Recently RBI barred Bandhan Bank from opening new branches and also has ordered the freezing of the CEO, Chandra Shekhar Ghosh’s salary over failure to stick to shareholding rules.

RBI asked Yes Bank to end Rana Kapoor’s tenure as managing director and chief executive on 31 January 2019 disregarding Yes Bank request to extend his term by three years.

Twenty-one public sector banks in India collectively have the highest ever losses and the biggest pile-up of gross non-performing assets (NPAs) in 2017-18. Has the salary of a public-sector bank CEO being frozen amid all the mess that has happened in the sector? Nor has any CEO been removed from office just due to NPA divergence (other than for big-ticket fraud cases). Why there is a difference in the way RBI is treating Public and Private Banks?

RBI asked Yes Bank to end Rana Kapoor’s tenure as managing director and chief executive on 31 January 2019 disregarding Yes Bank request to extend his term by three years. Rana Kapoor has led Yes Bank since its founding in 2004. RBI cited three reasons and they are: “Weak compliance culture in Yes Bank”, “Weak Governance In Yes Bank” and “Wrong asset Qualification”.

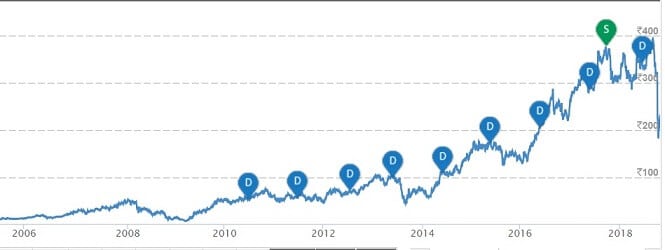

Yes Bank has given a great performance on the share market from past couple of years. But post uncertainties from RBI’s decision, the bank’s stock, between 20 August and 28 September, tumbled by a staggering 59% from its high of ₹404 to ₹166.15 on BSE. The stock is recovering slowly but it is still trading about 45% down from its 20 August levels. It took 3 to 4 weeks for the regulator and another promoter of yes bank Madhu Kapur to bring down the market cap of yes bank by 40%. Retail and small investors lost Rs. 30,000 crores in the past 4 weeks. Who is responsible for this loss?

In the absence of serious violations amounting to fraud or connivance, such regulatory restrictions send wrong signals to investors. The question that investors are facing is which lender will face the music next?

Rules are not for all? RBI’s actions mean so!

The total loss of PSU banks was a whopping Rs 79,071cr. In comparison, the private sector banks earned a net profit to the tune of Rs 42,000cr.

By 2009, courtesy beer baron Vijay Mallya’s, Rs 8,000 crore hole appeared in India’s PSU banks.

In 2018, thanks to diamond merchant Nirav Modi, NPA and absconding made the news once more. This time NPA was over Rs 11,400 crore and it was ‘created’ through outright fraud.

Has the salary of a public-sector bank CEO being frozen amid all the mess? Has any CEO been removed from office just due to NPA divergence?

The regulatory discrepancy between the private sector and public-sector banks is well known in the industry circles and many have been pointing it out for decades, including the first Narasimham Committee in the 1990s.

Is RBI being just? The crisis-ridden public-sector banks, neck deep in losses, have not faced the kind of activism seen in Yes Bank and Bandhan Bank. It’s time RBI needs to be more transparent in their approach. It is also important for the regulator to be sensitive in its harsh decisions as it is impacting not just the back but entire BFSI industry. In the process of regulating banks, RBI can’t destabilize the Banking sector. The regulator should also be cognizant of the banks’ larger stakeholder interests like Customers, investors, partners and employees.

Is the fall in Yes Bank Share Price justified or is it an opportunity to Buy?

its really very nice blog thanks for sharing with us. i am regular reader your blog website .

Thanks for kind words