The year 2017 will go down as a golden year for IPOs as most of the issues offering positive returns. While 2017 was the best performance of IPOs in recent years, a strong pipeline of draft prospectus filed with market regulator SEBI holds promise for a busy 2018 at IPO street. This article discusses Real Estate Trends, the IPO of 2017 and Lodha Group Developers IPO which may come in 2018.

Real Estate Trends

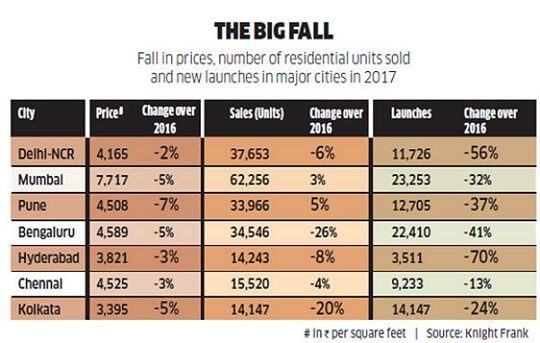

In Real estate market, the Residential segment has been low in 2017 due to demonetisation, GST, RERA. Sales slowed down, overall launches also declined. It created a lot of liquidity crunch. The impact was felt more in NCR and Mumbai, but the sector has suffered overall.

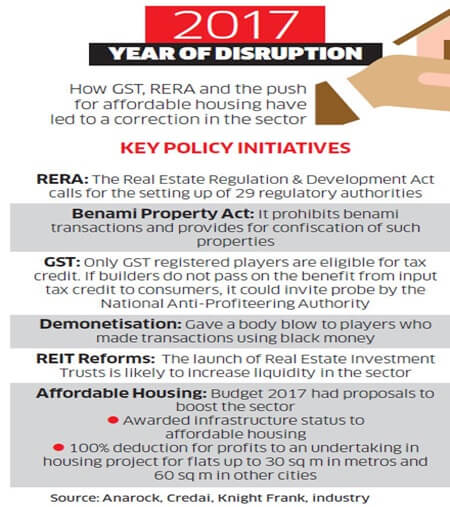

Implementation of reforms like RERA and GST has changed the real estate and has enhanced the trust of home buyers to a great extent.

The government passed the Real Estate Regulation & Development Act (RERA) in 2016, which makes mandatory registration of all projects with a clear deadline, empowers buyers to cancel a booking and get refunds, and calls for punitive action for non-delivery. The prime objective of RERA is to safeguard the interest of home buyers by restricting fly-by-night players, increasing the share of an organised segment and bringing in transparency. RERA has instilled confidence among buyers. An entry barrier has been created for nonserious players because of RERA. Developers are getting organised. Now projects will have to be completed.

Apart from GST and demonetisation, the law on benami property and push for affordable housing with infrastructure status have helped.

While the growth in real estate market may not be phenomenal, it is expected to be sustainable and backed by solid market fundamentals. Some of the real-estate trends are:

- Lowering of home loan interest rates Thanks to the excess liquidity in the banking system, the RBI has lowered the key lending rates. This increases savings on EMI encouraging buyers to become homeowner

- Affordable Housing: The government is supporting this sector by awarding it a much-required infrastructure status.

- Regulatory mechanisms have encouraged the global investor fraternity. The real-estate sector is expected to receive PE investments to the tune of $4 billion during the year.

All this should result in a more mature real estate market. This is a period of change that will benefit serious players

IPOs in 2017

The year 2017 saw many IPOs or Initial Public Offers which created a lot of buzz. Indian companies raised a record Rs 67,147 crore in 2017 through initial public offerings (IPOs), with 36 companies going public. It is 89% more than the previous record of Rs 37,534 crore reported in 2010.

Several factors, including a resilient Indian economy and strong domestic liquidity,due to equity being viewed as a preferred asset class, contributed to the buoyant market for IPOs. High-quality companies from a wide variety of sectors came to the market From new age banks to a shoe brand; from a staffing enterprise to a publisher and even a mass market grocery retailer went for IPO in 2017. Investors reacted positively to the mix of new sectors and themes.

Secondly, a large portion of the issuance this year has been in the form of offer for sales (OFS) in the secondary market, as sponsors took advantage of the constructive market environment to give an exit route to existing shareholders. Such offer-for-sale (OFS) deals accounted for over 48% of the IPO capital raised in 2017. Companies such as ICICI Lombard, HDFC Standard Life, SBI Life, Eris Life Sciences, Indian Energy Exchange, Bombay Stock Exchange, Hudco, sold shares worth Rs 31,890 crore and the biggest beneficiaries were promoters and PEs. Even the government got on the gravy train, raking in Rs 12,800 crore with divestments via the markets, accounting for some 80% of all OFS.

Not every stock which made its way to D-Street made money for investors. Stocks which disappointed investors include names like CL Educate, S Chand, The New India Assurance, Music Broadcast, GIC, Godrej Agrovent, Khadim India, Shelby, Matrimony, Bharat Road, MAS Financial Services, SBI Life Insurance, GTPL Hathway, Reliance Nippon, and Capacite Infraprojects.

The IPO pipeline is likely to remain robust for the year 2018, but a repeat of 2017 seems difficult. Some rough estimates show that fundraising up to Rs 25,000-35,000 crore is already in the pipeline The BFSI sectors are expected to continue to dominate the 2018 IPO pipeline and many telecom, auto and real estate companies are in the IPO pipeline for 2018.

The market outlook, maturity of the Indian markets, government’s disinvestment programme as well as the presence of sophisticated PE (private equity) investors in interesting new age businesses which are ripe for listing, all of these factors will continue to bring diversity to the IPO market and provide investors new opportunities to invest in IPOs in FY18.

IPO of Lodha Developers

Established in 1980, Lodha Group is India’s largest real estate developer by sales, with several landmark developments such as World One, Mumbai, the world’s tallest residential tower and Palava City, the first Greenfield smart city in the country. The company is currently developing around 40+ million sq. ft. of prime residential real estate globally with the largest land reserves in the Mumbai Metropolitan Region and has around 28 ongoing projects across London, Mumbai, Pune and Hyderabad and Bangalore. In 2015 Lodha Group delivered 5.7 million sq.ft. real estate and 5,500 units across projects.

Realty major Lodha Developers has revived plans to launch an initial public offer (IPO) and will soon approach market regulator Sebi with a fresh prospectus as it looks to raise Rs 3,000 to Rs 6,000 crore including by pre-IPO placement of shares. It had filed draft red herring prospectus (DRHP) with Sebi in September 2009 to raise about Rs 2,800 crore. The company got the Sebi nod in January 2010 but later shelved its plan to launch the IPO due to bad market conditions post the global financial crisis.

The group achieved sales bookings of about Rs 8,500 crore last fiscal from both domestic market and London despite a slowdown in the real estate market. The group had forayed into the London realty market in 2013 and acquired two prime sites in central London for an investment of about 400 million pounds. It has a land bank of 350 million sq ft for future development In London, the ‘Lincoln Square’ project was launched in 2016 and the second project ‘No 1 Grosvenor Square’, located in the heart of Mayfair, was launched in June of 2017 Lodha UK is eyeing a sales revenue of 1.5 billion pounds (over Rs. 12,000 crores) in the next few years from these two ongoing housing projects in central London.

Lodha group’s subsidiary Lodha Developers International Ltd had raised $200 million in March 2015 through the issue of bonds with maturity in 2020. In Jul 2017 It’s Indian debt stood at Rs 14,500 crore, while the debt of the London business was about 300 million pounds. In Nov 2017, Lodha group raised an additional USD 125 million through bonds to pre-pay its costlier debt and reduce interest expense.

Related Articles:

Buying a House,Renting,Home Loan,Tax,Selling,Capital Gain

Fair Market Value: Calculating Capital Gain for property purchased before 2001

2018 is the year real estate will look better with greater compliances and transparency. The IPO market has been heating up. Investors should exercise caution while investing in public issues. But, before putting your money in the primary markets, investors should do their own research.