Sukanya Samriddhi Account or Girl Child Prosperity Scheme is a special deposit scheme launched by Prime Minister Narendra Modi on 22 January 2015 for girl child. Under the scheme an account can be opened by the parent or legal guardian of a girl child of less than 10 years of age with a minimum deposit of Rs 1,000 in any post office or authorised branches of commercial bank.Under the scheme, an interest of 9.1 per cent is provided. The account will remain operative for 21 years from the date of opening of the account or till marriage of the girl child . Partial withdrawal up to 50 per cent of the account balance is allowed to meet education expenses of the girl child till she attains 18 years of age. This article explains in detail the Sukanya Samriddhi account, what are features of the scheme, how to open account, tax, how it compares with PPF.

Table of Contents

Sukanya Samriddhi Account

What is Beti Bachao, Beti Padhao Scheme? Beti Bachao, Beti Padhao (Save girl child, educate girl child) is a Government of India scheme that aims to generate awareness and improving the efficiency of delivery of welfare services meant for women. The scheme was initiated with an initial corpus of Rs 100 crore. According to census data, the child sex Ratio (0-6 years) in India was 927 girls per 1,000 boys in 2001, which dropped to 919 girls for every 1,000 boys in 2011. A 2012 UNICEF report ranked India 41st among 195 countries.

Who can open the Sukanya Samriddhi Account?

This account is specially meant for a girl child less than 10 years old and comes under small savings scheme. Natural or legal guardian can open only one account in her name. Account can be opened from the birth of the girl child till she attains the age of ten years. As this scheme was announced in Jan 2015 if the child turned 10 any time between December 2013 and December 2014 ie born between Dec 2003 to 2004, you can still open account in her name. Guardian of the girl child will be allowed to open and operate accounts of maximum of two girl children except in the case where they have twin girls the second time or triplets( three girl children). One can open account for girl born after Dec 2003.

NRI and Sukanya Samriddhi Yojna account

Can NRI parent open the Sukanya Samriddhi Yojna account?

Sukanya Samriddhi Yojna is governed by Post office Small Savings Scheme rules and NRIs are NOT eligible to invest in such schemes. It has been clarified under the scheme that account can be opened for child with Resident Indian citizen status only. NRI, OCI and others cannot open account. Further when the citizenship status changes, account will be discontinued.

What happens when the resident child becomes NRI?

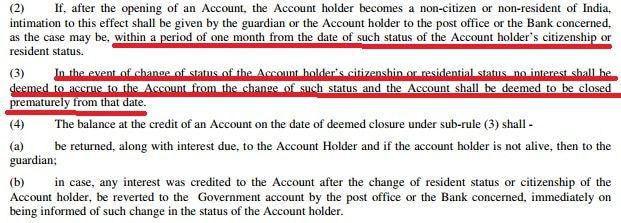

As per the Government notification in Mar 2016, upon a beneficiary changing citizenship or residential status, the account will earn no interest. It will be deemed to be closed prematurely. The excerpt from the notification is shown below

How much can one deposit in Sukanya Samriddhi Account and for how long?

The initial deposit is Rs. 1,000 and then in multiples of Rs. 100. You can make deposits for 14 years from the date of opening of the account. You can deposit varying amounts in a month or year. In a financial year(Apr- Mar)

- Minimum deposit is Rs 250(from 1 Oct 2018 before that it was Rs 1000). Failure to deposit Rs 1000 a year will cost Rs. 50 in penalty.

- Maximum Deposit : Total deposit should not exceed Rs 1.5 lakh.

- The deposit shall be made by cash, cheque or demand draft. (No online)

Please Note: You can only deposit for 14 years from the day of opening account. From 14 years – 21 years you cannot deposit. But government will pay interest on the amount accumulated (till 14 years) till closure of account.

14 years means 14 years from the day of opening of account. So if your daughter is 7 years old when you open the account then you have to deposit till she becomes 21 years old. Account will mature when she will be 28 years. But if she gets married after she becomes 18 years and 28 years, in our example, the account will close.

On opening an account, the depositor will be given a pass book bearing the date of birth of the girl child, date of opening of account, account number, name and address of the account holder and the amount deposited. One needs to take passbook at the time of depositing money in the account and receiving payment of interest and also at the time of final closure of the account on maturity.

When will the Sukanya Samriddhi account mature or close?

The account shall mature after twenty-one years from the date of opening of the account. If the girl gets married before completion of twenty one years, the operation of the account will not be permitted beyond the date of her marriage. An affidavit also has to be provided to the effect that girl is not less than eighteen years of age as on the date of closing of account. In the unfortunate event of the child dying, the account will be closed immediately and the balance will be paid to the guardian of the account holder.

Can one withdraw from Sukanya Samriddhi account

Withdrawal before the daughter turns 18 is not allowed. Partial withdrawal,50% of the total amount,is allowed when the account holder turns 18 or when she passes 10th standard or attains 18 years of age, whichever happens first, for financial requirements such as education or marriage.

How much can one accumulate by investing in Sukanya Samriddhi account?

Assuming you open the account the moment you girl child is born and if you invest the maximum permissible amount Rs 1,50,000 per year for 14 yrs. By the time girls turns 18 years you will have 55 lakhs. At 21 years you will have approx amount of Rs 72 lacs. (Assuming interest rate remains 9.1%). Note: You can deposit varying amounts. If you make a monthly deposit of Rs 1000 for 14 years then on completion of 21 years you will get 6.4 lakh. The breakup is shown below. For monthly deposit of Rs 2000 you will accumulate 1,214,257 Rs. For monthly deposit of Rs 20,000 you will accumulate 12,142,565

| Year | Balance Amount | Interest |

| 1 | 12,592 | 592 |

| 2 | 26,329 | 1,737 |

| 3 | 41,316 | 2,987 |

| 4 | 57,668 | 4,351 |

| 5 | 75,507 | 5,839 |

| 6 | 94,969 | 7,463 |

| 7 | 116,203 | 9,234 |

| 8 | 139,369 | 11,166 |

| 9 | 164,643 | 13,274 |

| 10 | 192,217 | 15,574 |

| 11 | 222,300 | 18,083 |

| 12 | 255,121 | 20,821 |

| 13 | 290,929 | 23,808 |

| 14 | 329,995 | 27,066 |

| 15 | 360,024 | 30,030 |

| 16 | 392,787 | 32,762 |

| 17 | 428,530 | 35,744 |

| 18 | 467,526 | 38,996 |

| 19 | 510,071 | 42,545 |

| 20 | 556,488 | 46,416 |

| 21 | 607,128 | 50,640 |

How does Sukanya Samriddhi account compare with existing schemes like PPF?

It is easy to relate to scheme as the purpose is clear save for your daughter. It is better than the children insurance plan. Before opening account you should consider :

Liquidity : You have to contribute till 14 years from the date of opening of account. Account closes only after 21 years from the date of opening of account or when daughter gets married (after she becomes 18 year). You can only withdraw up to 50% for the girl’s higher education and marriage after she becomes 18 years old.

Tax on interest: At present interest earned on Sukanya Samriddhi account is taxable in the hands of guardian and a deduction of Rs. 1,500 is available. Our article Clubbing of Income talks of how income of Minor child is clubbed with that of parent. Interest earned on Sukanya Samariddhi account is tax free. In Budget on 28 Feb 2015 the restriction of interest being taxable was removed.

Mode of Deposit: Cash/Cheque/ Demand Draft/ Transfer/ online transfers through internet Banking . SIP : Standing Instructions can be given either at the Branch or set through Internet Banking for automatic credit to Sukanya Samriddhi Account .

Transfer of funds to accounts standing in CBS enabled Post Offices through NEFT (National Electronic Fund Transfer) / ECS (Electronic Clearance Services) / RTGS (Real Time Gross Settlement)

No online Mode of deposit : The deposit can be made by only by cash, cheque or demand draft. No online facility. The account may be transferred anywhere in India if one shifts from the place where the account stands.

PPF: If you look at the features of this scheme then this scheme is similar to PPF. While PPF is open for anyone Sukanya Samridhi scheme is dedicated to girls. You can open this account if you have exhausted your PPF limit(1.5 lakh for self + child). Though you will not get tax benefits, but you can still save more money for your daughter. Our article PPF Account for Minor and Self explains about opening of PPF account for child.

What if something happens to the parents or one cannot contribute then?

Under special circumstances, legal guardian of the child would be required to make a request to prematurely close the account and withdraw the amount. Some legal formalities would be required like producing death certificate etc. Quoting from Govt. Gazette

(1) In the event of death of the account holder, the account shall be closed immediately on production of death certificate issued by the competent authority, and the balance at the credit of the account shall be paid along with interest till the month preceding the month of premature closure of the account, to the guardian of the account holder.

(2) Where the Central Government is satisfied that operation or continuation of the account is causing undue hardship to the account holder, it may, by order, for reasons to be recorded in writing, allow pre-mature closure of the account only in cases of extreme compassionate grounds such as medical support in life-threatening diseases, death, etc

Interest of Sukanya Samriddhi account

What about Interest on Sukanya Samriddhi account?

- It will be set every year just like other Government schemes PPF, NSC. The interest rates notified under the scheme are as under:

Financial Year Rate of Interest Min Amount 2014-15 9.1 % 1000 01.04.2015 to 31.03.2016 9.2 % 1000 01.04.2016 to 30.09.2016 8.6 % 1000 1.10.2016 to 31.03.2017 8.5% 1000 01.04.2017 to 30.06.17 8.4% 1000 01.07.2017 to 31.12.17 8.3% 1000 01.01.2018 to 30.09.18 8.1% 1000 01.10.18 to 31.12.18 8.5% 250 - Interest will be compounded yearly. Method of calculation of interest will be similar to the Public Provident Fund (PPF). PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of the month, however, the total interest in the year is added back to PPF only at the year-end

- The Interest earned is also tax free.

- Interest at the rate, to be notified by the Government, compounded yearly shall be credited to the account till the account completes fourteen years.

How will the interest be calculated on Sukanya Samriddhi account?

Method of calculation of interest will be similar to Public Provident Fund (PPF). PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end. Interest calculation for an year when monthly addition is Rs 1000 is shown in table below. Our Sukanya Samriddhi Calculator can be used to get approximate maturity value.

| Interest =9.1 % p.a | |||

| Monthly Interest=9.1/1200 | =0.007583333333 | Interest=(Opening Balance + Monthly addition)* monthly interest | |

| Month | Opening Balance | Monthly Addition | Interest |

| 1 | 0 | 1000 | 7.58 |

| 2 | 1000 | 1000 | 15.17 |

| 3 | 2000 | 1000 | 22.75 |

| 4 | 3000 | 1000 | 30.33 |

| 5 | 4000 | 1000 | 37.92 |

| 6 | 5000 | 1000 | 45.50 |

| 7 | 6000 | 1000 | 53.08 |

| 8 | 7000 | 1000 | 60.67 |

| 9 | 8000 | 1000 | 68.25 |

| 10 | 9000 | 1000 | 75.83 |

| 11 | 10000 | 1000 | 83.42 |

| 12 | 11000 | 1000 | 91 |

| 592 |

Because of the way of calculation of interest on Sukanya Samriddhi account it would matter if you deposit in beginning of month or all contribution in beginning of year (just like PPF)

If you deposit Rs 1000 in beginning of every month then you would get 6,07,128 but if you deposit 12,000 in Apr every year then you would get 631,261 i,e a difference of Rs 24,133.

More the contribution more would be the difference. For example If you make monthly investment of Rs 10,000 in 21 years you will get around 60 lakh 60,71,283.

If you make yearly contribution of (in Apr every year) Rs 120000 in 21 years you will get Rs 63,12,607. The Difference is of 2,41,324.

How much would you earn in Sukanya Samriddhi

If you invest a fixed amount yearly then approximately that you get after 21 years at 8.5% is shown in the table below

| AnnualAmount Invested | Amount Invested | Balance after 14 years | Balance after 21 years |

| 5,000 | 70000 | 134941 | 238865 |

| 10000 | 140000 | 269882 | 477730 |

| 15000 | 210000 | 404823 | 716595 |

| 20,000 | 280000 | 539765 | 955460 |

| 25,000 | 350000 | 674706 | 1194325 |

| 30000 | 420000 | 389646 | 809647 |

| 50,000 | 700000 | 1349412 | 2388650 |

| 1,00,000 | 1400000 | 2698823 | 4777301 |

| 1,50,000 | 2100000 | 4048235 | 7165951 |

Tax and Sukanya Samriddhi account

What about taxation and Sukanya Samriddhi account

The taxation on scheme comes under EEE which means Exempt on deposit,Exempt when account is functional and exempt on closing. So Sukanya Samriddhi account is just like PPF. Our article Taxation of investments : EEE, ETE, TEE.. explains EEE, ETE etc in detail

- The amount deposited towards Sukanya Samriddhi Account is deductible under section 80C . 80C has limit of 1.5 lakh rupees and also includes other deductions like EPF,PPF. Our article Choosing Tax Saving options : 80C and Others covers 80C in detail.

- No tax will be levied on the interest amount.

- No tax will be levied on the maturity amount.

Opening Sukanya Samriddhi Account

Where to open the account and what is the process?

You will be able to open this account in a post office or an authorized bank branch. Form can be downloaded from RBI website here. Sample of passbook can be checked out also at RBI webpage here. At time of opening of account one has to provide

List of Banks which have been authorised to open Sukanya Samriddhi Account :

RBI circular dated 11-Mar-2015 on Sukanya Samriddhi Account clarified the banks which are entitled to open Sukanya Samriddhi account. It is not clear whether all branches will open the account or there will be some dedicated branches which will allow open Sukanya Samriddhi Account. Other than public sector banks there are private banks like Axis Bank, HDFC Bank and ICICI Bank.

- State Bank of India

- State Bank of Patiala

- State Bank of Bikaner & Jaipur

- State Bank of Travancore

- State Bank of Hyderabad

- State Bank of Mysore

- Andhra Bank

- Allahabad Bank

- Bank of Baroda

- Bank of India

- Punjab & Sind Bank

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- Indian Bank

- Indian Overseas Bank

- Punjab National Bank

- Syndicate Bank

- UCO Bank

- Oriental Bank of Commerce

- Union Bank of India

- United Bank of India

- Vijaya Bank

- Axis Bank Ltd.

- ICICI Bank Ltd.

- IDBI Bank Ltd.

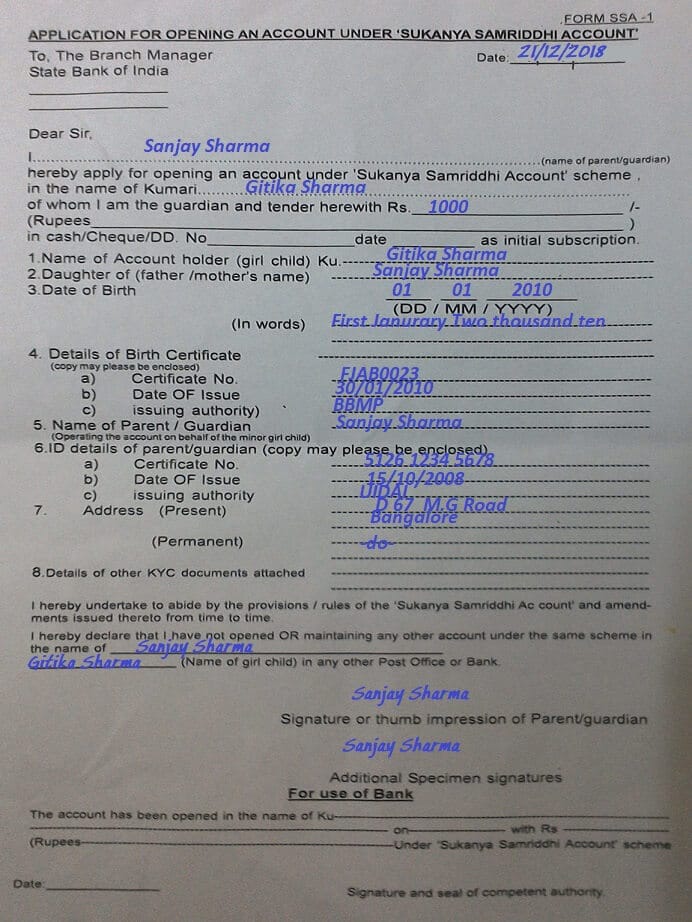

Account Opening Form of Sukanya Samriddhi Yojna

Account Opening Form of Sukanya Samriddhi Yojna of State Bank of India is given below.

Reference: Official information Sukanya Samriddhi Yojna at

- Indiapost website www.indiapost.gov.in/SukanyaSamriddhi.aspx , Govt latest information(with Forms) at http://www.indiapost.gov.in/dop/Pdf%5CCirculars%5Csukanya_samriddhi_SB_Order_2.pdf

- RBI webpage here.

Related articles:

- PPF Account for Minor and Self

- Understanding Public Provident Fund, PPF

- What are you teaching your kids about money?

- Money Awareness for Beginners

Sukanya Samriddhi scheme is very much focused on girl’s education and marriage expenses and their future. But how popular this scheme becomes needs to be seen. Women focused financial schemes like Bharatiya Mahila Bank have not been very popular. Will you open a Sukanya Samriddhi account? Why or Why not? How can this scheme me made more attractive? How do you save for your child and especially daughter?

405 responses to “Sukanya Samriddhi Yojna: A scheme for Girl Child”

hI

I WANT TO KNOW WHETHER THE AMOUNT CAN BE TRANSFERRED ONLINE FROM SBI SAVINGS TO SUKANYA SAMRIDDHI ACCOUNT

PLEASE ANY ONE UPDATE

Where do you have your Sukanya Account? in SBI?

Yes, it is possible. You can link SSA account with your net banking by giving one time request to the branch to add SSA a/c with your Saving a/c.

For SBI, select the option to Transfer Funds within SBI (Accounts of others) if both your SB and SSA accounts are in the SBI.

How to check ssa balance in SBI without going to bank

Hello Team,

Please clarify on the below scenario :

I have opened a SSY account for my daughter and paying till now.

After a couple of years – i plan to move overseas and eventually get new citizenship after 5 more years – what will happen to the account : take note that all the while Im paying into the SSY.

Can I still continue to pay in SSY till the 14th year and get the maturity at 21st year ? being an OCI

No. Govt has come up with notification

At any time after opening SSY account, if the girl child becomes non-resident or non-citizen of India, guardian shall intimate the bank within one month from such change. No interest shall be paid from the date citizenship or residential status changes and account shall be considered as closed.

Hi,

I’m Yuvaraj santhosh. I’m blessed with a baby girl and she is a month old. I have a question. if I want to go for 3,000 PM and in future if I want to upgrade the scheme to 5,000 PM or more. is this possible. if so what would be the best option for me. would need your suggestion

Hi i have opened up a SSY account in Post office. I am depositing the money for last Two years

when i am asking how much interest is accumulated and what is my latest balance, Post Office is refusing to tell me they are saying interest accumulated and final amount will be informed only after maturity.

something is not right. please immediately meet the post office manager. this is india. the person in the post office can sometimes keep the money to himself and act as if the pass book entry is correct. do not trust. verify immediately with the manager.

bank is not accepting 1.50lac in one amount to deposit in SSA.saying not possible to deposit without PAN CARD for account holder(SSA)SAYING PARTLY CAN DEPOSIT.GUARDIAN HAVE PAN CARD.can i get info regarding this matter

Are you tring to deposit in cash? or cheque?

Furnishing PAN will be mandatory from January 1 for cash transactions exceeding Rs 50,000

• The move is aimed at curbing the black money menace

• PAN will also be mandatory for term deposits exceeding Rs 50,000 at one go

Now you can transfer your SSY account from post office to bank.Just follow the instruction @ https://www.moneydial.com/blogs/6-step-process-to-transfer-sukanya-samriddhi-yojana-account-from-post-office-to-bank/

Hello,

My question is, in case, the guardian and the account holder both are affected by any undue circumstance or loses there lives, in that case to whom the money will be paid?

Thankyou.

I have an Sukanya Samrudhi account in BOI and want to transfer to ICICI Bank. Is transfer possible?

Yes Sir you can.

Customers can transfer their existing Sukanaya Samriddhi Yojana account held with other bank/ Post Office to ICICI Bank

SSY transfer process

Customer needs to submit SSY Transfer Request at existing bank/ Post Office mentioning address of ICICI Bank branch

The existing bank/ Post Office shall arrange to send the original documents such as a certified copy of the account, the Account Opening Application, specimen signature etc. to ICICI Bank branch address, along with a cheque/ DD for the outstanding balance in the SSY account

Process at ICICI Bank Branch

Once transfer documents are received at ICICI Bank branch, the customer is required to submit new SSY Account Opening Form along with fresh set of KYC documents.

Is it possible to transfer from Post office to any bank that offers this? I currently have it in post office for my daughters which does not have the internet banking facilities, I would like to move it to a bank which offers the ability to transfer money into these accounts.

Hello: I opened SSA in Indian Bank. I also have a SB a/c in Indian Bank. Since I have a new banking facility; I can easily transfer money into SSA. One needs to add the SSA in SB account and this can be dont online using net banking. But I think we cannot check the balance in SSA using online facilty, i.e. one cannot check the balance in SSA using net banking. Net banking is only provided for SB. But i think SBI is best. Becasuse we can check online of SSA.

Yes SBI is best for linking your SSA,PPF with the Saving Bank account.

After opening the SSY account, can anyone (other than guardian) deposit money into that account?

Are you saying money gifted to child or physically going and depositing money?

Yes! For example, my wife will be guardian for my daughter’s SSY, in that case, can I deposit money into that account?

Also, what happens if the amount deposited goes beyond 1.5L in a given year?

Yes anyone can deposit the money, I did it once for my niece. You cannot deposit more than 1.5L in a financial year. At Least at the post office they refuse to accept it.

Hi,

I have opened ssy account for my daughter wit sbi. Unlike mentioned in the blog I deposit money into the account thru online itself. We need not have to physically go n deposit the money. This options definitely not available wit postal offices. I haven’t enquired in others banks too, but wit sbi tat convenience is thr. Pls do take notice of this point.

Hi Kirti,

I am sorry but I am not clear with Monthly deposit vs yearly deposit before 5th April. I am planning to deposit 8000 per month.

Can you please help me with a calculator or something or maybe final amount which I will get with difference in Monthly vs Yearly payment.

Suppose if I open a Sukany Samm. ac/c in “Indian Bank”..can i pay every month by online mode? Does Indian Bank has any online paymode?

Thanks!

Very well written article. This has explained all the required information about this yojana in detail

Good article, Detailed explanation. But two statement in the description I felt contradictory .Here are the two senteces “Assuming you open the account the moment you girl child is born and if you invest the maximum permissible amount Rs 1,50,000 per year for 14 yrs.” & “For monthly deposit of Rs 20,000 you will accumulate 12,142,565” Its metioned you can deposit only maximum of 1,50,000 and also showing example of monthly deposit of 20,000 which will sum to 2,40,000 yearly. Can you help me understanding that.

Thanks for bringing it to our notice. It has been corrected.

My daughter was born on 23 September 2005.is she eligible to open the account?

Yes you can open Sukanya Samriddhi Account. One can open account for girl born after Dec 2003.

My Daughter was born on 23 September 2005. Is she eligible to open the account?

Dear Sir,

My daughter is a Sri Lankan citizen by birth, but she holds a OCI, is it possible for me to open a Sukanya Samriddhi Account.

We don’t think so. As the document required is birth certificate

Documents required for Sukanya Samriddhi Account Yojana SSA

Certificate of Birth of the girl child: The certificate of birth is often provided by the hospitals where the girl child is born. In other situations, even a certificate issued by government officials related to domicile would also be considered to be valid for opening of the account.

Address Proof of the parents or legal guardian of the girl child: The address proof document could be anything among Passport, Driving License, Electricity or Telephone Bill, Election ID Card, Ration Card or any other address proof issued by the Government of India.

Identity Proof of the parents or legal guardian of the girl child: Likewise, passport, PAN Card, Matriculation Certificate, Election ID Card or any other certificate issued by Government of India validating the identity of the concerned person would be valid as an identity proof for opening the account.

Dear Sir,

my daughter age is know 6 year.know if i deposit,how many years i have to pay? and when maturity this amount (is that age ways or year ways) pls explain me.

i want my daughter age 21 withdraw the full amount is that possible

If you open account You can make deposits for 14 years from the date of opening of the account. You can deposit varying amounts in a month or year. In a financial year(Apr- Mar)

14 years means 14 years from the day of opening of account. So if your daughter is 6 years old when you open the account then you have to deposit till she becomes 20 years old. Account will mature when she will be 27 years. But if she gets married after she becomes 18 years and 27 years, the account will close.

.

Withdrawal before the daughter turns 18 is not allowed. Partial withdrawal,50% of the total amount,is allowed when the account holder turns 18, for financial requirements such as education or marriage.

Hi Sir,

Is it possible to pay money quarterly/Half yearly once?

I am planning to open account in SBI,is it possible to pay online once account got opened????

Yes it is possible to pay even once best if you pay before 5 Apr.

The initial deposit is Rs. 1,000 and then in multiples of Rs. 100. You can make deposits for 14 years from the date of opening of the account. You can deposit varying amounts in a month or year. In a financial year(Apr- Mar)

Minimum deposit is Rs 1000. Failure to deposit Rs 1000 a year will cost Rs. 50 in penalty.

Maximum Deposit : Total deposit should not exceed Rs 1.5 lakh.

Thanks for your reply…

I am planning to open account in SBI,is it possible to pay online once account got opened????

Yes SBI allows doing Transfer to Sukanya Account once you link the account number to your internet banking.

You will not be able to see the balance though

Hi,

I have 2 questions:

1. Lets say I invested 20,000 in Year1. Should I invest same amount on Year2 as well? Or can I pay just the minimum Rs.1000?

2. What if financially I am not able to pay the money after Year5? If I dont pay for rest of the tenture, will I get anything at the end of maturity?

Hello Dev,

1. You can pay just the minimum i.e Rs 1000.

The initial deposit is Rs. 1,000 and then in multiples of Rs. 100. You can make deposits for 14 years from the date of opening of the account. You can deposit varying amounts in a month or year. In a financial year(Apr- Mar)

Minimum deposit is Rs 1000. Failure to deposit Rs 1000 a year will cost Rs. 50 in penalty.

Maximum Deposit : Total deposit should not exceed Rs 1.5 lakh.

2. Failure to deposit Rs 1000 a year will cost Rs. 50 in penalty.

Under special circumstances, legal guardian of the child would be required to make a request to prematurely close the account and withdraw the amount. Some legal formalities would be required like producing death certificate etc. Quoting from Govt. Gazette

(1) In the event of death of the account holder, the account shall be closed immediately on production of death certificate issued by the competent authority, and the balance at the credit of the account shall be paid along with interest till the month preceding the month of premature closure of the account , to the guardian of the account holder.

(2) Where the Central Government is satisfied that operation or continuation of the account is causing undue hardship to the account holder, it may, by order, for reasons to be recorded in writing, allow pre-mature closure of the account only in cases of extreme compassionate grounds such as medical support in lifethreatening diseases, death, etc

Dear sir/Maidam

I hv 3 daughters and i hv open 2 nos ssa account. 1st in sbi and 2nd in boi almost 2 months back.

Can i open 3rd account for my 3rd daughter?

My planing is to deposit 12.5k per month for each account. Please suggest me how to deposit is better monthly or yealy 1.5Lack.

How much difference will be after 21 year if i pay 1.5L in aprail month every year. i.e. now my first payment will be deposited in April 2016.

How can i manage deposits to get better returns….?

Regards

Hello Kriti,

I came to know that, we can able to pay the Term fee online. Is that True ? If yes please provide me the guidelines for the same.

FYI – I have already opened the account in POST OFFICE.

Thanks in advance!!

It seems that through SBI Bank one can do online transactions using internet banking/checking of the accounts.

ICICI Bank also allows it.

You need to transfer the account from Post office to Bank.

hi

I have opened a sukanya samrudhhi account for my daughter

and kept my wife as the primery account holder.My wife is a house wife.

Can I add myself as a joint account holder to this account,so that I can show it for tax benefit?

because I am not sure whether I will get tax benefits out of this savings as its on my wife’s name

please guide

If you look at the Sukanya Samriddhi Form

Name is of the Father or Mother who will be operating the account.

So it might be for your convenience one can give wife’s name

But one can still claim deduction under. Please submit the PASSBook as the proof

Hello,

I have 2 Daughters I have few doubts for which I am looking for clarifications..

1) Can I and my wife open 2 Accounts for each one which means for 1st daughter’s name 2 SSA Account (1 by me and another by my wife), so for 2nd daughter 2 Account ((1 by me and another by my wife) finally Total 4 Accounts for my 2 daughters?

2) Along with SSA for my 2 daughters can I open PPF Account for them (1 by me and another by my wife), so Total 4 PPF account for my 2 daughters?

GOI must allows this kind of Multiple investment because for 1.5L and return is 80L after 21 Years who knows does this 80L will have any value because for school education itself in Big cities school fees run in Laks. SO for professional college it will be running in Crores so mere one Account for one Girl child (If ceiling exist) then looks like GOI is bit shortsighted in forecasting cost of living in Metros and Non-Metros..

Thanks,

Jay

You can open 1 Sukanya account for each of your daughter and 1 PPF account. For account is in name of child and you can’t have multiple accounts in the same name.

Thanks for clarification!.

One small information as I have not named my 2nd Daughter but I have her Birth Certificate issued by Hospital, so still I can Open Account for 2nd Daughter with SSY and as well as with PPF?

OR Having Name is Mandatory for both the Accounts (SSY & PPF)?

In my above Post I mean Birth Certificate issued has mentioned name as “Baby Of XXXX (My Wife’s Name)”..

So I can use Baby of XXXX (My Wife’s Name) for my 2nd Daughter?

My daughter is almost 10 years (few months short of 10 years) I have opened an account in a bank, using my PAN card identity etc.,

However, I came to know later, that my in-laws have already opened for my daughter in a post office in a remote location few months before, using my wife’s identity and PAN details. (I am working at Mumbai, and my wife is staying with her parents due to her job in other location).

Now, I want to close that account which they had opened in post office, so that there will not be any confusion later. Moreover, I personally prefer opening it in a bank, because of ease of operability and likely future upgradations (online mode of payment). Now, what should I do. Can I close that post office SSA account and transfer few thousands already deposited in to the new account which I had opened in bank.

Yes you should close the account opened in post office. Whether they would allow you to transfer money to new account is to be seen.

As it has just started interest amount would not be too much. So worse come worse you would loose your interest in post office account.

namaskar, me and my 2 daughters, we are spanish passport holders with oci card, my wife is nri holding indian pasport, do my daughters are eligible for ssa, they are 7 years old now, pls.reply via email if u can, thanks.

mariocanario2010@hotmail.com

From what we know Sukanya Samriddhi account is for Indian residents only. There is no information about NRO or OCI. You can approach the bank and find out. And if possible update us.

Hi Kriti

Thanks a lot for the information you have posted. I have opened an account yesterday i.e. 11-06-2015. After reading your blog i thought i would have invested in 1-5th of the month i hope i will not get interest for this month.

I will be out of country from July so should be amount be deposited only in the post office where the account is taken or should it be any other near by postoffice, since i will be not be there in the next finanical year can my spouse take the passbook and deposit the money for the same.

I have opened the account with an intial deposit of 20000 so what if like i continue to invest 20000 till the completion of tenure i.e14 years how much money would i get in return with interest and which month is best in investing the same and which month is best for investing is it monthly or yearly and if monthly should be starting of the month from 1-5th or yearly in mar-Apr(1-5th).

Sorry for the large pool of questions because even the post office guys are not clear with this.

Hoping for a reply.

Hi Kriti

Thanks a lot for the information you have posted. I have opened an account yesterday i.e. 11-06-2015. After reading your blog i thought i would have invested in 1-5th of the month i hope i will not get interest for this month.

I will be out of country from July so should be amount be deposited only in the post office where the account is taken or should it be any other near by postoffice, since i will be not be there in the next finanical year can my spouse take the passbook and deposit the money for the same.

I have opened the account with an intial deposit of 20000 so what if like i continue to invest 20000 till the completion of tenure i.e14 years how much money would i get in return with interest and which month is best in investing the same and which month is best for investing is it monthly or yearly and if monthly should be starting of the month from 1-5th or yearly in mar-Apr(1-5th).

Sorry for the large pool of questions because even the post office guys are not clear with this.

Hoping for a reply.

Hi madam. I had a conversation with the a finacial planner and informed that i have opened SSA account. For this year i already deposited 1.5l . But she told that i should not invest all the money in this and she also adviced mutual fund (sip) will give a very good return than SSA. Please suggest whether it is true. Can i deposit the maximum amount in SSA or i should split it and go for mutual fund Systematic investment plan

You can better split the amount between Mutual Fund(go for only SIP) and SSA. if you invest in Balanced Mutual Fund, then u will get atleast 10-18% but u will get only 9.2% in SSA.

Dear Sir/Madam

I have opened SSA with Post Office on 26/5/15. I was not aware this facility is available with SBI.

I have saving account with SBI. Is it possible to switch account from Post Office to SBI Bank within short duration. I could keep track & transfer funds from Saving account to SSA online.

Online service saves time and efforts and make more easier.

Sir currently the documentation says no online facility but we expect Govt to allow banks to provide it for banks. Will keep u updated

Hello Kirti,

I contacted SBT bank today in Bangalore Electronic city.

They enquired an told me that SSA cannot be opened in any bank..Is this true ?

Any advise please

Kind Regards

Joe

I called Electronic City SBT and they told that they are not aware of the formalities yet and they are awaiting for some communication.

They will check and inform.

Just want to to see if this is the case every where ?

The scheme is good, but government just announcing the stuff and not keeping track of progress is not a great thing …

I would like to look for advises whether to wait for banks or go via Post office ? Pros and cons please

Kind Regards

Joe

Hi Kirti,

Any Other banks other than SBI and PJB started opening the Sukanya Samridhhi Scheme? if I open an account in SBI and I don’t have SB Account in SBI, will it possible for me to transfer the amount to Sukanya Samridhhi account from other bank through net banking?

Great initiative by Govt however their should be an online mechanism to opt for the same. It is difficult to deal with bank especially when they are clueless and least interested.

Hi Kirti,

would there be any difference in the final amount at maturity if i deposit 60,000 at once yearly or 5000 monthly deposits?

thanks

Yes Sir,

5000 monthly will give a total amount of 3,035,641

60000 annually will give a total amount of 3,156,305 (if contribution is made in Apr)

Reason for difference is that

Interest will be compounded yearly. Method of calculation of interest will be similar to Public Provident Fund (PPF). PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end

Today(23-05-2015) I went to SBI, Edappally Branch, Kerala for opening an account for my 3 years old daughter. This branch is not situated at my native place. It is near my work place. My work place is around 100 Km far way from my native place

They asked me the following documents.

1. Birth certificate of my daughter

2. My two ID proofs(Identification and address verification)

3. Three passport size photo of my daughter

4. Three passport size photo of mine.

5. Need to fill a KYC form. Inside that form, I pasted one of my passport size photo

6. After giving all this documents, I answered lot of their quires like why am opening an account on this branch ? why cant I open in my native place ? where am working, what is my company name ? etc.

7. After that they told me to write down my mobile number on the bottom portion of the form.

8. Finally they concluded that, It will take one or two weeks to process!!!!!!!!!!!. Once they processed my application, they will inform me through mobile. That time I need to visit the branch and pay the initial deposit.

My question.

Is this the right process ????????????? Please share your thoughts….

Hello Sir,

I have not personally opened the SSY account but I came across experience of Dr Dinesh Rohilla at Jagoinvestor. Sharing it with you.

It seems similar to the process you mentioned. Them asking why you are opening account in that branch doesn’t leave a good taste in mouth.

Anyway following is the procedure adapted by me :-

1) Downloaded form from internet along with gazette notification

2) Filled the form and deposit it along with i)Date of Birth Certificate of my daughter, ii) my identity card copy ,iii) Latest electricity bill for residence proof

Note:- I had pasted photo on form on which it is written that photo is optional but at post office they told me to give them two more photos. So be prepared.

3) Please check whether they had correctly written in pass book the name and differentiate who is account holder (girl child) and who is depositor (parent/guardian).

In my case they had written just depositor name ( girl child which is not correct way) and after bringing it to their notice they promptly corrected and said they write this way on all pass books but will be happy to know the correct method.

4) Please deposit original birth certificate .Postal staff told me that there is no need to deposit original certificate and photocopy will be sufficient. Being a Birth and Death registrar earlier I know that wherever required Birth/Death certificate should be original.You can take as many as certificates as you wish from authorities by paying fee .

5) On the day of opening account you cannot do other transaction as per staff but can open account with any amount.

Today(23-05-2015) I went to SBI, Edappally Branch, Kerala for opening an account for my 3 years old daughter. This branch is not situated at my native place. It is near my work place. My work place is around 100 Km far way from my native place

They asked me the following documents.

1. Birth certificate of my daughter

2. My two ID proofs(Identification and address verification)

3. Three passport size photo of my daughter

4. Three passport size photo of mine.

5. Need to fill a KYC form. Inside that form, I pasted one of my passport size photo

6. After giving all this documents, I answered lot of their quires like why am opening an account on this branch ? why cant I open in my native place ? where am working, what is my company name ? etc.

7. After that they told me to write down my mobile number on the bottom portion of the form.

8. Finally they concluded that, It will take one or two weeks to process!!!!!!!!!!!. Once they processed my application, they will inform me through mobile. That time I need to visit the branch and pay the initial deposit.

My question.

Is this the right process ????????????? Please share your thoughts….

Hello Sir,

I have not personally opened the SSY account but I came across experience of Dr Dinesh Rohilla at Jagoinvestor. Sharing it with you.

It seems similar to the process you mentioned. Them asking why you are opening account in that branch doesn’t leave a good taste in mouth.

Anyway following is the procedure adapted by me :-

1) Downloaded form from internet along with gazette notification

2) Filled the form and deposit it along with i)Date of Birth Certificate of my daughter, ii) my identity card copy ,iii) Latest electricity bill for residence proof

Note:- I had pasted photo on form on which it is written that photo is optional but at post office they told me to give them two more photos. So be prepared.

3) Please check whether they had correctly written in pass book the name and differentiate who is account holder (girl child) and who is depositor (parent/guardian).

In my case they had written just depositor name ( girl child which is not correct way) and after bringing it to their notice they promptly corrected and said they write this way on all pass books but will be happy to know the correct method.

4) Please deposit original birth certificate .Postal staff told me that there is no need to deposit original certificate and photocopy will be sufficient. Being a Birth and Death registrar earlier I know that wherever required Birth/Death certificate should be original.You can take as many as certificates as you wish from authorities by paying fee .

5) On the day of opening account you cannot do other transaction as per staff but can open account with any amount.

Hi,

Today I have open the SSA by SBI CEPZ Kakkanad, Kerala Branch. They have issued the normal pass book and we can trasfer the money to this SSA account thru net banking.

Thanks for sharing. They should allow Netbanking

Hi kirti

I am planing to Deposit 1000 p/m for one year and than second year i want to deposit 1.5 lakh in one month. and then to third year i want to Deposit 12000 for per year till close to account..

Is that possible ??

Yes Arvind, It is possible to Deposit 1000 p/m for one year and than second year i want to deposit 1.5 lakh in one month. and then to third year i want to Deposit 12000 for per year.

The initial deposit is Rs. 1,000 and then in multiples of Rs. 100. You can make deposits for 14 years from the date of opening of the account. You can deposit varying amounts in a month or year. In a financial year(Apr- Mar)

Minimum deposit is Rs 1000. Failure to deposit Rs 1000 a year will cost Rs. 50 in penalty.

Maximum Deposit : Total deposit should not exceed Rs 1.5 lakh.

The deposit shall be made by cash, cheque or demand draft. (No online)

Hi kirti

I am planing to Deposit 1000 p/m for one year and than second year i want to deposit 1.5 lakh in one month. and then to third year i want to Deposit 12000 for per year till close to account..

Is that possible ??

Yes Arvind, It is possible to Deposit 1000 p/m for one year and than second year i want to deposit 1.5 lakh in one month. and then to third year i want to Deposit 12000 for per year.

The initial deposit is Rs. 1,000 and then in multiples of Rs. 100. You can make deposits for 14 years from the date of opening of the account. You can deposit varying amounts in a month or year. In a financial year(Apr- Mar)

Minimum deposit is Rs 1000. Failure to deposit Rs 1000 a year will cost Rs. 50 in penalty.

Maximum Deposit : Total deposit should not exceed Rs 1.5 lakh.

The deposit shall be made by cash, cheque or demand draft. (No online)

Hi Kirti,

I have a confusion over the following scenario:

1. I had opened an account starting with 1500/- on the date of opening account.

2. For the next 3 months I paid 1500/- each , (i.e. 1500*3=4500)

3. Now, I skip next 3 or 4 months to pay

4. And

Question: How do I know that which scheme I belongs to?

Is scheme depends on the money which I paid while opening an account (i.e 1500) ?

How much I get after maturity of an account if I pay variable amount, monthly, yearly.

Is rate of interest in on Yearly amount?

I’m confused over my scheme which I belongs to:(

Kindly revert me,

Thanks,

Jack

Hi Kirti,

I have a confusion over the following scenario:

1. I had opened an account starting with 1500/- on the date of opening account.

2. For the next 3 months I paid 1500/- each , (i.e. 1500*3=4500)

3. Now, I skip next 3 or 4 months to pay

4. And

Question: How do I know that which scheme I belongs to?

Is scheme depends on the money which I paid while opening an account (i.e 1500) ?

How much I get after maturity of an account if I pay variable amount, monthly, yearly.

Is rate of interest in on Yearly amount?

I’m confused over my scheme which I belongs to:(

Kindly revert me,

Thanks,

Jack

Can the scheme’s maturity value be extended beyond 21 years, like in PPF which the depositer may continue in a block of 5 years even after 15 years.

Good question Avijit. But currently there is no such provision in the scheme that we are aware of.

Can the scheme’s maturity value be extended beyond 21 years, like in PPF which the depositer may continue in a block of 5 years even after 15 years.

Good question Avijit. But currently there is no such provision in the scheme that we are aware of.

Dear Kriti mam,

I have one silly question, suppose due to some differences between parent and daughter (after 18 years of girl) , if she left home and got married with her own choice, then who would be withdrew money, parent or daughter ??

Sir its not a silly question and you are not the first one to ask it.

The rules are not clear but my guess is after becoming 18 years daughter should be able to withdraw the amount on getting married.

Dear Kriti mam,

I have one silly question, suppose due to some differences between parent and daughter (after 18 years of girl) , if she left home and got married with her own choice, then who would be withdrew money, parent or daughter ??

Sir its not a silly question and you are not the first one to ask it.

The rules are not clear but my guess is after becoming 18 years daughter should be able to withdraw the amount on getting married.

I believe what you wrote made a great deal of sense.

But, what about this? what if you added a little content?

I am not suggesting your information isn’t solid, however suppose

you added something that grabbed folk’s attention?

I mean Sukanya Samriddhi Account | Be Money Aware Blog is a little vanilla.

You might glance at Yahoo’s front page and watch how they create

article headlines to grab people to open the links. You might add a video or a

pic or two to get people interested about what you’ve

written. In my opinion, it might bring your posts a little livelier.

I believe what you wrote made a great deal of sense.

But, what about this? what if you added a little content?

I am not suggesting your information isn’t solid, however suppose

you added something that grabbed folk’s attention?

I mean Sukanya Samriddhi Account | Be Money Aware Blog is a little vanilla.

You might glance at Yahoo’s front page and watch how they create

article headlines to grab people to open the links. You might add a video or a

pic or two to get people interested about what you’ve

written. In my opinion, it might bring your posts a little livelier.

My Daughter is 6 years Old.I have opened account in March 2015.Can i pay 1.5 Lakh this year as April starts and in the coming years according to my financial position i will pay may be 5000 to 12000 per year..what will be the Maturity amount and account gets closed when My daughter is 27..what if she gets married at 21 or 22 or 23..account gets closed in the sense..what will we get if she gets married before 27 ?kindly reply

Ravi,

Yes you can pay variable amount every year, minimum amount is Rs 1000.

The initial deposit is Rs. 1,000 and then in multiples of Rs. 100. You can make deposits for 14 years from the date of opening of the account. You can deposit varying amounts in a month or year. In a financial year(Apr- Mar).

The deposit shall be made by cash, cheque or demand draft. (No online)

Please Note: You can only deposit for 14 years from the day of opening account. From 14 years – 21 years you cannot deposit. But government will pay interest on the amount accumulated (till 14 years) till closure of account.

14 years means 14 years from the day of opening of account. So if your daughter is 7 years old when you open the account then you have to deposit till she becomes 21 years old. Account will mature when she will be 28 years. But if she gets married after she becomes 18 years and before 28 years, in our example, the account will close.

My Daughter is 6 years Old.I have opened account in March 2015.Can i pay 1.5 Lakh this year as April starts and in the coming years according to my financial position i will pay may be 5000 to 12000 per year..what will be the Maturity amount and account gets closed when My daughter is 27..what if she gets married at 21 or 22 or 23..account gets closed in the sense..what will we get if she gets married before 27 ?kindly reply

Ravi,

Yes you can pay variable amount every year, minimum amount is Rs 1000.

The initial deposit is Rs. 1,000 and then in multiples of Rs. 100. You can make deposits for 14 years from the date of opening of the account. You can deposit varying amounts in a month or year. In a financial year(Apr- Mar).

The deposit shall be made by cash, cheque or demand draft. (No online)

Please Note: You can only deposit for 14 years from the day of opening account. From 14 years – 21 years you cannot deposit. But government will pay interest on the amount accumulated (till 14 years) till closure of account.

14 years means 14 years from the day of opening of account. So if your daughter is 7 years old when you open the account then you have to deposit till she becomes 21 years old. Account will mature when she will be 28 years. But if she gets married after she becomes 18 years and before 28 years, in our example, the account will close.

Dear Kirti,

First of all; Many Thanks for your scheme awareness and clarification on majority of the concern of parents. As past experience; I have notice most of the good scheme unnoticed to general public due to lack of awareness and interest of Bank / post office staff (No incentive), NPA and SSA scheme are good examples for me in the recent past.

I am NRI and living in Dubai with my wife and 2 kids (Daughter and son. I have opened SSA account in the post office during my visit to India in March. In addition, I do have PPF account for all four of us. As I read in your blog that NRI are not allowed for PPF and not clear on SSA. I am really concern now on my investment as it is major plan for my Financial goal as I already depositing maximum limit of all us in the Family. What I can do now? Regards,

If you have already opened account and if they have not obbjected at the time of account opening; then what is your problem? By the time, your daughter turns may be you would have moved back to India.

Dear Kirti,

First of all; Many Thanks for your scheme awareness and clarification on majority of the concern of parents. As past experience; I have notice most of the good scheme unnoticed to general public due to lack of awareness and interest of Bank / post office staff (No incentive), NPA and SSA scheme are good examples for me in the recent past.

I am NRI and living in Dubai with my wife and 2 kids (Daughter and son. I have opened SSA account in the post office during my visit to India in March. In addition, I do have PPF account for all four of us. As I read in your blog that NRI are not allowed for PPF and not clear on SSA. I am really concern now on my investment as it is major plan for my Financial goal as I already depositing maximum limit of all us in the Family. What I can do now? Regards,

If you have already opened account and if they have not obbjected at the time of account opening; then what is your problem? By the time, your daughter turns may be you would have moved back to India.

Hi,I hv opened SSA for my daughter at Chennai.Can the amount be deposited into account from Vijayawada.Kindly advice.

Hi,I hv opened SSA for my daughter at Chennai.Can the amount be deposited into account from Vijayawada.Kindly advice.

I have approached SBI and BOB bank for opening this account. They Said that they haven’t received any pamphlet regarding the account from Head Office. can you please tell me when the account will be available in bank?

I have approached SBI and BOB bank for opening this account. They Said that they haven’t received any pamphlet regarding the account from Head Office. can you please tell me when the account will be available in bank?

I approached Punjab National Bank for opening a Sukanya Samvridhi Account. The manager told me that he has no objection to open account but the amount credited in this account is not shown whereas amount is deducted from depositor account and sent to RBI. what I should do.

Sir

You would get a passbook which will show amount deposited. Just like in PPF.

Sample of passbook (pdf)

So your money is safe

I approached Punjab National Bank for opening a Sukanya Samvridhi Account. The manager told me that he has no objection to open account but the amount credited in this account is not shown whereas amount is deducted from depositor account and sent to RBI. what I should do.

Sir

You would get a passbook which will show amount deposited. Just like in PPF.

Sample of passbook (pdf)

So your money is safe

Hi,

I have opened an account, who can withdraw an amount after maturity ?Account holder or Gaurdian ?

If the account holder(girl baby)can withdraw then, By the time of withdraw what needs to be produce ?

Thanks

A good question but the ans is not clear yet. Typically the account is opened by account holder for purpose of higher studies or marriage of his daughter. So Guardian should be the one to withdraw.

Hi,

I have opened an account, who can withdraw an amount after maturity ?Account holder or Gaurdian ?

If the account holder(girl baby)can withdraw then, By the time of withdraw what needs to be produce ?

Thanks

A good question but the ans is not clear yet. Typically the account is opened by account holder for purpose of higher studies or marriage of his daughter. So Guardian should be the one to withdraw.

HI

THE DOB OF MY DAUGHTER IS 27.01.2005, CAN I OPEN THE SSA FOR HER.

One can open account for girl born after Dec 2003. So you can open Sukanya Samriddhi account for you daughter Sir.

HI

THE DOB OF MY DAUGHTER IS 27.01.2005, CAN I OPEN THE SSA FOR HER.

One can open account for girl born after Dec 2003. So you can open Sukanya Samriddhi account for you daughter Sir.

Monthly Payment 12500 Fixed deposit in any co-operative bank

Yearly Payment 150000

Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14

2015 150000

2016 150000

2017 150000

2018 150000

2019 150000

2020 150000

2021 150000

2022 300000 150000

2023 300000 150000

2024 300000 150000

2025 300000 150000

2026 300000 150000

2027 300000 150000

2028 300000 150000

2029 600000 300000

2030 600000 300000

2031 600000 300000

2032 600000 300000

2033 600000 300000

2034 600000 300000

2035 600000 300000

2036 1200000 1140000 900000 840000 780000 720000 660000 510000 480000 450000 420000 390000 360000 330000 9180000

This calculation is when we make a Fixed deposit for 6.3 years, then whatever amount we have kept in fixed deposit it will be double.. if we make a deposit for 14 year each year 150000, then after completion of 21 years it is crossing more than 91 lakhs, but where as in this scheme it is approx. 72 lakhs…

Please clarify

Check India post website.

8 years & 4 months to get amount doubled.

Co-operative banks are much riskier to put money for such long time.

Apart from that you are getting TAX benefits every year along with no tax on maturity. This is not the case in getting money from Banks.

Monthly Payment 12500 Fixed deposit in any co-operative bank

Yearly Payment 150000

Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14

2015 150000

2016 150000

2017 150000

2018 150000

2019 150000

2020 150000

2021 150000

2022 300000 150000

2023 300000 150000

2024 300000 150000

2025 300000 150000

2026 300000 150000

2027 300000 150000

2028 300000 150000

2029 600000 300000

2030 600000 300000

2031 600000 300000

2032 600000 300000

2033 600000 300000

2034 600000 300000

2035 600000 300000

2036 1200000 1140000 900000 840000 780000 720000 660000 510000 480000 450000 420000 390000 360000 330000 9180000

This calculation is when we make a Fixed deposit for 6.3 years, then whatever amount we have kept in fixed deposit it will be double.. if we make a deposit for 14 year each year 150000, then after completion of 21 years it is crossing more than 91 lakhs, but where as in this scheme it is approx. 72 lakhs…

Please clarify

Check India post website.

8 years & 4 months to get amount doubled.

Co-operative banks are much riskier to put money for such long time.

Apart from that you are getting TAX benefits every year along with no tax on maturity. This is not the case in getting money from Banks.

HI,

i have opened a account in Mar month, is the calculation of one year means april to March or from the month of account opened.

If it is from April to march, will it says, i have completed one year with only one contribution,

With Regards

One year means one year from the day of opening the account. Yes in financial year 2014-15 you made one contribution.

for contribution in the month of Mar you would have earned interest which would be credited into your account.

Hi Kirti,

I have opened SSA for my girl in March 2014. Yesterday, I deposited additional money and checked no interest paid till date.

Post office officials say account opened after 10th March 2015 will not get the interest for 2014-15.

Is it true? Kindly clarify !

It’s first time I am hearing it.

From what I know :

Interest will be compounded yearly. Method of calculation of interest will be similar to Public Provident Fund (PPF). PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end

As the lowest balance was 0 between 5th Mar and 31 st Mar is 0 so maybe that is why they are putting any interest for year 2014-15.

But let me cross check and get back to you .

HI,

i have opened a account in Mar month, is the calculation of one year means april to March or from the month of account opened.

If it is from April to march, will it says, i have completed one year with only one contribution,

With Regards

One year means one year from the day of opening the account. Yes in financial year 2014-15 you made one contribution.

for contribution in the month of Mar you would have earned interest which would be credited into your account.

Hi Kirti,

I have opened SSA for my girl in March 2014. Yesterday, I deposited additional money and checked no interest paid till date.

Post office officials say account opened after 10th March 2015 will not get the interest for 2014-15.

Is it true? Kindly clarify !

It’s first time I am hearing it.

From what I know :

Interest will be compounded yearly. Method of calculation of interest will be similar to Public Provident Fund (PPF). PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end

As the lowest balance was 0 between 5th Mar and 31 st Mar is 0 so maybe that is why they are putting any interest for year 2014-15.

But let me cross check and get back to you .

RBI changes the interest for SSA as 9.4 %. so, any information in this. its effected from 9.1 to 9.4 since this finance year 2015 april to 2016 march.

Abid, can you share your source of information.

From what I know the Govt in budget on 28/Feb/2015 increased the return on Sukanya account from 9.1% to 9.2% for financial Year Apr 2015-Mar 2016

sorry. i get wrong information from local news paper. clarified from rbi web site. interest rate is 9.2. thank you for your valuable response kriti. god bless you. thank you once again.

RBI changes the interest for SSA as 9.4 %. so, any information in this. its effected from 9.1 to 9.4 since this finance year 2015 april to 2016 march.

Abid, can you share your source of information.

From what I know the Govt in budget on 28/Feb/2015 increased the return on Sukanya account from 9.1% to 9.2% for financial Year Apr 2015-Mar 2016

sorry. i get wrong information from local news paper. clarified from rbi web site. interest rate is 9.2. thank you for your valuable response kriti. god bless you. thank you once again.

thanks a lot for ur response

one small suggestions

all these details are not well communicated to the public . Because the post office employees itself not 100% clear about this.

can we do something about this. Because many people are getting affected

any escaptions can be made so that the government will educate or update the post office employees about these kind public welfare schemes

So true Geetha. We through our blogs are trying to increase awareness of such issues and help people get answers to the query.

thanks a lot for ur response

one small suggestions

all these details are not well communicated to the public . Because the post office employees itself not 100% clear about this.

can we do something about this. Because many people are getting affected

any escaptions can be made so that the government will educate or update the post office employees about these kind public welfare schemes

So true Geetha. We through our blogs are trying to increase awareness of such issues and help people get answers to the query.

Which is one is better to invest? Atal Pension Yojana or Sukanya Samriddhi Yojana? I have 3 year old girl child, should i save money on her name or should i go for Atal Pension Yojana ?

The two scheme objectives are different. Atal Pension Yojna is for pension after retirement. Sukanya Samriddhi Yojna is for higher education and marriage of girl child.

Which is one is better to invest? Atal Pension Yojana or Sukanya Samriddhi Yojana? I have 3 year old girl child, should i save money on her name or should i go for Atal Pension Yojana ?

The two scheme objectives are different. Atal Pension Yojna is for pension after retirement. Sukanya Samriddhi Yojna is for higher education and marriage of girl child.

i have opened the SSA for my daughter who is 10 Years old. I got the information that we can deposit the amount only till the girl attains 14years( I.e from 14 Years to 21years) no deposit allowed. Only interest will be given.

but you have mentioned we can deposit amount for 14 Years from the date of opening the account. Please clarify whether 14 Years is the age or period of time

so when my daughter become 31 Years only the account will get matured or she can get the amount when she gets married

please suggest

Geeta that’s the common confusion.

One can deposit in the account for 14 years from Date of opening.

When your daughter get’s married anytime after 18 years the account will get closed and you would be able to withdraw money for her marriage. So you won’t have to wait till 21 years after opening the account. Purpose of the account is to save money for higher education and marriage of daughter.

i have opened the SSA for my daughter who is 10 Years old. I got the information that we can deposit the amount only till the girl attains 14years( I.e from 14 Years to 21years) no deposit allowed. Only interest will be given.

but you have mentioned we can deposit amount for 14 Years from the date of opening the account. Please clarify whether 14 Years is the age or period of time

so when my daughter become 31 Years only the account will get matured or she can get the amount when she gets married

please suggest

Geeta that’s the common confusion.

One can deposit in the account for 14 years from Date of opening.

When your daughter get’s married anytime after 18 years the account will get closed and you would be able to withdraw money for her marriage. So you won’t have to wait till 21 years after opening the account. Purpose of the account is to save money for higher education and marriage of daughter.

I am an NRI,Is it possible that my parents or mother/father in law can open an account for my daughter ? In that case ,in addition to marriage certificate anything else required after maturity in order to get the amount?

Vivek, for NRI it’s not clear whether they can open Sukanya Samriddhi account.

To open account one has to provide birth certificate of the girl child along with identity and residence proof of the depositor.

We’ll keep you posted

I am an NRI,Is it possible that my parents or mother/father in law can open an account for my daughter ? In that case ,in addition to marriage certificate anything else required after maturity in order to get the amount?

Vivek, for NRI it’s not clear whether they can open Sukanya Samriddhi account.

To open account one has to provide birth certificate of the girl child along with identity and residence proof of the depositor.

We’ll keep you posted

My child is 10 yrs old.and i wish to deposite rs 100/-per month.how much i get after maturity.and how many years i have to deposite.?can i close the account after my child’s marraige?

If you deposit Rs 100 a month then after 21 years you will get 60,713.

On daughter’s marriage after 18 years the account would be closed.

My child is 10 yrs old.and i wish to deposite rs 100/-per month.how much i get after maturity.and how many years i have to deposite.?can i close the account after my child’s marraige?

If you deposit Rs 100 a month then after 21 years you will get 60,713.

On daughter’s marriage after 18 years the account would be closed.

In case of two girl children

Max deposit of 1.5L is applicable per child or both children put together?

Aravind it’s 1.5 lakh per child. So for two girls it’s 3 lakh.

In case of two girl children

Max deposit of 1.5L is applicable per child or both children put together?

Aravind it’s 1.5 lakh per child. So for two girls it’s 3 lakh.

Hi Kirti,

If we compare the sukanya sammridhi account with a combination of 14 years RD account and 7 years FD account in a Bank with same interest rate. According to you what will be the impact on interest amount and maturity amount. Pls advise

Interest would be taxable as per income of guardian. Till the child turns 18.

Hi Kirti,

If we compare the sukanya sammridhi account with a combination of 14 years RD account and 7 years FD account in a Bank with same interest rate. According to you what will be the impact on interest amount and maturity amount. Pls advise

Interest would be taxable as per income of guardian. Till the child turns 18.

CAN WE PAY THE AMOUNT THROUGH ANY BRANCHES OF POST OFFICE OR BANK BRANCHES ALL OVER INDIA.PLS REPLY

Sadly no. You would have to go physically every time to the branch where you have account to deposit. he deposit shall be made by cash, cheque or demand draft No ONLINE mode.

So please select the branch carefully where you would like the account.

CAN WE PAY THE AMOUNT THROUGH ANY BRANCHES OF POST OFFICE OR BANK BRANCHES ALL OVER INDIA.PLS REPLY

Sadly no. You would have to go physically every time to the branch where you have account to deposit. he deposit shall be made by cash, cheque or demand draft No ONLINE mode.

So please select the branch carefully where you would like the account.

CAN WE PAY THE MONEY THROUGH ANY BRANCHES OF INDIAN BANK OR ANY BRANCHES OF POST OFFICE BECAUSE WE GET TRANSFERR IN WORK IN ANY TIME.PLS REPLY

CAN WE PAY THE MONEY THROUGH ANY BRANCHES OF INDIAN BANK OR ANY BRANCHES OF POST OFFICE BECAUSE WE GET TRANSFERR IN WORK IN ANY TIME.PLS REPLY

hello… can i pay whole amount in single deposit.. like 168000 (14 years = 12000 per year) in one time, then i wait 21 years. is it possible.. can i avail whole amount at the closure (6 lakhs above i guess.)

Hello Abid,

In one year you can deposit upto 1.5 lakh. In a year you need to deposit atleast Rs 1000. If you miss a year you will have to pay penalty. Failure to deposit Rs 1000 a year will cost Rs. 50 in penalty.

So plan your investments in the Sukanya Samriddhi account.

thank you for reply. can i open this account in State bank of India. is it possible. if possible when there start this scheme. and i pay 2000 per month. after maturity. how much will come. thanks in advance.

Yes you should be able to open it in State Bank of India.

If you pay 2000 Rs a month for 14 years then after 21 years of opening the account you would get around 12 lakh

hello… can i pay whole amount in single deposit.. like 168000 (14 years = 12000 per year) in one time, then i wait 21 years. is it possible.. can i avail whole amount at the closure (6 lakhs above i guess.)

Hello Abid,

In one year you can deposit upto 1.5 lakh. In a year you need to deposit atleast Rs 1000. If you miss a year you will have to pay penalty. Failure to deposit Rs 1000 a year will cost Rs. 50 in penalty.

So plan your investments in the Sukanya Samriddhi account.

thank you for reply. can i open this account in State bank of India. is it possible. if possible when there start this scheme. and i pay 2000 per month. after maturity. how much will come. thanks in advance.

Yes you should be able to open it in State Bank of India.

If you pay 2000 Rs a month for 14 years then after 21 years of opening the account you would get around 12 lakh

Hi.

How i can open a A/c and what is the terms and condition

Hi.

How i can open a A/c and what is the terms and condition

Hi,

If I deposit 1.5 Lakh in PPf and deposit 1.5 Lakh in my daughters sukanya account, then is the interest from both these account will be tax-free while considering for taxation ?

In short, does it mean that the interest received on 3 Lakhs becomes tax-free, if I invest in full in PPF and in this account ?

Yes Chintan you are right. If you deposit 1.5 lakh in PPF for your daughter and in Sukanya account you would get tax free income.

Regarding PPF account for your daughter from our article PPF Account for Minor and Self

It’s clear one can open a PPF account for minor child and self. But whether one can invest beyond the limit of 1.5 lakh in each of the accounts or invest a total of 1.5 lakh in account of both self and minor is still not clear. We have tried to present both sides of the coin and leave it upto you. Incase you invest more than the maximum limit (1.5 lakh) in the account of self and minor child, the worst scenario is you will get back the principal without any interest. Are you prepared for such eventuality?

Hi,

If I deposit 1.5 Lakh in PPf and deposit 1.5 Lakh in my daughters sukanya account, then is the interest from both these account will be tax-free while considering for taxation ?

In short, does it mean that the interest received on 3 Lakhs becomes tax-free, if I invest in full in PPF and in this account ?

Yes Chintan you are right. If you deposit 1.5 lakh in PPF for your daughter and in Sukanya account you would get tax free income.

Regarding PPF account for your daughter from our article PPF Account for Minor and Self

It’s clear one can open a PPF account for minor child and self. But whether one can invest beyond the limit of 1.5 lakh in each of the accounts or invest a total of 1.5 lakh in account of both self and minor is still not clear. We have tried to present both sides of the coin and leave it upto you. Incase you invest more than the maximum limit (1.5 lakh) in the account of self and minor child, the worst scenario is you will get back the principal without any interest. Are you prepared for such eventuality?

i have deposit every year 12000 or monthely 1000. which amount more beneifit to my doughter?

Archana, The deposit of 12000 every year will be more benifit for u than paying 1000 every month. Because the interest is calculated every month for the least amount between 5th and last day of every month and compounted yearly. So it is better for u to deposit 12000 every year for earning more interest. It also save your timm too. All the best.

i have deposit every year 12000 or monthely 1000. which amount more beneifit to my doughter?

Archana, The deposit of 12000 every year will be more benifit for u than paying 1000 every month. Because the interest is calculated every month for the least amount between 5th and last day of every month and compounted yearly. So it is better for u to deposit 12000 every year for earning more interest. It also save your timm too. All the best.

Hello,

We are foreign citizens holding OCI/PIO status in India. Are we eligible to have this account?

Thank you

Not sure about it Kris. Wait for sometime as details slowly start coming out.

Thank you for the response

Hello,

We are foreign citizens holding OCI/PIO status in India. Are we eligible to have this account?

Thank you

Not sure about it Kris. Wait for sometime as details slowly start coming out.

Thank you for the response

hi priti ,

i have a question, if i deposit full amount(e.g) 12000 yearly till 14 year.

and suddenly my daughter got accident or what ever. In this case who claim this amount. can i receive this amount or not.

If parents got accident who claim this amount.

Good question Pawan.

It is mentioned in gazette that :

In the event of death of the account holder, the account shall be closed immediately on production of death certificate issued by the competent authority, and the balance at the credit of the account shall be paid along with interest till the month preceding the month of premature closure of the account , to the guardian of the account holder.

In case of death of the guardian the account can be closed before the maturity under the clause of causing any hardship on the depositor and the balance would be refunded.

Hope it helps

hi priti ,

i have a question, if i deposit full amount(e.g) 12000 yearly till 14 year.

and suddenly my daughter got accident or what ever. In this case who claim this amount. can i receive this amount or not.

If parents got accident who claim this amount.

Good question Pawan.

It is mentioned in gazette that :

In the event of death of the account holder, the account shall be closed immediately on production of death certificate issued by the competent authority, and the balance at the credit of the account shall be paid along with interest till the month preceding the month of premature closure of the account , to the guardian of the account holder.

In case of death of the guardian the account can be closed before the maturity under the clause of causing any hardship on the depositor and the balance would be refunded.

Hope it helps