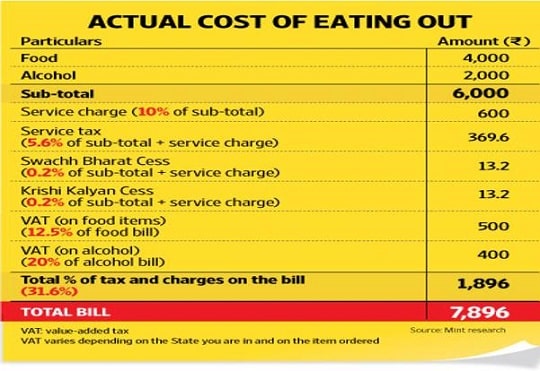

The Department of Consumer Affairs has clarified that the practice by restaurants of adding service charges often ranging between 5 to 20 percent in lieu of tips isn’t mandatory and hence can be waived by the consumer if he is not happy with the services provided by the restaurant. For instance, if your total bill at a restaurant comes to Rs.6,000, you may end up paying Rs.7,896, post charges and taxes, a 31.6% increase in the bill. So It is important to understand the different taxes on Restaurant Bill such as Service Tax, Swachh Bharat Cess, Krishi Kalyan Cess, VAT, and charges. It also explains the difference between the service charge and service tax.

Table of Contents

Breakup of Restaurant Bill

An example of Restaurant Bill is given below which shows how a Resturant Bill is taxed. Bill is defined as a statement of fees or charges which contains the list of items along with their prices that is provided from the seller to the buyer regarding the products bought by the buyer. Our article Bill,Invoice, Receipt and Voucher discusses the differences between the words bill, voucher, invoice, and receipt.

Service Tax and Restaurant Bill

The Central government levies several taxes, one of which is the service tax on people or businesses providing services. The service tax has to be paid by the service provider to the government, and in turn, the service providers pass on the amount to the customers. Examples of taxable services are travel agencies, courier services, chartered accountancy, banks, fashion designing, internet cafes, cab rentals, architectural services, telecommunications, and health clubs. Service tax is a uniform tax across the country. It is payable by service provider only if the services provided in a financial year is equal to or more than Rs. 10 lakh. Our article Basics of Service Tax discusses Service Tax in Detail

From 2012 Service Tax is also applicable to those restaurants that provide services in addition to food and beverage, such as air-conditioned seating, waiters, and attendants, This is a mandatory inclusion in your bill. However, take away outlets have the flexibility to include this tax into their menu pricing so what you see is what you pay.

- Only a restaurant that has central air conditioning or heating in some part of their facility has the right to charge service tax.

- The rate of service tax is 14%, throughout India.

- Service tax is imposed only on 40% of the value of the restaurant bill, which is assumed to be the standard service expense, as opposed to the remaining 60% that is the raw material of the food and beverages ordered by the customer.

- In order to make things easier for themselves, restaurants charge service tax on the entire amount, thus reducing the amount to only 5.6%(14% of 40% ) of the bill. If a restaurant is calculating service tax on the entire bill, then you are being cheated.

- In addition Swachh Bharat Cess of 0.5%, Krishi Kalyan Cess of 0.5% is also be added to the bill. Again, 40% of these, i.e., 0.2% is charged on the entire bill amount. So, total service tax becomes 6% (5.6%+0.2%+0.2%) of the bill.

- In order to make things easier for themselves, restaurants charge service tax on the entire amount, thus reducing the amount to only 5.6%(14% of 40% ) of the bill.

Cess, Swachh Bharat cess and Krishi Kalyan Cess

Cess is a tax that is levied by the government to raise funds for a pre-decided purpose. Collections from the Education Cess and the Secondary and Higher Education Cess, for instance, are supposed to be used for funding primary and higher and secondary education respectively. Likewise, money collected from the Krishi Kalyan Cess is to be used for funding agri development initiatives. Our article Tax : What are Cess and Surcharge? What is difference discusses it in detail.

The Swachh Bharat cess is levied only on the portion of taxable services (after abatement) and will go towards the funding of the cleanliness drive, a pet project of Prime Minister Narendra Modi.

The Krishi Kalyan Cess was implemented from 1 June 2016 to collect funds for development of the agriculture (krishi) industry.

On Resturant Bill Swachh Bharat Cess of 0.5%, Krishi Kalyan Cess of 0.5% is also be added to the bill. Again, 40% of these, i.e., 0.2% is charged on the entire bill amount. So, total service tax becomes 6% (5.6%+0.2%+0.2%) of the bill.

Service Charge on Restaurant Bill

Service charge is charged by the restaurant for the services rendered to you. Practically Service Charge is nothing but tips that you generally give your waiters. Usually, high-end joints, pubs, and fine dining restaurants add the service charge to the bill, as a way of ensuring that their staff gets the tips due to them for serving you. This service charge collected is distributed equally among the waiters, kitchen staff and cleaning staff at the restaurant. You do not need to put additional tips for your waiter if you have already paid the service charge in the bill. There is no clarity on whether service tax should be charged by takeaway outlets or home delivery. And restaurants usually charge service tax on home delivery and take away orders.

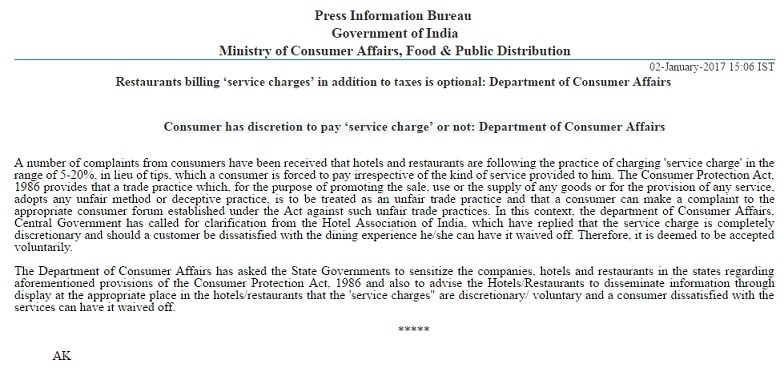

There are no guidelines on how much service charge can be levied on a customer. The charges can vary from 5% to 20%, it depends on the restaurant. If you are unsatisfied by the service, you are free to complain to the management about the charge forced out from you. However, The Department of Consumer Affairs has rung in the New Year 2017 with a statement that empowers customers to ask for the service charge to be waived off if the services offered are not up to the standard expected.

Restaurants will soon have to put up display boards to let customers know if they levy a service charge. So now as per the consumer affairs department, Government of India, it will be the customers’ discretion to pay the charge which is not a compulsory one.

VAT or Value Added Tax and Restaurant Bill

VAT is only applicable on food items that are prepared in the restaurant as they add value before serving it to you. So make sure that you are not charged VAT on packaged food items or water bottles. Our article What is Value Added Tax ( VAT) discusses VAT in detail

- Rate of VAT tax differs from 5 percent to 20 percent depending upon the state you are dining in because it is levied by each state separately. For example, in Delhi and Maharashtra, VAT on food is charged at 12.5%, whereas in Gujarat, it is 15%.

- VAT rates are different for different items. Alcohol generally attracts a higher rate of VAT. In Delhi, VAT on alcoholic beverages is 20% alcoholic beverages and other food items.

- Under the VAT laws, the tax base should be the value charged for the supply of goods and all incidental charges for this supply. So, VAT can also be charged on the service charge. Though not all restaurants do so.

- VAT is chargeable on the entire restaurant bill, which means there is a double tax on 40% of the bill (which pays both service tax and VAT).

Difference between Service tax and Service charge

Service tax |

Service charge |

| The service tax is a government levied tax | Service charge is an extra cost charged by the restaurant, which varies. It is a means to cover ‘tip’ cost |

| The service tax conforms to certain guidelines laid down by the government | Service charge is not bound by any guidelines from the government. |

| All restaurants pay service tax | Officially, only a restaurant which is centrally air-conditioned/heated is eligible to levy a service tax on the customers. However, some restaurants may be seen practicing this even if they do not come under this category. |

| The service tax is recovered by the government | the service charge goes directly to the restaurant. |

| Service Tax is fixed in every state of India, at 14 % payable on 40 pe cent of your total bill. The bill is inclusive of food, drinks, service charge and other services such as the ambiance. | Service charge varies from restaurant to restaurant. |

Waiving off Service Charge at Restaurant

Most of us have been forced to pay the service charge in a restaurant even though the service was poor. A tip has traditionally been a voluntary payment to the waiter for giving good service. Convention makes this tip about 10% of the total bill. Some years back, restaurants and hotels began to embed this tip as a service charge in the bill making it a mandatory payment. Their logic was that it is not just the person serving you, but the backroom staff as well who needs to be rewarded. But whether this mandatory service charge actually finds its way to the staff, no one knows.

In the notification of 2 Jan 2017, the Ministry of Consumer Affairs, Food & Public Distribution has made a clarification regarding levy of service charges by hotels and restaurants It said that service charges should be charged based on the discretion of the customer and that this is not a mandatory payment. Notice is given below

Restaurants and hotels have also been asked to display this information in appropriate places. So the next time you eat out, make sure you pay only for what you get. Get service charges waived off if you are not satisfied with the services

Related Articles:

- Tax : What are Cess and Surcharge? What is difference

- GST Bill : Good and Services Tax

- Bill,Invoice, Receipt and Voucher

- Basics of Service Tax

- What is Value Added Tax ( VAT)

- How Gold Ornament is Priced?

- Understanding Ex Showroom Price and On Road Price of Vehicle

What do you think of Government notification of waiving of Service Charge?

I actually added your blog to my favourite and will look forward for more updates. Great job, Keep it up. First of all let me tell you, You have got a great blog. I am interested in looking for more of such topics and would like to have further information. Hope to see the next blog soon.

This is very attention-grabbing, You’re an excessively professional blogger.

I’ve joined your feed and sit up for searching for more of your great post.

Additionally, I have shared your web site in my social networks

Really impressive post. I read it whole and going to share it with my social circules.

I actually added your blog to my favorites and will look forward for more updates. Great job, keep it up. First of all let me tell you, you have got a great blog. I am interested in looking for more of such topics and would like to have further information. Hope to see the next blog soon.