The government made NPS or National Pension System more attractive for investors on 10 Dec 2018. The biggest bonanza is for 18 lakh central government employees. NPS Changes are given below. Our article NPS and Government Employees explains about NPS and Government Employees

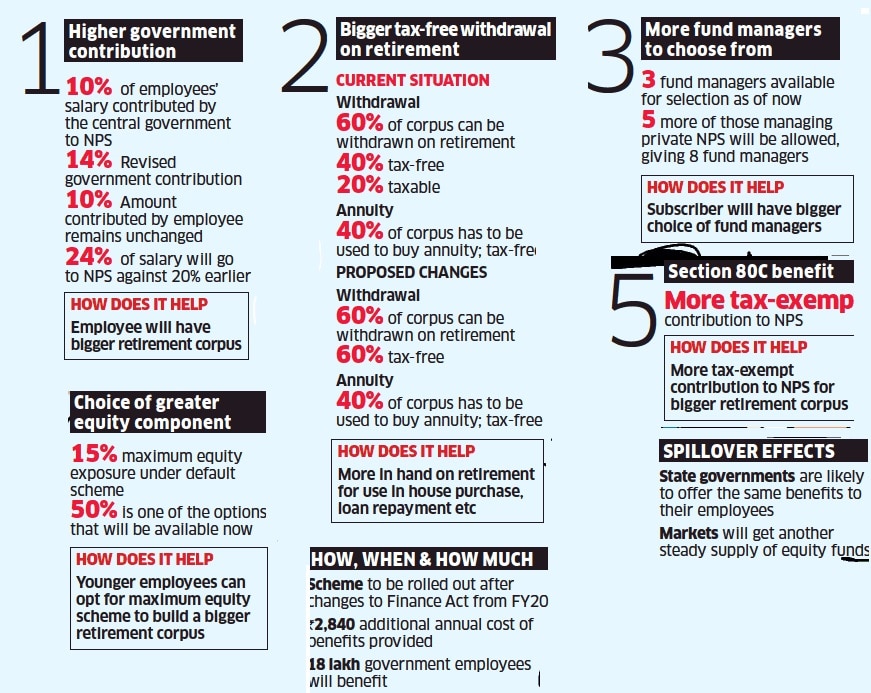

- The Centre will now contribute 14% of basic salary to their pension corpus, up from 10%. The employee’s contribution will remain at 10%. The total contribution will now be 24%.

- Entire withdrawal(60%) at the time of retirement will now be tax-free. At present, 40% of the accumulated corpus utilised for the purchase of the annuity is tax-exempt. Of the remaining 60% corpus withdrawn by the NPS subscriber at the time of retirement, 40% is tax-exempt and 20% is taxable. The tax exemption is now extended to the entire 60%.

- Contribution by government employees under Tier-II of NPS will now be covered under Section 80 C for deduction up to Rs 1.5 lakh for the purpose of income tax provided there is a three-year lock-in period.

- This is the same as schemes such as the General Provident Fund, Contributory Provident Fund, Employees Provident Fund (EPF) and Public Provident Fund (PPF),

- This reduction in the lock-in period pits the NPS against ELSS mutual funds in the battle for the tax-saving pie. Direct plans of ELSS funds charge up to 1.5% a year, while regular plans can cost 2.5%. The expense ratios of NPS funds are 0.01%.

- However, it is not clear how the gains from investments in NPS will be taxed when they are withdrawn. The government must make it clear whether the investments will get the same tax treatment as mutual funds. This is important because till now, the 20% of the Tier I NPS units withdrawn on maturity were fully taxed.

- Finance minister Arun Jaitley said the exact date from which these changes will come into effect will be notified soon, adding that normally, such changes are made from the new financial year. The government can start enhanced contribution beginning January but tax benefit would be available from the next financial year. Taking into account 18 lakh employees, the additional burden on the government due to enhanced contribution would be Rs 2,840 crore in 2019-20.

- Government employees will have more investment option.

- One option would be to invest up to 25% of the corpus in equity,

- another where up to 50% of the fund would be invested in equity and

- the third very conservative option of investing 100% in government securities.

- Government Employees can choose from the list of 8 rather than 3 fund managers.

The following image from Economic Times recaps the changes introduced by the Government

Related Articles:

Share

3 responses to “NPS Changes especially for Central Govt Employees”

I’m really impressed by the information this blog has given on nps.

The National Pension System (NPS) was launched by the Indian government on January 1, 2004. The aim of this voluntary contribution-based pension scheme is to empower retired individuals to live off their retirement income. It’s regulated and administered by the PFRDA (Pension Fund Regulatory and Development Authority).

Although initially NPS was launched for new government recruits, from May 1, 2009, its perks were extended to all Indian citizens who wish to opt for this pension scheme. The bigger picture here is to encourage our generation to start saving for our future.

Active for uan number

Yeah your UAN number should be active. You maybe interested in PPF account also. Please refer. https://easytechbank.com/ppf-account-online/