A low corporate income tax rate is attractive to investors, especially to those who are interested in minimizing their business start-up costs. A number of countries worldwide offer low corporate taxes while some jurisdictions impose no taxation on corporate profits. In this article, we list some of the lowest corporate taxes in the world.

Countries with a low corporate tax

Apart from the countries in the Caribbean and in several other locations, where there is no corporate income tax (as seen below), many countries in Europe also offer a very attractive taxation regime. Some of the countries in Europe with the lowest tax rates are the following:

- Hungary: 9%;

- Bulgaria: 10%;

- Moldova: 12%;

- Cyprus, Ireland, and Liechtenstein: 12.5%;

- Romania: 16$ standard rate and reduced rates of 3% and 1% under certain conditions.

- Poland: 19% and a reduced rate of 9% for small taxpayers.

In Asia, the countries with the lowest corporate tax rates are Macau (12%), Hong Kong (16.5%) or Singapore (17%), among others.

When choosing the jurisdiction where the company will be based, the corporate income tax rate can be important, however, the general business regime should also be taken into consideration. We recommend contacting a team of local experts, such as a team of attorneys in Poland if you are interested in company formation in this country. Likewise, you can reach out to a local team of experts irrespective of the chosen jurisdiction.

India and Corporate Tax

The Indian government reduced the corporate tax rate from 30 per cent to 22 per cent with effect from 2019-20. Any domestic company will have the option to pay income tax at the rate of 22 per cent (plus surcharge and cess; effective tax rate at 25.6 per cent) subject to the condition that they will not avail any exemption/incentive. Also, such companies would not be required to pay Minimum Alternate Tax (MAT).

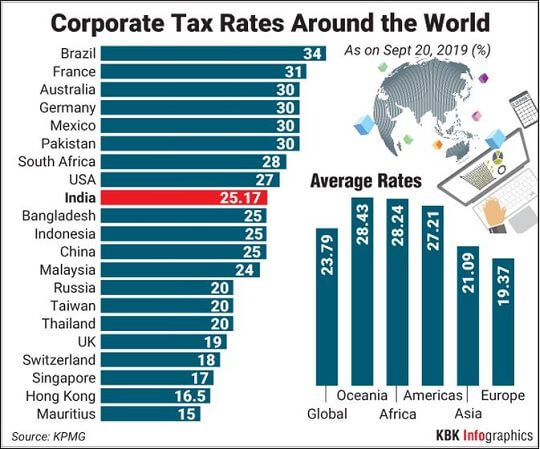

Any new domestic manufacturing company incorporated on or after October 1, 2019 making fresh investment in manufacturing, will have an option to pay income tax at the rate of 15 per cent (plus surcharge and cess; effective tax rate at 17.01 per cent). This benefit is available to companies that do not avail of any exemption/incentive and commence their production on or before March 31, 2023. These companies will also not be required to pay MAT. The corporate tax rates in the world is shown in the image below

Countries without corporate tax

Some jurisdictions impose no corporate income tax or personal income tax. These are often offshore centers or tax havens, as they are sometimes called. In the Cayman Islands, Isle of Man, the British Virgin Islands or the Bahamas there is no corporate income tax, however, in some of these locations, companies may be required to restrict their activities to international trade. Investors who are interested in knowing more about the regime in these countries should also obtain more information about the general conditions for doing business.

Opposed to these low-tax countries, jurisdictions with a high corporate income tax rate include Japan (30.86%), The Philippines (30%), Belgium (29%) or China (25%), among others.

According to region, Europe has the lowest average corporate income tax rate, lower than the average tax rate in Asia, the Americas, and Africa.