If you are looking for a Health insurance plan that will cover COVID-19, besides providing unlimited sum insured for any type of hospitalization then you should look at Max Bupa, ReAssure Health insurance plan. The reassuring feature of Max Bupa ReAssure plan is that customers can claim for same or different illnesses, as many numbers of times as required in a year for all covered family members.

Table of Contents

Salient Features of Max Bupa ReAssure Health insurance

Coronavirus and the high medical bills have led to increased interest and demand for medical insurance. In the current times, there is a possibility that 2-3 family members need hospitalization at around same time which can easily exhaust the base cover of the health insurance policy and customers may have to pay from his or her pocket. Realizing the need of the customers, the ReAssure Health insurance plan by Max Bupa focuses on customer’s health needs in times of Covid and beyond. It is a new age indemnity-health insurance plan, which is 100% cashless and offers 100% coverage of medical expenses, by covering the typical non-payable expenses like Personal Protective Equipment Kit, Gloves, Oxygen masks, Conveyance charges and more, under the Safeguard Benefit, ensuring customers don’t have to incur any out of pocket expenses due to hospitalization.

Max Bupa ReAssure Policy features are as follows:

- It covers Covid 19 treatment after a waiting period of 15 days. It is cashless and covers expenses for Gloves, PPE kits, Oxygen masks, Conveyance Charges etc.

- It provided Unlimited sum insured under ReAssure One can claim for any illness or any family member covered during a policy year, as many numbers of times as they want

- It not only covers pre-and post-hospitalization expenses but all types of day-care treatments such as dialysis, angiography. It also extends benefits for Homeopathic, Ayurvedic, Unani and Siddha treatment, in a government Hospital or recognized institute. It also covers a living organ donor’s Inpatient treatment for the harvesting of the organ donated

- If provides Booster Benefit, where if one makes no claim in a year, then next year, sum insured increases by 50%. So, if no claim is made for 2 years, the sum insured gets doubled.

- If encourages health life style through Live Healthy benefit, in which if one follows the steps monitored by Max Bupa Health app then one can get Discounts of up to 30% on renewal premium.

- Provides Life-long Renewal

- It also offers Health Checkup

- The ReAssure plan is available as Individual and as Family Floater with sum insured between Rs 3 lakhs up to INR 1 crore

Let us look at the features of the Max Bupa Reassure plan in detail.

ReAssure Benefit

Due to the ReAssure benefit, one can claim as many times as needed for any person or illness during the policy period.

For example, family buys a 10-lakh family floater Max Bupa Reassure plan which covers husband, wife and two children. If anyone of them gets diagnosed with COVID 19 or any other disease and needs hospitalization then, they can claim up to Rs 10 lakh like a regular health insurance plan. But God forbid, if any other family member also needs hospitalization for any illness during the policy period then also, they can claim again.

Booster Benefit

Booster Benefit of Max Bupa Insurance plan is also an interesting feature. In this benefit, if one does not file a claim during the policy term then next year sum insured will increase by 50%. And next year again if there is no claim then again, the sum assured will double. So, in 2 years of no claim the sum assured will double. And the best part is that Covid-19 treatment claim will not affect the Booster benefit.

Live Healthy

We also like the Live Healthy benefit through which one can collect heath points by taking steps counted using Max Bupa Health App. It offers multiple financial benefits such as up to 30% discount on renewal premium.

Image 1(A) shows the Health Score Tracking on the Max Bupa Health app.

Max Bupa Health Score

Life-long Renewal

One can get life-long renewal, regardless of health status or previous claims made under the policy. Renewal premium will increase as your age increases but will not alter based on your claim experience.

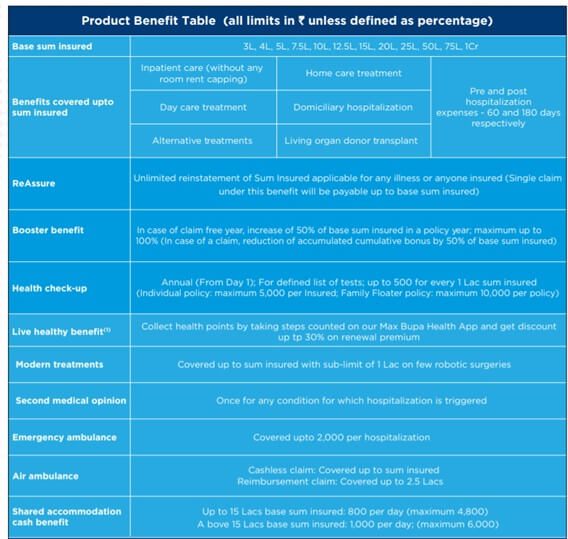

Image 1(B) below recaps the additional features of the ReAssure plan:

Max Bupa benefits table

Given the rise in Covid cases and the increase in medical expenditure, one definitely needs to have a health insurance plan to stay financially safe. Do check the Max Bupa ReAssure plan and let us know your thoughts.