Parag Parikh Flexi Cap Fund is one of the most popular funds in the Flexi Cap category. But is has not been performing lately? Why is Parag Parikh Flexi Cap Fund not performing ? What should you do?

The underperformance in Parag Parikh Flexi Cap can be explained by its portfolio and strategy.

Check out Parag Parikh Fund on ValueResearchOnline

Table of Contents

Portfolio of Parag Parikh Flexi Cap Fund

The reason it gave good performance was its portfolio which had exposure to US Market and now that is one of reason for its underperformance. Its tech stock holdings such as Microsoft , Alphabet, Amazon, and Facebook have certainly hurt recent returns, and the fall in these stocks has been sharp as well. Further, SEBI restricting Indian mutual funds from investing in stocks listed on overseas exchanges has adversely impacted the fund’s performance as it cannot buy the fallen Tech Stock.

Its Domestic portfolio is primarily large-cap oriented with stock choices such as HDFC, Bajaj Holdings, Power Grid, Hero Moto Corp, Coal India, IEX have either been flat or have declined in the year to date. Its many pharmaceutical stocks, too, have weighed on returns. It has ITC which has given great returns in 2022.

Strategy of Parag Parikh Flexi Cap Fund

The fund has adopted a buy-and-hold long-term strategy, picking stocks with sound fundamentals and attractive valuations. It keeps a low portfolio churn , including derivative transactions. It holds a heavily concentrated portfolio – the top 10 stocks often account for 60-65% of the overall weight.

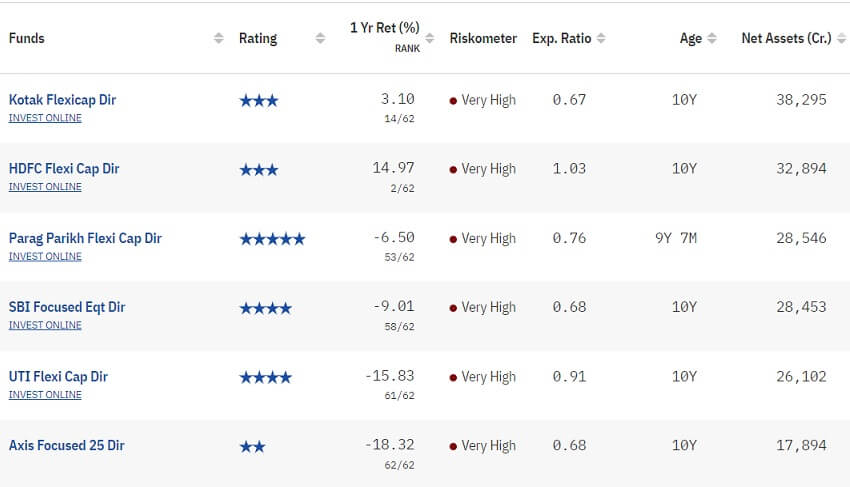

Comparison with the Other Flexi Cap Funds

Most of the FlexiCap funds have done bad. Outlier being HDFC Flexi Cap fund. But HDFC fund house was at the bottom of the inflows chart in the FY 2021-22. But its value style of investing which was reason for underperformance did well in 2022. Investors need to be cognizant of fund manager styles and look at performance across market cycles, rather than redeeming funds on shorter term underperformance

Parag Parikh fund has done relatively good. It manages better downside containment than the index and peers

Should you continue investing in Parag Parikh Flexi Cap Fund

Fund performance comes and goes. Costs stay forever.

Remember No one particular investing style performs consistently over long periods of time. There could also be an extended cycle of underperformance for any one of these investment styles. Para Parikh Flexicap Mutual Funds style of investing is not working out right now

Don’t go for redemption..unless you need the money now!

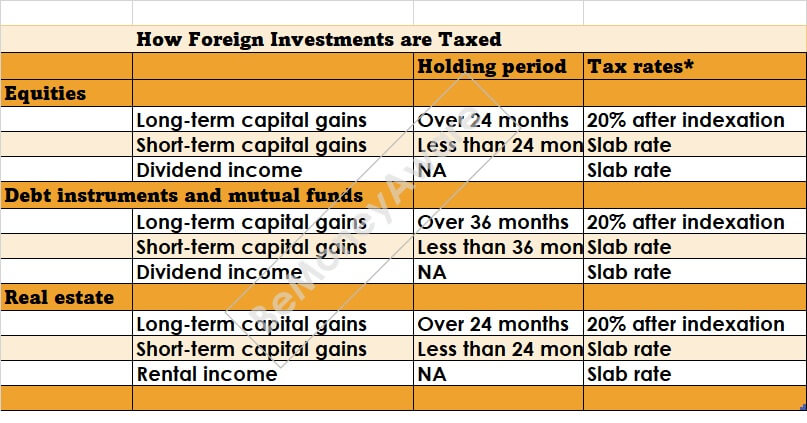

Do you want exposure to US stocks? More in article International Mutual Funds: What are these, Pros and Cons, Tax

Do you want exposure to US stocks but with Capital gain of Indian Mutual Funds? Then Parag Parikh Flexi Cup Fund is still a good choice

Alternative to Parag Parikh Flexicap Mutual Fund?

“The mutual fund industry is filled with hyperbole, misinformation, and a good deal of flimflam. It’s an industry that has embraced the gimmick and rejected the substance of investment.”

As John C. Bogle said in his The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

Investing is all about common sense. Owning a diversified portfolio of stocks and holding it for the long term is a winner’s game. Trying to beat the stock market is theoretically a zero-sum game (for every winner, there must be a loser), but after the substantial costs of investing are deducted, it becomes a loser’s game. Common sense tells us–and history confirms–that the simplest and most efficient investment strategy is to buy and hold all of the nation’s publicly held businesses at very low cost. The classic index fund that owns this market portfolio is the only investment that guarantees you with your fair share of stock market returns.

Details about Book The Little Book of Common Sense Investing by John Bogle here

- A fund’s returns are different than an investor’s (far lower).

- Money flows in funds after good performance and goes out when bad performance follows.

- Don’t pick winning funds from past performance.

- Yesterday’s winners, tomorrow’s losers.

- Buying funds based purely on past performance is one of the stupidest things an investor can do.

- Equity Funds lag the market due to costs. Fund investors take away less than even half the returns of equity funds. Why? Counterproductive Market Timing and Adverse Fund Selection.

Hence John Bogle suggests!

Emotions need never enter the equation. Own the entire stock market and do nothing. Don’t forget to do nothing.

Best Mutual Funds for 2023

You can go through our article Best Mutual Funds for 2023

- Mutual Fund giving good returns in past may not give good returns ahead: Example Axis BlueChip, Paragh Parikh Flexi Cap

- Most of Active Mutual Funds are not able to beat index fund these days.

- Small Cap index funds have not been able to generate more returns then large cap index level.

- For shortlisting index fund take care of expense ratio and error rate in it.

I suggest constructing the portfolio as below within your equity portfolio.

- 50% Large Cap Index+20-30% Nifty Next 50/Active Midcap Fund+20-30% Flexi Cap Funds/Hybrid Funds + 5% in Gold

- 50% Large Cap Index+30% Nifty Next 50/Active Midcap Fund+20% Flexi Cap Funds+ 5% in Gold

- 50% Large Cap Index+20% Nifty Next 50+30% Hybrid Funds + 5% in Gold

- 50% Large Cap Index+20% Nifty Next 50+30% Flexi Cap Funds + 5% in Gold

- However, my favorite is 75% Index and around 20% Flexi Cap+ 5% in Gold

Related Articles:

Have you invested in Parag Parikh Flexi Cap Fund? What are you doing about your investments in Parag Parikh?