Real Estate in India has been impacted by RERA, GST and demonetization. The trifecta of reforms will make the real estate industry more transparent for investors and buyers, boosting the confidence of both parties. If you are looking for investing in real estate, then you can look at SmartOwner, the online marketplace for real estate. This article covers changes that impacted real estate. It also explains how SmartOwner works and then explains the advantages of investing through SmartOwner.

Table of Contents

Changes that impacted Real Estate

India’s real estate sector has been marred by inordinate project delays and poor quality of construction. In 2016, the government had announced the much-awaited regulator for the realty sector. Between that and demonetization, real estate in India is going through major changes

- Demonetization announced on 8th November 2016

- Implementation of the RERA Act from 1st May 2017

- GST implementation from 1st July 2017

Pre-demonetisation, the real estate sector was already in the doldrums, grappling with legacy issues like inflated property prices which resulted in a supply glut.

The immediate impact of demonetisation was to reduce secondary transactions in the real estate sector, a large amount of which was cash payments. This means a higher number of transaction will now be made through the formal banking system

RERA in July created a blip of uncertainty. Builders needed to be registered to sell new units, and sales across the country fell until these registrations were completed. The RERA rules also placed constraints on when builders could be funded by lenders and how much they could use in each project – limiting the previous habit of launching many projects in parallel. Therefore, new project starts are much lower than they would otherwise be.

These changes are leading to a shift towards institutional capital, as the previous business model of many developers (centred around funding projects through end-user sales at an early state) has essentially been declared illegal. This will mean that smaller developers with less-than-excellent balance sheets may be exiting the market in the near future.

The discipline of RERA, combined with the other initiatives of the Government will separate the men from the boys- ensuring that the real estate sector has fewer but more organized players and that, in the long run, properties will be more affordable than was the case in the past.

These changes are designed to push the market towards a more sustainable trajectory. It will help Indian real estate market become stronger and stable.

Online Marketplace for Property: SmartOwner

India’s preferred choice of investment is real estate, with nearly 70% of total Indian household wealth invested in houses, flats, land, plots and other properties. But most of the property investments are localized, with buying happening where the investor lives or has family. And it is usually for residential purposes.

SmartOwner, India’s first and largest online marketplace for real estate investor, offers an alternative. It allows investors to participate in an early, high-growth phase of a real estate project, and then exit profitably. Founded in 2012, the Bangalore-based company makes investing in Indian real estate easy and profitable.

SmartOwner is not just a real estate company. Its business model is negotiating institutional-grade deals on high-ticket assets, then discretizing those deals and passing them on to anyone with an internet connection, at flexible ticket sizes.

- In classical economics, supply and demand meet at a point where the supplier wouldn’t sell any lower and the buyer wouldn’t pay any more

- However, in high-ticket markets, there’s a lopsided dynamic in favour of buyers – lots more people want a lot of money for something that are willing to give a lot of money for something.

- This is due to information asymmetry – there are not as many people who know about such deals as there are deals looking for capital. People would want to participate, but they are unable to source the deals themselves.

- SmartOwner fixes this by redefining what it means to be a buyer in this transaction. By making the deal available online, they are bringing investors together, and are able to dramatically increase the number of potential buyers at this end of the market.

How SmartOwner works

Selecting the property: SmartOwner scours the market to obtain good properties at exclusive rates. SmartOwner verifies each listing to ensure that the pricing, specifications and market trends are accurate. SmartOwner’s legal team conducts thorough due diligence and only approves a project once it passes their rigorous standards. Every project is backed by agreements to protect all client investments.

These properties are listed on their website with all descriptions. Units in premium residential developments, such as apartments and plots in gated communities, are made available in a wide range of ticket sizes. The holding period typically ranges from one to three years.

Investing in the Property: If one likes the property and is comfortable with ticket size and duration and terms then one can purchase online and transfer the money to SmartOwner’s escrow account.

In some properties, there are quarterly repayments, while in others, one takes advantage of the pre-launch/early stages.

After Investing: SmartOwner handles all the legwork. Whether it’s ensuring one receives a quarterly return from a commercial asset or resells a residential property ,SmartOwners works for you.

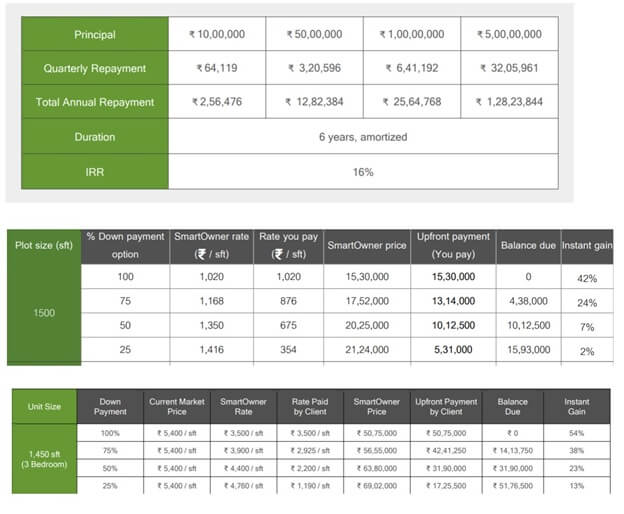

Following image shows the various options of different types such as Commercial, plot and bedroom.

SmartOwner advantages

SmartOwner has redefined what it means to be a buyer in a high-ticket transaction, bringing together hundreds of individual investors and negotiating an institutional-grade deal with major developers on their behalf.

In 5 years they have handled 17 projects spanning 13 million square feet, and continue to offer exclusive offerings that are not available in general marketplace.

SmartOwner is ideally positioned to take advantage of the changes that are happening in real estate.

- Has the ability to rapidly deploy large sums of capital (deals are between 40 and 400 crores)

- SmartOwner is diversifying into commercial property, hospitality, and high-value assets beyond real estate.

- SmartOwner’s key advantage is their unparalleled domain expertise when it comes to doing legal, financial, and project-specific due diligence to determine what is and isn’t a good investment. Their in-house team consists of India’s top legal talent, world-class architects and construction professionals, and real estate veterans with a deep understanding of the industry’s local and national dynamics. All of these teams must sign off on a project before they decide to invest in it.

- Each project must pass a 72-point checklist

- They spend 2 crores on the due diligence for a deal we decide to move forward with

In the case of SmartOwner, a strong majority of clients make repeat purchases, often in a diverse span of projects. If you are a high net worth individual looking for investing in real estate without associated headaches then you can look at SmartOwner.

Note: This article is for informational purpose only. We wrote it as we found this concept of investment in Real Estate interesting. It is very important to do your own analysis before making any investment based on your own personal circumstances.

Related Articles:

Buying a House,Renting,Home Loan,Tax,Selling,Capital Gain

Do read reviews of smartowner on quora and google reviews.

Also search for smartowner in economic times prime articles.

SmartOwner is ideally positioned to take advantage of the changes that are happening in real estate.