Transmission is the process by which units of a deceased account holder are transferred to the surviving joint holder(s) / nominee/legal heirs of the deceased account holder. Investment in a mutual fund can be made in a single name or in a joint mode with three people. The mode of holding can be anyone/survivor or joint.

Table of Contents

Demise Of First Unit Holder

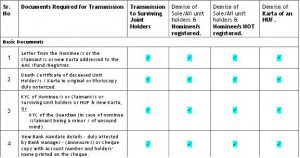

In case of the demise of the first holder, units will be transferred to the surviving unit holder(s) for which the following documents are to be submitted:

- Letter from the surviving unit holder(s) intimating the death of the first holder.

- Death Certificate in original or photocopy duly notarized or attested by gazette officer or a bank manager(In case of certification by bank manager, the document should be certified by the bank manager with his / her full signature, name, employee code, bank seal and contact number.)

- Address, bank details, PAN of new first holder.

- Know Your Customer (KYC) of the surviving unit holder(s), if not already available.

Documents required(pdf format).

Demise Of Joint Holder

In the case of demise of one of the joint holders (other than the first), the following will happen. Units will continue to remain in the name of the first unit holder. The first unit holder has the option to register any other person as a joint holder, for which the following documents are required to be submitted:

- Letter from the surviving unit holder(s) intimating the death of the joint holder.

- Copy of the death certificate of the joint holder duly certified in original by bankers/AMC.

- Name, PAN, signature of the new holder.

- Know Your Customer(KYC) of the new holder.

Documents required(pdf format).

Demise Of Single Holder with Nomination

In case there is only a single holder, and there is a nomination registered.

- Letter from claimant nominee(s) to the AMC/ Mutual Fund requesting for transmission of units.

- This has to be accompanied with an attested copy of the death certificate.

- Proof of identity of the nominee (passport, ration card, driving licence, etc) Bank Account Details of the new first unit holder as per specified format.

- KYC of the claimant(s),

- Declaration and indemnity against any other claims. .Each bank has it’s own Indemnity form. Sample at AMFI(pdf). Banks require it on a stamp paper.

- Copy of the statement of account issued by the Asset Management Company(AMC) may also be asked.

Documents required(pdf format).

Note:The above documents are required, irrespective of whether or not a will has been made.

Demise Of Single Holder without Nomination

If there is a single holder and there is no nomination, then it depends on whether deceased has left or not left a will. If the deceased has left a willtechnically it is called as Testamentary (Presence of Will) . If the deceased has not left a will, technically called as Intestate (Absence of Will)

- Letter from claimant(s) to the AMC/ Mutual Fund requesting for transmission of units,

- Death Certificate(s) in original or photocopy duly notarized or attested

- Bank Account Details of the claimant (new first unit holder) as per specified format

- KYC of the claimant.

- Indemnity against any other claims.

- Copy of the statement of account issued by the Asset Management Company(AMC) may also be asked.

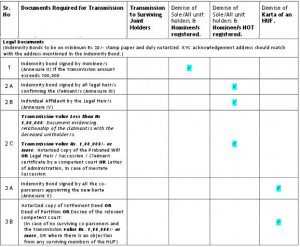

List of legal documents required depends on amount to be transferred, called as Threshold Limit, which is different for each Mutual Fund. For ex: For Kotak Mutual Fund Threshold Limit is Rs 1,00,000, while HDFC Mutual Fund’s is Rs 5,00,000. Please check your Mutual Fund for threshold limit.

If the transmission amount is below the Threshold Limit : Any appropriate document evidencing relationship of the claimant(s) with the deceased unit holder(s). If the transmission amount is equal to or more than the Threshold Limit as Any one of the documents mentioned below:

- Notarized copy of Probated Will, or

- Legal Heir Certificate or Succession Certificate or Claimant’s Certificate issued by a competent court, or

- Letter of Administration, in case of Intestate Succession.

Documents required(pdf format).

Note:

- If there is more than one claimant then any one of them claiming, has to obtain the No objection Certificate(NOC)/Deed of Relinquishment from other legatees and produce the Probate of the will/Letter of administration.

- If the claimant is a Minor: An attested copy of the proof of date of birth and Proof of identity of the natural guardian is also required.

- In case of death of ALL holders(in joint or Anyone or Survivor ship mode), procedure would be same as under SINGLE holding.

Explanations

Explanation and Details of some terms that you have come across above.

Know your Client (KYC): Investors in Mutual Funds need to comply with KNOW YOUR CLIENT. KYC formalities are required to be completed for all the investors, irrespective of the amount, for carrying out the transactions such as new/ additional purchase, switch transactions, new SIP/ STP/ DTP registrations received from January 1, 2011. The applications received for the aforesaid transactions without complying with KYC procedure are liable to be rejected. However, the said procedure is not applicable for redemption/ repurchase. Details of KYC at AMFI Website

Permanent Account Number (PAN):is unique alphanumeric combination issued to all juristic entities identifiable under the Indian Income Tax Act 1961. It is issued by the Indian Income Tax Department. This number is almost mandatory for financial transactions such as opening a bank account, receiving taxable salary or professional fees, sale or purchase of assets above specified limits. Details of PAN on India Gov website.

Death Certificate: A Death Certificate is a document issued by the Government to the nearest relatives of the deceased, stating the date, fact and cause of death. It is essential to register death to prove the time and date of death. Details of Death Certificate on India Govt website.

Indemnity is a form of guarantee protecting a corporation in event of claim at some future time of a security in this case Mutual Fund units which has been lost by the owner(s).

Succession Certificate, Letter of Administration, Probate of Will are legal documents that may be required. My post covers these in detail Succession Certificate, Letter of Administration, Probate of Will

Mutual Fund WebPages

Some of the Mutual Fund web-pages about Transmission of Mutual Funds are given below. The list is not exhaustive and is given for reference purpose only. For others please check your Mutal Fund website.

- HDFC Mutual Fund

- HSBC Mutual Fund

- Kotak Mutual Fund

- Tata Mutual Fund

- Birla SunLife Mutual Fund

- UTI Mutual Fund

FAQ

Is it possible for me to add my spouse as a joint holder in my folio?

Yes! This is possible. Investors would have to send a written request, duly signed by all the holders, requesting the mutual fund to change the mode of holding from ‘joint’ to ‘either or survivor’ or vice versa.

Can an investor appoint a nominee for his investment in units of a mutual fund while purchasing Mutual Funds?

A nomination can be registered at the time of purchasing units. While filling in an application form, there is a provision to fill in the nomination. In fact in the current application forms, investors are asked to specifically indicate if they do not wish to nominate.

Multiple nominations are possible in a folio and a minor can be a nominee. An investor may make up to three nominations for a folio and even specify the percentage of the units that will go to the nominees.

Please note that a nomination can be changed at any time and even cancelled. Standard forms for the purpose are available at the fund websites.Remember in case of mutual funds Nominee is just a trustee, he has to then hand over the money to legal heirs. Read Right Paper Work For Those You Love: Part 1 for details on Nomination.

What if nominee is not registered while purchasing

If an investor has not registered a nomination at the time of application, he/she may register a nomination later through a form which may be submitted with relevant particulars of the nominee. Forms are available at the mutual fund/ Registrar websites.

What about Equity Linked Saving Schemes (ELSS) which have lock in of 3 years?

Disclaimer: Please note while efforts have been made to provide correct information.We are not an expert in legal laws and it is advisable to visit a qualified lawyer/banks for any information on such laws before making any legal moves. We do not take any responsibility, if you read this post and act based on it. We also have no tie-up with any of the external websites mentioned in the post.

In the event of the death of the Unitholder, the nominee or legal heir, (subject to production of requisite documentary evidence to the satisfaction of the AMC) asthe case may be, shall be able to redeem the investment only afterthe completion of one year, or any time thereafter, from the date of allotment of units to the deceased unit holder.

31 responses to “Claiming Deceased’s Mutual Fund Units”

Dear Sir,

I need some clarifications from you. My father expired recently and he had invested in various mutual funds. In most of the folios he had kept me and my sister as joint holders or nominees.

After his death we finished all the necessary formalities with the concerned mutual funds for transmission and redemption. The mutual funds has transferred all the units in our respective names. However they have frozen the accounts now .

My father was not in good terms with my mother and my brother. He had been staying separate from my mother for almost 30 years now. He did not leave any funds for them at all.

He had made a will which I am holding and have given the same to the courts for probate.

The funds are now asking for a whole lot of documents now ie a NOC.legal heir certificate etc. However the same is not given in any of the web sites of the funds concerned.

My father has clearly mentioned in his will that any funds which are in joint names/ nominees should go the the said joint holder or nominee.

My mother and my brother have given letters to stop the payments claiming to be the legal hiers. My father has left some other assets to both of them.

Pl guide me the way out. The funds are transferred on our names but not redeemed.

Dear Sir,

My husband was passed away. After receiving monthly statement of Mutual Fund I know about this Mutual Fund Transaction. I dont know the nominee details. His brother told me that nomination is on his name so I am not eligible for it. Please advice shall I get MF on my name or it will transferred on brothers name.

Nominee , in Mutual Funds / Bank accounts / Postal Deposits , is not the heir but only a Trustee on behalf of all the heirs. The nominee is bound to pass on the amount to Testamentary beneficiaries ( in case of a valid Will )or as per the Succession Act ( in case of no valid Will )

Hi

My freind has invest 2000 sip in reliance company total 35 month his sip has deduct on 36 month he met accident and immidiate death . his father is nominee but they dont know about his investment now 1 letter has find him about his mutual fund . reliancr mutual fund has cover 10 lac . i want to know is he eligible for claim because now 5 years has crossed of his son death.

Plz help

the insurance claim can me made if the terms of the policy say so. pls check with rmf and the insurance company issuing the policy.

Hi,

In case Demise Of Single Holder without Nomination, lets say single holder was invested in direct/online mode.

“X” is the class I heirs but nominee of the Bank Account which is linked to the Mutual fund is mentioned as “Y” (class II heirs).

“Y” has access to the online MF Account and mobile and after death of MF A/c holder, “Y’ redeemed all units to the bank Account. Is “Y” breaking any rule.

According to law, nominee is not owner of your investments. He is only trustee of your investments. His job is to accept your assets in case of your death and distribute it to your legal heirs as per your will or if there is no will then according to succession law applicable to you. So it is primary responsibility of nominee to accept assets of the deceased person and transfer it to correct beneficiaries. By mere nomination one does not become owner of the assets.

In bank accounts, mutual fund and other investments nominee is merely a trustee and not owner of the money. His responsibility is to get the money in case of death of holder and transfer it to legal heirs.

I have a query :

If a person nominated Mutual funds to his grand daughter, but there’s no mention about it in his WILL. In such case, who will be the owner of the Units…? Legal heirs or the grand daughter…? Will the grand daughter treated as a trustee till the legal heirs produce the succession certificate…? Kindly advise. Thanks.

– Jayendra

Hi, thanks for the article. Though I have a question. One of my friend’s father expired and he had few mutual funds with surname “Hirani” and few with surname “Patel” whereas in the death certificate the surname is “Patel”. Hope you will be able to enlighten in this aspect.

Sad to hear about your friend’s father. Hope the family is fine.

Coming to question:

It is important to ensure that the name in the mutual fund application form matches with that on the Permanent Account Number (PAN) card and in the bank account.

If the name of the customer registered in the folio in AMC records does not match with that as per mutual fund account,update the correct name in the folio first by giving name change request to AMC alongwith relevant proof. You can check with the Mutual fund company typically

In case of difference in name, the investor has to attach a request letter, a notarised copy of the relevant notification in a government gazette, attestation from the bank manager confirming the investor’s name, branch, account number and signature, plus any other legal document with the new name (the documents may be bank statement and attestation from the school).

Please do keep us updated so that it helps others

What if a person holding mutal fund with nomination registered and he also made a will but nominee and will party is different then who has the first right to claim after the death of holder.

In Mutual Funds the nominee is just a custodian of the investments. On death, the mutual fund proceeds are given to the nominee, who in turn has to distribute it to the legal heirs, if different. In case of joint account holdings, if a joint holder other than the first holder dies, then the units remain in the name of the first holder and he/she has a right to register any other person as a joint holder

Legal heirs means will holder or any other

Legal heirs means will holder or any other and if there is no legal heirs then

A legal heir is the one whose is mentioned in the will. However, if a will is not made, then the legal heirs of the assets are decided according to the succession laws, where the structure is predefined on who gets how much.

Legal heirs are well defined in the Hindu Succession Law. All the relations are categorised into two classes called class I and class II. The first right on wealth is of Class I heirs. Only if there is no one available in Class I, then relations under Class II can claim their rights. If Class I & Class II both are missing , in then there is something called Agnates and Cognates

Class I Relations:

Son/Daughter

Widow

Mother

Son/Daughter of a pre-deceased son (per-deceased means “already Dead”)

Son/Daughter of a pre-deceased Daughter

Widow of a pre-deceased son

Son/Daughter of a pre-deceased son of a pre-deceased son (3 levels)

Widow of a pre-deceased son of a predeceased son

Class II relations

Father

Brother/Sister

Son’s daughter’s son/daughter,

Daughter’s son’s son/daughter

Daughter’s daughter’s son/daughter

Sibling son/daughter

Father’s Parents

Brother’s widow

Father’s sibling

Mother’s parents

Mother’s sibling

Dear Sir,

In connection with death of joint holder in mutual fund you have mentioned that the second holder’s will be deleted & the first holder can replace the deceased person’s name with anybody else but on inquiry with Franklin Templeton, Quantum as well as CAMS they all have categorically clarified that no replacement of name is allowed, it is only deletion that can be done & yes if required e first holder may add or change nominee. Your latest views especially if contrary or any update since article is of 2012?

1. If all joint holders die, without assigning a nominee. whose legal heirs can claim the amount ? Only the legal heirs of the first holder or legal heirs of all the joint holders ?

A very good question. I am not sure of the ans. The documentation says legal heirs so my guess is in case of joint account legal heirs of the first account holder.

Some facts regarding joint account in Mutual Funds

They can choose between ‘joint’ or ‘anyone or survivor’. If mode of holding is not mentioned, the mutual fund treats the mode of holding as ‘joint’ by default.

If the mode of holding is ‘joint’, financial and non-financial transaction requests should be signed by all unitholders. But if it is ‘Anyone or Survivor’, any one of the unitholders may sign the transaction requests.

Irrespective of mode of holding, request for nomination or cancellation of nomination must be signed by all joint holders in the folio. Rights of the nominee will arise only after the death of all joint holders in the folio.

In case one or more of the unit holders die, the units will be transmitted to the remaining unit holders after submission of death certificate and other documents as may be specified by the AMC.

All communications and payments (dividends, redemption) by the mutual fund are made to the first unit holder only.

[…] If nominee(s) have been appointed, to claim the investment they can produce basic documents, such as a death certificate. A claimant who is not a nominee would have to produce a host of additional documents such as a will, legal heir ship certificate, no-objection certificate from other legal heirs, among others. paper work required to claim deceased’s bank account , paperwork required to claim deceased’s mutual funds. […]

Thanks Paresh, it is such a very good article , i am very happy to see this information as the same not any where @ any fund house website.

Thanks Ganesh. But this information is available at each of the mutual fund websites(I have given some links), except we don’t look for it.

Hi,

Please say thanks to blog author..not me.

Pehle aap, Pehle aap mein kahin gadhi na choot jaye(First you first you should not make us miss the train)

Thanks Paresh for suggesting Ganesh to read our article and Ganesh for reading it 🙂

Hi,

Great efforts and truly useful info.

Thanks Paresh. Coming from one who runs his own personal finance blog(which is very useful) is a great encouragement.

Hi,

Thanks for that.

At least i sell the products through my blog..but your work is more remarkable as you are doing this work without having that motivation.

Thanks Paresh, very kind of you. I have checked your website and it has some great articles not directly related to products you sell(such as closing bank account etc). Keep up the good work!

Just back to original issue..many readers may want to know what happens to ELSS schemes where units get locked in for 3 yrs.[Sorry if you have already mentioned it and i not able to pick it up]

As far I have not experience of such case..but as far I think there is no need for nominee to wait for completion of 3 yrs but units can be claimed anytime after completion of one year…

I am not sure of the fact…

An interesting question that I had not covered in my article. Thanks Paresh for pointing it out.

Have updated the article. Yes you are right, units can be claimed after completion of one year.

Detailed information .

Thanks. Hope you found it useful too!