The Pradhan Mantri Garib Kalyan Yojana (PMGKY) notified along with other provisions of Taxation Laws (Second Amendment) Act, 2016 came into effect from 17 December 2016. It will remain open until March 31, 2017.

The terms and conditions of the scheme are as under:

2. Eligibility for Deposits.— The deposits under this Scheme shall be made from the 17th day of December, 2016 till 31st day of March, 2017, by any person who declared undisclosed income under sub-section (1) of section 199C of the Taxation and Investment Regime for Pradhan Mantri Garib Kalyan Yojana, 2016

An application for the deposit under this Scheme shall be made in Form II clearly indicating the amount, full name, Permanent Account Number (hereinafter referred to as “PAN”), Bank Account details (for receiving redemption proceeds), and address of the declarant. Provided that if the declarant does not hold a PAN, he shall apply for a PAN and provide the details of such PAN application along with acknowledgement number.

(b) The application under sub-paragraph (a) shall be accompanied by an amount which shall not be less than twenty-five per cent. of the undisclosed income in the form of cash or draft or cheque or through electronic transfer as provided under sub-paragraphs (c) and (d) of paragraph 5.

How the bill got passed?

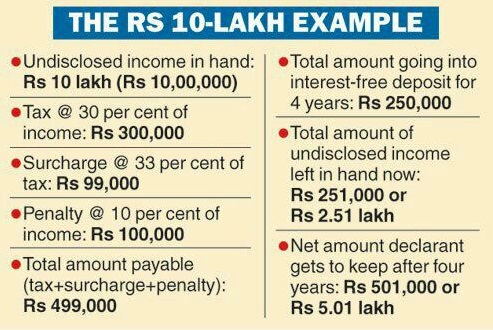

On 28 Nov 2016, Finance Minister Arun Jaitley introduced an amendment bill for Income Tax law. According to this amended bill, who declared his undisclosed income or Black Money since the ban on Rs. 500 and Rs. 1, 000 has announced will have to pay 30% tax of the undisclosed income. Along with 30% tax 10% penalty will also be imposed on Undisclosed Income and Surcharge (PMGK Cess) of 33% of tax amount (33% of 30% of Undisclosed Income). Moreover, declarants have to deposit 25% of undisclosed Income after demonetisation in the Pradhan Mantri Garib Kalyan Yojna. This article explains the Bill Introduced, why was it introduced, example of how much tax one would have to pay for Tax on Undisclosed Income under Pradhan Mantri Garib Kalyan Yojana, how does it compare with Penalty otherwise. Our article How to declare Unaccounted Cash in Demonetized Notes Options and Tax discusses various options to declare the Unaccounted Cash, tax impact.

Table of Contents

How much tax does one have to pay under Pradhan Mantri Garib Kalyan Yojana 2016?

One who declared his undisclosed income under the Pradhan Mantri Garib Kalyan Yojana 2016 shall be required to pay

- tax @ 30% of the undisclosed income,

- penalty @10% of the undisclosed income.

- Further, a surcharge to be called Pradhan Mantri Garib Kalyan Cess @33% of tax is also proposed to be levied.

- totalling to approximately 50%

- In addition to tax, surcharge and penalty (totalling to approximately 50%), the declarant shall have to deposit 25% of undisclosed income in a Deposit Scheme to be notified by the RBI under the ‘Pradhan Mantri Garib Kalyan Deposit Scheme, 2016’. No interest will be paid to the owner for this. After four years the owner can reclaim his money (25%)

What is the process for passing of the bill, Pradhan Mantri Garib Kalyan Yojana 2016 ,by Parliament?

- The Bill was brought in as a Money Bill requiring consent of Lok Sabha alone. Rajya Sabha, where the ruling party does not have a majority, cannot make amendments in a Money Bill passed by Lok Sabha and transmitted to it.

- On 29 Nov 2016 amid a din, the bill which seeks to tax money deposited in banks post demonetisation was passed in the Lok Sabha within minutes without any debate.

- The bill must now be approved by the Rajya Sabha within 14 days. If not, it automatically becomes the law.

Note the Bill is not a retrospective amendment as the financial year is still on and people have not filed return.

This is not an amnesty scheme saying tax and penalties proposed are steep. The scheme comes within two months of the close of domestic black money disclosure scheme wherein the total incidence of tax was 45 per cent. A total of Rs 65,250 crore in black money was brought to book by the close of the scheme on September 30 2016.

The disclosures in PMGKY scheme will ensure that no questions will be asked about the source of fund. It would ensure immunity from Wealth Tax, civil laws and other taxation laws. But there is no immunity from FEMA, PMLA, Narcotics, and Black Money Act.

Why was the bill for tax on Undisclosed Income introduced?

As a step to curb black money, bank notes of existing series of denomination of the value of Rs.500 and Rs.1000 [Specified Bank Notes(SBN)] have been recently withdrawn the Reserve Bank of India.

Concerns have been raised that some of the existing provisions of the Income-tax Act, 1961 (the Act) can possibly be used for concealing black money. The Taxation Laws (Second Amendment) Bill, 2016 (‘the Bill’) has been introduced in the Parliament to amend the provisions of the Act to ensure that people who are concealing black money are subjected to tax at a higher rate and stringent penalty provision.

The Statement of Objects and Reasons of the Bill said, “In the wake of declaring specified bank notes as not legal tender, there have been representations and suggestions from experts that instead of allowing people to find illegal ways of converting their black money into black again, the Government should give them an opportunity to pay taxes with heavy penalty and allow them to come clean so that not only the government gets additional revenue for undertaking activities for the welfare of the poor but also the remaining part of the declared income but also the remaining part of the declared income legitimately comes into the formal economy”

With the introduction of an Income Tax Amendment bill in Parliament on 28 Nov 2016, the government has proposed a new income disclosure scheme under the name of the Pradhan Mantri Garib Kalyan Yojana 2016 and simultaneously proposed plugging certain loopholes in the Income Tax Act which could have been exploited by black money holders. The government has offered the carrot – the least tax option of the Garib Kalyan Yojana – and shown the stick and closed the loopholes: the hiked tax and penalties under Sections 115BBE and Section 271AAC and Section 271AAB.

Example of How much tax one would have to pay on Undisclosed Income under Pradhan Mantri Garib Kalyan Yojana 2016

For Undisclosed income of Rs 5 lakh

- Tax @ 30% of the undisclosed income, Tax will be 1.5 lakh

- Penalty @10% of the undisclosed income, penalty will be Rs 50,000.

- Surcharge @33% of tax i.e 33% of 1.5 lakh will be 49,500,

- Total tax & penalty payable: Rs 2,49,500

- And above that 25% of undisclosed income in a Deposit Scheme i.e Rs 1.25 lakh will be locked in for 4 years without accruing any interest.

What is Penalty for those who continue to hold Undisclosed Income ?

The people who continue to hold undisclosed cash and if they caught

- flat 60% tax plus Surcharge of 25% of tax amount, as per the amended Income Tax law. Tax Under Section 115BBE

- Besides above charges, if assessing officer feels then he can impose additional 10% penalty to the 75% tax. For PENALTY under Section 271AAC

- Penalty for search/seizure cases : Penalty (271AAB)

- Penalty for under-reporting on income is flat 50% tax and 200% tax on misreporting. And are no changes to them.

How does tax on Undisclosed income compare to if one does not declare the Income and is caught?

For Tax Under Section 115BBE: Flat rate of tax @60% + surcharge @25% of tax (i.e. 15% of such income) + cess @ 3% of tax & surcharge. So total incidence of tax is 77.25% approx. (No expense, deductions, set-off is allowed)

For Example: If Rs 5 lakh is the unexplained credit, investment, cash and other assets,

- 60% tax is Rs 3 lakh

- surcharge @25% of tax (i.e. 15% of such income) i.e Rs 75,000

- plus cess @ 3% of tax & surcharge Rs. 11250

- which is equal to Rs 3,86,250 lakh i.e. 77.25% of unexplained credit, investment, cash and other assets

For PENALTY (Section 271AAC)

If Assessing Officer determines income referred to in section 115BBE, penalty @10% of tax payable in addition to tax (including surcharge) of 77.25%.

Example of undisclosed income of 5 lakh : In addition to Rs 386250 lakh, Rs 30,000 is to be paid.

Total tax plus penalty: Rs 4,16,250. This comes to 83.25% of the total unaccounted income disclosed

Penalty for search/seizure cases : Penalty (271AAB)

Example: Say, income undisclosed and thus seized or searched is Rs 5 lakh.

(i) 30% of income, if admitted, returned and taxes are paid 30% of Rs 5 lakh i.e. Rs 1.5 lakh

(ii) 60% of income in any other case 60% of Rs 5 lakh i.e. Rs 3 lakh

Where will the money for Pradhan Mantri Garib Kalyan Yojna be used

This locked into the Pradhan Mantri Garib Kalyan Yojna will be used for the Government projects of irrigation, housing, toilets, infrastructure, primary education, primary health and livelihood in order to spread justice and equality.

Some Common Questions on Deposit of money due to demonetization

If you have money which you can explain the source of, for example housewife or you have withdrawn over period of time then you need not decalre it under Pradhan Mantri Garib Kalyan Yojana

With demonetisation, we can deposit only up to Rs 2.5 lakh into savings bank account. I am a housewife with no taxable income and I do not file my return of income. I have saved Rs 2.2 lakh over past years from the money given by my husband for household expenses and this amount is in high-denomination notes. I have a PAN card. Can I deposit this amount? Do I have to pay any tax?

You can deposit Rs 2.2 lakh in your savings bank account.The bank will not share this information with the IT department, Rule 114E of IT Rules have been changed. Thus, banks have to give information only if a deposit in savings bank account is of `2.5 lakh or more between 09.11.2016 to 30.12.2016. As your income is below taxable, there will not be any tax liability in your hand as regard the deposit of Rs 2.2 lakh.

I run my proprietary business of Ms. Mehta & Co. out of a retail shop at Bora Bazar, Mumbai. I regularly file my return of income. I sell goods on credit as well as on cash. I receive cash from my retail customers, as well as from offices to which I supply stationery. As per my cash book, I have cash on hand of Rs 4.42 lakh as on Nov 8. Can I deposit it in my current account?

You can deposit the amount in your current account. The bank has to give information to the IT department only if there is deposit of Rs 12.5 lakh or more in the current account between Nov 9 and Dec 30. As you had cash on hand as per books of account, you are entitled to deposit the available cash with you to the extent of the cash on hand in your bank account. Even if the IT department makes enquiry, you will be in a position to explain the source of cash.

I earn monthly salary of Rs 1 lakh, file my return regularly, and deposit every month the salary net of tax in my bank account. I withdraw every month Rs 50,000 for my household expenses, including education and medical expenses of family. By-and-large, every month my expenditure is about Rs 42,000 – Rs 46,000. I have with me Rs 3 lakh in high-denomination notes. This amount is out of my past savings.Can I deposit this amount in my personal savings account? Will there be any enquiry?

If you deposit Rs 3 lakhs in your savings bank account, the information will be sent to the Tax department which will ask you to justify your claim of savings of Rs 3 lakh. Tax officials would probably say that if you had Rs 3 lakh, why did you withdraw Rs 50,000 every month from the bank and did not use your savings. Your claim that Rs 3 lakhs is out of savings may be genuine and reasonable, but you may find it difficult to explain. If possible you may deposit Rs 2.5 lakh (from your savings) into your savings bank account and the balance Rs 50,000 into savings bank account of your wife in order to avoid confrontation with IT officials.

OVERVIEW OF AMENDED BILL ON TAX OF UNDISCLOSED INCOME

| Particulars | Existing Provisions | Proposed Provisions |

| General provision for Penalty | Under-reporting –50% of tax Misreporting – 200% of tax. | No changes proposed. |

| Provisions for taxation & penalty of unexplained credit, investment, cash and other assets. | Tax (Section 115BBE)-Flat tax Rate of 30% + Surcharge + Cess (No expense, deductions and set-off is allowed) | Income Tax (Section 115BBE) – Flat tax rate of 60% + Surcharge of 25% of tax(i.e. 15% of such income). So total tax impose 75%. (No expense, deductions and set-off is allowed)

Penalty (Section 271 AAC) if Assessing officer determines income referred to in section 115BBE, penalty @ 10% of tax payable in addition to tax (including surcharge) of 75%. |

| Penalty for search seizure cases | Penalty (271 AAB)(i) 10% of Income, if admitted, returned and taxes are paid.

(ii) (ii) 20% of Income, if not admitted but returned and taxes are paid. (iii) 60% of Income in any other case. |

Penalty (271 AAB)(i) 30% of Income, if admitted returned and taxes are paid.

(ii) 60% of Income in any other case. |

| Taxation and investment regime for Pradhan Mantri Garib Kalyan yojna, 2016 (PMGK) | New taxation and investment regime. | (a) Tax, Surcharge, Penalty payableTax @30% of income declared.

Surcharge @33% of tax

Penalty @10% of income declared.

Total @50% of income (approx.)

(b) 25% declared income to be deposited in interest.

Free Deposit Scheme for four years.

|

Related articles:

- How to declare Unaccounted Cash in Demonetized Notes Options and Tax

- Giving Cash and Deposit money into Bank Accounts and Tax on Gifts

- Tax and penalty on Cash Deposit due to Demonetization

- Transactions reported to Income Tax Department

- Black Money : What is Benami Property and Benami Act?

- How to Exchange Rs 500 and Rs 1000 Notes ?

- New Rs 500 and Rs 2000 notes : Features,Comparison

Why no official intimation about the Pradhan Mantri Garibi Kalyan Yojana scheme

You are right it’s only in press or media that information was made available.

I think they are working out details and would announce the procedure soon