Without life insurance, your family is vulnerable to financial uncertainties if something unfortunate happens to you; especially if you are the one earning. So, can one buy multiple life insurance policies? Does it make sense to have several life insurance policies? And, what needs to be taken care of while buying multiple insurance policies? Get answers to all these questions if you are planning to get life insurance policies in the near future.

Table of Contents

Overview of Multiple Life Insurance Policies

The life cover should not just take care of your existing liabilities but should also include your future liabilities. You must take a term life insurance policy as early as you can to make sure your loved ones are secured for life. Having two-three plans of varying terms and covers is a good idea as this way one is at liberty to continue or discontinue policies on the basis of one’s requirement.

Here are the points you need to know when you start thinking of buying multiple insurance policies:

- Yes, you can have multiple policies from the same or different life insurance companies. If you are getting insured for a big amount you may opt for at least different insurance companies.

- While applying for a new policy you must disclose the previously bought policies to the insurer so that they are aware of your existing coverage.

- If you don’t disclose the previously bought policies, it might be taken as misrepresentation and your claim might be rejected.

- The combined sum assured of all policies should not exceed your Human Life Value

- Taking more than one policy means you’ll be paying the additional premium. So please plan accordingly.

- You need to track multiple policies.

Why should you have Multiple Life Insurance Policies?

- To diversify across insurers.

- As a hedge against claim rejection.

- To break down a large cover into smaller ones

- To have the flexibility of having term insurance plans spread across different time periods based on your liabilities. For example, if you have a Rs 50-lakh loan which you will pay off in the next 10 years, there’s no point taking a Rs 1-crore cover for 30 years that factors in the loan amount. One can break the cover into two smaller ones of Rs 50 lakh for 10 years and Rs 80 lakh for 30 years. You may like to diversify term covers based on maturity-some policies maturing just after you stop working and some extending to the maximum possible tenure

- Don’t buy too many life insurance policies as it increases the premiums. Try to keep it to a maximum of 3 as it increases the cost of premiums

Human Life Value

Life insurance is an example of Non-Indemnity insurance which means that there is no specific limit to a loss or compensation received by the insured. However, when buying multiple insurance policies, the total sum assured of all policies should not be more than your Human Life Value. So, what is this human life value? A human life value is the value that denotes the loss of income and increase in liabilities that your family would have to face in case of your sudden demise. It, therefore, helps you ascertain an amount that would be suitable as a life cover for you and can take care of your family’s needs in case of your unfortunate death. It is based on your income, savings, and liabilities. In insurance, this value is used to determine the amount of insurance that a person should buy. To put in simple terms, the sum insured must equal the human life value. To assess how much sum is required, you can use a human life value calculator.

When you apply for insurance to a life insurance company it does risk assessment technically called as ‘underwriting’ in life insurance. Insurability is assessed by reviewing the applicant’s income and existing life cover. In medical underwriting, health-related risks are assessed. Based on these details, which you provide when you apply for insurance, your insurers calculate your Human Life Value. You can use a term insurance calculator to get an idea about life premium based on your income and the insurance cover sought.

One way to assess human life value is to estimate your income each year until you retire, say around 60 years considering the inflation. So calculation of HLV should take into account:

- Life expectancy of the spouse

- Number of dependents such as children

- How old the children are, and how many years they’ll be dependent on you

- The financial goals you have for dependents (education, marriage)

- Your monthly household expenses

- Lifestyle expenses

- Savings for emergency

- Assets

- Current insurance (if any)

- Outstanding loans

- Cost of inflation

Informing the insurer when buying multiple Life insurance policies

The combined sum assured of all policies does not exceed your Human Life Value

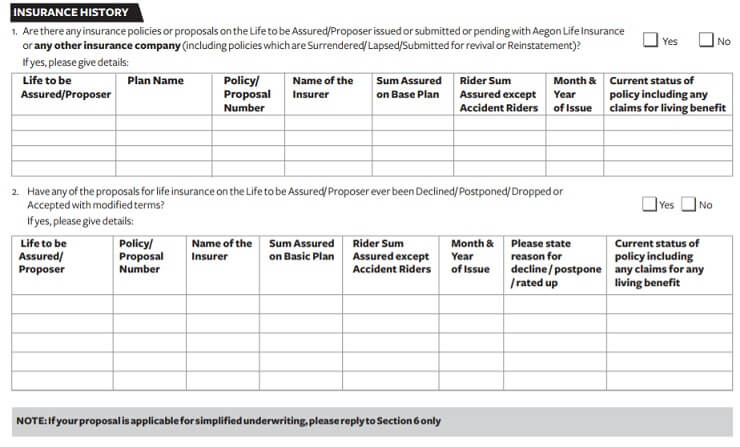

While applying for a new policy you must disclose the previously bought policies to the insurer so that they are aware of your existing coverage. If you don’t disclose the previously bought policies, it might be taken as misrepresentation and your claim might be rejected. The following images show the excerpt from the proposal form.

Cost-Benefit Analysis of Multiple Life Insurance Policies

The cost of multiple term plans is definitely more than that of a single term plan of the same sum assured. Does the benefit outweigh the cost? Let us look at an example:

Aarush and Aahan bought the term insurance plan of Rs 50 Lacs.

- Aarush has a single 20-year term plan and he pays a premium of र 5,500 per annum,

- Aahan has two 20-year term plans for which he pays a total premium of र 6,500 per annum. Aahan pays र 1,000 extra for the same sum assured.

- The र 1,000 amounts saved by Aarush if invested at the rate of 9% over a 20-year period gives the value of र 51,160. This is the opportunity cost for Aahan.

However, if Aarush death claim is rejected, his family will not get anything. On the other hand, if the death claims on one of Aahan’s term plans is rejected but the other one is paid, Aahan’s family will get र 25 lacs of sum assured. The benefit of र 25 lacs surely outweighs the additional र 51,160 opportunity cost.

It is recommended to take term insurance policy as early as possible. if you’re 25 years old and you take the term insurance policy for 30 years. Your insurance cover will be only until age 55 years. It is good to have insurance cover till you intend to work say 60/65 years. So now you don’t have any insurance cover from 55-65 years. Buying two different life insurance policies makes sense in such cases. You can take another insurance policy at 35 years. During 35-50 years you have more insurance. This is the time when you have lot of responsibilities like home loan, higher education of children, the marriage of children.

| Age(yrs.) | Term(yrs.) | Life Cover | Active life cover | Annual Premium(Rs.) | Total Premium | ||

| 20-35 | 35-50 | 50-65 | |||||

| 20-50 | 30 | 1 crore | 1 crore | 2 crore | 1 crore | 5900 | 177000 |

| 35-65 | 30 | 1 crore | 10,800 | 324000 | |||

How to claim in case of Multiple Life Insurance policies

Your nominee/family would have to inform each of the insurance company of the death of the insured

The first step is informing the insurance company. Based on the time from which insurance was taken deaths are classified as an early death where the insured dies within three years of having taken the policy and non-early death.

You then have to submit the claim. Our article How to Claim Life Insurance explains it in detail.

Related articles:

All About Insurance: Life Insurance, Health Insurance, Car Insurance, LIC

- Why one must buy insurance and types of insurance?

- Before Buying Insurance Policy to Save Income Tax

- Insurance at every lifestage

- Checklist for buying Life Insurance Policy

- How to Claim Life Insurance

The objective of life insurance is to buy protection for your family in the event of an untimely death. Having multiple life policies offers flexibility and strengthens the protection at a relatively small additional cost. When buying additional term plans, it is important that you declare your existing sum assured in the proposal form. Please compare different term plans before buying your policy.

Before I purchased my life insurance five years ago, one of my considerations was really the need for having the insurance. Well, basically I would want to give the best life to my family even when I’m gone so I chose this kind of insurance. The whole point of insurance is to protect your asset–and you are your family’s greatest asset and Life insurance is the best way to get the most bang for your buck.

The basic thing a person need to understand here is that he or she can only be insured to a maximum of his or her income worth. InsuringGurgaon.com has been insisting it’s clients to buy only the right amount of insurance.