Early this September, LIC came introduced its new online term plan (Plan 854) which is a Pure Online Term Insurance Plan. This replaces the LIC’s e-Term plan introduced in 2014. Along with New Tech Term Plan LIC has also introduced its offline Term plan Jeevan Amar in Sep 2019. Term plan is aimed to give financial protection to the insured’s family in the case of the insured’s unfortunate demise in the chosen period. This is inclusive of the accidental death benefit given to the rider. Let’s find out more about new LIC tech term plan, how it compares with other term plans, how to buy New Tech Term Plan online?

Table of Contents

New LIC Tech Term Plan (Plan 854)

Let’s look at the key features of new LIC Tech Term Plan. LIC was charging an extra premium on its earlier E-term plan. But LIC’s Plan 854 though cheaper than its earlier online term plan is still expensive compared to other private insurers as shown in the tables below.

Note that though you can buy the LIC Tech Term Plan online, LIC may conduct the health checkup depending upon your sum assured and your medical history. If, after the assessment, your health is found not in a good state then LIC may cancel the policy and refund your premium. Whatever would be the decision, you would be intimated the same to your registered email address/mobile number.

Comparison of premium of LIC New Tech Term Plan with Other Insurers

The old e-term plan of LIC was costly in comparison to that of the private players. But LIC’s Plan 854 though cheaper than its earlier online term plan is still expensive compared to other private insurers as shown in the table below

| Sum Assured of 1 Crore for Male of 30 years Non Smoker, Term -30 years |

|

| Age | 30 Years |

| LIC new Term Plan | 11,007 |

| ICICI Prudential iProtect Smart | 9,739 |

| HDFC Life | 9,718 |

| Max Life | 8,378 |

For Sum Assured of 1 Crore for Non Smoker Male of 30 years with Term as 10 years the premium of LIC and private insurers are comparable

| Age | 30 Years | 40 Years |

| LIC | 7396 | 12106 |

| ICICI Prudential iProtect Smart | 7262 | 12029 |

| HDFC | 7257 | 11999 |

| Max Life | 6726 | 10856 |

Features of LIC Tech Term Plan

- You can buy this plan only online from LIC website. So Plan 854 is a Pure Online Term Insurance Plan. To buy offline i.e from an agent you would have to buy Jeevan Amar policy.

- Who can buy the plan

- Only Indian nationals can apply. OCI/PIOs can’t apply.

- NRIs can purchase during their stay in India.

- Age Limit for buying the plans

- The Minimum age at entry must be 18 years and the maximum age for buying is 65 years.

- The Maximum age at the exit can be 80 years.

- The Minimum allowable policy term is 10 years.

- The Maximum allowable policy term is 40 years.

- Sum Assured

- The minimum sum assured is Rs. 50 lakhs.

- There is no limit for the maximum sum assured.

- Sum assured can be constant or one can go for increasing Sum assured option. In Increasing sum assured option the sum assured will remain the same for the first 5 years of the policy period. After that, it will increase at a rate of 10% for the next 10 years. However, after the 16th year, it will remain the same. (Explained below in detail)

- Premium:

- The users can pay premium through the online mode only.

- Premium payment options include Single Premium, Regular Premium, and Limited Premium.

- The policy has differential premium rates for smokers and non-smokers. The premium rates are lower for non-smoking individuals.

- Special discounts are available for women.

- Rider: An additional option of accidental death benefit rider is also available.

- Death benefits could be claimed in the installments of 5 years, 10 years, or 15 years. In case of death of insured, instead of one lump sum payment, sum assured can be taken in installments of 5 years, 10 years or 15 years.

- Tax exemptions can be availed to an amount of Rs 1.5 lakhs on the premium under section 80C and completely on the death claim under the sections 10(10 D)

Different Types of Sum Assured Level and Increasing

Unique feature of LIC is the Increasing Sum Assured options you can choose.

Under Level Sum Assured option, your life cover (Sum Assured) remains constant during the policy term.

Under Increasing Sum Assured, the life cover remains constant for the first five years. From the 6th policy year till the end of 15th policy year, your life cover will increase by 10% each year for the next 10 years i.e. the policy cover will double by the end of 15th policy year. From the 16th policy year till the end of the policy term, the life cover remains constant.

For instance, if you purchase LIC policy with sum assured of Rs 50 lakhs for 20 years under Increasing sum assured option.

- From 1st to 5th year life cover is Rs 50 lakhs.

- From the 6th till the end of 15th year, it will increase by Rs 5 lakhs each year (10% of 50 lakhs). In the 6th year, the cover will be Rs 55 lakhs. In the 7th year, the life cover will be Rs 60 lakhs and so on.

- In the 15th policy year, the cover will increase to Rs 1 crore (double of initial cover of Rs 50 lakhs).

- Thereafter, the life cover will remain constant at Rs 1 crore for the policy term.

Comparison of LIC Tech Term Plan with old eTerm Plan

Other than lesser premium the comparison of LIC Tech Term Plan with old eTerm Plan is shown below.

| LIC Tech Term Plan | LIC old E-Term Plan |

|

|

| The Maximum allowable policy term is 40 years.(min 10 years) | The policy can be taken for a period of minimum 10 years and a maximum of 35 years. |

| The minimum sum assured is Rs. 50 lakhs. | The minimum limit of sum assured is at 25 Lakhs for aggregate and 50 Lakhs for non-smokers. |

| Sum assured can be constant or one can go for increasing Sum assured option. | Sum assured was constant |

| Accidental Death Benefit rider available | No such rider |

| Claim payments to nominees can be a one time payment or in installments of 5 years, 10 years, or 15 years | Claim payments to nominees one time payment only. |

Comparison of LIC term plan with offline Jeevan Amar Plan 855

Along with New Tech Term Plan LIC has also introduced its offline Term plan Jeevan Amar in Sep 2019.

| Tech Term Plan 854 | Jeevan Amar Plan 855 |

| This is Online Term Plan by LIC | This is a Offline Term Plan by LIC |

| Minimum Sum Assured 50 Lakhs | Minimum Sum Assured 25 Lakhs |

| BSA Multiple 5 Lakh up to 75 Lakh

BSA Multiple 25 Lakh after that |

BSA Multiple 1 Lakh up to 40 Lakh

BSA Multiple 10 Lakh after that |

How to buy the LIC Tech Term Plan?

Since this is purely an online plan, you cannot buy it from an agent. To buy this new tech term plan online, follow the steps given below:

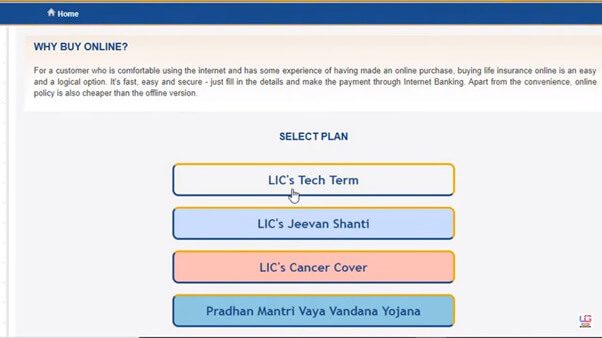

• Visit LIC website: https://www.licindia.in/

• Click Buy Policy Online on the Home Page.

After you click on that, you will be redirected to a new tab. On the new page, Select the Plan, ‘LIC’s Tech Term’.

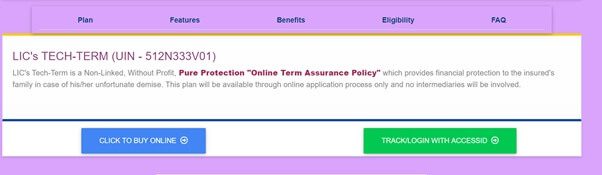

• A new page will appear with the plan details of LIC’s TECH-TERM (UIN – 512N333V01). At this stage, you can check the plan details, its features, benefits, eligibility, and the FAQ before purchasing the new Tech Term Plan. To purchase this plan, click on the button, ‘Click to Buy Online’.

• The next page will ask for your contact details. Enter the contact details and click on the button, ‘Calculate Premium’.

• LIC will then verify your mobile number/email. An OTP would be sent to your registered number. You need to enter the OTP and click on Proceed button to move to the next step.

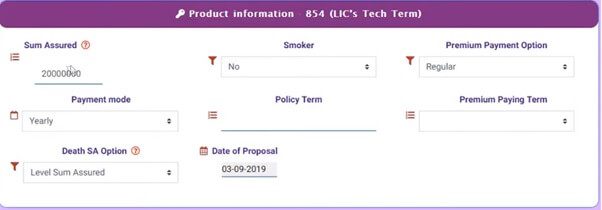

• Once your number is verified LIC will then ask for your personal information. You would also be required to fill the details for Product Information and rider benefits to calculate the premium

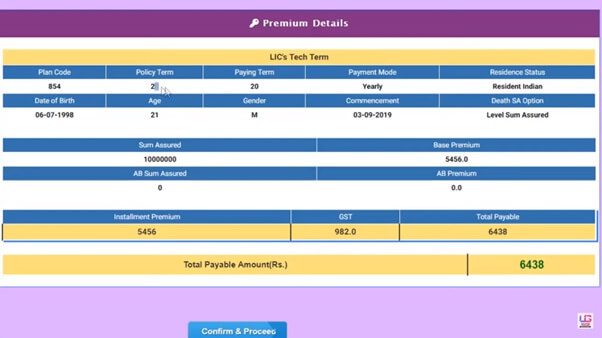

• The next page will allow you to check the Premium Details where you can check the Sum Assured, Base Premium, Policy Term, Total Payable amount, along with the other details of LIC’s Tech Term Plan.

• After you have checked the details, you can confirm and proceed to the next step. The next step will ask you to copy data from the previous policy. You can click No and Proceed if you want to fill the details from the scratch.

• Then you will be asked for Offline EKyc (Aadhaar Based). The users can proceed without EKyc.

• Once done, the users would need to fill details about the address, plan, occupation, previous policy, family history, medical, death benefits, and nominations.

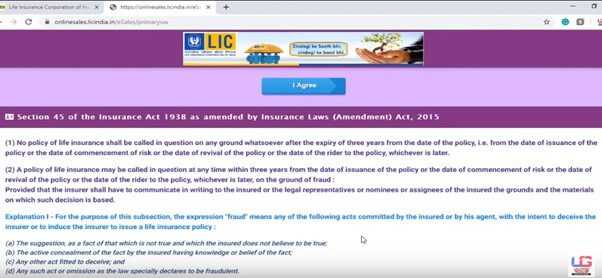

• After the details are filled, users are required to agree to the agreement.

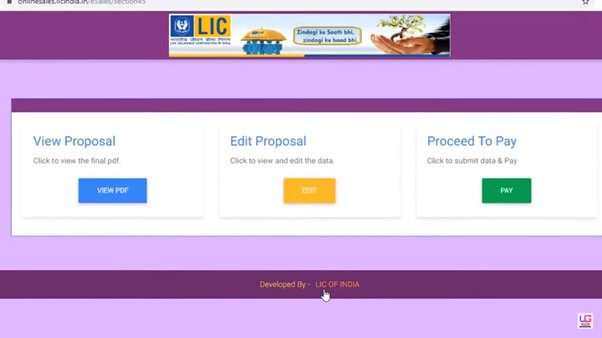

• After you click on the Agree button, you will be taken to the new page where you can view your proposal. If needed, you can edit that by clicking on the Edit button in the Edit Proposal tab. Or, you can proceed with the payment by clicking on the Pay button.

• In the payment window you can check the total amount (Incl. GST) to be paid. You can confirm by clicking on the proceed button.

• After you confirm, the next page would ask you to complete the payment through Net Banking/Card or NEFT/RTGS. You can select the one that is comfortable to you and click the ‘Proceed to Pay’ button.

That’s all you are done with the application form. LIC may now conduct the health checkup. This will depend upon your sum assured and your medical history. If, after the assessment, your health is found not in a good state then LIC may cancel the policy and refund your premium. Whatever would be the decision, you would be intimated the same to your registered email address/mobile number.

Related Articles:

- Checklist for buying Life Insurance Policy

- How to Claim Life Insurance

- Insurance at every lifestage

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- Basics of Insurance

LIC launched this plan is to compete with private insurance companies. LIC’s new term plan has unique features and less premium in comparison to their old term plan. Should one buy LIC plan? it is about your trust and the peace of mind.

How can I cancel the tech term after getting proposal no documents not verified yet. Will they return money which I deposited during filing initial proposal

What are the income proof for salaried person to getting this policy?

What Will be the premium for 47 years old non smoker LIC TECH TERM PLAN only

Premium depends on the amount insured and the period for which insurance is required.

You can follow the steps explained in article to find the premium.

What will be the primiam for a male at the age of 61yrs