Finance Minister, Arun Jaitley, in Budget 2015-16 introduced an additional income tax deduction of Rs. 50,000 for contribution to the New Pension Scheme (NPS) under Section 80CCD (1B). So a taxpayer in the 30% tax bracket can save up to Rs 15,450 in tax every year. The Budget has not altered any feature of the NPS, the additional deduction is a big incentive for investors. Note This additional benefit would be available from next Financial year (From Apr 1 2015). What are features of NPS, pros and cons of investing in NPS, returns of NPS, how much tax one saves by investing in NPS, difference between NPS and Mutual Fund,tax on NPS , should you put additional 50,000 and save tax by opening NPS account.

Overview of NPS (New Pension Scheme)

NPS is a flexible retirement savings scheme which offers both a lump-sum amount and monthly pension ie a fixed income to an employee after retirement. NPS was introduced in 2004 for the new government employees but from 2009, it was extended to all on a voluntary basis. Under this scheme, subscribers invest in a fund chosen by them and at the time of retirement they get a lump sum amount depending on the performance of that fund. The returns from NPS are not guaranteed; they are market-linked. NPS has very strict rules on withdrawals and the corpus cannot be taken out before the age of 60. There is a proposal to allow 25% of the corpus to be withdrawn for specific purposes (medical emergency, higher education of children, marriage of daughters, house purchase etc.

The official site for NPS is npscra.nsdl.co.in and www.npstrust.org.in . Detailed explanation of the NPS is covered in our article Understanding National Pension Scheme – NPS

Overview of NPS features are given below.

- Any resident Indian or NRI aged 18-60 years can open an NPS account at a a post office, a bank(some branches only) or a distributor, technically called point of presence Service Providers (POP-SP). You will have to get a Permanent Retirement Account Number (PRAN) to open an NPS account. As per KYC norms Photo Id proof, Date of birth proof and Address proof are required to be submitted along with application form.

- The minimum investment is Rs 1,000 in a financial year. The minimum contribution is 500 per transaction. There is a transaction charge of .25% or Rs 20 (whichever is higher) on every transaction. There is no maximum limit for investments in NPS, though the tax deductions on such contributions are capped.

- The investor has various investment options available in terms of allocating between different types of funds (E Class Fund, C Class Funds, G Class Funds) or going with predefined allocation called as LifeStage Fund. Investors can choose their asset mix but allocation to equity funds cannot exceed 50%. Lifestage fund For investors who don’t actively track their investment or cannot decide the allocation, the LifeStage Fund is a useful option. Under this, the allocation to equities is defined by the age of the individual. This is the default option to be followed if the investor does not mention the desired asset allocation.

- E class funds are equity funds and invest in Nifty stocks.

- The C class funds are debt funds that invest in corporate bonds.

- The G class funds invest in government securities

- The scheme is structured into two tiers: Tier-I and Tier II accounts. The Tier-I account is the non-withdrawable account meant for savings for retirement. Tier II account is a voluntary saving account.

| Functionality | Tier I | Tier II |

|---|---|---|

| Contribution | Minimum Contribution of Rs. 500 per contribution.Minimum Contribution Rs. 6000/- p.a. | Minimum Contribution of Rs. 1000 at the time of Account opening.Minimum Contribution of Rs. 250 per contribution.Minimum Balance of Rs. 2000/- at the end of each Financial Year |

| Withdrawals | No withdrawals allowed during vesting period except as per the norms prescribed by PFRDA | No limit on Withdrawals |

| Tax Benefits | Triple Tax Benefits are available | Triple Tax Benefits are NOT available |

- Investors in the NPS, unlike a pension fund or a ULIP, can choose from different pension fund managers and even shift from one to another. But you are allowed to switch managers just once in a year. There is no tax implication when you shift from one fund option to another or change a pension fund manager.

- The NPS is one of the cheapest financial product with an expense ratio of only .01%. There are also other charges , such as the one-time expenses for obtaining a PRAN and opening the account and the transaction charge of .25% or Rs 20 on every contribution.

- Tier 1 account of NPS offers tax deductions under various sections(not the Tier 2). These are:

- Rs 1,50,000 under section 80CCD . 80CCD is part of investments under Section 80C which includes EPF,PPF,Life Insurance etc.

- Rs 50,000 under section 80CCD(1b) (Effective from 1 Apr 2015)

- 10% of Basic Salary + Dearness Account (DA)

- You can exit the scheme after attaining 60 years of age. You have the option to defer the withdrawal and stay invested in NPS up to 70 years of age however you are not allowed to make further contributions.

- One has to compulsorily annuitize 40% of the accumulated pension wealth. Option to annuitize 100% of the corpus is also available.

- Subscribers can exit from NPS even before attaining the age of 60 by using at least 80 per cent of the accumulated pension wealth for purchase of an annuity for providing for the monthly pension. The balance is paid as a lump sum payment to the subscriber.

- Accruals from your NPS account are taxable only when you opt out or withdraw from the scheme or on maturity (at the age of 60).

- The annuity/pension which you receive is taxable on yearly basis.

- In case of untimely death of the NPS account holder before completion of 60 years of age, the nominee can withdraw the corpus accumulated at the time of death of the account holder. The money received by the nominee or legal heirs is fully exempt.

How can companies or corporate contribute to NPS?

There are two models under the New Pension Scheme (NPS)

- All Citizens Model – Available to all citizens of India , explained above.

- NPS-Corporate Sector Model – Provide NPS benefits to the employees of corporate entities:

- Employees’ contribution to NPS will be deductible up to 10% of salary subject to overall cap of Rs 1.5 lakh (which includes investments under Section 80C).

- An additional deduction of Rs 50,000 is also available for any contribution made by employees to NPS.

- Employer’s contribution will also be available for deduction up to 10% of salary (without any cap).

- On resigning, the employee can carry this account with him over to the next employer.

For more details one can read NPS Corporate Broucher(pdf)

What is Annuity?

An annuity is a financial instrument which provides for a regular payment of a certain amount of money on monthly/quarterly/annual basis for the chosen period for a given price. In simple terms it is pension. Pension is taxable.

How much tax would you save if you invest in NPS ?

Tier 1 account of NPS offers tax deductions under following sections. Please note these deductions are NOT available for Tier 2 account.

- Rs 1,50,000 under section 80CCD . 80CCD is part of investments under Section 80C which includes EPF,PPF,Life Insurance etc.

- 10% of Basic Salary + Dearness Account (DA) under section 80CCD(2). It works when the employer also invests in NPS. Under this Section, an employer can contribute upto 10% of the basic salary plus dearness allowance to the NPS account of an employee. The employer can show his contribution as deduction from the business income under Section 36 I (IV)

- Rs 50,000 under section 80CCD(1b) (Effective from 1 Apr 2015)

How much tax you save if you open Tier 1 NPS account?

If you open Tier 1 NPS account then your contribution towards NPS will be included in 1.5 lakh limit of 80C which includes your EPF, ELSS, Life insurance etc. By restructuring your salary so that you can contribute to NPS the tax saved (using Income tax calculations for 2015-16)is calculated as shown below.

| Description | Without NPS | With NPS |

| Salary | 25,00,000 | 25,00,000 |

| Basic (40% of Salary) | 10,00,000 | 10,00,000 |

| NPS Contribution | 0 | 1,00,000 |

| Deductions | ||

| Under section 80C | 1,50,000 | 1,50,000 |

| Under section 80CCD | 1,00,000 | |

| Total taxable income | 23,50,000 | 22,50,000 |

| Tax (at 30%) | 5,30,000 | 5,00,000 |

| Tax with Edu cess at 3% | 5,45,900- | 5,15,000 |

| Additional Tax saved | 0 | 30,900 |

How much tax would you save by investing upto 50,000 Rs ?

From Apr 1 2015 one can do additional saving of Rs 50,000 under section 80 CCD(1B). This would lead to additional saving as shown in table below. You can use our Income tax calculator

| Description | Without NPS | With NPS |

| Salary | 25,00,000 | 25,00,000 |

| Basic (40% of Salary) | 10,00,000 | 10,00,000 |

| NPS Contribution | 0 | 1,00,000 |

| Deductions | ||

| Under section 80C | 1,50,000 | 1,50,000 |

| Under section 80CCD(2) | 1,00,000 | |

| Under section 80CCD(1B) | 0 | 50,000 |

| Total taxable income | 23,50,000 | 22,00,000 |

| Tax (at 30%) without Edu cess | 5,30,000 | 4,85,000 |

| Tax with Edu cess at 3% | 5,45,900 | 4,99,550 |

| Additional Tax saved | 46,350(30,900+15450) |

Tax saved in 20% slab is Rs 14,832

Comparing putting and not putting additional 50,000 in NPS ?

If you do not invest in NPS you have 50000- tax amount left,for above example 50000 – 15450 = 34550 Rs left. If you invest this money annually in equity fund which gives returns of 10% for 15 years you would get 10.97 lakh. This would be tax free.

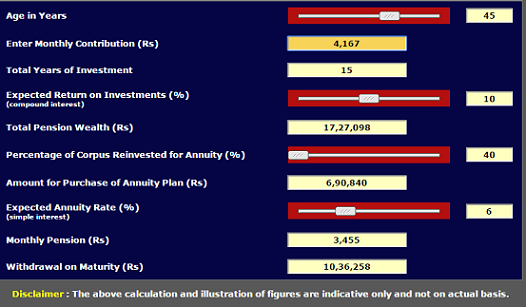

If you put it in NPS and make monthly contribution of Rs 50,000/12 = 4167 the using the Pension calculator of NPS at www.npstrust.org.in/PENSIONCALC/Index.html then amount you get and pension shown in image below. You would get 17.27 lakh on maturity. If you just commit minimum percentage i.e 40% to buying annuity then 6.9 lakh is amount for annuity and 10.36 lakh is withdrawal amount on which you would have to pay tax. Whenever you withdraw money from the NPS, the returns will be taxed as capital gains. The pension you receive every month would also be taxable. Question is will NPS with only 50% in equity give you the same return as equity fund?

How are the returns from NPS?

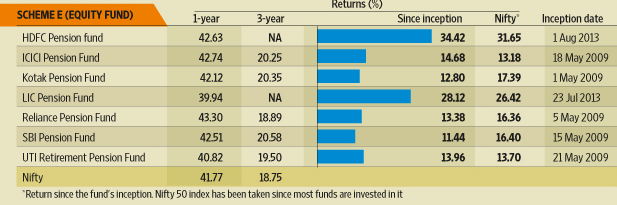

Will NPS with only 50% in equity give you the same return as equity fund? You can check the returns of the NPS schemes at www.npstrust.org.in/index.php/navreturns/returns. As on 27th Feb 2015 the returns are as shown in image below. You can see that the returns are market-linked and perform the same way as NIFTY. Remember equity portfolio in NPS is invested in an index,presently Nifty, and is passively managed. An actively managed equity portfolio can give better returns.

What are the differences between NPS and Mutual funds?

| Mutual Funds | NPS (Tier I account) |

| No limit depends on investor | Equity limit is restricted to 50% |

| Wide array of funds to choose from | Only in Funds selected by PFRDA |

| Can change fund anytime | Can change fund only once a year |

| No forced discipline unless through SIP | If employee then automatically contribution gets deductedElse minimum contribution limit |

| Tax benefits only in ELSS | 80C benefit and if employer contributes his contribution gets 80CCE |

| Can withdraw anytime | Restricted withdrawal |

| No pension benefit on maturity | Forced to take annuity on withdrawal or maturity of 60 years which generates pension |

To invest or not to invest in NPS is the question?

It is not a simple YES/NO answer. An additional deduction should not be the only reason to invest in the NPS. Go for it if it suits your risk profile and investment horizon. Also do consider the lock in and liquidity of your investment. Tier I account locks in money till retirement but it ensures that it is used for the original goal. NPS outweighs mutual funds for its low cost and tax exemption. If you aren’t worried about saving taxes, then mutual funds (equity or balanced) make more sense for long-term investors willing to take higher risk for better returns. Remember the additional benefit would be available from Financial year FY 15-16 (AY 2016-17),i. e, From Apr 1 2015.

Related articles:

- Understanding National Pension Scheme – NPS

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- Goals Based Financial Planning

- Choosing Tax Saving options : 80C and Others

- Taxation of investments : EEE, ETE, TEE..

Do you have an NPS account? What do you think on NPS? Does it make sense to save additional 50,000 Rs ? Is liquidity factor a major block for investing in NPS? What is making you look at NPS?

I am a self employed dentist. My annual income is about 20 lakhs.

My sole purpose of investing in nps is to save tax.

I am not interested in earlier withdrawals.

Do I need to take the lump sum amount on attaining 60 years?

Do I invest in Tier 1 or Tier 2.

I prefer the auto option.

Is the limit only 50000 or 10 % of my income?

I have my other source of income viz rent

I am mainly looking for a regular high pension.

For a tension free retirement.

For my life style I will require 30000 per month.

Please suggest me a best option.

I am now 49 years old.

Dear Friend,

NPS is open for masses & hence, impact on future govt. vote bank. Just like when Govt. thought to implement tax on EPF withdrawal they could not do under pressure from common man. Even Govt. employees have to invest in NPS (Mandatory). Hence, forget all worries & invest in NPS. It is always beneficial during your retired life. Why one thinks for partial withdrawal on retirement ? why not opt for a pension plan where entire amount is invested in your pension scheme & after death of husband & wife the entire amount is paid to your nominee. This is a tax deferred scheme. Also as on today the allowable deductions are 2.5 L as standard deduction. after this Sec-80C+80CCC+80CCD(1) = 1.5 Lacs., After that 80CCD(1B) – 0.5 Lacs. At the time of retirement the SD may be 5.00 lacs.

Hence, one may opt for withdrawal of 20 Lacs from NPS fund (by paying minm tax) & remaining fund may be invested in pension equity for monthly pension.

Good idea !! For retirement needs go for PPF investment which is tax free on withdrawal.

Sir,

I am a State government employee. I have invested Rs 1.5 lakh in Public Provident Fund (PPF). I also contribute around Rs 72,000 per year to National Pension System (NPS). The government, my employer, also contributes a matching amount. I want to know whether I can claim my PPF investment of Rs 1.5 lakh under Section 80C and the additional R50,000 under Section 80CCD(1) on my compulsory contribution to NPS?

I am a central govt employeee. Can I avail the addl tax benefit by investing Rs. 50000/- in the name of spouse under section CCD(IB). How much % will be withdrawal after age of 60 yrs of spouse.

Can a person who fall in old pension scheme (state govt.) open a NPS account to avail the benefits of 80CCD (1B) for 50,000 Rs.?

Yes you can open NPS account to claim avail benefits of 80CCD(1B)

plz clarify, to get additional tax benefit of Rs. 50,000/- by 80ccd(1B) whether a CG employee required to invest addtional 50,000/- apart from his contribution to NPS fund (10%) of Basic salary. or he can claimed 80ccd(1B) on his existing contribution towards NPS?

Short ans TO claim additional 80CCD(1B) benefit you need to make additional contribution.

Long Ans from Govt circular (pg 33) (pdf)

Section 80CCD(1) allows an employee, being an individual employed by the Central Government on or after 01.01.2004 or being an individual employed by any other employer,

or any other assessee being an individual, a deduction of an amount paid or deposited out of his income chargeable to tax under a pension scheme as notified vide Notification F. N. 5/7/2003- ECB&PR dated 22.12.2003 National Pension System-NPS or as may be notifed by the Central Government. However, the deduction shall not exceed an amount equal to

10% of his salary (includes Dearness Allowance but excludes all other allowance and perquisites).

As per section 80CCD(1B), an assessee referred to in 80CCD(1) shall be allowed an deduction in computation of his income, of the whole of the amount paid or deposited in the

previous year in his account under the pension scheme notified or as may be notified by the Central Government, which shall not exceed Rs. 50,000. The deduction of Rs. 50,000 shall

be allowed whether or not any deduction is allowed under sub-section(1). However, the same amount cannot be claimed both under sub-section (1) and sub-section (1B) of section

80CCD.

MY SAVING UNDER SECTION 80C IS 120000 AND UNDER NPS 80000. SHALL I CLAIM 150000 UNDER 80C AND REMAING 50000 UNDER 80CCD(1B)

yes

You may like to read my post on this topic.

http://aapkaca.com/investments/whether-you-should-invest-in-nps-national-pension-system/

Hi

I already exhausted 1.5lakh under 80C section with VPF,PPF and postal savings . But i want to invest in NPS. Can you please help me to understand through NPS how i can use the 80CCD (2) & 80CCD(1B)option for my overall tax deduction tax slab ?

I am govt.employ from 1996.i can find nps benifits

congrats

Sir, please tell me the NPS amount deduct 10% from my salary and gov. give same amount in my NPS account Then the income tax benefit in 20% amount total or 10% deduct from sallary . I am employe of uppwd

Sir, please tell me the NPS amount deduct 10% from my salary and gov. give same amount in my NPS account Then the income tax benefit in 20% amount total or 10% deduct from sallary . I am employe of uppwd

Good illustration.

2 question:

1. In the comparison shown of tax saved with and without NPS, how is taxable income with NPS is shown to be 22.5 L in first example and 22 L in second example? As deduction under 80CCD is part of 80C, for which the total limit it 1.5 L, why is the additional investment of 1L shown under 80CCD is considered for tax computation?

2. If my employer is investing 10% of my basic in NPS, is not upto me to show this under 80CCD(1b) for additional tax benefit of 50K? (this being the only investment in NPS )

Good illustration.

2 question:

1. In the comparison shown of tax saved with and without NPS, how is taxable income with NPS is shown to be 22.5 L in first example and 22 L in second example? As deduction under 80CCD is part of 80C, for which the total limit it 1.5 L, why is the additional investment of 1L shown under 80CCD is considered for tax computation?

2. If my employer is investing 10% of my basic in NPS, is not upto me to show this under 80CCD(1b) for additional tax benefit of 50K? (this being the only investment in NPS )

but sir what is the surity that this clause 80ccd(1b) of additional 50000/- will remain for ever, it can be removed in any future budget as it is added in this budget. in that case one will get stuck with nps for life and will have to make at least min investment in it for his life till retirement. so i think opening nps should be independent of this tax rebate and based on individual requirments and merits of the product.

Good point Baljit. You never know what can be added/removed

I totally agree with you opening NPS should be independent of tax rebate. Infact any investment should be seen how it fits into one’s investment portfolio.what is liquidity,returns instead of just focussing on tax.

but sir what is the surity that this clause 80ccd(1b) of additional 50000/- will remain for ever, it can be removed in any future budget as it is added in this budget. in that case one will get stuck with nps for life and will have to make at least min investment in it for his life till retirement. so i think opening nps should be independent of this tax rebate and based on individual requirments and merits of the product.

Good point Baljit. You never know what can be added/removed

I totally agree with you opening NPS should be independent of tax rebate. Infact any investment should be seen how it fits into one’s investment portfolio.what is liquidity,returns instead of just focussing on tax.