We regularly get queries regarding Senior citizen Fixed Deposit. My father/mother is retired. He has a fixed deposit with a bank interest of Rs 50,000 a year. Does he need to file his income tax return? Is there any way he could be exempted from taxes?

We regularly get queries like above. Fixed Deposits are very popular among retirees and FDs feature in almost every senior citizens investment portfolio. The advantages are:

- It offers a high degree of safety to funds and

- Fixed returns and banks provide senior citizens with 0.25 % to 0.50 % extra interest rates

- It also provides a good degree of liquidity as FDs can be broken at fairly low penalty rates.

But..the cons

- Interest from Fixed Deposit is fully taxable.

- TDS(Tax is deducted at Source) if interest from a FD exceeds 10,000 Rs. TDS is deducted at rate of 10%.

As interest from Fixed Deposit is taxable, this needs to be added to the Senior Citizen income. If total income for a senior citizen exceeds the exemption limit ( the income on which senior citizen does not have to pay tax) then senior citizen is required to pay tax. But if the income of the senior citizen is less than the exemption limit then senior citizen has two choices :

- Ask the bank not to cut TDS by submitting filled form 15H (pdf) to bank every April.

- If TDS has been deducted ask for refund.

In this article we shall discuss who is Senior Citizen and Very Senior Citizen, tax slabs for Senior Citizens, Fixed Deposits for Senior Citizens, Form 15H to avoid TDS, show interest in Income Tax Return and how to fill ITR form for refund.

Table of Contents

Who is senior citizen?

From Income tax perspective there are two categories of Senior Citizens given below.

- Senior Citizen: For age of 60-80 years

- Very Senior Citizen: Above 80 years

This has come into effect from FY 2012-13 was suggested in Budget 2011-12. Before the age limit to be considered a senior citizen was 65 Years.

Interest on Fixed Deposits for Senior Citizens

Banks offer a higher rate of interest on fixed deposits to senior citizens. The offering is 0.25-0.75% more than the prevalent interest rates. The minimum age to get a premium on your deposit is 60. A younger age group person can also enjoy this benefit if he opens a joint account with a senior citizen. But the deposit needs to be in the name of the elder one. How much extra will senior citizen earn, let’s see through an example Using our Fixed Deposit Calculator (In India Interest rate on Fixed Deposit is compounded quarterly)

- Senior citizen investing Rs 50,000 for a 3-year-tenure at 9.5% will get 66,266.95 on maturity

- A person invests Rs 50,000 for a 3-year-tenure at an interest rate of 9% get Rs 65,302.5 on maturity

Senior citizen will get Rs 965(964.45) more. If a senior citizen opts for quarterly payout of interest, then he earns Rs 750 more. Interest rates on fixed deposits changes from time to time. For example last year interest rates offered on term deposits were higher. At any particular time interest rate depends on

- Period or tenure of deposit ( 15 days, 1 year , 5 years etc),

- Interest paid every quarter or on maturity(cumulative)

- Amount invested (less than 15 lakh, more than a crore etc)

- Bank. Interest rate varies from bank to bank.

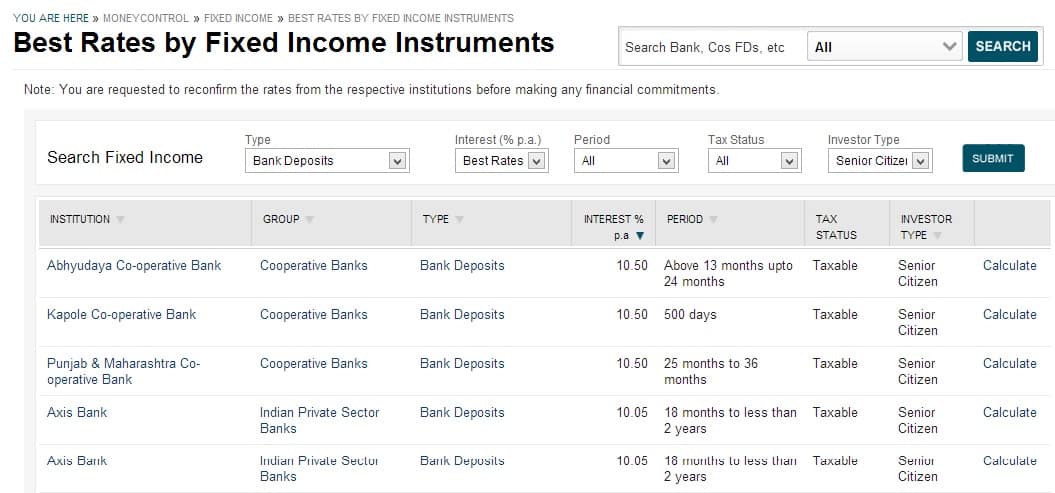

While many websites cover interest rates on fixed deposits ,but check if the information is updated. We found that Moneycontrol’s Best Rates by Fixed Income Instruments allows one to search on different parameters (Tenure, Investor Type) quite updated. To find rates for Senior Citizen choose Investor Type as Senior Citizen. In any case you are requested to reconfirm the rates from the respective institutions before making any financial commitments. (Click on image to enlarge)

TDS on Senior Citizen Fixed Deposit

Tax or TDS is deducted by the bank, if the aggregate interest income from fixed deposits that you are likely to earn for all your deposits held in a branch is greater than Rs 10,000 in a financial year whether you are senior citizen or not. If Bank deducts TDS then bank would give you FORM 16A and it would also come up in FORM 26AS. Please verify. (Avoid TDS : Form 15G or Form 15H covers the topic in detail)

TDS can be avoided by:

- Distributing FD investment: Split the FD to separate banks or branches of banks in such a way that interest earned from any of the FD does not exceed the Rs 10000 limits.

- Timing the FD: The TDS can also be saved by timing the FD in such a way that interest for any of the financial years does not exceed Rs 10000. For example, a 12-month FD of Rs 1 Lac @ 10.5% could be started in September as the financial year closes on 31st March so the interest would split in two financial years, and hence TDS could be avoided.

- By Submitting Form 15G/15H. For Senior Citizens Form 15H

Remember

- Whether TDS is deducted or not interest in Fixed Deposit is taxable ,

- Tax on FD is calculated by adding interest income from FD as income from other sources to your salary etc and then tax is calculated as per your income slab

Under the Income Tax Act, a senior citizen is a person who at any time during the previous year has attained the age of 60 years or more i.e for a person who is of age 60 but less than 80 years on end date of financial year (for 2016-17 is 31-Mar-2017) will be considered as senior citizen for that Financial Year. So

- A person who is of age between 60-80 years on 31st Mar 2017(including 31st Mar) will be considered as Senior Citizen for FY 2016-17 or Assessment Year 2017-18.

- A person who is above 80 years on 31st Mar 2017(including 31st Mar) will be considered as Senior Citizen for FY 2016-17 or Assessment Year 2017-18.

The age for Senior Citizen(and Very Senior Citizen) and the various tax slabs are announced in Budget every year.Tax slabs for FY 2016-17(AY 2017-18) is as follows.( Our article Understanding Income Tax Slabs,Tax Slabs History discusses Tax slabs etc in detail) Income Tax for AY 2017-18 or FY 2016-17

| AX | MEN and WOMEN below 60 years | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 10% tax | 250001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

| Surcharge | 15% of the Income Tax, where total taxable income is more than Rs. 1 crore | ||

| Education Cess | 3% on Income-tax plus Surcharge. | ||

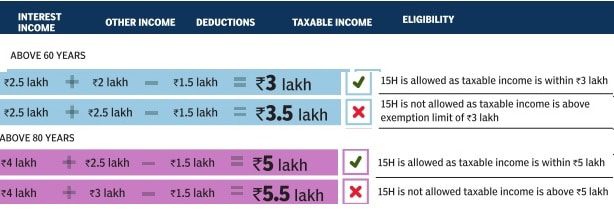

Form 15H to avoid TDS for Senior Citizen

Form 15H is a declaration made by senior citizen for Bank to not deduct tax when

- He is a senior citizen

- His estimated income in the year will be below the exemption limit.

- Has submitted PAN

- Form 15H is valid only for a year. It has to be submitted every year in the month of April for every fixed deposit whether interest is paid or not (in case of cumulative)

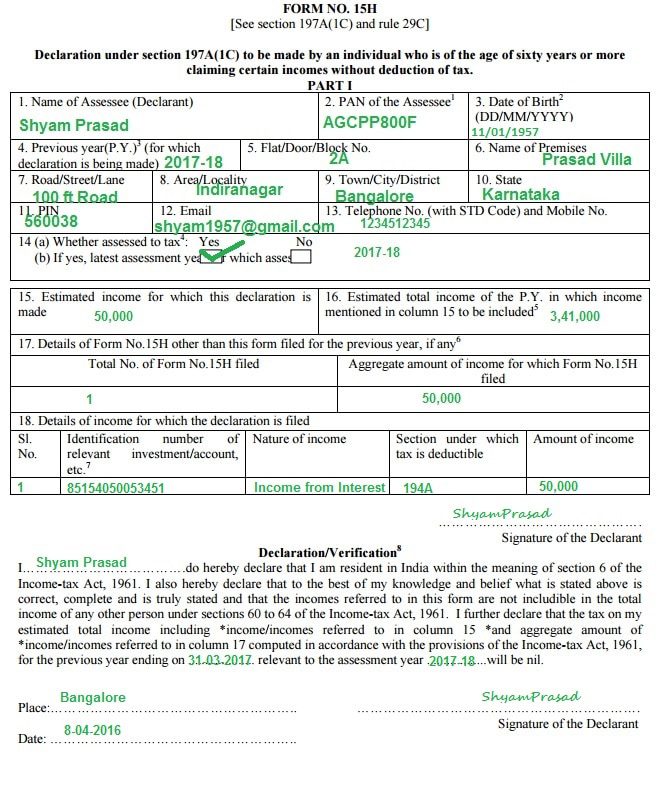

If a senior citizen does not fill form 15H, does not fill on time or due to bank officials somehow Form 15H is not considered, TDS will be deducted when interest for all one’s deposits held in a branch is greater than Rs 10,000 in a financial year. Note: interest on FD in that Financial year should be more than 10,000, it’s not the amount invested in FD or total interest earned in FD. Sample filled form for no deduction of TDS in FY 2016-17 or AY 2017-18 for Fixed Deposit interest is shown in the picture below.

PAN is necessary. If PAN is not submitted then TDS will be at higher rate and Form 15H will be invalid.

- As per section 206AA introduced by Finance (No. 2) Act, 2009 wef 01.04.2010, every person who receives income on which TDS is deductible shall furnish his PAN, failing which TDS shall be deducted at the rate of 20%(as against 10% which is existing TDS rate) in case of Domestic deposits and 30.90% in case of NRO deposits

- In the absence of PAN TDS certificate will not be issued, form 15G/H and other exemption certificates will be invalid even if submitted and penal TDS will be applicable (as per CBDT circular no:03/11)

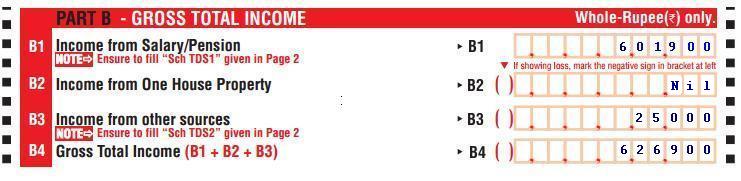

TDS and Income Tax Return If you file Income Tax Return then you need to show interest earned from Fixed Deposits and TDS.

- Interest from Fixed Deposit comes under Income from other sources.

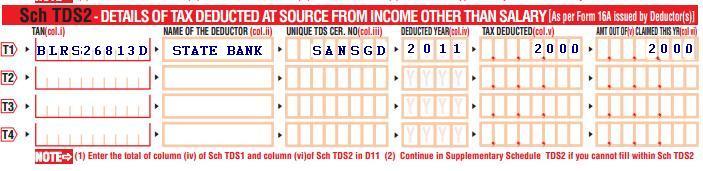

- TDS cut is shown in DETAILS OF TAX DEDUCTED AT SOURCE FROM INCOME OTHER THAN SALARY. (Note: This is as per Form 16A and is reflected in Form 26AS)

Sample images from Filling ITR-1 : Bank Details, Exempt Income, TDS Details are shown below for Mr. Mehta who had income Interest on saving bank account (Rs 5000) and Interest from Fixed Deposit(Rs 20,000) and bank deducted 10% TDS i.e 2,000 Rs on FD. (Note: These images are for ITR1 of FY 2011-12(AY 2012-13. Forms for FY2012-13(AY 2013-14) may be different).

Refund on TDS

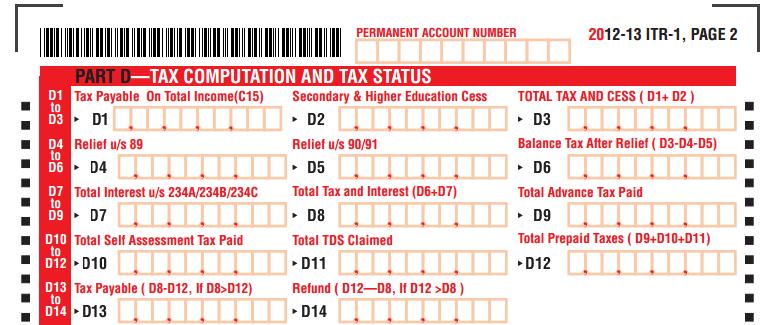

If TDS has been deducted for interest on FD and senior citizen(or any individual for that matter) is not liable to pay tax then one can claim refund on tax. Income Tax Return Form have a portion called as Tax category. Where one needs to Fill Tax Refundable in Nature of Tax in ITR. The category is based on total tax payable with and interest and total prepaid tax.

- If total tax and interest < total prepaid tax then fill tax refundable

- If total tax payable > total prepaid tax then fill tax payable

- If total tax payable = total prepaid tax then fill nil tax balance

It has to be supported by showing the tax computation and tax deducted. Which are in Part TAX COMPUTATION AND TAX STATUS of the ITR Form. For ITR 1 of FY 2011-12(AY 2012-13) parts of ITR1 is shown below.

Ref: Livemint answer on tax oninvestments for Senior Citizen (Nov 2012)

Related Articles:

- FAQ on Tax and Fixed Deposits

- Filling ITR-1 : Bank Details, Exempt Income, TDS Details

- TDS, Form 26AS and TRACE

- Advance Tax:Details-What, How, Why

- Understanding Income Tax Slabs,Tax Slabs History

In this article we discussed who is Senior Citizen and Very Senior Citizen, tax slabs for Senior Citizens, Fixed Deposits for Senior Citizens, Form 15H to avoid TDS, show interest in Income Tax Return and how to fill ITR form for refund.

If my father pension 19000 and he fix 2000000 for 5years . Then tds will apply ?

Hello sir,

If you father makes a Fixed Deposit of 20 lakhs at 7.1% every year his interest would be as given below.

As in each year amount of interest is more than 10,000 Rs bank will deduct TDS at the rate of 10%.

To avoid TDS he can submit Form 15G/15H depending on whether he is a senior citizen or not if his income is below exemption limit.

2018-2019 70640.29

2019-2020 151294.39

2020-2021 161664.63

2021-2022 173794.92

2022-2023 186467.19

2023-2024 99630.58

Iam a seniou citizen of age 75years I have a fd with bank of india.iam travelling to hongkong I need funds for my trip. My fd is maturing on 27th Dec 2017 but I require funds on 18th so will bank of india pay me the full amount or will they charge penalty.for example amount of 50000rs what I will get on 18th.you have also said that bank considers individually the case and deducted amount.plreply immedimmediatley

Sir it is best to speak with the bank Manager.

Dear Sir / Madam,

My Mother was a sr.citizen and earned interest on FD is 295000/- per year.But 10% tax is deducted from first month interest due to lack of information provided by Kotak bank staff regarding non submission of 15H .

I request you to kindly guide me how to get the interest back and how much time it will take to complete the process.

Note that only the I-T Department can give you a refund on excess TDS, not the bank. This is because the bank has already deposited your TDS with the government.

You need to file your mother’s ITR and claim the TDS deducted.

Please check that the TDS is reflecting in your mother’s Form 26AS PArt A.

Please submit form 15H ASAP so that no more interest is deducted.

Our article What to Verify in Form 26AS? explains it in detail

Sir, I am57 yrs of age and took premature retirement, from the CPF payment, I have invested, Rs.1500000 in senior citizens savings scheme in po. Now if I want to invest more, I think I shall have to open an other actt with my wife as first acctt Holder, the interest recd from this Acctt will be whose income, mine or my wife income

Sir,good afternoon,my mother is 85 years old and she is retired from central government and pensioner the bank is asking to provide pan no ,she does not have the pan card,aadhar number is already linked in the a/c,they have blocked her a/c.and also cut tdson her pension.

Bank is justified in blocking her account but why have they cut TDS on pension? Is her pension more than 5 lakh (as she is super citizen)

CBDT has amended the tax rules, and provided a deadline of 28 February to update PAN or Forms No. 60 in all the savings accounts, which are held with a bank or a post office.

Now you can submit Form No 60.

Form No. 60, which can be used in place of PAN, can be downloaded from the website of scheduled banks or the post office. These are also available at the branches of banks and post offices. Form No. 60 is a self-declaration form, where a person not having a PAN declares that she does not have a PAN card.

After this declaration, the account holder can do transactions in cash, such as depositing or withdrawing money from the account. A person furnishing the Form No. 60 needs to mention details such as: address along with a valid address proof, status of income tax assessment, and reason for not having a PAN.

Though you can provide Form No. 60 instead of PAN to comply with the rules, it is better to get a PAN. Obtaining a PAN has been made easy by enabling the online application process.

Online applications can be made either through the portal of NSDL (http://tin.tin.nsdl.com/pan/index.html) or the portal of UTITSL (http://www.myutiitsl.com/PANONLINE/). The application form has been enabled with digital signature certificate (DSC) and Aadhaar based e-signature. Aadhaar can also serve as proof of identity, address and date of birth.

Sirs, I am housewife aged 64 yrs. so far i have not paid tax. my accured interest is 68000 for the period 1.4.16 to 31.3.1917. Now i wants to pay Income tax as self assessment payer. i do not have any tax savings under 80 c. my tax comes to 56400 . if i take 1.50 tax saving 5 yrs fd can i full exemption or how much amt can i get under exemption under 80c. my husband is retired bank employee 67 yrs paying medical insurance 16000 cover for both of us . can i take it under 80 d. …..sirs, in the above case what could be the my tx burden for the fy 1916 to 1917 and how i shall i pay tax. shall i approach tax consultant in this regard…..pl. reply to my email. …rkokati@yahoo.com. ,,,k, jhansi rani wife ramarao.

My total income for the period March 16 to February 17 is Rs. 330000. I am senior citizen aged 62 years. What will be my income tax to be paid for current financial year 2016-17.

Good post, Thanks for sharing

Employee Provident Fund

epf balance

pf balance check with uan number

how to check pf balance online

epf member balance information

how to know my pf balance

epf member balance check online

epfo login

epf balance check

epf balance enquiry

pf claim status

Sir my father is earning an interest of Rs.2.4lakh from fixed deposits in bank.then how to file itr ?? Is it mandatory to disclose all information regarding fixed deposits in bank like the total amount invested in bank.

Is that the only income of your father? Does he not receive any pension or rent etc?

You need to calculate his total income

Is he less than 60 years his total income after exemptions is less than 2.5 lakh he need not file ITR

If he is more than 60 years and his total income after exemption is less than 3 lakhs he need not file ITR

Sir my father has fd in bank and past 5years he submits 15h and this financial year he forgot to fill form and he died in Aug month at date of maturity fd when I gone to bank they says tax is deducted from fd deducted amount is 12000 and he puts bond as E or S and survivor should fill 15 h or 15g and how to refund that amount sir my father get pension 1800 per month EPF pension sir pls tell how to refund it.

Good afternoon sir my name is Aleem and my question is my father has fd in bank and he every year he submits form 15h and this year he forgot to fill the form after maturity date bank people saying that tax is deducted from my father fd.and he died in Aug sir.how can my mother get refund those tax deduction sir and he put bond as E and S sold reply how to refund tax sir

My aunt is 85 years old she does not have PAN card

1)can she submit 15H form to the bank?

2)If her income on interest is exceeds than the limit, does she has to file the return or only deduction of TDS is sufficient?

Lets start with why She needs to fill Form 15H ?

When the interest on FD is more than 10,000 Rs bank deducts TDS of 10% if PAN is provided and 20% if no PAN is provided.

If you don’t want bank to cut TDS then you must provide Form 15H and a PAN.

If TDS is deducted, the only way to claim it file ITR.

See if your aunt meets the conditions

I am retired from central gov. My fd interest is more than 2.5lack year can i avoid tds/tax by giving form 15h

No Sir. As your income is above the exemption limit it is taxable so you should not submit Form 15H

Hello,

We are planning to make 1lakh FD for my mother in law who is a senior citizen and does not have any source of income. A property is on her name and she receives money from my husband for day to day expenses.

We are planning to make this FD as a substitute to medical insurance. My question is:

– Any other investment option other than an FD?

– She does not have a pan card, is it necessary to create one before making FD in her name?

– Is there any way by which we can make FD in her name without the PAN card submission requirement? (joint FD maybe where I submit my PAN card)

– Kindly suggest some banks with good interest rates?

My mother who is a senior cityzen,had no income other than two fixed deposits of 2 lakhs opened in July 14 . Unfortunately, she did not have PAN endorsed with her FD a/c ,neither had submitted 15H and the bank had ducted TDS @20.6% since Jan15 .Now that she has endorsed PAN with her a/c can she claim TDS on FD for previous years 2014-15 and 2015-16?

My mother who is a senior cityzen,had no income other than two fixed deposits of 2 lakhs opened in July 14 . Unfortunately, she did not have PAN endorsed with her FD a/c ,neither has submitted 15H and bank has deducted TDS @20.6% since Jan14.Now that she has endorsed PAN with her a/c can she claim TDS on FD for previous years 2014-15 and 2015-16?

Ammend to read,tax deducted from Jan 2015.

Hi,

My Mother-in-Law is 82 years old. She wants to sell her property and deposit 4 lakhs as FD. she does not have PAN card. Is Tax deducted for the interested earned.

She can fill Form 15H no TDS will be deducted.

If her income is interest from FD + other income is less than 5 lakh as she super senior citizen she does not need to file ITR.

hello, I am 27year old and want to do FD for my father who is 55 years and woking as business man. If I will do a FD on name of my father for rupees one lakh say then who have to pay tax for same. kindly suggest.

As you are adult you can gift money to your father.

FD interest is taxable for the person who is primary holder. So if you make investment in name of your father then he would have to pay tax on the interest earned from FD.

Infact gifting to parents

Please check out these article How gifting money to Parents helps in Tax saving in India?

Seven ways your family can help you save taxes

Sir,I M A RETIRED PERSON FROM UP GOVT OF 62 YES I’M REVIVING THE Pension from lic policy TERM 122-12 RS 4776 QUARTERLY. IS THAT TAXABLE

LIC Policy 122-12 is Jeevan Suraksha policy. LIC Jeevan Suraksha is a deferred annuity/pension plan, which allows policyholder to make provision for regular income after the selected term or after the age of retirement.

The lumpsum of 25 per cent is taxable in the year of receipt.

the pension/annuity received is fully taxable in the hands of the individual or the legal heirs

Pension received from LIC comes under Income from Other Sources.

Hello sir

My father is a senior citizen who retired in 2012.he has monthly income scheme and fixed deposit in one bank.the total income of interest is almost 200000.his pension come in other bank which is 120000.as per 2015 16 financial year senior citizen exempted from income tax if it is up to 300000.if I add both pension+interest the income goes up to 320000.since 2012 he has filed 15h form to avoid tds.now I want to know whether he I liable to pay tax.

My father is above 60 year and he has two Fd. Can he fill single form 15H for both Fd?

I am 60 years old and retired from Central Govt. service in November 2015.My yearly pension plus interest from FDs exceed Rs. 5 Lakh , and I come under the 20.6% tax bracket. How to pay self assessment tax for my income . In which months I have to deposit this tax By IT Challans in Nationalised Banks.

Sir Senior citizen don’t have to pay advance tax. So if you some tax to pay please pay it before filing your ITR, You can pay in any bank using physical challan or online. Our article Challan 280: Payment of Income Tax discusses it in detail.

I am 63 years old and retired from Central Govt. service in November 2015.My yearly pension plus interest from FDs exceed Rs. 6 Lakh , and I come under the 20.6% tax bracket. How to pay self assessment tax for my income . In which months I have to deposit this tax By IT Challans in Nationalised Banks.

I am 60 years old and retired from Central Govt. service in November 2015.My yearly pension plus interest from FDs exceed Rs. 5 Lakh , and I come under the 20.6% tax bracket. How to pay self assessment tax for my income . In which months I have to deposit this tax By IT Challans in Nationalised Banks. Interest accrued amount on senior citizen deposits scheme in Post offices & nationalised Banks is exceed Rs 10000/- Whether Interest amount is Taxable

My wife has FDs and a PAN holder.She became senior citizen on Jan 7,2016 before the maturity of FDs.If she breaks the deposits and renew for the same period, will she gets the interest 0.5% more and interest before breaking with out penalty.

My mother is a widow,aged 82, whose is living on my small financial support

and living separately in a small house. By her small savings she deposited

Rs.50000/- and Rs.25000/- fixedly for 3 years. On maturity, the bank

deducted Rs. 2763/- and Rs.1354/- towards IT from the Senior citizen who

has no income and had no PAN also. How she is able to get the Income Tex

deducted by the bank unnecessarily from the non taxable citizen.

You are right but Banks are also tied up with rules.

Banks are required to deduct TDS at 10% , if the total interest earned on your fixed deposits in a bank branch exceeds Rs 10,000 in a financial year.

Make sure than your PAN is updated with the Bank otherwise TDS will be deducted @ 20%

Please apply for PAN and file her ITR and claim the TDS deducted.

i am a retired employee. the amount received on retirement is deposited in 2 bank a/cs and is giving me int. monthly for my wife and myself which is meagre for our livelyhood. I would like to know how much can I besafe without tax. thanking you

Sir we can understand your situation, many senior citizens are in the same position.

Interest on Fixed Deposits is taxed as per the income slab.

If only income you have is interest from FD and interest from all the FD is less than 3 lakh – the interest not the FD amount then you don’t have to pay any tax.

3 lakh is basic exemption limit for senior citizen i.e above 60 years of age.

sir my father 67 after selling property want to deposit (FD)3000000/- in bank now he don’t have any income then what will be the tax on FD it is on the income interest or on all deposited amount that that means if bank giving 9%annum on 3000000 that is 270000 then he have to pay intrest on 270000 or 3270000?and how much

Interest on FD is taxable so 2,70,000 is taxable as per the income slab.

As your father is above 60 years the exemption limit is 3 lakh. So if only income is interest from FD its Tax free!

Hello sir, my father retired from a government job this year on January 2015 and was paid around 15 lakh for whom tax has already been deducted by company. My father fixed the money as FD and MIS in bank for earning on interest and submitted form 15H. But when I checked Form 26AS of my father for this year, 20k money is showing in it under 15H column in the assessment year 15-16 for money accrued during February and march 2015, for which TDS has not been deducted. ( In March beginning my father got 6k as interest and other 15k has been shown by bank by dividing the total interest on FD monthwise and shown it as earning in current year which my father didn’t get ).

So my question is whether 20k money which is showing under 26AS is taxable as extra income or non taxable.

Sir Interest on FD and MIS is taxable as per the income slab. As your father had submitted 15H form , bank honoured the wishes and informed the Income tax department that it has not deducted the interest.

The interest will be paid only when the FD matures and one can choose whether one should show interest yearly or maturity. It is recommended that one use the yearly method of reporting interest especially if the entry would be in Form 26AS i.e for interest above 10,000.

On the retirement money that your father received you have to see how much is taxable ex gratuity, leave encashment and then arrive at the income from salary and exempt income.

But its just two months after retirement Feb and march 2015, which came under last financial year. So do you suggest whether that 15K which my father has not got, but is shown on 26 AS – Should father give tax on that 15K or not.

You father should include entire 21K as income from Other sources and calculate tax libility

My father’s age is 65 means he will be coming under senior citizen slab. He is getting pension + interest on fd( income from other source). Qus is when sumitting ITR how/where to get relaxed hra/medical amount or it is not applicable for senior citizen.

Sir other than basic exemption limit the process for filling ITR remains same for senior and non senior citizen.

Even for non-senior citizen HRA can be claimed if not in Form 16 . Claiming HRA is explained in our article

Medical insurance can be claimed, not medical bills.

Our article How to Claim Deductions Not Accounted by the Employer explains it in detail

My parents are senior citizen and they are depending on me, and they are not in tax payers band. My question is that if i gifted money (say l lakhs) to my parents and they deposited the money in their names in bank, then is it possible to show gifted 1 lakhs in 80C section(My 80C limit is not crossed) for me to show as an investment?

Sadly No, you cannot claim gift under 80C deduction

Sir,

My wife and I both are Sr.Citizen over 70 yrs.i am retd.no pension depending on my 2 sons financial help.my wife a post surgical patient, me and my wife spend over 10K on medicines/Diagonistic /month. My only asset my flat I intend to sell out could fetch 1.5 cr. in present market price( was bought 20 yrs. back for 7 lacs. only)I would klike to keep this entire money in FD and live till we survive on the interest of te same. kindly let me know the ideal tax plan to save for the best monthly retun for Med.Expense and our daily requirements. The FD will be equally shared by our 2 sons after our demise as per my Will. Thanking you, with best regards, S.K.Bose.

I have opened an FD in the name of my father from my account . Will I be tax liable for it?

If the FD auto renews itself the next year , then who will be tax liable?

No as you are adult you can say you have gifted the money to your father.

FD is in your father’s name, PAN number would be of father.

Your father can avoid TDS if he submits form 15G/form 15H to bank

Dear Sir,

If any senior citizen give a loan to a Proprietorship firm and charged a interest of Rs. 30000/- in a f.y. so please advise me TDS deducted by the firm or he submit Exepmtion Form.

Hi,

My mom is a senior citizen and she has some FDs in her bank account, around 4 lacs. There is no other income but she is living with my sister who has a job. Would any TDS be deducted from her FD interest. What is the threshold at which she has to pay TDS? Also would my sister’s income affect her TDS since they live in the same household. I am not in India and I have no clue about India’s tax laws. Just wanted to help my mother to make good financial decision. Thanks a lot for providing help on this matter. Your website is very much organized and has good information.

Thanks Sapna. Good you have started to take interest in your mother’s financial affair.

Coming to your questions

1. TDS is deducted if interest from FD ia a bank branch is more than 10,000 in financial year which is 1 Apr – 31 Mar of next year. Rate of deduction is 10% with PAN submission and 20% without PAN.

2. Interest on Fixed Deposit is calculated based using quarterly compounding(if she is not taking monthly/quaerterly interest) and depends on amount, time period and interest rate.

Assuming that she has invested 4 lakh for 1 year at 9% , using our FD calculator

the interest amount turns out to be 37233.33 which is more than 10,000 so bank will deduct TDS.

3. Person who is the first holder of FD has to pay interest on Income from interest on FD. So has she opened FD in her name with your sister as second holder or your sister as nominee.

If your sister is second holder then your sister will not have to pay tax on interest income. If your sister is the first holder then that’s a different matter.

4. If only income your mother has is interest from FD or if her income is less than the exemption limit for paying tax then two scenarios come :

a. For the TDS which has been deducted for last year she need to file Income Tax Return (ITR) and claim Refund.

b. For the current financial year she should submit Form to the bank to ask them not to deduct TDS. Form is 15H or 15G depending on whether she is senior citizen or not.

Is your mother a senior citizen i.e is she above 60 years? There is another category called Very Senior Citizen for those above 80 years.

Sadly we are not taught about tax laws in colleges so it’s okay if you don’t know. (I am still learning and I have been working since last 15 years :-))

Please ask any point which is not clear to you. Our purpose of starting the blog is to help increase the awareness to money related matters.

Thanks a lot.Much useful to Sr.Citizens

Just to confirm what has been said in this article…I have a joint account with my mother who is a Senior citizen. The first name in the account is mine. She has opened a FD for Rs 1,00,000 in the account in her name and has submitted form 15 H. Would the interest generated from the FD be taxable if my mothers income for the year is less than 2.5 lakhs. Would I be liable to pay tax om the interest form this FD. ?

I am confused who has first name in your FD?

If it’s you – you will have to pay tax on interest if it’s your mother – she has to pay .

If she has opened FD in her name and has submitted for 15H TDS will not be deducted on her interest earned. If her income is less than 2.5 lakh.

You cannot pay for tax on income of some other. Whether your mother has earned it herself or you gifted her.

Thanks for the reply Kirti..The FD is in my mothers name and her income is less than 2.5 and has submitted 15 H. Then as per your reply no TDS will be deducted and she won’t have to pay income on the interest on the FD…

Yes Gagan your mother, a senior citizen (between 60 years-80 years) will

not have to pay income tax on interest earned in FD if her income is less than 2.5 lakh

If she has submitted form 15H and has PAN card bank should not deduct TDS . Is she doesn’t have PAN card then bank would deduct TDS at 20%

She needs to fill form 15H every year and hope that bank does not goof up.

sir my clients invested above 30 lakhs, he is senior citizen, this year intrest income above

RS.250000/- he is submmited form 15h but the company say form 15h not applicable

we will cut 10% TDS, IF THERE IS ANY RULES KINDLY LET ME KNOW

THANKS

We have a question regarding “he is submmited form 15h but the company s” is it a bank or a company fixed deposit?

As senior citizen interest income only is more than 2.5 lakh taxable limit for FY 2012-13 bank will deduct the 10% TDS. That’s the rules. You can read about the rules

at IDBI webpage also

Hi,

My father is 61 & mother is 59. They both used to have PPF accounts (both being non-salaried). Upon maturity they withdrew the money and put it in an FD.

(10 lacs each)

I would like to know if there is a better way to invest this money for them to get good returns minimizing their taxes since they will both stop earning income in next 4-5 years.

Are there any pension plans / fixed income gurantee plans with minimal risk that exist?

Aparna first of all it’s good to know you are helping your parents with their financial matters.

it is difficult to answer with limited information about your parent’s finances.

Questions like : would parents get the regular income (pension) after retirement, how will they manage their day to day expenses, why did they withdraw from PPF when they could have extended it for 5 years? Did they not need money (On Maturity of PPF account)

why invested in Fixed deposit as interest of fixed deposit is fully taxable (Fixed Deposits and Tax)

their liabilities, responsibilities

You need to sit down with your parents and make a plan which takes into account their risk profile, liquidity needs and returns. (Beginner to Investing – Approaches, Plan, Psychology). Some links to help you

Investment after Retirement

Best investment options for senior citizens in India for 2013

A checklist of investment options for senior citizens

very well written…U have covered all the important aspects of this scheme…thnx for sharing your knowledge with us…

Regards

Thanks for sharing kind words with us! We strive to provide as much information as possible!

Nice info.Might help lot of senior citizens. Thanks and Keep Sharing.

Thanks Vishal, I hope the blog article serves it purpose