The article, Smart money tips every student should know, appeared in ET Wealth on 9 Jul 2018. We have added our inputs.

Table of Contents

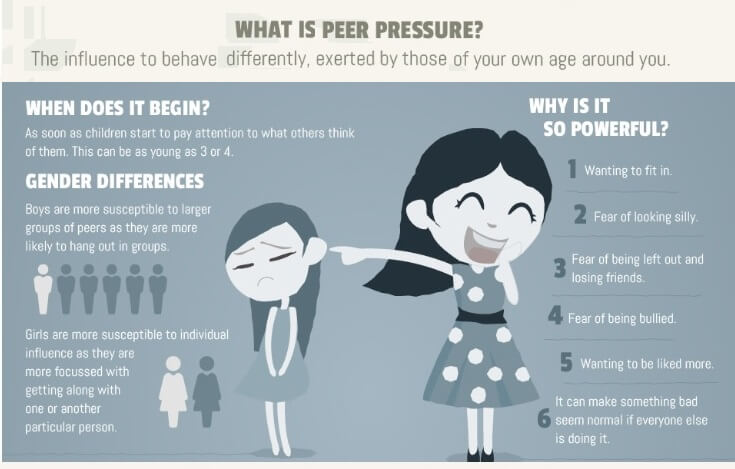

Peer Pressure to spend

She is confident, articulate and tactful. Yet, Punya Sehgal took months to convey to her friends that she did not enjoy eating out. This Delhi based law student didn’t share her friends’ love for junk food, but she had to conform to their preference due to peer pressure. “I ended up wasting a lot of money on food I didn’t like,” says Sehgal, a fitness enthusiast.

The pressure to spend is a major problem for youngsters. Take the case of Anasuya Borah, a third-year botany student. Borah lives on a shoestring budget but often overspends just to be part of the crowd. “I agree to go out for weekly dinners of college societies just to feel included,” she says. Though she has tried wriggling her way out, Borah’s attempts have not always been successful.

By hiding the truth about their limited resources, youngsters only add to their money worries. So, how do you tell your friends that you can’t go out because you are short on cash? Proposing inexpensive alternatives is one way. Say, if you are invited for dinner, tell your friends you would instead like to have them over for a cup of coffee or a barbecue. This will convey that you want to spend time with them but cannot spend on eating out.

Escaping peer pressure does not mean forgoing friendships or having no fun. Free or low-fee recreational activities, such as film festivals, theatre, art exhibits, fests and tours to heritage sites with friends are a good substitute for movie nights at multiplexes. Socialising and eating at facilities on the campus is also an affordable option. “Students should limit their expenditures by eating at campus food joints that offer student-friendly rates,” advises Amit Suri, Founder, AUM Wealth Management.

Again, don’t let money hold you from having a good time. Opt for free facilities such as photography clubs, dancing classes, sports activities and take vocational courses offered by your college. You may also volunteer at NGOs to increase social awareness. Own experiences instead of buying things—you will have a lot of fun, learn new skills and won’t have to stretch your limited resources.

LearnTalkMoney take on Peer Pressure

Peer pressure spending can wreak havoc on more than just your wallet. There are always going to be times when you feel peer pressure to spend. What’s the best way to turn down something? Just say no! Honesty will get you far in terms of avoiding spending because of peer pressure, so don’t be afraid to tell people that you just haven’t got the money. And if they don’t want to be with you because you can’t spend, pause and think are they the right kind of friends?

What is Peer Pressure and why is it so powerful

Balance needs & wants

Spending behaviour of millennials is drastically different from that of the previous generations. They often end up spending on things they don’t need due to too much brand awareness. Experts say poor budgeting skills is the reason why youngsters fail to distinguish between needs and wants. “In college, aspirations are high but the money available is limited. Students must learn to prioritise,” says Suresh Sadagopan, Founder, Ladder7 Financial Advisories. Listing expenses in the order of their importance is a simple way of ensuring that you spend on the necessary things first. Having paid for your needs, if you are left with some cash, you may look at addressing some of your wants.

Needs and Wants, Why parents say Money doesn’t grow on Trees discusses Needs and Wants

Start with fixed expenditures conveyance, books and supplies, bills, rent—and allow a fixed amount to each head. Create a separate budget for discretionary expenses with the leftover money. Or, you can save the leftover money. Before shelling out a massive amount on a laptop, ask yourself if you really need it—can you manage with your existing laptop? The extra buck that you can save from such avoidable expenses can be stashed away in a savings account.

“An effective way to chart a budget is by penning down expenses in a diary or an excel sheet as opposed to mental calculations,” says Suri. Money management apps such as Walnut, Homebudget or Wally can help you draft a budget on your smartphone.

LearnMoneyTalk take on it

Budget..it is so boring. Who wants to make a list of things to spend on. Creating a budget (staring at that blank piece of paper) can be overwhelming. Tracking every single penny day after day is..just not it, the money is gone right. But sadly money always will be limited. It might be 2000 Rs today, 5000 Rs a year later, 50,000 2 years later…. but We will never ever have all the money in the world to spend and our wishes are endless. So we need to take steps to take control of our money. And earlier the better.

One of the best ways to manage the budget is with cash envelopes.

- At the beginning of the month, sit down and figure out what will you spend on and what those amounts are.

- Each expense gets its own envelope. Write the name of the expense on the envelope.

- Now, as you spend, you will ONLY remove cash from that specific envelope. If you’re buying food, you can ONLY remove money from the outside earing envelope.

- Once the money in that envelope is gone. It’s gone and you’re done spending money on that category.

- At the end of the week, if I had to get more cash out, I know exactly what my deficit is for the week. If I have money left in my envelope at the end of the week, I know I saved money.

Make the most of your money

For students, savings come in handy during emergencies, especially if they do not stay with their families. They also enable one to make discretionary purchases. Sehgal, for instance, saves systematically to purchase clothes. “I put aside ₹1,500 every month and shop for clothes during the sale season. I don’t have to ask my parents for money each time I have to buy some clothes,” she says.

You can stretch the little money in your pocket by cutting avoidable expenses. For example, books are a major expense for college students, but buying used books can substantially reduce this expense. Used books are available at local book markets and also online at Amazon India, Aberuk, etc. Take a leaf from Shivam Singh, a medical student, who relies only on used books. He also uses the library to avail of the books he doesn’t need to refer frequently. “The savings on books for two semesters have helped me purchase a new pair of stereo speakers,” he says.

Be careful, for you might be paying for things you can get for free. For example, spending ₹25 on bottled water daily amounts to an unnecessary outgo of ₹750 in a month. Make every rupee count, which means avoiding a fee of ₹20 on using other banks’ ATMs for more than three transactions in a month. Such careless small spends can add up fast, especially if you are living on a shoestring budget.

Make some money

If savings are not enough to meet your lifestyle expenses, try earning a little extra by way of internships, part-time work, blogging, freelancing, etc. “This extra money will go a long way in easing your spending worries,” says Sadagopan. Cash prizes won in various debating competitions have helped Borah spend without feeling the pinch. “I have used the prize money to finance things in my bucket-list—getting a violin and a tattoo,” she says.

Sometimes, money made on the side can help you take complete charge of your finances. Take the case of Bengaluru-based law student Phalitha Ashok, who doubles up as a compere on the weekends. Her passion for public speaking has made her financially independent. “I earn about ₹15,000 every month. Being able to finance all my expenses gives me immense joy,” she says.

Using Credit Cards

Studies on the spending behaviour of the youngsters show that swiping cards leads to frivolous spending. Borah agrees: “I feel less guilty of spending digitally because it seems the cash is not going out of my hands.” For students, the biggest risk associated with digital payments is getting into debt through the indiscriminate use of plastic cards. “It can be disastrous for students to take up monthly payment options,” says Sadagopan. They can end up paying a lot more than they can afford.

Simple precautions can help you avoid many troubles. For instance, use debit instead of credit cards. Here the responsibility also lies with parents as credit cards are linked to parents’ account and not issued independently to students. Parents should avoid getting credit cards for their kids. Costs associated with credit cards, such as annual fees, interest, late-payment charges also make them a costly proposition.

The best way to check overspending is to entirely avoid using the plastic money for discretionary spends. Use cash instead, especially for shopping. The pinch of cash slipping out of hands prevents people from making unnecessary spends. If you do use plastic, make the most of cash back offers, discounts and reference bonuses on offer.

LearnTalkMoney take on it

Credit cards aren’t scary — or, at least, they don’t have to be if you’re using them correctly. And Sooner or Later you would start using it. Let me ask you two questions.

Is Knife Good or Bad? It depends in hand of surgeon it saves a life, In the hand of a murderer, it takes life. Problem is not in the knife but in person using it.

A man is driving a car and has an accident: Who is responsible for the accident, the car or the man. The problem is not of the credit card but the person using it.

As SpiderMan says “With Great Power comes Great Responsibility”. Same is with Credit Card. A credit card is convenient, it helps one to rake up reward points, builds credit history and teaches you to be responsible for your own decisions.

The image below shows the pros and cons of using Credit Cards.

Pros and Cons of using credit cards

Be careful of online transactions

Online frauds are another worry. Young students are more likely to become victims of such frauds due to their limited awareness of cyber-crimes. They should take the necessary measures to ensure safety while transacting digitally. “Students must ensure that they pay only through certified payment systems. Refrain from using seemingly attractive new payment apps to avoid getting duped,” warns Suri. You should be careful when sharing banking and card details online and changing passwords.

LearnTalkMoney take on online transactions.

The world is changing and you have to keep pace with the world and the new technology. You, Your parents, Your grandparents started using WhatsApp, Facebook right. You use Instagram. So like a pandora box, it’s out in open, you cannot close the box and go back. You will have to do online transactions, sooner or later. So learn about it just like the new feature of Insta!

- Actively check your last login activity.

- Do not click on links which you are not sure of

- Do not open unsolicited attachments, they can be phishing emails. Phishing is the fraudulent practice of sending emails purporting to be from reputable companies in order to induce individuals to reveal personal information, such as passwords and credit card numbers

- Do have an eye on headers of the email to see if the email is coming from any non-genuine domain.

- Try and stay away from applications within social media platforms. Many criminals design games on social media and when you click on them, the hackers are able to see details which might compromise your account

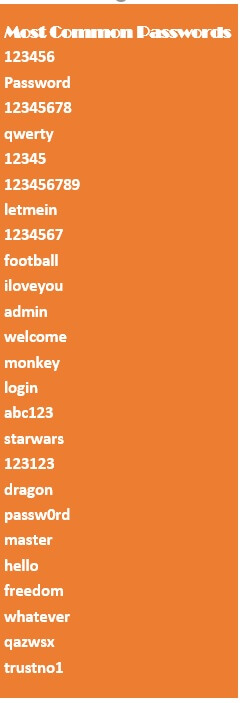

- Use good passwords. These are the list of most common passwords which people use online and now we know why many accounts get hacked!

Most common Passwords

Related Articles:

- Different payment methods like Cash, Cards, Digital Wallets

- How is Credit Card Swipe Processed

- Brand vs Unbranded: What is a brand? Value for Money

What do you think are the Smart money tips that a student should know? How to learn about them.

Useful post. Avoiding online frauds is extremely important.

However, when it comes to online frauds, it is also important to know what the users must do if they find themselves at the receiving end. Right steps will limit their liability.

Please do follow up with a post on this topic.