“A large proportion of India’s population is without insurance of any kind, health, accidental or life. Worryingly, as our young population ages, it is also going to be pension-less. Encouraged by the success of the Pradhan Mantri Jan Dhan Yojana (PMJDY), I propose to work towards creating a universal social security system for all Indians that will ensure that no Indian citizen will have to worry about illness, accidents or penury in old age,” said Finance Minister Arun Jaitley in his budget speech on 1 Mar 2015. Schemes were launched by Prime minister on 9 May 2015.

The official website of the scheme is www.jansuraksha.gov.in. National Toll-Free – 1800-180-1111 / 1800-110-001 and StateWise Toll free number are listed in this document Statewise Toll-Free (pdf)

Forms are available in Bangla,English Gujarati,Hindi,Kannada,Marathi,Odia,Tamil and Telugu which can be downloaded fromwww.jansuraksha.gov.in/forms.aspx

Our article FAQ & List of Banks for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY) many such questions.

Government announced insurance schemes Pradhan Mantri Suraksha Bima Yojana (for Accidental Death and Disability), Pradhan Mantri Jeevan Jyoti Bima Yojana (for life insurance) and Atal Pension Yojna (for pension). This article gives the highlights of these schemes. These schemes would be come in effect from 1 June 2015.

The government plans to use technology to the extent possible to reach out to the beneficiaries, thereby plugging leakages in the system. The JAM (Jan Dhan Yojana, Aadhaar and mobile) number trinity will allow government to transfer benefits in a leakage-proof, well-targeted and cashless manner

Table of Contents

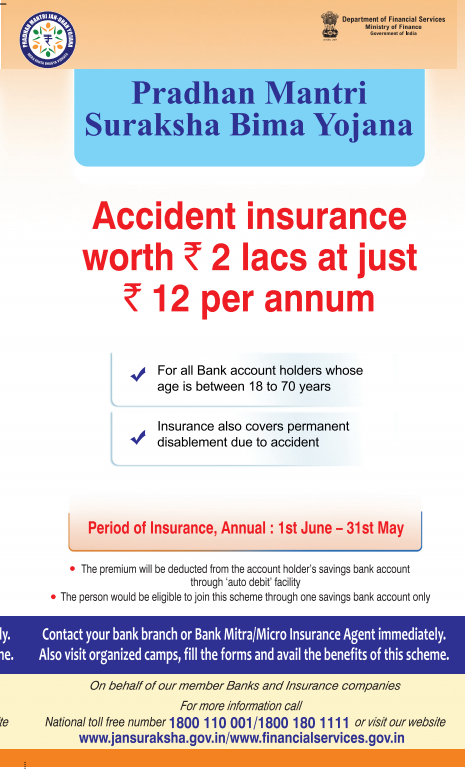

Pradhan Mantri Suraksha Bima Yojana

- Eligibility: Available to people in age group 18 to 70 years with bank account.

- Premium: Rs 12 per annum.

- Payment Mode: The premium will be directly auto-debited by the bank from the subscribers account. This is the only mode available.

- Risk Coverage: For accidental death and full disability – Rs 2 Lakh and for partial disability – Rs 1 Lakh.

- Eligibility: Any person having a bank account and Aadhaar number linked to the bank account can give a simple form to the bank every year before 1st of June in order to join the scheme. Name of nominee to be given in the form.

- Terms of Risk Coverage: A person has to opt for the scheme every year. He can also prefer to give a long-term option of continuing in which case his account will be auto-debited every year by the bank.

- Who will implement this Scheme?: The scheme will be offered by all Public Sector General Insurance Companies and all other insurers who are willing to join the scheme and tie-up with banks for this purpose.

- The premium paid will be tax-free under section 80C and also the proceeds amount will get tax-exemption u/s 10(10D).But if the proceeds from insurance policy exceed Rs.1 lakh , TDS at the rate of 2% from the total proceeds if no Form 15G or Form 15H is submitted to the insurer.

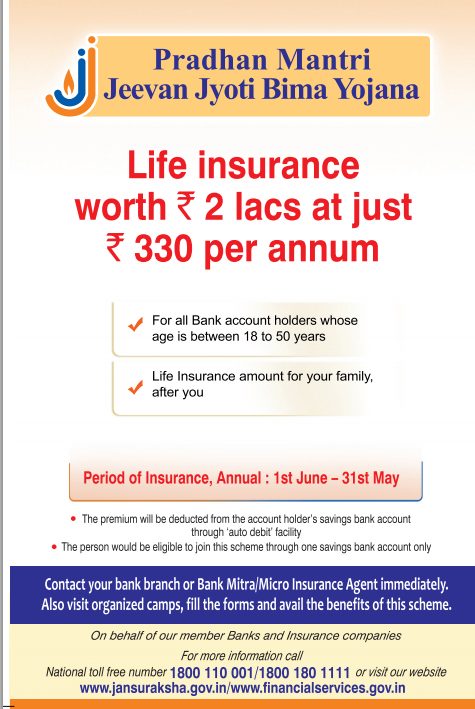

Pradhan Mantri Jeevan Jyoti Bima Yojana

- Eligibility: Available to people in the age group of 18 to 50 and having a bank account. People who join the scheme before completing 50 years can, however, continue to have the risk of life cover up to the age of 55 years subject to payment of premium.

- Premium: Rs 330 per annum. It will be auto-debited in one instalment.

- Payment Mode: The payment of premium will be directly auto-debited by the bank from the subscribers account.

- Risk Coverage: Rs. 2 Lakh in case of death for any reason.

- Terms of Risk Coverage: A person has to opt for the scheme every year. He can also prefer to give a long-term option of continuing, in which case his account will be auto-debited every year by the bank.

- Who will implement this Scheme?: The scheme will be offered by Life Insurance Corporation and all other life insurers who are willing to join the scheme and tie-up with banks for this purpose.

Comparison between Jeevan Jyoti Bima Yojana (PMJJBY) vs Suraksha Bima Yojana (PMSBY)

| Features | Pradhan Mantri Suraksha Bima Yojana (PMSBY) | Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) |

| Eligibility | 18-70 years | 18-50 years |

| Number of Policy | One Policy Per Person | One Policy Per Person |

| When to Join the Scheme? | Any time | Any time |

| Sum Assured (Fixed) | Rs 2 lakhs | Rs 2 lakhs |

| Premium | Rs 12 per annum | Rs. 330 per annum |

| Cover stops at age | At the age of 70 years | At the age of 55 years |

| Maturity Benefit | Nil | Nil |

| Death Benefit (Natural Death) | Nil | Rs 2 lakhs |

| Death Benefit (Accidental Death) | Rs 2 lakhs | Rs 2 lakhs |

| Disability of both eyes, both hands, both legs or one eye and one limb | Rs 2 lakhs | Nil |

| Disability of one eye or one limb | Rs 1 lakh | Nil |

| Maximum Insurance cover | Rs 2 lakhs | Rs.2 lakhs |

| Risk Period | 1st June to 31st May every year. | 1st June to 31st May every year. |

| Mode of Payment | Premium will be auto debited from account in the month of May every year. | Premium will be auto debited from account in the month of May every year. |

List of Banks which are offering Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Those who have bank account with banks like ICICI Bank, HDFC Bank have got SMS

Dear Customer, Get Rs 2 lac Accident Cover with Pradhan Mantri Suraksha Bima Yojna for an annual premium of Rs 12. To subscribe SMS PMSBY Y to 5676712 from your registered mobile number. Premium amount will be debited from Your HDFC Bank Savings Account. For T & C & other details click here

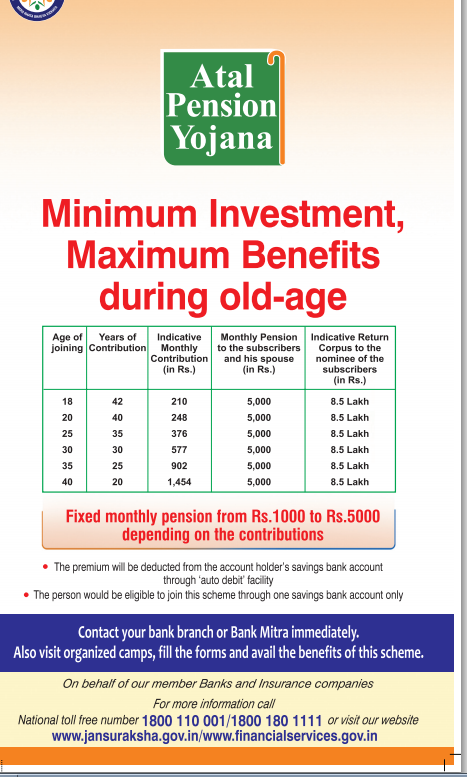

Atal Pension Yojna (APY)

Eligibility for APY: Atal Pension Yojana (APY) is open to all bank account holders who are not members of any statutory social security scheme.

Age of joining and contribution period: The minimum age of joining APY is 18 years and maximum age is 40 years. One needs to contribute till one attains 60 years of age.

Enrolment agencies: All Points of Presence (Service Providers) and Aggregators under Swavalamban Scheme would enrol subscribers through setup of National Pension System.

The Table of contribution levels, fixed monthly pension to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period is given below.

- if person joined Atal Pension Yojna at 35 years, he will contribute till age of 60 years ie 25 years.

- If he wants monthly pension of Rs 1000 he would contribute Rs 181 a month. On his death his wife would get Rs 1000 per month and after her death the nominees will get 1.7 lakh.

- If he wants monthly pension of Rs 3000 he would contribute Rs 543 a month. On his death his wife would get Rs 3000 per month and after her death the nominees will get 5.1 lakh.

- If he joins at the age of 18 years to get a fixed monthly pension of Rs. 1,000 per month, the subscriber has to contribute on monthly basis Rs. 42 for Rs 5000 pension he has to contribute Rs. 210.

- if he joins at the age of 40 years to get a fixed monthly pension of Rs. 1,000 per month, the subscriber has to contribute on monthly basis Rs. 291 and for Rs 5000 pension he has to contribute Rs. 1,454

| Age of Joining | Years of Contribution | Indicative Monthly Contribution for Monthly Pension of Rs 1000 and Corpus of Rs 1.7 Lakh(in Rs.) | Indicative Monthly Contribution for Monthly Pension of Rs 2000and Corpus of Rs 3.4 Lakh(in Rs.) | Indicative Monthly Contribution for Monthly Pension of Rs 3000 and and Corpus of Rs 5.1 Lakh(in Rs.) | Indicative Monthly Contribution for Monthly Pension of Rs 4000 and Corpus of Rs 6.8 Lakh(in Rs.) | Indicative Monthly Contribution for Monthly Pension of Rs 5000 and Corpus of Rs 8.5 Lakh(in Rs.) |

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1,454 |

Atal Pension Yojana (APY) and Swavalamban Yojana NPS Lite

How to open Atal Pension Yojna Account

- Submit the APY Form

- Provide Aadhaar No and Mobile Number

- Deposit the initial contribution according to the type of pension opted.

If one does not have a Bank Account

- Provide KYC Documents and open a Bank account by providing KYC document and Aadhaar

- Submit a signed APY proposal form

- Savings Bank account details, mobile number and authorization letter to the bank for the monthly auto debit option for remittance of contribution. •

- Spouse/Nominee details in APY form

Charges for not paying Monthly Contributions

In Atal Pension Yojna monthly contribution would automatically be deducted from Subscriber’s bank account. Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. If there is delay in contributions then Bank would levy penalty. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

- Rs 1 per month for contribution upto Rs. 100 per month.

- Rs 2 per month for contribution upto Rs. 101 to 500 per month.

- Rs 5 per month for contribution between Rs 501 to 1000 per month.

- Rs 10 per month for contribution beyond Rs 1001 per month.

Discontinuation of payments of contribution amount shall lead to following:

- After 6 months account will be frozen.

- After 12 months account will be deactivated.

- After 24 months account will be closed.

Exiting from Atal Pension Yojna

- On attaining the age of 60 years: The exit from APY is permitted at the age with 100% annuitisation of pension wealth. On exit, pension would be available to the subscriber.

- In case of death of subscriber pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension corpus would be returned to his nominee.

- Exit Before the age of 60 Years: Exit before 60 years of age is not permitted however it is permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease.

- Saving For Retirement : Pension Plans,NPS,EPF,PPF

- Checklist for buying Life Insurance Policy

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- What is ULIP or Unit Linked Insurance Plan

These insurance schemes intentions are well but how they would be executed and how would be the response , only time will tell. What do you think of these insurance schemes? How have you planned for your retirement? Do you have insurance and pension plan?

Dear Customer, Get Rs 2 lac Accident Cover with Pradhan Mantri Suraksha Bima Yojna for an annual premium of Rs 12. To subscribe SMS PMSBY Y to 5676712 from your registered mobile number. Premium amount will be debited from Your HDFC Bank Savings Account. For T & C & other details click

1,232 responses to “Pradhan Mantri Suraksha Bima Yojana,Pradhan Mantri Jeevan Jyoti Bima Yojana and Atal Pension Yojna”

This Pradhan Mantri Suraksha Bima Yojana,Pradhan Mantri Jeevan Jyoti Bima Yojana and Atal Pension Yojna is very beneficial to Indians. Great work

CAN 1 PERSON CAN APPLY ALL 3 schemes (APY,PMSBY, PMJJBY)

I had cancel my apy, as said on circular the premium of my monthly contribution will be refund to account, so how can i get it? my apy period time sept 2016 to january 2017.

Here is how you need to proceed:

Walk up to the bank where you opened your APY account.

Ask for APY account closure form. Fill in the form properly with all necessary details and submit the form.

The bank will process your account closure form and will refund the money you deposited under APY to you provided savings account number. You will get a notification when the money from your APY account hits your preferred savings bank account.

Once the bank processes the closure application form, here is what the bank will do:

Bank will first calculate the amount of money you have contributed to your account and the amount of money that has been contributed by the government.

Bank will then calculate the amount of interest earned by your deposited money and the interest earned by government’s deposited money.

Once these calculations are done, the bank will set aside the government contribution and the interest earned on government’s contribution.

Once that amount is separated, the remaining amount is your money (which includes the amount you deposited and the interest earned by that deposited amount).

Once the bank has calculated the money it owes to you, the bank will then calculate the amount of money that has been spent on maintaining your account under APY. This maintenance amount will be deducted from your money (your deposited amount and your interest earnings).

The remaining balance will be refunded to your savings bank account and you will be notified that your APY account has been closed.

Sir,

I have an APY at Katwa SBI Main Branch IFC COde-SBIN0000111. Now I want to transfer this saving bank account to Burdwan Main Branch IFC Code-SBIN0000048.

Will there be any problems for subscription and deduction from this account after transfer?

Thanking you,

No there should not be any problem.

I am constantly proclaiming that its hard to find good help, but here it is and while checking out http://www.pradhanmantriyojana… yesterday I found this

this is the most useful and admirable post which really helped me to solve my problem.

I have found so many useful link on your post page .

Where ever I look I found an useful post. I am really thankful to the Admin of this page.

I hope you will continue writing good quality post as you are writing now a days.

Best of luck.

thank you sir, Bas aap se ek gujaris hai ki jo bhi BPL card wale ho unhe lone dene ki kripa kare kam se kam lagat per plese sir

Sir mere father ki death last month 54 ki age mein hui hai to ky unhe jyoti bima ki 330 rupees wali policy ka claim ammount milega??

An unique scheme – Now can you please do something better with ESI , person those who have already retired from Private concern, but not getting any pension and have not yet spend a single money with ESI hospital. Many senior citizens are asking for the same and not getting proper facilities. Please arrange online remittance of renewal payment. Thanking you

I need this Scheme, need a Bima Policy today for the life saving.

Sir

Meri sister NE pmjjy liya tha unfortunately pmjjy lene ke 41ve din uski death ho gayi

Kya unka nomini ko claim milega

Milega. Insurance ka purpose hi yehi hai.

Aap apne bank to sampark karen!

mera ICICI bank or SBI me SB a/c hain,ICICI Bank main may2015 mein ne dono SMS kiya tha PMSBY & PMJJBY ke liye,but koy amount debit huya nehii ,usske baad SBI bank mee PMSBY & PMJJBY ka application form fill up korke dhono policy hoo giya,kuch din baad ICICI bank me bhi again hoo giya,ICICI bank me sampark kiya too bola ek thow cancelle hoo jaega,but Rs.330/-& 12/- not return to my any bank account,dono bank mee dotho policy generat huya,and this year dono bank seI SMS aaya ki 31/5/16 Rs.330/- & 12/- auto debit ho jaega.kaya kare,please help me,main chahata huu ek bank se debit huye….(+91-94332-18668)

Please ask one of the banks that you don’t want to continue as you have already enrolled in another bank.

From our article FAQ & List of Banks for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY)

In case of multiple saving bank accounts held by an individual in one or different banks, the person would be eligible to join the scheme through one savings bank account only. So You can have one type of insurance policy per saving bank account.So with same saving bank account you can take 1 Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & 1 Pradhan Mantri Suraksha Bima Yojana (PMSBY). One can also take Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) from 1 saving bank account & Pradhan Mantri Suraksha Bima Yojana (PMSBY) from other saving bank account.

But one cannot enrol for more than 1 Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) or Pradhan Mantri Suraksha Bima Yojana (PMSBY) policy. In case one buys Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) Pradhan Mantri Suraksha Bima Yojana (PMSBY) covered through more than one account and premium is received by insurance company , insurance cover will be restricted to Rs. 2 Lakh and the premium shall be liable to be forfeited.

Money got auto debited through bank for schemes PMSBY & PMJJY for financial year 2016 – 2017, but renewed policy is not send to registed mail id till now, Since last policy is valid till 1 June 2015 to 31 June 2016.

i also want to withdrew from the scheme, i enrolled in syndicate bank, what is the procedure for doping the scheme.

Do TAX Deduction apply to PMJJBY, PMSBY and PMAPY under 80C? Rather can policy documents associated with the above work as investment proofs for tax benefits?

Also, is there any URL where I can check the account details for my PMAPY scheme. My bank has no idea about this.

No there are no tax deduction for PPJJBY,PMSBY.

Initially there was no tax exemption on the premium amount paid in Atal Pension Yojana scheme. But a recent circular from Income tax department says that APY would have same benefits as NPS this means that premium amount paid can be claimed under section 80CCD. Current Limit for 80CCD tax exemption is rs 50 thousand. Ref

Periodical information to the subscribers regarding balance in the account,contribution credits etc. will be intimated to APY subscribers by way of SMS alerts.

The Subscriber will also be receiving physical Statement of Account. Periodic statement of APY account will be provided to the subscribers.

Have you received any SMS,information?

Can I enroll for the Pradhan Mantri Suraksha Bima Yojana now ?

I had not enrolled last year .

If not is there any other policy which I can enroll this year at affordable cost

you can enroll any time in your respective bank account.

sanjeet kumar thakur(indian bank)

I had enrolled for PMJJB through a auto voice call from HDFC. However did not get any confirmation/certificate. Then I had enrolled through Netbanking and got certificate. But now, I am observing that there is already a debit based on the first voice call. Now, I have 2 policies. How do I cancel one and get refund?

Regards

one cannot enrol for more than 1 Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) or Pradhan Mantri Suraksha Bima Yojana (PMSBY) policy. In case one buys Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) Pradhan Mantri Suraksha Bima Yojana (PMSBY) covered through more than one account and premium is received by insurance company , insurance cover will be restricted to Rs. 2 Lakh and the premium shall be liable to be forfeited.

Please get in touch with the bank and ask for refund.

Dear Sir

Myself and and my wife have already enrolled and had submitted our forms ,which are as follows:_

Swapan Bhattacharya – Policy No- SBI 12378201532209083241

Ila Bhattacharya – policy No- SBI 12378201532209083112

Above forms were being submitted on November, 2015 and till now our premium amount has not been deducted from our SBI Bank account. Please help us and let us know where to put our complaint

hi,

AT SVC bank iam open the PMJJBY &PMSBY DT. 24.07.2015 , BUT TILL DATE BANK NOT DR. ANY RS. 330 & 12 AT MY ACCOUNT , I AM ASKING BANK TODAY SCHEME IS CLOSE SO YOUR MONEY IS NOT DR. AT YOUR ACCOUNT, BUT I AM REQUEST TO BANK BUT HE SAY THIS SCHEME MANAGEMENT NOT INFORM ABOUT THIS SCHEME IS RUNNING OR NOT TODAY, SO KINDLY INFORM TO ME THROUGH MAIL OR MOB. NO. 9920320920 IS THAT TRUE OR NOT

good schemes,but its not reaching out to each and everyone in the country,implementation and advertising is very poor,should be brought to notice of the government.

I have subscribed this jeevan jyoti and jan dhan yojana but due to some problem I WANT TO STOP OR DISCONTINUE THEM???????????WHAT IS THE PROCESS?????????????

Submit application to bank so that premium is not deducted for next year.

This year the premium will not be refunded and you can enjoy the cover till May 31

I need this Scheme, need a Bima Policy today for the life saving.

How can i download SBI PMSBY Insurance Certificate ???

There is no place that we know of from where you can download the certificate. Your bank has to provide the policy. Contact your bank.

can i get this scheme for my brother if i can then how?

can i get this scheme for any other person like my brother

Hi Sir, How to check the status of Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) as i applied in HDFC Bank , please provide the procedure.

Thanks

Naresh Kumar.

Whenever I go to our nearest SBI branch,UJALPUR,SUNDARGARH,ODISHA;then the bank staff are saying to me that the validity date of PMSBY & other Bima Yojan’s are already finished. Where I had visited to branch office from March to till date 08.08.2015; they were told me the same sentence.

What I can fill up my Bima Yojana now?

dear

this scheme is just started, please contact nearest post office or nationalized bank, every bank is authorized to open account under this scheme,account may be opened till 26th January, 2016, the date may be extended

regards

Dev Sharma,

22/07/2015

I hd applied for PMJJBY. When i downloaded the policy certificate, I hv found that nominee is mentioned wrongly as my self name. Pls let me know, how it can be changed.

Thanks

It can be changed at the nearest bank or post office from where have you got the PMJJBY

Hi sir/madam

i have applied for PMJJBY from AXIS banck but now i want to change nominee name which i gave applying time.

please help me on this.

Advance thanks!!!

Please visit the branch and tell them clearly the issue. Please chase them.

account open a form

Dear Sir Or Mam..

mane Pradhan Mantri Jeevan Jyoti Bima Yojana me sbi se online form bhar diya he aur approved bhi ho gaya.form me nominee me meri wife ka name he

par usme mistake me is minor me tik ho gaya he to use me change karna chahta hu to kese hoga..pls help me.. thank.you..

Aap bank jaiye, woh appko nomination form de denge. Aap usme nomination change kar dijiye.

Dear Sir,

I m Live in Oman Employment VISA and I have NRE (Non-Resident External)bank account, Can I take (PMJBY) Pradhan Mantri Jeevan Jyoti Bima Yojana Scheme?

i join PMJJBY this month.my query is this,the bank manager said if u have any other policy(not same) then the claim is not pass.is that true?

Not true at all. I have personally taken it and I have other policies.

sir,

Mera A/c. SBIndia ki Y. N. Road, Indore men hai. maine 8 din pahle Pradhanmantri bima yojna ka form bhar kar diya. magar aaj din tak bima yojna lagu nahi hui. inquiry karne par mujhse kaha gaya ki abhi to mahine bhar pahle ke form bhi rakhe hue hai. Tumhara No. ayega tab ho jayega. men kya karu, kripya upay batayen.

Intezaar karne ke alwa aap kya karna chahte hain.

Kya aapka paisa deduct ho gaya ..agar nahin tu aap cancel kar sakte hain

varna aapki insurance der se shuru hogi hai..

U Should open it through internet banking it opens within 5 min

which death (accidental or Natural death) is covered under Atal Pension Yojna (APY). Please define.

Dear Rajan,

Pension is different from risk cover. Pension is the money which you get when you are not able to work. In case of death, the pension will be given to your nominee and in case of the nominee death, the remaining amount will be sent to his/her nominee.

i have an account with axis bank can i take part in atal pension yojana with this bank.

I checked Axis bank and couldn’t find them providing APY.

You could check with the bank. If it provides you can enroll from APY from Axis Bank

My age is 33. I want to enroll APJ plan.

But my confusion is who will be the nominee: my wife or my son?

If my son is the nominee then after I die will my wife get the pension?

Please clarify?

Typo: its APY plan.

U can give any one as nominee which you Like to get pension i.e wife of son.

My age is 35 year and i m staying in Ahmedabad. I want to take APY scheme in the Rs.902 premium and i will give premium upto 60 year age (25year) then i will start the pension of Rs.5000 from the Government. My name is main in the form then my wife is a nominee and if myself and my wife no more then my son is nominee so i want to know that after 3 to 4 year i will dead then who will get the pension and if Myself and my wife both are dead then how much money my son get from the government? The scheme is continue or stopped?

Hi Hemal,

In case of both of you are dead, the remaining amount handed over by you to government will be given to the nominee your wife has chosen.

श्रीमानजी,

अटल पेन्शन योजना में जो लास्ट मै अभिदातावोकी नमिती को मिळणे वाली मुलनिधी १.७०,३.४,५.१,६.८,८.५, ये राशी कब मिलेगी.

Shashikant,

The minimum age of joining APY is 18 years and maximum age is 40 years. One needs to contribute till one attains 60 years of age.

The Table of contribution levels, fixed monthly pension to subscribers and his spouse and return of corpus to nominees of subscribers and the contribution period is given below. For example, to get a fixed monthly pension between Rs. 1,000 per month and Rs. 5,000 per month, the subscriber has to contribute on monthly basis between Rs. 42 and Rs. 210, if he joins at the age of 18 years. For the same fixed pension levels, the contribution would range between Rs. 291 and Rs. 1,454, if the subscriber joins at the age of 40 years.

How to read the table.

30 30 116 231 347 462 577

If you join at 30 you have to put money till 30. For monthly pension of Rs 1000 you need to contribute Rs 116 and would get corpus of 1.7 lakh, Rs 231 for monthly pension of 2000 Rs and corpus of 3.4 lakh.

Hope it helps

Dear Concern,

Kindly share Outsourced companies details of PMSBY. Some companies are offering to do project but i am confused because as per information of Gov website and other sources it comes to know that bank will complete it directly.

Regards,

Vimal K

Hi,

I had applied for the Pradhan Mantri Yojana Jeevan Jyothi from ICICI bank but i never got an intimation regarding my application being registered. thereafter I went to SBI and applied and was aware the application was registered. After few weeks ICICI sends across a message that policy has been issued. I tried to cancel it but the ICICI Bank people are not aware of the policy details for cancellation. I stand to have my isurance becoming void. Please do let me know if there is a possiblity to cancel the policy as well as get my account credited with the money debited. if yes kinldy guide me through

you need to contact ICICI HO they will contact insurance company. It may take some days but policy will definitely get cancelled and your money will be refunded.

Dear

Mam/sir

this PM yojna Amount will be auto debited My account. next year or not.

because i want cancel It please help me.

How to cancel .for Amount will not auto debit next year my ac.

It auto renewal by default, but you can submit a letter to your bank branch for not making it auto renewal

Hello

I have enrolled to this scheme.

PMJBY & PMSBY

And

amount got debited from my Central bank. Now, I

want

to #cancel it.

Could you please tell me, How to cancel this

policy?

Do help

plzzzzz!!!!!

Dear Sir/Mam

I have one question. Can I mention new name of my wife (after marriage name) as a nomine? Before marrige-Shama & Now Veena. Please guide me.

What is her name in id proof such as Aadhaar or PAN Card.

Sir regarding the name of wife please think of what name she would continue with.

Our article Changing Name:What to do? talks about it detail

yes you can feed both name in your nominee column i.e.Shama Urf Veena….

or Veena Urf Shama so in any further circumstances there should be not any problem by God grace.

I have been miscommunicated about the policy premium in HDFC bank and therefore I want to cancel it.

But there are mixed responses one time the customer desk says the bank will cancel it, one time they say that I have to send an application letter for cancellation.

Please communicate the precise way

I am at age of 41, if I apply for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and I will pay premium of Rs.330 per annum till the age of 55 yrs. After 55 years whenever I died by accidental or natual death (may be I died 80 yrs) in that case my nominiee will get the beneficial amount ie. 2 lacs.

sir

i am 37 yrs now i have taken a atal pension yojana

if something happened after 10 years to me the amount will go nominee

can i change my nominee name afterwards .

how to I get the pm polices.

pls tell me?

I enrolled both PMSBY and PMJJBY through corporation bank. But they have not provided the acknowledgment or policy document. When asked they told to contact insurance companies. when i contact insurance companies they told there is no policy documents issued for this scheme separately to each person as it is group policy. I really confused, what is the problem in providing the acknowledgment or policy document or any other which gives the details about the insured person and his nomination made. Is it possible for my nominee to claim without acknowledgement or policy document. Though the scheme is good, Now i am in mind to cancel because of this.

You need not have a document for the same as your premium amount is being deducted at your own SB account that deduction transaction itself acts as document , the same can be claimed by your nominee submitting supported documents with their ID proofs

How to claim these policies were availed.which prosissure.

Sir did you mean

– how to know whether policies were claimed – you should get a policy document

– how to claim , for PMJJBY and PMSBY nominee has to visit the bank from where the policy was take and submit claim document, death certificate etc.

You need not have a document for the same as your premium amount is being deducted at your own SB account that deduction transaction itself acts as document , the same can be claimed by your nominee submitting supported documents with their ID proofs

dear,sir

મેં apy યોજના માં મારૂ અને મારી વાઈફ નું ખાતું ખોલવ્યું. પરંતુ મારી વાઈફની જન્મ તારીખ બેન્ક મેનેજરની ભૂલ ના કારણે 06/06/1986 ની જગ્યાએ 06/6/1988 કરી હતી. તેના કારણે મારી વાઇફ ની ઉમર માં 2 વરસ ની ભૂલ આવી. મને બીજા દિવસે જ્યારે ભૂલ વિષે ખબર પડી ત્યારે હું બેન્ક માં ગયો અને મેનેજર સાહેબ ને જાણ કરી તો તેમણે બેન્ક અકાઉંટ નું ફોર્મ મંગાવ્યું. અને ડોકયુમેંટ ચેક કરી ને જન્મ તારીખ સુધારી દીધી. પરંતુ APY ના ખાતા માં તો ભૂલ નહીં સુધરે તેમ કહ્યું. તો તે ભૂલ સુધારવા માટે મારે શું કરવું. પ્લીઝ યોગ્ય માર્ગદર્શન આપશો ? મારે પાછળ થી કોઈ પ્રોબ્લેમ તો નહીં થાય ને ?

Kya main online kuch pension yojona Kara sakti hu..

Aap kya Atal pension yojna ki baat kar rahi hain yaa kuch aur ki?

need nps( pran card) franchisee ? Pan card franchisee ? E- Insurance franchiese ?

i am back guys. anybody interested to sell these three services ( as service agency or Service center) can contact me. any state any city..

sunil arora 8427029001, 9877770001

thanks & Regards

need nps( pran card) franchisee ? Pan card franchisee ? E- Insurance franchiese ?

i am back guys. anybody interested to sell these three services ( as service agency or Service center) can contact me. any state any city..

sunil arora 8427029001, 9877770001

I have enrolled for both PMJJBY & PMSBY by online in SBI A/c. When i enquiry to bank about physical/email policy document, bank refused for policy document. Is it correct method ???

No it’s not correct. You are supposed to get atleast online policy document. The bank may also not be aware of it.

How long it has been since you availed PMJJBY & PMSBY ?

Even I have taken PMJJBY online and till datee i havent recevied any receipt of acknoledgment .

Some document should be there for future refernce and online banking has deducted Rs.330/- twice i dnt know why ..

could some one help me out

If you are doing ONLINE you should received immediatly Acknowledgement paper with Master policy Number

i also did not get acknowledge till now …i have applied online . what to do. bank are saying that online application we cannt give certificate.

Yes that has been bane of all the Yojnas. I have also applied and have just got one certificate.

I would like to cancel my PM Policies.

Kindly guide me , how to cancel the Policies 12 Rs and 330 Rs

We don’t know how to cancel them – they don’t have 15 days free look unlike other insurance polices. We’ll try to find out

But we are intrigued – why do you want to cancel.

can we paid preamium amount for six months or one year?

Premium for PMSBY and PPJJBY would be once a year before 31st May.

Premium for APY is monthly which will be auto debited from saving bank account

Hi,

Can 1 person avail for 2 schemes at a time. The 12 rs and 330 rs either from the same bank or from different banks. If yes good and if no why.

Preferably you should get it from same bank. Easy to maintain.

I have personally got it from same bank.

Both the insurance schemes at same bank. If done from different banks

all indians are thankful for these yojnas of government but there is a question in my mind that what is the benefit of the yojnas for our governments and banks

great pm for nation

what if I opt for Pradhan Mantri Jeevan Jyoti Bima Yojana and I die after 55 years , do the nominee get the amt..

No Sir . If one enrolls for PMJJBM one has to pay premium till one is 50 years of age. The cover is till 55 years of age. If subscriber passes away after 55 years nominee does not get anything. As PMJJBY is a term insurance plan

Is NRI can take this policy, without aadhar is it possible to take policy.

I mean APY

It is not mandatory to provide Aadhaar number for opening APY account for subscriber . However,For enrolment, Aadhaar would be the primary KYC document for identification of beneficiaries, spouse and nominees to avoid pension rights and entitlement related disputes in the long-term

There is no information on whether NRI can or cannot apply

We will try to find out if you get some information do let us know too.

My query is this that if we don’t save acknowledgement after conformation in psby how can we find it.

As The money is deducted from your saving bank account you do have the proof.

You should get the policy document.

Sir please contact your bank.

Dear Sir,

Want to know about PMJJBY & PMSBY i have enrolled for both. If something happened to me how the Nominee will claim this amount & whom to approach for the same.

If i have other company insurance still i will nominee will get the claim?

Kindly advise.

If the subscriber passes away then nominee has to inform the bank branch from which policy was taken. On receipt of death intimation, the servicing bank branch shall send the Claim form , Death Certificate, Discharge form and Certificate of Insurance from the nominated Beneficiary to Insurance company. On admission of the claim, the claim amount will be paid to the bank account of the nominee with intimation to the designated branch of the Bank .

In case of requirements or claim is not accepted, the same will be intimated to designated branch of the Bank. Please inform the nominee of the paper work.

Hello,

My age is 42, without knowing the details of

PMJJBY, I have enrolled to this scheme. And

amt got debited from my Central bank. Now, I want

to #cancel it.

Could you please tell me, How to cancel this

policy?

Do help

Sir PMJJBY is Available to people in the age group of 18 to 50 and having a bank account.

So you are covered for life insurance of 2 lakh till May 2016. If you don’t like the policy you can cancel it next year.

PRADHAN MANTRI JEEVAN JYOTI BIMA YOJANA

• PRADHAN MANTRI SURAKSHA BIMA YOJANA

I have enrolled for both using HDFC bank and they have deducted the premium as well, but when and how will i get the policy documents? Also can this premium be used for tax rebate? i know the amt of tax saved will be negligible, but just asking..

Pradhan Mantri Suraksha Bima Yojana

PRADHAN MANTRI SURAKSHA BIMA YOJANA

I have enrolled for both(via HDFC bank), how and when will i get the policy document? One premium is already taken by HDFC

Also is this eligible for tax deduction, i know the tax saved on both is negligible, but still valid question right?

Hello Sir,

I am a law student(4th year). I really want to know is there any scheme covered under Pradhanmantri Yojna, where a student can invest so that he/she can be financially benefited after the maturity of the short term investment plan, like after 2 or 3 years.

Thank you for time and consideration.

No Mahima not that we know of. If you have need money after short time then do not fully invest in equities or equity mutual fund due to volatility.

As a student your income would be less than basic exemption limit so you can invest in a Recurring Deposit for which though interest is taxable would not affect you because of your income. You would have to get PAN and submit Form 15G.

Does that make sense to you?

I have registered myself through Net Banking in PMJJBY & PMJSBY but even after many days I have not recieved acknowledgement,any information and policy documents etc.So is there any sources online from where I can get necessary documents? Pliz suggest.

I am a Telangana State Government Employee. CPS will be deduction from my salary.

My age is 42 years. Is policy PMSBY and PMJJBY useful to me? in what way?

IS AADHAAR NO IS NECESSARY FOR ATAL PENSION YOJNA

If you look at the form of Atal Pension Yojna Aadhaar does not seem mandatory.

FAQ says

It is not mandatory to provide Aadhaar number for opening APY account. However,

For enrolment, Aadhaar would be the primary KYC document for identification of

beneficiaries, spouse and nominees to avoid pension rights and entitlement related disputes in the long-term.

But Aadhaar is becoming more and more important so we would suggest you to get for yourself and your family members. Even Income Tax return forms need Aadhaar.

Is there any particular reason you don’t want Aadhaar

I have enrolled(only basic deatails filled when email sent from bank) for both suraksha bima and jeevan jyoti bima yojana & my amount has been reduced from HDFC Bank account. I dont have any policy document/Nominee details for both policy. Can I get policy document? Can I update Nominee details.

SIR,

i haven’t open any pension account though i am a student,age 25…..would you give me some idea…thk u

Dorjay,

Pension is a fixed amount you get every month.

If you join APY you can choose how much pension you want 1000/2000/3000/4000/5000. For remaining 35 years i.e till you become 60 you will contribute corressponding amount. 151/226/301/376

After attaining 60 years you will get monthly pension for amount you have chosen.

After death of subscriber the spouse gets monthly pension for life.

After death of both subscriber and spouse the nominee gets lump sum amount.

As you are a student i.e not income tax payer and not covered under EPF scheme Govt will co-contribute 50% or Rs 1000 which ever is lower for 5 years or till you satisfy the above conditions

Modi government. Atal Yojana retirement pension.

A Calculation.

@@@@@@@@@@@@@@@@@@@@@@@@

Arrive age. – 18

Years of paying – 42

Rupee paying Rs42 / =

Atal retirement pension Yojana By project

Get a payment of – 17000.00

Monthly pension. – 1000.00

@@@@@@@@@@@@@@@@@@@@@@@@@

Calculation of the Post Office.

Arrive age. – 18

Years of paying – 42

Rupee paying Rs42 / =

Pay at the post office

interest of 8.4% per annum (quarterly

compounded) and recive a amount Rs 193673.00

The sixty-year-old senior Citizen for Rs 193673.00

Will receive interest rate of 9.3% per annum.

Monthly income by interest 1500.00 / =

??????????????????????????????

hi i have ENROLLED IN ATAL PENSION YOYNA but i am a tax payer. If i continue the scheme shall i get pension after 60 year? if anwer is yes then what will be rate of interest i will get on accomulated amount.

Yes Maam. Being a tax payer means that Govt. will not co-contribute into your APY account.

APY, Government will co-contribute 50% of the total contribution or Rs. 1,000/- per annum, whichever is lower, to the eligible APY account holders who join the scheme during the period 1st June, 2015 to 31st December, 2015. The Government cocontribution will be given for 5 years from FY 2015-16 to 2019-20.

Insurance cannot be compared to investment. You will get pension for rest of life. After your death your husband will get pension for rest of life. And then nominee will get a lump sump amount.

This scheme is very use full for every Indian.Modi government is great.

hi…

my mom n dad and my sister n brother has given my name as nominee. kya muze in charon ke marneke baad 8laakh milenge….?

Jee haan unless they change their nominee

Hello sir,

I took all the 3 policies for both my wife and myself. I have a question regarding the pension policy. We have specified nominee as each other, that is: I have specified the nominee as my wife and she has given my name as nominee.

as per your replies to the questions above, If a person dies, spouse gets the pension and if the spouse also dies then the nominee get the total amount. So, if the nominee is spouse then what happens once both are dead? Should we specify nominee as our child, as anyways the spouse would be getting the pension every month on death?

Please clarify.

Thank you.

Sir For Atal Pension Yojna the name of nominee should be other than wife/husband. As you rightly pointed out nominee is name of spouse who will get the lump sum amount. So please do change the nominee

Hi sir/madam,

I read some of your query solving things, they were too good. I hope my querry also to be get resolved.

Query:

I met an accident in 2012, I have one more operation to do now(2015). Am I eligible for that operation is covered in bima yojna…pls reply. It will helpful for many people.

Sir Bima yojna does not cover hospital expenses. It is not medical insurance.

if person joined Atal Pension Yojna, he will contribute till age of 60 years

eg…..

If he wants monthly pension of Rs 1000 he would contribute Rs 181 a month. On his death his wife would get Rs 1000 per month and after her death the nominees will get 1.7 lakh.We understood….

But Clear the death period for taking benifits of Corpus.

eg, Period Between Year of Contribution / After Contribution / Both period

Insurance covers one when the premium is paid.

So once the person who subscribes to Atal Pension Yojna passes away any time after taking the APY plan, the spouse will start getting pension without paying extra premium.

Schemes are really good…but will 1000 or 5000 pension is good as per increasing inflation. ….at time when we reach 60…

Itne paise me itna-ich milega 😀

Hello,

My age is 57, without knowing the details of PMJJBY, I have enrolled to this scheme. And amt got debited from my icici bank. Now, I want to cancel it.

Could you please tell me, How to cancel this policy?

Do help

Sir,

Your request should have been rejected and money refunded. Please bring it to notice of ICICI bank

You can call 1800-180-1111 / 1800-110-001

My wife age is 37 years.

She is house wife and is having PAN No.

She is also having PPF account.

She is filling NIL Income Tax Return.

Can she is eligible to applying APY.

If eligible, can govt. will be contributing in this scheme i.e. 50% of the contribution.

Sir,

These policy are very concinious.And profitable sovery nice

Yes Sir she is eligible to apply for APY.

Govt should contribute 50% of the contribution . Please do keep us updated.

I AM VERY VERY THANKFUL TO SH. MODI JI (PM OF INDIA) FOR THE BIMA YOJANA

Sir

As per the Atal Pention Yojana, those who are contributing EPF thery are not eligible for the pension. Suppose one person 18 yrs old he started the pension scheme. After 5 yrs he is in service & he is started to contribute the EPF. In this case whether he is eligible to get the APY pension.

Sir,That is not so.

So if you have an EPF account you can still open Atal Pension Yojna account but government will not contribute to your APY account. You would have to make full contribution for selected pension amount.

As u mentioned if a person has EPF account then also he is eligible for opening APY account but he needs to make full contribution. I would like to know what do you mean by full contribution In APY scheme? And when and how does govt does 50% contribution in APY scheme?

Hi

If any maturity amt we will get from PMSBY and PMJJBY

Maam, this is an insurance scheme and not investment scheme and that too which offers only protection. Something like buying helmet, you buy it to be safe not to think money is being waster if its not used

There is no maturity amount

Comparison between Jeevan Jyoti Bima Yojana (PMJJBY) vs Suraksha Bima Yojana (PMSBY)

PMJJBY is offering more benefit than PMSBY with very less premium and the age bracket is more offered by PMJJY. Any reason? are there any hidden benefits in PMSBY or hidden cost in PMJJY.

Interesting question Kiran.

The two polices are different, PBSBY is for personal accident while PMJJBY is for life

I want to change my nominee’s name in PMSBY Policy (as my nominee is a minor), in that case is there any provision to change nominee’s name through SMS or directly through internet?

Change of nominee Form has to be filled in. This is still not available.

Sir,

My question is regarding APY.

1) If the policy holder dies soon after enrolling the scheme, what will happen ? Is the policy in force ? If yes, is remaining premium to be paid ? And who will pay ?

2) Suppose the policy holder dies at an age of 80 years and his wife dies on 87 years, will his nominee get the bulk amount(eg:8.5 L for monthly pension of Rs. 5000/)

sir,

1. The insurance works like this, one takes a cover and pays premium. if one dies during the cover period the insurance comes in. So if one dies anytime after taking APY the spouse will start getting pension. The premiums won’t have to be paid.

2. Your understanding is correct. Yes if policy holder dies at age of 80 years then the spouse starts getting pension. When spouse dies at age of 87 years, nominee gets the bulk amount.

THANKS “SABKA SATH SAB KA BIKASH” THIS IS THE RIGHT SCHEMS AND YOJANAS FOR THE BENIFITS OF THE MEASURE CITIZEN OF INDIA

THANKS “SABKA SATH, SAB KA BIKASH” THIS IS THE RIGHT SCHEMS AND YOJANAS FOR THE BENIFITS OF THE MEASURE CITIZEN OF INDIA

Thanks, India

Dear Sir/Kirti Mam n Bemoneyaware Team,

I am a CSP to SBI-Kiosk Banking.

Heartly thanks to Ho. PM Modiji and to all of you !

Thank You Arvind

Sir,

I have two queries regarding the atal pension yojna, please clarify:

i) Can my wife(housewife) apply for this yojna, specifying myself(government employee) as the nominee.

ii) Starting 60yrs of age for how many years she will get the pension? For example i am opting for 5000 as the pension amount, will she get it till her death or maximum of 8.5lakhs. (850000/12*5000)

Starting 60yrs of age for how many years i will get the pension?

Sir, if someone subscribes to Atal Pension Yojna, anytime the person dies(before or after 60 years), the spouse gets the pension.

If person live till 60 years he gets pension till he is alive.

After death of spouse the nominee gets lump sum amount corressponding to monthly pension 1.7 lakh if one went for Rs 1,000 of pension, 8.5 lakh if one subscribed to 5000 Rs monthly pension

Yes Sir

1. You and Your wife can both apply for this yojna if you are between 18-40 years. You &your wife can nominate your child. Each of you can mention spouse name.

As your wife is home maker – she would not be paying any income tax and would not be covered by any Pension scheme so for 5 years Govt will contribute. In APY, Government will co-contribute 50% of the total contribution or Rs. 1,000/- per annum, whichever is lower, to the eligible APY account holders who join the scheme during the period 1st June, 2015 to 31st December, 2015. The Government cocontribution will be given for 5 years from FY 2015-16 to 2019-20.

2. Once the pension scheme starts In case of death of the Subscriber due to any cause pension would be available to the spouse and on the

death of both of them (subscriber and spouse), the pension corpus would be

returned to his nominee.

i had given nomination to the bank for PMJJBY scheme.now i want to change.can bank modify ?

Yes Sir you can change it. But forms are not available. If you could find and update us are change of nomination form available it would be beneficial to other readers.

I am 27 and I have enrolled today for both suraksha bima and jeevan jyoti bima yojana, and my question is – if I died accidentally then how much amount my nominee will get,whether it’s 2 lakhs or 4 Lakhs(for both the plans)?

If accidental death, 2lakhs from both scheme, together 4lakhs. In case of natural death, 2lakhs from jeevan jyoti bima yojana only.

4 lakhs

Modi is a real prime minister for poor person. thanks modiji.

CAN THE POLICY BE TAKEN NEXT YEAR???

You can take these even now. Cover will be from 1 June 2015 to 31 May 2016

I donot have Adhar card but i have saving actt.no147010100086790 in Axix bank jammu bahu plaza.when i aproached the bank they refuse to provide me accidental insurance inspite of pan no. already provided in the actt.

My husband & children also donot have Adhar card but they got the insurance from J&k bank & PNB .my contact no 9419196946

kya in dono yojna ka her saal ka primium same hoga.

Jee haan

PMSBY ka premium Rs 12

and PMJJBY premium is 330 Rs

sir thanks for giving us such a wonderfull saving cum lifeinsurence cover guidence .

If I am having “Pradhan Mantri Jeevan Jyoti Bima Yojana” and if i died at the age of 55(natural death) will be my nominee receiving the insurence cover amount ??

Maam if a subscriber subscribes to PMJJBY and pays premium till 50 years of age, at any time on death of the subscriber,natural accident, nominee will get 2 lakh Rs.

Do i need to submit the form in bank? Can’t I just send the SMS or enroll it online? Please reply.

Banks like SBI, ICICI, HDFC Bank are allowing people to apply through internet banking. Soon most of the banks will also provide the facility.

If your bank provides subscribing to these social security schemes through internet you can do so,

For example for ICICI bank

Pradhan Mantri Suraksha Bima Yojana

To Apply:

Through Internet Banking, please login to your Internet Banking account at ICICI Bank and follow the navigation :

Service Requests > Bank Accounts > Enroll for Pradhan Mantri Suraksha Bima Yojana

Or

Through mobile, please send SMS PMSBY Y to 5676766 from your registered mobile number.

Dear Kirti Mam,

Thanks for your kindly responses with highly patience !

1) If some one wants to join all the three yojnas and wants to pay FULL PREMIUM in all of them in one instalment at the beginning, whether this is permissible to him/her ?

2) In APY, is any document required such as for date of birth proof or income proof?

1. For PMJJBY and PMSBY premium is to be paid every year. For Atal Pension Yojna premium payment is monthly but it will be auto debited from the account.

2. Your date of birth is same as in the bank records.

sir, is there a chance to enrol in june for PmJJY and PMSBY

Upto what age pension will bw continue?

Till life as no age has been mentioned in APY documents

Thank Prime Minister your are really our care taker lot of thanks for these three gift of our nation.

regards

rajitha

If I die before 60, then how much money to be given to him instantly & how much after the tenure of policy? If I die after 60 then what will be the scenario? Tollfree and bank branch are not able give appropriate answere. Please help.

Sir We assume you are talking about Atal Pension Yojna.

For pension you pay premium till you become 60 years. Then after 60 years you start getting pension for whatever amount you contributed 1000/2000/3000/4000/5000 a month.

Once subscriber dies, before or after 60 years but has paid all the premiums, then the spouse gets the pension.

When both die the nominee gets corpus for ex : 8.5 lakh for 5000 Rs monthly pension & 1.7 lakh for Rs 1000 of monthly pension

One hypothetical question for every body !!!

If someone died in a road accident ( before 60 yrs) after taking all the 3 schemes, how much money to be given to his nominee? What will be the scenario if he dies after 60 years ??

Sir, age limit in each of the scheme is different.

Pradhan Mantri Jeevan Jyoti Beema Yojna one pays premium till one becomes 50 years of age. If one dies before 55 years of age nominee gets 2 lakh. If one dies after 55 years of age nominee does not get anything. Death can be though natural causes or accident

For Pradhan Mantri Jeevan Suraska Bima Yojna one pays premium till 70 years. If one dies through accident till 70 years nominee gets 2 lakh. If one dies through natural causes nominee does not get anything.

For Atal Pension Yojna one pays premium till 60 years of age. Then after 60 years you start getting pension for whatever amount you contributed 1000/2000/3000/4000/5000 a month. Once subscriber dies, even before 60 years of age, the spouse gets the pension. When both die the nominee gets corpus 8.5 lakh for 5000 Rs monthly pension. Death can be through accident or natural causes

We hope Sir it clarifies the question

Thank you so much honorable Prime Minister Narendra Modi Ji !!!

Dear Kirti Madam, I am 32 yrs old & working in pvt organization & getting 3.5 lakhs per annum, also enrolled in epf (1800/- per month) through my present company. I have taken all the 3 schemes of central govt today, I have to pay 630/- every month for APY (5K per month scheme). My younger brother is my nominee, if I die before 60, then how much money to given to him instantly & how much after the tenure of policy? If I die after 60 then what will be the scenario?

I think if you are a EPF member the APY doesnt works for you…

Sir,

I applied two times of both of the Pradhan Mantri Suraksha Bima Yojana and Pradhan Mantri Jeevan Jyoti Bima Yojana on a same axis bank savings account, one is by going to the bank and another is by online. I want to cancel the one request for both of the insurance. But the bank said that they can’t help me to cancel that. Can you help me?

Has the money been debited from the account for both?

Theoretically the same request should not accept the request from the same bank for same scheme.

Worst situation is that you might loose your premium.

yes. money is debited for both. How do I know if I loose the premium?

#bemoneyaware, what is the claim procedure in all these insurance polices,

if the claim procedure is difficult enough, the policy which is to provide the insurance benefit for the poor people who are mostly illiterate and does not know to follow elaborate claim procedures, they’ll end up paying commission to others who have knowledge and apart from that no guidance is being given to them on this behalf.

Is it not govt duty to make people specifically in this Pradhanmantri Insurance plans to make transparency on the claim procedure to the people. If it is not being done in the mean time..

the outcomes will be only

Poor people will not be able to claim if they claim they will end up paying high commissions

or it simply means govt does not have any intention to claims compensation. because at 12*1cr means =12 Cr for the bare minimum 1 cr people for the lowest premium policy

Dear sir, I want to subscribe Atal Pension Yojana, as per my age i need to pay 577Rs/month. If i want to pay entire yr at a time, is there any conditions for that.

Sorry currently there is no such option. The amount would be auto debited from your saving bank account so you won’t have to do something yourself.

Why do you want to pay for 1 year together?

Dear Madam

I am exactly 25 years i just want to Start investing in all the 3 schemes announced by our PM Modi Sir

My Question is

1. If i pay 12 Till 70 Years and still alive will i get my amount Return

2. If i pay 330 also after the maturity will i get the amount back or else the amount will be lost?

3. I am willing to get pension 4000 so i have to invest till 35 years in this as i understood if i die my nominee will get pension if nominee dies who will get the lumpsom amount. and how did you calculate that you are getting 8.5 bolke

please give me a reply your reply is the only thing madam that i will star investing

please understand

Sir, age limit in each of the scheme is different.

Pradhan Mantri Jeevan Jyoti Beema Yojna one pays premium till one becomes 50 years of age. If one dies before 55 years of age nominee gets 2 lakh. If one dies after 55 years of age nominee does not get anything. Death can be though natural causes or accident

For Pradhan Mantri Jeevan Suraska Bima Yojna one pays premium till 70 years. If one dies through accident till 70 years nominee gets 2 lakh. If one dies through natural causes nominee does not get anything.

For Atal Pension Yojna one pays premium till 60 years of age. Then after 60 years you start getting pension for whatever amount you contributed 1000/2000/3000/4000/5000 a month. Once subscriber dies, even before 60 years of age, the spouse gets the pension. When both die the nominee gets corpus 8.5 lakh for 5000 Rs monthly pension. Death can be through accident or natural causes

We hope Sir it clarifies the question. Please think before applying as why do you need these schemes?

First of all thank you for providing such a exhastive information. I hope you will clarify my doubts on Pension Scheme:

1. What is Corupus amount? Is is apart from the Montly Pension or its the max sum of pension Amount? (ie) I will be eligible of 8.5L and monthly income 5000 or Max montly income can’t exceed 8.5L

2. Could you explain how pension scheme is better than PPF which is giving me 9.7L for 28year old guy paying for 32years?

3. As a tax payer, am I eligible to enrol this scheme?

4. for my brother, he is not a tax payer, if he joins and later if he becomes tax payer, will the scheme end for him?

Awaiting for your reply

Sir we shall try.

1. For pension you pay premium till you become 60 years. Then after 60 years you start getting pension for whatever amount you contributed 1000/2000/3000/4000/5000 a month. Once subscriber dies the spouse gets the pension. When both die the nominee gets corpus 8.5 lakh for 5000 Rs monthly pension.

2. You can’t compare pension to PPF. PPF is for 15 years tax free and you can put in till 1.5 lakh

3. yes you can enrol in the scheme but you won’t get Govt contribution

4. If the subscriber’s income at time of joining APY is below taxable limit (2.5 lak for FY 2015-16) then Govt will co-contribute 50% of the total contribution or Rs. 1,000 per annum, whichever is lower, to the eligible APY account holders who join the scheme during the period 1st June, 2015 to 31st December, 2015.

The Government co-contribution will be given for 5 years from FY 2015-16 to 2019-20.

If income becomes taxable before 2019-20 then Govt will stop co contributing.

Thanks for the clarifications, still I have the doubts

1. So, we will get pension till we die and after that our nominee will get 8.5L right?

2. We can extend PPF beyond 15 years I think (not sure tough) and 1.5L is max annual limit right?

You are most welcome to ask doubts.

1. Yes you get pension till you die, after death the spouse gets the pension and after the spouse death nominee gets the lump sum amount which for 5000 Rs of monthly pension is 8.5 lakh and 1.7 lakh for Rs 1000 monthly pension

2. Yes you can extend PPF account after 15 years for 5 years with or without contribution. Yes the maximum annual limit is Rs 1.5 lakh for PPF. It comes under 1.5 lakh limit of 80C which includes EPF, Life insurance premium

Our article On Maturity of PPF talks about extending PPF after 15 years.

thankyou for the prompt reply.. Now I understand the difference b/w PPF and Pension scheme

1. PPF will get Tax exemption, whereas pension scheme wont

2. PPF wont get any corpous after death, pension has corpous in addition to monthly pension

Great Article and great response. Hats off to the team!

Dear Kirti Mam,

In APY, if subscriber’s income becomes taxable, after some period of enrollment, will he exit from the plan? and what about the contribution made by the subscriber upto that certain period ?

Which documents are needed for APY ?

Thanking you,

Sir If the subscriber’s income at time of joining APY is below taxable limit (2.5 lak for FY 2015-16) then Govt will co-contribute 50% of the total contribution or Rs. 1,000 per annum, whichever is lower, to the eligible APY account holders who join the scheme during the period 1st June, 2015 to 31st December, 2015.

The Government co-contribution will be given for 5 years from FY 2015-16 to 2019-20.

If income becomes taxable before 2019-20 then Govt will stop co contributing.

Hi Sir

Today i enrolled in Life Insurance – Social Security Scheme 31.05.2015 Reference No -JN1515140653

But not able to get receipt from bank site this is my mistake

Can i get

If possile please advoice

RPGupta

Kirti Mam,

Heartly thanks for your co-operation with relating to make satisfied the people by providing the information about insurance plans….

Please clerify about the last dates of applications to all the three plans.

Initially on launch for the cover period from 1st June 2015 to 31st May 2016 subscribers are expected to enrol and give their auto-debit option by 31st May 2015, extendible up to 31st August 2015.

Enrolment after 31 Aug 2015 will be possible prospectively on payment of full annual payment and submission of a self-certificate of good health.

Hi i need to change my nominee details in PD bima yojana and suppose i had kept my fathers detiails as nominee in my bima yojana form and suppose if my fathers death happen then after my death who will be entilteled as nominee in my bima yojana ??

do reply

Sir

all insurance scheme’s allow change of nominee. So even PMJJBY will allow. Soon the change of nominee form will be allowed.

Sir,

One confusion.

I am interested in all three [PMSBY, PMJJBY, APY]. Now I want to have my wife as the nominee.

On the other-hand my wife [working] too is interested in all of those and she wants to have me as the nominee.

Will this create any complication? What will be the due course?

Yes Sir you can take all 3 scheme with your wife as nominee, if you meet eligibility criteria

You wife can also take all 3 schemes with you as nominee if she meets eligibility criteria.

Each scheme is independent by itself so there should not be any complication. Infact during claim it would be easier.

Sir,

I am a State Govt School Teacher, aged 36. My wife is 27 and she is a home maker. Can I opt for APY for my wife? Can we take both the yojanas-PMSBY and PMJJBY for my wife and me too?? Is there any yojana which will suit us from the central govt?

thank u..

Yes Sir you can take all 3 schemes or any 1 of the scheme such as Atal pension yojna with your wife as nominee,

You wife can also take all 3 schemes with you as nominee if she meets eligibility criteria. In her case Govt would contribute upto Rs 1000 for next 5 years as she in not income tax payer and not covered by EPF

which is the last date of 3 pradhan mantri yojana ?

Initially on launch for the cover period from 1st June 2015 to 31st May 2016 subscribers are expected to enrol and give their auto-debit option by 31st May 2015, extendible up to 31st August 2015.

Enrolment after 31 Aug 2015 will be possible prospectively on payment of full annual payment and submission of a self-certificate of good health.

Dear Sir/Maa’m

I have a doubt.Please clarify.Actually I wish to know that if husband is working with a PSU n his wife is housewife then whether She will be eligible for the APY.

If Yes then Plz Clarify.Husband is already availing benefit of another pension scheme

Sir you are also eligible for APY and also your wife.

Having another pension scheme does not affect APY.

As you are govt employee you are not eligible for Govt contribution. Though your wife maybe.

Government co-contribution is available for 5 years, i.e., from 2015-16 to 2019-20 for the subscribers who join the scheme during the period from 1st June, 2015 to 31st December, 2015 and who are not covered by any Statutory Social Security Schemes and are not income tax payers.

In APY, Government will co-contribute 50% of the total contribution or Rs. 1,000 per annum, whichever is lower, to the eligible APY account holders who join the scheme during the period 1st June, 2015 to 31st December, 2015. The Government co-contribution will be given for 5 years from FY 2015-16 to 2019-20.

i m 26 n unmarried. i made nominee to my mom after my marriage in case i died who will receive insurance amt nominee or husbnd.. plz reply

komal make nominee to your parents and after you let your parents get all the benefite… sorry for advicing you because i’m 16 yr old boy but i think i’m correct.

Your nominee will receive insurance amount.

But you can change your nominee .

We are tracking when the change of nominee form will be available and update once we have the info

Nominee is only recipient of the amount and is supposed to handover the amount to legal heir(s). However,after marriage you may change the nominee.

sir how to cancel Pradhan Mantri Jeevan Jyoti Bima Yojana? i alredy applied that

If you have applied through two banks then either approach one of the banks to stop your application.

one cannot enrol for more than 1 Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) or Pradhan Mantri Suraksha Bima Yojana (PMSBY) policy. In case one buys Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) Pradhan Mantri Suraksha Bima Yojana (PMSBY) covered through more than one account and premium is received by insurance company , the premium shall be liable to be forfeited.

Dear Sir,

Is 31/5/2015 is the last date for these schemes? Kindly reply

No the scheme is open till 31st Aug. The insurance cover will start from 1 Jun 2015 to 31 May 2016

I’m calling call center no.18001022636 the representative told me last date is 31st may 2015 to enroll this PMJJBY And PMSBY scheme. but you told 31st Aug 2015 is last date for enrollment.plese guide me for the matter.

Dear Kirti,

If me and my wife both take the ATAL pension scheme, in case of my death, whether my wife is eligible to get pension from both the policies?

Yes Sir if both husband and wife Mrs and Mr Sharma enrol for APY and make each other the nominee and pay the full premium.

Then if Mr Sharma passes away before 60 years say at 45 years then Mrs Sharma will start get the pension amount for Mr Sharma after Mr Sharma’s death. Her own pension amount she will get when she turns 60 years. The same would happen if Mrs Sharma passes away, Mr Sharma will get pension.

If Mr Sharma live till 60 years he starts getting his pension and when Mrs Sharma turns 60 she gets her pension. Now after 60 years if Mr Sharma passes away Mrs Sharma will get Mr Sharma’s pension and her pension. The same would be applicable if Mrs Sharma passes away after 60 years.

After death of both Mrs and Mr Sharma their nominee (if same) will get the lump sum amount for both Mrs and Mr Sharma.

Hope it clarifies your doubt Peter

Proud to have a active pradhan manthriji (Pradhan Sevak) for our nation. His intentions shows that how much he and his team is working towards the welfare for the mankind of this country. really these yojanas help at the time of Old Age. Thanks for Ideology

MODI : Maker Of Developed India.

Dear Kirti,

If me and my wife both take the ATAL pension scheme, in case of my death, wether my wife is eligible to get pension from both the policies?

Thank u our prime minister for selecting this type of scheme for poor people. .. u r the minister who really take care of poor people. …

I am having my account in UCO Bank, Santacruz (West) Branch, Mumbai. Can I submit PMJJBM form to UCO Bank in other city. Pls reply by E-mail urgently.

My Account is in UCO Bank, Santacruz (West) Branch, Mumbai. Can I submit PMJJBY Scheme form to UCO Bank in other city as I am out of Mumbai. Please reply urgently on my E-mail as this scheme closes on 31-05-2015 (Sunday) and banks will work until 30-05-2015.

Sir why the hurry. The scheme is not closing on 31 st May. It’s open till 31st Aug 2015 and even after that.

You need to submit form in the branch in which you have saving bank account as premium will be auto debited. You can enrol through netbanking and in that case nominee would be the one in the bank account

A great gift to every Indian citizen. So Lakh salam to Prime Minister Mr Narendra Modi

It is said that if I have any life insurance policy, I will not be eligilible to get benefit under PMSBY and PMJJBY.

Kindly guide me.

No that’s not true. You can take PMSBY and PMJJBY even if you have any other life insurance policy.

I am above 40 years so i am not eligible to APY. But my wife is under 40.So i want to take this policy in d name of my wife .If after 60 year or before my wife passed away by any reason than I am eligible for the pension after my 60 years .I am working in a limited company from 20 years . After my retirement , kuch pension mujhe PF ke dawar bhi milagi to kya mai jo APY kara raha hu apni wife ke nam se to kya ye dono prakar pension 60 yrs ke bad mujhe milti rahangi ya nahi . Kya 60 sal ke bad pension aur 8.50 lac bhi milega . 40 yrs ke liye 1454 Rs.monthly Jama karne he to kya isme government bhi kya kuch jama karege ya nahi.

Dear Pawan,

Its realy a good scheme.

1. If you wife is the policy holder and she died before the age of 60 you will be eligible for Lumsum payment depending upon the which pension scheme your wife had choosed during that time. If she attained the age of 60 year or more and paid the full premium…she willb eligble of monthly pension and unfortunatly she died after 60 year, you will be eligible of her pention and on the death of both (husband and wife) then nominee will get the lumsum corpus depending upon the pension scheme adopted. for 5000 pm ie. 8.50 lac.

2. No matter you are getting pension from your company, I don’t think there is any problem.

3. 40 year kay liye 1454 pmer month jama karnay hai for next 20 year.Yes the govt will deposite 50% of the contribution amount or 1000 P.A which ever is low but only in the situation if the contributor is not regsitered with any Social security scheme of india. If she is registered with any pention or pf etc.

sir, i completely understand the point no 1& 2 of your reply and a lot of thanks .

But sir i have some confusion in point no. 3,Pls. tell me in detail about point no. 3.

1. If i deposited Rs. 1454 monthly for 20 years or Rs 17448 yearly for 20 yearly then how much amount government will deposited on monthly basis or yearly basis , I will deposited in 20 years Rs. 3,48,960 what is the contribution of d government .

Sir does your wife pay income tax, is she covered in EPF. if yes then Govt will not contribute anything for her. If not

In APY, Government will co-contribute 50% of the total contribution or Rs. 1,000 per annum, whichever is lower, to the eligible APY account holders who join the scheme during the period 1st June, 2015 to 31st December, 2015. The Government co-contribution will be given for 5 years from FY 2015-16 to 2019-20.

Hope it clarifies your doubt

kirti madam ,

u have been really helpful.please clarify my queries.

i am 21 , on attaining the jivan bima scheme , until what age am i supposed to pay the premium ? what if i die before the maturity date ? kindly clarify…

You have to pay premium till you turn 50 years ie 29 more years. If some one takes PMJJBY and dies before attaining 55 years but has paid all premium his nominee will get 2 lakh.

But if subscriber dies after 55 years his nominee will not getting anything.

That’s how term insurance works!

While filling up the details, I mentioned the wrong date of birth of the nominee. Can I change it now ?

A form for change in nominee should be available soon. Will find more and keep you updated

I have join both schemes(PJJY,PSBY) and if i met with accident, will i be eligile for 2lakhs + 2lakhs cover?

i will get both insurance money

Yes Maam you are right. If someone subscribes to both PJJBY & PBSBY and has an accident the nominee will get both 2 lakh + 2 lakh.

Dear Sir/Mam,

What is last date of Sukanya smrudhi yojna.

There is no last date for Sukanya Smardihhi Yojna.

If a person joins both schemes(PJJY,PSBY) and met with accident, will he ne eligile for 2lakhs + 2lakhs cover?

Yes you are right Sree.

Yes one can enrol for both Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY).

If one enrols for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and pays all the due premiums then if death happens through natural or accident till subscriber is 55 years of age nominee will get 2 lakh.

If one enrols for Pradhan Mantri Suraksha Bima Yojana (PMSBY) and pays all the due premiums then if death happens ,due to accident ,only till 70 years of age nominee will get 2 lakh. Incase of natural death nominee will not get 2 lakh. In case of Disability of both eyes, both hands, both legs or one eye and one limb due to accident one will get Rs 2 lakhs. And for Disability of one eye or one limb one will get Rs 1 lakh

Dear Sree,

PMSBY is for accidental insurance

PMJJBY is for natural death.

If a person dies naturally, he is eligible for PMJJBY and gets 2lakh insurance.

If a person dies accidentally and he is enrolled in both PMSBY & PMJJBY and as a insurance cover will he get four lakhs.

i am 29 years old please tell me about my Premium Per month ??????

For PMJJY & PMSBY everyone who subscribes pays a flat amount of Rs 330 and Rs 12 per annum.

For APY the premium amount depends on age of subscriber and monthly pension he/she goes for.

For example:

For age 29 years one needs to contribute till 60 years

Monthly pension, premium

1000, 106

2000, 212

3000, 318

4000, 423

500 529

SABKA SATH SABKA VIKAS YE MODIJIKA NARA SAHI HO GAYA SABKO PENSION MAT LO TENSION RAHO ATTENSION

I am already having Insurance of 10 lakh from LIC. Is this scheme Pradhan Mantri Suraksha Bima applies to the person already insured

As explained in our article FAQ & List of Banks for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) & Pradhan Mantri Suraksha Bima Yojana (PMSBY) Will this cover be in addition to cover under any other insurance scheme the subscriber may be covered under?

Yes. It is over and above any other covers that you have. So if you have any personal accident or life insurance policy you can claim from that policy and this one. Please note that insurance cover for PBJJBY & PMSBY will be for 2 lakh only.

Hi

If i don’t have aadhar card. Am i also eligible for these policies or i should have adhar card to take benefit of these policies.

Please reply………

Sir Aadhaar card is not compulsory to enroll for these polices. Aadhaar card is compulsory for spouse and nominee in Atal pension Yojna.

If you checkout the form Aadhaar number is not required.

Sir Aadhaar card is becoming more and more important. Aadhaar is required as the single point for all your credentials and entitlements. This number will serve as a proof of identity and address, anywhere in India.

This year proposed ITR form also asked for Aadhaar.

We would suggest you get your Aadhaar number. Our article Aadhaar : What is Aadhaar, How to enrol,Check Aadhaar status,Download e Aadhaar explains it in detail.

Dear Sir/Mam

For Atal Pension yojana age limitation is 40 yrs but is there

any other yojna for over 40 yrs.

I already have a corporate scheme for death or accident but I want to do PMSBY so can I go for it.

Yes Sir you can go for PMSBY. This insurance policy is in addition to any other insurance policy that you have or will take.

I don’t want pradhan mantri jeevan jyoti bema yojana. How can i cancel it. I want only pradhan mantri suraksha bema yojana. Can you help me

You are free to decide. The policies are not auto activated. You have to apply for whichever you want to go for.