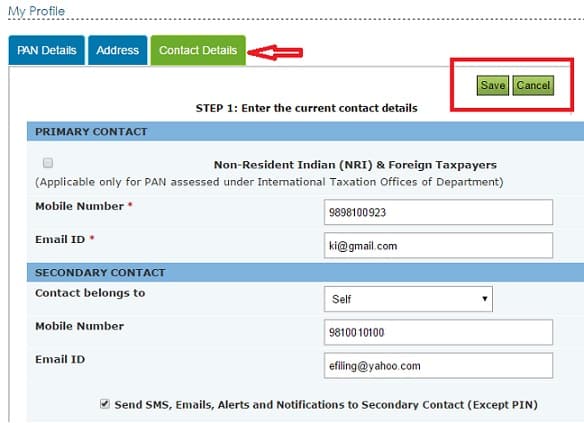

- You would see 3 tabs PAN Details, Address and Contact Details

- Click on Contact Details. You would see the current Primary and Secondary Email Ids that are set currently.

- Click on Edit to make changes.

- Update the correct Contact Number and Mail Id

- Click Save after making Changes

- Upon submitting the details, the department will send OTP1 and OTP2 to the new email id and mobile number respectively.

- These OTPs have to be entered in respective boxes on the e-filing portal to assess and validate the authenticity of contact details.

- Once successfully authorized, the mobile number and email ID will be updated in the taxpayer’s profile.

- If you have entered the contact details for updating but you fail to receive any OTP within a feasible amount of time, click on resend PIN. The PINs received once will be valid for 24 hours and taxpayers can update their contact details with the same PIN within the stipulated period.

- If the PINs are not verified together within the time limit, the taxpayer will have to follow the above procedure again.

Related Posts:

- Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice…

- Filing ITR : Video on Steps to File ITR, Ways to File,Documents required

- Video on Which ITR to Fill

- Registering on Income Tax efiling Website

- Which ITR Form to Fill?

- Mistakes while Filing ITR and CheckList before submitting ITR

- Paying Income Tax Online, epayment: Challan 280

6 responses to “How to update contact details on Income Tax e-Filing website”

my name is ravi kumar plz change my mobile no 7015268604 bcz m apna password bhul gaya hu

Hi My name is jessica hills and we can fairly quickly promote your website to the top of the search rankings with no long term contracts!We can place your website on top of the Natural Listings on Google, Yahoo and MSN. Our Search Engine Optimization team delivers more top rankings than anyone else and we can prove it. We do not use “”link farms”” or “”black hat”” methods that Google and the other search engines frown upon and can use to de-list or ban your site. The techniques are proprietary, involving some valuable closely held trade secrets. Our prices are less than half of what other companies charge.We will also provide you with a checklist to show you the strengths and weaknesses of your current website.If you would like to have a no-obligation discussion with me, please reply with your phone number?Can I call you this week to discuss your campaign?Best regards, jessica hills Online-Manager

TO GET FREE STOCK FUTURE TIPS VISIT BEST STOCK FUTURE TIPS

Want a Free Trial? Give us http://www.wealthwishers.com/payment.aspx

a Missed Call: 08030636442

PAY NOW

TO GET TWO DAYS FREE CALLS FOR OPTION,STOCK FUTURE,NIFTY FUTURE,CASH OR COMMODITY PLEASE VISIT Check WEALTH WISHERS trades