If a employee contributing to NPS changes his job, what will happen to his NPS account? This article explains how to transfer NPS when one shifts office. It explains various sectors of NPS,Nodal Office, Shift from EPF to NPS, Shifting NPS using Form ISS.

Table of Contents

NPS account is portable

NPS is a pension system which offers financial security after retirement to a person. During the service life of an employee, only one NPS account is maintained irrespective of change of employer. You can shift from one sector to another,from one State Government service to another State Government service, from Central Government to Corporate and vice-versa etc. So, if you opened account as Central Government Employee and quit your Government Job, you can still continue under All Citizens model by making contribution of Rs 1,000 to keep your NPS account active. You do not have to quit NPS when you quit your job or shift to an employer which does not offer NPS.

Permanent retirement account number (PRAN) is a unique number allotted to a National Pension System (NPS) subscriber. PRAN or the account is portable and can be moved even if a government servant moves to the private sector. You can have just 1 PRAN just like you can have only one Permanent Account Number(PAN). So You can use the same PRAN across different Government departments, state governments, employers or even after changings job.

Various sectors or Models of NPS

Let’s go over the sectors or the models of National Pension Scheme. Currently, NPS and APY together have more than One Crore subscribers with total Asset Under Management (AUM) of more than Rs.1 lakh crore.

- Government Sector:

- Central Government : From 1 Jan 2004 Government made it mandatory for new government employees (except armed forces) to contribute to National Pension Scheme with matching contribution by government

- State Government: NPS is applicable to all the employees of State Governments, State Autonomous Bodies joining services after the date of notification by the respective State Governments. All state governments gradually adopted the NPS. Tamil Nadu had signed to shift their employees to the NPS in April 2003, Maharashtra signed up in November 2005,Kerala finally agreed to join the NPS from 2013-14.

- Corporate Sector: Corporate National Pension Scheme (NPS) was launched in December 2011 by PFRDA (Pension Fund Regulatory Authority). Just like a Provident Fund, NPS is a contribution scheme through which both the employer as well as the employee can build the employees’ pension wealth. The biggest advantage is the tax benefit up to 10% deduction on the Basic Pay+DA of the employer’s contribution on behalf of the employees. This is over and above Rs 1,50,000 benefit under Section 80 C, which is applicable to the employee’s contribution to the NPS kitty. Even the employer can claim tax benefit for its contribution by showing it as business expense in the profit and loss account.

- All Citizens Sector: NPS has been made available to every Indian Citizen from 1st May 2009 on a voluntary basis. All citizens of India between the age of 18 and 60 years as on the date of submission of his application to Point of Presence (POP) / Point of Presence-Service Provider (POP-SP) can join NPS.

- NPS Lite or APY or UOS( Unorganized sector)

- NPS Lite or The Swavalamban Scheme is to provide the retirement benefit for unorganized sector. Under this scheme, the Govt. of India will contribute Rs.1000 per year,for 5 years, to every NPS-Swavalamban account provided the contribution is between Rs.1000 to Rs.12000 per year. The people forming part of this low income groups will be represented through their organisations known as Aggregators who would facilitate in subscriber registration, transfer of pension contributions and subscriber maintenance functions. Subscribers in the age group of 18 to 60 can join NPS – Lite through the aggregator and contribute till the age of 60.

- From Jun 1 2015 Atal Pension Yojana (APY), replaced Swavalamban Yojana NPS Lite. The existing subscribers of Swavalamban Scheme were automatically migrated to APY, unless they opt out. We have covered the scheme in detail in our article Atal Pension Yojna

What is Nodal office of NPS?

PFRDA has appointed National Securities Depository Limited (NSDL) as the Central Record Keeping Agency (CRA) to maintain the records of contribution and its deployment in various pension fund schemes for the employees. The records of the contribution of each employee will be kept in an account known as the Permanent Retirement Account which will be identified by a Permanent Retirement Account Number (PRAN).

Government offices like DTO and DDO or offices equivalent thereof which will interact with CRA on behalf of the Subscriber are collectively referred as Nodal Office. CRA-FC is Facilitation Centre appointed by CRA to facilitate Nodal Offices to submit applications for allotment of PRAN and application for change in signature and photograph of the subscriber

- Nodal offices under Central Government include the Principal Accounts Office (PrAO), Pay and Accounts Office (PAO) and Drawing & Disbursing Office (DDO) under the Central Government or analogous offices .

- Nodal offices under the State Government include the Directorate of Treasuries and Accounts (DTA), District Treasury Offices (DTO) and Drawing & Disbursing Office (DDO) .

Nodal Offices are identified by a unique number, i.e., Pr.AO /PAO/ DDO registration number that is allotted to them by the CRA on successful registration.

Can I shift my NPS account to eNPS?

Unfortunately, you cannot port your NPS account to eNPS i.e. eNPS cannot be your target PoP when you are shifting. You must open account using eNPS portal for it to be your PoP. But you can contribute using eNPS.

On Shifting Jobs

Our parents(mostly fathers) worked in the same or at most two jobs in one career, they retired on their provident funds. But now people hop from one job to the other looking for better and lucrative job opportunities. But to ensure a smooth financial transition one needs to take care of our salary bank account, Tax computation, Employee Provident Fund(EPF), Health insurance etc. Our articles Changing Jobs:Take Care Of Bank Account,Tax Liability focuses on exploring what to do with Salary Bank Account, Tax liability when ones switch jobs.

Changing jobs often leads to a situation where an individual gets tax exemptions twice from his earlier employer as well as from his new employer. Exemptions and Tax Liability form an important consideration while switching jobs. Making a job switch in the middle of the year involves making sure that the deductions and exemptions regarding tax liability are made only once. Our article Changing Jobs and Tax, Form 12B explains it in detail.

Shifting from EPF to NPS

The proposal to switch from EPF to NPS was announced in 2015 budget. A legislation to amend the Employees’ Provident Fund & Miscellaneous Provisions Act has already been framed and is lying with the Law Ministry. Till the move becomes reality one would either have to withdraw money from EPF or let EPF account continue without any contribution and let EPF will earn interest.

The amendments allows EPF subscribers to make a one-time switch to the NPS. Within 30 days of applying, the entire balance in his EPF account will be transferred to the NPS. Opting for the NPS would also mean the individual exits from Employees Deposit Linked Insurance as well as the Employees’ Pension Scheme (EPS). The Bill is silent on what this means for the amount mandatorily deducted from the employer’s contribution and put into the EPS.

But the best part about the proposal is , the employee will have a one-time chance to return to the EPF fold. However, on rejoining the EPF, the subscriber will be treated as a new entrant and will not be eligible for benefits he might have accumulated in his previous tenure in the EPF. Also, after this ghar wapsi, the subscriber will not have the option to go back to the NPS.

Shifting NPS within the Central Government/ a State Government

In case a subscriber shifts within the Central Government or a State Government then there is just change of Nodal office i.e. from one PrAO/DTA/PAO/DTO/DDO or to another PrAO/DTA/PAO/DTO/DDO then the subscriber need not submit any separate request. For shifting of NPS within Government sector, the Subscriber is required to intimate his PRAN to the target (new) office with whom he/she will be associated after shifting. The new office will facilitate shifting in the CRA system by uploading the NPS contribution. PRAN will get associated to new office in the CRA system on successful credit of the monthly NPS contribution. Subsequently, the new office is required to update Subscriber’s employment details in the CRA system.

Shifting NPS using Form ISS

A subscriber can shift from one sector to another sector or from one office to another office with the same PRAN e.g. from Central Government (CG) to State Government (SG) or from one department to another, etc. For most of the cases when one needs to Shift NPS one needs to submit Inter Sector Shift (ISS) Form . It can be downloaded from npscra.nsdl.co.in or Click Here or you can get it from an existing point of presence of the service provider (POP-SP).

- Fill in complete details of the shift you are making ex: from State Govt to State Govt or from Govt to Corporate etc, discussed in detail later.

- Attached appropriate documents

- Form with supporting documents has to be submitted to target POP -SP.

- A stamped acknowledgement is given.

- Once details are verified, the change is communicated to the subscriber.

Before shifting Please note

- PRAN should be active.

- Details such as PRAN number, employer information and salary information must be filled correctly as these are recorded in the NPS system.

Shifting NPS Form ISS (Inter Sector Shift)

One must submit Form ISS-I. It can be downloaded from npscra.nsdl.co.in or Click Here or you can get it from an existing point of presence of the service provider (POP-SP).

- Name and address, PRAN details, details of the existing and new POPSP need to be provided in the form.

- Please quote the correct PRAN and attach a copy of the PRAN Card

- Please provide Details of the DDO / POP-SP with which the PRAN is currently associated.

- Please provide Details of the DDO / POP-SP with which the PRAN will be associated.

- Sector for ‘Existing PRAN association’ and ‘Target PRAN association’ can be the same only if a subscriber is shifting from one State Government to another State Government

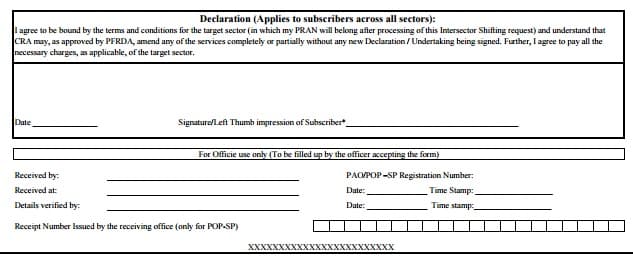

Declaration to be filled by subscribers across all sectors. On successful verification of the change request form, POP-SP shall accept the same and shall issue a 17 digit Receipt Number as an acknowledgement to the subscriber. The nomenclature of the receipt

- First 2 digits (from left) – Type of request (19 for Subscriber shifting)

- Next 7 digits – Registration Number of POP-SP e.g., 6000002

- Next 8 digits – Running sequence number eg.00000001

- For Example: 17 digit receipt number will be “19600000200000001”

POP-SP shall handover the acknowledgement to the subscriber as receipt of the acceptance of the request. The POP-SP shall affix the seal as well as the user shall sign the acknowledgement before providing the same to the subscriber.

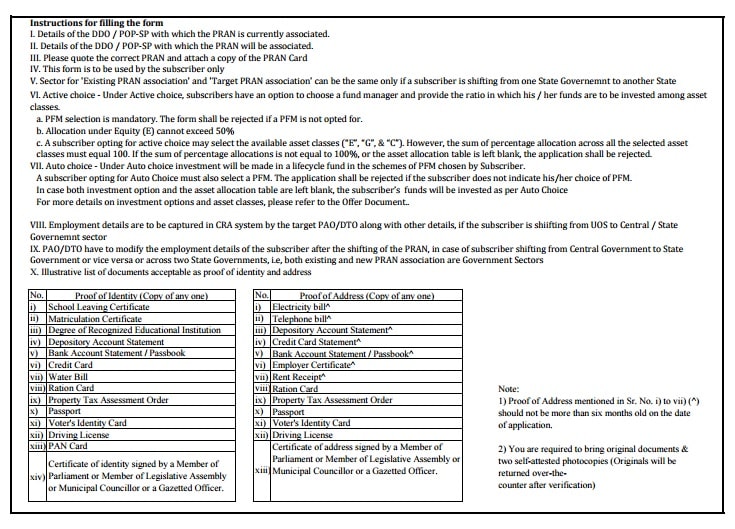

Instructions and Documents that one needs to provide are shown in image below:

Shifting NPS Between State Government and Central Government

For shifting PRAN from one sector to another or from one State Government to another State Government, the subscriber is required to submit Form ISS-1 to the target Nodal Office i.e. to the Nodal Office with whom he/she will be associated after shifting. The target Nodal Office initiates the shifting of PRAN along with accumulated NPS contributions under the PRAN in the CRA system.

- Download Form ISS-1(Inter Sector Shifting form). To Download Click Here

- Fill in complete details and attach documents

- Submit the form to your Target Nodal Office (i.e. Pay & Accounts Officer/ Drawing & Disbursing Officer)

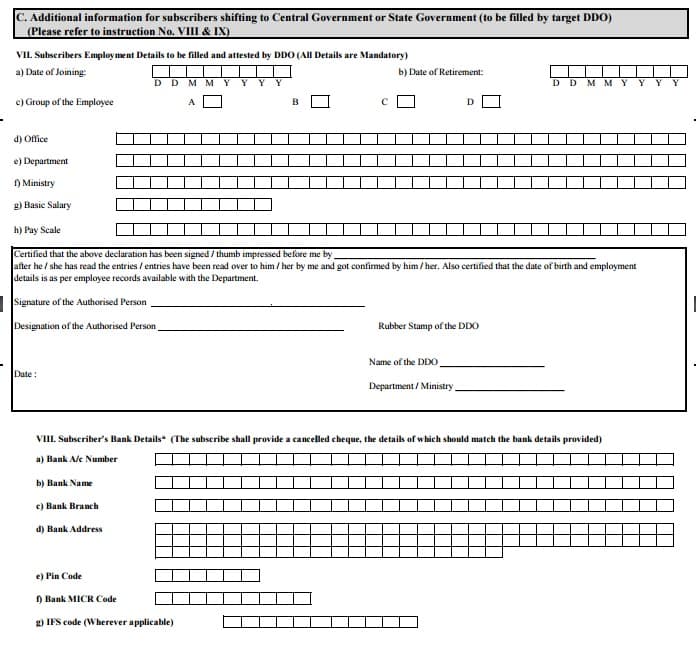

Shifting NPS to Central Government or State Govt

Subscribers shifting to central /state government need to furnish employment details including salary and department involved. The information needs to be attested by employer. Bank details have to be provided with cancelled cheque.

The Government of India or a Government of States in India classifies public employees into Group A (Gazetted/Executive), B (Gazetted), B (Non-Gazetted), C and D. This classification is based on the recommendations of 6th CPC.

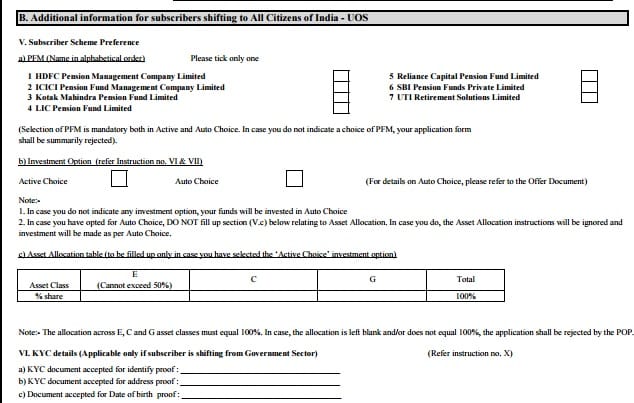

Shifting NPS to UOS or Citizen Sector

In case, the subscriber is shifting from UOS to Central or State government, the process remains the same as in Shifting NPS Between State Government and Central Government. Internally The Swavalamban Flag (even if already activated) will not be applicable in Government Sector. Image below shows additional information required when one needs to Shift NPS to Citizen or Unorganised Sector.

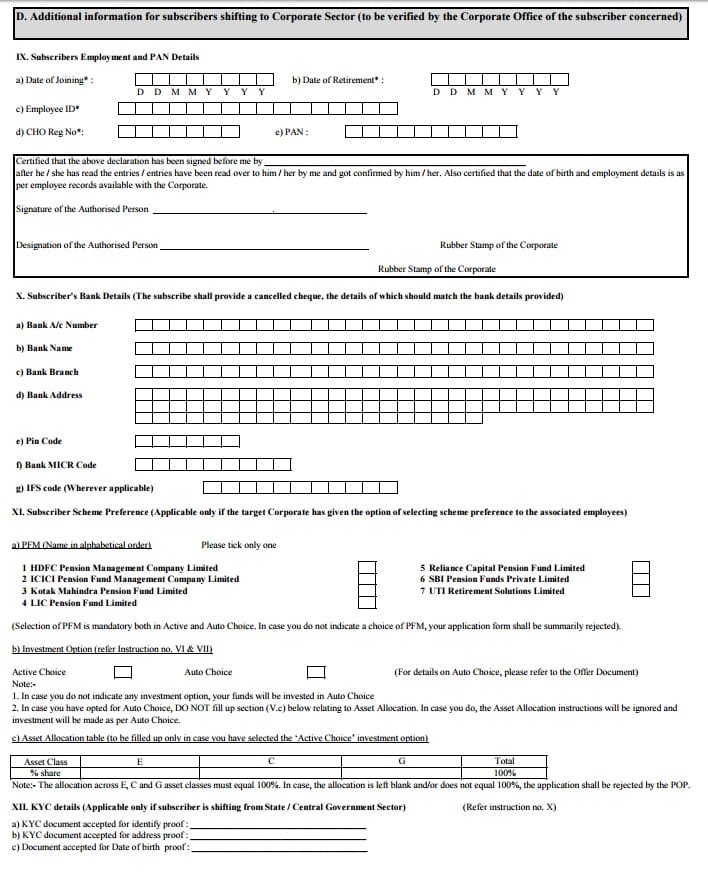

Shifting NPS to Corporate Sector

The subscriber will submit the duly filled form for shifting along with a copy of the PRAN card to the target POP/POP-SP. Image below shows additional information required when one needs to Shift NPS Corporate Sector.

- Subscribers have to provide employment, bank and PAN details.

- They also have to choose PFM and investment option.

Related Articles:

- Understanding National Pension Scheme – NPS

- eNPS : Open NPS account online, contribute to NPS online

- Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax

- Saving For Retirement : Pension Plans,NPS,EPF,PPF

- Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24

- Tax Planning Traps To Avoid

- Returns of NPS

Hello Sir,

I recently joined a Government Department. While registering for eNPS, I wrongly selected the option of “Individual Subscriber” rather than “Government Servant” (Tier – I). Now the PRAN is already mapped to my PAN card and I am unable to create another NPS account as “Government Servant”. What should I do?

Sir I left my center gov. job2016 and close my nps account .now I want to transfer my account at my state and want it continues.

Plz tell me where I contact.

sir

my wife worked in panchayath.now she is in police. how we can shift our pran a/c panchayath to police

Ask her to contact payroll department

I newly joined in bank as a clerk and apply PRAN card through online. Nd now i get a ISS form bt i don t know how nd where i get DDO/CBO/POP-S reg. No. And name. Nd frm where i have attest nd ruvver stemp on ISS form plz give me sol.

Hello sir

Please help me out with my querry

I was self employed and i opened eNPS with karvy CRA 1 year back under “all citizen”

recently i have joined a state govt job

Now when i enquired, customer care rep at Karvy told me that i need to shift my CRA to NSDL by filling ISS form. Now i dont understand the following

1. do i need to keep changing cra everytime i change job like NSDL to KArvy and vice versa?

2. currently i have eNPS in karvy…. my target POP would also be eNPS or will be different?

3. what will be my target POP-sp no.? where do i get it from ?

3. where do i sent my ISS form to … there is no customer care no. for enps at nsdl?

please reply

One of the core attributes of NPS is portability of PRAN across sectors. The PRAN allotted under NPS is unique and portable. This unique account number will remain the same for the rest of the Subscriber’s life. Subscriber will be able to use this account and this unique PRAN from any location in India

The following are the portability features associated with NPS

– NPS account can be operated from anywhere in the country irrespective of individual employment and location/geography.

-Subscribers can shift from one sector to another like Private to Government or vice versa or Private to Corporate and vice versa. Hence a private citizen can move to Central

Government, State Government etc with the same Account. Also subscriber can shift within sector like from one POP to another POP and from one POP-SP to another POP-SP.

Likewise an employee who leaves the employment to become a self-employed can continue with his individual contributions. If he enters re-employment he may continue to contribute and his employer may also contribute and so on.

-The subscriber can contribute to NPS from any of the POP/ POP-SP despite not being registered with them and from anywhere in India.

You can call NSDL at (022) 2499 3499

You should be able to give your PRAN number to paycheck department of the state Govt.

or check Contact us page of NPS website.

Sir I was working in BSF under ministry of home affairs. Now I have shifted my job to state government education department. I have Mt PRAN number. I want to shift it. So please tell me what should I do and what are the documents needed to be attached with ISS form and where this ISS form to be submitted.

How much time it will take to be shifted my account.

Hi sir,

I was a police officer from 2011 to 2013. Now I have resigned to police job and working as software in MNC. My question is how to transfer the PRAN(NPS) Amount to UAN account. Please advise.

Sir mane online pran banavaya hai.shifting from bhar diya hai.Nps katoti bhi ho rahi hai .Par mere nps account se charge cut raha hai .kyu please tell.2 months me 81 rupees cut gaye ye kis ke cut rahe hai .iski information kaise aur kha se milegi . Please tell.

Hi,

I was working in one of the PSBs (Syndicate Bank). Now, I have shifted to Kolkata Port under the Ministry of Shipping. I have already intimated my PRAN number in my new Organisation. But the contribution to my NPS A/C is yet to start. It’s already been two months since my joining. Do I need to submit the ISS form given that both are Govt. organisations?

Check with your payroll department.

Where to submit iss1 form?

I was working in a private bank now working in another private bank.

Form ISS-1 applicable when you are shifting your NPS account across sectors (Central Government, State Government, All Citizens Model and Corporate Sector).

For example

Shifting from Central Government to All Citizens model or vice versa.

Shifting from one State Government to another State Government.

Shifting from State Government to Central Government or vice versa.

Shifting from Corporate Sector to any other sector (Central or State Governments or All Citizens model) or vice versa.

As you are in Citizens model to Citizen’s model you don’t need to submit ISS Form,

You inform your new bank od PRAN number

I was in CISF and had NPS and PRAN but there is no contribution in my NPS account from last one year. Now I am going to join PNB, then how can I avail or resume my previous NPS account or what else can be done? Eagerly waiting for your response.

As PRAN is unique and portable across employment & location, NPS contributions can be transferred by the prospective employer to same PRAN already allotted by previous employers.

As you have not contributed to NPS it should have got blocked.

No transactions will be allowed until one pays the bare minimum contribution with a penalty amount of Rs. 100 per year of defaulting contributions.

But in Aug 2016 as per the circular

Pt 5 the accounts should have been unfrozen.

Please check the details of your account by logging to CRA.

A penalty of Rs. 100 has to be paid for missing default contribution. PFRDA in Aug 2016 reduced the mandatory annual contribution to NPS from Rs 6,000 per annum to Rs 1,000 per annum in Tier-I NPS Account.

Let us know if your account is blocked or frozen?

Hi Sir,

I was working in a private bank i have nps account and pran number with online transaction login id, Now i resigned and joined another private sector bank please tell me where to submit iss 1 form to newly joined bank or nps department.

Please let me know if you’re looking for a article writer for your weblog.

You have some really great articles and I feel I would be a good asset.

If you ever want to take some of the load off, I’d absolutely love to write some content for your blog in exchange

for a link back to mine. Please shoot me an e-mail if interested.

Thank you!

Having read this I believed it was rather informative.

I appreciate you spending some time and energy to

put this content together. I once again find myself spending a lot of time both reading and leaving

comments. But so what, it was still worth it!

i have submittes iss form , can i know how much time it will take to shift my nps..

Can you tell me what documents are needed for shifting from corporate sector to state govt..do i need to attach a state govt challan of 50rs. With it..

Sir if one is NRI and he opens a NPS account, it would be in All Citizens Mode.

Once he is back to India, all he has to do is change his status to resident and and bank account status

Contribution to NPS for NRI as per exchange conversion norms is through

– NRE Account

– NRO Account/ Local sources

You have given a complete analysis on NPS.Thanks for the great info.

If NPS is opened by an NRI and he returns to India and starts working in India, what shall be the procedure for shifting NPS.It will be somewhat similar to the above procedure.I suppose he can use the same PRAN as alloted to him as an NRI.Can you just clarify a bit on it.