NPS is applicable to all new employees of Central Government employees and State Government employees. This article talks about NPS and Government Employees, Can Government Employee choose the Fund Manager or Scheme to invest in NPS in Tier1/Tier2 account, NPS Tax Benefits for Government Employees, Comparison of NPS with Government Provident Fund(GPF) which NPS replaced, FAQ by Govt Employees on NPS

Table of Contents

NPS and Government Employees

NPS is applicable to all new employees of Central Government service (except Armed Forces) and Central Autonomous Bodies joining Government service on or after 1st January 2004. NPS is applicable to all the employees of State Governments, State Autonomous Bodies joining services after the date of notification by the respective State Governments.

The New Pension Scheme works on a defined contribution basis and has two tiers Tier-I and II. Contribution to Tier-I is mandatory for all Government servants joining Government service on or after 1-1-2004 (except the armed forces in the first stage), whereas Tier-II is optional and at the discretion of Government servants. Every month 10% of his salary (basic + DA) and equivalent(14% announced on 10 Dec 2018) government’s contribution will be invested in NPS.

The provisions of Defined Benefit Pension and GPF(Government Provident Fun) is not available to the new recruits in the Government service.

Any other government employee who is not mandatorily covered under NPS can also subscribe to NPS under “All Citizen Model” or Individual Modal through a Point of Presence – Service Provider (POP-SP). Investment in NPS can be made by the following sectors: Central/State Govt. Employees Corporates All Citizen Model (Individual) Unorganized Sector Workers.

Under the NPS, a Government employee will be entitled to exit only at the time of retirement at the age of 60, however at least 40 per cent Pension wealth would be used for purchasing annuity from a life insurance company approved by the IRDA.

Changes in NPS for Government Employees

On 10 Dec 2018, Government allowed following changes in NPS.

- The Centre will now contribute 14% of basic salary to their pension corpus, up from 10%. The employee’s contribution will remain at 10%. The total contribution will now be 24%.

- Entire withdrawal(60%) at the time of retirement will now be tax-free. At present, 40% of the accumulated corpus utilised for the purchase of the annuity is tax-exempt. Of the remaining 60% corpus withdrawn by the NPS subscriber at the time of retirement, 40% is tax-exempt and 20% is taxable. The tax exemption is now extended to the entire 60%.

- Contribution by government employees under Tier-II of NPS will now be covered under Section 80 C for deduction up to Rs 1.5 lakh for the purpose of income tax provided there is a three-year lock-in period.

- This is the same as schemes such as the General Provident Fund, Contributory Provident Fund, Employees Provident Fund (EPF) and Public Provident Fund (PPF),

- This reduction in the lock-in period pits the NPS against ELSS mutual funds in the battle for the tax-saving pie. Direct plans of ELSS funds charge up to 1.5% a year, while regular plans can cost 2.5%. The expense ratios of NPS funds are 0.01%.

- However, it is not clear how the gains from investments in NPS will be taxed when they are withdrawn. The government must make it clear whether the investments will get the same tax treatment as mutual funds. This is important because till now, the 20% of the Tier I NPS units withdrawn on maturity were fully taxed.

- Finance minister Arun Jaitley said the exact date from which these changes will come into effect will be notified soon, adding that normally, such changes are made from the new financial year. The government can start enhanced contribution beginning January but tax benefit would be available from the next financial year. Taking into account 18 lakh employees, the additional burden on the government due to enhanced contribution would be Rs 2,840 crore in 2019-20.

- Government employees will have more investment option.

- One option would be to invest up to 25% of the corpus in equity,

- another where up to 50% of the fund would be invested in equity and

- the third very conservative option of investing 100% in government securities.

- Government Employees can choose from the list of 8 rather than 3 fund managers.

How does a Government Employee subscribe to Tier 1 account of NPS

For the Government employees contribution through their nodal office to National Pension System (NPS) is mandatory. Every month 10% of his/ her salary (basic + DA) and equivalent government’s contribution will be invested in NPS. The Government employees can subscribe for NPS (Tier-I) through the following process:

- Submit form S1 to the Drawing and Disbursing Officer (DDO) or equivalent offices.

- The DDO shall provide and certify the employment details.Subsequently, the DDO shall forward the form to the respective Pay and Accounts Office (PAO) / District Treasury officer (DTO).

- The form should be submitted to Central Recordkeeping Agency (CRA)

Can Government Employee choose the Fund Manager or Scheme to invest in NPS in Tier1 account?

For Government employees, the option to change scheme preferences or pension fund managers for their NPS accounts is not available. Under Tier I, there is only one scheme (default) available to Central/State Govt. wherein the contributions are allotted to three Public Sector Pension Fund Managers (PFM). NPS contributions are equally split among the three selected PFMs, who invest the money in a pre-decided manner. Each of the PFM’s invest the funds in the proportion of up to 55% in Government Securities, up to 40% in Debt Securities and up to 5% in Money Market Instruments.

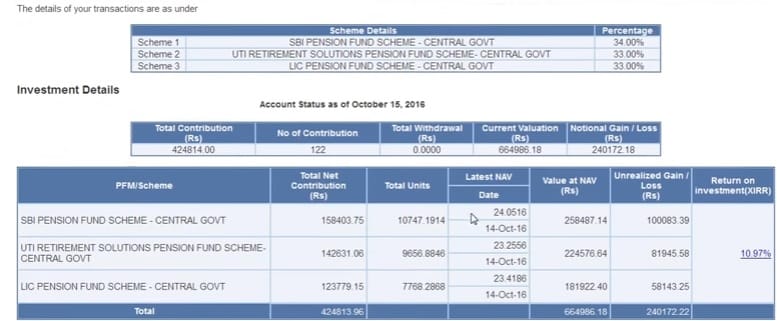

- SBI pension Funds Private Limited (34%)

- UTI Retirement Solutions Limited and (33%)

- LIC Pension Fund Limited (33%)

The image below shows the investment details from the statement in CRA.

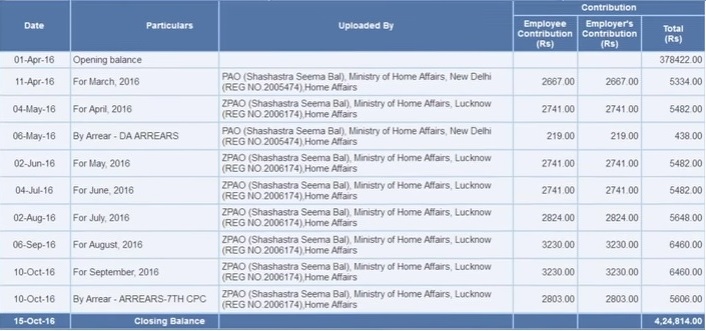

SMS alerts on balances in the NPS account being sent to the subscribers on the quarterly basis, in addition to regular monthly alerts on contribution and other changes in the PRAN. Online reset of password and facility to change mobile no. and email Id has been provided to all the NPS subscribers. The image below shows the transactions in NPS for a government employee.

How does a Government employee open Tier2 account of NPS?

If the Subscriber is an existing PRAN Card holder, he can activate the Tier II account by approaching the nearest POP -SP or eNPS. One can submit a duly filled Form UOS-S10 along with a copy of PRAN Card, PAN Card, a canceled cheque and initial contribution of Rs 1000. The list of POPs is available on NSDL website (www.npscra.nsdl.co.in) under the menu Quick Links.

Can Government Employee choose the Fund Manager or Scheme to invest in NPS in Tier2account?

Yes For Tier II, the government subscriber has been given the flexibility to choose one out of six Pension Fund Managers(PFMs) and also the percentage in which the selected PFM will invest the funds. The six PFMs are

- ICICI Prudential Pension Funds Management Company Limited

- IDFC Pension Fund Management Company Limited

- Kotak Mahindra Pension Fund Limited

- Reliance Capital Pension Fund Limited

- SBI Pension Funds Private Limited

- UTI Retirement Solutions Limited

For Tier II, the Subscriber has to submit the physical application form (Form-UOS-S3) to change Scheme Preference. However, such changes can be done only once in a financial year. The transaction is chargeable. You can submit the request to your POP-SP through whom your Tier II account is activated. Please collect a 17 digit acknowledgment number against your request.

NPS Tax Benefits for Government Employees

National Pension System is another tool in hand for planning your tax obligation. Tax Benefits on NPS is available only for Tier-I account. Income Tax Act allows benefits under NPS as per the following sections,

- On Employee’s contribution under Section 80CCD(1): Employee’s own contribution is eligible for tax deduction under sec 80 CCD (1) of Income Tax Act up to 10% of salary (Basic + DA). This is within the overall ceiling of Rs. 1.50 Lacs under Sec. 80 CCE of the Income Tax Act.

- On Employer’s contribution under Section 80CCD(2): Up to 10% of Basic & DA (no upper ceiling) under 80CCD (2). This rebate is over and above 80 C.

- Tax Benefit under Section 80CCD(1B): As announced by Govt of India in Budget 2015-16, a subscriber will be allowed tax deduction in addition to the deduction allowed under Sec. 80CCD(1) for additional contribution in his NPS account subject to a maximum of Rs. 50,000 under sec. 80CCD 1(B).

A government employee can invest in NPS and get the additional benefit of Rs. 50,000 under section 80CCD (1B). This benefit is open for all, including central /state government employees irrespective of their joining date.

If you are an existing Government subscriber, you can approach any POP-SP or your Nodal Office or alternatively you can visit eNPS website (https://enps.nsdl.com) for making an additional contribution in your Tier I account.

The print out of the Transaction Statement could be used as a document for claiming tax benefit.

Comparison of NPS for Government Employees with Government Provident Fund

GPF or General Provident Fund account is a provident fund account which was available for government employees. A government employee who joined before 1.1.2004 became a member of the fund by contributing a certain percentage of his salary to the account. The accumulations in the fund are paid to the government employee at the time of superannuation or retirement. For more information on GPF one can read GPF rulebook.

The NPS replaced the Government Provident Fund, a defined benefit pension scheme in which the pension increases each year in accordance with the dearness allowance declared twice a year. Since the DA is supposed to take inflation into account, GPF pension resembles an inflation-protected annuity. Unfortunately, since the basic pension is much lower than the ‘basic pay’ last earned, the biannual increase in DA will not do much to combat inflation.

The NPS on the other hand, reduces the liability of the government. Once an employee retires, a minimum of 40% of the NPS corpus must be annuitized, That is an organization like LIC would take the money and offer a fixed interest for the rest of retirees life (other options exist. For example, annuity benefits can be extended to the spouse).

Unlike the GPF, the NPS annuity has no connection to the service and last pay earned. You put in a fixed contribution into an account known as Tier I. The government matches your contribution. When you retire, the corpus entirely depends on the history of the debt and equity markets when you were in service.

Article NPS is far beneficial than Government Pension compares the GPF with NPS. In the example if one starts with Pay of 20514 in 2014 and works for 35 years with 3% annual increment, 14-20% increase in DA

- If contributes to NPS would get gets 3.8 crores on retirement (60% of Pension Wealth + Encashed Earned Leaves) and gets a monthly pension of Rs 83,306. One can also he can withdraw the remaining 40% of his pension wealth of Rs. 1,14,90,481 before turning 70 years.

- If the Govt employee contributes to GPF he will get 38.32 lakhs in retirement. Would get a pension of Rs 1,00,934 per month. After the death spouse can take only 60% of the basic pension ie Rs 17195 x 60% = Rs.10317 plus D.A.at the prevailing rates. After spouse’s death children are unlikely to draw the pension as they would have already crossed the age limit.

Quoting from article

Let me take a case of Upper Division Clerk(UDC) who joins government service in 2014 at the age of 25 and renders 35 years of service till attaining 60 years of age. He/She gets 3% annual increment every year and gets one promotion every 10 years under M.A.C.P. Although he she is likely to get 14 to 20% increase in D.A every year as per Consumer Price Index I just take 12%(assuming 6 + 6%) 2 times D.A in a year. Following Table shows Basic Pay, total pension wealth under NPS.

| Year | D.A. assumed @ 12% Per annum |

PAY + GRADE PAY with 3% annual increment |

D.A | TOTAL | Total Monthly Subscription (employee and Govt) |

Annual Subscription |

Annual Appreciation of Investments @ 8.7% Only |

TOTAL PENSION WEALTH |

| 2014 | 107% | 9910 | 10604 | 20514 | 4102 | 49224 | 2320 | 51,544 |

| 2015 | 119% | 10210 | 12150 | 22360 | 4471 | 53652 | 7012 | 1,12,208 |

| 2020 | 179% | 11860 | 21229 | 33089 | 6618 | 79416 | 44487 | 592234 |

| 2030 | 299% | 16900 | 50531 | 67431 | 13486 | 161832 | 249371 | 3189883 |

| 2040 | 419% | 25190 | 105546 | 130736 | 26148 | 313776 | 866975 | 10976010 |

| 2048 | 515% | 33380 | 171907 | 205287 | 41058 | 492696 | 2057162 | 25928520 |

| 2049 | 527% | 34390 | 181235 | 215625 | 43126 | 517512 | 2280169 |

28726201 |

Therefore, the total pension wealth of a government servant who joined in 2014 and retiring under New Pension Scheme shall at the time of his retirement be Rs. 2,87,26,201 ( 2.87 crore)

- (A) 60% of the lump-sum pension wealth which he/she will be getting on retirement: Rs 1,72,35,720.6 (1.72 crore)

- (B) 40% invested in an annuity scheme which he/she can receive before 70 years: Rs 1,14,90,481 (1.14 crore)

- (C) Earned Leave Encashment: Rs. 2,15,625 x 10 months : Rs. 21,56,250 (21 lakh)

- TOTAL of (A) and (C) will be Rs. 3,08,82,451 (3.8 crore)

At the assumed Interest at the rate of 8.7% per annum on 40% of pension wealth of Rs.1,14,90,481 invested in annuity shall fetch monthly pension of at least: Rs.83,306

Not only this, before he attains the age of 70 he can withdraw the remaining 40% of his pension wealth of Rs. 1,14,90,481 which if invested in Fixed Deposit of a nationalized bank can fetch interest

This is just a tip of the iceberg. If we consider the other 4 pay commission benefits that materialize on 1/1/2016, 1/1/2026, 1/1/2036 and 1/1/2046 which a NPS pensioner who joins as UDC shall be getting before his retirement in 2049.

Benefits under Central Government Pension Scheme

Now let us see what will be the retirement benefits of the above person if he/she is put in government pension scheme:

- 1. Gratuity for 16.5 months : Rs.2,15,625 x 16.5 months = Rs 35,57,812 Restricted to Rs.10,00,000 10 lakh

- 2. Earned Leave Encashment: Rs. 215625 x 10 months : Rs.21,56,250

- 3. Pension Commutation: As per the CCS (Pension) Rules, the government also gives an opportunity to its employees to commute a part of their pension in return for a lumpsum payment. The maximum percentage of pension which can be commuted under these rules is 40%. Upon the receipt of the lumpsum commuted value of the pension, the pensioner draws reduced pension to the extent of the amount commuted, for 15 years. Thereafter, his pension is restored to full.

- Rs 34390 / 2 = Rs 17195 (basic pension being 50% of pay and grade pay)

- 17195 x 40% = Rs.6878 (40% of basic pension towards commutation which will be restored after 15 year)

- Balance basic pension is Rs. 10317

- The amount of lump sum payable in lieu of the commuted amount is determined by means of a Commutation Table containing the commutation factors. The formula for working out the lump sum payable is as follows

- Amount offered for Commutation x 12 x Commutation factor.

- Therefore in the above case the amount will be equal to 6878 x 12 x 8.194 years = Rs 6,76,300

- Total Benefits under Central Government Pension Scheme: Rs.38,32,550(10 lakh as gratuity +6,76,300+ 21,56,250)

He will get monthly pension is Rs.1,00,934 1 lakh per month with break up as follows

- i) 10317 (basic pension being 50% of pay and grade pay – 40% of basic pension towards commutation (Rs 6878) ) .

- ii) DA @ 527% of basic pension of Rs 17195 = Rs. 90617 (subject to increase in DA every 6 months based on consumer price index)

After the death of the government servant, say at 67 years, the spouse can take only 60% of the basic pension ie Rs.17195 x 60% = Rs.10317 plus D.A.at the prevailing rates. After spouse’s death children are unlikely to draw the pension as they would have already crossed the age limit.

FAQ by Govt Employees on NPS

- A Govt employee can claim a deduction of your employer’s contribution towards NPS under Section 80CCD (2), up to a limit of 10% of your salary (i.e. Basic Salary + Dearness Allowance). Employer’s contribution towards NPS or EPF (Employees’ provident fund) is not the part of your gross salary, but is added by your employer in your CTC (cost to company).

- A central government/state government officers are entitled deduction under section 80CCD (1B) on their own i.e employee contribution towards his NPS account

- You can claim a deduction of only your own contribution towards NPS under Section 80CC.

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

- Employer’s contribution (62,000) in NPS is eligible for tax deduction u/s 80CCD(2).

- The employee has a choice as to which section ,80CCD(1) or 80CCD(1B), he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

I am a central government employee. I have invested Rs 1.5 lakh in Public Provident Fund (PPF). I also contribute around Rs 72,000 per year to National Pension System (NPS). The government, my employer, also contributes a matching amount. I want to know whether I can claim my PPF investment of Rs 1.5 lakh under Section 80C and the additional Rs 50,000 under Section 80CCD(1) on my contribution to NPS?

An employee’s contribution is eligible for tax deduction of up to 10 per cent of his salary (basic + DA) under Section 80CCD(1) within the overall ceiling of Rs 1.5 lakh under Section 80CCE. The employee is also eligible for tax deduction of up to 10 per cent of his salary (basic + DA) contributed by the employer under Section 80CCD(2) over and above the limit of Rs 1.5 lakh provided under Section 80CCE. As per the last Budget, an additional tax deduction of up to R50,000 can be claimed under Section 80CCD(1B) on investments in NPS. However, the aggregate amount of deduction under section 80C, 80CCC and 80CCD(1) cannot exceed R1.5 lakh.

That means you can claim a total tax deduction of Rs 2 lakh like this: Your contribution to NPS is Rs 72,000. You can claim a deduction of Rs 50,000 under section 80CCD(1B) and Rs 22,000 under section 80CCD(1). The remaining R1.28 lakh (R1.5 lakh – R22,000) can be claimed under section 80C on your investment in PPF.

I work for a PSU bank and 10% of my salary goes into the NPS. In this financial year, my contribution to NPS will be around 85,000. Can I claim deduction for 50,000 under the new Section 80CCD (1B) and for the remaining 35,000 under Section 80CCD?

Yes, you can claim the deduction for 50,000 under Section 80CCD(1B) and Rs 35,000 under Section 80CCD. Apart from this, you can still claim deduction of the balance Rs 1.15 lakh by investing in other suitable tax-saving options under Section 80C.

I am a central government employee, Due to some arrears, my National Pension System (NPS) contribution is Rs 2.1 lakh this financial year. My account department did not consider the additional R 50,000 tax deduction under 80CCD(1B). Can I claim refund of this amount while filling my income tax returns?

You can claim a total deduction of Rs 2 lakh together under Section 80C and Section 80CCD this financial year while filing ITR. Since you have already made a contribution of Rs 2.1 lakh to National Pension Scheme (NPS), you can claim a total deduction of Rs 2 lakh, including Rs 50,000 under Section 80CCD(1B).

I am Central Govt Employee,I already had made saving of Rs. 98,500 u/s 80C through following. NPS employee contribution for the FY 2016-17 is 51,500. Can I avail tax benefit of NPS contribution u/s 80CCD which allows extra 50,000 over and above 1.5 Lacs of 80C for FY 2015-16.

- ELSS Mutual Fund – 80,000

- LIC premium – 18,500

You can claim deduction of Rs 50,000 as under section 80CCD(1B) as there is no such pre-condition that you have to first exhaust the limits of 80CCD(1). 1,500(51,500-50,000) you can claim under section 80C.

I have invested Rs 1.5 lakh in PPF and Rs 62,000 in NPS. Am I still entitled to the employer’s contribution of NPS (62,000) under Section 80CCD(2)?

Yes, you can claim deduction if the contribution to the NPS has been made by the employer. This deduction can be claimed over and above Sec 80C and employee’s contribution to NPS. The deduction will depend on your basic salary. If your basic salary, excluding all allowances and perquisites except dearness allowance, is upwards of Rs 6.2 lakh, you can claim deduction of Rs 62,000 under Sec 80CCD(2). Else, the deduction will be capped at 10%.

Can I get an additional benefit on Rs. 50,000 in NPS u/s 80CCD (1B) over and above of Rs 1.50 lakh if I already get a benefit in u/s 80CCD (1) and 80CCE in my existing NPS. Is this benefit u/s 80CCD(1B) also applicable on existing customers of NPS?

Yes, you can claim the additional benefit of Rs. 50,000 under section 80CCD (1B), provided you haven’t claimed this amount under 80CCD (1).

Yes, this benefit is available to even existing customers of NPS. This additional benefit is available from April 2015 and even customers who have opened NPS account before April 2015 are eligible for Rs. 50,000 deduction.

I am a government employee and they are deducting every month 10% from my salary and depositing in National Pension System (NPS), which comes to Rs 70,000 p.a. I have save Rs.1.50 lakh in Public Provident Fund (PPF). Can I show Rs 50,000 (from this Rs.70,000) under 80CCD (1B). i.e total saving is Rs 150,000 (PPF) + Rs.50,000 (NPS) = Rs 200,000 ?

If you are declaring only the PPF contribution of Rs.1.50 lakh for claiming benefit under Section 80C, then you can claim the additional deduction of Rs.50,000 towards NPS contribution under Section 80CCD (1B).

Related Articles:

- Salary,Allowances,Dearness Allowance,Government Salary, Pay Commission

- What is Gratuity?

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Pay and perks of Indian MP, MLA and Prime Minister

- What is Leave Travel Allowance or LTA

- Understanding Variable Pay

- Understanding Form 16: Part I

58 responses to “NPS and Government Employees”

I am a Tamilnadu state govt. employee. our CPS fund maintained by TN Govt. Data center only(Not Central Record keeping Agency(CRA). if it possible to deduct Rs.50,000/- under Section 80 CCD 1(b)

regards

Saravanakumar G.

Tamilnadu

Do you have a PRAN?

Check with your payroll department if they allow extra contribution to NPS from your salary?

Else mostly people login to NPS site with PRAN and make extra contribution

Is goverment employees invested in GFP is eligible for NPS & Deduction Under sec 80CCD.My CA tell me that “Can invest in NPS but not eligible for Deduction Sec 80CCD”

I am a Central government employee and joined the service on 10/01/2000. I am entitled for pension on retirement as per the old policy. Can I still open a NPS account and get additional tax benefit if I contribute Rs. 50000 per annum. If so, whats the procedure ?

You can only have one NPS account.

No need to open another NPS account.

A government employee can invest in NPS and get the additional benefit of Rs. 50,000 under section 80CCD (1B). This benefit is open for all, including central /state government employees irrespective of their joining date.

As expalined

Amit is a government employee and his employer deducts Rs 62,000 per annum (which is 10% of basic + DA) from salary as employee’s contribution in NPS. It also deposits Rs 62,000 per annum as employer’s contribution in NPS. How and under which section should he claim tax benefit on NPS?

Employer’s contribution (62,000) in NPS is eligible for tax deduction u/s 80CCD(2).

The employee has a choice as to which section ,80CCD(1) or 80CCD(1B), he wants to show his contribution. Ideally he should show Rs 50,000 investment in NPS u/s 80CCD(1B). The tax deduction on rest Rs 12,000 can be claimed u/s 80CCD(1). The section 80CCD(1) along with Section 80C has investment limit eligible for tax deduction as Rs 1.5 lakhs. So he should make additional investment of Rs 1,38,000 in Section 80C to save maximum tax. In all he can save Rs 2 lakhs tax u/s 80C and 80CCD(1B).

Respected sir,

i am central government employee working in tribunal court. i joined my service in month of september 2018, and due to some reasons my nps deduction started from march 2019. But, i want nps deduction of previous months i.e from sept, 2018 to february 2019. My question is this only that my earlier months deductions can be possible in nps?

You have to check with the colleagues/department as to why the NPS was not deducted from Sept 2018 to Feb 2019.

Is there some kind of probation period of 6 months?

Sir,

The same case is happened to me, and now the accounts ud deducting my previous nps I.e. october 2018 to march 2019 with every month 1+1 I.E. 1 april 2018 and 1 october 2018.

Now I want to know can I pay the all 6 months nps in one month by salary deduction or by cheque?

Sir/Madam,

I got my job in a govt. Sector College before 1.1.2004 which effectively means I have a pension at the time of superannuation. Now I want to know from you, Can I Still invest in NPS?

If yes please let me know.

Regards,

I too have the same doubt…

Need clarification

Sir, I am government employee, my contribution towards nps from my salary 150000, please clarify whether can I claim tax benefit under 80CCD2 of employer contribution of RS 150000. If yes,

1.should I show computation of employer contribution in ny my tax calculation.

2. As it’s government organization, the employer contribution will not be filed.

3.whether the drawing and disbursing officer has to mention in the form16

please clarify, and kindly provide any details for claim 80CCD2

Yes, you can claim tax deduction On Employer’s contribution under Section 80CCD(2): Up to 10% of Basic & DA (no upper ceiling) under 80CCD (2).

This rebate is over and above 80 C.

It will come under section 17 and will be part of Form 16

Sir,

. I am a State Government servant joined in 1990 and eliigible to get pension. My age is 51. I want to know whether I can invest in NPS 80CCD to avail additional tax exemption of Rs.50,000/- . Please clarify since some of my friends say that those who joined in govt.service on or after 2004 alone are eligible to avail this tax exemption as they are in CPS PENSION SCHEME.

T.R.DHANDAPANI

I’m a central govt employee. Is it possible to change scheme in TIER I. I mean, like you mentioned in your article, either up-to 25% equity or up-to 50% equity. The current default scheme is having an equity exposure around 10% only. Is there any way to increase the equity exposure in TIER I account for central govt employees?

Any one please help me is adhaar mandatory for nps account for government employees??

What is effect date of the enhanced hike of govt .contribution of 14%. .01.01.2004 or 01.04.2019 if from 01.04.2004 will they give arrears to tier1 account.. .

It has not been announced. But is expected to be 1 Apr 2019.

As explained in the article

Finance minister Arun Jaitley said the exact date from which these changes will come into effect will be notified soon, adding that normally, such changes are made from the new financial year. The government can start enhanced contribution beginning January but tax benefit would be available from the next financial year.

Dear I am a Govt. Employee and i am going to receive my grade pay arrear w.e.f Oct.,2012 to June ,2018 . Is there any rule position to deduct my NPS contribution from that Grade Pay arrear. Pls reply with rule position, so that i can take the benefit of NPS.

I’m a kerala state Government employee. I joined the service in May – 2014 and from that time itself i am contributing towards NPS. What are the benefits which i would get at the time of my retirement? As of now i would retire in 2040.

Dear sir iam state govt serv.

My form 16 shown Nps is 52861 under80 ccd1 only. My all saving under 80c less than 1.5 lakh.

May i deduct same amount of nps under 80ccd2 by myself.

Sorry you can’t.

As under

80CCD1 is an employee’s (10% of Basic+DA) contribution is eligible for deduction.

80CCD2 is Employer’s contribution

You can claim 52861 under 80C

Why is your employer’s contribution not in Form 16.

What proof do you have that employer has contributed.

A bank employee, deduction from salary from my part for NPS is Rs. 42,000 and the same contributed by employer. I have other 80 C expenses and investments like LIC, ELSS, PPF amounting to 1.5 Lakh. Could I claim this Rs. 42,000 under 80 CCD(1)B?

While the deductions under different sub-sections of 80CCD have to be shown separately in the forms, there is no clarity regarding whether ‘employee contributions’ can be treated as ‘self contribution’.

As there is no clarification on it from Income Tax Dept, many are claiming like the way you suggested.

An employee’s mandatory contribution to NPS is eligible for deduction under Section 80CCD (1b)

“If you have contributed Rs 50,000 or more towards NPS via salary deductions, maximise the tax benefits under both Section 80C and Section 80CCD(1b). Claim the full Rs 50,000 under the new section first and then adjust the residual to achieve total tax deduction of Rs 2 lakh

Hi,

I am a govt employee and i contribute 30000 per year in nps Account. How much amount will be accumulated in my account after 31 years. And how it is calculated. Please tell

Hi,

I am a govt employee. I contribute 30000 per year in nps account. How much total amount will be accumulated in my account after 31 years. And how it is calculated. Please tell.

I am PSU bank employee and my form no 16 does not have employer contribution enlisted in it. My employee contribution is nearly 1 lakh and equivalent contribution is given by my employer in my NPS account. Being psu bank employee, while claiming tax deduction do I have to include my employer contribution in my taxable income and then claim tax deduction or I do not have to add employer contribution in my taxable income as its part of ctc .

Hi, I have moved from a corporate to another, and want to move the scheme to UOS from corporate. Where shall I submit Form-ISS-1? Which is the nodal office for citizens?

Can you log in to the eNPS portal, and see if the option “Shift to NPS” is available to you as shown in the image below.

You can Call NPSDL at CRA Toll free number 1800 22 2080 or you can e-mail them at info.cra@nsdl.co.in

Typically If you want to move to Corporate account You have to submit the Form for Corporate Subscriber Employment and Scheme Preference Change (CS-S3) to your company.

Subscribers Employment Details to be filled and attested by corporate. All Details are Mandatory

They will do the needful.

But as you want to move to All Citizen model need to submit Form ISS-1 : Inter Sector Shifting form.

My daughter joined state govt service as teacher in 3/2003.She is covered by pf, graduvity, pension scheme. Can she join the NP Scheme?

Yes she can join the NPS scheme.

Any other government employee who is not mandatorily covered under NPS can also subscribe to NPS under All Citizen Model

Is goverment employees invested in GFP is eligible for NPS & Deduction Under sec 80CCD.My CA tell me that “Can invest in NPS but eligible for Deduction Sec 80CCD”

If my daughter joined govt service in 3/2003,covered by pf, graduvity, pension scheme,now joins the new NPS,will the amount paid to NPS elegible for deduction under sec 80ccd(1b)? If elegible, can she make single premium in an year or to make payment in everymonth? For I T elegiblity ,has she to join in Tier 1 or Tier2? Pl clarify.

R Sir .Madam

I am state employee from 2002 and make savings of150000 under section80c.can i too go for NPS to save additional 50000 under section 80cc.and from where should i open acc.

Yes, you can claim can claim an additional deduction of up to Rs 50,000 under Section 80CCD (1B),

You don’t need to open another account.

Just invest in the same account. You can contribute online by going to the eNPS website and click on the Contribution button as explained in our article How to do online Contribution to NPS using eNPS

R/Sir,Madam

I am a center govt. Employee. My quarry is this, can I skip the one month contribution to the NPS ? Due to some reason a have to opt this. Is it possible ? In the next month I am ready to pay the pending contribution of last month too. For example an amount 4800 rupees my own contribution for the month of jan.18 ..I want to skip and in the next month I am ready to contribute an amount 9600 rupees( 4800 rupees of last month) in Feb 2018. Please send the letter or official order in this regard if it is possible.

Thank you

In NPS, a government employee contributes towards pension from monthly salary along with a matching contribution from the employer.

As it is deducted from your salary it is not possible.

You can speak to your payroll department.

I am retired govt.servant who has total NPS 2.3lakhs in tier I.how much I can put in annuity now whether 100 %.Pl.clarify.Regards.

At age 60, maximum 60% of the corpus can be withdrawn while annuity is paid on the balance 40% of accumulations. Although, maturity corpus was made partially tax-free by giving tax-exempt status to 40% of the corpus amount, the balance 20% of the corpus that can be withdrawn still remains taxable. One may, however, defer the lump sum withdrawal till age 70, or to avoid paying taxes on this balance, one may club it with 40% annuitisation amount to buy the annuity.

Yes,One can use 100% of accumulated pension wealth to buy annuity plan.

urrently, there are seven empanelled annuity service providers:

Life Insurance Corporation of India

SBI Life Insurance Co. Ltd.

ICICI Prudential Life Insurance Co. Ltd.

HDFC Standard Life Insurance Co Ltd

Bajaj Allianz Life Insurance Co. Ltd.

Reliance Life Insurance Co. Ltd.

Star Union Dai-Ichi Life Insurance Co. Ltd.

Annuity Options available under NPS

Annuity/ pension payable for life at a uniform rate.

Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive. (I do not understand how this works)

Annuity for life with return of purchase price on death of the annuitant.

Annuity payable for life increasing at a simple rate of 3% p.a.

Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her lifetime on the death of the annuitant. The purchase price will be returned on the death of the last survivor.

Option 6 is the default annuity option.

Only monthly annuity is allowed under NPS.

Employer’s contribution towards NPS or EPF (Employees’ provident fund) is NOT the part of your gross salary: I need proof for this …please show any authenticated document…

dear sir,

im railway employee joined in 1994. am not covered under NPS.

Can I get the benefit of additional 50000 under section 80ccd(1b) over 150000 in section 80 c.

Whether cpse employees get 10% contribution from employer in nps

Sir,

i joined the State govt. office in 2016 sept but my N.P.S. started deducting after opening my N.P.S. account and it could have been possible in aug-2017, so for the tenure 2016 sept to aug-2017 can i deduct the entire contribution to N.P.S. in 2 or 3 time{means 4 month as an arrears in once} or it or mandatory to only deduct one month as an arrear with the running month contribution.

in which mode the govt will add the same amount in my account whether 1st or 2nd?

I am central government employee right now and wish to join state government in further few months. Does I need new pran number for state government ? If not then how pension fund will be switched as state government has ?

In case a subscriber shifts within the Central Government or a State Government then there is just change of Nodal office i.e. from one PrAO/DTA/PAO/DTO/DDO or to another PrAO/DTA/PAO/DTO/DDO then the subscriber need not submit any separate request.

For shifting of NPS within Government sector, the Subscriber is required to intimate his PRAN to the target (new) office with whom he/she will be associated after shifting. The new office will facilitate shifting in the CRA system by uploading the NPS contribution. PRAN will get associated to new office in the CRA system on successful credit of the monthly NPS contribution. Subsequently, the new office is required to update Subscriber’s employment details in the CRA system.

Explained in our article Shifting NPS account: Sectors in NPS, Form ISS

is it must that the employer contribution comes in form 16.

is it must to included employer contribution in gross salary.

what are proof of employer contribution.

Yes employer’s contribution should come in Form 16.

Yes employer contribution is included in gross salary

Form 16 is prrof of employer contribution.

-For NPS you can check your account details

-For EPF the UAN passbook

hello siri want to know whether employer contribution of 10% basic and da must be shown in gross salary if yes then how to show it in 80ccd under tax benefit whether it show shown under 1.5 ceiling or above 1.5 lakh ceiling because for a central govt employee 10% of nps contribution of employer also added in gross salay.

plz clarify

The employer contribution is shown in Gross Salary as it is part of your taxable Salary.

Your payslip should show break up of salary into various components

Check your Form 16 from the employer, you should see all the contributions as shown in the image below.

If your employer is contributing to your NPS account you can claim deduction under section 80CCD(2). There is no monetary limit on how much you can claim, but it should not exceed 10% of your salary.

I am state government employee I contribute 150000 towards ppf and 62000 towards nps isn’t I have to pay income tax

Couldn’t understand the question.

State Govt would be deducting tax from your salary which you can check in your Form 16.

Dear Sir

I was a govt employee. I was on leave without pay for over an year. Now after my resignation my department is asking me to remit their contribution as well as mine in NPS Tier -1 account (which they continued making when I was on Leave without pay). Was just wondering how to get this sorted out, when I wasn’t earning any salary, why did my department kept on depositing my NPS? They say it is a norm and correct as per rules. What I understand is NPS should be 10% of my salary, now when my salary is zero, my contribution should also be zero.

Can you guide on this. Do I have to pay?

Regards

Rajveer

Rajveer as per the rules the Department should not have deducted your NPS. Quoting from Nodal Office Standard Operating Procedures

In case of promotions / increments/ leave without pay, the PAO/CDDO User will have to modify the amount in the Subscribers and Government Contribution columns.

Now the dept messed up.

The question is how to resolve amicably by talk.

if a railway employee don’t want to contribute in NPS scheme , whats the way for this or will he be terminated ? please reply

There is no way to opt out of NPS. If you retire after superannuation you can purchase annuity for minimum 40% of the accumulated amount, remaining can be withdrawn as lumpsum.

If accumulated corpus is less than Rs 2 lakhs, 100% amount can be withdrawn.

I m a govt employee ok earn 53000 per month

Deduction of nps is4800 and employers contribute is alsoo4800 My employer add govt contribution in my pay and also give me 80ccc and 80ccd to 200000

Is it right to add govt contributions in nps to my total income

Can I get extra benefits of 80ccd1b above 200000=200000+50000

nice detailed article

I am a state government employee. I need a yearly statement. state government contribution (14 % ) is the part my income/sallary ..yes/no.

Suggest me… Can I write state government contribution in my statement.. Yes or no.. Please reply me.

When I write state government contribution in my statement then how many tax benefit in my 16 no form

You can get the statement from your NPS account.