In a major assault on black money and terror financing, Prime Minister Narendra Modi on November 8 2016 announced demonetisation of 500 and 1,000 rupee notes and asked holders of such notes to deposit them in bank account. What will happen to Banned Notes of Rs 500 and Rs 1000? What happens to the soiled, old notes? How are old notes destroyed in other countries like USA.

Table of Contents

What happens to old Notes in India?

Our article Currency Management: How does Indian Notes and Coins reach People talked about how does Indian Notes and Coins reach people? where are Indian rupee Notes and coins printed? What are currency chests, Cost of Printing Indian Rupee Notes and Cost of Replacing the Rs 500 and Rs 1000 notes? What is ReCalibration of ATM?

Most central banks destroy soiled and mutilated banknotes on a regular basis and replace them with new, crisp ones. The average age of the notes are usually less than a year but depend on usage. Lower the value, higher the usage. For example, a Rs 10 note could last no more than eight to 10 months, whereas a Rs 1,000 note could remain fresh for a long time, as these tend to be stored and used carefully.

In reply to a right to information(RTI) request, the RBI in 2012 released data on what it costs to print notes of each denomination.For example, it is cost-effective to print a Rs 1,000 note at Rs 3.17, instead of printing ten Rs 100 notes and incurring Rs 17.9for the same value. That might explain why a little more than 80% of the value of currency in circulation is of high-value notes. Total Costs for printing was 34.3 billion during 2015-16 against 37.6 billions during 2014-15.

In India Until 2001, the soiled and torn currency notes that were taken back were subjected to a manual system of verification by RBI’s staff. The non-issuable notes later used to be burned. That manual system was highly inefficient and the old currency notes used to get burnt without any meaningful examination. Burning of old notes was thought to be bad for the environment too.

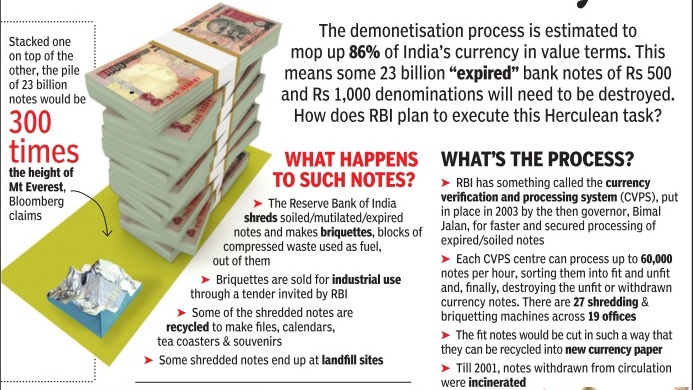

In 2003, Bimal Jalan introduced a system of mechanised sorting and subsequent destruction of notes. The soiled notes are examined, sorted and the unfit among them disposed of under the currency verification and processing system (CVPS). Of the segregated notes, those considered to be worth reissuing would be given for circulation. ref : Hindu

There are 27 shredding and briquetting machines in 19 offices of the RBI

- The notes identified for disposal are shredded and made into briquettes weighing about 100 gms.

- The shreds are on-line transported to a separate briquetting system where they are compressed into briquettes of small size. It is an environment-friendly system, as it does not create pollution that was created by burning of notes in the past.

- The briquettes are sold for industrial use through tenders.

- Briquettes, usually made of farm waste in India, are used for cooking, lighting and heating. They are cheaper than coal, have lower ash content, are less polluting, and easier to store and pack. They are mostly used as fuel in factory boilers. But briquettes made out of shredded cash are brittle and serve no such purpose.

- They can even be used for land fillings

- A kg of such briquettes are sold for a minimum of Rs.6. On an average, nearly 8.28 lakh kg briquettes are manufactured every year.

- Such briquettes are also distributed as souvenirs to the visitors at the stalls of RBI in exhibitions.

- The shredded currency is recycled into various products, including files, calendars and even paper weights.

Currency verification and processing system

In 2003, RBI Governor Bimal Jalan introduced currency verification and processing system to ensure quicker and secured processing of soiled notes. There are 27 shredding and briquetting machines in 19 offices of the RBI. Each CVPS installation can process upto 60,000 currency notes in an hour. Besides counting the notes, it also check their genuineness following which it divides them into fit and unfit categories. The unfit ones are destroyed by shredding them while the fit ones are cut in a way that they can be recycled to produce new currency notes.

BSBS means Banknote Shredding & Briquetting System that shreds old currency notes and turns them into little chunks of paper pulp that could potentially be put to some environment-friendly use.

Interested readers can read India’s Idiotic Currency Management Policies to know more about the CVPS and BSBS scams.

Demontization and old 500 Rs and 1000 Rs notes

India is the highest PRODUCER & CONSUMER of currency notes after China. 98% of all consumer payments in India use cash. RBI spends more than Rs.2,700 crore on currency production each year.

The demonetisation , which scrapped two high-value denominations the 500 and 1,000 rupee notes to crack down on black money or illegal cash holdings is estimated to mop up 86% of India’s currency in value terms. The data collected by the Reserve Bank of India (RBI) shows that about 86 percent of the Rs 17.77 lakh crore that was in circulation till March 31 2016 was in the form of Rs 500 and Rs 1000 currency notes in terms of value. A total of 9026.6 crore bank notes were in circulation across the country in terms of volume till March 31. Around 24 percent or 2,203 crore of those notes were of Rs 500 and Rs 1000 currency notes. This means some 23 billion pr 2,203 crore “expired” bank notes of Rs 500 and Rs 1,000 denominations will need to be destroyed.

Stacked up these 23 billion notes would be 300 times the height of Mount Everest.

Central bank officials believe shredding 20 billion banknotes will not be a huge challenge. In 2015-16 the Reserve Bank of India destroyed more than 16 billion soiled notes. More than 14 billion were removed in 2012-2013 after nearly 500,000 fake notes were found in the system.

How old notes are destroyed by Federal Reserve in US

In several other countries, discarded currency notes are used for heating buildings. Bank of England did so till 1990. But, after that the bank started recycling the notes by compost treatment, which was found improving soil quality.

The practice is similar in the US, counterfeit banknotes are sent to the Secret Service, while unfit notes are shredded and sent to landfills or given away as souvenirs to the public touring the Federal Reserve Bank. the Federal Reserve Bank cuts the notes into small pieces, which are used for artistic purposes or put to commercial use by selling as souvenir

In USA, Federal Reserve,aka Fed, controls the money supply, the technical term for the amount of money in the economy. The U.S. Bureau of Engraving and Printing creates all of the nation’s banknotes or bills, while the U.S. mint creates its coins. But they also destroy money.

The Fed is diligent about keeping our currency fit since a torn or mangled bill can’t go through an ATM, a vending machine, or another electronic reader. As a result, the average life of each bill is surprisingly short:

- $1 bills: 3.7 years

- $5 bills: 3.4 years

- $10 bills: 3.4 years

- $20 bills: 5.1 years

- $50 bills: 12.6 years

- $100 bills: 8.9 years

Overall the average life for all bills is about five years. It processes currency submitted to its Federal Reserve banks by the public to check for fitness. The cash offices uses a sophisticated high-speed sorting machine called the “Banknote processing system 3000,” manufactured by German firm Giesecke & Devrient. The BPS 3000 has sophisticated sensors that check bills for authenticity and defects like graffiti, dog ears, tears, excessive soiling, and limpness. If a bill is counterfeit, it is sent to the Secret Service. But if it’s merely unfit by the Fed’s standards, then the machine shreds it. Those shredded notes are sent to landfills or packaged and provided as souvenirs to the public on Federal Reserve Bank tours. In 2010, its cash offices destroyed 5.95 billion notes. In 2009, that number was even larger at 6.05 billion notes

Related Articles:

- New Rs 500 and Rs 2000 notes : Features,Comparison

- Currency Management: How does Indian Notes and Coins reach People

One response to “How does RBI deal with old notes, banned notes of 500 and 1000”

85% Penalty or 50% Tax on Unaccounted Deposits – Demonetisation Update.

More info@ https://www.moneydial.com/blogs/85-penalty-or-50-tax-on-unaccounted-deposits-demonetisation-update/