An investment portfolio is a collection of financial products such as Fixed deposits, PPF, EPF, NPS, Gold, Property(Real estate), stocks, mutual funds, exchange-traded funds, Cryptocurrency and International markets. It is like making your own Cricket Team from all the available options. It is like making your thali in a buffet or a marriage party but instead of choosing starters, desserts one is choosing the investment option. You can be a DIY(Do it Yourself Investor), or hand off your portfolio to financial advisors or Robo advisors but at any stage, you should be in control, in the driving seat as it is your money. There is no ‘one size fits all’ approach in Food, Cricket and Investing. You must invest as per your goals, requirements. This article talks about how to make your Investment Portfolio? Gives an overview of all the investment options, How much in Equity, How much in Debt? How to make a Debt Portfolio? How much in stocks, How much in Equity Mutual Fund

Check your Risk Tolerance by taking part in this Quiz.

Check out quiz on How to build an Investment Portfolio

“The most fundamental decision of investing is the allocation of your assets: How much should you own in stocks? How much should you own in bonds? How much should you own in cash reserve?”

Jack Bogle, the founder of Vanguard

An investor’s biggest strength is his portfolio. To be able to diversify the portfolio will help an in cutting his losses and maximize his returns.

Table of Contents

How to make your Investment Portfolio?

We all want an Investment Portfolio that maximizes returns year after year with no downside volatility. Well, like the perfect man or woman they do not exist in real life.

An investor’s objective should be to allocate the minimum possible to risky assets while meeting one’s required annual return over the long term. A realistically ideal Asset Allocation minimizes regret. On how much downside you can tolerate while maximizing return

To make your portfolio you need to have done the following. Remember no one strategy fits all. It is as personal as you are.

- Know your risk tolerance

- Have an understanding of various investment options

- The amount you want to invest

- Decide the frequency of Investment: Is the investment lump sum or you want to set up SIP, STP, SWP

- Understand the tax on various investment options.

- Rebalancing the portfolio

Overview of Investment Options

When it comes to investment, do not keep all your eggs in a single basket. So you should diversify your investment.

Investing is like going to have food at a Buffet. Just like in Buffet there are many options which can be grouped like Starters, Mains, Desserts, etc. You should not have a lot of Desserts and have a good but not heavy meal.

Investing is Like selecting a cricket team. Just like a cricket team is made up of diverse players like batsmen, bowlers, wicket-keeper, fielders, etc. your portfolio also needs the right mix of asset classes like equity, debt, cash, and gold to name a few. Team selection also depends on the format of the game, so there is a different team for T20, one-dayers, and test matches. It is no longer a ‘one size fits all’ approach. In case of investing too, there is no ‘one size fits all’ approach. You must invest as per your goals with discrete portfolios for each goal

So let’s start with first understanding what investment options are available. There are various investment options with their Risk, Tenure, Liquidity, Returns & Task is given below in the image from our article Understanding Investing

Basically, there are only two ways of investing money:

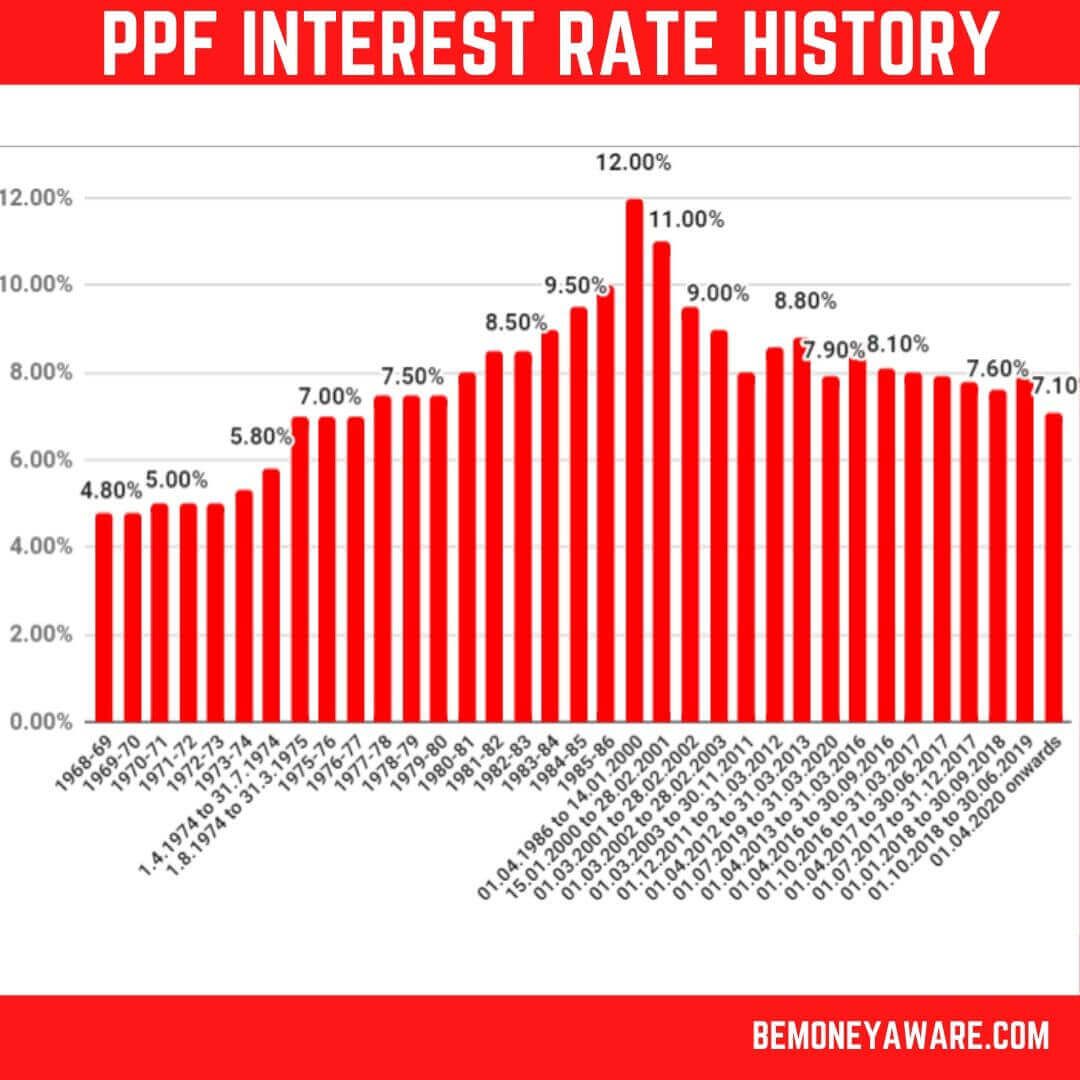

Lend it to someone: for example when we do a fixed deposit we lend money to the bank. This is true in savings bank accounts as banks use the money to give loans. Similarly in post-office saving schemes, like PPF, Senior Citizen schemes we lend money to the government. The returns are guaranteed but less. Returns from the PPF scheme over the years have gone down to 7.1%

Have a business: Running a business is not everyone’s cup of tea. But by investing in stocks any of us can be part owners of a business. If we buy stocks, directly or indirectly we get a share in the business without the hassle of running it. But returns from the stock are dependent on how the business does, in the long run. Fundamentally weak stocks, those that have debt piles, corporate governance issues, are wealth destroyers

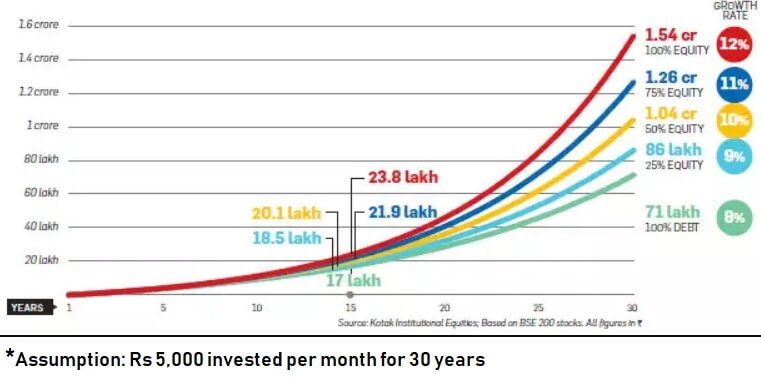

How much would money grow over years by investing in different investment options is given below.

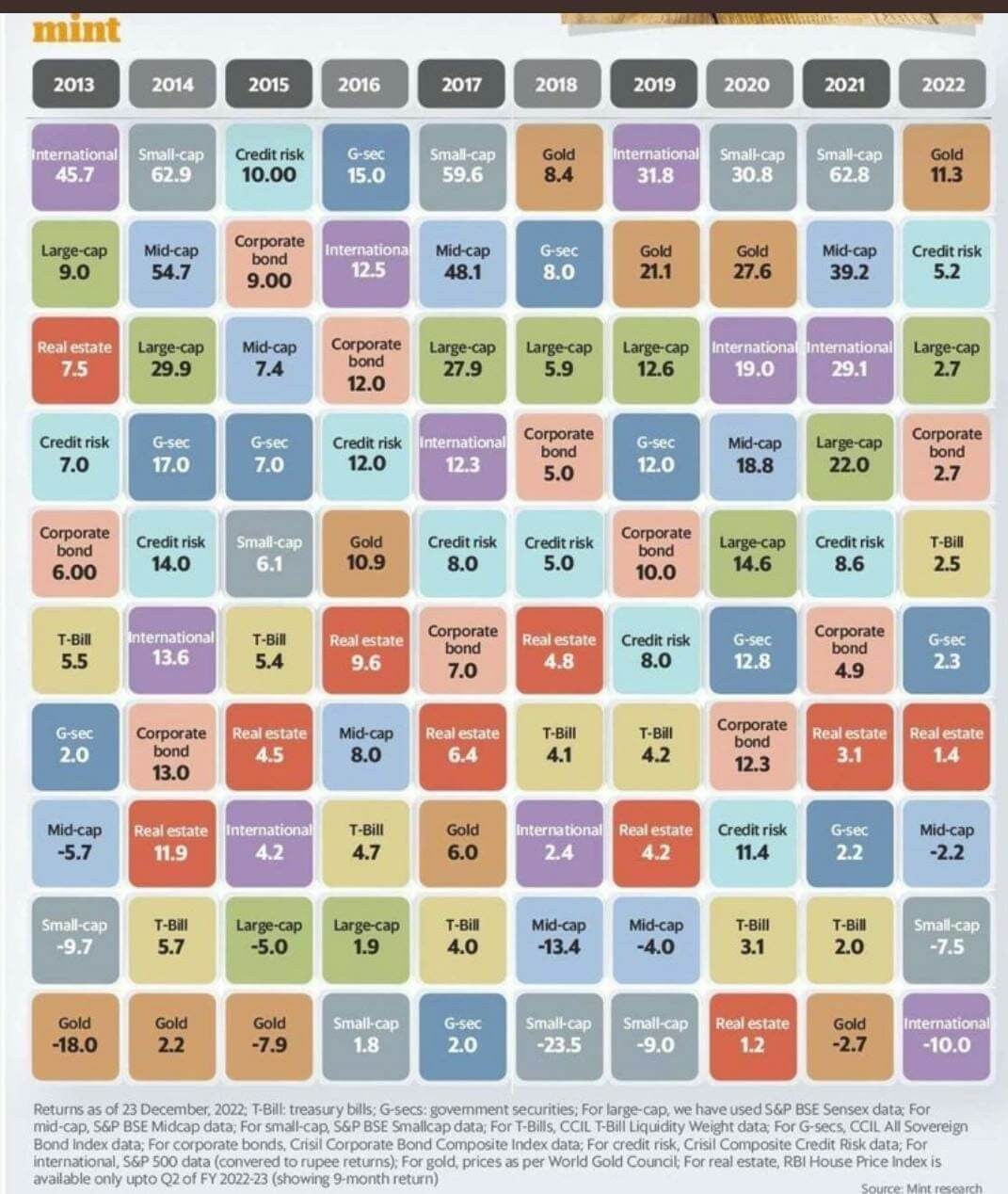

Returns of various Investing options across various years are given below.

A Simple Investment Portfolio

One such Investment portfolio with suggested percentages is given below. You can modify the percentages as per your requirements and change as you get comfortable. Just like no two cricket teams or thali’s are the same, the same is with the Investment Portfolio.

Come up with your own investment philosophy.

- Emergency Fund: in cash, bank saving account, Fixed Deposit, if Debt Mutual Funds then Liquid or Ultra Short Term Funds.(10%)

- Equity India: Index funds or ETFs for equity exposure in India (30%)

- Equity International: Index funds for International exposure preferably the USA, (15%)

- Debt: EPF, PPF, Bharat Bond ETF(35%) to give stability to Equity Portfolio.

- Gold if you need to, through Gold Mutual Funds & Sovereign Gold Bond(10%)

- House which you have bought and are staying in is not considered for investment.

Track your portfolio regularly( not every day ) but Rebalance at least once a year.

How much in Equity, How much in Debt?

The first step in deciding how much would go in equity and how much in debt?

The General Thumb rule of investing in Equities(Stocks/Mutual Funds) is 100-your age.

So a person of age 30 should have 70% in equities while of age 60 years should have 30% in equity. But that is just a thumb rule. A person in their 40’s can take more risk if he has saved and invested enough than a person in his 20s how has just started earning and has responsibilities.

The allocation to equity depends on three factors: when you need the money, your capability for risk, and the volatility you can bear.

The main aim of investing in debt is to preserve your money and not returns and stability to the overall portfolio.

The optimal portfolio is one that allows you to sleep at night. It allows you to generate reasonable returns, while also maximizing your quality of life and control over your life. It will stand the test of tough recessions and other blips in the road. Most academic understandings of the ideal portfolio ignore the very real human factors that come into play and that may cause you to deviate from the strategy.

Beginners Tip: If you are not sure you can start with 50% in equities & 50% in fixed income.

How to make a Debt Portfolio?

The main aim of investing in debt is to preserve your money and not returns and stability to the overall portfolio, so you have to focus on Safety and Liquidity. Debt plays a supporting role in your investments.

There are three elements to consider when constructing a debt portfolio.

- An Emergency Fund: you will need the money instantly. You can keep in bank saving account, Fixed Deposit, if Debt Mutual Funds then Liquid or Ultra Short Term Funds.

- Core: Look at assured return investments from Employee Provident Fund (EPF), Public Provident Fund (PPF), fixed deposits, RBI bonds, and small savings schemes

- Tactical: This is where you can afford to be experimental and look for higher returns by taking advantage of market conditions, 15-20% of your debt allocation can be in this bucket such as Gilt funds

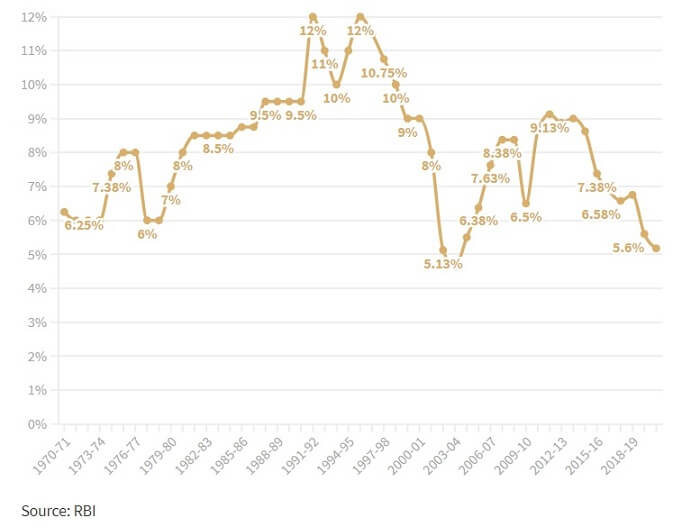

Returns of Debt Investing options keep on changing, as Interest rate changes.

How PPF interests have changed over the years are given below.

Fixed Deposit Rates over the years

How to make an Equity Portfolio: Stocks or Equity Mutual Funds

Making an Equity Portfolio is choosing between Mutual Funds and Direct Investing in Stocks.

Both stocks and mutual funds have their benefits. What you choose depends on factors such as how much time you have (and are willing to spend) to research your investments.

Choosing between investing in stocks and how much is mutual funds is like choosing whether you want to drive your own vehicle or you want to take public transport like a bus or Uber. Both have their advantages and disadvantages.

How much to invest in stocks and how much in mutual funds?

“If you have trouble imagining a 20% loss in the stock markets, you shouldn’t be in stocks”, John Bogle, the father of index funds

90% of traders lose 90% of their money in 90 days

Investing or Trading: Are you Investing in the stock market for the short term(Trader using Intraday trading, Swing Trading, Futures, and Options) or long Term(Investor)?

But here let’s talk about investing for the long term, at least 3 years.

When you buy stock of a company, you become one of its owners. If the company does well, you may receive part of its profits as dividends and see the price of your stock increase and are entitled to various benefits, like attending the shareholder’s meeting, voting right, etc. But if the stock price falls, the value of your investment can drop, sometimes substantially. At any given time, stocks’s value depends on whether its shareholders want to hold it or sell it, and on what other investors are willing to pay for it.

To invest in the stock market, the investor needs to analyze and choose the equity shares to invest in. This is easier said than done. Choosing a good equity share requires a broad understanding of the economy, sectors, and the company itself. One has to go through the financials of the company like balance sheet, profit, and loss account as well as all other parameters that indicate the health of the enterprise. It is said that as individual investors, most people do not have the time, capability, or inclination to do.

You may also choose both mutual funds and direct stock investments depending on your knowledge about the stock market, return requirement, risk appetite, diversification needs and availability of time to manage your investments.

General Guideline on Investing in Mutual funds and stocks

If you have the time and expertise to look at the financial statements of companies and have a flair for research, then you can consider creating your own portfolio of stocks. Remember that the great returns associated with stock investing come with a fair amount of volatility

Mutual funds give you a wide variety of options to choose from, if you are OK with your money being managed by a team of experts then mutual funds are the right option for you.

Tip: if you are a first-time investor then start with mutual funds before trying your hand at stocks.

Difference between Mutual Funds and Stocks

| Description | Shares | Equity Mutual Fund |

| Control over investment | You are directly responsible for the choice of stocks. You choose time to buy, price to buy and exit | Fund Manager decides your portfolio of stocks.

You have no control over the stocks, weightage to stocks, timing etc. |

| Diversification | At a time, you can purchase only a particular share. | You can have a diversified portfolio with a one-time investment. |

| Fees and charges | Brokerage charges and other transaction fees. | Fund management charges,exit load etc |

| Investor type | Best suited for people having expertise in stock markets. | Anyone can invest in Mutual funds. |

| Risk | Risky investment. Subject to market volatility. | Subject to market volatility but as Professionals are handling it the risk is less than Direct Investingin stocks |

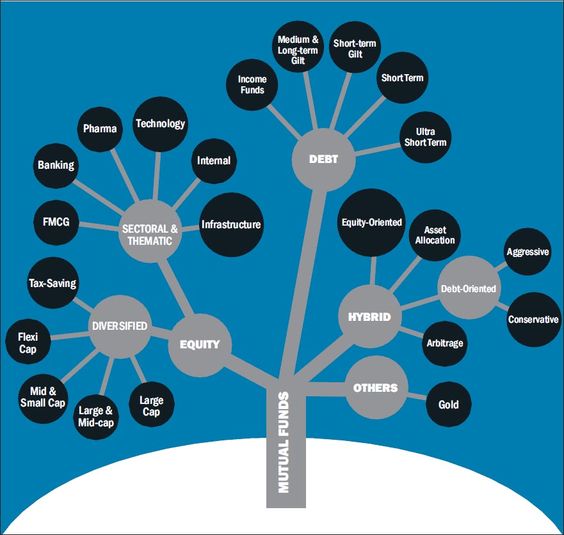

Types of Mutual Funds

A mutual fund is a professionally managed financial instrument that pools money from many investors to purchase securities such as stocks, bonds, money market instruments, etc. It offers diversification and the opportunity for investors to do smart investments without being actively engaged in the day to day investment activities.

The image below shows the types of mutual Funds.

The funds that invest in the stocks are classified as Equity Funds. They are differentiated based on Market Capitalization, Sector, Tax Saving funds.

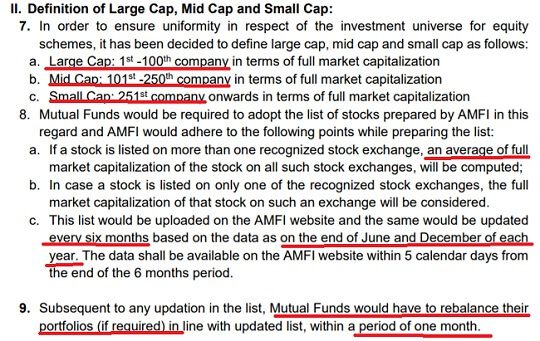

Equity Mutual Funds according to market capitalization

Market capitalization or market cap is the total valuation of the company, calculated by multiplying the current market price of the company’s share with the shares (total outstanding or free float) of the company. It varies with the share price and the number of shares.

For example, if a company has 15,000,000 shares and a share price of Rs 20 per share then the Market Capitalization will be 15,000,000 x Rs. 20 =Rs. 300,000,000.

It is a measure by which we can classify a company’s size. It is the current market value of the company’s outstanding shares.

Before Oct 2017, each Mutual Fund used to have its own definition of large-cap, mid-cap etc. So SEBI(Securities and Exchange Board of India), the regulator of Mutual Funds, came up with a standard definition of large-cap, mid-cap etc. Excerpt from the SEBI circular on the definition of large-cap, mid-cap etc is given below.

What is Index? Sensex & Nifty

The stock exchange has 1000s of companies listed.

Just as the average marks in a class test tell you how the students in the class have fared in the test, the stock index tells you the general health of the stock market.

Sensex is an index that captures the increase or decrease in prices of stocks of the largest 30 companies(as per Market Capitalization) that are traded on the Bombay Stock Exchange. Nifty is Sensex’s counterpart on the National Stock Exchange and comprises 50 companies.

To know more about What is an index? How is it calculated? You can read our article Stock Market Index: Difference between Sensex,Nifty

What are Index Funds and ETFs?

Index Fund: The primary aim of an index fund is to replicate the performance of its index like Sensex, Nifty 50, Nasdaq 100. In Index Mutual Funds instead of researching and selecting just those stocks that the fund manager thinks will outperform, an index fund buys all the stocks that make up a particular index. For example, an Index fund based on the Sensex would invest in all of the 30 stocks that form the Index in the same weight as that of the index.

So an investor who buys an index fund doesn’t have to pay a fee to the fund manager, hence the Expense Ratio of the Index Funds is low.

One buys and sells Index Fund just like any other Mutual Fund. So you can buy index funds on any mutual fund platform like MF Utility, ET money, Zerodha, Groww etc like you buy any mutual fund

ETF or exchange-traded fund is a basket of stocks that tracks a particular index, just like an Index fund. But one has to buy and sell it just like a stock. So one needs to have a Demat Account to buy and sell ETFs.

So one can use brokers like Zerodha, Groww, ICICIDirect, HDFC Securities, Upstox etc. Our article How to choose a stockbroker? Where to open a Demat Account? discusses it in detail.

Our articles What are Index funds? What are ETFs? Do Index Funds Work? , What is ETF, Difference between ETF and Mutual Fund, ETF vs Index Fund, How to buy or sell ETF explains the difference in detail.

Tip: So if you cannot decide, then one can go for ETFs/Mutual Funds based on ETFs.

Investment in Index Funds and ETFs

In Dec 2017 Warren Buffet won the bet of a million dollars that he had placed in 2007. The bet was that an index fund would outperform a collection of hedge funds over the course of 10 years. He said that by investing in a boring, low-cost stock index fund you could outperform most hedge funds

John Bogle’s created the first index fund, Vanguard 500 Index (VFINX) in 1976. To this day, the fund is one of the best S&P 500 Index funds. His philosophy was that average investors would find it difficult or impossible to beat the market over time led him to prioritize ways to reduce expenses associated with investing in mutual funds

As Morgan Housel, author of the book Psychology of Money says in his interview

In their early 20s they’re day traders, thinking they have some big insight that no one else does and they can beat a system composed of the collective wisdom of millions of brilliant people. Then, after years of disappointment, they either find a simpler approach or just put everything into index funds. Viewed this way, you can avoid a lot of grief as a novice investor but starting out with the simple approach of index funds. Keep it as simple as possible.

Also remember that investing is a long-term game, and long term means years and decades, not months and quarters.

I’m actually now down to the Vanguard Total Stock Market Index and Berkshire Hathaway. My entire net worth is now literally a checking account, a house, and those two stocks. I don’t think it needs to be more complicated than that.

How to make a stock portfolio?

While making stocks one has to take care of the following points

- Selection of the right stocks

- Buying at the right price

- Holding it for the desired period

One should diversify across a variety of sectors and market capitalization to lower a portfolio’s overall risk.

- Determining the sectors/industry(s) to invest in. Such as Banks, Pharma, Telecom, Information technology, FMCG.

- Determine what type of stocks will you buy? Market capitalization or market cap, which is determined by multiplying a given company’s outstanding shares by the current price of one share on the market (large-cap, mid-cap, small-cap, etc.). Stocks with bigger Market Capitalization are stable. While those with small market caps are riskier. It’s like when you make a movie will you choose Aamir Khan, a saleable star or a newbie.

- Determine the number of stocks you will buy

Types of stocks

- Growth stocks increase in value faster than the rest of the market, based on their prior performance record. They may entail more risk over time but offer greater potential rewards in the end

- Value stocks are those that are “undervalued” by the market and can be purchased at a price lower than the underlying worth of the company would suggest. The theory is that when the market “comes to its senses,” the owner of such a stock would stand to make a lot of money.

- Dividend stocks are those that have a history of paying out dividends though they would rise slowly.

- Blue-chip stocks are those that have performed well for a long enough period of time that they are considered fairly stable investments. They may not grow as rapidly as growth stocks or pay as well as income stocks, but they can be depended upon for steady growth or steady income. They are not, however, immune from the fortunes of the market.

- Defensive stocks are shares in companies whose products and services people buy, no matter what the economy is doing. They include the stocks of food and beverage companies, pharmaceutical companies, and utilities

- Cyclical stocks, rise, and fall in cycles such as industries as steel, oil, coal, commodities, agricultural products, and real estate.

- Speculative stocks include the offerings of young companies with new technologies and older companies with new executive talent. They draw investors looking for something new or a way to beat the market. The performance of these stocks is especially unpredictable, and they are sometimes considered to be high-risk investments.

Mistakes while Investing Directly in Stock Market

5 HOT stocks that will double in 6 months

Get hot tips on stock futures: Trade now to make 50% profits

Just invest Rs. 10,000 a month and receive Rs. 1 crore in 5 years

Investing in the stock market can be a tricky game, and if you’re not careful, you may make some grave investment mistakes that could cost you a lot of money.

Buying Penny Stocks: Penny stock investors often erroneously think that a low share price indicates that they would be able to buy more number of shares. But Penny stock companies are tiny and often targets of pump-and-dump schemes. Con artists often target penny stock investors by promoting a penny stock company as the next hot investment. Building hype about a penny stock can pump up its share price, and the price increase itself can be misleadingly cited as evidence of the company’s success. After the stock price increases, the scammers typically sell (dump) their shares for profit and stop promoting the stock. The share price then usually declines, causing large losses for the late-arriving investors who believed the hype.

If we can’t persuade you to not invest in penny stocks, then you should at least Determine the maximum amount that you’re willing to lose.

Buying Popular stocks: Some investors give too much importance to what is written or spoken in financial media.

Having no plan: An investor with no plan does not know what he wants.

Relying on Emotions Relying on emotions in a volatile market is another common investment mistake. If you cannot wait to buy or sell a stock for a few days, you are probably making an emotional decision. You should not rush your investment decisions because you “felt” like it. The fewer feelings you involve in the market, the better.

Lack of Patience Successful long-term investing is 1% action and 99% patience. However, many investors lack that patience and end up continually tinkering with their portfolios.

Best to have an investing journal that records the reasons for buying and selling Investments.

Please check your risk tolerance

Unless you can watch your stock holding decline by 50% without becoming panic-stricken, you should not be in the stock market says, Warren Buffett

Check your Risk Tolerance by taking part in this Quiz.

One of the most important things to consider when creating a portfolio is your personal risk tolerance.

Typically investor’s risk tolerance is divided into 3 categories, Conservative, Moderate & Aggressive.

Risk tolerance is the variability in investment returns that an investor is willing to bear. Your risk tolerance boils down to two main considerations: your financial ability to take on risk and your personal comfort level with risk.

if you take on too much risk than you can stomach, you might panic and sell at the wrong time. Basically, Risk tolerance will define if you are able to sleep peacefully at night after investing?

So a person’s risk tolerance determines what type of investments he or she is likely to make. Knowing the risk tolerance level helps one plan their portfolio and provides guidelines on how they invest. For example, if an individual’s risk tolerance is low, he will invest more in will be made conservatively and will include more low-risk investments and less high-risk investments.

Risk tolerance is tied to age, investment goals, income, and comfort level. But a person’s risk tolerance can(and should) change throughout his life.

How does Financial ability & Comfort Level matter in finding Risk Tolerance?

| Financial ability | Comfort level | |

| Why it matters | If your investment portfolio took a nosedive, would it be catastrophic for your finances, or would you have plenty of other resources to fall back on? | Would you be pulling out your hair if your investments fell 10% or 20%, or are you comfortable rolling with the market’s ups and downs? |

| What to consider |

|

|

There’s no defined formula for calculating risk tolerance. Financial planners and advisors typically offer risk tolerance questionnaires to new investors.

Your answers will determine where you land on this spectrum:

| Conservative | Moderate | Aggressive |

| Lowest risk tolerance | Moderate risk tolerance | Greatest risk tolerance |

| Low financial ability and personal comfort level | Ability and/or comfort level somewhere in the middle | High financial ability and personal comfort level |

How much help do you want in building your portfolio?

If building an investment portfolio from scratch sounds like a big task, you can still invest and manage your money without taking the DIY route. Robo-advisors are also an alternative. Advisors take your goals , risk tolerance into account and build an investment portfolio for you.

But don’t just rely on your advisor. Learn from him, talk to him. Discuss with him.

It’s your money, you should be in the driver’s seat.

What do Financial Coaches do for their clients?

- Guide them

- Plan for contingencies so they never ever run out of money even in these COVID-19 times

- Get them to think, set meaningful goals and prioritize them

- Help them save while getting them to live the lifestyle that they desire or is realistically possible. Saving is the bedrock of wealth creation and helping a client figure out his number and help him save is one of their most important tasks.

- Help them Invest and guide them to be disciplined about their investments.

- Help them avoid costly mistakes

- Handhold them through turbulent times, remove emotional biases out of decision making and course-correcting in a meaningful way to help reach their destinations successfully.

Check your Risk Tolerance by taking part in this Quiz.

Check out quiz on How to build an Investment Portfolio