What are Robo advisors? How is Robo Advisor different from Human advisors?Are Robo advisors safe? How do Robo advisors work? This article answers such questions.

Table of Contents

What are Robo Advisors?

Robo-advisors

- Provide financial advice or manage portfolio online with minimal human intervention.

- Provide advice based on lots of data using mathematical algorithms.

Why are Robo Advisors needed?

When one starts investing one has two options to choose from:

- Do it yourself. Read books, Google, get information and then somehow invest.

- Get a financial advisor. When you try to get a financial advisor

- Many have minimum asset requirements or more. These requirements put many financial advisors out of reach for younger and individuals who want to invest small amount.

- Are they wolf in sheep clothing? Most financial products such as mutual funds or insurance are sold by those who rely on commissions from selling the product. So one is not sure if the product they are suggesting is for your good or their own good. Banks and wealth management firms and private banker cater to sophisticated clients but are have to meet their targets. This results in mis-selling, and one ends up having unsuitable and many times unaffordable products.

Now there is another choice that of RoboAdvisors. While one may argue that Robo-advisors are not perfect, it is better than the advice which most individuals have, which is nothing! One gets some logical advice and one is saved from mis-selling to some extent.

Difference between Financial Advisors and Robo Advisors

Let’s see How does a Financial Advisor work? A financial advisor offers financial advice to his clients for a fee.

- The process starts with the advisor sitting with the investor to discuss income, expenses, loans, tax saving and financial goals.

- The financial advisor does some risk-evaluation and comes up with a plan.

- The financial advisor may also help the investor with investing.

- This is not a onetime activity. For the advice to be effective, the financial plan has to be evaluated at least once a year. Changes might have to be made based for example if equity market has run up and its weightage in investor’s portfolio crosses maximum limit the amount may have to be moved to debt schemes.

- To really serve investor interests well, the financial advisor also needs to play psychiatrist when the market’s going down to keep the investor from straying off track.

The difference between Traditional Advisors and Robo Advisory are given below

| Robo Advisory | Traditional Advisors | |

| Advise | Powered by machine learning & deep industry Insights Advice based on future potential |

Limited views.

Advice based |

| Emotions | No emotional bias | Risk of emotional bias |

| Follow-up | Auto- notification to rebalance portfolio |

May or May not get |

How do a Robo Advisor works? ARQ from Angel Broking.

To talk about Robo Advisory We will take the example of ARQ of Angel Broking to understand the approach better.

A robo-advisor can crunch huge amount of data to assess your risk profile, take the emotion out, automatically rebalance your investment portfolio, and deliver transparent reports.ARQ from Angel Broking uses high-end computer programs that

ARQ from Angel Broking uses high-end computer programs that analyses lots of past data and explores future potential using sophisticated algorithms. It also interprets investors data and tabulates his responses to give a unique solution. So it takes emotional bias out of investing. ARQ offers recommendations for both Stocks and Mutual Funds. All Angel Broking Customers can access ARQ using Angel Eye or the Angel Broking App.

Once an investor starts using ARQ, it takes input from investor to understand his risk profile and period of investment. It then provides recommendations on a periodic basis. There is no fee or minimum investment amount. ARQ is an advisory product & not a PMS product.

So Execution of the recommendations is up to the investor but through Angel Broking platform. Once the investor receives the recommendations, he decides to go ahead with the recommendations or not

How does ARQ give you recommendations?

As mentioned earlier ARQ uses high end computer programs that analyses lots of past data and explores future potential using sophisticated algorithms. It also interprets investors data and tabulates his responses to give a unique solution. For example, SBI may be a good investment idea for Investor X but Yes Bank may be a better choice for Investor Y. This is ARQ’s key differentiator.

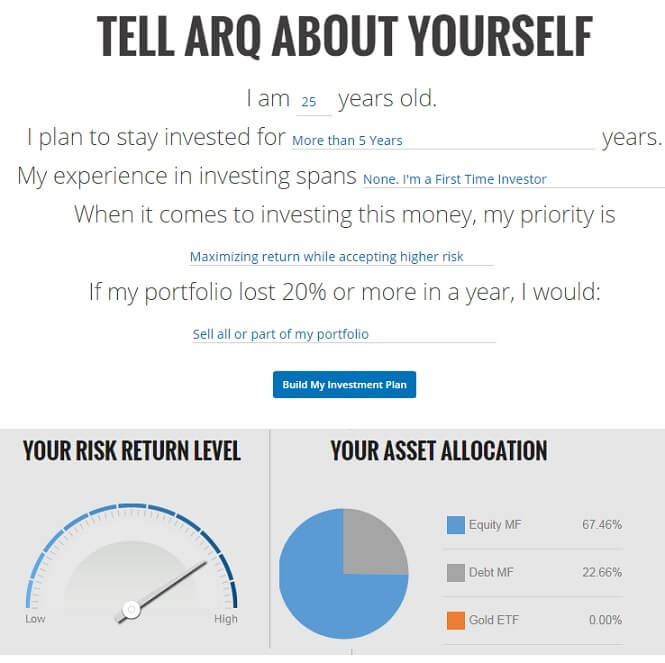

You can also experience ARQ by clicking here. We plugged in details for a 25-year-old who can invest for more than 5years and ARQ advised asset allocation as shown in the image below.

How does Robo Advisor recommend?

Let’s look at how ARQ advises

ARQ Advisory is based on a model whose performance has been optimized to provide recommendations with high outperformance and strike rates. The model has been tested using scientific back-testing and has also been validated based on its track record. The model has been calibrated to take advantage of the upticks in the stocks or mutual funds during an investment period. ARQ’s performance test results are available for you to examine before you take the plunge with your hard-earned money.

Let’s look at ARQ Mutual Fund Schemes Performance

Without ARQ’s advice you might end up buying under-performing MF schemes as the traditional methods of MF selection have proven to be inadequate:

- In last 5 years, Top 10 MF schemes gave 14% returns while Bottom 10 schemes gave 5.1% returns.

- Size didn’t matter. The 5 largest schemes in 2013 were not even in the Top 50 performance charts over the next 3 years.

- Past performance did not equal future performance. Top 5 schemes between 2006-11 were nowhere near the top between 2011-16. In fact they lagged behind the 2011-16 top performers by more than 30%.

- Holding the same scheme for years at a time was not the ideal strategy. Over the last 4 years, only one scheme held onto its Top 3 position for 2 consecutive years, while ten other schemes featured in the Top 3 only once in the last 4 years.

So are Robo Advisors good?

A Robo-advisor is a good if you:

- Are Young or are ready to invest in stocks and mutual funds.

- Lack Investment Experience and are not sure about where to begin.

These Robo advisories don’t cost much to use and are a good starting point.

As you become more experienced and understand the way stock market and mutual fund works you could always try other approaches. Remember these services are not perfect but their recommendations would be better than throwing dart in dark or chasing top performers or being mis-sold.