What are the components of Salary, How is take home salary calculated? What are different kinds of allowances, what is Dearness allowance, What is the salary of a Government employee, what is 7th pay commission? This article tries to answer these questions.

Table of Contents

Components of Salary

Money that is received under Employer-Employee relationship is called as Salary. If one is freelancer or is hired by an organization on contract basis, their income would not be treated as salary income. In such case the income is treated as income from business and profession. The salary consists of following parts.

- Basic Salary: As the name suggests, this forms the very basis of salary. This is the core of salary, and many other components may be calculated based on this amount. It usually depends on one’s grade within the company’s salary structure.It is a fixed part of one’s compensation structure. Many allowances and deductions are described in terms of percentage of the Basic Salary. For example Your PF is deducted at 12% of your Basic Salary. HRA is also defined a percentage of this Basic Salary.

- Allowance: It is the amount received by an individual paid by his/her employer in addition to salary to meet some service requirements such as Dearness Allowance(DA), House Rent Allowance (HRA), Leave Travel Assistance(LTA) , Lunch Allowance, Conveyance Allowance , Children’s Education Allowance, City compensatory Allowance etc. Allowance can be fully taxable, partly or non taxable.

- Perquisite: Is any benefit or amenity granted or provided free of cost or at concessional rate such as Rent free unfurnished house, Rent free furnished house, Motor car facility, Reimbursement of Gas, Electricity & Water, Club facility, Domestic Servant Facility, Interest Subsidy on Loan , Reimbursement of medical bills, Reimbursement of Hospital bills, Reimbursement of telephone bills, Benefits derived by employee stock option, and so on.

The whole amount is spilt into basic pay and various allowance,to provide the tax benefit to employee.

Gross Salary : Salary before deductions is called as Gross Salary.

Deductions : Certain deductions are available from the gross income, under such as tax- saving deductions under Income tax sections 80C to 80U. Some examples are contributions to provident fund, payment of Life Insurance Premium, subscription to certain equity shares or debentures, bank deposits under notified scheme,etc. Deductions can also be claimed against medical expenses of your dependants. Professional tax is also allowed as a deduction from your salary income.

Your Take-home salary will include

- Gross Salary received each month

- minus allowable exemptions such as HRA, LTA, conveyance allowance etc.

- minus income taxes payable (calculated after considering Section 80 deductions)

Example of Take Home Salary from our article, Salary, Net Salary, Gross Salary, Cost to Company: What is the difference, is shown below

| Component of Salary(per annum or p.a) | Amount |

| Basic Salary | 480,000 |

| Dearness Allowance | 48,000 |

| House Rent Allowance | 96,000 |

| Conveyance Allowance | 12,000 |

| Entertainment Allowance | 12,000 |

| Overtime Allowance | 12,000 |

| Medical Reimbursements | 15,000 |

| Gross Salary | 6,75,000 |

Your Cost to Company (CTC) includes

- Salary received each month

- Retirement benefits such as PF and Gratuity

- Non-monetary benefits such as an office cab service, medical insurance paid for by the company, or free meals at the office, a phone provided to you and bills reimbursed by your company.

Benefits vary from company to company. Example of benefits for the above employee are:

| Medical insurance | 2000 |

| Provident Fund (12% of Basic) | 57,600 (12% of 4,80,000) |

| Laptop | 50,000 |

| Total Benefits | 109600 |

| Cost to Company=Gross Salary + Benefits | 6,75,000 + 109600=7,84,600 |

Allowances

Allowance is defined as a fixed quantity of money or other substance given regularly in addition to salary for meeting specific requirements of the employees. Some allowances are taxable,some are partially taxable and some are tax free. There are various Kinds of Allowances that one can get under the Head Salary. Some popular Allowances are

- House Rent Allowance or HRA : The allowance is for expenses related to rented accommodation. Salaried individuals who live in a rented house/apartment can claim House Rent Allowance or HRA to lower taxes. This can be partially or completely exempt from taxes.

- Conveyance allowance is given to employees to meet travel expenses from residence to work. The conveyance allowance for up to Rs.9,600 per annum is exempt from tax. Starting FY 2015-16, this limit has been increased to Rs.19,200 per annum.

- Leave Travel Allowance: Salaried employees can avail exemption for a trip within India under Leave Travel Allowance. The exemption is only for shortest distance on a trip. This allowance can only be claimed for a trip taken with your spouse, children and parents, but not with other relatives.

Income Tax webpage talks of the Allowances available to different categories of Tax Payers, what are the exemptions available on Allowances, under which section of Income Tax Act.

What is Dearness Allowance?

Dearness Allowance is allowance is paid to the employee against the price rise in country economy i.e to mitigate the impact of inflation.In India the Dearness Allowance (DA) is a cost of living adjustment allowance paid to Government employees, Public sector employees (PSU)and pensioners . It is taxable. Dearness Allowance is calculated as a percentage of an basic salary.The guidelines that govern the DA vary according to where one lives (for example, whether rural or urban). The Dearness Allowance was introduced following the second World War, and was then known as the Dear Food Allowance.

Central Pay Commissions

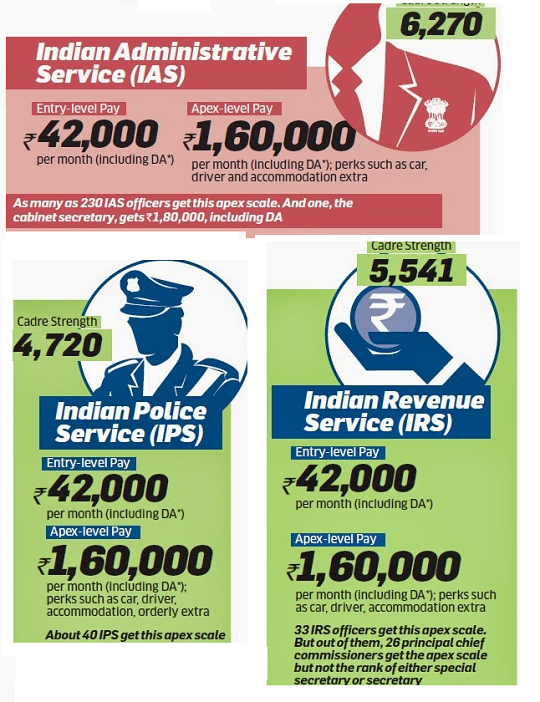

The government constitutes the Central Pay Commission(CPC) almost every 10 years to revise the pay scale of its employees and often these are adopted by states after some modifications. Unlike in the private sector, the pay hike in government is a once-in-10-years-affair, making CPC, right from the first that submitted its report in 1947, a hugely powerful agency. Yes Government employees have to undergo an annual appraisal process called Annual Performance Appraisal Report (APAR), but that exercise is only for promotion, and not for any pay hike. Government employees do get a regular hike in dearness allowance, a measure meant for offsetting inflationary pressure on their earnings, but at the end of the day it is the CPC that fixes the bureaucrats’ pay for 10 long years. Image below shows the salaries of some of the Government officials, Reference Times of India.

Initially DA was given in response to demand of employees for wage revision, however later it was linked to Consumer Price Index. Our article Understanding Inflation covers Inflation,WPI & CPI in detail. In the past various committees have been constituted to look into the issue of payment of DA to Central Government employees. That’s precisely why officers and staff of every service can’t afford to ignore the CPC. An overview of the various Central Pay Commissions is given below. For detailed information,read Wikepedia’s Pay Commission

| Central Pay Commissions | Date of Appointment | Date of Submission of Report | Highlights |

|---|---|---|---|

| First Pay Commission | May, 1946 | May, 1947 | |

| Second Pay Commission | August, 1957 | August, 1959 | |

| Third Pay Commission | April, 1970 | March, 1973 | Payment of DA whenever the CPI rose by 8 points over the index of 200 (with base 1960 = 100). The extent of neutralisation granted with effect from 1-1-1973 ranged from 100% to 35% |

| Fourth Pay Commission | June, 1983 | Three Reports submitted in June, 1986; December, 1986 and May, 1987 respectively |

Implemented with effect from January 1, 1986.The grant of DA on a ‘percentage system’ of the basic pay (1986).It also recommended payment of DA twice a year; 1 January and 1 July.Each instalment of DA was to be calculated with reference to the percentage increase in the 12 monthly average of All India Consumer Price Index (base 1960). The extent of neutralisation now ranged from 100% to 65%. |

| Fifth Pay Commission | April, 1994 | January, 1997 | Implemented with effect from January 1, 1996.It looked into the issue of differential neutralisation and found it to be injustice to senior officers and recommended uniform neutralization of 100% to employees at all levels. The Commission had suggested that dearness allowance should be converted into dearness pay every time the cost of living rises by 50% over the base level. |

| Sixth Pay Commission | October, 2006 | March, 2008 | Implemented with effect from January 1, 2006, .Recommended revision of base year of the Consumer Price Index (CPI) as frequently as feasible.It also changed base year for DA calculation to 2001 (base year 2001=100) |

| Seventh Pay Commission | Feb, 2014 | Before Dec 3015 | Scheduled to take effect from January 1, 2016. |

Seventh Pay Commission

The Seventh Pay Commission was set up by the government to revise remuneration of about 48 lakh central government employees and 55 lakh pensioners. It’s mandate is to recommend pay, allowances and the like for Central government employees for a decade beginning January 2016,keeping in view the nation’s economic conditions and the need for fiscal prudence . Employees in union territories, regulatory bodies (except the RBI), Supreme Court and pensioners to be covered. It was constituted in February 2014. Expected to submit its recommendations by Dec 2015. Revised pay to be effective from January 1, 2016. Meena Agarwal is the secretary of the Commission. Other members are Vivek Rae, a retired IAS officer of 1978 batch and Rathin Roy, an economist.

The 6th Pay Commission played a key role in insulating the Indian economy from the shocks of the Lehman crisis of 2008. Salaries of government employees went up by an average of 35 per cent on the back of the 6th Pay Commission recommendations; employees also got arrears for more than 30 months because of the delayed implementation of the 6th Pay Commission in October 2008. According to Bank of America Merrill Lynch, higher salaries – resulting from the implementation of the 6th Pay Commission, drove two-wheeler and car sales, and led to a recovery in cement demand. The arrears resulted in robust demand for consumer discretionary products that resulted in sustained stock performance over 3-5 years.

Seventh Pay Commission impact will be two fold,

- How the implementation of Seventh Pay commission for Government employees will boost the spending ability of Indian Middle class thereby boosting the economy.

- At the same time jump in compensation in one shot there is the fears of inflation rise and fiscal pressure for government.

There’s no consensus about how much salaries will go up , Bank of America expects a modest 15 per cent increase, while Religare expects salaries to go up by 28-30 per cent. Credit Suisse says salary hikes can be as high as 40 per cent.Economists, however, agree that the 7th Pay Commission will help kick-start the domestic economy, which continues to be plagued by weak demand and excess capacity. For details one can read the article How the 7th Pay Commission can fire up the Indian economy- NDTV Profit

Salary of Government Employee

Central government salary is divided into various pay bands. Government employees’ gross salary is sum of different components. Typically Government salary is expressed as Rs( 5240-20000) + Grade Pay of Rs 2000 + central govt allowances. Ref Quora

- Basic Pay ex: Rs( 5240-20000). Number1 ex 5240 : It is the basic pay at which your salary is calculated when you are appointed. Number2 , 20000,: It is the maximum basic pay a person can receive in a designated post.

- Grade Pay :Apart from basic pay, government employees receive grade pay which depends on the category/class of employee. The sum of basic pay and grade pay is used to calculate dearness allowance and other allowances.

- Dearness Allowance :The Dearness Allowance(DA) is a cost of living adjustment to allowance. It is calculated as a percentage of (Basic pay + grade pay). Dearness allowance is updated every quarter of calendar year to compensate for inflation in consumer price index. It may increase or decrease depending on inflation rate. (Decrease in DA is rare).

- House Rent Allowance :House rental allowance(HRA) is allowance paid for house rent. It depends city to city. Cities are classified as X, Y and Z, on the basis of their population, as recommended by Sixth Central Pay Commission in 2008. HRA is also used by the Indian Revenue Service(IRS) to provide income tax exemptions.

- Other miscellaneous allowances : Miscellaneous allowance(MA) includes phone allowance, shift allowance, travel allowance etc.

- Percent – To compensate for inflation, an increment is added to your basic pay after a fixed period. This increment is in percent of your current basic pay and the fixed period is usually a year.

It means salary will be calculated as (Basic + grade pay)+DA+HRA+MA. Presently, DA is around 110%, HRA may vary from 10% to 30% and MA can vary widely.

Assuming DA=110% HRA=20% MA=40%

- Basic pay = 5200-3%-20200

- Grade pay =1800

- Gross monthly salary = (5200+1800)+(7000*1.10)+(7000*0.2)+(7000*0.4) = 18900

- Your net salary (that is your in hand salary) will be a little less due to PPF and other deductions. It is about 15-20% roughly. So net salary will be around Rs. 16000 per month.

This salary will change after every three months due to change in DA. After 1 year of service, your basic pay will be 5200*1.03 = Rs.5356. This increase in basic pay will continue every year till it reaches 20200 limit. But most likely because one gets promoted to higher designation within first 4 years of service. And this cycle will continue with different basic pay limits. Though Basic pay changes after every promotion, Grade pay may or may not change with change in designation.

Various Pay Bands in the Government Salary as per 6th Pay Commission from 90paisa.blogspot.in’s Expected Pay Structure Of 7th cpc is given below

|

6th CPC PAY STRUCTURE

(2006 – 2015) |

||||

| Pay Band | Pay Bands | Grade Pay | Pay in the Pay Band | Pay Scale |

| PB-1 | 5200-20200 | 1800 | 5200 | 7000 |

| PB-1 | 5200-20200 | 1900 | 5830 | 7730 |

| PB-1 | 5200-20200 | 2000 | 6460 | 8460 |

| PB-1 | 5200-20200 | 2400 | 7510 | 9910 |

| PB-1 | 5200-20200 | 2800 | 8560 | 11360 |

| PB-2 | 9300-34800 | 4200 | 9300 | 13500 |

| PB-2 | 9300-34800 | 4600 | 12540 | 17140 |

| PB-2 | 9300-34800 | 4800 | 13350 | 18150 |

| PB-3 | 15600-39100 | 5400 | 15600 | 21000 |

| PB-3 | 15600-39100 | 6600 | 18750 | 25530 |

| PB-3 | 15600-39100 | 7600 | 21900 | 29500 |

| PB-4 | 37400-67000 | 8700 | 37400 | 46100 |

| PB-4 | 37400-67000 | 8900 | 40200 | 49100 |

| PB-4 | 37400-67000 | 10000 | 43000 | 53000 |

Related Articles:

- Pay and perks of Indian MP, MLA and Prime Minister

- What is Leave Travel Allowance or LTA

- Understanding Variable Pay

- Understanding Form 16: Part I

- How To Fill Salary Details in ITR2, ITR1

- HRA Exemption,Calculation,Tax and Income Tax Return

[poll id=”76″]

Hope this article helped in understanding components of Salary and How Government Salary is calculated and why there is so much talk about Seventh Pay Commission. Do you think Government Job is better than Private Job? Why or Why not?

12 responses to “Salary,Allowances,Dearness Allowance,Government Salary, Pay Commission”

sir 6th pay commission APAR mae grading average mila ho toa department permotion ho jate hen

I am working in a private organisation My basic pay is 8,578 and Gross is 19,250, How can I calculate Scale of pay/Pay Scale, what is my Grade pay and what is the meaning of Grade pay? What is the “5200-20200”?

Hi there, I read through a few of your articles here. I did have a question though that I hope you could answer.

I was wondering, Can off-duty police officers have the same authority as on-duty officers?

I’m about to get hired as an officer so It’s something I’d like to know.

I would really appreciate any help you could give me!

how many percentage of basic salary should be given as a TA to employee.

My basic pay is 4440-7440 and grade pay is 1300.

What wipp be my in hand pay?

Hi I’m a assistant teacher in a public school.. My salary was told 12000 pm.. School deducted rs 1500 saying it’s conveyance charges but I use my own conveyance ..also 10% TDS is deducted.. Plz explain why 1500 deducted.

Its better you ask the school.

Conveyance allowance, also called Transport Allowance is a type of allowance offered to employees of a company to compensate for their travel from residence to and from respective workplace location. In general, conveyance allowance is paid by an employer only if the there is no transportation provided by the employer. In case an employer offers office transport, conveyance allowance will not be provided to employees.

So if the school is providing you transport and you are not taking it then they can say you are not using school transport.

Conveyance allowance is given an exemption of up to Rs.19,200 per annum or Rs.1,600 per month. The sections under which this exemption is applicable are Section 10(14)(ii) of Income Tax Act and Rule 2BB of Income Tax Rules.

Before April 2015, the conveyance allowance taxation exemption limit was capped at Rs.800 per month or Rs.9,600 per annum.

They should not deduct TDS at 10% as your total income is less than taxable limit.

Just awesome topic! Unfortunately, I found this article too late – I already found the answer on another service. By the way, if anyone is facing a problem of filling DS-5504, I’ve found a template here

https://goo.gl/NRtwAU. You also can esign the form and fax it.How to calculate ctc if employer is giveing loan repayment benefit?

How to decide CTC for a new employee. & i need ctc breakups . I m a new employee in HR plz,

CTC would generally include the following cash, non cash and perquisite-based components:

* Components of the salary like Basic, DA, HRA, Allowances

* Perquisites and Reimbursements given to employees (i.e.) – bonus, incentives, reimbursement of conveyance/medical/telephone/, benefits extended through various schemes like housing/vehicle/furniture/ Air-conditioners etc.

* Contributions that the company makes for the employees like PF, Super Annuation, Gratuity, Medical Insurance, etc.

* Reasonable estimates of Leave Encashment, Stock Option Plans and Non cash concessions

* Fringe Benefit Tax on Stock Option plans only.

And would not include

* Gifts and Promotional items

* Overhead costs of the company

* Adhoc payments and commissions

Here are some tips to Structure the CTC of your employees:-

* The breakup of the CTC needs to be clearly mentioned in the appointment letter to the employee.

* Frequency of payment (Monthly, Quarterly, Annual..), Variability and calculation logic is to be explained in the appointment letter and/or the policies of the company.

* Base pay needs to be differentiated from performance and variable pay

* Cash, Non-cash components and perquisites have to clearly identified

* If the employer is offering a Flexible benefit plan the rules for availing the Plan have to be clearly mentioned.

* Include reasonable and actual cost to the company for Non cash benefits like Canteen Facility, Recreation and Entertainment facilities, Gratuity and Super annuation benefits.

* Check for the wage rates as per The Minimum Wages Rules of the State.

* Compare the tax benefits of House Rent Allowance vis-à-vis Company leased accommodation.

* Finally it helps to keep the CTC Structure simple

thank you