A survey by credit information agency CIBIL revealed that as high as 92% of Indian credit card holders pay more than their minimum monthly dues. This is encouraging in light of the fact that only 88% Canadians, 89% Americans and 44% South Africans credit card holders pay more than their minimum monthly dues.

More encouraging is the fact that Indians also seem more aware of the penalties that come with non-payment of credit card dues. This has been established from a CIBIL survey that showed nine out of 10 credit card users were aware that delay or non-payment on credit card bills negatively impacts their credit score and penalties that are applicable for the same.

Credit card usage is markedly higher in cities like Delhi, Ahmedabad, Pune, and Mumbai compared to Kolkata, Bengaluru, Hyderabad and Chennai. It also indicated that about 78% of respondents usually pay off the full balance. This reflects the lowest delinquency rate ever.

In fact, Indians are much more aware when it came to credit card billing metrics. About 33% Indians are uncertain about the importance or benefits of paying more than the minimum due. This is in contrast to 39% Canadians who were uncertain, 25% Americans and 21% South Africans. Consumers who pay more than their minimum due on credit cards are less likely to go delinquent, according to Harshala Chandorkar, COO, TransUnion CIBIL.

In fact, a survey conducted across eight metro cities in India with 1,100 consumers. Among these eight metro cities surveyed, credit cards the most popular in Delhi with roughly 93% of respondents claiming that use their credit card for online and offline retail shopping. This is also proof of higher awareness as Delhiites also had a higher awareness of 81% as compared to other cities on the negative impact of a settlement.

About 90% of respondents knew that non-payment would affect their credit history and scores, which would, in turn, affect their borrowing capability. The CIBIL survey showed respondents in Kolkata and Chennai had maximum 95% awareness and zero uncertainty when it came to credit card usage.

Our Credit Card Payment Calculator shows how much time or money you need to pay your balance on credit cards.

Remember these to not to have credit card debt

- Don’t spend much more than you can afford.

- Pay your Credit Card 3 days before due date, keep a reminder on phone if it helps

- Don’t keep very high credit limit, if you can’t control yourself when it comes to spending

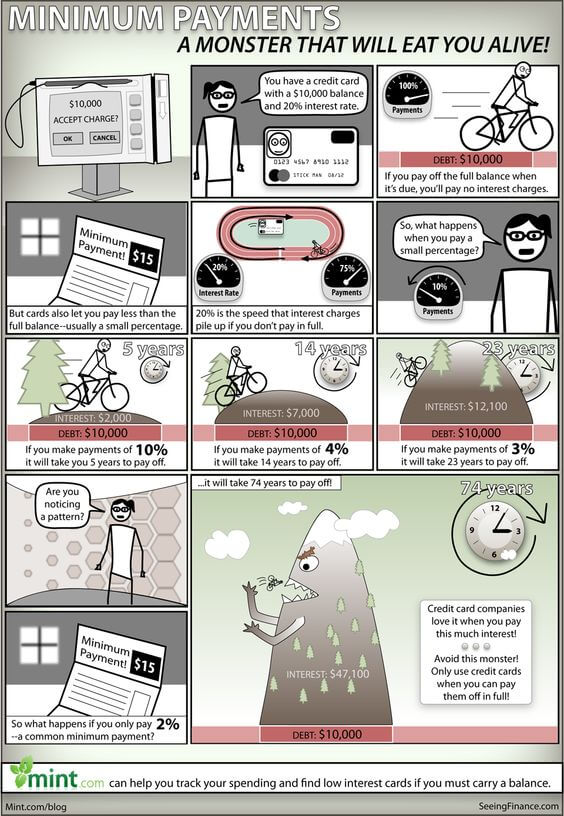

The following image shows how the monster of paying Minimum on credit card will eat you alive

Related Articles:

List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- What’s The Price Of Cool?

- Understanding Loans

- What happens when credit card is swiped?

- Credit Card Fees and Charges

- Paying Credit Card Bill, Understanding statement,Paying Just Minimum

- How to get Free CIBIL Credit Report and CIBIL Credit Score