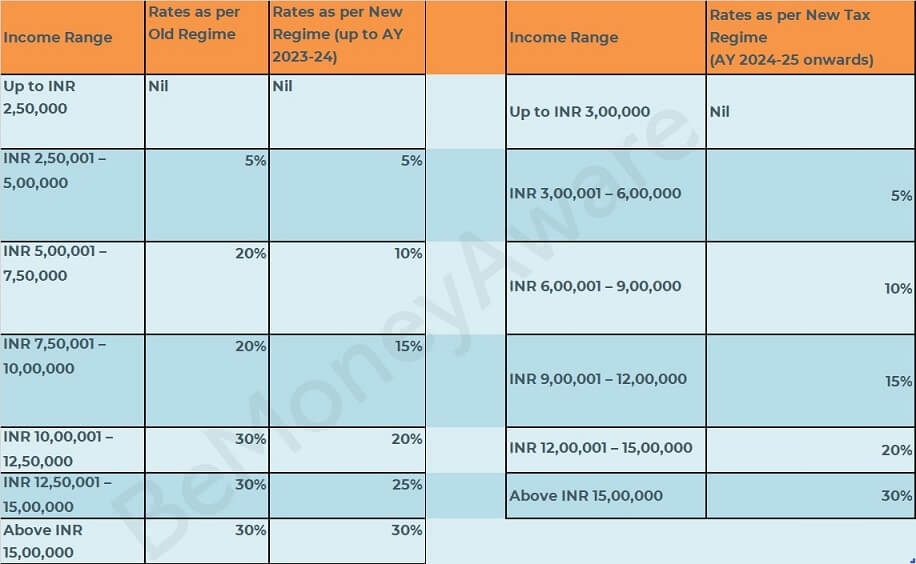

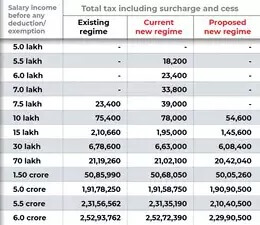

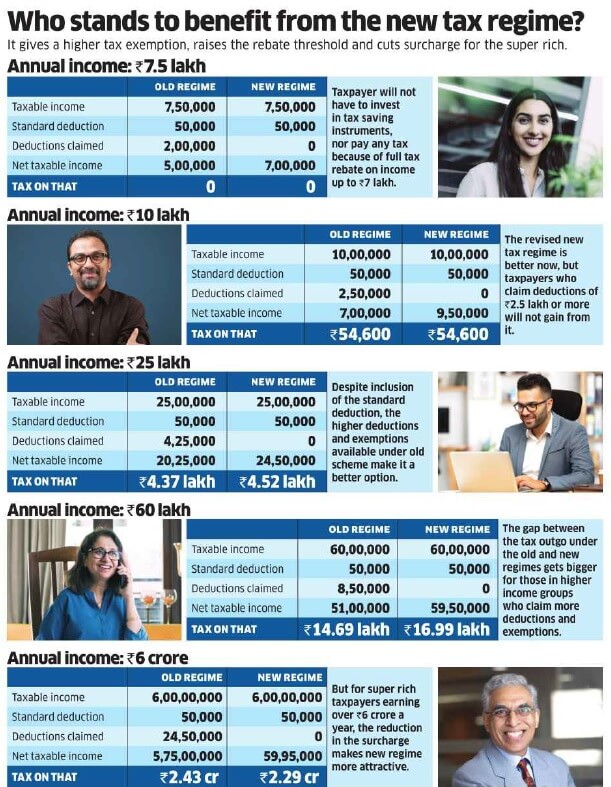

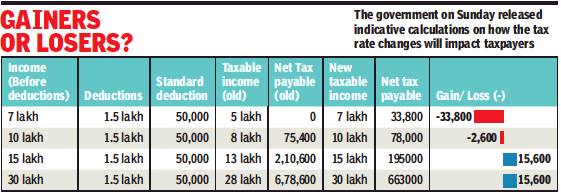

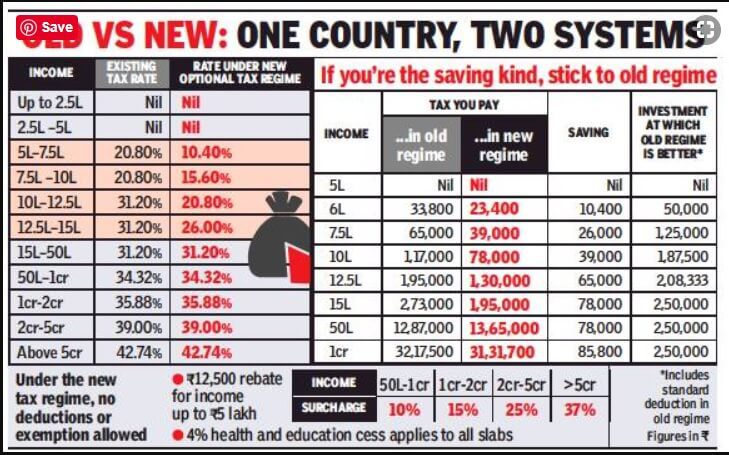

From FY 2023-24, tax rates for the new tax regime are revised. The new Tax Regime was introduced in Union Budget 2020-21. So now there is old tax regime, new tax regime applicable till AY 2023-24 and Revised new Tax Regime applicable from AY 2024-25. Now taxpayer has a choice to Take Deductions and stick with the old tax slabs and not take deductions and opt for new tax slabs. Which one should one choose? People availing deductions like interest on home loans, health insurance, and PPF would need to evaluate as in their case, the old regime could still prove more tax efficient. The image below shows some examples. We also have given a calculator for you to compare the tax between the two regimes.

Table of Contents

Revised New Tax Regime from AY 2024-25

- Tax rebate on an income of up to ₹7 lakhs has been introduced under the new tax regime. This means that taxpayers with an income of up to ₹7 lakhs can claim all the tax paid(Yes you need to file ITR)!

- Standard deduction:

- Salary income: ₹50,000 standard deduction under the new tax regime as well. .

- Family pension: Standard deduction on such pension: ₹15,000 or 1/3rd of pension, whichever is lower.

- Highest surcharge under the new tax regime has been reduced to 25% from 37% for people earning more than ₹5 crore. This move brings down their tax rate from 42.74% to 39%.

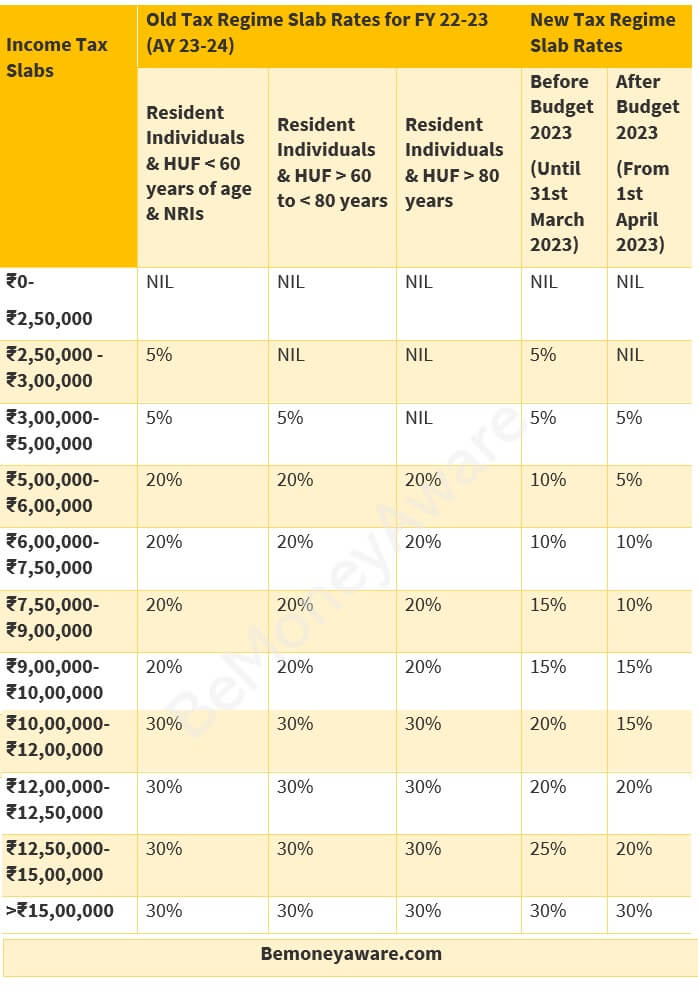

| Slab | New Tax Regime

Before Budget 2023 (until 31st March 2023) |

New Tax Regime

After Budget 2023 |

| ₹0-₹2,50,000 | – | – |

| ₹2,50,000 -₹3,00,000 | 5% | – |

| ₹3,00,000-₹5,00,000 | 5% | 5% |

| ₹5,00,000-₹6,00,000 | 10% | 5% |

| ₹6,00,000-₹7,50,000 | 10% | 10% |

| ₹7,50,000-₹9,00,000 | 15% | 10% |

| ₹9,00,000-₹10,00,000 | 15% | 15% |

| ₹10,00,000-₹12,00,000 | 20% | 15% |

| ₹12,00,000-₹12,50,000 | 20% | 20% |

| ₹12,50,000-₹15,00,000 | 25% | 20% |

| >₹15,00,000 | 30% | 30% |

Overview of Old tax system vs new

Difference between old and New Tax regime is the deductions that you can claim.Whether one should take old or new tax slabs epends on the deductions one plans to take. Deductions like 1.5 lakh under 80C, Standard deduction of Rs 50,000(available from FY 2023-24 in revised new Tax Regime) and LTA and HRA for salaried, Home Loan Interest.

To choose old or new Tax System

- Calculate all the deductions you will take

- Find tax using the old system.

- Find tax using the new system

- Find the difference

- Check the paperwork required to claim, if it is worth it. For example if you want to take Insurance policy to save, understand the payment frequency, returns etc.

Some Important Points about Old and New Tax Slabs

- You have to choose old or new tax slab while filing Income Tax return form but plan accordingly beforehand(if you want to save). From Apr 1 2023, Default is New Tax Regime. Before that default is new Tax Regime

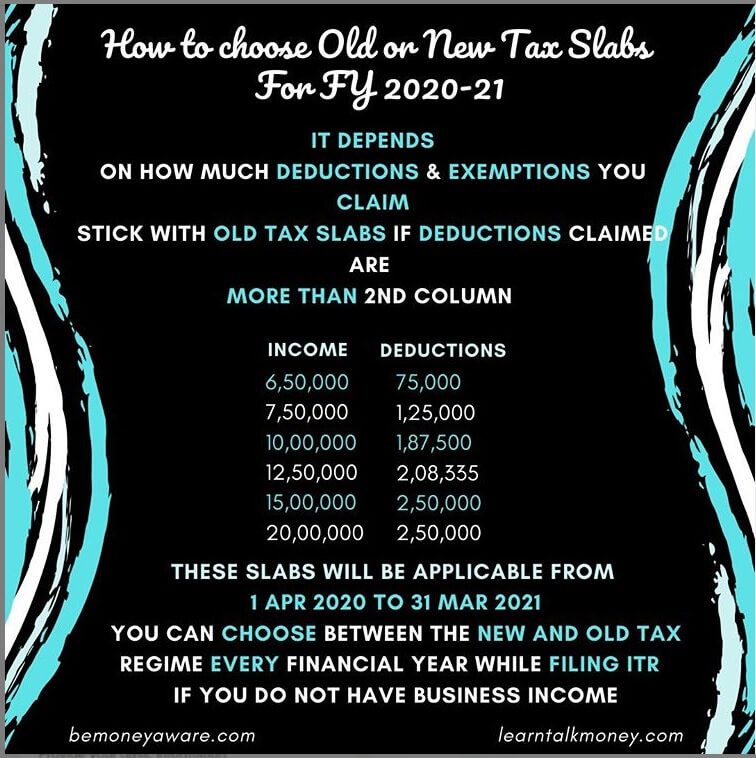

- You can choose between the new and old tax regime in every financial year provided you do not have business income.

- Form 10IE is a declaration for choosing the ‘New Tax Regime’ (till AY 2023-24) After that this is default. The taxpayers must furnish Form 10IE before filing the income tax return of the relevant assessment year.

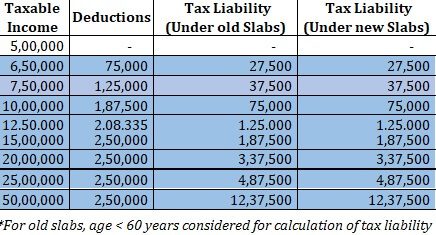

The table below shows the amount of deductions at which tax is equal in both and the new old tax scheme. If you claim deduction less than the breakeven amount you should go with the new tax regime else you should go with the old tax regime.

For example, Shyam has a salary of 7.5 lakhs and he takes a deduction of 1.25 lakhs then using both old and new tax system tax is the same.

- But If Shyam claims tax deductions less than 1.25 lakh say 1 lakh. Then under the old regime, the tax is Rs 44,200 and the new regime is Rs 39,000. So Shyam should go with the new regime.

- But Shyam claims tax deductions of more than 1.25 lakh say 1.3 lakh then under the old regime, the tax is 37,960 and the new regime is 39,000. So Shyam saves money with the old regime.

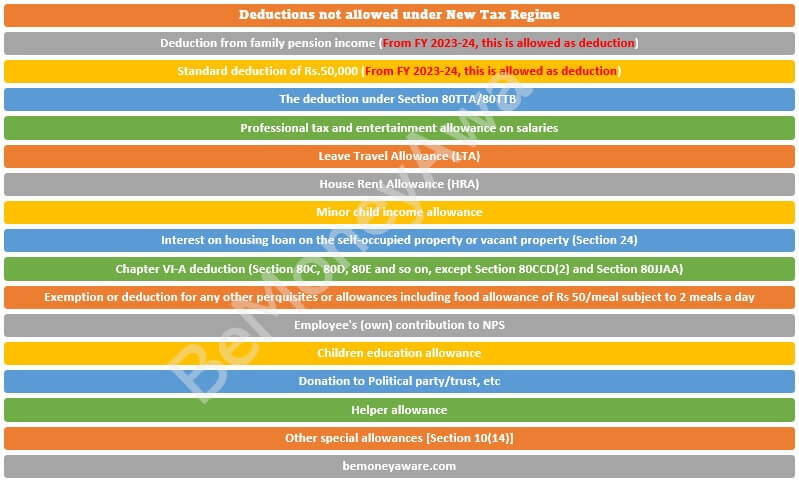

There are various Deductions and exemptions that you have to let go in the new tax system. Some common one ,

- For salaried: The standard deduction of Rs 50,000 Allowances like LTA (Leave Travel Allowance), House rent allowance(HRA)

- For everyone: 80C Deductions up to 1.5 lakhs (EPF, PPF, Life Insurance), Home Loan Interest under section 24 in respect of the self-occupied or vacant property

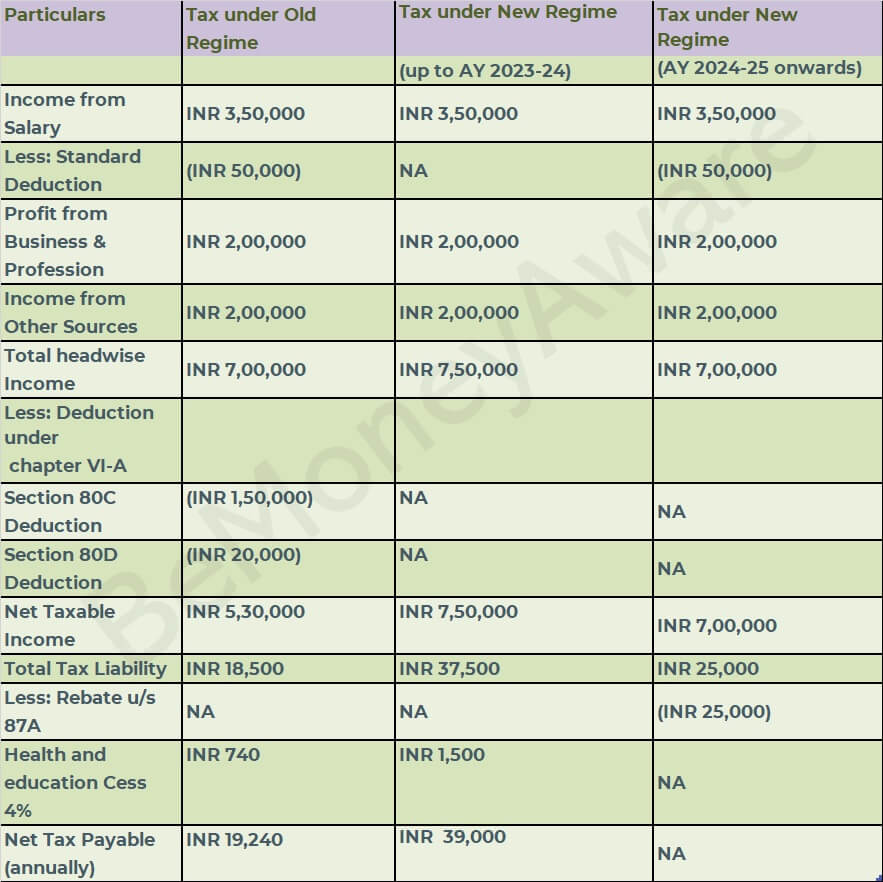

The image below shows examples in the new and revised new Tax regime

Pros of the old tax regime

The older regime by enforcing investments in specified tax-saving instruments, over the period inculcated the savings culture in individual and led to savings for any future eventuality like marriage, education, purchase of house property, medical, etc. India’s gross savings rate was approximately 30 per cent in March 2019

Cons of the old tax regime

The tax benefits under the old regime are available on investments in specified instruments and also there is a specific lock-in prescribed for most of the instruments from three-five years. This may not be a suitable tax-saving option for many such as millennials, who prefer to spend than save, and senior citizens, as they would prefer having liquidity in their hands and investing in instruments which have a flexible and open-ended tenure.

In case of assessment proceedings before the tax authorities, documentation and proof of investments are required to be retained in the old regime, which may not be required in the new regime.

Explaining the rationale of offering taxpayers a choice between a flat rate and an itemised deduction system, the government said the new tax rates would not make anyone worse off and taxpayers were free to decide which regime suited them. Exercise may result in loss of ₹40,000cr

What are income tax slabs and rates proposed in the new tax structure?

The new income tax slabs and rates proposed are as follows but one cannot take many tax deductions meant earlier

| Slab | New Tax Regime

Before Budget 2023 (until 31st March 2023) |

New Tax Regime

After Budget 2023 |

| ₹0-₹2,50,000 | – | – |

| ₹2,50,000 -₹3,00,000 | 5% | – |

| ₹3,00,000-₹5,00,000 | 5% | 5% |

| ₹5,00,000-₹6,00,000 | 10% | 5% |

| ₹6,00,000-₹7,50,000 | 10% | 10% |

| ₹7,50,000-₹9,00,000 | 15% | 10% |

| ₹9,00,000-₹10,00,000 | 15% | 15% |

| ₹10,00,000-₹12,00,000 | 20% | 15% |

| ₹12,00,000-₹12,50,000 | 20% | 20% |

| ₹12,50,000-₹15,00,000 | 25% | 20% |

| >₹15,00,000 | 30% | 30% |

-

Note: old tax slabs are linked to the age of the taxpayers. There is relaxation available to senior (>=60 years) and very senior citizens (>=80 years). The new tax slabs are the same for everyone, irrespective of the taxpayer age.

- Do I have to forgo all the tax exemptions and deductions if I opt for the new tax structure?

A taxpayer opting for the new tax regime will have to forgo all the commonly available tax-breaks such as those available under sections 80C, 80D etc except for section 80CCD (2), i.e., employer’s contribution to NPS. - Can I choose between new and old tax regime every year?

Yes, you can choose between the new and old tax regime in every financial year provided you do not have business income. You have to choose this while filing Income Tax return form,

- Are cess and surcharge still payable in the new tax regime?

Yes, cess at the rate of 4 per cent and surcharge, applicable as per your income level, is still payable in the new tax regime -

Can I still claim a tax rebate under section 87A in the new tax regime?

Yes, as per the budget proposals, if his/her net taxable income does not exceed Rs 5 lakh in a financial year.(Till AY 2023-24) and 7 lakh (From AY 2024-2025)

Which is a better choice: Old or New Tax Slabs ?

It depends. Whether you should take old or new tax slabs vary on case to case basis as it depends on the deductions you are taking. The total taxable income with maximum deduction and without deductions where tax is the same is shown above. Therefore, if your actual deductions are greater than the break-even points, you can go with either old regime or new tax regime. The calculator is given below.

For example, for Tax Regime upto Fy 2022-23/AY 2023-24, If your income is above Rs 15 lakhs or above, you are better off with the new regime if the deductions are up to Rs 2.5 lacs in a financial year. If your deductions are greater than Rs 2.5 lacs, you are better off sticking with the old tax slabs.

Why did Government come out with the New Tax Slabs without deductions?

In an interview with Times of India, revenue secretary Ajay Bhushan Pandey said that the assumption that all exemptions be taken into account for all slabs did not reflect in actual filings. The interview can be read here.

The choice is with the taxpayers — choose the old regime or the new one. Not a single taxpayer is going to lose in the process The proposed system would make life simpler for those who opt for it.

The government’s move would benefit a large section of the population, such as seniors who did not want to park money in tax-saving instruments and had paid off housing loans or youngsters just joining the workforce. Such people do not have substantial amounts to purchase life covers or deposit money in public provident fund.

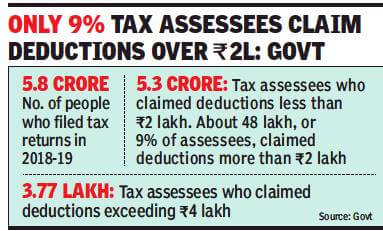

Data available with the tax department showed that of

- The around 5.8 crore people who filed returns for fiscal year 2018-19, 5.3 crore claimed I-T deductions of less than Rs 2 lakh, including deduction under section 80C of the I-T Act (for PF, PPF, life insurance premium), section 80D (mediclaim insurance), section 80CCD(1B) (additional deduction for NPS), deduction for housing loan interest and standard deduction.

- Only 3.77 lakh taxpayers have claimed deductions exceeding Rs 4 lakh.

- This may result in loss of ₹40,000cr for Govt.

List of Exemptions removed

Let’s look at the list of exemptions and deductions that go out if you opt for the new regime are given below. From FINANCE BILL, 2020 PROVISIONS RELATING TO DIRECT TAXES

(i) Leave travel concession as contained in clause (5) of section 10; How to claim LTA. You cannot claim it while filing ITR

(ii) House rent allowance(HRA) as contained in clause (13A) of section 10; HRA Exemption,Calculation,Tax and Income Tax Return

(iii) Some of the allowance as contained in clause (14) of section 10;

(iv) Allowances to MPs/MLAs as contained in clause (17) of section 10;

(v) Allowance for income of minor as contained in clause (32) of section 10;

(vi) Exemption for SEZ unit contained in section 10AA;

(vii) Standard deduction, the deduction for entertainment allowance and employment/professional tax as contained in section 16; Income Tax for FY 2019-20 or AY 2020-21

(viii) Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. Income from House Property and Income Tax Return

(Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

(ix) Additional deprecation under clause (iia) of sub-section (1) of section 32;

(x) Deductions under section 32AD, 33AB, 33ABA;

(xi) Various deduction for donation for or expenditure on scientific research contained in sub-clause (ii) or sub-clause (iia) or sub-clause (iii) of sub-section (1) or sub-section (2AA) of section 35;

(xii) Deduction under section 35AD or section 35CCC;

(xiii) Deduction from family pension under clause (iia) of section 57;

(xiv) Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA,

80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc). However, deduction under sub-section (2) of section 80CCD (employer contribution on account of the employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

Tax saving options : 80C,80CCC,80CCD,80D,80U,80E,24

List of Deductions, Exemptions still available

The income tax deductions still available in the new regime include:

- Death-cum-retirement benefit

- Commutations of pensions

- Leave encashment on retirement

- Amount received on VRS up to Rs 5 lakh

- Employee Provident Fund money(EPF)

- Short-term withdrawals and maturity amount from the National Pension Scheme

- Money received as scholarship for education

- Cash received as awards constituted in public interest

- Deduction under sub-section (2) of section 80CCD (employer contribution on account of the employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

Tax Calculator choose old or new tax regime

Use the calculator to find which tax regime is better. Enter the Total Taxable Income, the deductions you claim and click on Calculate Button.

It will show the tax under the new and old regime and which regime is better considering the old regime for those less than 60 years.

Video on how to choose old or new Tax slab

This 7 minute video talks about how to choose old or new Tax slabs

Choose the old or new tax regime for FY 2022-23

To recap

Related Articles:

Understand Income Tax: What is Income Tax, TDS, Form 16, Challan 280

What do you think of the new Tax Regime? Is it more confusing or has become easier? Will you go for old system or new system?

3 responses to “Old or New Tax Regime?”

[…] Particulars in our article Previous or New Tax Regime? […]

Hallo sir my bank kyc panding plize halp me sir

1014177334761