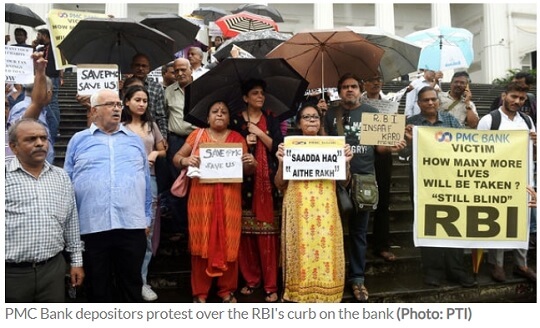

PMC or Punjab and Maharashtra Cooperative Bank was put under RBI watchlist in Sep 2019. PMC is in trouble for misreporting loans of Rs 6500 to Mumbai-based real estate developer Housing Development and Infrastructure Ltd (HDIL). Depositors were allowed to withdraw only 1000 Rs(subsequently raised to 40,000) for six months. The scam has already claimed five lives. Angry depositors have been gathering to protests to get their money out. What is the PMC Bank Crisis? Why was it not caught earlier?

I am losing my patience and money with every passing day. I have put all my hard earned money in the bank and this is what I get in the end. What wrong did I do that I am being made to beg for my own money?” 71-year-old Tek Chand echoed sentiments of PMC depositors.

Tek Chand is a retired government servant and a resident of Janakpuri in west Delhi, and his family has over Rs 18 lakh in the Tilak Nagar branch of PMC.

Table of Contents

PMC Bank Crisis

Established in 1984 in Sion in central Mumbai, PMC Bank is a scheduled urban cooperative bank with operations in 6 states i.e Maharashtra, New Delhi, Karnataka, Goa, Gujarat, Andhra Pradesh, and Madhya Pradesh. Spread over seven states with 137 branches and 51,000 members, PMC Bank has deposits of around Rs 11,617 crore. It is among India’s top five urban co-operative banks.

Cooperative banks are non-profit banking institutions owned by the members of the cooperative. They were set up to allow ease of access to credit and ensure financial inclusion.

PMC Bank crisis is a grim reminder of the Madhavpura Mercantile Co-operative bank (Gujarat-based) fiasco involving the infamous stock broker Ketan Parekh during 2012 where still many depositors have not received even Rs 1 lakh from the DICGC

There are usual villains in the bank crisis: property developers who allegedly over-borrowed due to relationship with bank MD; complicit senior bank management, MD who has two wives, and politicians who wield considerable influence over co-operative banks. The scam came to light after MD Joy Thomas informed the Reserve Bank of India (RBI) of the mess at the bank. His letter to RBI can be read here.

How things unfolded in PMC crisis

In an SMS to shareholders on 25 Sep 2019, Joy Thomas, suspended managing director of PMC Bank, informed that the bank has been put under regulatory restriction by the Reserve Bank of India (RBI) for six months.

Joy Thomas admitted that the bank had been breaking the rules for six to seven years by lending to now-bankrupt realty company Housing Development and Infrastructure Ltd (HDIL). PMC, which has a total asset book of Rs 8,383.33 crore as on 31 March 2019 has provided loans of Rs 6,500 crore to HDIL which is around 70% of the bank’s loan book. This was not unreported to the auditors and the RBI for years. For the last three years, although the repayment from HDIL was irregular, the bank did not report the advances as NPAs as it held security worth twice the value of the loan.

The stressed legacy accounts belonging to HDIL group were replaced with dummy accounts(21,000) to match the outstanding balances in the balance sheet. As the loans were mentioned as loans against depositors and were of lower amounts, they were not checked by the RBI.

According to the bank’s 2018-19 annual report, PMC’s percentage of gross NPA to gross advances is 3.76% while net NPA to net advances is 2.19% for the year ended March 31. The total deposits stood at Rs 11,617.34 crore

Why PMC gave money to HDIL?

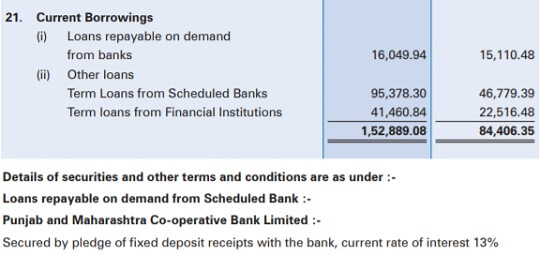

For years, the Wadhawans owners of HDIL have treated PMC bank as a personal lender. They have invested money in PMC bank as shown in the image from their annual report of 2017-18. The partnership can be traced back when the Rajesh Kumar Wadhawan, then director of Land Development Corp. and many other firms run by the Wadhawan family, infused ₹13 lakh into the bank in 1986-87. Since then the relationship between the lender and the Wadhawan family had only grown.

In 2004, the Wadhawan family deposited ₹100 crores to again help the bank tide over a financial crunch. However, trouble began when HDIL started defaulting in 2012-13 particularly after its airport slum project was cancelled.

Joy Thomas ex MD of PMC bank said. “Our intention was to grow fast. We did not disclose our exposure because that would have created a run on the bank“,

Thomas said the bank advanced an additional Rs 96 crore to the promoters of HDIL in Aug 2019 despite the company being admitted for proceedings under the Insolvency and Bankruptcy Code. This was to protect our security and prevent it from being part of bankruptcy proceedings, said Thomas

What actions have been taken in PMC bank crisis?

Following people are in judicial custody and are being investigated

- Joy Thomas managing director of PMC Bank. accused in a police complaint of criminal breach of trust, forgery and falsification of records in relation to PMC’s dealings with the HDIL. Thomas’s lawyer told the court that his client was acting under the instruction of the bank’s board of directors.

- Surjit Singh Arora, a former director of PMC who was a member of its loan committee.

- HDIL’s promoters Sarang Wadhawan and Rakesh Wadhawan

- PMC’s former chairman Waryam Singh. He was chairman of the bank between 1999 and 2005 and again took charge in 2015. Waryam Singh was on the board of HDIL the bank’s largest borrower. As per the disclosures made by HDIL at Bombay Stock Exchange, Singh sold 79.9 lakh shares in HDIL representing a 1.9% stake on March 22.

- India’s financial crime-fighting agency said it had identified and seized assets worth more than ₹3,830 crore, including two private jets, a yacht and several luxury cars which it says belong to HDIL’s directors and promoters, PMC bank officials and other related entities

Death of PMC Bank Depositors

Ever since the scam unfolded, many stressed account holders of the bank have died.

- On 14 October, 51-year-old Sanjay Gulati died of cardiac arrest after returning from a protest in the PMC Bank issue. Sanjay Gulati, who had lost his job when airline Jet Airways collapsed, had kept his lifelong savings of ₹90 lakh in the bank. He was in regular need of cash to pay for medical bills of his specially-abled son.

- On 15 Oct another customer of the scam-hit bank Fattomal Punjabi also died due to heart attack.

- On 16 October, 39 year old Nivedita Bijlani committed suicide in Mumbai by taking overdose of sleeping pills at her residence. She is said to have deposits of over Rs 1 crore with PMC Bank. The police, however, denied any link to the PMC Bank issue with her suicide.

- On October 19, Murlidhar Dharra, an 83-year-old depositor of the crippled cooperative lender, died, which the family attributed to their inability to arrange for funds to pay for his critical heart surgery. He had about Rs 80 lakh in deposits with PMC Bank

- On 20 October, another account holder of PMC Bank, Ram Arora, died in Mulund. However, Arora’s family members claimed that his death was not related to the bank scam or resultant restrictions on withdrawal of deposits.

- Bharati Sadarangani (73), died after a sudden cardiac arrest. Sadarangani was reportedly worried about her family’s future as her daughter and son-in-law have deposits in the bank worth Rs 2.5 crore

Many depositors chose to vote for NOTA in the Maharashtra elections held on Oct 2019. For example, in Jogeshwari (East), though Shiv Sena’s Ravindra Waikar won the election comfortably but NOTA got over 12,000 votes.

Joy Thomas, Properties, Second Marriage

Joy Thomas, the former MD of scam-hit PMC Bank, allegedly jointly owns 10 properties with his second wife in Pune bought since 2012. His second wife was his former assistant at the bank. Thomas married his personal assistant at the bank after converting to Islam and acquired a new name, Junaid Khan

Thomas also owns a flat in adjoining Thane and a commercial property which is under the control of his son from his first wife.

When Thomas’s first wife came to know about his second marriage, she filed for divorce and the case is in the final stages.

HDIL

How will PMC be able to recover its dues from a company whose cash flows are lower than its outstanding debt on books?

Once considered the third-largest realty developer in India, Mumbai-based Housing Development and Infrastructure Ltd (HDIL) now HDIL is fighting for survival.

- HDIL’s wholly-owned subsidiary, Guruashish Construction Pvt Ltd, has been taken for insolvency process by the Union Bank of India due to default in repayment of the loan and interest on July 24, 2017.

- On 20 Aug 2019, Bank of India filed a case in the National Company Law Tribunal Mumbai bench against HDIL, as the realtor defaulted on payment of Rs 522.29 crore on December 2018.

In July 2007, HDIL’s initial public offering (IPO) was fully subscribed and the company raised close to Rs 1,500 crore. In Oct 2019 it was trading at the value of Rs 1.75 on BSE.

In October 2007, HDIL bagged Mumbai airport slum rehabilitation project, a massive job at hand to clear 276 acres of airport land before October 2010, to rehabilitate 80,000 families and generate development rights of over 43.4 million sq. ft. But the project went behind the schedule, stuck midway and too much debt were taken to fund it. The project ended with a termination notice in 2014. The company also used up all the proceeds of the IPO to buy additional land parcels for the project.

HDIL is related to another non-banking finance company DHFL, which is having financial troubles. As part of a 2009 restructuring, Sarang and his father Rakesh took complete charge of HDIL, while cousins Kapil and Dheeraj Wadhawan took over the management of Dewan Housing Finance Corp. Ltd (DHFL), as well as the family’s other retail and hotel businesses.

According to HDIL’s latest annual report, unpaid interest and principal amount to banks and financial institutions is Rs 1,780.97 crore. HDIL’s debt, as on the annual reports, does not indicate a loan as huge as Rs 6,500 crore.

Cooperative Banks

What are cooperative banks?

Cooperative Banks are non-profit banking institutions that are started by people coming together to form a cooperative society, getting required approvals and licenses. Just like Amul which is a cooperative society for milk.

Their main function is to get the deposit from members and public and grant loans mostly to farmers(even farmer who is not a member ) and small industrialists in both rural and urban area. These are formulated to allow ease of access to credit while ensuring financial inclusion. Cooperative Banks are regulated by both banking and cooperative legislation.

Cooperative banks pay higher interest rates, are around for a long time and are popular because of the localised personal attention they provide their clientele, which is missing in large commercial banks.

There are over 1,551 urban co-op banks and around 96,600 rural co-operative banks

UCBs in the aggregate have just Rs 483 billion but a deposit base of Rs 4,565 billion. Investments, loans and advances together constituted nearly Rs 4,303 billion!

Difference between the cooperative banks and Commerical banks

The difference between the cooperative banks and Commercial banks(which can be public or private) are as follows:

- Commercial Banks are required to have a capital of more than 1,000 crores. Whereas the small banks are required to have a small capital of over 100 crores.

- Commercial Banks are regulated by RBI. While, cooperative banks, on the other hand, are regulated by both RBI and cooperative legislation (under the Cooperative Society Act, 1912).

- Cooperative Banks are not listed on the stock exchange while the Commerical banks are listed on the stock exchange.

Banks that have failed in India

If the banks fail people mostly lose their savings in the bank. They get only deposit insurance which is up to 1 lakh rupees.

Deposit insurance scheme covers bank deposits including savings, fixed and recurring with an insured bank. This deposit guarantee can be released only if the bank gets closed. if the bank is a going through problem customers do not get it.

Our article Deposit insurance on bank failure, Amount, Limit explains it in detail.

Nationalization of Banks

Between 1947 and 1969, 559 private banks in India failed, with numerous people losing their life’s savings. One of the reasons for the Indian government’s decision to nationalise the biggest banks in India in 1969 was the huge number of instances of private banks going bust.

Our article Nationalisation of banks: When, Why and Impact discusses about why the banks were nationalized

From 1969 onwards, 36 private banks have been put under moratorium in public interest, due to mismanagement and have gone out of existence. Several of them were merged with healthy Public Sector Banks (PSBs), such as the high-profile case of the Global Trust Bank which was merged with the Oriental Bank of Commerce in 2004.

Our article Can Banks Fail

Bank Frauds in India

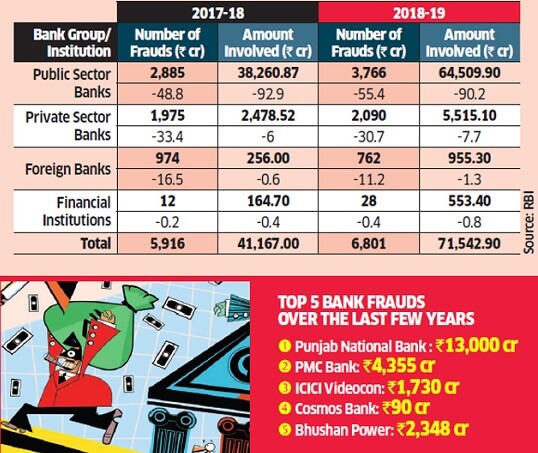

As per the latest Reserve Bank of India (RBI) data, 6,801 frauds totalling Rs 71,500 crore, were detected in FY19. That amounts to a 15% rise in volume and 80% climb in value from FY18 This rise eclipses the FY18 banking fraud at Punjab National Bank(PNB), the most infamous in India’s history when it was revealed that over the course of 7-8 years, fugitive diamond merchants Nirav Modi and Mehul Choksi allegedly siphoned off nearly Rs 13,000 crore from the lender.

Of these frauds, 73% were large ticket corporate frauds worth over Rs 100 crore. Public sector banks originated 92% of those fraudulent loans. Many of these frauds took place at least five years ago, and some over a decade ago. The most shocking data of all was the fact that average time for fraud over Rs 100 crore to be detected was 55 months

The public perception of fraud is mostly a Nirav Modi-style external attack on a bank, perpetuated by a crook with the help of an insider with corrupt motives and planned meticulously for months. However, in most cases, RBI data suggest that these are just defaults by promoter lacking equity due to stalled or ‘zombie’ projects, where an overzealous banker may not have conducted proper due diligence and ended up lending way more than the leverage on the bloc.

For more details, one can read the article

Should one put money in cooperative banks?

It is recommended to put money in private or public sector banks.

After all these scams, it is the depositors who suffer in the end. They find it difficult to get their hard-earned money back from the system. In the recent case of PMC, RBI has first allowed the depositors to withdraw INR 1,000 in 6 months from their bank account. This limit was further raised to INR 10,000, to INR 25,000 and then to 40,000 Rs.

These cooperative banks have been placed under restrictions.

There is a need for more stringent laws to be in place for cooperative banks. RBI must be given more power and control over the cooperative banks.

Related Articles:

Let us know what you think about this matter in the comments section below.

2 responses to “PMC Bank Crisis”

[…] a depositor can get up to Rs 1 lakh under the Deposit Insurance Scheme of the Bank. The debacle of Punjab and Maharashtra Co-operative (PMC) Bank has brought back the focus on depositors’ money protection and deposit insurance. Let’s […]

[…] PMC Bank Crisis […]