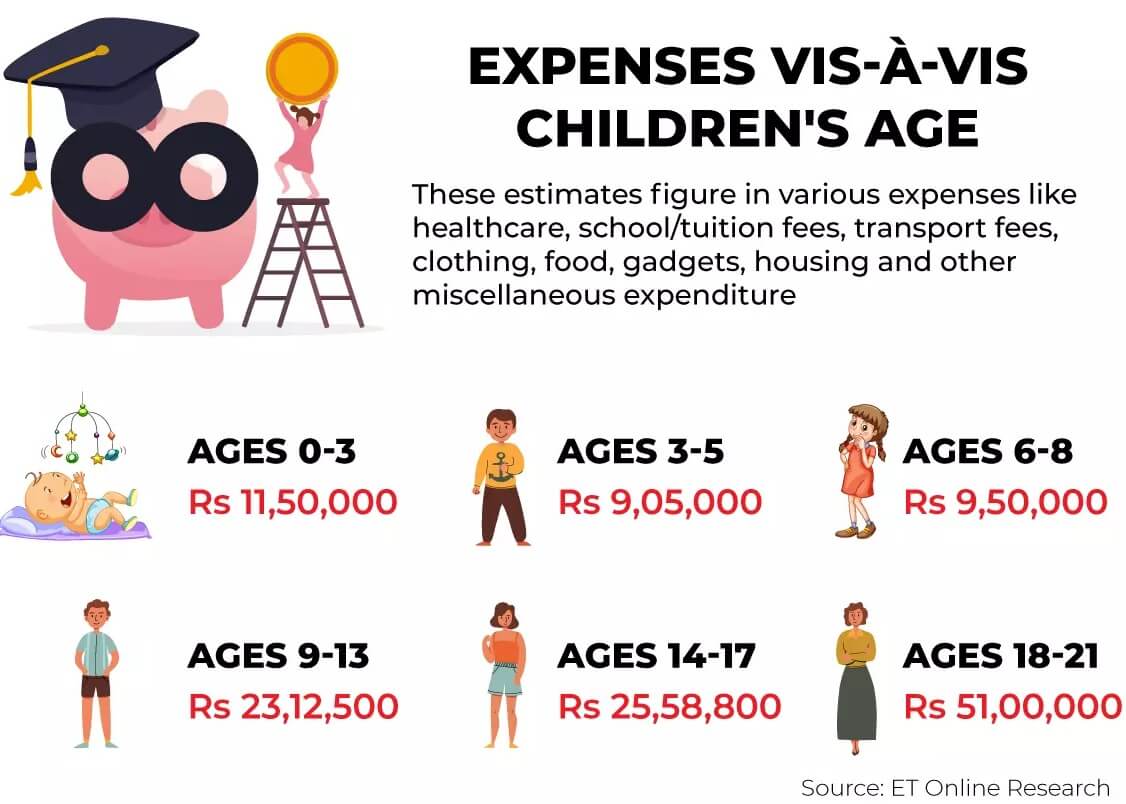

Here’s a quick table illustrating the costs of the child at various stages factoring inflation:

| Total Costs of Raising a Child | Commerce Stream | Science (MBBS) Stream |

| In 2019 (Without including inflation) | 8,313,689 | 22,364,689 |

| In 2042 (With Inflation) | 20,084,919 | 67,256,774 |

Table of Contents

How much does a Baby Cost?

Why should we look at the child in terms of its cost? The child is not a cost to parents! Absolutely right, child will carry on your legacy, your family name. I am a proud mother of two children and I say that pros of having a child outweigh the cons. Quoting the tagline of the famous ad They are worth it(the trouble, the money). Interested readers can checkout Lifehacker To Have Kids or Not to Have Kids: Your Best Arguments . The arrival of a child heralds a change in spending and saving habits. It is important to rework financial goals, ensure a clear strategy for funding them, and begin a saving and investing plan.

But along with the little slip,the pregnancy test, that says that your baby is on his way comes a price tag. The payment which starts with that pregnancy test grows faster than your child and can assume gigantic proportions. Food, clothing, and health care are just a few items that can add up into tons of expenses before adulthood. Okay so it’s expensive to raise a child. But just how expensive is it? How much money does the average child need from the time of birth to when he or she turns 18? The answer depends on many factors. Does one parent stay at home or does the family hire nanny or a maid or will grand parents help out? Which school will the child attend ? What stream(Engineering, Medical) your child chooses?

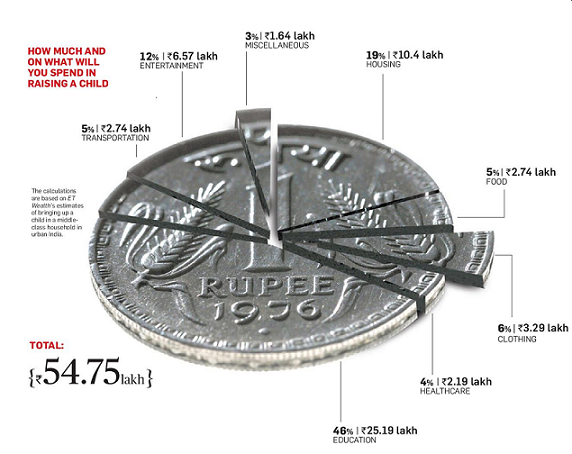

An estimate in Economic Times in March 2011, cost of raising a child from birth to age of majority (21 Years) for middle to upper-middle income family comes to about Rs. 55 Lakh (Rs. 5.5 Million, or about 90,000 USD as of Sep’2014) in total. Some excerpts from Economic Times are given below. For the full infographic checkout it out on bemoneyaware’s pinterest here or click on image below.

Costs of Raising a Child

The cost of raising a child can be divided into various stages. Note that the actual prices for your family may vary, based on your lifestyle, location, and other preferences. This is just to give you an idea. For breakup of costs, one can look at How Much Does It Cost to Raise a Child in India

| The Cost Of Prenatal Care (0-9 Months) | 50,000- 1.5 lakh | In the prenatal stage, major expenses go towards medical and Pre-birth Rituals |

| The Cost Of Child Delivery (During Birth) | 40,000-1.5 lakh | The hospitalisation cost is the major expense. It depends on the type of delivery: normal or C-section delivery.

While C-section delivery could cost anywhere between Rs 60,000 to 1.5 Lacs, a normal delivery could cost about 40,000 to 1 Lac depending on the type of hospital chosen or the city you live in. |

| The Cost Of Raising An Infant (0-2 Years) | 2,00,000-5,00,000 | Vaccination Costs, Cost of Diapers, Maid, Birthday party, Toys |

| The Cost Of Raising A Toddler (2-3 Years) | 1,50,000-3,00,000 | Pre-school fees, Toys, Maid |

| The Costs For A Child During Primary School (3 – 8 Years) | 5,00,000-12,00,000 | Education, Extracurricular Activities, Food, Clothes and Toys, Maid |

| The Costs For A Child During Middle School (8 – 13 Years) | 10,00,000- 12,00,000 | Education, Extracurricular Activities, Food, Clothes and Toys |

| The Costs For A Child During High School (13 – 18 Years) | 12,00,000-15,00,000 | School fees, Special Classes, Extracurricular Activities, Gadgets (Laptop, Mobile) |

| The Costs For A Child During College (18 – 21 Years) | 5,00,000+ | College fees (depends on stream, college chosen), |

Having a baby: How to manage finances?

Planning for Baby

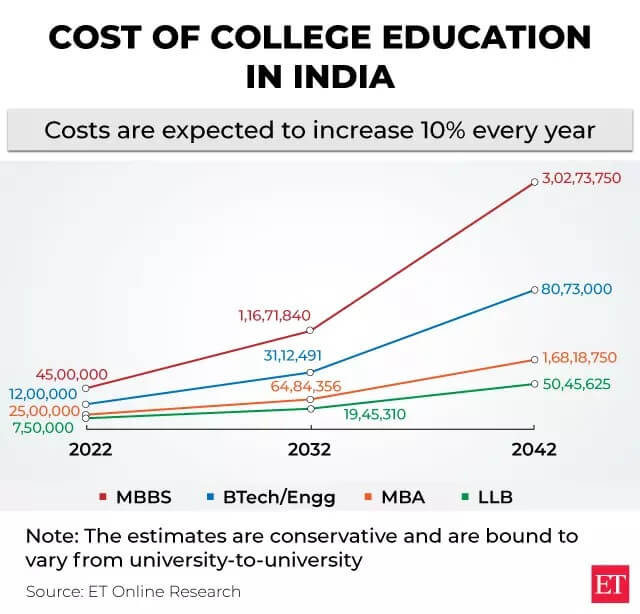

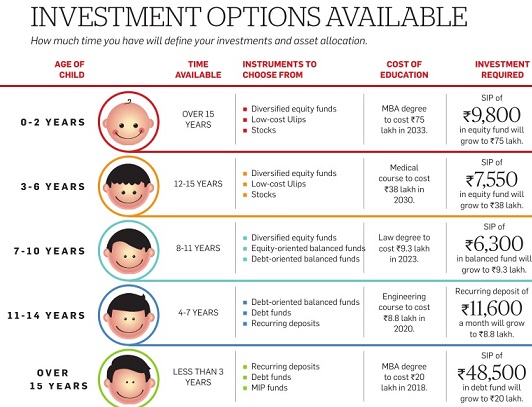

Higher education costs have been galloping. The cost of higher education is already high and rising at 10-12% a year. Children’s education is one of the biggest cash outflows that families must plan for.

Elite higher education within India is steep.

- Enrolling in a top-rated engineering college, like one of the twenty-three IITs or any other private institution, for a 4-year BTech or a 3-year BSc, costs around Rs 4-20 lakh. Expenses for coaching for entrance exams like JEE, JEE (Main) and other exams range from Rs 30,000 to Rs 5 lakh.

- A top-rated management institution like one of the twenty IIMs, or any other private university in the country, costs Rs 8 lakh-Rs 23 lakh. Coaching for qualifying tests like CAT or GMAT has extra cost.

- In a field such as finance, a CPA costs Rs 3,60,000; CMA would cost Rs 80,000-1,20,000 inclusive of training, examination, and IMA membership fees.

- To complete a Chartered Accountancy course, the overall expenditure is Rs 86,000, excluding the tutoring fee.

Images below from the Economic Times article Best ways to invest for your child’s education is to forewarn you about the rising costs and how you can prepare for your children higher education.If you have a daughter and she is currently less than 10 years old you can open Sukanya Samridhhi account for her.

Related articles:

- Rising Education costs

- My experiments with money

- To quit or not to quit job after child

- Understanding Education Loans

Supporting a family is hard work. They say Forewarned is Forearmed. Be aware of the changes, emotional, financial that you need to make and make them so that you can enjoy the journey of parenthood which is 24X7 with no holidays. Many people these days are deciding to have just one child due to high expenses. How did you deal with your finances on the addition of a new member to your family? Did you/your wife leave the job? Do you think one should have just one child? What financial changes do you suggest? How are you preparing for your child’s higher education?