Modern man drives a mortgaged car over a bond-financed highway on credit-card gas. Today’s young believe in concept Spend now, Save later ,Borrow and pay EMI, spending more, saving less and taking loan. The young are well educated, skilled,have high expectations about their careers or income flows and thanks to the attitude change borrowing is no longer viewed negatively. Be it a new mobile or some other household appliance, a wedding in the family or a foreign vacation, if you do not have money, just walk into a bank and get the money you need. In face of cash-crunch they look for credit card or personal loans to bail out. But what if they are not able to pay their EMI’s for a month, two months, three months then? On defaulting loan one may has to face recovery agents, at times, harassment also at their hands. Hindi movie EMI (2008),starring Sanjay Dutt, Urmila, Arjun Rampal, looked at lives of urban Indians affected by one common problem, that of, accumulated debts which they are unable to pay. Our webpage Money and Fun has songs and Hindi movies related to money, for story EMI click Hindi Movies and Money:2000’s This article is based on Economic Times article Pay up or Else (21 July 2013).

“Your son has taken a loan of 5 lakh from the bank and run away. Give me his number,” said the man who claimed to be a recovery agent with HDFC Bank. In mid-June, 82-year-old A L Bhargav got a call at around 10 pm at his Jaipur residence. When the senior citizen refused to share the number, the recovery agent repeatedly called and threatened him. Bhargav was forced to bear with the abuses silently . A L Bhargav’s son, Anand, had been a customer with the bank for over the last decade. The bank had found him creditworthy enough to sanction multiple loans against his name, which he had been repaying diligently. But in 2012, he was forced to quit his job and after failing at business, he found a job abroad. According to Anand, he had informed the bank executives concerned about his overseas assignment. He had also sought some time to regularise accounts. Anand said he knows that defaulting on a loan is wrong. “But what could I do once I lost my job? And if the bank wanted to collect on the loan, they should have contacted directly and not my father”

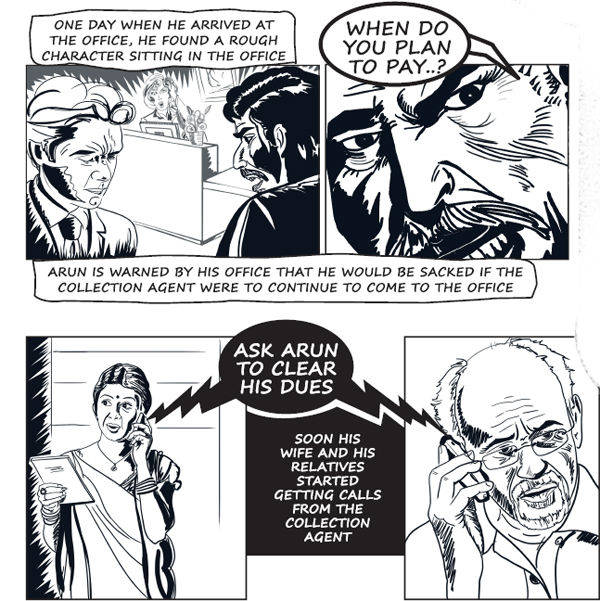

Ajay S, a customer with ICICI Bank, struggled to close a personal loan after he lost his job. The 23-year-old finally did manage to settle it but hardly had he closed out the personal loan when he started getting calls about the dues on his credit card. The youngster told the collection agent that he was not in a position to settle the dues on his card immediately and that he had sought some time from the bank. “This collection agency then started calling up my distant relatives whom they had tracked down, I suspect, using social media. The agency called up my relatives repeatedly and told them that I needed to settle my card dues if they wanted to live in peace” Ajay admits that ideally he should not have defaulted on his dues. But he is indignant about the fact that the recovery agent concerned dared to harass his relatives. “Which law allows recovery agents to call up friends and relatives of a debtor without their permission, I wonder,” he asks.

Feroze, a customer who had defaulted on a credit card issued by Axis Bank, says a collection agent misbehaved at his office which forced the HR department to issue a warning. “The language [used by the agent] was so filthy that I don’t even want to repeat what he said,” he says going on to add that the recovery agent called up his mother and told her they would kidnap him unless the dues were cleared.

Instances of debtors, their family and friends getting threat calls have been reported from multiple locations across India. Consumer forum websites like consumercourt.in and consumerlaw.in are flooded with complaints from defaulters being harassed by recovery agents. Even legal online portal lawyersclub.com has been consulted by distressed defaulters who are unsure about how to handle the stress.

Note: We found was that lawyersclub.com site is up for sale, consumercourt.in has cases reported in 2009. But found site lawyersclubindia.com with such cases reported recently for example Harrasment by icici banks recovery agents , consumerlaw.in also having cases such as Unfair, unethical & illegal Practice by ICICI & Syndicate Bank credit card System where inspite of paying loans in 2006 CIBIL records were not updated till 2013 and then mentioned with settled remark / status.

Table of Contents

Why the defaults?

At a time when economic growth has slowed down, the job market is tight with layoffs not uncommon and salary hikes not matching spiralling inflation, the risk of defaults on retail loans is on rise. Typically most of these individuals are young professionals in hitherto rapidly growing sectors like IT/BPO who are now grappling with the changed economic realities.

Banks are also lending more to individuals, retail customers, in a bid to rely less on a debt-heavy India Inc. For example At HDFC Bank, the overall loan mix is 54:46 in favour of retail, with retail lending growing 26%, against wholesale lending at 17% . One way of mitigating that risk and reducing loan losses is by more efficient — and perhaps more aggressive — follow-up with defaulters of secured (home and auto) and unsecured (credit card and personal) loan.

Is Harassment Legal?

The harassment is despite the fact that the courts have passed a series of judgements against aggressive recovery agents; and consumer commissions too have pulled up banks in the past for hiring musclemen to carry out their collection. The RBI had framed guidelines on how debt recovery agencies should approach customers and conduct their business in 2007. Back then, the banks were under tremendous pressure after the media reported extensively about debtors being harassed and physically assaulted by collection agents. In those days, most recovery agents were referred to as “goons”. In 2006, for instance, ICICI Bank was fined 55 lakh by the Delhi State Consumer Dispute Redressal Commission after recovery agents attacked a youngster and forcibly took possession of a vehicle.

In the years since, banks appear to have taken some steps to stop recovery agents from attacking customers. In recent years, the cases of physical assault of debtors appear to have been significantly reduced; the RBI ombudsman also reports that complaints against recovery agents have dwindled from over 1,600 in 2009 to 459 in 2012. Most recovery agencies have also become more professional given the strict guidelines framed by the RBI. The central bank mandates that a person can be employed as a recovery agent only after he completes 100 hours of training and passes a written exam on debt recovery. Customers are to contacted from 7am to 7pm. All calls and visits are made to customers at the registered details [numbers and addresses of the customers] with the bank.

However, despite these improvements, a significant number of debtors in the country continue to get abusive calls from recovery agents. Research done by ET Magazine suggests that HDFC Bank, ICICI Bank and Axis Bank , perhaps the three most aggressive banks on the retail front , have been getting the most complaints about abusive calls on portals dedicated to consumer complaints for at least five years now. Complaints against Standard Chartered Bank, Citibank and HSBC Bank for sending collection agencies which violate regulations have also been posted on consumer websites.

When do recovery agents step in?

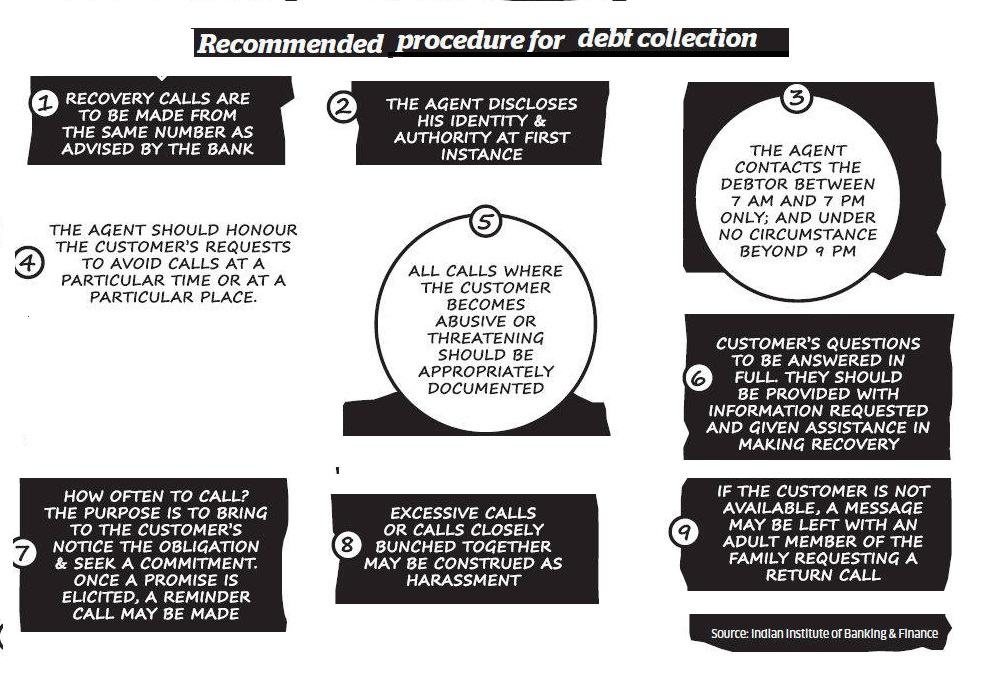

Banks stringently monitor EMI repayment of customers. The moment a debtor fails to make a payment, the system ensures that he gets a call and thereafter the follow-up is quite persistent, Banks classify a loan as an Non Performing Asset (NPA) when a borrower fails to make interest or principal payments for 90 days. Insiders in the recovery business say that anyone who has defaulted for more than three months on a loan could end up having to face recovery agents. At this point, normally, a recovery agency will dutifully call the customer and merely remind him to pay his dues. It is difficult to comprehend whether there is a default threshold for retail loan and credit card customers, crossing which, recovery agents feel free to intimidate people. Procedure for debt collection is as shown in picture below:

The significance of recovery agencies can be gauged from the fact that some of these private banks in the country employ over 1,500 agencies each. Though banks says that agreements with external vendors emphasise on compliance with the code of conduct and explicitly cover the bank’s expectations of vendors in their interactions with customers both face to face and over the phone. For example The HDFC Bank says it ensures that all telecallers and field executives are trained by Indian Institute of Banking and Finance (IIBF) and undergo a mandatory DRA certification. And agency penal action is initiated against the vendor as per internal norms for any violation of policy guidelines. Steep collection targets are set by the banks or when the recovery agents are asked to recover from people who have no means of repayment, it is possible that some agencies could still be bending a few rules.

Banks have observed that in some cases, complaints are being used as an avenue for evasion of outstanding legitimate dues or to negotiate for higher waivers.

Recovery Agencies

The Matrix Group is a private company that has a credit risk unit as well as a debt recovery team and has been in business for the past 11 years. The head of the company Rajiv Mahajan says that his organisation, which employs 500 people and earned around 8 crore last year, has always tried to maintain standards in debt recovery. “All the conversations between telecallers and debtors are recorded and nobody is allowed to abuse any debtor”

26-year old Manju Bhatia who has started an all-women debt recovery team, Vasuli, where Bhatia is a joint managing director, employs only women as recovery agents to collect. The agency has collected on debts worth 500 crore under her stewardship. Her story has been captured by Rashmi Bansal in her book on women entrepreneurs titled Follow Every Rainbow (Westland, 2013). Bhatia was almost forced into the business years ago after Vasuli was presented with the tough choice of recovering from a minister. Bhatia was then an employee with the firm, which decided to send her to the minister; she recovered the proceeds without any ado.She understood that male recovery agents often find it tough to deal with fraudsters who conveniently file false cases against the collection agents. “I thought why not employ more women as recovery agents. Because any home or office we go to, we get a lot of respect”

Reference : Economic Times article Pay up or Else (21 July 2013).

Related Articles :

- Understanding Loans

- FAQ on CIBIL CIR Report and Score

- Credit Card Debt

- What’s The Price Of Cool?

- Parents & Us:Changes in the Way We Earn,Spend,Invest

- Our webpage Money and Fun has songs and Hindi movies related to money, for story EMI click Hindi Movies and Money:2000’s

We were shocked when we read the article. Brought up by parents who insisted on saving, married into a family where if loan taken must be for building assets(education loan, home loan),must be within your paying capability and must be paid first, I thought this problem is not so severe, till I started discussing with my colleagues . I was shocked to know that those in late 20’s were actually servicing personal loans and not paying credit card bill fully, though thankfully none of them had to face recovery agents. Do you think, younger generation is taking loan casually? Are public sector banks better than private banks? Have you defaulted on a loan? Did you have to face recovery agent?

Sir bajaj finance is one such 3rd class company which hires 3rd class rowrdies for collecting loan emi. my mother sometimes pays the emi with just 15-20 days delay. she pays penalty for that as well. but she pays all the dues promptly every month. As you can understand some time home expense will be there. But bajaj loan collectors are pure classical rowdies. They call everyday, They visit home everyday until the emi is paid. And they shout and use rough language. Let me know please if someone could help volunterely with this. I’m sick of them.

I would shoot them with my Pistol

Nice post ..Thank you for sharing .

loan offer in 48 hours.

Hi Do you have financial problems? And those who have trouble getting capital loans from local banks and other financial institutions. Please refer to this E-mail address: maurogiovanni00@gmail.com

Whatsapp: +55 11 97 6315 893

My father’s 04 credit card from last 10year and my father every month timely pay all emi and bills and my father take loan from credit card for my mother’s operation. Last year my mother’s first operation and in this year again my mother’s second operation and 3 month before my father’s accident and after 01 month of accident my father hospitalized for problem in lever then after all things my father lost his job.

Now I’m not able to pay credit card loan emi because I have no money, no any bank balance and no property now we stay on rented house And I’m single son of my father.

And now father and me both ride ola uber bike….My father talkink with banks for settlement but banks not ready for settlement my father total dues approx 8 or 9 lakh…My father daily take so much tension and told me I feel like die.

Please anybody help me…We both very frustrated

Please advice me

First Thanks for such informative post. It is too valuable information you have given in your post. And it is very valuable for us.

nice blog keep sharing such informative blog

https://www.lawwagon.com/

Too valuable information you have given in your post. And it is very valuable for us.

Private finance in 72 hours without cibil from private lenders, NBFC with salaries above 15k or self employed with IT or without and with low interest rate of 5% to 15% PA contact us Astha Note:charges at the time of loan disbursement.asthafinance2326@gmail.com +916361764092

Hi My name is Dev and i take a loan for 1 lac rupees from Yesbank in a year ago. after 3 month i lost my job. and i am very sick. But i pay emi regularly. but since last 2 months again i lost my job and i miss 3 emi. i co-ordinate with them that i pay all emi but give me 1-2 month time. but they said that come at your home and give you a notice. or you have to pay or i am getting some harresment calls.

please advise me

Hi m unable to pay my per loan from the bank n thinking to leave the city n settled somewhere…is this possible

Try to talk to bank and settle.

Running is not advisable, it will catch up sooner or later.

I need an urgent advice and help from a lawyer who won’t expect any fee. 10 years ago my ex-BF made take a loan for him on my name from ICICI – it was just 60k. THings went bad and he left. I paid 55% of the amount. My health is very very bad. I am not in a situation to pay and I want to just close it. My family members keep getting calls and they ask me to pay. Few years ago they also visit and harassed my sister and mother. Also, the bank has been saying a different amount. I don’t have the papers or anything except the bank should have known what I have already paid. How do I completely close it? If I file bankruptcy will that help me to be free?

I don’t have any proof. I really really want to make them stop. Any help would be appreciated. I am so tired with these problems and top of it my health and unsupportive family I felt I shouldn’t live any more. My email: munnilovesdisney@gmail.com Please help me or I don’t have an option… but to die. My family won’t support me…

Just Simple recovery person gali dete hai to aap bhi do, wo marte hai to aap bhi maro. once issue will go to court then you can settle there with solution, if lost everything then go with court whatever court will decide.

but don’t fear with any person.

I have taken 30 lakhs of home loan from indusind Bank in 2015 and due to financial problem now i could not pay instalments regulary .what action will be bank take nexxt.I have not paid two instalments now

I have a Car Loan from Indusland bank started in Year 2015 . From some time i am facing financial crisis ,i havnt paid 2 EMI and all the time tellecaller call me and try to threatend ,i clearly told them that i want one more month to pay the EMI .The collection agent threatend me that they will trace my car and they told that they had send me notice as well but i havnt recieved anything.

I just want to know that if i am unable to pay 3rd EMI so when they will trace my car . And what all i can do legaly

I had taken a loan from citibank against cerit card about 20 months backs. Since november they have started charging 15% service tax against interest portion of the emi. I was not informed about the same, nor i am being given any other option . This is sheer haraasment and loot, what should i do. Please advice.

Dont take loan ever from the bank.its a trap

Why do you say so?

My father took a loan from a local finance company ..he is a shopkeeper.. Now due to note ban and other reasons he is unable to pay the installments at regular dates .. Now they are harrasing to pay .. Is this harrasments are legal?

I have taken 30 lakhs of home loan from Axis Bankin 2012 and due to financial problem now i could not pay instalments regulary .what action will be bank take nexxt.I have not paid two instalments now

My father passed away 6 months before due to an accident and few days before my relative in Kerala got visited by a person who said he is from HDFC bank and he informed them that my father got a personal loan from their bank in the year 2007 and they want me to pay them back. Am I liable for his debt? Of note, I do not know that my father got a loan as he has not said to me about this and I have not heard from the bank.

next time give that guy to police .

Communicate with the bank officially via regd a/d and give them copy of death certificate, after they give you loan details. If they continue with their adventures thereafter , you should report to police.

No Vikas certainly not at first personal loan is a Unsecured in nature and the loan which has been taken by your father will not fall on your shoulder. You can submit death certificate directly visiting the branch stating that i am not in a position to pay. There is no law to say that you are liable to pay your Fathers Personal loan.

ConsumerComplaints.in › Axis Bank › Axis Bank — Recovery

Axis Bank — Recovery

1 Review

Av avinashsing on Nov 22, 2016Mark as Resolved

Hi this is Avinash singh my loan is PPR012601756125 i have taken the loan in the month of april after few months i have lost my job and open small buisness and my buisness got shut down and now my mom is hosptlize and axis bank people are threatning that they are comming to house to collect the money i had a word with exacutive his number was 01139171327 he was abusing and threatning and asking to meet him because he wants to beet him please save me

i will commite suicide if the will keep on threastning me please help me

My no is 9582198170

My email adress is Avinashsingh.singh243@gmail.com

Regards

Avinash singh

You can report this matter to police station by raising a complaint against the executive and please inform your particular situation and problems which you are facing right now. As per RBI ICICI bank has been penalized by the committee for appointing aggressive collections agents as per RBI it is crime. Don’t worry and take care of your mother.

Sir,

I had taken a PL FROM CITIBANK IN THE YEAR 2004.I did 13 emi payment regularly after which I had an attack of TB-Meningitis which left me out of job and paralysed.I was in hospital for nearly two years and left with partial memory loss. In the year 2008 the bank got in touch with my father who had agreed for a settlement and paid the amount. Today after nearly 10 years i get a call from kotak bank stating that the amount is still due and i have to pay it up.I told them regarding the settlement and they are telling me that i have to produce the proof of the same.My father does not have the proof with him but my question is why were they silent for so many years and now all of a sudden harassing me?

Is it right?

I am a disabled person with stringent income.what should i do.please advise.

We provide Personal Loans, Home Loans, Business Loans etc…all over the India, with any issues in Cibil. And if there is any issues in updating or improving the Cibil score we will be able to help you in getting updated, as soon as possible. Also we do help you to get the loans in Couple of days, with (Private Sector Banks, Public Sector Banks, Foreign Banks, Nationalised Banks & Chit Funds). with the very low rate of interest (upto 5%) please call us for further queries immediately

Syed: 9739870082

Email: financialsuccess070@gmail.com

Hi my dad’s friend has borrowed 2 lakhs from private financer using my dad’s good will name, there is no documents or papers signed by my dad.The private financer who’s interests rates are massively humongous.. The borrower could only pay the interests until he lost his job… Now the financer is harrasing my dad, even when the borrower is willing to settle the amount until his circumstances changes. My dad is suffering from paralysis and neuro problem. I’m not able to sustain the stress and harassment both are causing to us. Will I be able to complaint in the police station or just keep getting harassed by this guy.

Hi All,

i have the same problem but SBI Recovery guy is not ready to settle and now he starting the call to our office my parents and harassing them.

and also would like to know the step which i can on bank?

now i just get call from SBI Executive earlier he was ready to settle in 90K(and 90K is Principal amount which was used by me) so i tell him i will pay 10K every month so now he telling me now that we will not settled ur accounts whatever u want u can…

In fractional banking system, loans are used for financial slavery.

Hi,may some one tell me that why these recovery agents call up again and again. Actually there was a fraud of perspnal loan done on my account for about 02 lacs around 06 years ago. And not only me many others from my office had faced this. I really do not understand why these people call up all my relatives even far ones and even my office mates whom I dont even know. Is these recovery agent allowed to call anyone and that too for an amount of 02 lacs and after 06 years. Being a commerce grad I know that such loans goes into bad debts. Can some one suggest me what shall I do in this case,

Please don’t do anything with life …all settled if you face it very strongly. ..

Dear Sir,

I had taken a Personal loan with HDFC Bank in the year 2009 and paid 22 EMI Well in time when i was in the job but after wards i had lost the job in recession time and this bank had put my name in cibil, with this my career had been badly damaged and i am no where position to pay the remaining emi of my PL> I had visited bank many times to settle but no body had come forward to this and their collection executive was putting mental pressure on my parents including me and thrown out of my job many times by entering the office. I had mail them to all important person in management position but no proper is coming from them to close my PL.

They had filed EP against me in 2012 and i came to know recently that they had issue arrest warrant on me , kindly tell me what should i do know?? i had tried my level best to speak to them and settle for amount which i can do so in this bad time, but no response is coming and they are telling me to settle in court now???

Please advice me urgently on my email id at the earliest…

regards

Hakeem

Please note that Bemoneyaware does not recommend or suggest whom to contact. if you are contacting anyone do so at your own risk.

I have a Car Loan from HDFC started in Year 2014 . From some time i am facing financial crisis ,i havnt paid 4 EMI and all the time tellecaller call me and try to threatend ,i clearly told them that I am job less since a year after that I arranged money every month and paid to bank.The collection agent threatend me that they will trace my car and they told that bank will issue sec 9 and bank will pick the car any time.

I just want to know that if i am unable to pay 4th EMI so when they will trace my car . And what all i can do legaly

Please call me 9899882735

i had a credit card loan in Dubai after 7 years they are calling to clear the amount due to crises i was job less and could not pay the amount now they are calling my wife and in office and mentally harrestment can i file a case against the local agancy who are calling ?

Hi Muneer, please call me on 8087496332.. I am facing the same problem..

7 years, Dubai Bank, threatening calls

They will arrest you, Aniket . Why don’t you pay up, man? Do you know they have legal rights in arresting you and putting you in jail in Dubai, even if you have fled from Dubai?

They have already done so with many debtors like you.

Mr. Amit Shukla,

You work for which recovery agency or rather “goons providing” agency ??? Please don’t post bullshit. I would like to know under which law are you justifying harassment to an aggrieved defaulter ???

Rudra

Have replied to Muneer khan. Why dont you record their calls and file a complaint with police ???

Hello

You haven’t heard about “police” or “lawyers” ??? Don’t be scared at all. Just record the calls and file a complaint.

There is absolutely no need to be scared.

Rudra

I have a Car Loan from HDFC started in Year 2012 . From some time i am facing financial crisis ,i havnt paid 2 EMI and all the time tellecaller call me and try to threatend ,i clearly told them that i want one more month to pay the EMI .The collection agent threatend me that they will trace my car and they told that they had send me notice as well but i havnt recieved anything.

I just want to know that if i am unable to pay 3rd EMI so when they will trace my car . And what all i can do legaly

i am getting frequent calls from 022-61988331, fake abnamro bank

My frend he nt able to pay her personal loan because he got heavy loses in the business. Nw frm 5yrs he is nt able to pay the loan n the recovery agency r telling him that they will bring stay order from the court. Are this people going to bring stray ordr or they are just making him frighten

MY SON HAD CREDITCARD WITH ICICIBANK ABOUT 7 YEARS BACK AND DUE TO SOME FINANCIAL PROBLEM HE COULD NOT PAY THE SAME REGULARLY AND ASKED THE BANK FOR SETTLEMENT .BANK AGREED AND ISSUED THE SETTLEMENT LETTER FOR THE SAME AND ASKED ME TO PAY IN 5 EMI AND ACCORDINGLY I PAID THE SAME .AFTER 7 YEARS NOW THEY ARE RAISING THE ISSUE FOR THE PAYMENT AND THAT TOO NOT FROM MY SON BUT TO ME..THERE OFFICER FREEQUENTLY CALLING ME TO PAY THE AMOUNT AND DOES NOT AGREE THE SETTLEMENT AND WHERE AS MY SON IS NO MORE WITH ME AND HE HAS LEFT AND SEPERATED FROM ME..EVEN NOW THEY ARE HARRASING ME AND CALLING ME DAILY SEVERAL TIMES FROM DIFFERENT NUMBERS..IN THIS CONNECTRION I HAD LODGED THE COMPLAINT BY EMAIL TO ICICI BANK CHENNAI..IS IT RIGHT FOR THE BANK TO CALL AND HARRASED ME..I AM ASENIOR CITIZEN AGED ABOUT 65 YEARS..KINDLY ADVISE ME..

Sad to hear your case. Do you written proof that the account was settled?

Please record the call. Do you have phone number from which call was made?

Have witness.

You can register a case against ICICI for harassment in the Consumer Forum and register a case/complaint/FIR in police station.

Please also complain to the RBI against the bank.

thanks for this information. i am facing nowdays same problem but these people are not sending me datails at all. they gave me hdfc bank email id which is getting bounced again and again.alson their phone number in true caller id is getting in spam. my dues are finished last year but they started calling me again after a year. i requested them to give me statement which they denied and harring me calling my office staff.they are telling that they are calling from hdfc mumbai.and want cash 30000 which i already paid, they are not ready to accept even cheque..

Hi All,

This HDFC Recovery People are assholes. my friend have taken a loan but is not paying is EMI. and while taking a loan he as given my reference moblie Number. this HDFC recovery bastards son of a bitch,, the start harassing me and come to my home harassing my family and giving me the calls unnecessarily. and harassing for the money.i want SU them in a court on this.

on harassment case.

Sad to hear about it.

Despite RBI guidelines, significant number of banks’ recovery agents harass defaultersSection 5 of the Circular clearly states that Banks must be careful while employing Collection Agencies. Further, seeking Privacy as per Section 6 of the circular, you can go ahead and file a complaint with the Ombudsman of HDFC Bank for Mental Agony and Harrasment and seek compensation.

dear Sir/ Madam

Even I’m getting same harassment calls,they are abusing my family and frenz.I told them that I’m ready to pay in installment with my current situation. Infact last month I paid Lil amount. I don’t kno from where they are getting my family member contact no. Please help

reply

dear sir

do u really think this guy can handle so easy.no they are ….just like a dog ..this is a high time …..just want to tell you that …i have talk with 20 …30 people with this same kind of problem …..one man can’t give them so much tension they just don’t listen to any one even some one phasing serious problem …and they don’t think about the complaint ….so its my humble request to you send me your mail id where i can contact u we all will take some very serious ….action ….with this guys …they all know that ….bank is setting behind them and they will save him ……so don’t think so much ….i have with me some of the insurance case also with me …m not a lawyer but i have already talk with some of the lawyer ..about the harassment case …m also fasing same kind of problem

with the HDFC BANK ……and its all done my patience level over now we all get together and and take some serous action …..reply …and contect me or give me your mail id where i can talk with u ….thanks

thanks

ABC

dear sir /madam ,

i am a divorced single mother with no income and job ,my father expiored in 2010 and staying with my old senior citizen mother 82 yrs old have one son ,we are staying on a pension ,cant afford to make the dues to the icici bank credit card ,the maximum i can pay is 10000/- tat also in 2installments, i am getting threatning calls from this number 9643228347 he is claming to be callin me from nasik police station to arrest me on sec 420 and 156,i spoke on a number of a lawyer given by this person he is claming himself as pathak who sits in mumbai for icici legal department number is 08745839648 name as k.d pathak his id is kd.pathak@gmail.com dey are forcing me to pay 40k and before 28th june which is not possible for me at all ,in dese circumstances i feel like committing suicide as i am a single divorced parent with no income at all except my old mothers pension,i am a heart patient + high diabetic patient ,since last nite my health has gone under toss …please help me …

I am facing the same problem with the same people. Do you know anyone else who might be facing this problem ? can i have your contact details .. we can talk as i am looking at options.

Dear Garima,

Life is precious and it happens only once. Whatever is the problem never lose your life. never even for a moment think of committing suicide. It shows only the weakest part of yours conscience. There are other areas in you that will respond to living up against any harrasement. SO DO NOT EVEN IN THE REMOTEST TIME HAVE the IDEA OF SUICIDE.

The only way to tackle the problem is to ignore the threats. For all that you had mentioned he may be an imposter using status and other means to create fear in you. Just ignore what he says. If he is genuine and actually send you the summons I am sure that the judge is more human and moderate and will look at your case from the practical point. If you do not have any resource to pay the whole amount he may say pay in installments that you can afford.

So do not loose hope. There are many good and reasonable people in this world and they will support you both physically and morally and emotionally. Be brave. You have never said that you will not pay. But you will repay in installments that you can at present condition afford.

That is all I have to say now.

There may be some good and generous person who may volunteer to pay off your credit card debt on your behalf.

Good luck to you.

kamath

16 September 2015

Hello, This is not a big problem of the life. Even i have faced similar situation and that time i also scared alot. But later i decided not to fear. I just told them that i want go for one time settlement amount. My total outstanding was about 85000/- but finally managed to get 15000/- as one time settlement payment offer. So don’t be scared and try to negotiate with them for settlement with lesser amount. In my case, i have stated with 5000 ended with 15000/- .

Hi Ganesh,

Please connect with me or explain your process of negotiation and settlements. I am facing same situation. Your explanation will help greatly.

Hi Ganesh bro. It’s great to hear from you. Actually I also have hdfc credit card dues and my outstanding is 50000 as of now and they have given me a settlement of 28000 only. I have to pay it now.

Garima ji will you please call me 9899882735

harassment by recovery person is not change they are still doing all illegal way for recovery.

they are harrassment my family and i am asking to go court that also they are not doing.

why?

Guess the collection team doesn’t follow even one single rule nowadays… Thanks for enlightening everyone to know their basic rights…

Guess the collection team doesn’t follow even one single rule nowadays… Thanks for enlightening everyone to know their basic rights…