Have you needed cash in a hurry for a medical emergency? Many take a personal loan in such situations. From funding a holiday trip, marriage, home renovation, buying gadgets, personal loans can be utilized for any purpose other than buying a house. Availing personal loan is easy with simplified documentation and speedy approvals. Hence we often hear that one can get a personal loan in less than an hour and can convert his purchases into EMIs. But before taking personal loans let us understand, what factors should one consider in getting Personal Loans? Many consider the interest rate as the only deciding factor. Getting a personal loan at lower interest is just not sufficient. Different methods are used in calculating interest on Personal Loans such as Flat rate vs Reducing Balance rate. Please use a Personal Loan Calculator to find the EMI and amortization table to know how much would have to pay as interest.

Factors to bear in mind when getting Personal Loans

Most of the people while going for personal loan consider interest rate as the only deciding factor, it is also important to be aware of other charges that the loan entails.

- Interest rate for personal loans depends on user’s credit history

- Applicants having a credit score of 850 and above get loans at lowest rate of interest

- Applicants having a CIBIL score of 750 and above are offered the low rate of interest.

- Those loan applicants who have a credit score of 550 or above are offered loans at the highest rate of interest.

- Shopping around for the lowest rate can also go against you if you apply to many financial institutions. Every time when an individual applies for a loan the lender accesses his credit score to understand his ability to repay the loan. If you apply to too many lenders, your credit score would be affected, and you might be a credit hungry person.

- Interest rate is lesser for Salaried than for Self Employed.

- Salaried individuals will be paid salary at the end of the month, this makes banks confident about the regular payment of the EMIs and loan.

- For self- employed individuals, banks are hesitant of their ability to pay EMIs in time. Hence a bank needs more documentation.

- For the salaried employee it depends on the company one works Companies are categorized as Super A, B, C, D. Research shows that employees from the top IT and pharmaceuticals companies are preferred

- Your relations with the bank also affects the interest rate. If you have good relations and have been a customer of the bank for long time, then you are getting the loan at lower rates.

- How interest is calculated, Flat rate vs Reducing Balance rate

- Processing fee is usually 1-2% of the loan principal outstanding

- Loan tenure can be between 1 year to 5 years.

- Pre-closure charge is usually between 1% and 2%

Flat rate vs Reducing Balance rate

Interest is a portion of the loan which is repaid to the lender over and above the principal amount. The interest rate is usually shown in percentage calculated annually also known as APR or Annual Percentage Rate. Each EMI repayment, in any loan, has a portion which goes towards the principal amount and other which goes towards the interest. But there are 2 methods of calculating interest rate Flat rate and Reducing Balance rate. They differ in the way interest is calculated.

- In Flat Interest Rate loans, interest is calculated on the initial principal amount throughout the loan tenure.

- In Reducing Balance Interest Rate loans, interest is calculated on the reduced principal amount.

Let’s see with an example, Manoj got 2 offers for loan

- 2 lakh personal loan from a bank at an interest rate of 16%.

- 2 lakh personal loan at an interest rate of 12%.

Sounds that Manoj should take the loan at 12%. But no, the difference in EMI amount, the total amount paid is shown the image below.

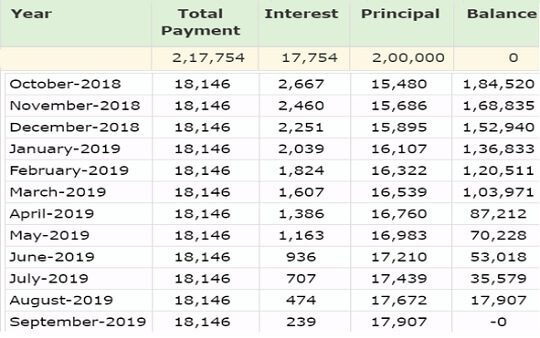

Amortization Table of the Flat rate of the Personal loan is shown below

Amortization Table for Reducing Balance Rate is shown below

Our conclusion

Mostly while taking personal loans many consider the interest rate and do not pay attention to other fees and charges. Remember Devil is in the detail and many end up paying lots of interest. These all factors you should consider while applying for personal loan.

Related Articles:

You could have added Equated Weekly Installment.

Professionals like doctors, lawyers and petty vendors, merchants etc opt for the scheme. Thus a petty vegetable vendor can repay 30000, by 15 EWIs of 2062.09 at 20% rate.

Thanks for info