Recognizing the compliance burden on senior citizens the government has exempted senior citizens of 75 years and above from filing income tax returns. This was announced in Budget 2021. What are the conditions under which Senior citizens can use it? Has this made compliance simpler for Senior Citizens? Does it sound too good to be true or there is more to what meets the eye?

Are Senior citizens above 75 years not required to file Income Tax Returns?

“For senior citizens who only have a pension and interest income, I propose exemption from filing their income tax returns. The paying bank will deduct the necessary tax on their income,” Finance Minister Nirmala Sitharaman had said In the Budget Speech 2021-22. She had said that in the 75th year of Independence of our country, the government shall reduce the compliance burden on senior citizens who are 75 years of age and above.

Let’s understand this in detail.

- This relaxation will come into effect only from FY 2021-22, available from the assessment year 2022-23, i.e., for ITR to be filed next year.

- Senior citizens are not exempted from paying tax but only from filing income tax returns (ITR)

- The senior citizens must be residents in India and of the age of 75 or more during the financial year

- Their income should be only pension and interest income from FD(Fixed Deposit) from the same bank in which they receive the pension.

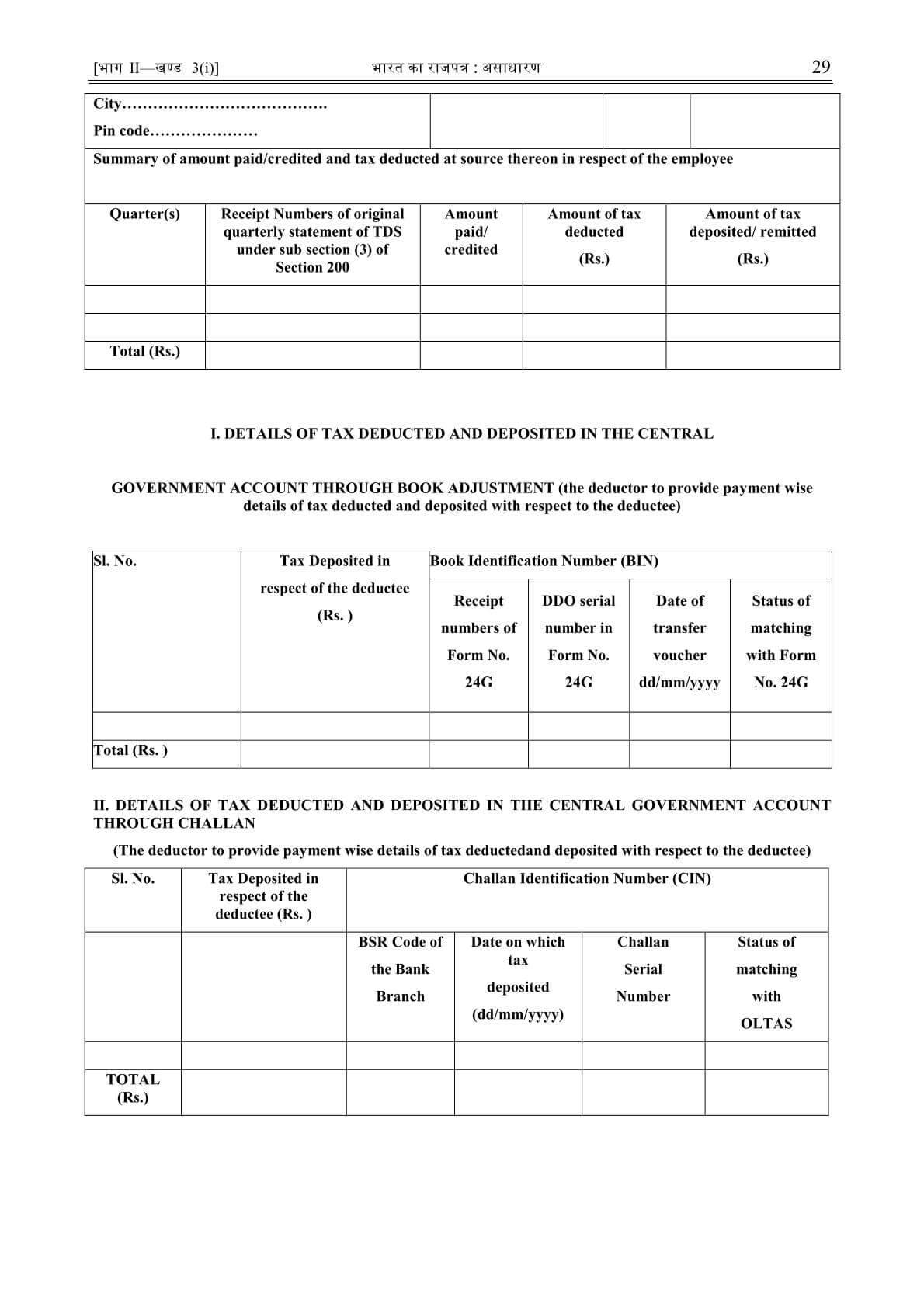

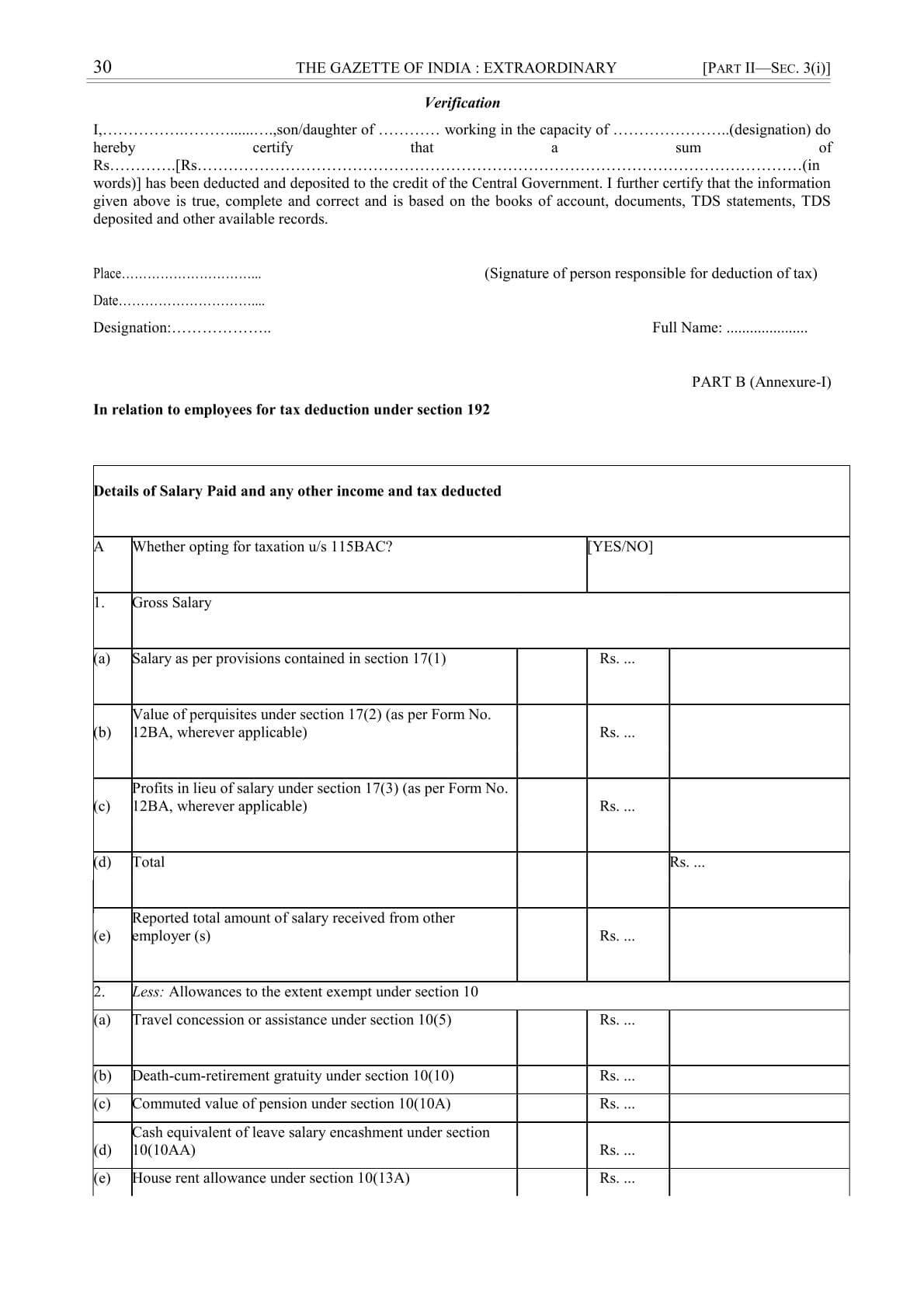

- The senior citizens, instead of filing ITR, will have to declare their income in Form 12BBA under section 194P to be furnished in paper form(offline) duly verified, (format is shown later in the article)

- ITR1 form is much much simpler than Form 12BBA. Form 12BBA has 23 pages.

- The form can only be submitted to specified banks.

Once the senior citizen above 75 years submits the form to the bank. The bank would be required to compute the income of such senior citizens after giving effect to the deduction allowable

under Chapter VI-A and rebate allowable under section 87A of the Act, for the relevant assessment year and deduct income tax on the basis of rates in force.

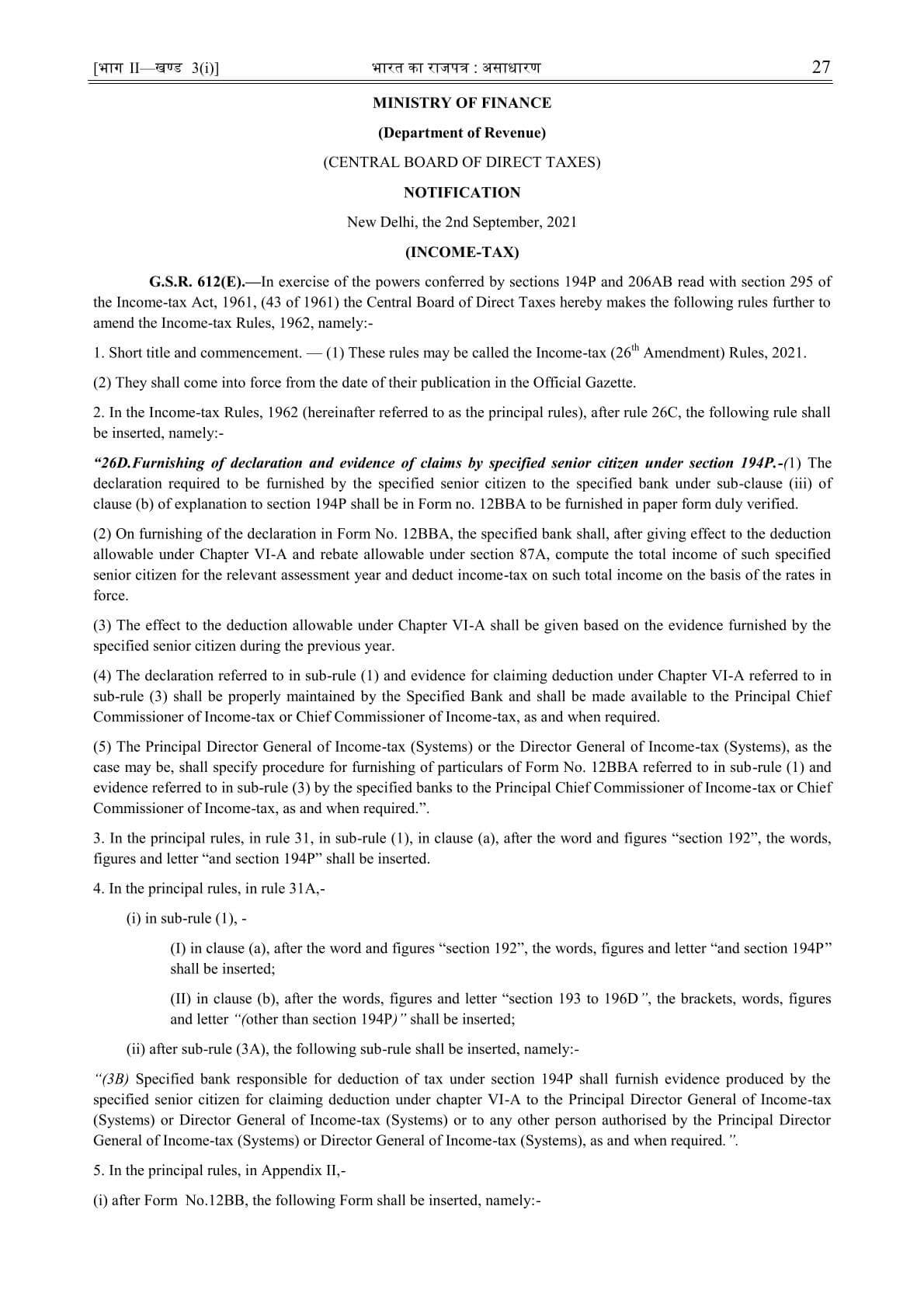

Form 12BBA for Senior citizens above 75 years not required to file Income Tax Returns

The Notification and the Form 12BBA required to be furnished for Senior citizens above 75 years are shown below. An excerpt of images is shown below

Notification

Loading…

Loading…

What Bemoneyaware thinks of Senior citizens above 75 years not required to file Income Tax Returns

We feel that the execution does not meet the intent.

- The Form 12BBA needs to be filed in paper form, details are more than in ITR.

- Banks will then have to upload the information to Income Tax Department. As the form is submitted offline, this involves manual work hence chances of manual error are high.

- In fact, it will be more painful for those above 75 years.

Related Articles

Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280

How to file ITR Income Tax Return, Process, Income Tax Notices

- How to File ITR for FY 2020-2021 or AY 2021-2022

- Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280

- How to file ITR Income Tax Return, Process, Income Tax Notices

- New Income Tax Website : Features, Benefits, Look and Feel

What do you feel about Senior citizens above 75 years not being required to file Income Tax Returns?