At least 5 suicides in Telangana and one in Delhi, have been linked to extreme harassment over failure to repay loans disbursed by instant loan apps. Such loan apps which can easily be downloaded from App stores provide loans easily but have high penalty charges on default and are leading people into a debt trap, In Dec 2020, Telangana police requested Google to take down 158 such apps from its Play Store. Google has started taking down many such apps such as OkCash, Go Cash, Flip Cash, ECash, and SnapIt Loan. RBI has issued a warning against such killer lending apps. This article explores such lending apps. How do these killer lending apps work? Are these Lending Apps Legit? What is RBI or Google Playstore doing?

Table of Contents

How do lending apps work?

The rise of smartphones and affordable mobile internet in India has seen a proliferation of hundreds of personal lending apps in recent years. Many lending apps are available on the App stores like Google Play store. Loans are small-size loans (typically Rs 1,000 to Rs 3 lakh) given to people in the age group 21-35. Such unauthorized apps grew during the lockdown when people needed quick cash

Applying for a loan is easy as it requires downloading the App, submitting a copy of Aadhaar, bank details, a selfie-and other personal information – after which the loan is credited directly to the bank account.

People do not look at the time period of loan or charges associated with the loans. Most of such apps offer loans for seven days to three months. Interest rates vary from 25-40 percent a year, while the processing fee is 15-20 percent. In addition, an 18 percent goods and service tax (GST) is levied on the processing fees. In real terms, borrowers end up paying interest rates as high as 60% per week

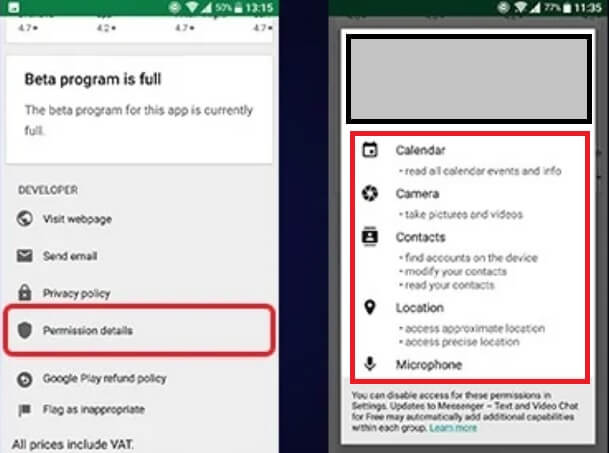

People downloading the apps also say Yes to the various permissions asked such as access to their phone contacts and photo gallery as shown in the image below.

Authorized ones do your know-your-customer verification, the unauthorized ones don’t even ask for any documents.

For failure or delay in repayment of loan, these apps charge huge penalties (overdue fees). They also use a combination of coercion, blackmail, and threats

After issuing loans to customers from their app for seven days, they divide all the customers into different categories of buckets.

- On a due date, it is called a D-0 bucket;

- after the due date from day 1 to day 3, it is S1 bucket

- from day 4 to 10, it is an S2 bucket;

- and from day 11 to 30, it is an S3 bucket.

After the due date, a customer will be harassed with dozens of calls from these agents. During the S2 bucket, abusive calls will be made to family members. Later, threats and blackmail start. Finally, they access the contacts of relatives and friends of the customers and send them WhatsApp messages defaming the defaulter.

Are these Lending Apps Legit? What is RBI or Google Playstore doing?

There are no clear norms on lending apps in India. Right now they fall in a grey zone.

Google has introduced a global policy for its platform in 2019 “to protect users from harmful or deceitful practices”

While applying for a loan, you must verify the background of the lending company, interest rates, time period. Indian banks typically offer personal loans with annual interest rates of 10-20%, and they usually do not have to be repaid in full for at least a year.

RBI issued a warning “Members of public are hereby cautioned not to fall prey to such unscrupulous activities and verify the antecedents of the company/

firm offering loans online or through mobile apps,”

RBI also says that borrowers must only borrow from firms that are either registered with the RBI or regulated by state governments. It has also mandated digital lending platforms to state the names and addresses of banks or non-banking finance corporations (NBFC), upfront. Look for the partner bank or NBFC’s details. The loan agreement must mention these details. You should check the names and addresses of the NBFCs registered with the RBI, which can be accessed here.

A Chinese link to many apps has also surfaced, with the arrest of four Chinese nationals by various police teams.

List of Killer Lending Apps

Some of the Lending Apps List submitted by Telengana police are:

Cash Mama, Loan Zone, Dhana Dhan Loan, Cash Up, Cash bus, Mera Loan, Hey Fish, Monkey cash, Cash Elephant, Water Elephant, QuickCash, Kissht, LoanCloud, InstaRupee Loan, Flash Rupee-Cash Loan, Mastermelon Cashtrain, GetRupee, ePay Loan, Panda iCredit, EasyLoan, RupeeClick, OCash, Cashmap, Snapit, RapidRupee, ReadyCash, Loan Bazaar, Loanbro, Cash Post, Rupeego, Cash Port, RsRush, Pro Fortune Bag, Rupee Loan, Robocash, CashTM, Udhaar Loan, Credit Free.

A citizen group, Cashless Consumers and Banbreach, engaged in raising awareness around digital payments released a list of suspicious lending apps (Fake) Digital Lending apps Database.

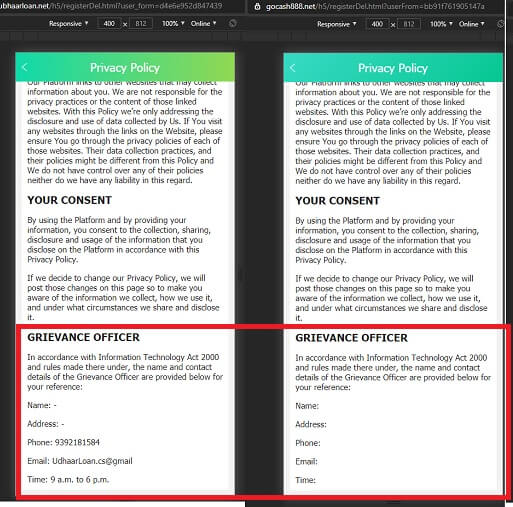

- The name of the apps is very similar to popular apps like Udhaar(Udhaar Loan), FlipCash(Flip Cash) etc.

- Look at the privacy policy of the app, Check for details of grievance officers. There would be No or fake details

- None of these apps have any sort of payment gateway integration. It is most likely that these rogue apps use UPI / PayTM to transfer money and collect and is counted as P2P transaction.

- Technical people can check where the apps are hosted. Often servers of these apps are hosted on Alibaba cloud

- Don’t get taken in with the number of downloads or reviews. Most likely these have been generated by bots to have higher listing value in search results.

How to register a complaint with RBI

In case of any unauthorised activity, people can lodge complaints with enforcement agencies about such fake apps and platforms.

This complaint can also be filed online through the Sachet portal by visiting https://sachet.rbi.org.in/

The complaints submitted are immediately forwarded to the regulator/law enforcement authority that takes necessary action as per their procedures against dubious digital lenders.

It is important for consumers to be aware of what apps they are installing and whether the entity operating it is a legal one or not.

Related Articles:

Online Fraud : UPI Scam, AnyDesk, Matrimonial Site, Lottery, Fake Job Offer etc

You Should Safeguard Yourself From Lending Apps. If it is too good to be true then it is. One should always keep emergency funds to get over such situations. And when you download any app please check the permissions that you are giving to apps.