The Reserve Bank of India has task of issuing, managing and distributing currency notes and coins. This article talks about Currency Management in India, how does Indian Notes and Coins reach people? where are Indian rupee Notes and coins printed? What are currency chests, Cost of Printing Indian Rupee Notes and Cost of Replacing the Rs 500 and Rs 1000 notes? What is ReCalibration of ATM?

Table of Contents

How Currency Management happens in India?

The Reserve Bank of India(RBI) has the task of issuing, managing and distributing currency notes and coins. The Reserve Bank manages currency in India on the basis of the Reserve Bank of India Act, 1934.

- The Government, on the advice of the Reserve Bank, decides on the various denominations.

- The RBI also co-ordinates with the Government in the designing of bank notes, including the security features.

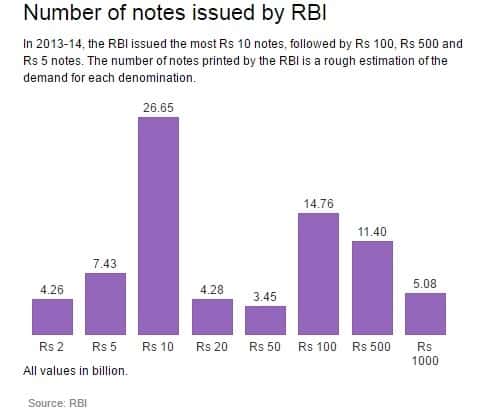

- RBI estimates the quantity of notes that are likely to be needed denomination-wise and places the indent with the various presses through the Government of India. Indian Statistical Institute studies to refine the demand estimation model then helps RBI forecasts demand for currency notes.

- In 2015-16 21.2 billion pieces of currency notes were supplied, indent was for 23.9 billion pieces

- In 2014-015 23.6 billions pieces of currency notes were supplied, indent was for 24.2 billion pieces

- The notes received from the presses are issued and a reserve stock maintained.

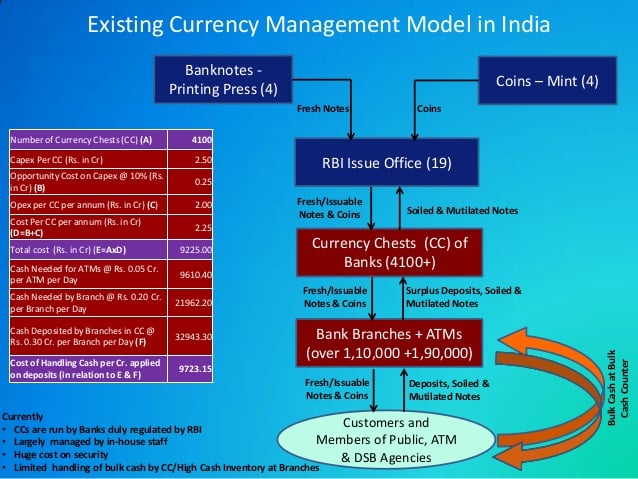

- RBI distributes notes and coins through bank branches called chests. Currency chests and coins depots are managed by commercial, operative and regional rural banks. SBI manages the highest number of currency chests – 1965

- Banks officials are responsible for movement from chest to a branch. Chests distribute currencies to branches depending on specific demand. Branches demand currencies based on business volume.

- Banks replenish cash into ATM based on daily withdrawal propensity. Many banks outsource tasks of replenishing off site ATMS.

- Currency flows like this : Printing presses , RBI offices, currency chests, bank branches and public.

- RBI Currency management system has 19 issue offices, 4075 currency chests and 3,746 small coins depots. .

- Notes received from banks and currency chests are examined. Notes fit for circulation are reissued and the others (soiled and mutilated) are destroyed so as to maintain the quality of notes in circulation. RBI disposed 16.4 bn of soiled notes and issued fresh ones against these in 2015-16.

- While a soiled bank note can be exchanged for full value, a mutilated note can be exchanged for full value or half, depending on the degree of mutilation

- Coins do not come back from circulation, except those which are withdrawn.

Currency Management: How does the currency reach people?

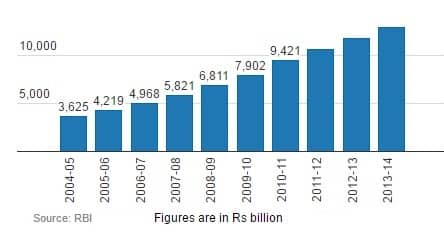

The Reserve Bank of India(RBI) has the task of issuing, managing and distributing currency notes and coins. It is a meticulous process that involves a great deal of co-ordination and calls for a high level of security procedures, among other things. A small lax anywhere in the currency supply chain could lead to mishaps of the kind ,when cash was stolen from the Chennai-bound Salem Express carrying about Rs 342 crore. Following image shows Total amount of Money in circulation in different years.

What are the present denominations of bank notes in India?

At present, notes in India are issued in the denomination of Rs 5, Rs 10, Rs 20, Rs 50, Rs 100, Rs 500 and Rs 2,000. These notes are called bank notes, as they are issued by the Reserve Bank of India. The printing of notes in the denominations of one rupee and Rs 2 has been discontinued . However, such notes issued earlier are still in circulation. The printing of notes in the denomination of Rs 5 had also been discontinued, however, it has been decided to reintroduce these notes so as to meet the gap between the demand and supply of coins in this denomination.

History of currency issued in India

Paper currency was first issued during British East India Company rule. The first paper notes were issued by the private banks such as Bank of Hindustan and the presidency banks during late 18th century. Via the Paper Currency Act of 1861, the British Government of India was conferred the monopoly to issue paper notes in India.

Where are the Indian Rupee notes and coins made?

- Indian Rupee Notes are printed in four presses. The Security Printing and Minting Corporation of India (SPMCIL) has presses at Nashik in Maharashtra and Dewas in Madhya Pradesh. The other two are owned by RBI, through a subsidiary, Bharatiya Reserve Bank Note Mudran (BRBNML), at Mysuru, Karnataka, and Salboni in Bengal.

- Coins are made at four government-owned mints :at Mumbai, Hyderabad, Kolkata and Noida.

Currency Movement

Currency flow is: Printing presses , RBI offices, currency chests, bank branches and public.

RBI manages the currency operations through its offices in 18 cities. RBI offices receive notes from presses and coins from mints. These offices then send them to the other offices of the Reserve Bank. The notes and rupee coins are stocked at the currency chests and small coins at the small coin depots. RBI offices are located at

- Ahmedabad, Bangalore, Bhopal, Bhubaneshwar, Belapur (Navi Mumbai), Kolkata, Chandigarh, Chennai, Guwahati, Hyderabad, Jaipur, Kanpur, Lucknow, Mumbai (Fort), Nagpur, New Delhi, Patna and Thiruvananthapuram.

- Reserve Bank offices located at Kolkata, Hyderabad, Mumbai and New Delhi initially receive the coins from the mints.

Currency Chests

RBI is located only in 18 places for currency operations. RBI distributes notes and coins through bank branches called chests. To facilitate the distribution of notes and rupee coins, the Reserve Bank has authorised selected branches of banks to establish currency chests. These are actually storehouses where bank notes and rupee coins are stocked on behalf of the Reserve Bank. In 2016, there are 4,422 currency chests. The currency chest branches are expected to distribute notes and rupee coins to other bank branches in their area of operation. .Currency chests and coins depots are managed by commercial, operative and regional rural banks. SBI manages the highest number of currency chests, 1965.

Small coin depot

Some bank branches are also authorised to establish small coin depots to stock small coins. There are 3,784 small coin depots spread throughout the country. The small coin depots also distribute small coins to other bank branches in their area of operation.

Movement of Currency

Banks officials are responsible for movement from chest to a branch. Chests distribute currencies to branches depending on specific demand. Branches demand currencies based on business volume. The bank branches receive the bank notes and coins from the currency chests and small coin depots for further distribution among the public.

Specially built trucks for short distance (journey completed during the day), railways for long distance Guarded by police, remittance accompanied by officials of RBI to chests. Further movement from chest to a branch done by the bank concerned

Banks replenish cash into ATM based on daily withdrawal propensity. Many banks outsource tasks of replenishing off site ATMS.

ATM and ReCalibration of ATMs

Challenges of distribution of Currnecy

Size of the country and volume of currency, security and availability of railway wagons when required, political boundaries defining jurisdiction of Issue Offices lead to sub-optimal logistics, cross movement of currency is unavoidable, cross movement of currency, security- police is preoccupied with other activities of priority, orivate security is unavailable and not favoured, transport through railways involves enormous coordination of logistics and privatisation of transport – introduced recently in respect of coins only.

Following image shows Existing Currency Management Model in India

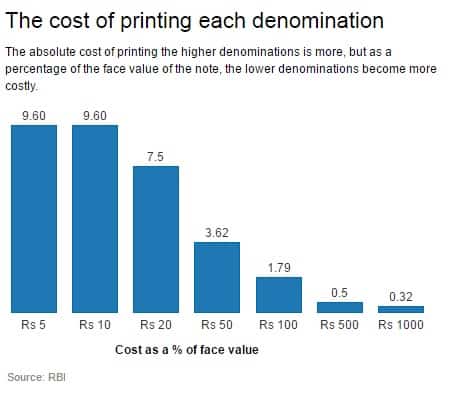

Cost of Printing Indian Rupee Notes and Coins

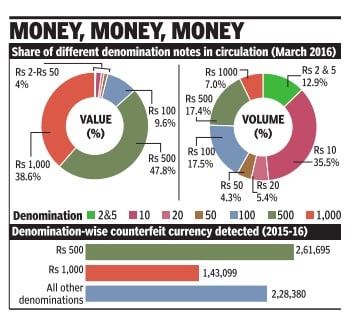

According to RBI’s annual report 2016, at the end of March, there were 6.3 billion of Rs 1,000 notes, and 15.7 billion of Rs 500 notes — 7% and 17.4% of those in circulation, respectively. In comparison, there were 15.8 billion of Rs 100 notes, about 17.5% of the notes in circulation (90 billion). In 2015-16, the two high-value denominations, Rs 500 and Rs 1,000, made up 24.4% of currency in circulation by volume, but a steep 86.4% by value.

Cost of Replacing the Rs 500 and Rs 1000 notes

- Data from a Right to Information answer by the RBI in 2012 shows that it costs Rs. 2.50 to print each Rs. 500 denomination note, and Rs. 3.17 to print a Rs. 1,000 note.

- That means that it cost the central bank Rs. 3,917 crore to print the 1,567 crore Rs. 500 notes in circulation, and Rs. 2,000 crore to print the 632 crore Rs. 1,000 notes in circulation currently.

- Assuming that the new Rs. 500 notes cost the same to print, then that is an additional Rs. 3,917 crore spent in simply maintaining the same number of notes in circulation.

- The new Rs. 2,000 notes are likely to cost about the same or a little more than the Rs. 1,000 notes, which means an additional cost of Rs. 2,000 crore to print them.

In total, removing the old notes and replacing them with the new Rs. 500 and Rs. 2,000 notes will cost the central bank a total of at least Rs. 12,000 crore. This figure is likely to go up since additional security measures, which the new notes are set to have, will only add to the cost of printing.

Related Articles:

New Rs 500 and Rs 2000 notes : Features,Comparison