Where is all the information related to your financial life? Your policy details, FD, mutual funds, etc Is it stored in your head or hidden in your emails? You’ve kept the documents in the top cabinet of the steel almirah, but who knows about it! What about the insurance policies you have taken? And the locker keys? Do you have a money book which has all the information, that you can refer to? This Money book will help you while filing returns, doing review of your financial life, and also your family in time of emergency or when you are not around them. The excerpt is given below. Download the sample MoneyBook in Excel form here or check out the money book released by HDFC Mutual Fund.

We always believe we will live forever.

Bad things always happen to others.

Only when things hit us bang on our head we realise…

Life is so unpredictable….

She passed away unexpectedly 15 days ago. Our neighbour, who lived by herself. The children could not come due to travel restrictions. Relatives and friends managed everything. The tough task of sorting her belongings fell upon me and another friend. We had to make lists, pore over everything she had and let the children know. They would then decide what to do with it all. Why can’t we strategically prepare to go? Why can’t we give away, organise, list, and make it easy for others when we are gone? Uma Shashikant, said in the article, Why you should keep financial assets organised and listed while you are alive.

Table of Contents

Video on Why We should

You realise you don’t have time to mourn and grieve for the person with whom you spend the best years of your life. Because you are busy sorting all the paperwork.

Experience of a young chartered accountant after the death of her husband in an accident.

What should be in your Money book

- List of important documents and their locations, eg., Passport, Driving licence, PAN etc.

- Important contacts, like the doctor, CA, your stockbroker and their details.

- Your EPF/NPS details, Your stocks options, along with office insurance policy and contact of your collegaue.

- Your bank details

- Your bank locker details

- Your credit card details.

- Your property details, Property taxes, rent etc.

- Your insurance policy details

- Your mutual fund investment details

- Your stock details, at least the platforms through which you invest

- Your Income tax return details

- Loans that you have taken, given. Paperwork of it.

- Your will or Important instructions for them to carry out, once you are dead. Eg., insurance claim process, steps to selling off some property, claiming the bank account, investments etc.

Download the sample MoneyBook in Excel form here.

Why should you have a money book?

As Uma Shashikant, said in the article, Why you should keep financial assets organised and listed while you are alive. We can do a lot without spending money, and money well spent can do a lot. Let your money help you and those around you live better. Rather than lying meaninglessly in expired bonds, unaccessed PPF accounts, unused vases and unworn dresses.

It will help you to control your financial life. Help you to review your portfolio, file ITR and filter. Sounds difficult and time-consuming, searching through your mails. But once it is done. You just need to update it. If you are just starting your financial life then it is simpler.

Often, children, the spouse does not take much interest in these financial matters. This can turn out to be one of the best gifts you ever make for yourself and them.

Keeping paperwork in order is a challenge. Are there accounts without nomination? Are there joint holdings with the dead husband’s/wife’s name; Are there dormant bank accounts? Are there broking accounts that were long in disuse? Are there transactions in the bank for large withdrawals not accounted for. These could be hand loans to friends and relatives. Keep the paper in order. Find someone to do it if you don’t like to do it yourself.

Neglect creeps in, we lose interest along the way. There are non-performing shares, unpaid insurance premia, a few post office deposits that matured long ago, PPF account gone inactive and discontinued SIPs. We fail to consider the end value of the investment to make sure it is closed and completed. It is tough to retrieve the money, especially after the person is gone. Track and get your money, even if it is small.

Have a strategy for the bequest. It need not be a will or a formal statement, though that would be best. Even in an amicable situation of siblings not quarrelling, it is tough to value and decide who gets what. Both daughters want the same pieces of jewellery. Both sons want the house. We have no way of finding out what she would have liked. There are no claimants for the hundreds of knick-knacks. We can’t even have an estate sale in the current times.

Personal Details in MoneyBook

| Name | Expiry Date | Location | |

| PAN | |||

| Aadhaar | |||

| Passport | 10/Apr/2022 |

In Steel Almirah Safe

|

|

| Driving License | 5/Jun/23 | In Wallet | |

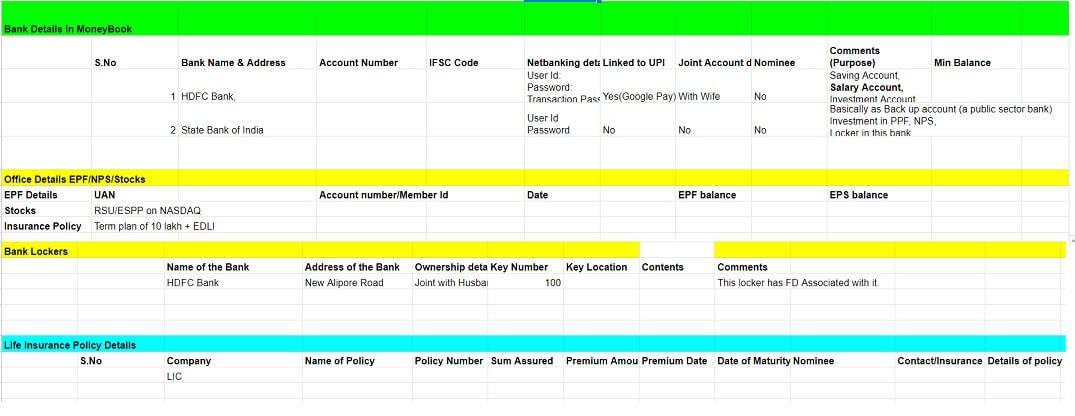

Office Details in Money Book

|

Office Details EPF/NPS/Stocks

|

|||||||||

| EPF Details | UAN |

Account number/Member Id

|

Date | EPF balance | EPS balance | ||||

| Stocks |

RSU/ESPP on NASDAQ

|

||||||||

| Insurance Policy |

Term plan of 10 lakh + EDLI

|

||||||||

Contact Details

| Contact Details | Name | Address | Contact Number | Comments | ||

| Doctor | ||||||

| Boss, Colleague |

Contact Shyam for informing Boss, Insurance

|

|||||

| Insurance Agent |

Life Insurance, Health Insurance

|

|||||

|

Tax Lawyer or Chartered Accountant

|

For Tax Filing | |||||

| Financial Advisor |

Bank Lockers Details in MoneyBook

| Bank Lockers | SNo | Name of the Bank | Address of the Bank | Ownership details | Key Number | Key Location | Contents | Comments |

| 1 | HDFC Bank | New Alipore Road | Joint with Husband & mother on law | 468 | Black pouch in steel almirah safe | Gold Jewellery |

This locker has FD Associated with it.

|

|

Life Insurance Policy Details

| S.No | Company | Name of Policy | Policy Number | Sum Assured | Premium Amount | Premium Date | Date of Maturity | Nominee | Contact/Insurance Agent |

Details of policy

|

| 1 | LIC | Term Plan | 12345123 | 10 lakh | 5378 | 2 Mar Annually | 2 Mar 2030 | Daughter | Online | If I die before Maturity Date will get the sum assured.

Else Nothing |

Health Insurance Policy Details

| S.No | Company | Name of Policy | Policy Number | Sum Assured | Premium Amount | Premium Date | Date of Maturity | Details of Policy | Contact |

| 1 | Office Policy | Group Insurance Policy | 5 lakh | 0 | Wife, Children and Mother covered Floating |

Colleague Sakhsam,

HR |

|||

Details about Other Policies in Moneybook

| S.No | Company | Name of Policy | Policy Number | Sum Assured | Premium Amount | Premium Date | Date of Maturity | Contact | Details of policy |

| Personal Accident Policy | |||||||||

Bank Details in MoneyBook

| S.No | Bank Name & Address | Account Number | IFSC Code | Netbanking details | Linked to UPI | Joint Account details | Nominee | Comments (Purpose) |

Min Balance |

| 1 | HDFC Bank, | User Id: Password: Transaction Password: |

Yes(Google Pay) | With Wife | No | Saving Account, Salary Account, Investment Account |

|||

| 2 | State Bank of India | User Id Password |

No | No | No |

Basically as Back up account (a public sector bank)

Investment in PPF, NPS, Locker in this bank FD |

Credit Card in MoneyBook

| SNo | Issuing Bank | Credit Card Number | Name on Card | Any Add on Card | Expiry Date | Credit Limit | Billing Date | Due Date | Mode of Payment | Details Purpose |

| 1 | HDFC Regalia Card | 1234-1234-1234 | Swayam Mehta | Mother Wife |

06/21 | 4th of every month | 25th of every month | Netbanking through HDFC Card |

Used often

Lounge Access Good reward points-redeem for booking tickets |

|

|

|

Loan Details in Money Book

| Sno | Type of Loan and Bank | Loan A/c No. | Total Amount | Interest Rate | EMI amount | EMI Start Date | EMI End Date | Prepayment Details | Comments |

| 1 |

Home Loan from State Bank of India

|

50 Lakh | 8.75% | ||||||

| 2 | Car Loan from HDFC Bank | 5 lakh | 10% | ||||||

| 3 | Loan given to Brother | 10 Lakh | 0% |

For starting new business.

Will return by 2022. |

Property Details in MoneyBook

| S.No | Address of Property | Registration Deed No | Property Owner(s) Detail | Bought on | Bought for | Property Tax Details | Rental Details |

Details about Property Papers

|

| 1 | Coowner Wife 40% |

12 Apr 2010 | 65 lakhs | 6232 | In Locker of State Bank | |||

| 2 | self | 28 Jun 2000 | 40 lakhs | 4129 | In Locker of State Bank |

PPF Details in MoneyBook

| PPF Account Number | Start Date | Maturity Date | Investment Year | Amount Invested in Year | Interest earned |

| 20-Oct-2017 | 1-Apr-2033 | 5000 | |||

| 2-Apr-2018 | 50,000 | ||||

| 3-Apr-2019 | 70,000 | ||||

Deposits With Banks/ Post Offices/ Company Deposits/

| S.No | Company/Bank

with Address |

Ownership Details (Joint) | Amount Invested | Investment made on | Date of Maturity | Interest | Shown in ITR | Nominee | Comments |

Demat Account Details

| S.No | Company | DP ID, Client ID | Ownership Details | Login Details | Nominee | Details of account |

Mutual Fund Details

| S.No | Company | Folio Number | Ownership Details | Investment Details

Amount Invested Date of Investment |

Nominee | Details |

Important Instructions in Money Book

Make sure, you mention all the things which you wish your spouse/parents/children to do or carry out.

How to Break FD’s or redeem Mutual funds in case of emergencies

Put some details in, on how they can break the FDs or redeem the mutual funds, in your name, in case of emergencies.

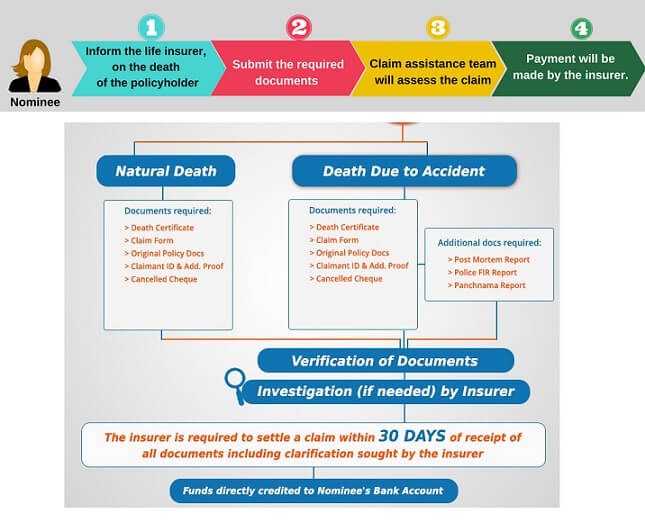

Life Insurance claim procedure

Give them detailed instructions on what they should do to claim your Insurance amount from the Life Insurance company. It can start from contacting the agent, filling up the forms, making sure all the documents are in place, constant follow-up with the company etc.

Our article How to Claim Life Insurance on death explains it in detail

Claiming Deceased’s Mutual Fund Units

How to use your life Insurance money for future: Once they get money from your Life Insurance, suggest how they can channelise it into different instruments based on their understanding, risk-taking capability and the amount of ease you want them to have in dealing with those.

Location of Important Documents & Records

| S.No | Company |

| Cheque Book(s) /Passbook(s) | |

| Bank Locker Keys | |

| Public Provident Fund (PPF) Passbook(s) | |

| Property Ownership Document(s) | |

| Insurance Files (Life / Mediclaim / General) | |

| Fixed Deposit Certificate(s) | |

| Tax Files (Income Tax / Wealth Tax/Gift Tax) | |

| Loan related Document(s) (e.g. Loan agreements etc.) |

|

| Shares / Bonds / Units Certificates | |

| Educational / Domicile / Marriage Certificates | |

| Receipts of Telephone / Gas / Electricity etc. Will(s) |

|

| Rent Receipts, Tenancy Agreements (Correspondence with Landlord/Tenants) |

|

| Court Decisions / Judgements / Pending Litigation Others: |

Your Financial Life in Editable PDF

Related Articles:

Paper Work: Aadhaar, PAN, Will, Nomination

- Records to keep: Bank Statements,Income Tax Statements,Property Records

- Will: Right PaperWork For Those You Love-Part II

- NSDL CAS, CDSL CAS: Statement of holdings in all Demat Accounts, Mutual Funds

- What is Folio Number in Mutual Funds?

- How to get Capital Gain Statements for Mutual Funds CAMS, Karvy etc

- Claiming Deceased’s Mutual Fund Units

What do you feel about this idea of creating a Money which would help you and later your family? How much value do you feel one will add to his/her financial life by doing this? Have I missed out some points?

Take Action today! Unless you take action, reading this article is worthless! And Don’t forget to update this document every year. And share this money book with your spouse or your family members!