NPS comes with two accounts: Tier I and Tier II. Tier I is the retirement account which gets a host of tax breaks, whereas NPS Tier II is a voluntary account is like a mutual fund, meaning there is no lock-in till retirement and money can be withdrawn any time thus offering greater flexibility. This article will discuss in depth about Tier II account of NPS scheme, its distinctive features, pros and cons of investing in NPS Tier II,taxation and withdrawal on Tier II account, along with returns from investment in NPS Tier 2 account.

Table of Contents

Overview of NPS Tier II account

The Tier 2 variation of the NPS scheme was launched in December 2009.

- For investing in Tier-II NPS account, you need to have a live Tier-I NPS account.

- It is associated with the same Permanent Retirement Account Number or PRAN.

- Minimum amount mandatory for opening Tier-II NPS account is Rs. 1000.

- You have an option to choose your category of funds for investment, but only 50% can be invested in an equity fund. Else the funds get automatically invested based on your job profile, age and risk taking capability.

- You can withdraw the money invested in Tier-II NPS account without paying any exit load or penalty.

- Lack of locking period calls means no tax deduction/rebate on Tier-II NPS account.

- Any contribution made towards Tier-II NPS account is not deductible under Section 80C of the Income Tax Act.

- There is no clarity on tax treatment of Tier II NPS returns. It is very subjective and different people have different views on the matter. For instance, some believe that even the long-term gains from equity funds may get taxed and debt fund investments may not be eligible for indexation benefit.

- You also have a one-time opportunity to transfer funds from Tier-I NPS account to Tier-II NPS account.

What is the difference between NPS Tier-1 and NPS Tier-2 account?

- In order to enroll for NPS Tier-1 account is a mandatory account, whereas Tier-2 is optional.

- All the tax benefits available in NPS are associated to Tier-1 account only. No tax benefit is available to Tier-2.

- Tier-2 function as a mutual fund as the withdrawal option are unlimited, whereas in Tier-1 withdrawal options are limited.

- The minimum contribution for Tier-1 is Rs. 6000 and Tier-2 is Rs. 2000 per financial year

Cost structure for Tier-II NPS account

NPS Tier II is suitable only for higher value transactions where the impact will be minimal. Small SIPs of Rs 1,000-2,000 will attract high fixed costs. NPS has the lowest fund management charges, but there are also ancillary charges.

- If you invest in NPS through POPs, fees of 0.25% of the contribution (Min. Rs 20 Max. Rs 25000) is applicable.

- However, if you opt to self-invest through eNPS, the charges are 0.05% of the contribution, capped at a minimum of Rs.5 and maximum of Rs.5,000 per transaction.

- Any other transaction like a switch, withdrawal or a request for a statement will cost you Rs 25 plus service tax.

The fund management charges of NPS Tier II plans are barely 1% of the cost of the average direct plan. For managing an investment of Rs 1 lakh

- A regular mutual fund charges Rs 1,500-2,500 per year

- A direct mutual fund charge 0.75-1.5%—or Rs 750-1,500 per year

- But NPS Tier II charge only 0.01%—or Rs 10 per year for managing an investment of Rs 1 lakh.

The ultra-low costs mean higher returns for investors. NPS Tier II plans have outperformed mutual funds of the same vintage by .7-2% across different time frames.

Despite the obvious advantage of higher returns, very few investors have put money in NPS Tier II plans. The total AUM of the NPS Tier II segment is Rs 197 crore, which is a tiny fraction of the estimated Rs 5,00,000 crore invested in direct mutual funds.

Should you use invest in NPS Tier II

You can compare NPS Tier to a Mutual Fund

Cons:

- If you have a short-term goal, it doesn’t make sense to invest in Tier II. You have much more options in mutual funds for a shorter duration, say, 1-3 years. You have a wider range of debt mutual fund options available in the market. You can choose a scheme, depending on your goal and risk appetite. There are liquid schemes, arbitrage funds, credit opportunities fund.

- It won’t be a great idea to use NPS Tier II account for long-term investment needs either because it doesn’t allow you to invest more than 50 per cent of your total corpus in stocks.

- There is still no clarity on taxation on withdrawal.

Pros:

- The fund management charges of NPS Tier II plans are barely 1% of the cost of the average direct plan. It can be used as replacement for Balanced Fund.

- You can withdraw the money invested in Tier-II NPS account without paying any exit load or penalty.

Fund Managers of NPS Tier II or NPS Tier 2 Account

Currently, there are 7 fund managers for NPS Tier2 account:

- LIC Pension Fund

- HDFC Pension management company

- ICICI Prudential Pension Fund

- Kotak Mahindra Pension Fund

- Reliance Pension Fund

- SBI Pension Fund

- UTI Retirement Solutions

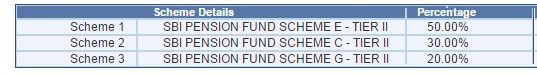

One has the liberty to choose any of the fund managers and the percentage in which the selected Fund Manager will invest in the following asset classes. The following image shows the distribution of an investment in NPS Tier2 account across different schemes

- E- Equity, C- Corporate bonds, G- Government securities.

- Maximum contribution in Equity in NPS Tier2 account is 50%

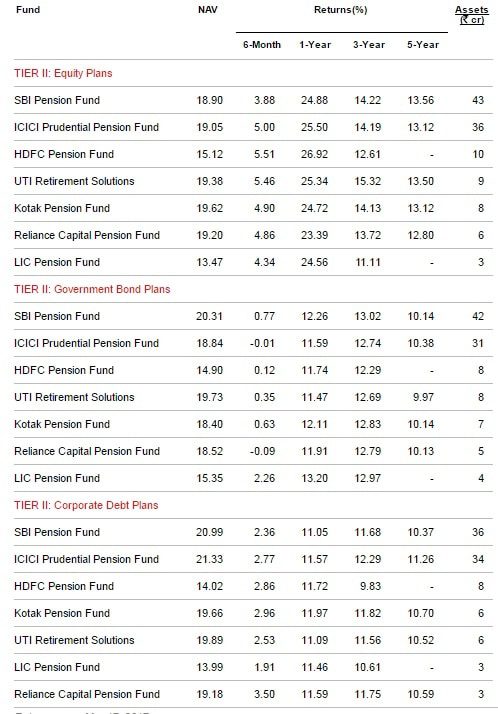

NPS Tier 2 Performance

The performance of NPS Tier 2 Funds from Valueresearchonline NPS are given below. Returns as on Mar 17, 2017 and Assets as on Feb 28, 2017

Eligibility Criteria for NPS Tier 2 Account

In order to obtain an NPS Tier 2 Account, the following is the eligibility criteria that needs to be fulfilled.

- Any citizen of India, resident or non-resident can join the National Pension System and can obtain the NPS Tier 2 Account

- An active Tier 1 NPS Account is a prerequisite of obtaining a Tier 2 Account

- Individual needs to be 28-60 years of age on the date of submission of NPS form

- Non Resident Indians are also eligible to register for the NPS scheme

How to open NPS Tier2 Account

A NPS Tier I and Tier II account can be opened together by submitting a composite application form.

If you have only opened NPS Tier1 account then you can open a Tier II account

Open NPS Tier2 Account Offline

- The Tier II account can be opened through the subscriber’s POP-SP .The subscriber needs to download the Annexure 1: Tier II Details form (pdf) and send it to the POP-SP after it has been filled out You will need to provide your bank account details as well for opening a Tier II account because the withdrawals are directly transferred to the subscriber’s bank account.

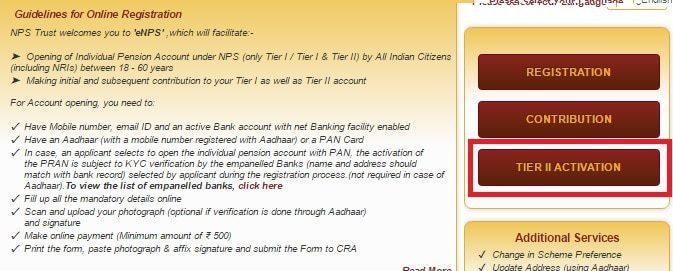

Open NPS Tier2 Account Online

e NPS is electronic National Pension Scheme at https://enps.nsdl.com/. Click on Tier II Activation as shown in the image below.

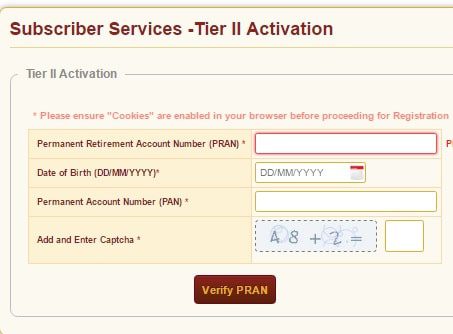

It opens another window as shown in the image below, asking for your PRAN , Date of Birth and PAN details.

How to withdraw from NPS Tier 2 Account

Amount from Tier-II NPS account can be withdrawn any number of times and is considered to be highly liquid account.

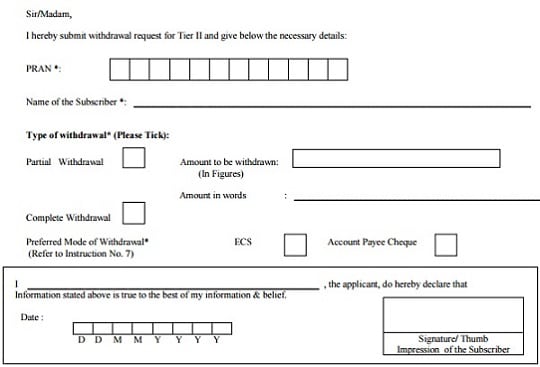

Withdraw from NPS Tier 2 Account Offline

- Go to https://www.npscra.nsdl.co.in/download/non-government-sector/all-citizens-of-india/forms/UOS-S12-Withdrawal-form-TierII.pdf

- Download, print and fill UOS-S12.

- Fill in the amount of withdrawal. The amount in redemption will vary upon the NAV value of the funds during the day of withdrawal.

- This form is to be submitted to the NODAL office or associated POP-SP.

- Within 3 working days from date of submission, amount will be transferred to the subscriber’s bank account.

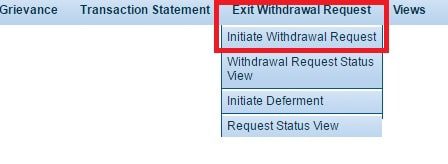

Withdraw from NPS Tier 2 Account Online

- Go to https://cra-nsdl.com/CRA/

- Login with your PRAN and iPIN. Our article Accessing NPS account and CRA: How to Set IPin,Tpin discusses it in detail.

- In the Menu select Exit Withdrawal Request and Initiate Withdrawal Request as shown in the image.

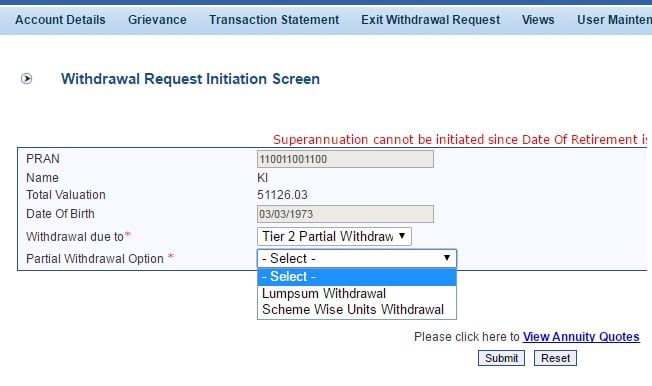

You will see a window as shown in the image below. Select Tier2 Partial Withdrawal and then select LumpSum or Partial Withdrawal as shown in the image below

Related Articles:

- All about NPS

- eNPs:How to open NPS account

- How to do online Contribution to NPS using eNPS

- Facts about Partial Withdrawal of NPS Corpus

- Returns of NPS

- Tax Benefits of NPS

- Accessing NPS account and CRA: How to Set IPin,Tpin

9 responses to “NPS Tier 2 or Tier II Account: Performance,How to open,Withdraw”

Hello..

I work in private sector with facility of NPS. Active tier I .

Now i am going to do job in evening time in another service provider ,,,can i receive my NPS from both side?

Thanks..quite systematically presented.

Thanks for encouraging words

eg tair 1 mai apnay 1000 katnay se company 1000 deti hai

1 Waisa tair 2 mai b hai kya …?

2 Jitna hm invest krny se utna copmany b degii kya ..?

Dear Sir,

I heard that those central govt. staff joined before 1.1.2004 and having GPF facility and who do not have any NPS A/c, they can open the Tier-II A/c of NPS, and get an deduction of Rs.50,000/-(Rupees Fifty Thousand Only) from their taxable income, under Section 80CCD(1B). I repeat, it is u/s 80CCD(1B). This facility is from fin. year(2015-16). Kindly clarify the same. Thanks.

I have requested withdrawal online yesterday from tier 2 account-partial amount but still not get money in my bank account,please tell how much time this will take for withdrawal money.

It seems there is no way to transfer money from tier I NPS to tier II. All one can do is invest his saving from the net salary to tier II account ! Why would anyone do that given the whole market is flush with lots and lots of simpler and easier ways to invest.

My query is about Swavalamban Scheme

I have read somewhere that contribution has no upper limit

Secondly i am depositing money 12000/- per year from last 3 years, but till date i do not know about the status of my contribution.

I am having PRAN No.

Where do i check the status.

Kindly help me.

Go directly to nps online or for help u can contact to customer care also they will help u step by step . .