Surrendering the insurance policy means exiting from the insurance policy before the maturity. It is the voluntary termination of the insurance contract by the policyholder. But what does it mean to surrender a policy? How to surrender a policy? In our article on Discontinue Life Insurance Policy: Surrender,Paid Up,Loan we discussed the various options available to an insurance policy holder if (s)he wants to discontinue the policy.

- Let the Policy Lapse

- Surrender the Policy

- Make the Policy Paid up

- Take loan against the policy

We also gave an overview of Surrendering the insurance policy. In this article we shall discuss in detail about surrendering the policy, tax implications of surrendering the policy, calculating the surrendering value, how to surrender a policy.

Table of Contents

Overview of Surrendering the Insurance Policy

Surrendering the policy means exiting from the policy before the maturity. It is the voluntary termination of the insurance contract by the policyholder before the maturity or premature encashment of the life insurance policy. On surrendering a policy:

- The life cover or protection ends.

- The tax benefit, if availed of on the premium paid till then,may be reversed if surrendered before premium has been paid for two years and 5 years for ULIP products after the date of commencement of policy.

- On surrendering before the maturity date the cash value that you receive is called the surrender value of a policy.

- Policies usually acquire a surrender value after premiums have been paid for three years.

- If any extra premium is paid towards riders such as Accident benefit etc, it is usually excluded.

- The surrender value is calculated by the insurance company depending upon the time for which the policy was in effect (the age of the policy), the total duration of the policy, the premiums paid and any bonus accrued.

- If the policy is in its initial stages (3-4 years old) the surrender value is only about 30% of the premiums paid plus any bonuses that may have accrued till then. The closer you are to the maturity date of your policy, the higher is the amount you get when you exit. Towards the end of its term, this can be as high as 80% of the premium. Even after three years, during the early stages of policy the surrender value is just a fraction of the total premiums paid.

Tax implications of Surrendering a Policy

Tax benefits on buying a life insurance policies come are: deductions under 80C section and tax benefit on benefits received under section 10(10D) . Tax treatment of policy on maturity or death of policyholder, on receipt of surrender or paid-up value, is similar. From our article Life Insurance

- Benefit is available to Individual assessee and Hindu Undivided Family assessee.

- In case of individual assessee – Himself/herself, spouse, children of such individual

- In case of HUF assessee – any member of HUF.

- For insurance policies issued before 01 Apr 20013 to on or after April 01 2012, deduction under 80C is allowed for only so much of the premium payable as does not exceed 10% of the actual capital sum assured. Before Apr 1 2012 the limit was 20% of sum assured.

- Insurance products give you deduction of up to Rs 1,00,000 from taxable income under 80 C, subject to the life cover being at least five times the premium. If it is less than the minimum, the amount that can be claimed under Section 80 C for tax savings reduces appropriately. For example, if you take a single premium insurance policy with life cover of 1.25 times, then the amount claimed under 80 C will be only R 25,000 for Rs 1,00,000 premium paid. Ref:YourOwnAdviser

- Premiums paid towards a life insurance policy qualify for tax deductions under Section 80C, with a limit of 1 lakh in a financial year, is restricted to 20% of the sum assured of the life insurance policy.

- Under Section 10(10D), any amount received under a life insurance policy,from the maturity or claims on a life insurance policy, including bonus, is not taxable provided some conditions are met.

- For policies bought before 1 Apr 2012, The proceeds from the maturity or claims on a life insurance policy were exempt under Section 10(10D) if the premium was not more than 20% of the sum assured or the sum assured was at least five times the premium paid.

- For policy bought after April 1, 2012 the sum assured needs to be at least 10 times the premiums paid,

- For policies whose premium is greater than 10% of Sum Assured getting money on maturity or even surrendering them early means you will be subject to tax on whatever you receive.

Let’s try to understand these conditions by example for deductions under section 80C.

For a sum assured of Rs. 10 lakh, the maximum premium that one can pay to claim deduction for policy bought after 1 Apr 2012 under section 80C is 10% of Sum Assured i.e Rs. 1 lakh.

Mr. Mehta takes life insurance plan with Sum Assured of Rs 2 lakh before 1 Apr 2012 . The maximum premium benefit he can avail is 20% of 2 lakh i.e Rs 40,000. If he pays premium of Rs 50,000 only Rs 40,000 will be considered. So one should always take Sum Assured as 5 times the annual premium to fulfill the 20% condition.

Mr. Khanna takes life insurance plan with Sum Assured of Rs 2 lakh after 1 Apr 2012 . The maximum premium benefit he can avail is 10% of 2 lakh i.e Rs 20,000. If he pays premium of Rs 50,000 only Rs 20,000 will be considered.

For tax benefit under section 10(10D)

Mr Khan pays 1 lakh of premium per year for a policy with Rs. 5 lakh sum assured bought after 1 Apr 2012, so premium is greater than 10% of Sum Assured (50,000) .

- Three years later,he would have paid Rs 3 lakhs.

- Let’s say when he surrenders after 3 years its surrender value is Rs 3.5 lakhs. As his annual premium was greater than 10% of Sum Assured so benefit received is taxable.

- So, 3.5 lakhs is added to his income and he would need to pay upto Rs 1.05 lakhs as tax (if in the 30% bracket).

- His investment: Rs 3 lakhs. His return: Rs 2.45 lakhs

Reversal of 80C benefits : According to 80C rules, tax savings on traditional life insurance plans will have to be reversed if :

- you do not keep single premium policy in force for two years after the date of commencement of the policy OR

- regular premium policy premiums are not paid for two years.

For ULIPS it’s 5 years. The amount of deduction allowed under Section 80C in earlier years shall be deemed to be income of the customer and (s)he will be liable to tax in the year of surrender of policy. So if you do not pay any additional premium after buying a regular premium policy, not only do you not get any surrender value, you will also have to reverse the Section 80C tax savings you have taken. It will be a double whammy for you!

Calculating the Surrender Value

The surrender value factor is a percentage of paid-up value plus bonus. It is zero for the first three years and keeps rising from third year onwards. It differs from company to company and depends on various factors. There are two types of surrender value

- Guaranteed surrender value and

- Special/cash surrender value

While the guaranteed value is easy to calculate and is mentioned in the product brochure and the policy bond, the special surrender value is calculated only after the policyholder puts in the surrender request. Different companies use different approaches to arrive at the Special/cash surrender value. Usually, the calculation takes into consideration factors such as completed policy years, policy type and time to maturity, with-profit fund performance in case of participating policies, besides the company’s customer philosophy and industry practice.

Guaranteed Surrender Value (GSV)

As per the Insurance Act 1938, after three premium payments, the GSV works out to 30% of the premiums paid minus first year premium.

- You are eligible to receive this if you have paid premium for at least three years.

- It is 30 per cent of the basic premiums paid, excluding the first year premium.

- Additional premium for riders such as accidental death benefit is excluded.

Please Note Usually the first year premium is not counted. For example, if you are paying a annual premium of Rs 20,000 then in the 5th year,

- The premium paid = 20,000 * 5 i.e 1,00,000.

- Premium without the first year = 20,000* 4=80,000.

- Minimum surrender value is 30% of 80,000 which is Rs 24,000.

If you have paid Rs 75,000 (Rs 25,000 annually for sum assured of Rs 5,00,000) in the first three years, the minimum you will get is 30 per cent of Rs 50,000 (total premium paid minus first-year premium), that is, Rs 15,000.

This does not include the bonus that you may have received from the insurer. If your policy pays bonus, which you accrue during its term, the amount you will receive on premature closure (surrender) of the policy will be the special surrender value.

Special or Cash Surrender Value (SSV)

If you stop paying premium after a specified period, your policy will continue but with lower sum assured. This reduced sum assured is called paid-up value or paid-up sum assured. Special surrender value is arrived at by multiplying the total paid-up value (paid-up value + bonus) with a multiplier called the surrender value factor. The surrender value depends on a factor (known as surrender value factor!) and it depends on the age of the policy and bonuses offered and is heavily insurer dependent. Not all companies declare the surrender value factor in the product brochure or on their website.

Paid Up Value = Original sum assured * (Number of premiums paid / Total number of premiums that were required to be paid)

Total Paid Value = Paid Up Value + bonus.

Special surrender value = { Sum Assured * (Number of Premiums Paid/Total Number of Premiums Payable) + Bonus } * Surrender Value Factor.

= (Total Paid Value) * Surrender Value Factor

Example: The paid-up value as Rs 75,000. Assuming that the bonus is Rs 60,000 and the surrender value factor in the 3rd year is 27.76 per cent, then

the special surrender value = 27.76 per cent (Rs 75,000+Rs 60,000) = Rs 34,476.

Example: Mr. A has taken an Endowment policy of 30 years term for Sum Assured of 2 lakhs and has paid premium till 25 years. Now he wants to know how much is the surrender value. First let us find out the Paid up value and bonus.

- Paid up value = [25 * 2,00,000/ 30]

- Bonus is given from the bonus chart of LIC for 25 years Endowment plan which in this case 1583 per 1000 of Sum Assured. As Sum Assured is 2 lakh (2,00,000) Bonus would be 1583 * 2,00,000/1000

- Total Paid Up Value = [ 1583 * 2,00,000/1000] = [ 166667 + 316600]=4,83,267

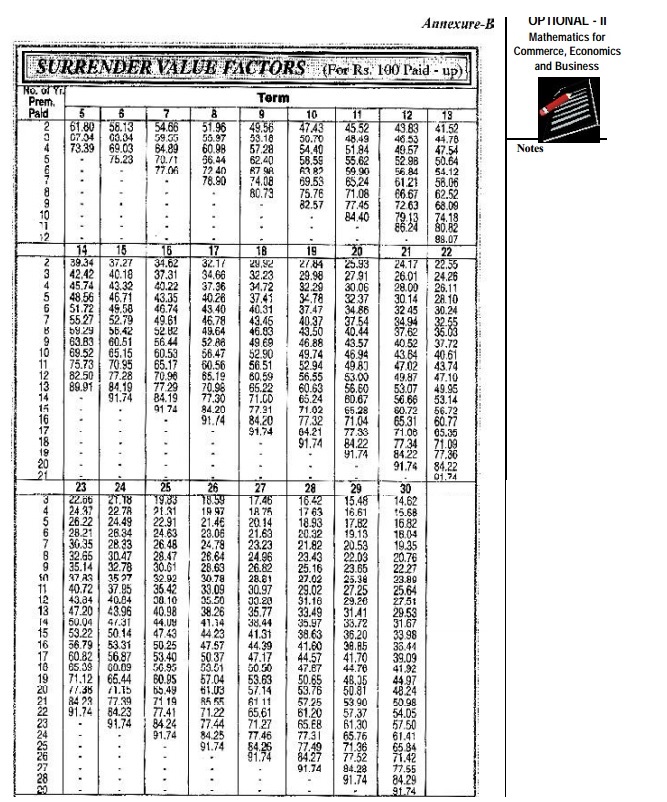

- SURRENDER VALUE = Surrender value factor * Paid up value /100. Assuming a surrender value factor from LIC chart is 65.84

- Surrender value = 65.84 * 4,83,267 / 100 = 3,18,183

Loan Value = 90% of Surrender Value (approximate) In above case you can get loan of up 90% of 3,18,183 = 2,86,365

Example: if a policyholder takes LIC’s endowment plan for 20 years with SA of Rs 1 lakh, for premium Rs4,881 pa. (Ref MoneyLife: Surrendering Life Insurance Policy, think again)

- After four premium payments, the policyholder would have paid premium of Rs 19,524 (4881 * 4).

- Guaranteed Surrender Value (30% of premiums excluding the first year) =( 30* 4881*3)/100 = 4,392.9

- In this example, the GSV is Rs 7,910, even though, going by the actual policy wording the GSV is only Rs4,392. What explains the difference between Rs7,910 and Rs4,392? It is the cash value of existing vested bonus (partial bonus).

- The SSV offered by LIC is Rs 9,099

The customer gets the higher of SSV or GSV. Moreover, the longer you stay with the policy, the higher is the amount of partial bonus added. It means your GSV as well as SSV will start looking better when you stay for a longer period with the policy. Surrender Value Factor of LIC polices is given below. Click on image to enlarge. (Ref: Source for LIC surrender value factors (pdf file))

Using these IIT M Prof,Pattabiraman M who runs Free Personal Finance Calculators, has written an excel Insurance Policy Surrender Value & Paid-up Value Calculator. Try it to get an idea of surrender value

Bonus Rates

When Life Insurance companies make profits and share the profits with their policyholders they do so by calling it a Bonus. It’s mainly the traditional insurance policies like the endowment policy, whole life insurance policy and money back plan that are eligible for bonus. Each type of Traditional Policy has 2 versions, namely the

- Participating Insurance Policy or Policy with Profit

- Non-participating Insurance Policy or Policy without Profit

Participating insurance policy means that this particular policy will participate in the profits of the insurance company. And hence only the Participating polices receive bonus and the Non-participating do not. Of course, the premiums for participating policy are higher than the non-participating policy for a similar coverage and same customer criteria. The policyholder will have to choose whether he wishes to have a Participating Policy or a non-participating one, right at the inception of the policy.

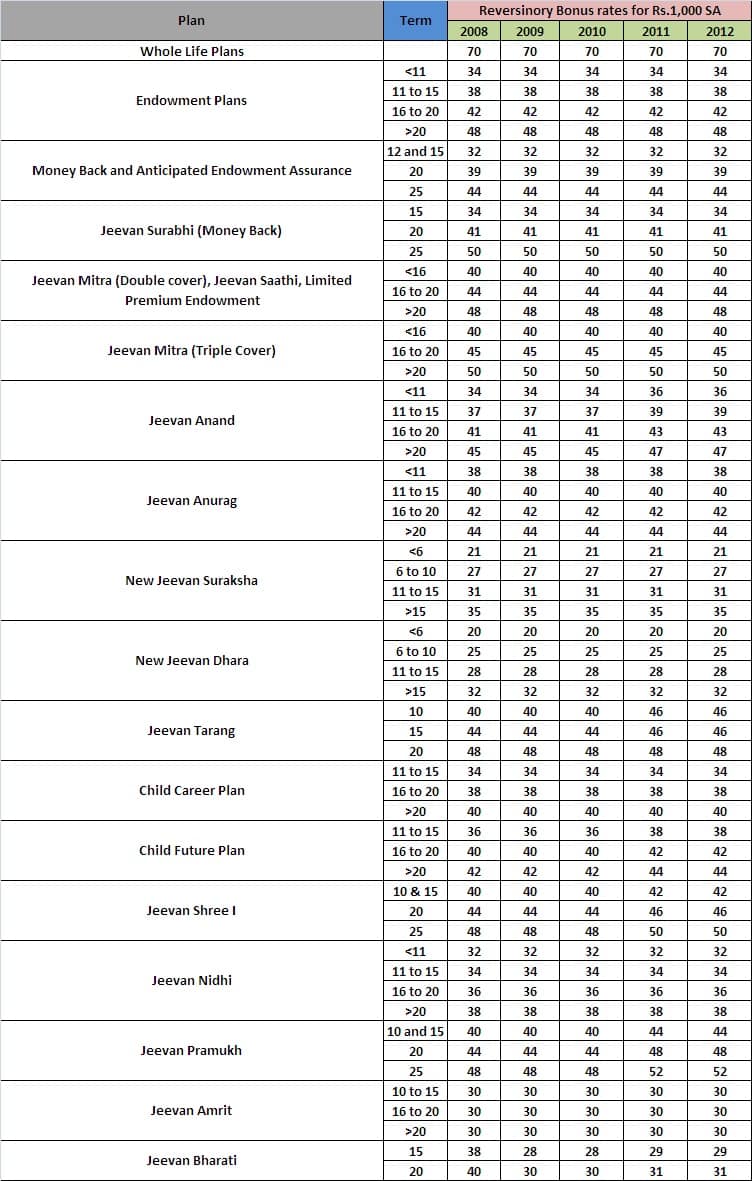

The bonuses are declared regularly and paid at the end (at the time of claim) are called reversionary bonuses. They are declared as a percentage rate, which applies to the sum assured of the policy, in respect of the basic policy benefit. There are other bonuses like Terminal bonus (paid at maturity or at the time of claim)

There is no standard rate for the bonus of any particular company. The bonus rate varies from company to company and from year to year. The bonus rate varies from product to product, and also varies with Terminal Bonus, Final Addition Bonus, etc. Hence there can be no set formula for calculating bonus. It is only calculated after it is declared.

It is declared like Rs 70 per thousand Sum Assured(PTSA). That is, if your Sum Assured is Rs 5 lakhs, then the bonus that you would receive is 70/1000 X 500000, i.e. Rs 35000 for that particular year.

LIC’s webpage for Bonus Information, LIC’s Bonus rates for 2010-11 (pdf) ICICIPrudential Bonus , HDFCLife Bonus From Basunivesh LIC’s Bonus rates for 2012-13 and comparison (Click on image to enlarge)

How to surrender a policy

Each insurer has his own guidelines, so please check with your insurer. There is not much information on surrendering a policy. Some information that we found are SBILife download centre SBI Life Surrender/Partial Withdrawal Application Form(pdf), Surrender Checklist(pdf). Documents usually required to surrender life insurance policy are.

- Policy surrender form

- Policy bond (Original life insurance policy document)

- A self-attested copy of your ID proof

- Any cancelled cheque/bank attested bank statement/bank attested passbook copy.

- One rupee revenue stamp to be put on the policy surrender form.

These documents need to be submitted at the branch office. For LIC you need to submit at the home branch office (the branch which issued your policy). What happens after the surrender request or how much time it takes – not much information From BajajAlliance Support Centre for Surrender of Policy

After the surrender request is submitted the customer gets a confirmation call for the payout. If the customer prefers a cheque payout, the process takes 8-10 days. If the customer prefers a direct credit payout, the process takes 7-8 days(Ref).

Surrendering LIC policy

LIC website does not have information or form for surrendering LIC policy(though LIC website has section called download Form). Quoting from LIChelpline LIC Surrender Form

Any Traditional policy of LIC OF INDIA can be surrendered only after 3 years from Date of Commencement (DOC) of the LIC POLICY. In order to surrender the LIC POLICY, the LIC POLICYHOLDER needed to submit the surrender form duly signed by the POLICYHOLDER on the 1st and 2nd page( sign on the 2nd page should be across the revenue stamp) along with the LIC POLICY BOND at the home branch.

Please note these documents need to be submitted at the LIC Branch Office from where your policy was issued (you cannot submit them at any other branch office). LIC sends the amount by cheque. How to surrender LIC ULIP policy

Searching on the internet led us to two types of Form Delhi Division -III(form in both Hindi and English Surrender Form; Form no 5074 & 3510.(pdf)) and Bangalore Division(Only english Policy wala)

Related Articles:

- Mixing Insurance with Investment

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- Life Insurance

- Basics of Insurance

In this article we discussed about surrendering traditional life insurance polices,Tax implications of Surrendering a Policy,calculating surrender value. Have you surrendered a life insurance policy? If yes Why did you surrender it? How easy or difficult was the process? Please share your feedback,comment.

46 responses to “Surrendering Life Insurance Policy”

Sir,

I am a NRI having ICICI Life Stage Pension Policy. I am being given to understand if I surrender the policy I will be subject to TDS @ 30.8%.

My question is how can I claim refund for the same in my return as I am in UAE having DTAA agreement and will be able to get Tax Residency Certificate for the FY. Abstract of UAE DTAA is as below.

ARTICLE 22 – Other income – 1. Subject to the provisions of paragraph (2), items of income of a resident of a Contracting State, wherever arising, which are not expressly dealt with in the foregoing articles of this Agreement, shall be taxable only in that Contracting State.

meaning its exempt from Tax in India

Dear Sir,

I have ICICI Prodential Cash plus policy, purchased on 23rd August 2006. I am paying Rs20,000 yearly and maturity is on 2011.My fund value is Rs2,92,000 and i would like to surrender this policy now what will be surrender charges and how much i will receive. Is money received is taxable.

I have Two police jeevan saral 165-20 sum assured 500000 Dated 18.04.11 fist prim um 12130 next 18.10.11 Rs 12130 total 24260 continue 5 years(police 28 y period 2030

5 year complete premium summit time to time 121300 Total amount paid

second Komal jeevan plan 159-18 sum assured 200000 Date 28.12.12 prim-um amount 14743.00 yearly 5 year(police 28 y period ) total 73715.00 paid amount

Lic surrender Value Amount get to me paid

Dear sir, i am in chennai, i am holding 6lic policy as below, till now i am paying the policy, now i want surrender all policy due my finalcial problem , how much i will get , all policy 12 year over now , 1.jeevan mitra T133 , SUM 75000/- Policy date 12.2.2000 , premiun 355/month 2.Jeevan chhaya T103,SUM4,00,000/-,POLICY DATE 10.3.04,PREC 5220/QTY. 3.Marriage endownment /Edu, aunnual plan T-90,SUM 225000/-,POLICY DATE 10.3.04,PREMIUM 2331/QTY.4.eNDOWNMENT ASS. POLICY-T14,SUM75000,POLICY DATE103.14,5..Marriage endownment /Edu, aunnual plan T-90,SUM 200000/-,POLICY DATE 10.3.04,PREMIUM 2185/QTY 6.THE WHOLE LIFE POLICY T5,SUM101000/- PRE741/QTY. KINDLY ANY ONE SUGGEST HOWMUCH I WILL GET PLEASE

[…] Surrendering Life Insurance Policy | Be Money Aware Blog – Surrendering the insurance policy means exiting from the insurance policy before the maturity. It is the voluntary termination of the insurance contract by the … […]

Sir, I had taken a new Jeevan Anand policyon 28-12-2013 for 18 terms and sum assured is five lakhs and premium is 33648. Now I want to surrender. How much I will get.

Hi sir,

I need your advice for Postal Life Insurance (PLI) Endowment Policy. Below are the details:

Plan : Santosh

Sum Assured : 5 Lacs

Installment Premium : Rs.1375/Monthly (Rs.1401 with Service tax)

Issue Date : 30/10/2012

Maturity Date : 30/10/2039

Last Premium Paid Till : 31/08/2016

Paid up Value (as per PLI Website) : 72530.86

Current Surrender Amount (as per PLI Website) : 24515.00

I want to surrender the policy. However, after reading the IRDA Guidelines, I have a query.

“Guaranteed Surrender Value (for regular premium policies) will be as below.

A) 30% of premium paid less any survival benefit already paid, if surrendered within 2nd Or 3rd Year.

B) 50% of premium paid less any survival benefit already paid, if surrendered within 4th To 7th Year……….

30/10/2012 to 30/09/2013 >> 1st year

30/10/2013 to 30/09/2014 >> 2ndt year

30/10/2014 to 30/09/2015 >> 3rd year

30/10/2015 to 30/09/2016 >> 4th year

My query is: Am I getting 30% or 50% Surrender value.? If I am getting 30% then is it beneficial to pay 1 or 2 premiums and get back 50% of Surrender value.?

Kindly suggest me.

I hv completed 3 yrs of Jeevan aanand policy and I want to quit . Can i get my money back immediately after quit the policy? or how many time it will take to get my money back ?

Hi,

I have taken lic money back policy 20 years plan in Dec 2011.i am paying 16112 premium quarterly.i have availed 89000 as loan in 2015.i am supposed to get 20% of sum assured in Dec 2016.will they deduct my loan amount and interestfrom my sum assured amount which I am supposed to get by Dec 2016.please reply

sir,

I have SBI life pension plan with yearly 60,000/-. only one premium paid and I am unable to continue. so please let me know, how I can surrender the policy.( the policy is 5 years).please advice me.

thanks.

Surrender will be allowed after 3 years provided three years full premiums have been paid in case of Regular Premium and

after 1 year, in case of Single Premium, from the start of the policy.

The Guaranteed Surrender Value for regular premium policies, is 30% of all Premiums paid excluding 1st year’s Premium

and Rider Premium, if any and for Single premium policies, Guaranteed Surrender Value is 75% of Single Premium

excluding rider premium, if any. Cash value of the allocated Bonuses, if any, will also be added.

The Non-Guaranteed (Special) Surrender Value (SSV) will be based on an assessment of the past financial and demographic

experience of the product / group of similar products and likely future experience and will be reviewed from time to time

depending on changesin internal and external experience and likely future experience. This Surrender Value will depend on the

termofthepolicy,thenumberofyearsforwhichPremiumshavebeenpaidandthedurationelapsedatthetimeofsurrender.

On surrender, the higher of the Non-Guaranteed SSV and the GSV will be paid.

Surrender Value can be used as per following options:

I. To purchase immediate annuity from the entire policy proceeds

II. To purchase immediate annuity with an option to commute upto one-third of the total surrender value as per current

Income Tax rules

III. The entire proceeds can be used to purchase a single premium deferred pension product

[…] Surrendering Life Insurance Policy | Be Money Aware … – Example: if a policyholder takes LIC’s endowment plan for 20 years with SA of Rs 1 lakh, for premium Rs4,881 pa. (Ref MoneyLife: Surrendering Life Insurance Policy … […]

I have paid 6 premiums of 42035/- for JEEVAN SARAL till now but my SUM ASSURED is only 850000/- which is obviously very very low .

I want to surrender it but my broker told me that I have paid total money till now = 252210/- but if I surrender it now then I will get only 205000/- .

Although I have paid it for 6 YEARS .

I m not feeling well , I think the broker is doing some changes or may be deducting some money on his behalf

because I have passed 6 years already , I should get atleast my ORIGINAL PAID PREMIUMS

the broker is insisting me to hold it for next 4 years more and after completion of 10th year , I will get TOTAL PREMIUM + LOYALTY but they are not giving me any exact figure ,

so I m very doubtful now

Please give me your suggestions , what should I do now ?

Thanks

My policy jeevan anand 149 of premium Rs 31390 of 11 years of Rs 3 lac is matured in next month. I want to know that if I dont want whole life insurance and want to close the policy on its maturity, can I surrender it and how much money i will get against surrender in whole life insurance

Sir how many years did you take the policy for? Could you provide more details.

If policy is maturing or near maturity then surrendering it would not advisable.

I Have a Jeevan Saral Policy which I took in Dec 2010. Yearly premium of Rd 72060 for a term of 20 yrs, Sum assured 150000. Age at the time I bought the policy was 23. I have paid 5 full premiums but I want to now close the policy.

Q1. What is the amount i will get if I want to close it now.

Q2. I haven’t paid the 6th premium in dec 2015. If the policy lapses can I get it surrendered without paying anything extra?

Work at home

Hi its Atul,i would like to know that i have an policy of Rs 50000 for 10 years and i would like to surrender it ….It has been activated on 15 Dec 14….could you please let me know that how much i will get it if i surrender after 1 year….

Thanks editor, we got lots of information from this post.

I have ICICI Pru Life Stage Wealth II with Sum Assured for 1500000.00, with Annual premium of 1 Lac (which is paid by monthly installments of 8333).

The Policy commenced from 1st April 2011 ( But actual policy money paid from Aug -2011). Since i observer very poor performance (Value of the Units) progress in this, i want to withdraw the money and invest it in regular mutual funds. I also i have a Term Plan that gives better insurance coverage.

1. I do not show this in the Tax exemption of 80C/80CC

2. What will be the money i’ll be getting (% of the ULIP Unit Value) if i surrender now? As i badly need money.

3. How much i tend to loose approiximately

4. Can i pay next years payment by now to reduce the loss and withdraw now?

Thanks for your superior help.

Regards

Aravind

HI

My brother is an NRI and has polciies with ICICI Pru since 2009. All are ULIP policies.

1) Elite Pension fund- 2009 commencements, policy term 6 years. Premium pais 5 lakhs at one shot. We want to surrender this policy , what are the implications. Tax wise. Sum assured zero.

2) Life Stage Assure- 2009 Commencement. Policy term 10 year. Premium pais for 5 years. Surrender value is more than premium paid. So we ant to surrender. Can you please tell us the tax implications for thsi too.

Look forward to your response at the earliest.

under section 10(10D), surrendered amount in insurance plans after 5 years, is exempt from tax as long as the premium amount does not exceed 10% or 20% of the sum assured. As the policies have completed 5 years , If you surrender your policy now, you will receive at least 90% of your fund value. The entire surrender value will be added to your annual income and taxed as per your tax slab. In the case of Unit Linked Pension Plans, insurers do not deduct tax at their end. Service tax is collected by the insurance company when an investor pays the premium. It will not be charged while surrendering the policy.

For more details its best you contact ICICI Pru

Hi ! I am asking this question on behalf of my friend,who has been pressurised by ICICI prudential insurance ,through outsources to close his insurance policy that is preclose.He has been paying a premium of monthly 2500₹, for 3 years now.But there has been frequent phone calls from people of ICICI asking him to preclose his Guaranteed savings insurance plan,saying he will not receive the assured sum at the end of 15 years .The Netambit agency who has done the insurance procedure is the cause for this problem,is their reason.But nothing was formerly informed about this Netambit until this Saturday.What should we do?Is anyone having the same problem?

Can you tell us the name of ICICI prudential insurance plan?

Sara we haven’t heard of any such case. It is sad to hear about it. Nomatter through whom you buy plan finanlly it’s the company that’s involved and has to honour its commitment.

Sara in ICICI guaranteed plan if you pay the premium for at least 3 years then the policy acquires surrender value, which I take to mean that if you cancel before that time period you don’t get anything at all.

Then to calculate the surrender value – you have to see the higher of the two:

Guaranteed Surrender Value: This is 35% of the base premiums paid minus the first year premium. So if we go back to our example and say that we want to cancel after the 4 installment. Then 35% of 1,00,000 is Rs. 35,000 and if you reduce the first premium from that then you are left with Rs. 10,000 only.

Non Guaranteed Surrender Value: This is the present value of the paid up sum assured discounted at the gross redemption yield at the review date immediately preceding the date of surrender, plus 2% annum. Quite frankly, I don’t know how to calculate this or even what this means, I can only hope its close to the money you have already paid but that’s probably not how it is.

I have taken Jeevan Saral policy (Plan165 ) of LIC in 2010. Annual premium is Rs. 9796.Upto this date I have paid more than five annual instalments. I now want to surrender the policy as the returns are negligible.

Kindly inform me how much amount i will get on surrender. I had claimed tax exemption under 80C.What type of tax treatment will be given for the surrender amount.

I have taken LIC jeevan anand policy in 2010 by paying 16356/- annually. Now I want to surrender the policy. In the lic portal login the vested bonus is showing as 52,200/-. How much amount i will get if i surrender the policy.

Naveen, recently tried to surrender my Jeevan Anand policy.I ve paid upto 16Kusd for four years and now I am getting only 4000 usd ..when u surrender u will not be eligible for vested bonus ..these are been accumulated for your maturity period..be prepared for the hidden charges which may be deducted at the maturity period..

every insurance company is doing business..they are not running social charity..so think before u invest in insurances..whether its private or public..

I have taken Jeevan Saral policy (Plan165 ) of LIC in 2011. Annual premium is Rs. 60050.Upto this date I have paid four annual instalments. I now want to surrender the policy as the returns are negligible.

Kindly inform me how much amount i will get on surrender. I had claimed tax exemption under 80C.What type of tax treatment will be given for the surrender amount.

My client had taken an insurance policy. for a sum insured of Rs. 1000000/- in December 2009 With a regular premium of Rs.200000/- per annum. In the 1st year he also paid a top up premium of Rs.300000/-. After payment of 3 regular premium he had stoped further payments. After 5 years the insurance company cancelled the policy and released an amount of Rs.128200/- after deducting tax @2%. As explained above the regular premium was only 20% of the sum insured. Party had not availed deduction under 80C in any of the previous years. Could you please explain the taxability on such receipts.

With reference to my earlier post , if ibuy an annuity for 1/3 ofthe receipt amount , does that save me any tax ? If yes , what are the investments that qualify for this tax shield?

I purchased a HDFC SL Pension Champion Plan in 2010 with an annual premium of Rs. 2.0 lacs. In 2015 after having paid 5 premiums I surrendered the policy and received a total amount of Rs 12.9 lacs. I assumed that after an investment of Rs 10 lacs over a period of 5 years I have earned 2.9 lacs which after capital gains tax would leave me with something over Rs. 2.0 lacs net profit. But after reading your blog it seems that I am liable for a tax at max rate on the entire amount of 12.9 lacs leaving me with a loss of over Rs 1.o lacs. I did not avail of any 80C benefits on the amount paid. Is this the correct position ? What sort of a tax regime is this ? Was I throwing away my money for the insurer to charge me hefty management fees & the govt. to take away all my gains & a part of my principal too ?

Dear MP Singh,

we are also facing the similar problem with the HDFC, although we had paid the 5 regular premiums of Rs. 100,000/- each year under SAP, we are told that we will only get 3.40 lac in case we surrender. pls guide and share with us your experience!!

Regards

valuable information which helps 2 all indians about itax

Valueable comment which encourages us to write more such articles. Thanks

sir

I want to surrender jeevan anand policy after paying premium for 3 years following are my queries 1)whether I have reverse or not the exemption under 80 c of income tax which I have taken 2)what will be surrender value premium is 50000 for 29 years

can you explain more in detail about life time pension, life time in ICICI prudential (Ulips) and its value – whether to go along or to continue, now in 8th year

Your blog is very helpful . Please continue to share these details . Thanks

Thanks Vishal. Your comment are very helpful. Please continue to give us (provided we keep on delivering helpful articles)

This is best information for surrender value of life insurance policy because most of complaint generate when person go for surrender value

Better we must read offer and policy document before buying Life Insurance policy

and thanks to sharing this kind of information its really needed.

Thanks Chetan. If you like please share it with your friends!

Sure, I am happy to send information like this to my friends & Client

Thanks a lot Jeet. We checked your website you have been in this field since 2000. Very impressive.

Does all these information particular to a specific LIC policy be present in policy doc?

A very interesting question. Sadly no Suhas. Policy document of LIC ( double sided 2 page document) has information of premium payment, Date of commencement, Date of maturity etc,

Nice Information. One should take of all these points before buying the policy

Thanks Vishal for your encouraging words!