In our earlier article Tax : Income From House Property we had given an overview of how to calculate Income From House Property, and Tax and Income From One Self Occupied property we discussed about tax and income from one house for self-occupied purpose i.e being used by the owner for residence and owner has no other property. In this article we shall talk about tax and income from the property that is let out.

Table of Contents

Overview of Income from House property

Annual Value of a home is the capacity of the property to earn income i.e sum for which the property might reasonably be expected to be let out from year to year. Computing income from house property is shown in table below :

| Gross Annual Value | **** |

| Less: Municipal Taxes (if paid by owner) | **** |

| Net Annual Value | **** |

Less:Deduction under Sec.24

|

**** |

| Income from house property | **** |

Terms related to Income from Let Out Property

Actual Rent: Rent received or receivable from let out property during previous year.It does not include rent for the period during which the property remains vacant.

Expected rent: Municipal value or fair rent whichever is higher but higher value cannot exceed Standard Rent, if Standard Rent is not applicable than Municipal value or fair rent which is higher. Let’s look at these

- Municipal Value: The municipal value of your property is the value the municipal authorities assign to it to charge taxes. The municipal authorities have a host of factors which they consider to arrive at a municipal value of your property on which municipal taxes are then levied.

- Fair Rental Value: The rent which a similar property in the same or similar locality would have fetched is the fair rental value of the property.

- Standard Rent: Rent Control Act was an attempt by the Government of India to eliminate the exploitation of tenants by landlords. Rent legislation tends to providing payment of fair rent to landlords and protection of tenants against eviction. Under the Rent Control Act, the standard rent is fixed and it is expected that an owner should not receive rent higher than that specified in the Rent Control Act. The rent control laws applicable in various states in India are different with respect to various aspects. For example there is Maharashtra Rent Control Act, Delhi Rent Control Act, Tamil Nadu Rent Control Act, Karnataka Rent Control Act. For details on Rent Control Act read Rent Control Laws in India A Critical Analysis(pdf)

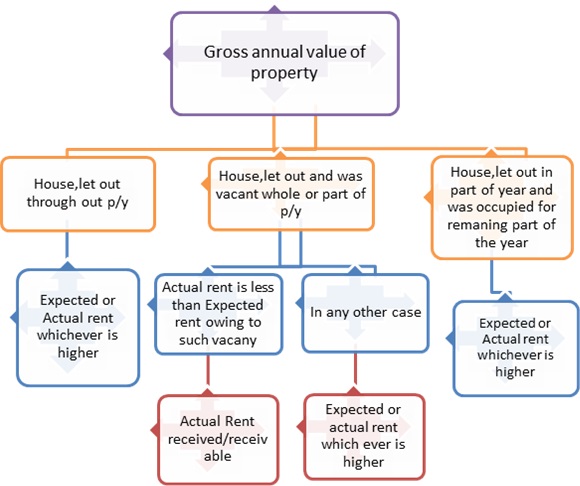

Determination of the Annual Value for different type of properties

Depending on the time period for which the property was let-out House property can be divided into following types :

- House property which is let out throughout previous year– Under Section 23(1)(a)/(b) Gross Annual Value would be higher of Expected Rent and Actual Rent.

- House property which is let out and was vacant during the whole or part of the previous year– There may be two situation in this type of house property

- Actual rent received/receivable is more than Expected rent in spite of vacant period- in this situation Gross Annual Value would be actual rent received/ receivable.

- Actual rent received/receivable is less than Expected rent owing to such vacancy- in this situation Gross Annual Value would be Actual rent received/ receivable.

- House property which is part of year let and part of the year occupied for own residence– Gross Annual Value would be higher of Expected rent and Actual rent.

Summary of Calculation of Gross Annual Value for Let Out Property is shown in image below from Taxguru’s Taxability of Income from Real Estate

Example of Calculation of Gross Annual Value

Find the Gross Annual Value in the case of the following properties:

| 2 | 3 | 4 | 5 | ||

| Municipal value | 52,000 | 1, 00,000 | 60,000 | 75,000 | 1, 80,000 |

| Fair rent | 60,000 | 1, 02,000 | 68,000 | 70,000 | 1, 85,000 |

| Standard rent | NA | 90,000 | 70,000 | 60,000 | 1, 75,000 |

| Actual rent receivable | 55,000 | 95,000 | 72,000 | 72,000 | 1, 68,000 |

| Unrealized rent | – | – | 5,000 | – | 42,000 |

| Loss of Rent due to Vacancy | – | – | – | 48,000 | 14,000 |

| Gross Annual Value | 60,000 | 95,000 | 68,000 | 24,000 | 1, 61,000 |

Explanation for arriving at Gross Annual Value for each of the property is given below.

(1) Since Rent Control Act is not applicable, GAV will be the highest of municipal value, fair rent and actual rent. Hence, the GAV will be Rs. 60,000.

(2) GAV cannot exceed the standard rent or actual rent, whichever is higher. Therefore, GAV will be Rs. 95,000.

(3) Actual rent receivable will be reduced by the amount of unrealized rent i.e. Rs. 72,000 – Rs. 5,000 = Rs. 67,000. Now, GAV will be the highest of municipal value, fair rent and actual rent, subject to the maximum of standard rent. Hence, GAV will be Rs. 68,000.

(4) GAV will be the actual rent receivable adjusted by the loss due to vacancy i.e. Rs. 72,000 – Rs. 48,000 = Rs. 24,000.

(5) Actual rent receivable will be reduced by the amount of unrealized rent and loss due to vacancy i.e. Rs. 1, 68,000 – Rs. 42,000 – Rs. 14,000 = Rs. 1, 12,000. Now, we will take the highest of municipal value, fair rent and actual rent, subject to the maximum of standard rent. So, GAV will be Rs. 1, 75,000 reduced by the loss due to vacancy i.e. Rs. 1, 75,000 – Rs. 14,000 = Rs.1, 61,000.

Deduction of Municipal Taxes

From the Gross annual value as determined above municipal taxes are to be deducted if the following conditions are fulfilled:

- The property is let out during the whole or any part of the previous year

- The Municipal taxes must be borne by the landlord (If the Municipal taxes or any part thereof are borne by the tenant, it will not be allowed)

- The Municipal taxes must be paid during the year (Where the municipal taxes become due but have not been actually paid, it will not be allowed. Similarly, the year to which the taxes relate to, is also immaterial)

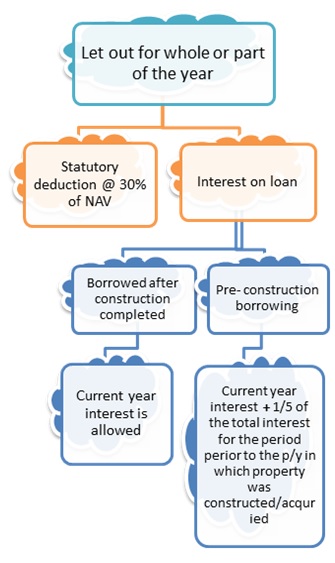

DEDUCTIONS UNDER SECTION 24

Two deductions will be allowed from the net annual value (which is gross annual value less municipal taxes) to arrive at the taxable income under the head income from house property. The deductions admissible are as under:

Statutory deduction: 30 per cent of the net annual value will be allowed as a deduction towards repairs and collection of rent for the property, irrespective of the actual expenditure incurred.

Interest on borrowed capital: The interest on borrowed capital will be allowable as a deduction on an accrual basis if the money has been borrowed to buy or construct the house. Amount of interest payable for the relevant year should be calculated and claimed as deduction. It is immaterial whether the interest has actually been paid during the year or not.

The interest paid/payable for the pre-construction period is to be aggregated and claimed as deduction in five equal installments during five successive financial years starting with the year in which the acquisition or construction is completed. The deductions are shown in image below from Taxguru’s Taxability of Income from Real Estate

Income from House property which is let out throughout previous year

Ravi owns a house which is let out for a rent of Rs 11,000 per month. The municipal value of this house is Rs 1,30,000 p.a, fair rental value is Rs 1,10,000 p.a, standard rent is Rs 1,20,000 p.a . If municipal taxes are 10% of municipal evaluation. Interest on borrowed capital was Rs 40,000 for the year.

| Description | Amount Rs | Amount Rs | |

| Compute Gross Annual Value | |||

| 1 | Highest of (Municipal Evaluation,Fair Rent) but restricted to Standard Rent | 1,20,000 | |

| 2 | Actual Rent Received 11,000 * 12 | 1,32,000 | |

| Gross Annual Value (Highest of 1 and 2) | 1,32,000 | ||

| 3 | Gross Annual Value | 1,32,000 | |

| 4 | Municipal Tax (10% of 1,20,000) | 13,000 | |

| 5 | Net Annual Value (3-4) | 1,19,000 | |

| Deductions under Section 24 | |||

| 6 | 30% of Net Annual Value (.3 * 1,19,000) | 35,700 | |

| 7 | Interest on borrowed capital (without any ceiling) | 40,000 | |

| 8 | Total deductions (6+7) | 75,700 | |

| Income from house property ( 5 – 8 ) | 43,300 |

Income from House property which is let out and was vacant for part of the previous year

Rekha owns a house with municipal valuation as Rs 2,50,000 p.a, fair rental value is Rs 2,00,000 p.a, standard rent is Rs 2,10,000 p.a . It was let out for a rent of Rs 18,000 per month. However tenant vacated the property on 31.01.2013 If municipal taxes paid are 8% of municipal valuation, Interest on borrowed capital was Rs 65,000. What would be the income from Let out property

| Description | Amount Rs | Amount Rs | |

| Compute Gross Annual Value | |||

| 1 | Highest of (Municipal Evaluation,Fair Rent) but restricted to Standard Rent | 2,10,000 | |

| 2 | Actual Rent Received 18,000 * 11 | 1,98,000 | |

| Gross Annual Value (Lowest of 1 and 2) due to vacancy | 1,98,000 | ||

| 3 | Gross Annual Value | 1,98,000 | |

| 4 | Municipal Tax (8% of 2,50,000) | 20,000 | |

| 5 | Net Annual Value (3-4) | 1,78,000 | |

| Deductions under Section 24 | |||

| 6 | 30% of Net Annual Value (.3 * 1,78,000) | 53,400 | |

| 7 | Interest on borrowed capital (without any ceiling) | 65,000 | |

| 8 | Total deductions (6+7) | 1,18,400 | |

| Income from house property ( 5 – 8 ) | 43,300 |

Income From House property which is part of year let and part of the year occupied for own residence

If a house property is self – occupied for a part of the year and let out for the remaining part of the year, the benefit of Section 23(2) (a)(i.e. the annual value will be taken as nil and only interest on borrowed capital will be deductible upto the maximum limit of Rs. 1,50,000 or Rs. 30,000, as the case may be) is not available and the income from the property will be calculated as if it is let out.

Mrs RajaLakhsmi owns a house with municipal valuation as Rs 5,00,000 p.a, fair rental value is Rs 4,20,000 p.a, standard rent is Rs 4,80,000 p.a . It ws let out for a rent of Rs 50,000 per month upto Dec 2012.There after tenant vacated the property and Mrs RajaLakhsmi However tenant vacated the property on 31.01.2013 If municipal taxes paid are 8% of municipal valuation, Interest on borrowed capital was Rs 65,000. What would be the income from Let out property for assessment Year 2013-14(Financial Year 2012-13)

| Description | Amount Rs | Amount Rs | |

| Compute Gross Annual Value | |||

| 1 | Highest of (Municipal Evaluation,Fair Rent) but restricted to Standard Rent | 2,10,000 | |

| 2 | Actual Rent Received 18,000 * 11 | 1,98,000 | |

| Gross Annual Value (Lowest of 1 and 2) due to vacancy | 1,98,000 | ||

| 3 | Gross Annual Value | 1,98,000 | |

| 4 | Municipal Tax (8% of 2,50,000) | 20,000 | |

| 5 | Net Annual Value (3-4) | 1,78,000 | |

| Deductions under Section 24 | |||

| 6 | 30% of Net Annual Value (.3 * 1,78,000) | 53,400 | |

| 7 | Interest on borrowed capital (without any ceiling) | 65,000 | |

| 8 | Total deductions (6+7) | 1,18,400 | |

| Income from house property ( 5 – 8 ) | 43,300 |

Note: If a house property consists of two or more independent residential units, one of which is self – occupied and the other unit(s) are let out, the income from the different units is to be calculated separately.

- The income from the unit which is self – occupied for residential purposes is to be calculated as per the provisions of Section 23(2)(a) i.e. the annual value will be taken as nil and only interest on borrowed capital will be deductible upto the maximum limit of Rs. 1,50,000 or Rs. 30,000, as the case may be.

- The income from the let out unit(s) will be calculated in the same manner as the income from any let out house property

Income from House property which is let out and interest from preconstruction stage

Mr. Rajan constructed a house property for which he borrowed a loan of Rs.2 lakhs at 12% per annum on 1.10.2007. The construction of the house was completed by end of January, 2009. Interest pertaining to the period from 1.10.2007 to 31.3.2008 amounts to Rs.12,000. The house property has been let-out for Rs.6,000 per month from September, 2012. Municipal taxes paid during the previous year 2012-13 is Rs.7,500. Repairs incurred Rs.12,500. Insurance premium due for the year but outstanding is Rs.1,500. Current year interest on the loan of Rs 24,000 is outstanding. Computation of income from house property is as follows:

| Particulars | Amount Rs. | Amount Rs. |

| Gross Annual Value | 12,000 *6 | 72,000 |

| Less : Municipal taxes paid | 7,500 | |

| Net Annual Value | 64,500 | |

| Less : Deduction u/s 24 | ||

| (i) 30% of Net Annual Value | 29,350 | |

| (ii) Interest on Loan | 24,000 | |

| (iii) Interest from pre construction period | 2,400 | |

| 55,750 | ||

| Income from House Property | 8,750 |

Interest pertaining to the period from 1.10.2007 to 31.3.2008 amounts to Rs.12,000. This amount should have been claimed in equal installments over a period of 5 years commencing from the year 2008-09 which is the year of completion of construction, relevant to the assessment year 2009-2010 and ending with assessment year 2014-15. Therefore, deduction of 1/5 of interest i.e 2400 (1/5 of 12,000) can be claimed for each of the assessment year 2009-2010 to assessment year 2014-15. No deduction can be claimed for the assessment year 2015-16 and afterwards.

Unrealised rent and received subsequently to be charged to Income Tax under Sec. 25AA

Unrealised rent is when the owner cannot realize rent from a property let to a tenant. In order to exclude such unrealized rent in computing the actual rent received or receivable, following conditions prescribed under Rule 4 are satisfied :

- The tenancy is bonafide;

- The defaulting tenant has vacated or steps have been taken to compel him to vacate the property;

- The defaulting tenant is not in occupation of any other property of the assessee; and

- The assessee has taken all reasonable steps to institute legal proceedings for the recovery of the unpaid rent or satisfies the Assessing Officer that legal proceedings would be useless.

Unrealised rent is excluded from actual rent, subject to fulfillment of conditions under Rule 4, in the determination of annual value under section 24. Subsequently, when the amount is realized, it gets taxed under section 25AA in the year of receipt. The amount so realized shall be deemed to be income chargeable under the head “Income from House Property”. It would be accordingly charged to income tax as the income of that previous year in which such rent is realized whether or not the assessee is the owner of that property in that previous year.

Arrears of Rent Received – Sec. 25B

Where the assessee is the owner of any property which has been let to a tenant and he receives any amount by way of arrears of rent from such property which was not charged to tax earlier, the amount so received shall be chargeable to tax under the head “Income from House Property”. For example , the owner may have sought enhancement of rent from the tenant and same could have been in dispute. Subsequently, as and when the additional rent is realized, the same is liable to tax as it was not charged to tax in any earlier years. Such an amount is assessable under Section 25B. It shall be charged to tax as the income of the previous year in which such rent is received even if the assessee is no longer the owner of such property. In computing the income chargeable to tax in respect of the arrears so received, 30% shall be allowed and consequently, 70% alone shall be chargeable to tax. The deduction of 30% is irrespective of the actual expenditure incurred.

Unrealized rent is one which was deducted from the actual rent in any previous year for calculating annual value. The basic difference between Sec. 25AA which deals with unrealized rent received subsequently and Sec. 25B which deals with arrears of rent received is that 30% of the amount is not available as deduction under section 25AA, whereas it is allowed as deduction under section 25B.

Example of Unrealized Rent Received

Mr. Lal has received a sum of Rs.15,000 from a defaulted tenant during July, 2010 out of the arrears of Rs.25,000 due from him. Mr. Lal had claimed the unrealized rent of Rs.25,000 for the assessment year 2011-12 as deduction under section 24. Incidentally, Mr. Lal had sold his property during March, 2012.

Computation of taxable quantum of unrealized rent recovered where the entire unrealized rent was claimed as deduction, the sum of Rs.15,000 recovered is chargeable to tax in the year of receipt. The position does not change even if Mr. Lal had disposed off the property in March, 2012. The sum of Rs.15,000 becomes chargeable under the head “Income from House Property” for the assessment year 2013-14.

However, if only Rs.20,000 had been unrealized rent as against the arrears of Rs.25,000, the amount chargeable to tax out of the sum of Rs.15,000 recovered is 10,000 :

| Description | Amount | |

| 1 | Unrealised Rent recovered | 15,000 |

| 2 | Unrealised rent for which no deduction was allowedDeduction claimed (Rs.25,000) less deduction allowed (Rs.20,000) | 5,000 |

| Taxable amount (1-2) | Rs 10,000 |

Coowners and Loss from Property

When the house property owned by co-owners is let out, income from such a property shall be computed as if the property is owned by one owner and thereafter the income so computed shall be divided among the co-owners as per their share.

If there is a Loss from House Property, the same can be set-off against income from any other head in the same Assessment Year as per the provisions of Section 70

If the Loss cannot be set-off against income from any other head in the same Assessment Year, the Loss is allowed to be carried forward and set-off in 8 subsequent Assessment Years against income from House Property only as per the provisions of Section 71B. For details please read our article Tax and Income From One Self Occupied property

References : Delhi University INCOME FROM HOUSE PROPERTY (pdf) wirc-icai’s Income from House Property (pdf), Income Tax Deparment’s Income from House Property (pdf)

Related Articles :

- Tax : Income From House Property

- Tax and Income From One Self Occupied property

- On Selling a House,

- Capital Loss on Sale of House

- Income Tax for Beginner

In this article we have covered various cases of tax and income from let out property with various examples.

18 responses to “Tax and Income from Let out House Property”

Hi, My mother is having 2 flats in different locations. One is self occupied & other is let out. Now another flat which both me & my mother are purchasing as joint owner & scheduled to be completed by 31st March 2018. Now due to some official issues, I am thinking to register that flat Only in my mother name, then what will be the tax implication, wealth implications on that new flat (3rd one for her) ?

Another doubt, can we claim deduction of the municipality tax that we pay annually in income tax? If yes, under which section can she claim deduction in Income tax?

Mrs Mangla owns a house. It is given on rent to a post office. Municipal value of the property is Rs230,000. Fair rent is 240,000 and standard rent is Rs 234,000.Muncipal taxes paid by Mrs Mangla is Rs 50000 on March15,2015 and Rs 55000on May15,2015. On May 1, 2015, rent is increased from Rs 15,000 to 20,000 per month with retrospective effect from April 1,2014Arrears of rent of 2014-15 are paid on May1, 2015. Find out the income chargeable to tax for the assessment year 2015-16 and 2016-17.

This is a textbook question. Solution for it is given below

Dr. Bankey Lal, a businessman, constructed a multi-storied building consisting 16 flats of equal size. The construction was started in April 2004 and completed on March 31, 2008. Of these 16 Flats, 8 were let-out to tenants for their residence, 2 to tenants for their business, 2 were used by Doctor Bankey Lal for their business, 2 were used by him for his own business and 2 were allocated to 2 employees of Dr. Bankey Lal; Business for their residence and the occupation of these 2 flats by the two employees facilitated the carrying of on his business. The rent charged from each of the ten tenants were Rs 500 p.m. but from the two employees of Dr. Bankey Lal@ Rs 200 p.m. One of the tenants were in arrear of rent for two months during the year and was unable to pay the same. After, he vacated the flat, Dr. Bankey Lal had to wait for two months to get new tenant. The expenses incurred by Dr. Bankey Lal in respect of the flats during the year ended on 31 March 2013 were as follows :- Municipal taxes for each flat Rs 750, cost of repair of each flat Rs 500, annual interest on loan on construction of house Rs 24000, Fire is insurance premium for flat Rs 100, Law charges in connection with a lease agreement were paid for each flat Rs 500.Compute the income from house property of Dr. Bankey Lal for the assessment year 2013-2014.

This a Question you would have got as an assignment in college.

Where are you getting stuck?

how to calculate gross annual value for rent and arrear of rent for two months during the year and was unable to pay the same. After, he vacated the flat, Dr. Bankey Lal had to wait for two months to get new tenant.

I am not able to solve this whole question.

would be glad if u could answer it

As it is for your course we have asked our CA who is out of town.

Once he gets back we shall update.

I have to submit my assignment on 28th may.. Will be glad if you / CA could solve the above case study before 28th may ..don’t have much time. Looking forward to your reply, Thank you for your concern.

Sorry both os us are on vacation. If you find the answer do share.

Hello,

To help you with assignment, you have to follow the instructions as explained by Pallavi on her website to your question.

The annual value of property consisting of any building or lands appurtenant thereto of which

the assessee is the owner shall be subject to Income-tax under the head „Income from House

Property‟ after claiming deduction under Sec. 24, provided such property or any portion of

such property is not used by the assessee for the purpose of any business or profession,

carried on by him, the profits of which are chargeable to Income-tax

Example: ABC owns 3 house properties situated in Delhi.

The particulars of the houses are as under:

House I Rs. House II Rs. House III Rs.

Municipal Value: 1,20,000 1,70,000 2,00,000

Fair Rent: 1,60,000 2,00,000 2,40,000

Standard Rent: 1,40,000 2,20,000

Actual Rent (per month): 12,000 18,000 21,000

Period of vacancy: Nil 1 Month 6 months

Municipal taxes for the year: 20% of Municipal value

40,000 50,000

Municipal tax paid during the year 24,000 80,000 30,000

Compute the income under the head house property of all the 3 properties.

House I: As the house property is let out through out the previous year the annual value shall

be determined as per clauses (a) and (b) of Sec. 23(1).

Particulars Amount (Rs.)

Step I:- Compute gross annual value

The Gross Annual Value shall be higher of the following two:

a) Rs. 1,20,000 or Rs. 1,60,000 whichever is higher but

subject to maximum Rs. 1,40,000

1,40,000

b) Actual rent received or receivable, i.e., Rs. 12,000 * 12 1,44,000

Gross Annual Value 1,44,000

Step II: Deductions

Less:- Municipal tax paid during the previous year 24,000

Net Annual Value 1,20,000

Less:- Statutory Deduction @30% 36,000

Income from house property 84,000

House-II

Particulars Amount (Rs.)

Step I:- Determination of value as per Sec. 23(1)(a)

Municipal Value Rs. 1,70,000

Fair rent Rs. 2,00,000

Standard Rent Rs. 2,20,000

Value as per Sec. 23(1)(a) 2,00,000

Step II: Actual rent received/receivable (18,000*11)= Rs. 1,98,000 1,98,000

Since the actual rent received/receivable in spite of vacancy is more than the value

determined as per clause (a), Sec. 23(1)(c) will not be applicable and the gross annual value

shall be Rs.1,98,000, being higher of the amount determined as per Sec. 23(1)(a) and Sec.

23(1)(b).

Particulars Amount (Rs.)

Gross Annual Value 1,98,000

Less: Municipal tax paid 80,000

Net Annual Value 1,18,000

Less: Statutory deduction @ 30% 35,400

Income from House Property 82,600

source (As amended by Finance Act, 2013) : http://www.trpscheme.com

House III

Particulars Amount (Rs.)

Computation of Gross Annual Value

Step I: Determination of value as per Sec. 23(1)(a)

It will be Rs. 2,00,000 or Rs. 2,40,000, whichever is higher as

Standard rent is not applicable in this case

Value as per Sec. 23(1)(a) 2,40,000

Step II: Actual rent received/receivable (21,000*6) 1,26,000

Since the property is let out and was vacant for part of the year and the actual rent received is

less than the value determined u/s 23(1)(a), Sec. 23(1)(c) would be applicable.

Therefore, the gross annual value shall be the actual rent received or receivable,

Particulars Amount (Rs.)

Gross annual value 1,26,000

Less: Municipal tax paid 30,000

Net annual value 96,000

Less: Statutory deduction @ 30% 28,800

Income from House Property 67,200

Dr. Bankey Lal, a businessman, constructed a multi-storied building consisting 16 flats of equal size. The construction was started in April 2004 and completed on March 31, 2008. Of these 16 Flats, 8 were let-out to tenants for their residence, 2 to tenants for their business, 2 were used by Doctor Bankey Lal for their business, 2 were used by him for his own business and 2 were allocated to 2 employees of Dr. Bankey Lal; Business for their residence and the occupation of these 2 flats by the two employees facilitated the carrying of on his business. The rent charged from each of the ten tenants were Rs 500 p.m. but from the two employees of Dr. Bankey Lal@ Rs 200 p.m. One of the tenants were in arrear of rent for two months during the year and was unable to pay the same. After, he vacated the flat, Dr. Bankey Lal had to wait for two months to get new tenant. The expenses incurred by Dr. Bankey Lal in respect of the flats during the year ended on 31 March 2013 were as follows :- Municipal taxes for each flat Rs 750, cost of repair of each flat Rs 500, annual interest on loan on construction of house Rs 24000, Fire is insurance premium for flat Rs 100, Law charges in connection with a lease agreement were paid for each flat Rs 500. Compute the income from house property of Dr. Bankey Lal for the assessment year 2013-2014.

A question about the tax deduction and income from let out property in case of co-owner/co-applicant.

I and my wife are co-owner of property and co-applicant of the loan. However, since she is Homemaker, I pay 100% EMI and the rent is received in her bank account. In this case can we show the income from property in her name and I can still claim for deduction of 100% of interest repaid?

I tried to search various sites but could not find this exact case!

Once again very informative post and helpful to me .

Why helpful to you?

Once again very informative post and helpful to me .

Why helpful to you?