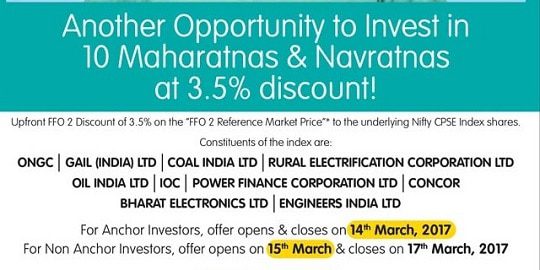

Reliance Mutual Fund CPSE ETF FFO 2 is open from 15 Mar to 17 Mar 2017 for Individual Investors at a discount of 3.5%. Government of India (GOI) is using tis innovative route to divest its holding in CPSEs via ETF. The investment objective of the Scheme is to provide returns closely correspond to the total returns of the Securities as represented by the Nifty CPSE Index.

- Minimum application size: Rs 5,000 and there is no upper limit on the investment amount. However, retail investors investing upto Rs. 2 lakhs will be given preference in allotment in case there is an oversubscription. Your investor category will depend on your application amount. To be in retail category maximum amount you can apply for is 2 lakh.

- 3.5% Discount for Investors – To attract more and more investors, the government is offering a discount of 3.5% to all investors. This 3.5% discount will be calculated on the “FFO 2 Reference Market Price” of the underlying shares of the Nifty CPSE Index and will be passed on to the CPSE ETF by the government of India.

- Please note that following allotment of FFO 2 Units, the NAV of the FFO 2 Units will be same as the NAV of the existing Scheme. There will be no separate NAV calculation for the FFO 2 Units.

- Entry & Exit Load – This scheme is not subject to any entry load or any exit load.

You can also buy this CPSE ETF from the stock markets through your equity trading account. The only difference is that you will not get the discount offered by the government to the investors for subscribing to this ETF in FFO.

Table of Contents

Before Applying for CPSE ETF

Demat account is mandatory to apply for this ETF. Without a Demat account, your application won’t go through and would be rejected.

No ASBA facility: ASBA facility is not available for this offer. So, you need to submit a cheque or a DD along with the application form or invest online through your broker’s trading platform to apply for this ETF.

KYC compliant for mutual funds: The applicant is required to be KYC compliant. If one is not KYC compliant then you can submit your KYC form along with a photograph and the required documents i.e. PAN card copy and address proof copy, along with the application form

Multiple applications: You can submit multiple applications. But, to be considered a retail investor and get preference in allotment over other investors, the sum of all your applications should not exceed Rs. 2 lakhs.

Minimum/Maximum Investment Size – Individual investors can invest in the scheme with a minimum investment amount of Rs. 5,000 and there is no upper limit on the investment amount. However, retail investors investing upto Rs. 2 lakhs will be given preference in allotment in case there is an oversubscription.

If I apply for Rs. 4 lakhs and allotted only Rs. 1.5 lakhs worth of units due to oversubscription, will I get discount? Will I be considered as a retail investor?

If you apply for more than Rs. 2 lakhs, you’ll still be entitled to a discount(3.5% in second FFO and 5% in first FFO). But, your investor category will depend on your application amount. So if you apply for 4 lakhs you will not be considerd as the Retail investor.

Should you invest in Reliance CPSE ETF

The performance of the first CPSE ETF has been impressive. Since its inception, the fund has clocked 14.5% annualised return while the Nifty 50 index gained 7.5% during the same period. After adjusting for loyalty units, retail investors have made a gain of 17.2%. Over the past year, the fund delivered 17.43% return even as the Nifty 50 index clocked 2.8%.

For Government at the center key agenda is to enhance the efficiency of the PSUs and make it more globally competitive, Prime Minister is known to have turned around PSUs in Gujarat will surely try to work his magic when it comes to this segment at a pan India level, although the pace of progress will be slow. The other big positive point for investing into this ETF is the attractive valuations. But as Government is the major stake holder in all the companies included in this index, it is going to be subject to policy changes, which will inturn create volatility in the portfolio. The uncertainties on the commodity prices front will also adversely impact this ETF.

You can expect more CPSE Exchange Traded Funds (ETFs) in 2017. Against the backdrop of a successful listing of CPSE ETF the finance minister said Exchange Traded Funds or ETFs are likely to remain preferred investment vehicle for divestment purpose

The ETF claims to offer investors a play on the India growth story through a diversified basket of PSU stocks. But a closer inspection of the composition of the underlying index suggests that the portfolio is far from diversified. Three stocks–ONGC, Coal India and IndianOil–together constitute around 63% of the entire portfolio. The portfolio is also skewed towards a few sectors, with energy, metals and financial services making up 90% of the portfolio. This lends a higher risk element despite the fact that the stocks are some of the biggest names in their respective sectors.

Investors should rather invest in diversified equity funds which will diversify beyond PSUs. Note if a particular PSU is doing exceptionally well, it would anyway be a part of the portfolio of a good diversified equity or a largecap mutual fund scheme. Hence, considering the pros and cons of this ETF, we would recommend this product only to those aggressive investors who are already invested into sector funds and has a time horizon of 5 years

About CPSE ETF

What are Exchange Traded Funds (ETFs)?

ETFs are similar to index funds. ETFs are passively managed (just like index funds) and try to replicate performance of a benchmark index. To do that, ETFs try to hold securities in same ratio as the underlying index.

What is CPSE ETF?

CPSE Nifty Index – It is one of the indices of the National Stock Exchange (NSE) carrying 10 public sector undertakings (PSUs) in which the central government has more than 55% stake and these companies have more than Rs. 1,000 crore in market capitalisation. All these companies are profitable and are either Maharatnas or Navratnas. All the companies in CPSE are profitable and pay relatively higher dividends on a regular basis. High dividend yield stocks have historically carried lower volatility in returns. So, you can expect a relatively stable performance from these stocks

- Oil & Natural Gas Corporation Limited Oil – 24.6%

- Coal India Limited Minerals/Mining- 19.6%

- Indian Oil Corporation Limited Petroleum Products – 18.4%

- GAIL (India) Limited Gas – 11.7%

- Rural Electrification Corporation Limited Finance – 5.8%

- Power Finance Corporation Limited Finance – 5.5%

- Container Corporation of India Limited Transportation – 5.0%

- Bharat Electronics Limited Capital Goods – 4.1%

- Oil India Limited Oil – 2.9%

- Engineers India Limited Construction Project – 2.0%

CPSE ETF is benchmarked against Nifty CPSE Index. Hence, the ETF will replicate the composition of Nifty CPSE Index. .Through the CPSE ETF, you can take exposure to following ten public sector unity by investing in CPSE ETF. The ratio in which these companies are held in CPSE ETF is based on composition of Nifty CPSE Index. There can be tracking error due to ETF expenses, cash balances etc.

What is the difference between FFO and actively managed mutual funds already available in the market?

Actively managed funds, having the same stocks, can increase or decrease their proportion of investment in each of these stocks. They have no obligation to follow & alter their portfolio as per the Nifty CPSE Index. Whereas CPSE ETF has to follow the CPSE Index. Moreover, you will get discount only with this FFO and not with other mutual funds.

History of CPSE ETF

Price of CPSE ETF or Central Public Sector Enterprises Exchange Traded Fund

CPSE ETF NFO (Mar 2014)

CPSE ETF was launched only in March 2014 by Goldman Sachs for the bundle of 10 Maharatna and Navratna PSUs to facilitate Government of India’s initiative of dis-investing its stake in selected Central Public Sector Enterprises through Exchange Traded Fund CPSE ETF route. When it was launched, the government had offered an upfront discount of 5% on the issue price to sweeten the deal for investors. This initial NFO (New Fund Offer) was for Rs. 3000 crore and was oversubscribed to the tune of Rs. 4363 crore and the excess amount of Rs. 1363 crore was refunded to investors.The allotment price was Rs 17.45 per unit.

A year later, the government issued loyalty units in the ratio of 15:1 to eligible retail investors who remained invested since the new fund offer, which amounted to an additional discount of 6.66%.

Reliance MF CPSE ETF First FFO (Jan 2017)

Goldman Sachs AMC was taken over by Reliance Nippon Life Asset Management Company in 2015. The second offer as CPSE ETF FFO (Further Fund Offer) came in Jan 2017 to mobilize Rs. 6000 crore (base size is Rs. 4500 crore and green shoe option for Rs. 1500 crore). Out of the total offer, 30 per cent was reserved for Anchor Investors, for whom the offer opened for a day i.e. on 17.01.17 and for other categories, the offer opened on 18.01.17 and closed on 20.01.17. Out of the residual portion, 70 per cent was kept for retail investors (i.e. application up to Rs. 2 lakh) on firm allotment basis and the second preference was given to EPFO and PFs and the rest will be for HNIs and QIBs.

Reliance Mutual Fund CPSE ETF FFO got bids of approx. Rs. 12,000 crore (us$ 1.7 billion) -over two and half times the base issue size of Rs. 4,500 crore (US $471 million)

It received the applications from over 2 lakh investors across 300 cities and towns in India.

Anchor Investors submitted bids of Rs. 6,000 crore (US $ 895.5 million) : Morgan Stanley, Nomura, Kotak MF, SBI Bank, LIC amongst prominent domestic and foreign institutions that participated as anchor investors.

Non-Anchor portion received bids of Rs.6, 000 crore two times of Rs. 3,000 crore reserved in the issue. Non-Anchor portion largely subscribed by Retail Investors and PFs – both domestic and foreign Retail Investors got first preference and assured allotment as part of the CPSE ETF FFO norms

Retail investors were allotted units at NAV 25.2141. Full allotment was made to each and every successful retail applicant applying up to Rs. 2 lakh worth of these units.

Reliance MF CPSE ETF Second FFO (Mar 2017)

The Reliance MF CPSE ETF FFO2 opens for all other investors from March 15-17, 2017 with allocation priority to retail and PFs. The Reliance MF CPSE ETF FFO2 proposes to raise an aggregate of Rs 2,500 crore across all categories of investors.

Reliance MF CPSE ETF second FFO anchor issue oversubscribed by over 7.5 times on day 1. Anchor investors put in bids of Rs 5,700 crore – over 7.5 times the amount of Rs 750 crore reserved for them.Some of the leading names that participated in the bid on the first day, as anchor investors include: BNP Paribas, Morgan Stanley, SocGen, CitiGroup while the domestic investors include LIC, Exide Insurance, SBI Bank, Axis Bank and Canara Bank.

Tax and CPSE ETF

Tax Saving under section 80CCG : CPSE ETF FFO 2 is in compliance with the provisions of Rajiv Gandhi Equity Savings Scheme and thus qualifies for a tax exemption of up to Rs. 25,000 under section 80CCG. Budget 2017 has proposed to end the benefits of Rajiv Gandhi Equity Savings Scheme (or RGESS) and tax exemption under section 80CCG from FY 2017-18.

You need to fulfill two most important conditions to avail tax exemption under 80CCG: one, your gross total income should not exceed Rs. 12 lakh in the current financial year and two, you must be a first time investor in equities.

Lock-in period for this investment : However, investors who seek tax exemption under section 80CCG, will be subject to a lock-in period of 3 years – 1 year of fixed lock-in and 2 years of flexible lock-in. The fixed lock-in period will start from the date of your investment in the current financial year and will end on March 31 next year i.e. 2018. The flexible lock-in period will be of two years, beginning immediately after the end of the fixed lock-in period i.e. beginning April 1, 2018 till March 31, 2020.

There is no lock-in period applicable to those investors who do not avail any tax benefit under section 80CCG out of this ETF. They would be free to sell their units any time they desire to do so.

Tax and Capital Gains: Taxation for this ETF is like that of equity shares or equity mutual funds. LTCG will be tax exempt and STCG will be taxed at 15%

How to invest in CPSE ETF?

Physical Application You can submit your physical application at the Investor Service Centers (ISCs) of Reliance Mutual Fund and Karvy Computershare branches.

Additionally, KRA compliant individual investors can use the below mentioned online modes to apply for this ETF:

- Reliance Mutual Fund website

- Reliance Mobile App

- MF Utility

- NSE MFSS, NMF II Platform of NSE, e-ETF under web based NSE e-IPO platform

- BSE StAR MF

Allotment and Listing of CPSE ETF

Allotment is not on first come first serve basis: Allotment will be made on a proportionate basis as it is done in case of equity IPOs. In case of oversubscription, efforts will be made to allot 5,000 units to each of the retail investors.

Listing: As per the offer document, units of this ETF will get allotted within 15 days from the closing date of the issue and listing on the NSE and BSE will happen within 5 days from the date of allotment

.

An excellent in depth article on the evolution of CPSE ETF and details of present offer. The article is clear and succinct.